The Smart Money Switches from Tech to Biotech

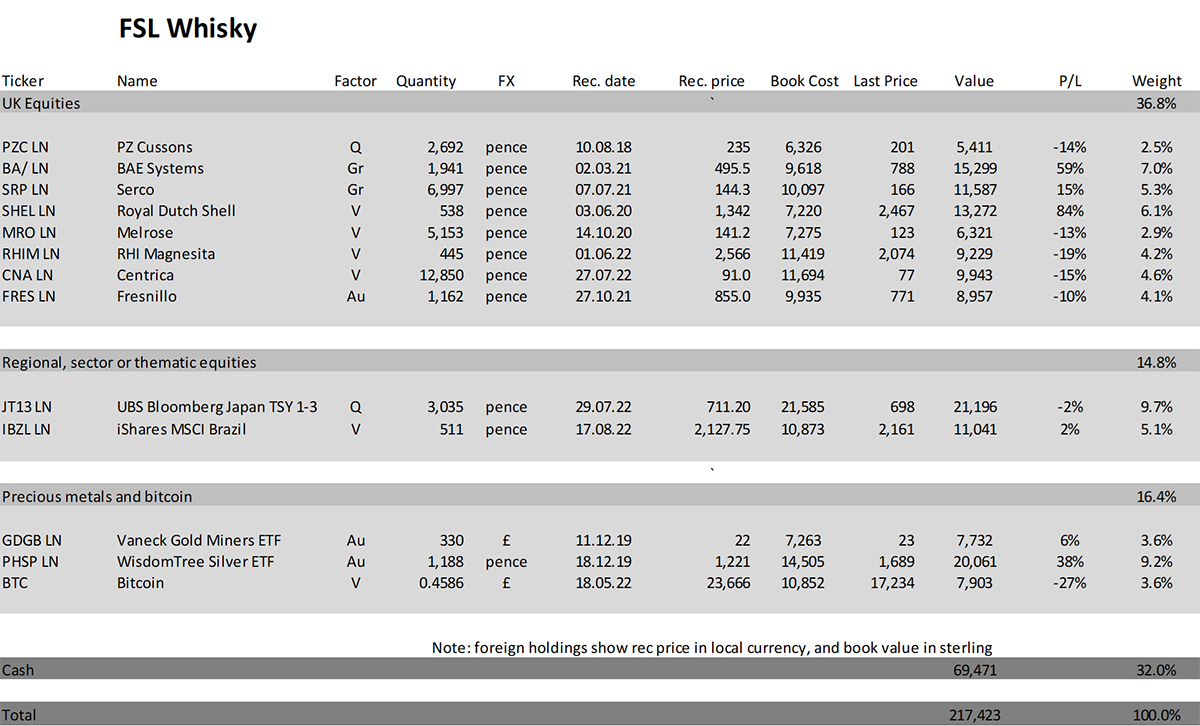

Trade in the Whisky Portfolio

There is good news in the everything bubble. The unwind of market excesses is now well underway, and in certain areas of the market, evidence grows that the worst may be behind us. Last week, I looked at UK commercial property with the idea that while the price of buildings may remain under pressure, REITS have sold off too much and subsequently offer good value.

This week I turn to healthcare, or more specifically biotech, where the market has been treading water for seven years following the 2015 bubble. The sector today looks to be in good health, with attractive valuations, and the time has come to embrace it.

In markets more generally, there has been noticeable strength appearing in crypto, precious metals, and several value stocks, such as Rolls Royce (RR), have started to perform. Driving this is the sense that the dollar has peaked, which brings relief as the pace of the rate hikes has peaked (the pace, not the level).

These are encouraging signs, and we have survived the autumn crash season (many of the great crashes were in October), and I repeat, the worst of the tightening is behind us. For the first time in a while, the bull case has become a little stronger.

The Bull Case: Peak Interest Rates Are Within Sight

Our central bankers will soften their fight against inflation. There will still be more rate hikes, but the pace and scale of the moves will slow down. I know that because they have told us, and that is why the dollar has cooled.

