Defending the Gold Premium

Disclaimer: Your capital is at risk. This is not investment advice.

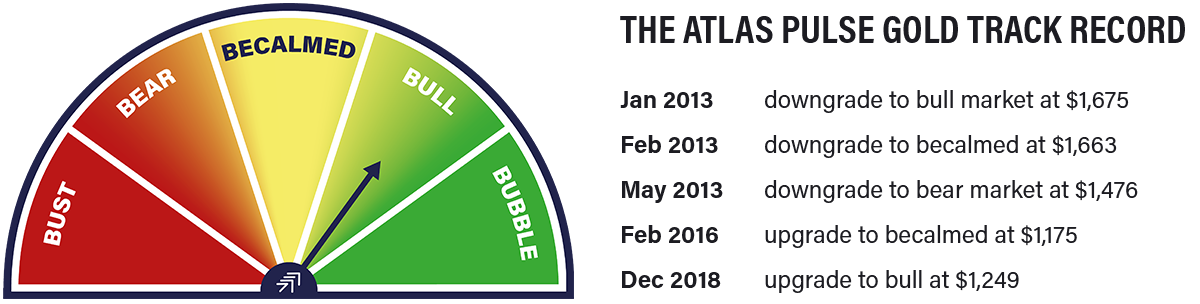

Atlas Pulse Gold Report; Issue 77

When you look around the world for a big, liquid, globally accepted safe haven, there is only one, and that is gold, which continues to reassert its status as the asset of last resort. Pre-1970, in the days of the gold standard, gold formally enjoyed this role. Today, after a 50-year break, the free market is putting gold back onto the pedestal where it belongs.

Highlights

| Macro | Momentum crash and a weaker dollar |

| Valuation | Gold is 20% overvalued |

| Regime | Headline versus Core CPI predicts the gold price |

| Flows | Central banks can’t get enough |

Before getting stuck into my latest thoughts on gold, a quick note to regular readers of the Fleet Street Letter that I have resigned. But don’t despair, I am moving all the portfolios and commentary to ByteTree.com under the title The Multi-Asset Investor. For more details, please see the note at the end.

Macro

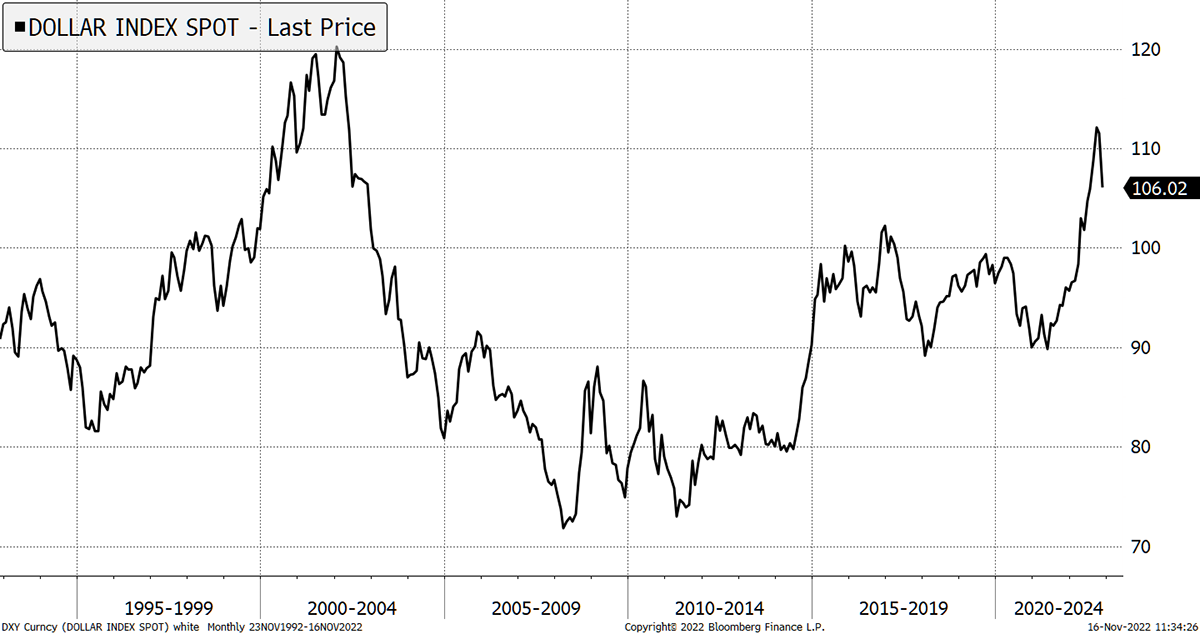

In response to ever-so-slightly-lower CPI data last Thursday, financial markets went nuts. They concluded rate hikes would slow, and that was enough to sink the dollar. As I have been saying since the summer, the dollar is overvalued, and it has likely peaked. Everybody knows that gold likes a weak dollar.

