ATOMIC 72

It’s been a traumatic week in crypto markets, but the collapse of FTX will force the space to improve standards. Meanwhile, the worst of the macro looks behind us, and the on-chain activity is improving. The next group of leaders are starting to reveal themselves.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Change of leadership? |

| On-chain | Miner capitulation |

| Macro | Dollar relief |

| Investment Flows | Holding for the long-term |

| Cryptonomy | FTX will pass, crisis reveals leaders |

Technical

As the collapse of FTX plunges us into another crypto wobble, it’s worth noting that bitcoin hasn’t been as defensive relative to the rest of crypto as in the May/June collapse earlier this year. So far.

You can see in the chart below, which measures ETH in BTC, that in the first half of this year, as crypto came under pressure firstly from the macro and secondly from the Luna collapse, that bitcoin was a port in the storm (in crypto terms at least).

Ethereum priced in Bitcoin

Source: CoinMarketCap, 10/11/22

Obviously, we are early into this particular episode, and it is right to be nervous about aftershocks. But the bigger picture is intriguing. If ETH holds up, it sends a message that investors are not fleeing the space but are continuing to accumulate the strongest long-term assets. After all, the collapse of a crypto exchange doesn’t make crypto a “bad thing” any more than the failure of an equity exchange makes equities a bad idea.

Crypto is full of bad actors and ill-disciplined; we know this. In 12 months’ time, we will have forgotten about FTX and moved on. However, because of the forced selling induced by the FTX collapse, long-term investors are right to treat these moments of stress as an opportunity.

Perhaps we should also be a bit concerned about the behaviour of bitcoin. As the most pristine asset in the space, you would hope that it would hold up a bit stronger. Clues as to why it might have suffered more than expected can be found in the on-chain data.