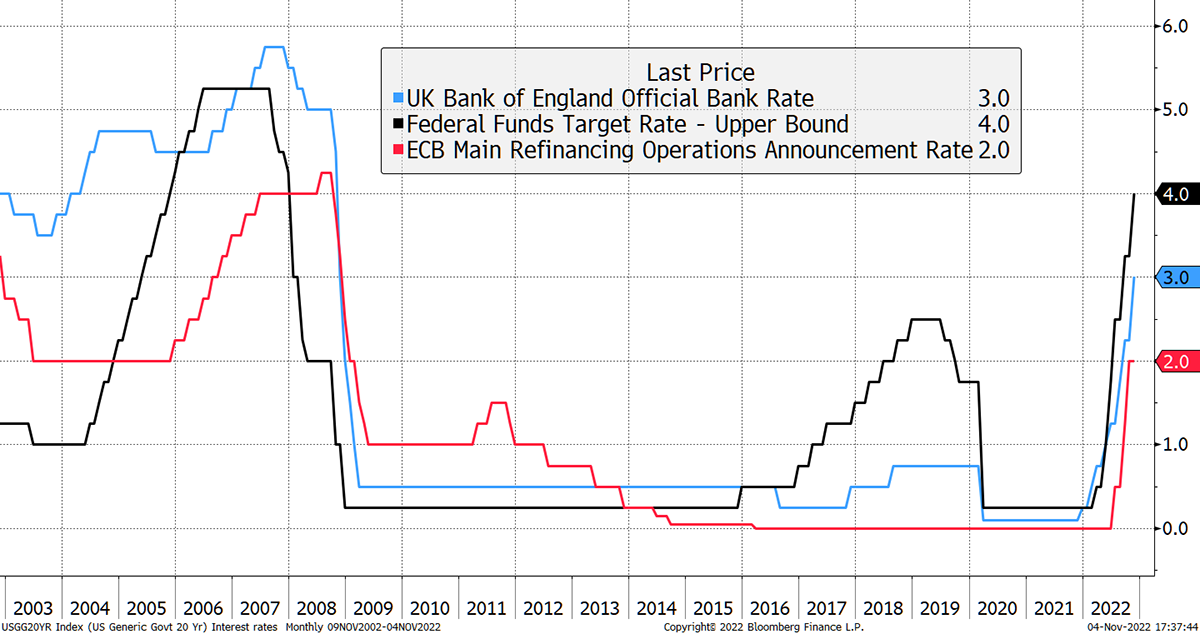

Last week, the Federal Reserve hiked interest rates to 4%, the Bank of England to 3%, and the previous week, the ECB hiked to 2%. A year ago, rates were zero across the board, and now they have already risen above the 15-year average.

Andrew Smithers, the renowned market strategist, always said that it wasn’t the level of interest rates that mattered, as the system would adjust within 12 to 18 months, it was the speed of change. Investors have never seen anything like 2022 before.

Not Just the Level of Interest Rates but the Pace of Change

Source: Bloomberg

The good news is that everything we were right to worry about in recent years has happened. As predicted, the bond market has crashed. By heavily steering clear of bonds and bond-like stocks, the portfolios have pulled through 2022 in good shape.