The US dollar breaks

Source: Bloomberg

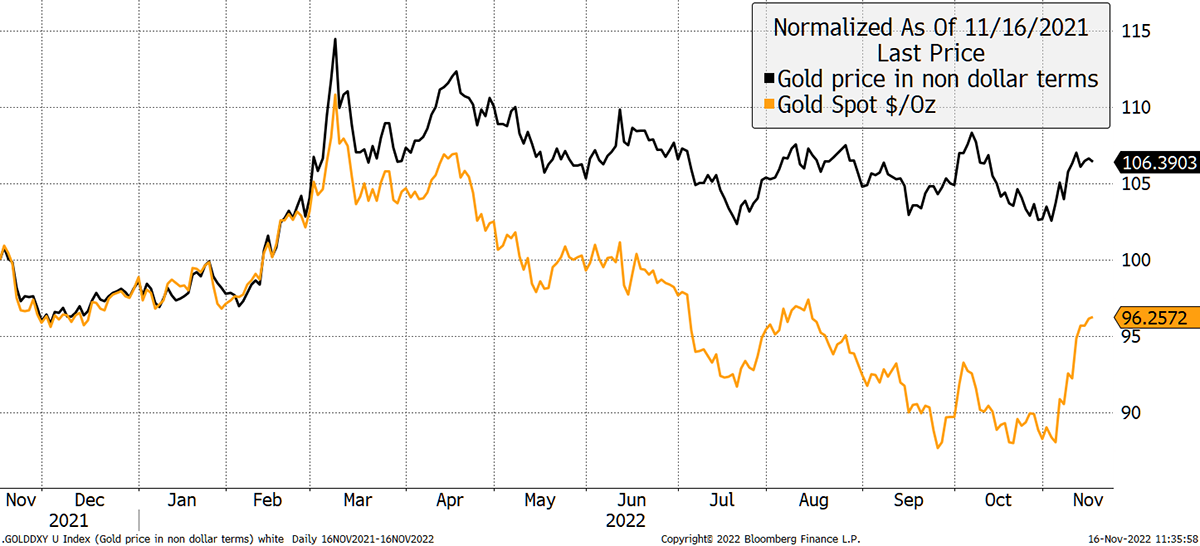

But a gold price rally in dollars is no fun when it isn’t felt everywhere. Outside of the dollar zone, no one noticed. A falling dollar alone will not lead to prosperity.

Spot the gold rally in non-dollar terms

Source: Bloomberg

Behind the dollar’s fall was lower US inflation data which implies a slowdown in rate hikes. That also caused the third-largest momentum crash in the US stockmarket on record. I recently wrote about this, and increased equity exposure as a result (more on that later).

With inflation down a little, investors celebrated that peak interest rates were in sight. They are probably right because if the Fed don’t back off, the system will break. Furthermore, lower inflation gives the Fed a reason to calm the hikes as they can say they took on the fight against inflation and won.

If the oil price can stay below $100 until February, then the contribution to inflation from energy will be zero. Food basically follows energy (tractors use diesel), and goods were already negative last month. That leaves services which are largely wages and rents. People can’t afford sky-high rents, so they will demand a wage rise and probably get one, especially if they work for the government.

The bottom line is that rate hikes caused the 2022 equity bear market, so it stands to reason that equities will be relieved when they see an end to the hikes.

The recent momentum crash has seen a sharp reversal in the prevailing trends. The former stockmarket winners have stalled (Apple, Microsoft, healthcare, defensives) but do not necessarily have to fall, while selective former losers have exploded to the upside. This often marks the end of a bear market, or, at the very least, a significant rally.

What’s important is how an asset behaves in the aftermath of a momentum crash because that gives clues to its likely performance over the next market phase. It is good news that gold recently rallied, but I would have liked it to be stronger.

It’s risk-on for markets, albeit with a twist. As usual, most will dismiss what’s happening as just another bear rally. The market rallies in March and June were mere bear rallies, but this one is accompanied by a momentum crash, which means it should be taken more seriously.

Furthermore, we can be confident that rate hikes will slow. Inflation will come down, but nowhere close to 2%. Perhaps we’ll meet in the middle, and inflation will average 4% or 5% over the next few years.

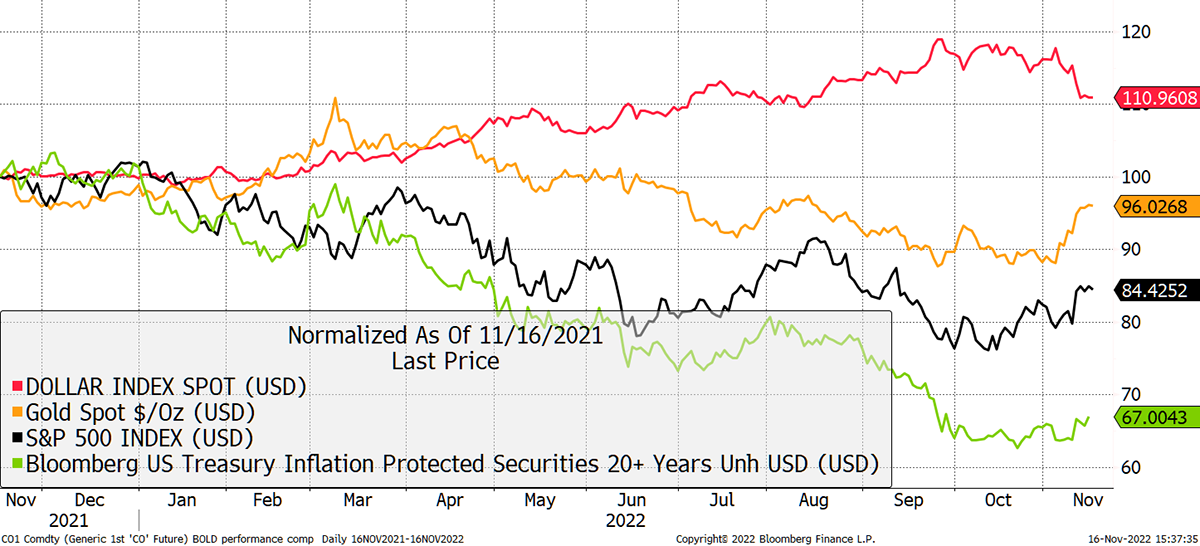

Gold is a well-known inflation hedge, yet its failure to thrive in 2022 has been noted by the media. In their opinion, gold has failed.