On-Chain

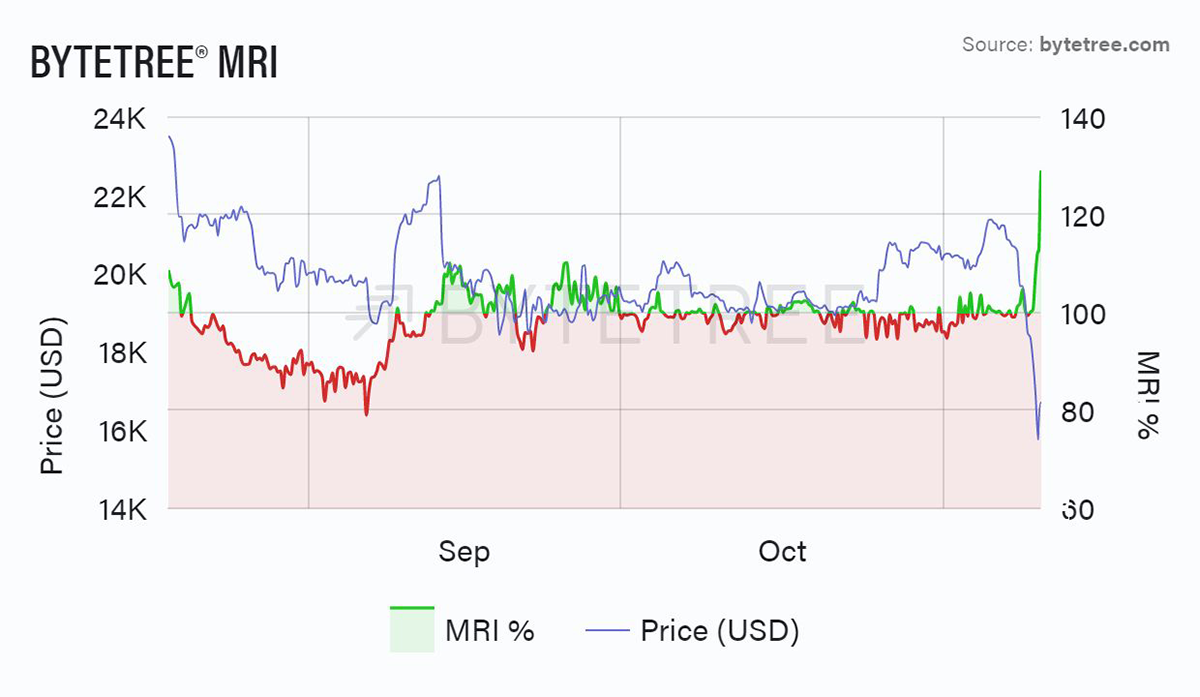

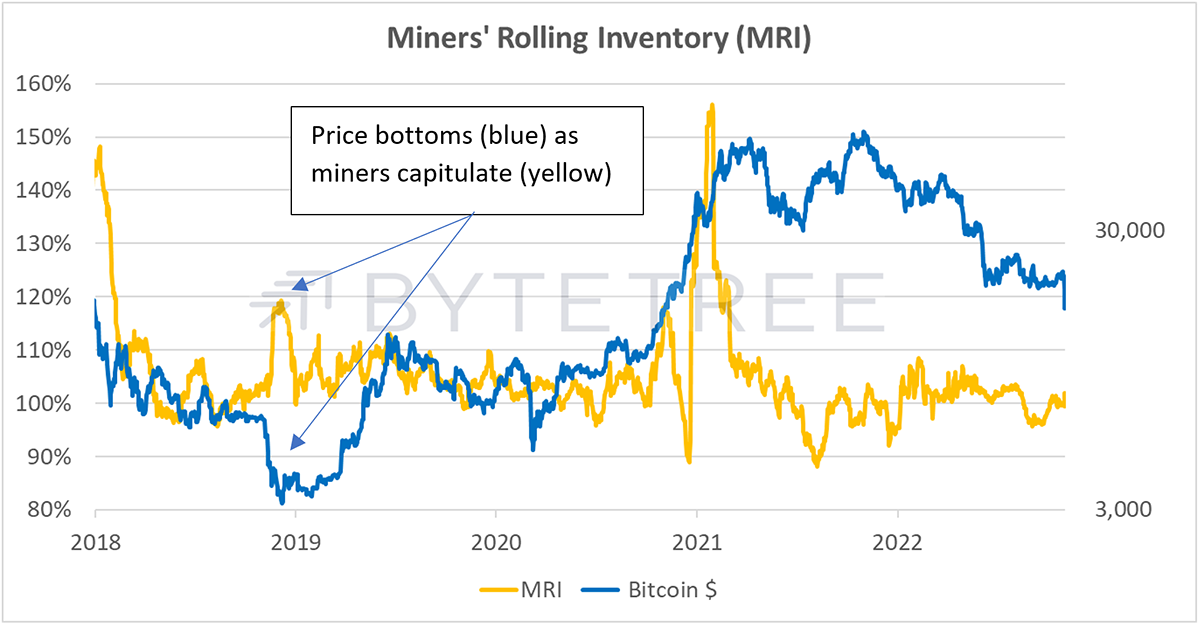

There has been a big spike in First Spend. First Spend is a measure of coins that have been mined but never moved, so it’s a strong proxy for miner behaviour. We can see this in the chart below, which shows Miner’s Rolling Inventory (MRI). Quite clearly, someone has pushed the sell button as the bitcoin price cracked down below US$18,000. Why? Almost certainly because they need the money – they are forced sellers.

There will be another harsh lesson learned by the miners in this bear market: they are not investment experts. A miner’s business is mining, and, if run properly, they should sell what they mine, not speculate on it. You would expect this from any other commodity producer.

Source: ByteTree. Miner’s Rolling Inventory (%) and bitcoin price (USD) over the past three months.

However, because bitcoin miners think they are investment experts, their behaviour might give a useful clue as to when the market capitulates. It certainly did in 2018, as shown in the graph below. Note that we don’t see a recent spike in the yellow data series below because MRI is calculated using a 42-day moving average of First Spend. But if this pattern continues, we will see inventory continue to drop.

Source: ByteTree.

