Will the Bitcoin Halving Cycle 'Three-Peat'?

Disclaimer: Your capital is at risk. This is not investment advice.

Bitcoin has been through two clear “halving” cycles in its short existence, from 2012-2016 and 2016-2020 (epochs 2 and 3 on the chart below). We ignore the first epoch because the asset was too young and wild (even for it) to be of any use. These cycles are book-ended by the 4-year “halvings”, when the supply of newly minted bitcoins coming into the market halves. According to ByteTree Terminal data, the next halving is due on the 9th April 2024. This is now only 18 months away, which in market terms means it is time to sit up and pay attention.

It’s a short history, but the pattern has been remarkably similar. Euphoria at the start, slump in the middle, recovery at the end. It doesn’t take a genius to appreciate that if this pattern repeats this time around, we are at an extremely interesting moment.

However, it is both complacent and reductive to think that just because something has happened before, it will happen again.

Let us first consider reasons why we might not see a recurrence of the cycle.

Firstly, bitcoin might have reached peak adoption. We don’t believe this will be the case, but in truth, data from the last few years aren’t particularly encouraging on this front.

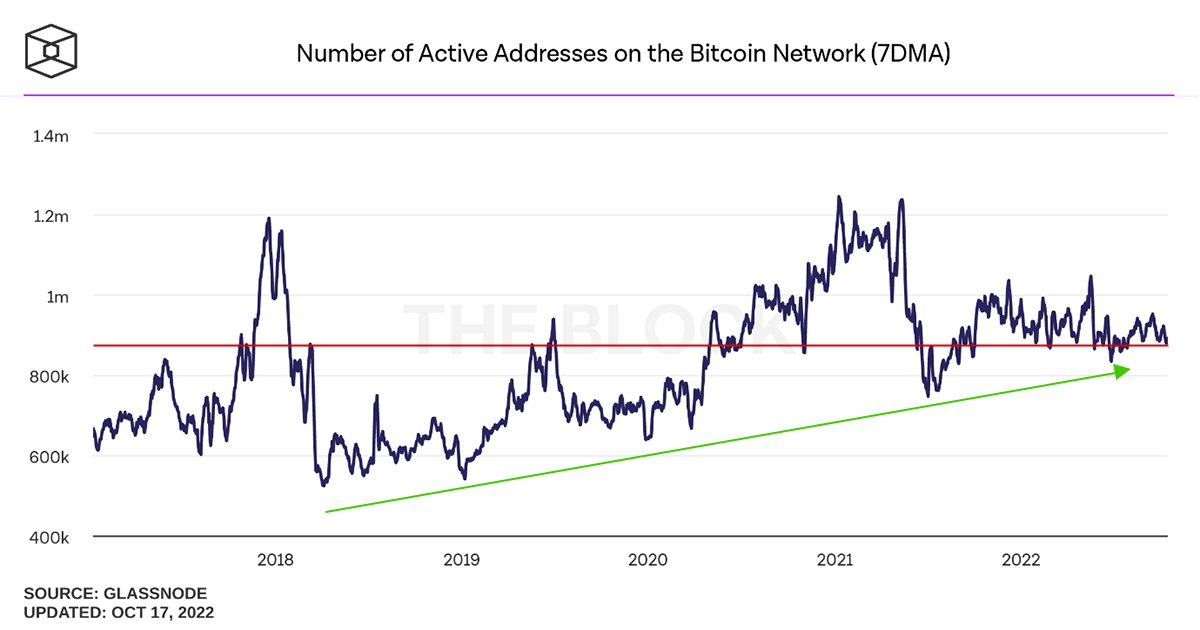

The number of active addresses is around the same level as in October 2017 (red line, above), which is over 5 years ago. This is hardly the behaviour of an exponential growth asset. In its defence, we could look at the green line trend of rising lows. Any break to the upside would be something to celebrate, but we’re still a long way from that. As a network effect asset, this explains a great deal about recent price weakness.