They might consider that gold is ahead of US Treasuries, TIPS, and equities by a sizeable margin which makes it a winner. On the other hand, it fell against the dollar, which has been unusually strong of late.

Gold has been resilient in 2022

Source: Bloomberg

The gold bugs know that the dollar is going to zero, and recent strength might have confused them. All currencies are headed for zero, just slowly, but occasionally quickly, and by design.

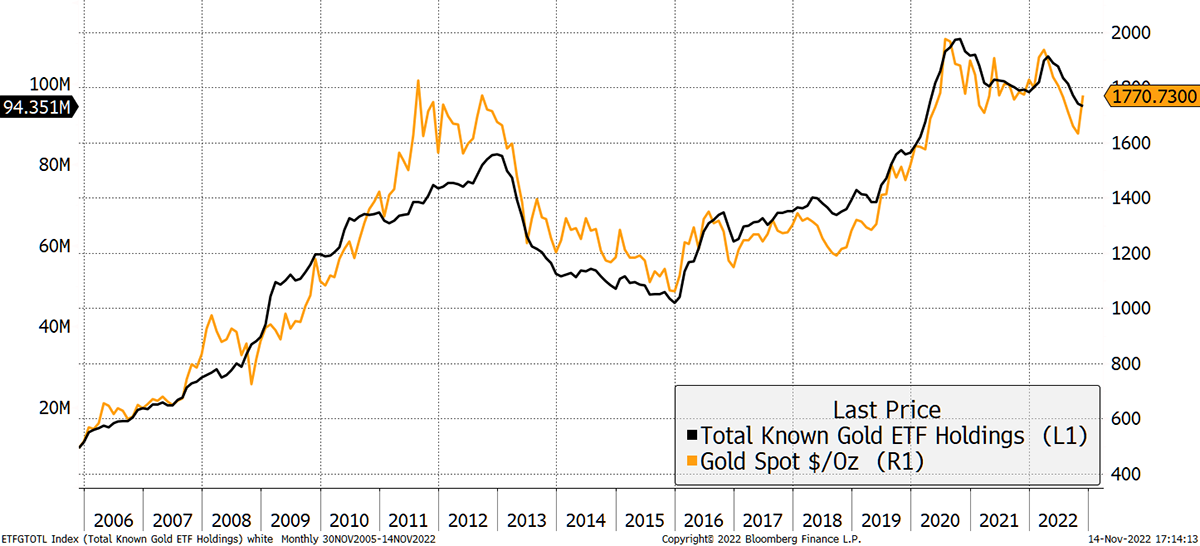

Given this perpetual tailwind, it remains a mystery why investors have been selling gold so aggressively, to the tune of 17 million ounces that have left the ETF vaults.

Gold and investment flows have been highly correlated

Source: Bloomberg

It is a strange time to be dumping gold when uncertainty has been so high. What did they buy with the proceeds? ARKK? Bitcoin? TIPS? Whatever it was, it must have been worse.

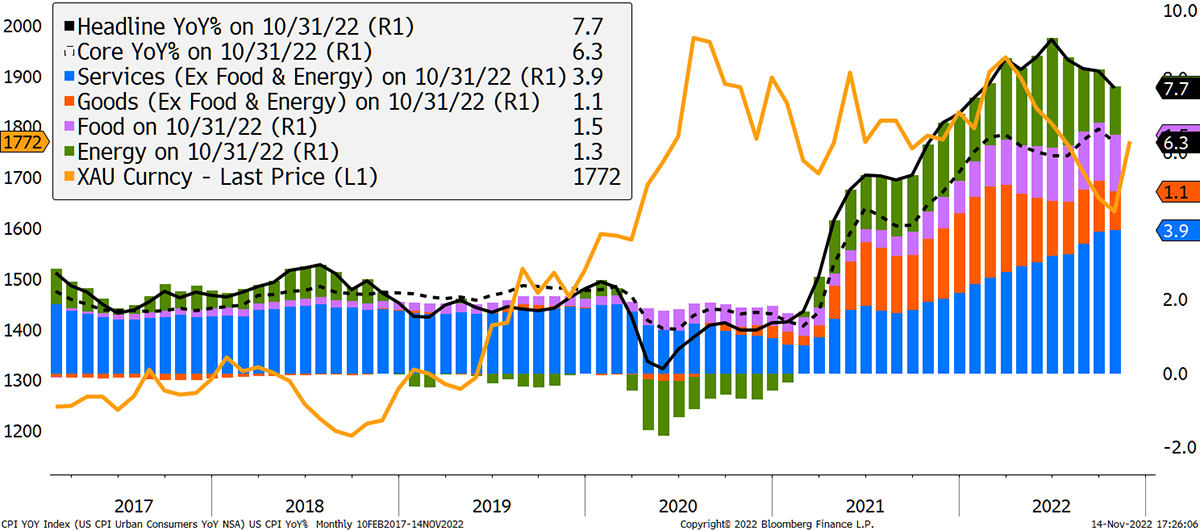

Protection against a collapse in fiat currencies is the same as an inflation hedge. I have proof that gold is on the right side of this. In observing the CPI (Consumer Price Index) data, I wondered if gold did better when headline CPI was greater than core CPI. Or not.