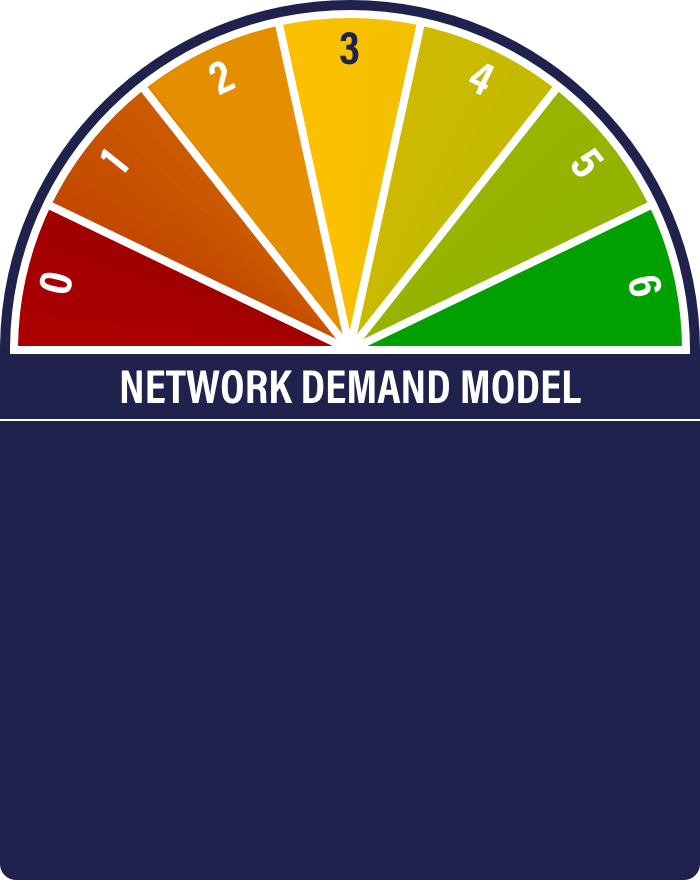

Lastly, the Network Demand Model, which has been generally grumpy since May 2021, remains on 2/6. Dare one say it, but it is looking perkier. Short-term transaction and velocity remain on (velocity has just jumped again, as it tends to in moments of stress), but in addition to a recovery in MRI (as just explained), it’s interesting to see that the fee signals may be coming back to life.

{% include ndm-gauge.html needle-main=”2” needle-sub=”1” label=”2-up” txvalue-long=”off” txvalue-short=”on” fees-long=”off” fees-short=”off” velocity=”on” mri=”off” %}