The Bear Case: Big Tech Has More Pain to Come

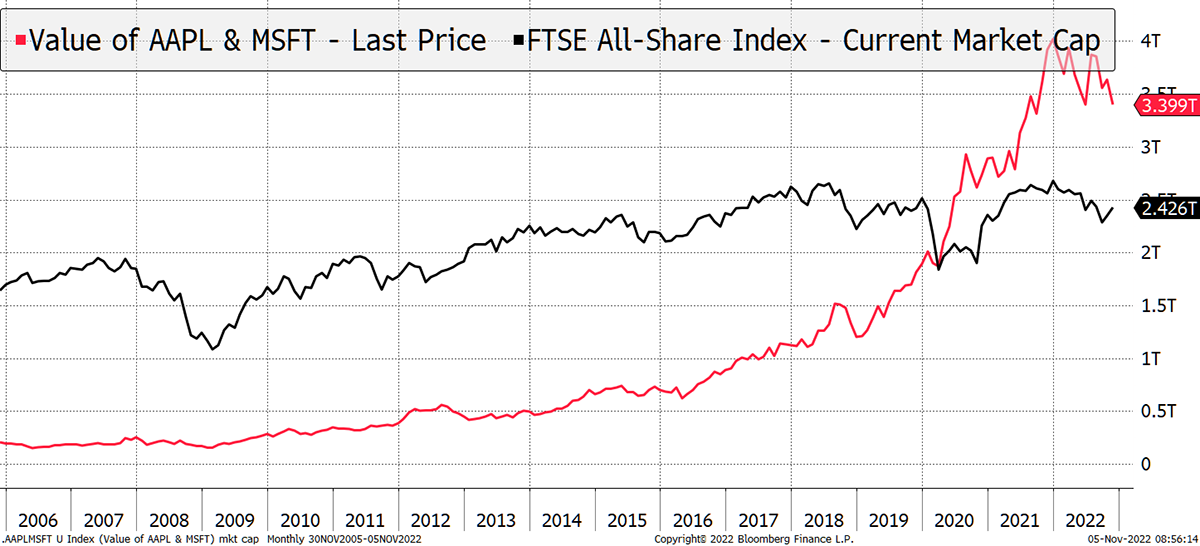

Much of the work to normalise the stockmarket is complete, but there are still unrealistic pockets of excess. With so many tech stocks down significantly, the two that stand out are Apple and Microsoft (AppSoft). Combined, they are worth more than the entire UK stockmarket.

AppSoft Are More Valuable Than the FTSE All Share

Source: Bloomberg

AppSoft are great companies, but that is ridiculous. They made $150bn of profits last year, which is remarkable, but the FTSE All Share made $265bn across 593 companies. More profits at a lower price simply means the UK market offers better value than AppSoft. More to the point, the FTSE is diversified, and, as a result, performance is unlikely to shine, but at the same time, less likely to flounder. That is one reason I have been comfortable holding the FTSE tracker this year, albeit in small size.

AppSoft won’t be able to repeat their success over the past decade in the next decade. I believe they still face significant capital destruction, and a decade from now could see a combined valuation below $1tn. That would mean they lose the equivalent value of the entire FTSE.

Here’s why.

The Last of the Bubbles

Apple is the world’s most valuable company ($2.2 trillion) and, therefore, the largest holding in the NASDAQ. It traded on 3x sales in the dotcom bubble and 7x in 2007 when it was growing like a weed. Today’s price/sales is 6x, yet it is a mature company with lower expected growth.

The high valuation in 2007 was justified because a growth burst lay ahead, driven by new and innovative products. Today, Apple trades close to that same price to sales multiple but without the growth spurt. It does not matter how much money they made in the past, the market will adjust to how much they will make in the future.

Elephants Don’t Gallop

Source: Bloomberg

A good outcome would be to avoid following Nokia, Ericsson, Blackberry, Palm, Sinclair, Amstrad, Sony and so on. Hardware isn’t an easy business (Apple calls itself a software company) to maintain high market share at high margins in perpetuity. I believe the average price/sales will be 2x over the next decade.