Gold the inflation hedge

Source: Bloomberg

Core inflation is headline inflation minus food and energy. Core inflation takes out the racy stuff and gives a better structural picture.

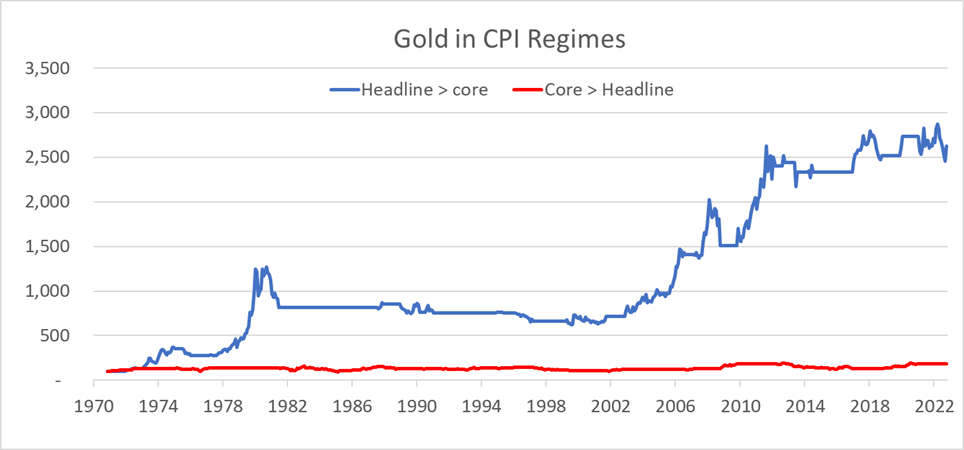

In the test, the blue line shows the performance of holding gold when headline inflation is greater than core inflation, and the red line vice versa. In simple terms, gold does much better when food and energy prices are rising more than goods and services.

Source: ByteTree, Bloomberg

It’s one hell of a difference from a simple observation. $100 invested in gold when headline CPI was greater than core CPI became $2,623, and just $180 when core was greater than headline.

For reference, the scenarios were evenly split across time, meaning that you don’t need to own gold half the time. Currently, headline CPI is greater than core CPI, so our simple model would suggest remaining long gold. Maybe it’s obvious that gold likes rising commodity prices.

Some say gold failed as an inflation hedge over the past two years. I say gold saw it all coming. Not the virus per se, but the inevitable outcome of sustained negative real interest rates and easy money. After all, gold rallied from $1,200 to $2,000, with much of it occurring after the word covid (literally) went viral.