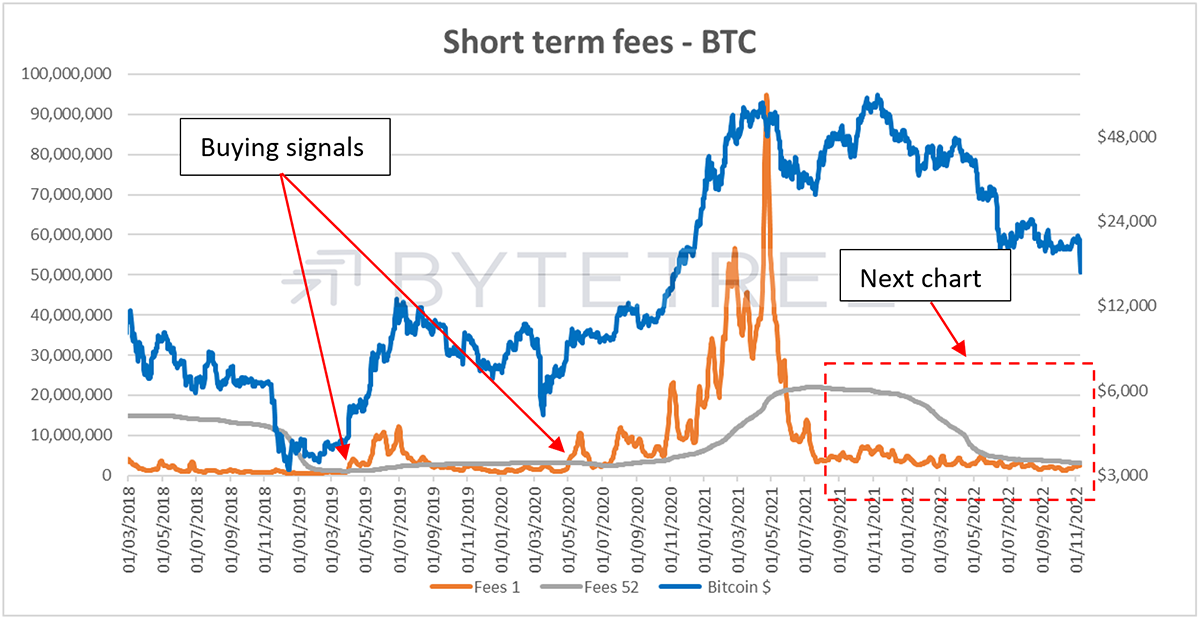

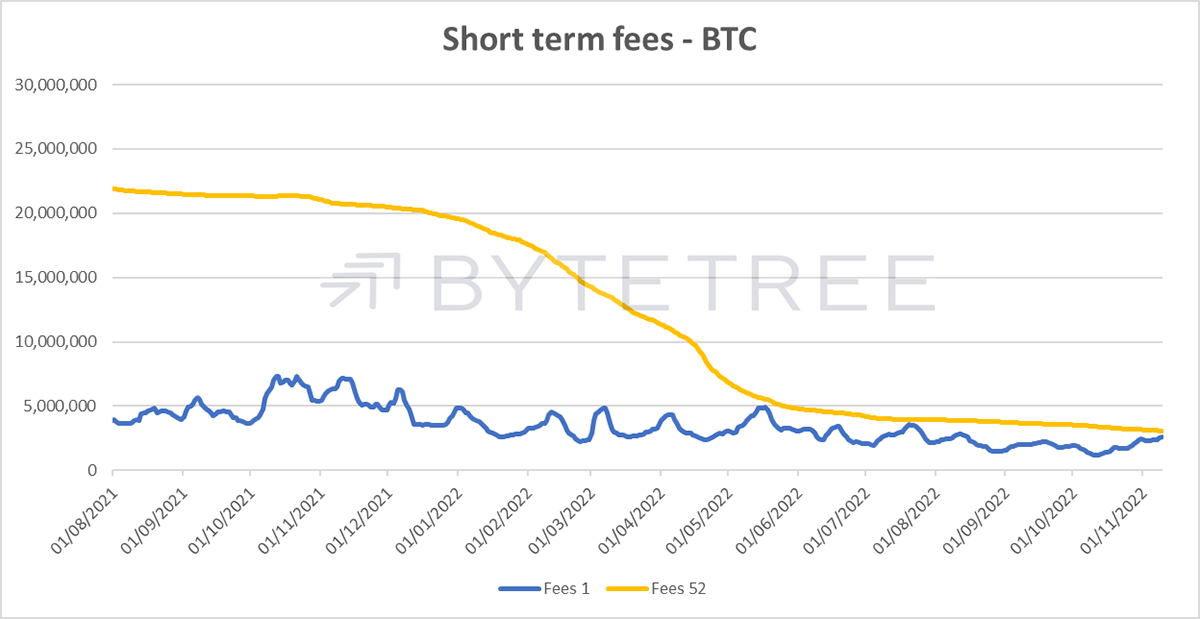

Historically fees have been a powerful guide as to when we emerge from the bear, as you can see from the charts below, showing the short-term fee signal. Fees have been moribund for an age, but at some stage, they’ll give us a good sense of when things are getting better. Judging by the zoomed-in second chart, that might not be far away.

Source: ByteTree.

Source: ByteTree.

Macro

Our view that the US dollar has been mightily over-extended has been vindicated following today’s US CPI print. The October number has risen 0.4% MoM and 7.7% YoY, against expectations of 0.6% and 7.9% respectively, triggering a big relief rally in risk assets and currencies. In the few minutes since the announcement and writing this, crypto has been borne along with the tide.

Questions will now be asked about whether this is temporary relief in a structurally inflationary environment, or whether the Fed has made yet another major policy error and has already over-tightened. For what it’s worth, our view tends toward the latter. Property markets have already been drastically impacted by higher rates, while prices of just about everything have already been coming down, including energy. Outside the public sector, it’s surely hard to find many with enough bargaining power to expect a big pay rise, particularly with lay-offs accelerating across the tech sector, for example. If this is right, we are getting very close to the end of this tightening cycle. That should be positive for crypto.

If the Fed is making a mistake, it’s also vindication for those who argue for bitcoin as an alternative, rules-based monetary system. How long can the rest of the world tolerate the errors and unintended consequences of the decisions made by a small group of economists in Washington?