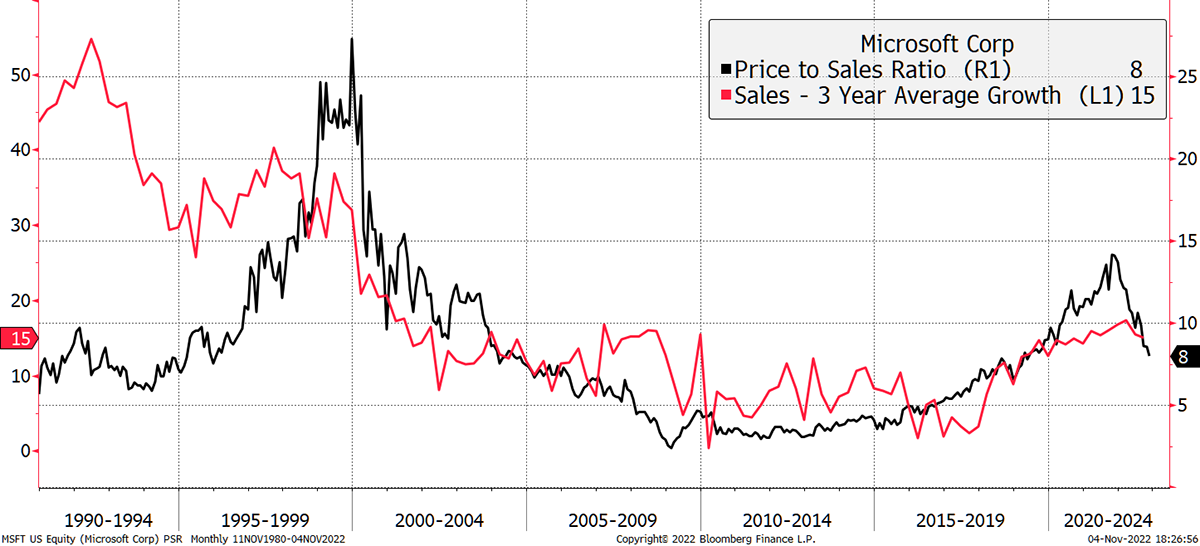

Microsoft Is Overpriced Too

Microsoft (MSFT) is the world’s third most valuable company (the second is Saudi Aramco which is reasonably priced). I am hooked on Microsoft products and have been for years, but that doesn’t mean their share price should rise to infinity.

Once again, I look at the price/sales ratio over three decades to compare how the market priced MSFT. The products have evolved, but they still enable a PC, so in that sense, not much has changed.

I show three-year sales growth alongside the price to sales ratio. In the 1990s, MSFT sales took off, yet the shares traded on 8x sales – perfectly reasonable for a 40% high-margin grower. The valuation rose in the dotcom bubble into 2000 before the growth slowed, and the shares derated from a peak of 25x price to sales to 2.5x by 2009. That was a 90% downward adjustment in the market valuation.

Microsoft Hasn’t Changed Much, but the Valuation Has

Source: Bloomberg

Growth of 40% in the 1990s slowed to single digits in the 00s. Then in around 2015, the company successfully adapted into a subscription-based SAAS model (web) from a model linked to PC sales (software in a box). Growth picked up to around 15% while the shares duly surged to 14x sales last year.

In 2009, MSFT had profits of $15bn, yet last year they were $28.5bn, which is impressive. The bit I struggle with is how the shares rose 15x between 2009 and last year when the profits only doubled.

AppSoft are great companies, but what they do for me today is not dissimilar to what they did for me five or ten years ago. Yet the stockmarket treats them like can-do-no-wrong demigods, and that’s the problem.

The NASDAQ market cap peaked at $20 trillion late last year and is now just below $13 trillion. I believe we are well over the halfway mark in wealth destruction, but the notable exception is AppSoft, where the damage lies ahead. When they finally capitulate, the capital destruction required from the 2022 bear market will be complete.

This is the risk in markets. Many prices are much lower, but not all and I don’t believe we are done yet.

Market Rotation

Yet there are bright spots, and along with value and hard assets, which we already hold, biotech stands out.

Biotech sits at the cutting edge of medical technology in contrast to healthcare, which encompasses insurance, hospitals, and pharmaceuticals. The industry strives to make us live longer and richer lives.

Back at school, I learnt physics, chemistry, and biology as separate subjects. In today’s biotech industry, they have merged. There are chemicals - living and dead. Things are measured in nanometres, and nothing happens without computing power. I am no expert on biotech, but I am keenly aware that what happens in these labs is highly impressive.