Valuation

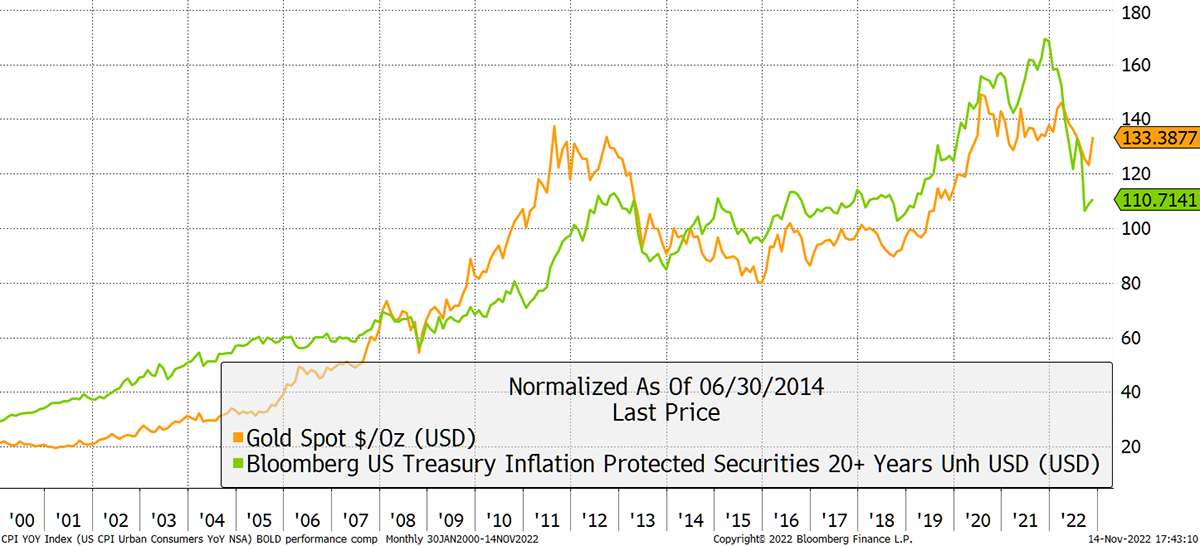

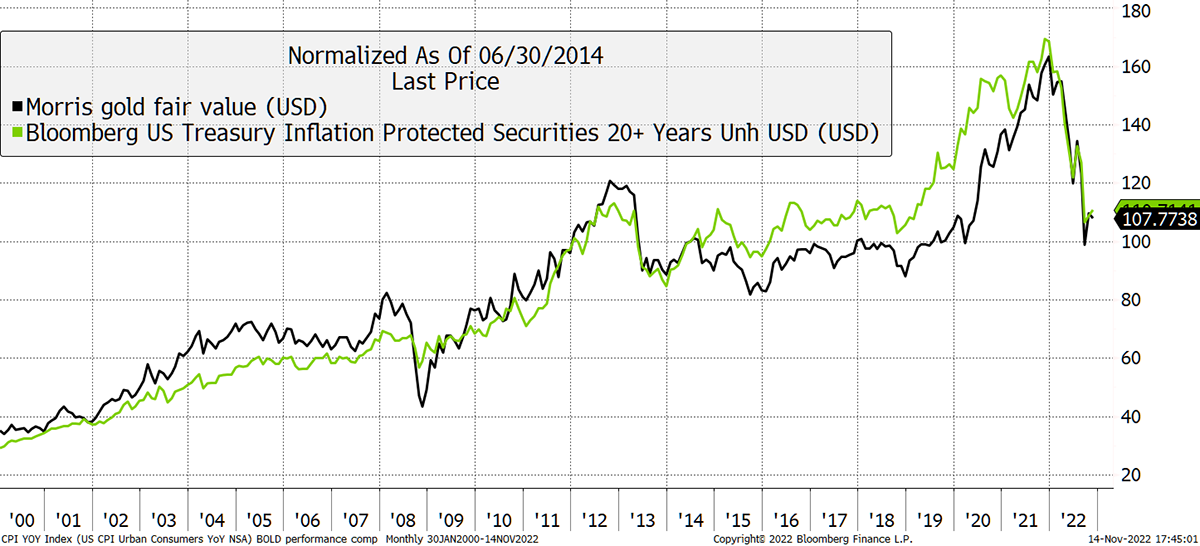

Gold has fallen 5% over the past year when US TIPS have fallen by 34%. Normally these asset classes are aligned. TIPS have an income stream, albeit modest, but it adds up over 22 years.

Gold has beaten 15+ TIPS

Source: Bloomberg

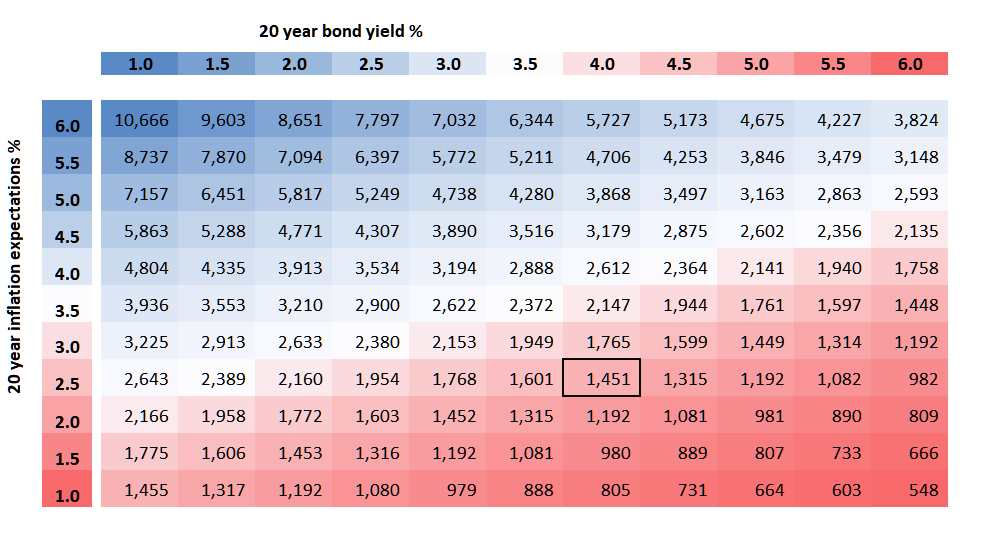

I have long said that gold is a 20-year TIPS and modelled it accordingly. That is because there is a volatility match. Both 20-year TIPS and gold have long-term volatility of around 15%. A 10-year bond is too calm, and a 30-year bond is too volatile; 20 years fits nicely.

The chart above was normalised in 2014, a time my gold valuation model below suggested gold traded at fair value. The differences between the model and the TIPS Index are the model has no income and duration is a constant 20 years. The 20+ TIPS index will face real-life issues as different bonds have different characteristics.