Investment Flows

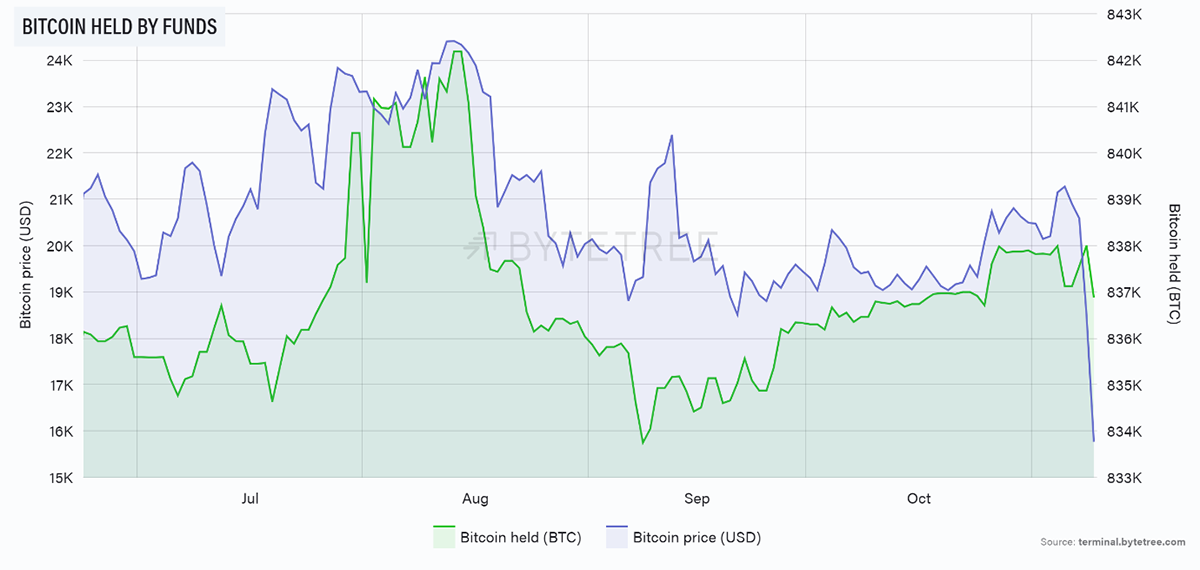

There’s been a bit of BTC selling in the wake of the FTX news, but it’s tiny. The resilience of investors at this point in the market is highly encouraging. The same applies to Ethereum holdings.

Source: ByteTree. BTC held by funds (BTC) and bitcoin price (USD) over the past six months.

Source: ByteTree. ETH held by funds (ETH) and the price of ETH (USD) over the past three months.

Cryptonomy

Firstly, a hat-tip to the ByteFolio team. The single action point in Monday’s ByteFolio update was to sell FTT. We didn’t know how bad this episode would be, but our process told us to sell. I hope that saved a few readers their annual subscription.

The all-consuming news at the moment is of course the collapse of FTX. We posted about our initial thoughts yesterday, most of which I stick with, although on reflection, it’s pretty unlikely an alternative buyer will be found now that Binance doesn’t want it. Still, this is crypto, and anything’s possible.

Our central case is that everything that tends to go wrong in crypto is a bad habit imported from traditional finance. Over-leveraging, inter-company lending, lack of transparency, liquidity mismatches, and so on. There are almost always inadequate risk controls because organisational power is overly centralised. The great irony is that crypto is ideologically a reaction against centralisation. This is one of the beauties of Bitcoin. Anyhow, another lesson learnt and one we hope crypto learns from too.