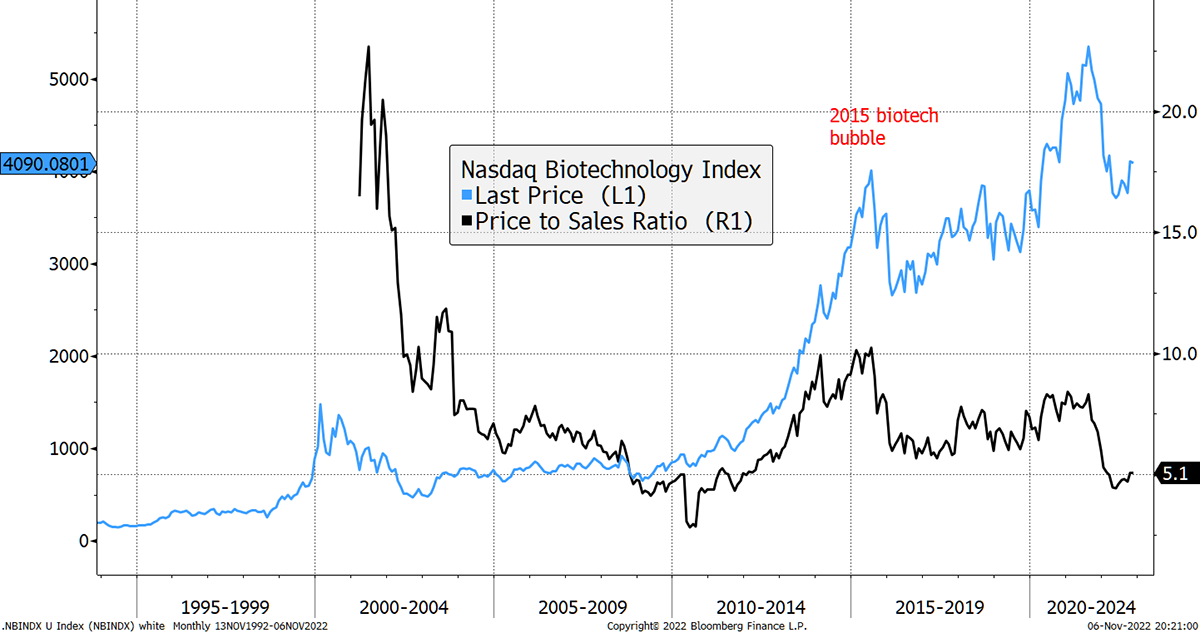

The financial metrics are compelling. Biotech surged into 2015, when it was all the rage following a growth spurt. I had a $100 million position in the Pictet Biotech fund at the time (on behalf of my clients at HSBC), which did very well. I bought it not long after the credit crisis in 2008, as it was clear that the sector was finally turning ideas into profits. In other words, that rally was born out of a crisis.

For example, Mediclinic (MDC), which we recently sold, was trading at £12 per share in 2015. We bought it at over £3.34 in June 2021 before it was bid for this year. It reminds us how buoyant the healthcare and biotech sectors were seven years ago - and how unpopular they later became.

After the 2015 peak, biotech crashed. In part, there was confusion in Washington over drug pricing, and there were high-profile frauds such as Theranos. When a sector looks too good to be true, it probably is.