ByteTree’s gold fair value model mimics 20-year TIPS

Source: Bloomberg

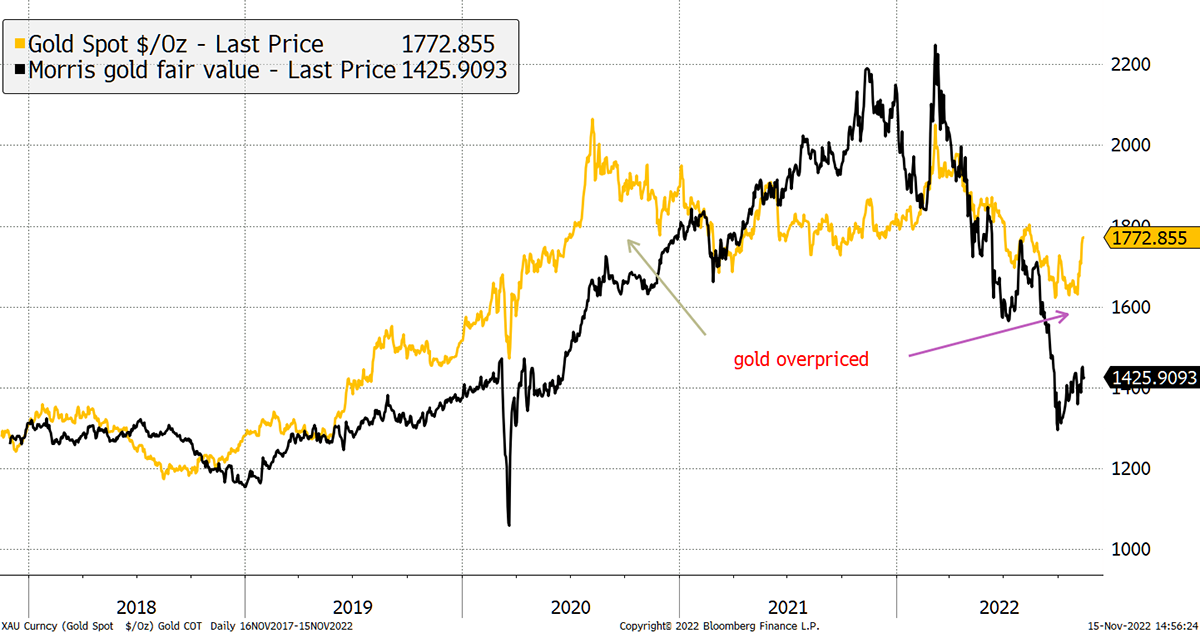

My gold model shows that gold is trading at a 23% premium to fair value (or TIPS). To put it another way, if you simply want inflation protection, then TIPS are currently better value than gold.

Gold risk is that it is highly priced

Source: Bloomberg

You might think the gold ETF investors, who dumped 17 million ounces, were smart cookies who switched to TIPS, but they didn’t. TIPS ETFs have seen heavy outflows. Investors seem to have dumped inflation protection assets en masse.

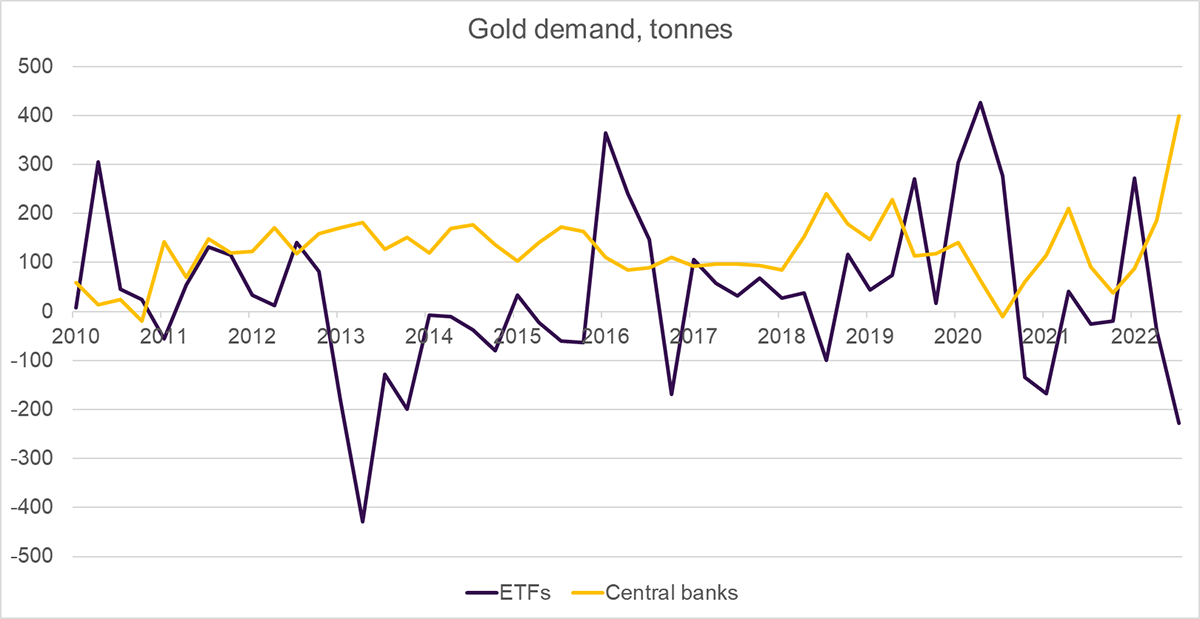

The remarkable thing about gold is how it has held up so well despite being dumped by investors. Unlike most assets, it has the central banks on its side. In the last quarter, the central banks purchased a record 399.3 tonnes of gold, as reported by the World Gold Council. The largest purchases came from Turkey, Uzbekistan, and Qatar. This demand surge has more than offset the outflows from the ETFs.

Source: World Gold Council

It is easy to see why Turkey is buying gold: their inflation is 85%, yet their currency is only down 29% this year. This explains why the Istanbul stockmarket is surging, and there is an opportunity for them to accumulate gold on the cheap. At some point, the Lira will inevitably plunge again, so best they make hay while the sun shines.

The central banks used the recent weakness in ETFs as an opportunity to accumulate gold. I like their contrarian behaviour, shrugging off the taper tantrum of 2013 and avoiding the hype in 2020. This time they have surpassed themselves.