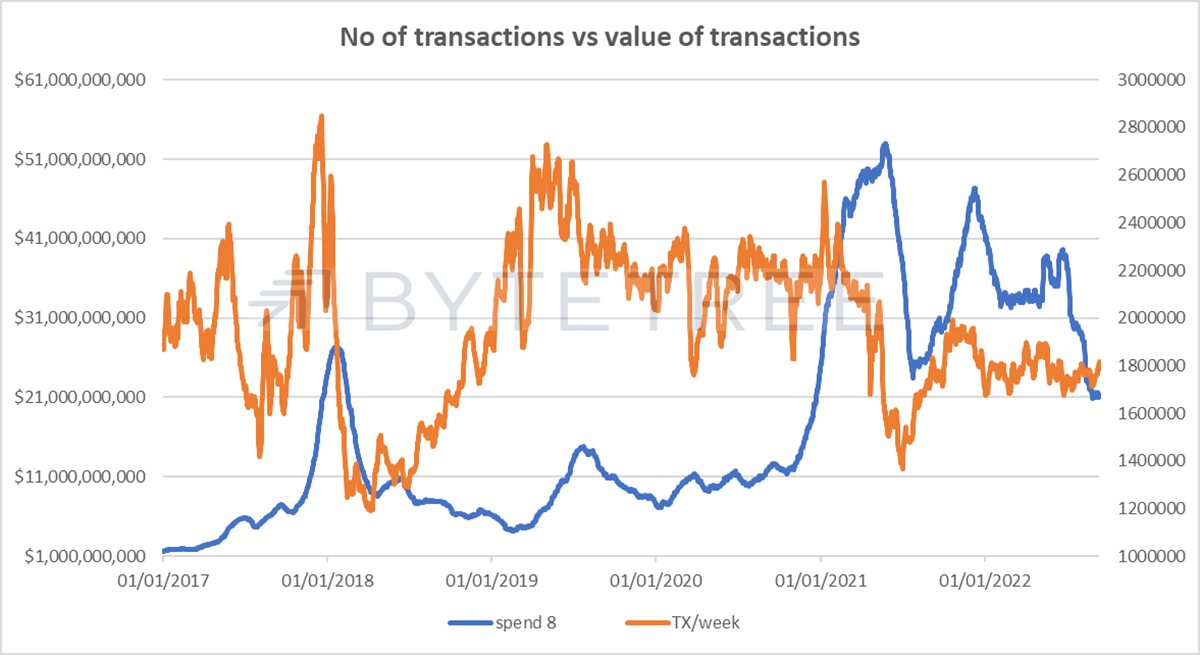

We could draw a similarly downbeat conclusion from the value transacted over the network (spend 8) and the number of transactions (TX/week), as shown below. The number of transactions has been steadily declining, while the spend is back to levels last seen in 2020.

This might not be as negative as it first appears, simply because the growth of exchanges means that much more activity happens off-chain. Also, it is easy to forget that bitcoin is a technology of money and, like all technologies, will constantly find ways of improving, which could be transformational. I will discuss this later.

On the surface, it doesn’t look like bitcoin is making a great case for another run. Yet our view remains that this epoch will echo previous ones, albeit with a lower amplitude given its scale. There are several reasons for this.

Firstly, we must understand why bitcoin adoption has been so slow. Predominantly it is because most of the world’s population is banned or heavily discouraged from owning it, let alone transacting in it. There is absolutely zero compulsion to get involved in bitcoin in the everyday course of life, unless you live in a failed or failing state, or have a deep curiosity about decentralised ledger technology (in which case you’ve probably moved beyond bitcoin), or are morbidly gloomy about the future of the world’s financial system and reckon bitcoin is the lifeboat. Mainstream institutions will not own it until they have regulatory clarity, and it struggles to get a tick in the ESG box. Sure, some family offices will stick in a toe, while hedge funds and investment banks use elaborate instruments to trade it between themselves, but the point stands – bitcoin adoption will remain marginal until the legal environment permits otherwise.

Will this change? Regulators have been slow to wrap their arms around it, which, given bitcoin’s claims to be an alternative form of money, is hardly surprising. Turkeys don’t vote for Christmas after all. Indeed, it’s one of the contradictions of the bitcoin idea – a money network celebrated for its detachment from central authority that wants to become part of, and ultimately supersede, the incumbents. Can it have it both ways? It is most likely that it becomes another tool in the investor armoury, much as gold or property are today. There is no reason why it can’t sit comfortably alongside other financial instruments.

Regulation will come at some stage and, unless it is made illegal (which seems impractical and unlikely in a free market economy), it will take bitcoin to the next step: the ability for retail investors to own it as part of a savings portfolio. That will be a quantum leap in its addressable market. The important geography in this respect is the USA, with others falling in behind. It would be a surprise not to see some sort of resolution at some stage in this epoch, if only because the potential roll-out of Central Bank Digital Currencies will both legitimise and enable wider use of the crypto architecture.

Bitcoin’s final step would be acceptance as legal tender, but short of some sort of epic fiat currency collapse, it’s incredibly hard to see this happening - even in the medium term - making it a discussion for future epochs.

This brings us to the supply/demand dynamic. It remains a source of surprise to many that at a price of US$20,000, bitcoin needs to find US$18 million of fresh money every day to soak up newly minted supply, or about US$540m per month. The next halving of that supply means the number reduces to US$270m per month or roughly US$3.24bn per year. This might seem large, but it’s peanuts in the scheme of things; interest payable on UK government debt in June 2022 alone was £19.4bn! If regulation permits wider institutional ownership, it is easy to see bitcoin being squeezed higher.

Thirdly, we need to consider the technology. Remember that “bitcoin” consists of 2 elements: the Bitcoin Network, which is the system infrastructure, and bitcoin, the unit of exchange that runs on top of it. Solutions to dramatically improve the utility of the infrastructure are being rapidly developed and deployed. The Lightning Network, which sits on top of the Bitcoin Network (known as Layer-1), enables near instantaneous peer-to-peer transactions at a vanishingly low cost. These payments can be made in fiat currencies and carried over the Lightning Network, piggybacking on the Bitcoin Network’s security and using it as a settlement protocol (analogous to paying a bar tab at the end of an evening). If this scales, then the Bitcoin Network can become a global payment network. This gives bitcoin a massive use case and immediately shifts the narrative from being “digital gold” to something far more practical (while retaining the hard money characteristics of gold).

Lastly, external macro forces will play a part. In this current tightening cycle, risk assets of all denominations have come under pressure against the US$. Depending on the durability of inflation and/or the ability of governments to tolerate lower growth, it is reasonable to suggest that we see an adjustment in the rate of change at some point in the remainder of this halving epoch. That alone would be a boost for bitcoin. As it stands, poor liquidity is already starting to clot up the financial system. If something goes wrong, it seems likely that authorities will reach for the printing presses again, precisely the conditions for a hard asset, like bitcoin, to thrive in.

In conclusion, the stars are aligning for a “three-peat” of previous halving cycle behaviour. The technology is going to make it easier to use and expand its use case, regulation will provide greater investment clarity and the punishing macro headwinds will abate. This will bring greater activity into an ecosystem which is heading for another supply shock. If that’s correct, the next few months should be the perfect time to accumulate.

Comments ()