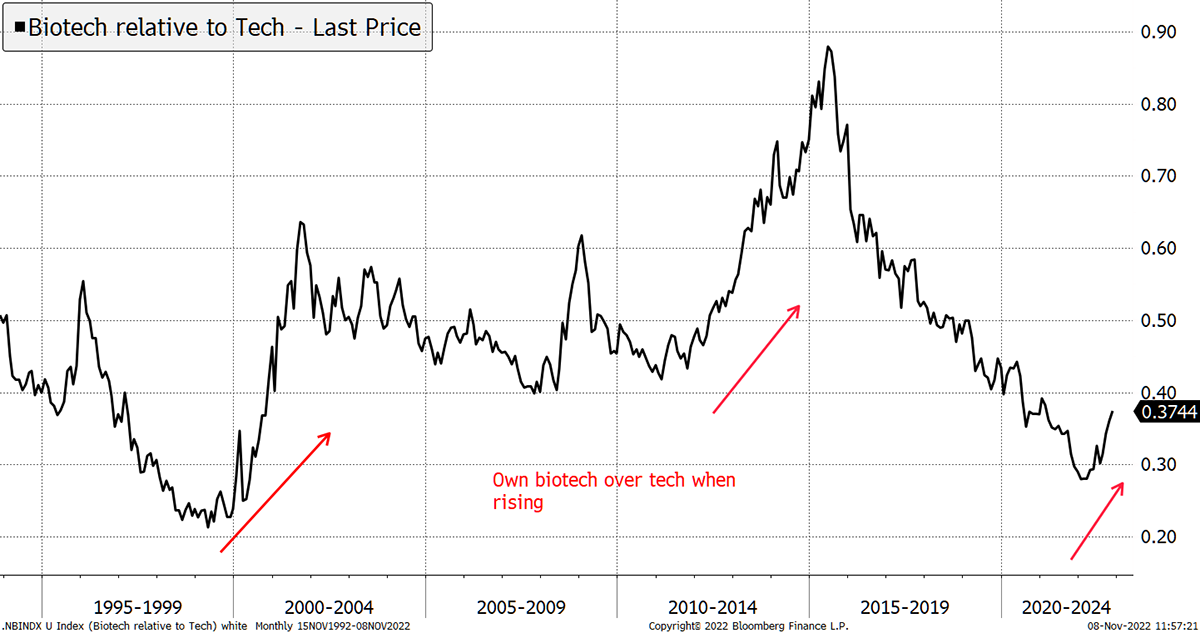

The Biotech Bubble Has Been Cooling for Seven Years

Source: Bloomberg

Since then, biotech has spent seven years nursing its wounds. The NASDAQ Biotech Index is at the same level today as it was in 2015, yet the companies have doubled their sales in the interim. That means the price to sales ratio has halved across the industry, back down to levels rarely seen.

Biotech is a growing industry that is undervalued. More to the point, tech investors would be wise to switch sides. Biotech has now turned the corner against tech.

Biotech Prepares for Multi-year Outperformance

Source: Bloomberg

Despite some hype around Covid vaccines and tests, the biotech sector has largely sat on the sidelines during the “everything bubble”. Given the sector has not attracted the hot and fast money, it is less risky than other areas that have.

Furthermore, healthcare spending is safeguarded by governments. We are in the midst of a cost of living crisis, and investments insulated from the squeeze are better positioned.

I am generally cautious of defensive sectors during bear markets because it is not enough to simply seek sanctuary. If the opportunity to make a return isn’t there, then I would prefer to do nothing and hold cash. But see how advanced this industry has become and how embedded it is within the healthcare industry. The recent relative strength of the sector is impressive, and I believe it is time to buy.

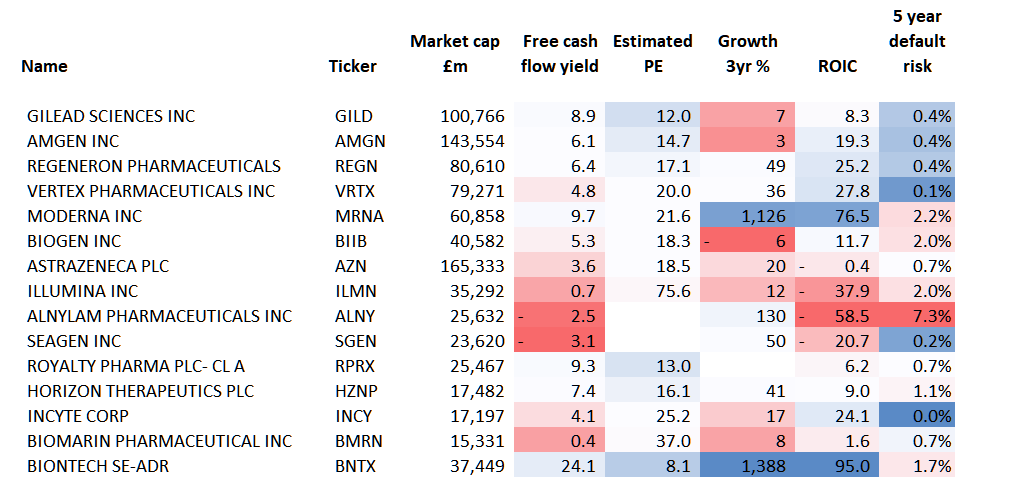

Buy 5% iShares NADAQ Biotech Index (BTEK) in Whisky

Having looked at the possible ways to invest in biotech, I have concluded an ETF is the best option. BTEK is diversified across 365 companies in the biotech sector, with the largest holding shown below. It is therefore highly diversified and charges a modest 0.35% management fee.

Source: Bloomberg

These companies are growing, and unlike pre-2008, they are normally cash-generative. The valuations are undemanding, certainly given the industry growth, while the risk of defaults is low. More generally, biotech is likely to grow regardless of the shenanigans in the economy.

As an alternative, I looked at the Worldwide Healthcare Trust (WWH), which trades on an 8% discount to net asset value. Unfortunately, it has only matched BTEK performance over ten years, so I was not tempted. If the discount was wider, then perhaps, but I highlight WWH as a viable option for those who prefer investment trusts.

There is also the Polar Global Healthcare Trust (PCGH), which has performed well and trades on a 7% discount. Performance is good, but the shares are not sufficiently liquid for a Multi-Asset Investor recommendation.