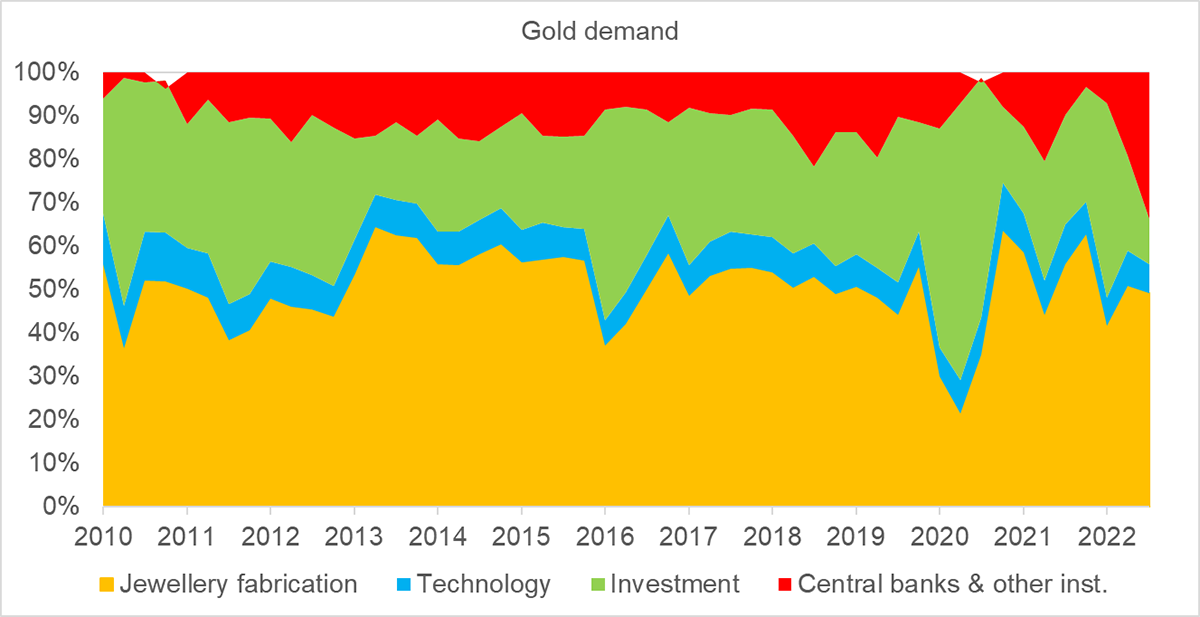

The central banks normally purchase around 10% of the new gold supply, but this has recently surged to around 30%. Jewellery and tech demand is generally economically cyclical, with investment and central bank demand more counter-cyclical. This natural stability is unique to gold and helps to explain its low volatility and subsequent deep liquidity.

Source: World Gold Council

It is understandable why the central banks have ignored the gold premium and kept on buying. You could say that gold is currently rich versus TIPS, or, alternatively, that TIPS trade at a discount to gold because the world has changed.

The war in Ukraine has turned asset confiscation into a weapon. If there is a central bank out there that wants to give me a job, I promise to avoid US Treasuries and stick with gold – while embracing the premium.

When you look around the world for a big, liquid, globally accepted safe haven, there is only one, and that is gold, which continues to reassert its status as the asset of last resort. Pre-1970, in the days of the gold standard, gold formally enjoyed this role. Today, after a 50-year break, the free market is putting gold back onto the pedestal where it belongs.

The central bankers in the developed world do not understand this. They think gold is a barbarous relic and hold it for “tradition” (Mark Carney actually said that). Yet the central banks in the emerging world keep on accumulating gold, and, since 2010, at an ever-increasing rate.

How else should they invest their reserves? The choice must be big, liquid, risk-free, and globally accepted. Bitcoin is still trying to slip onto the list but is still struggling with the risk-free part. We shall revisit this in a decade.

Defending the gold premium

Having established that gold trades at a premium to TIPS, we need to understand whether that is a risk or a structural change.

Gold is a high-quality asset, and today many high-quality assets trade at a premium. Large blue-chip stocks typically trade at higher valuations than their mid cap counterparts, as they have greater certainty and liquidity. Two years ago, government bonds traded at a staggering premium to any sort of reasonable measure of value, which has since broken down. Premiums do not last forever. Is gold at risk of that too?

Saying that gold behaves like a 20-year TIPS is uncontroversial as it fits like a glove and smacks of logic. What is more questionable is the calibration between the assets.

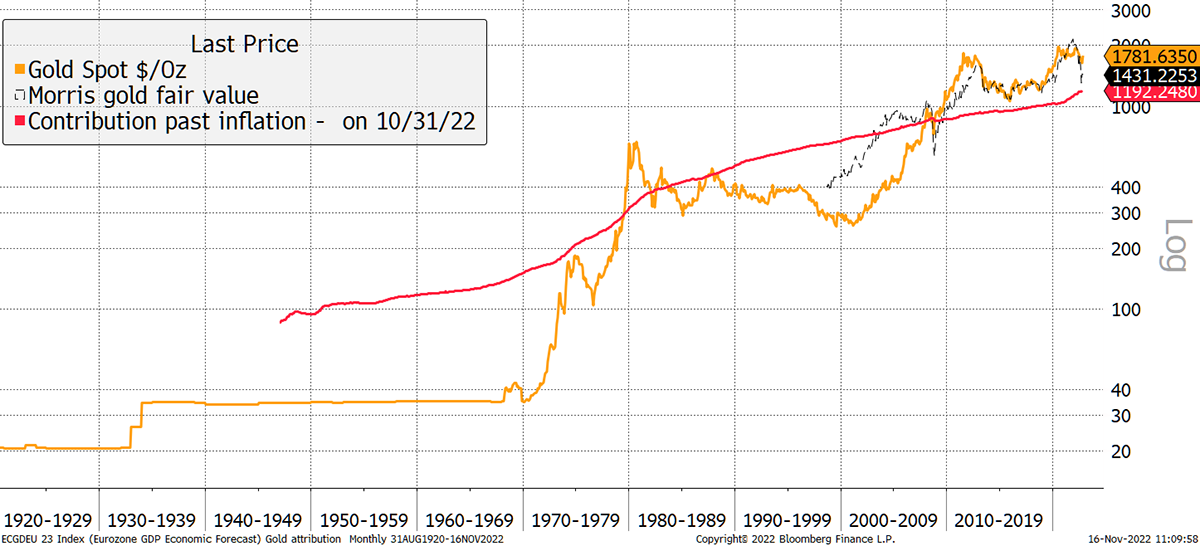

Since 2007, my fair value model has explained much of the gold price. I had always put down the cheapness in 2000 to the end of a 20-year bear market, where gold traded at $255 when the model called for $400. A big discount after a prolonged bear? Why not.