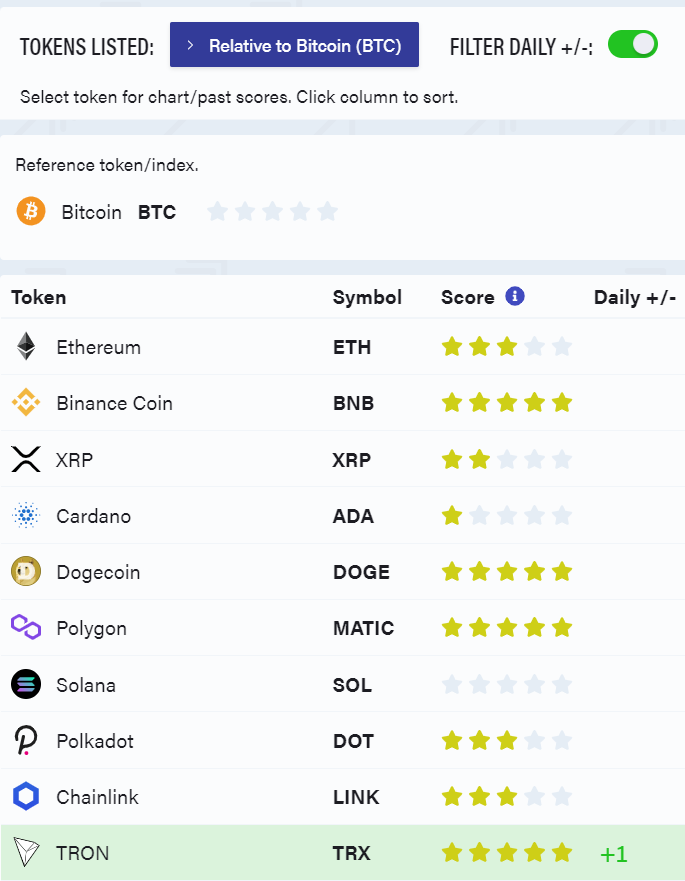

ByteTrend

This is a good time to be glued to ByteTrend. While the world frets about FTX, this is the moment to see which coins and tokens are outperforming. Just taking the top 10 by market cap, below, it’s great to see that so many stars remain on. Contrary to what you might be feeling about crypto at the moment, this is a market behaving rationally. Babies are not being thrown out with the bathwater.

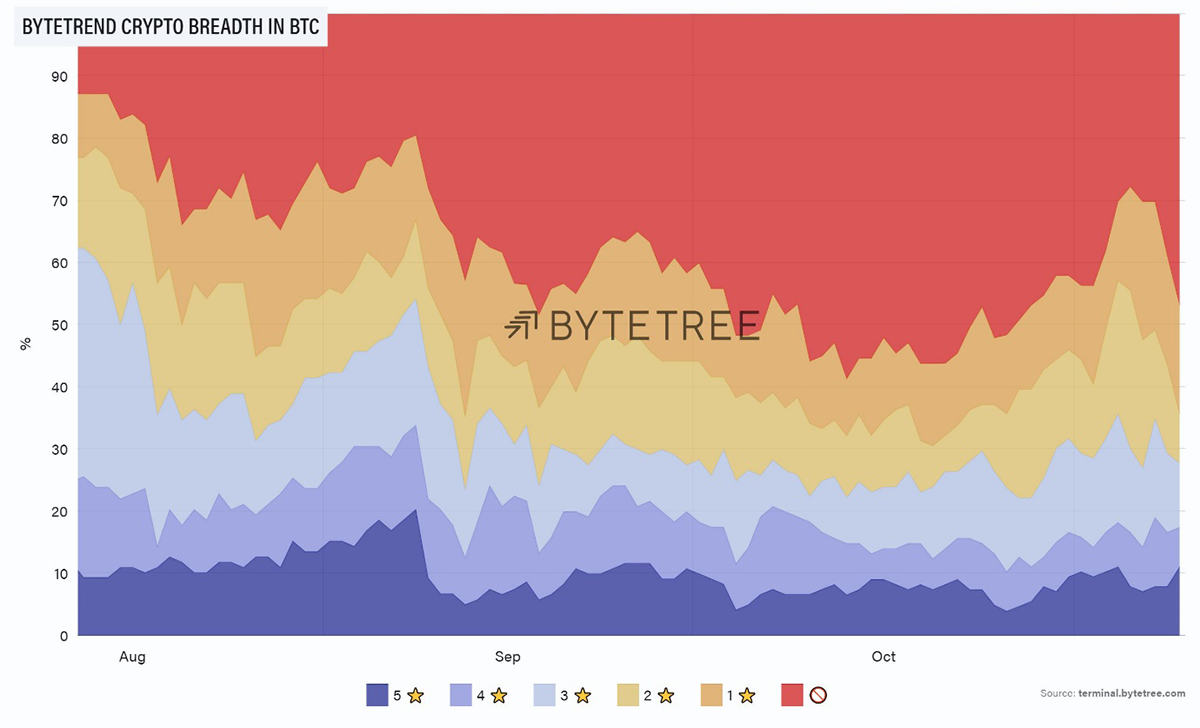

This is backed up by the breadth chart, below, which is further evidence of dispersion in the sector. Note that while the red sky just got larger, so did the dark blue sea. There are actually more 5-stars against BTC coming out of this sell-off than going in, which is unusual. The rubbish is being left behind while the leadership is coming into greater focus. Particularly notable is the performance of MATIC, the token of Polygon, a Layer-1 Ethereum scaling solution. Super-interesting.

Source: ByteTree. ByteTrend crypto breadth chart, in BTC, for the top 100 crypto tokens over the past three months.

Summary

It’s important to remember that what has happened to FTX isn’t the fault of bitcoin. In the same way that drug money laundered in US dollar bills isn’t the fault of the dollar bill. Crypto will recover from this, FTX won’t. Most people will have forgotten about FTX in 12 months.