Risk

This is a diversified sector trade with underlying liquid assets. The sector is in good health and trades at attractive valuations. BTEK is liquid, and I deem it to be medium risk in pursuit of long-term growth. The largest holding is Gilead (GILD), with a 9% position.

Postbox

I had some feedback on the iShares UK Property ETF (IUKP). The largest holding is Segro (SGRO), with an 18% position. This is large but not unusual for a sector fund, where concentration is always higher than in country funds. I am perfectly happy with SGRO, and 5% in IUKP means less than 1% of Soda is invested in SGRO, which is fine.

I would also add that sector ETFs are always in better shape after a crash, like we recently had in REITS because the riskier companies have fallen the most and, subsequently, now have a lower weight. It is after a bull market that ETFs are most at risk, as the largest positions tend to be risky having become too large. Big picture, I believe that IUKP is well timed.

What a fantastic offering on the premium service. It was a no brainer, I signed up last week fully to the service. Are you happy for ByteTree Premium members to write to you with questions for the weekly publication of the Multi-Asset Investor service? Just as was the case with FSL for all those years.

Absolutely. charlie.morris@bytetree.com is an address solely dedicated to The Multi-Asset Investor. That is the best way to keep in touch. I am also thinking of a periodic town hall on Zoom/Twitter or something like that. If readers would like that, please let me know.

I enjoyed the YouTube video with Jeff Boccaccio for an education on the ByteTree ETF analytics - very useful indeed. May I ask, how might one refine their ETF selections if there are 10-20+ ETFs all showing 5 stars? Do you have any further YouTube videos that might be of benefit to members on how to best apply/use ByteTrend to invest/trade? You referenced you are going to build in further search features, such as commodities, sectors, industries and potentially stocks? Is this an early 2023 addition? Be fantastic to be able to screen for the investment universe on the site; best part of it.

It was a good interview. Jeff isn’t well known, but he knows his stuff, which is what counts. It was a massive compliment to all at ByteTree that he showed such interest in the project.

We are building improved screening tools which will avoid repetition. We will be calculating fund flows for 500+ ETFs so we can see how the money is moving around the system. We will be recording more videos to explain how things work, so please follow our YouTube channel.

Time scales are always tough to predict, but we move as quickly as we can. Be sure that ByteTree will always be building!

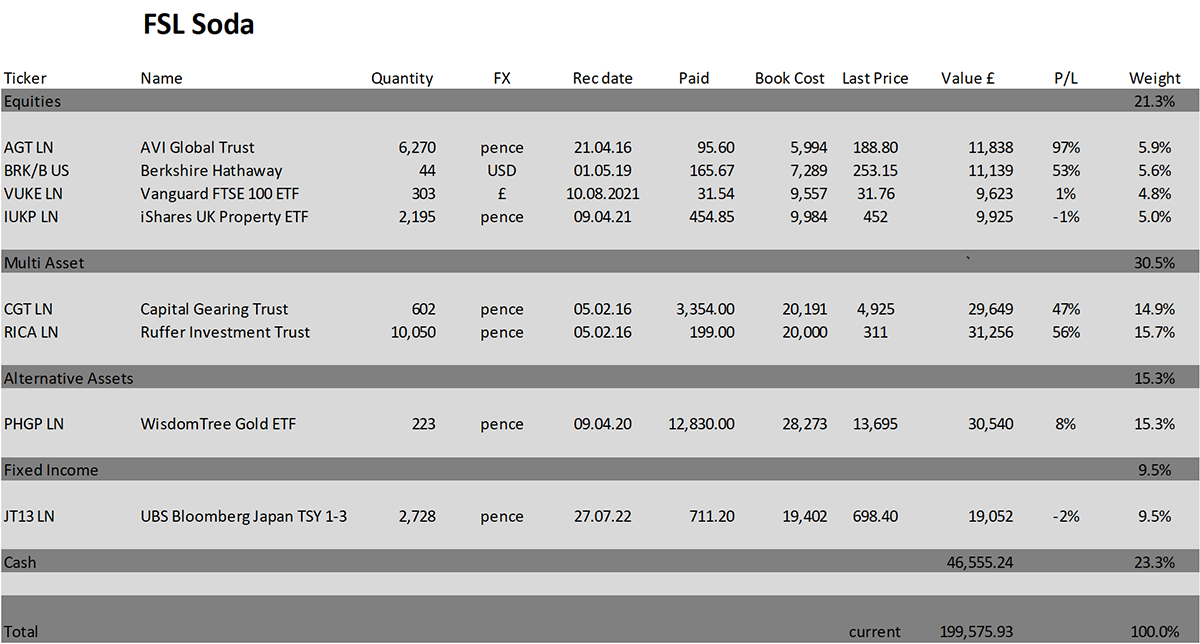

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 3.2% this year and up 99.6% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.1% this year and up 117.4% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