If true, the strength into 2007 was simply catch up. This is justifiable given the extremities of the gold market in the late 1990s, a time of its brief irrelevance.

Calibrating the gold price

Source: Bloomberg

Gold should cross the red CPI line (CPI with a multiplier of 4) when the 20-year bond yield is twice the level of the 20-year breakeven, which was briefly the case between 2007 and 2009.

The gold price crossed the redline in late 1979, when the bond yield was 10.2%. If gold was fairly valued at the time, it implies the 20-year breakeven was around 5.1%. If we had a 5.1% breakeven rate today, which is roughly the level seen in Brazil, the current gold price would be around $4,000. Suddenly the gold premium just evaporated – and then some.

Source: ByteTree

A pickup in inflation expectations would rightly see gold soar, but I have become more sceptical about the ability of breakeven rates to forecast inflation. They seem to get the direction and timing right, but the levels are more doubtful.

Things change over time, and we rightly assume that an uncertain world demands a higher gold price. Calibrating and periodically re-calibrating gold within our TIPS framework is the challenge. Does the global money supply matter? The population, total wealth and so on? I suspect many things will have an impact, and we need to be flexible when calibrating assets without a natural anchor.

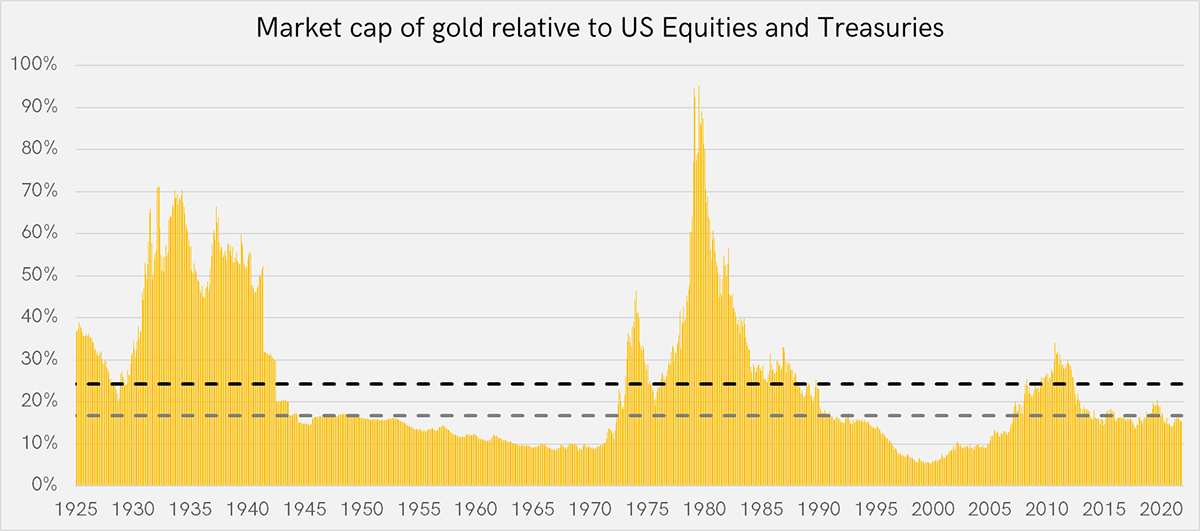

The next chart suggests there is no premium, and gold is probably undervalued. I have compared the value of the world’s gold (total mined) to the value of US government bonds and equities combined over the past century. The value is 15.4% in contrast to the median (grey) of 16.8% and the mean (black) of 24.2%. The 50-year cycle looks for another high in 2030, which works out well for my $7,000 price forecast.

Source: Bloomberg, ByteTree, World Gold Council

The Multi-Asset Investor

I have spent a thoroughly enjoyable seven years as the Editor of the Fleet Street Letter and have decided to dedicate myself to ByteTree full-time. That meant moving across my work, which I will continue to write for ByteTree Research under the new name “The Multi-Asset Investor”. Yesterday, I covered the recent momentum crash.

I will continue to manage the Whisky and Soda Portfolios, which have performed well since inception in 2016. I will also be keeping readers informed on market events, making recommendations and answering questions.

Soda is a balanced portfolio with a strong focus on risk management. It invests in investment trusts, mainstream ETFs, bonds and gold. Whisky comprises FTSE 350 stocks and non-core ETFs (sectors, themes, commodities, EMs). Both portfolios have performed well, and you can see performance data and learn more.

Summary

Gold is trading at a premium to TIPS that may or may not be deserved. Intuitively we stand by it because the world economy is a bigger place, and more countries have more demand for gold. The developed world sits in the past - still believing in their fiat monetary system. In the meantime, the emerging world already knows of its flaws.

Despite my model showing it, I suspect gold isn’t trading at such a hefty premium because the world has changed. The challenge is recalibration, not just of our models, but the entire financial system. That’s why they call it the great reset.

Comments ()