I am not convinced this bear market is over, more that we are a step closer to the finish line. The end of the rate hikes is within sight. But that alone is not enough for a new bull market, or even a recovery. The trouble is the market still believes inflation will be tamed, and rates will then come down again. All will be well.

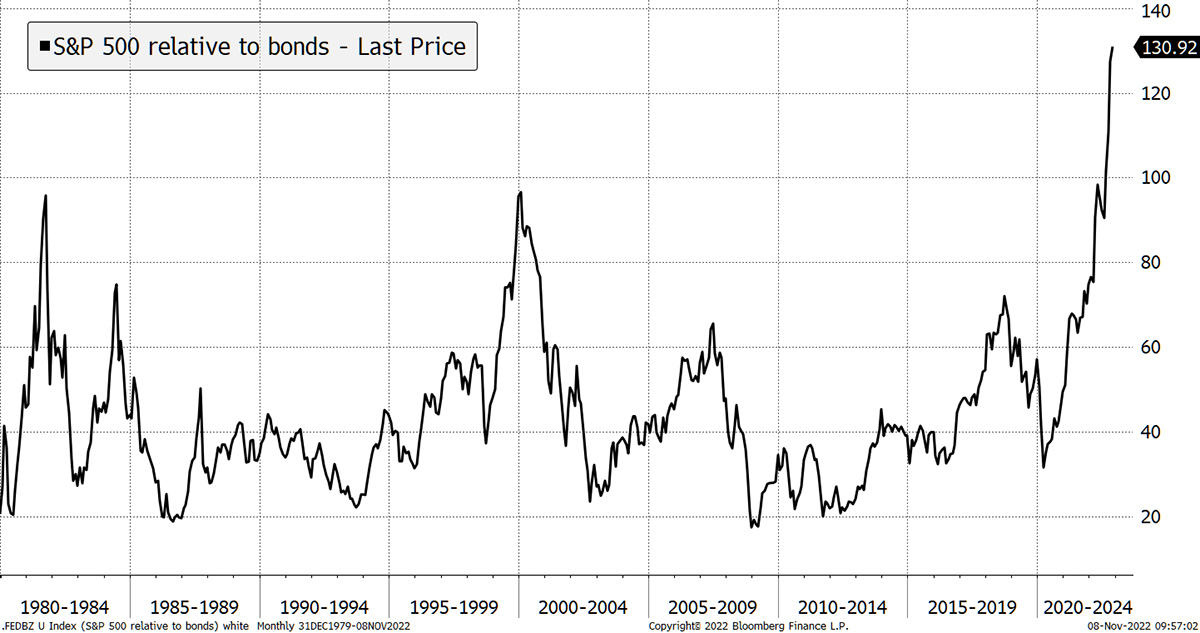

But what if they don’t? The relationship between equities and bonds is more stretched than ever before. This morning showed an all-time high (130 on this arbitrary scale), and I remind you that I started to worry at 90!

Equities Remain Extended Versus Bonds

Source: Bloomberg

AppSoft alone could lose $2.5 trillion from here, and I think they will, even if it takes years rather than months.

But in recent days, the likes of Rolls Royce (RR), which we avoided last year despite the modular nuclear hype, have risen 25% or so. This is a value rally, driven by a softer dollar, and not a full-scale momentum crash. At least if it is a momentum crash, it is confined to the UK and Europe and not playing out in the USA.

That is why I have my doubts about its longevity and attribute any strength to a softer dollar. That is welcome and has brought a relief rally in value. But let’s not forget that no lasting bull market was ever built on a weak dollar.

US inflation data is out on Thursday. Let’s see.

Thank you for subscribing to ByteTree Premium.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()