Token Takeaway: AAVE;

With the crypto market sentiment being quite bearish and the aftereffects of the FTX fallout still playing out, it is important to keep an eye on projects that work through these tumultuous times. In this Token Takeaway, we look at the Aave protocol, its native token AAVE, and its upcoming decentralised stablecoin, GHO. While Aave is down significantly on its TVL since its October 2021 highs, could GHO change this trend?

Overview

Aave is an Ethereum-based decentralised finance protocol founded in 2017 by Stani Kulechov. Kulechov is the CEO of Aave Ltd, the company behind the Aave protocol, which is based in London, UK.

Before rebranding as Aave in 2018, the protocol was known as ETH lend. “Aave” is the Finnish word for “ghost”, and, according to their mission statement, this symbolises their goal to create a transparent and open infrastructure through DeFi.

Aave had its ICO in 2017, and the ERC-20 token LEND (now replaced by AAVE) was sold for $0.017 per LEND. The ICO sold 1 billion LEND tokens, raising $22.1m, while the founder and developers kept approximately 297 million LEND. According to Crunchbase, the protocol has raised $49m in funding over nine rounds, with its latest funding round in February 2022. After the token was rebranded from LEND to AAVE, LEND holders were able to swap their tokens for AAVE at a rate of 100 LEND: 1 AAVE.

The Aave protocol initially launched on Ethereum and has since expanded to other EVM blockchains such as Polygon, Avalanche, Fantom, and Ethereum scaling solutions like Optimism and Arbitrum.

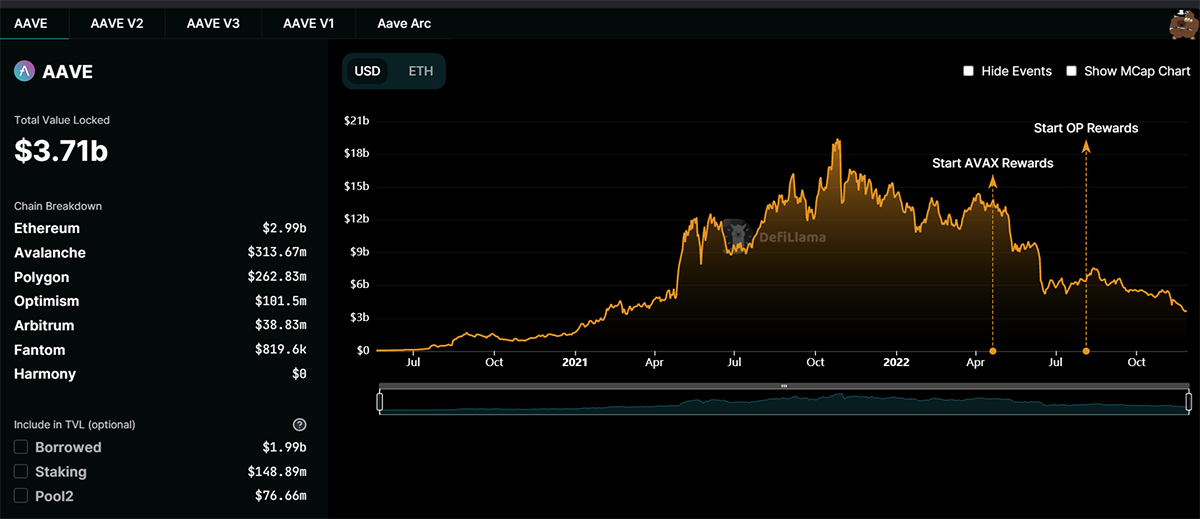

According to DefiLlama, the expanded Aave ecosystem currently has a total of $3.7 billion TVL. While that is not a figure to scoff at, it is a far cry from its all-time high in late October 2021, when the ecosystem had $19.4 billion in TVL. The downturn in TVL can be attributed to many factors, such as the overall bearish market sentiment, the war in Ukraine, and fears of inflation, to mention a few. But this begs the question; what value proposition does Aave provide that has enabled the protocol to accrue assets worth in the billions?

What is Aave?

Aave allows users to lend and borrow cryptocurrencies without an intermediary, like banks, in a trustless manner through smart contracts. In comparison, banks would require customers to undergo KYC or AML to access similar services.

Aave can provide these services as users are able to deposit their funds in liquidity pools that other users can then borrow from. Users who deposit their assets in liquidity pools are incentivised by receiving returns on their deposited assets.

To ensure Aave users remain liquid, they are given aTokens, which denote the number of crypto assets supplied to liquidity pools and the interest earned on those assets. Their value is pegged to the value of the corresponding supplied asset at a 1:1 ratio. As users accrue interest, small fractions of aTokens are deposited into their wallets, which can be exchanged for the actual token through Aave.

At the time of publication, Aave offers 37 different crypto assets for lending and borrowing and requires users to supply recognised assets as collateral. Platform transactions are over-collateralised to ensure that there are no liquidity issues, so we don’t expect to see a bank run happening any time soon. The maximum amount users can borrow depends on the value they supply as collateral. Users repay their loans with the same asset they borrowed. For instance, if a user were to borrow 10 ETH, they would pay back 10 ETH with interest accrued.

The AAVE Token

AAVE tokens are used for the governance of the Aave protocol. Token holders can vote on changes made to the protocol and decide how the treasury’s funds are utilised. Additionally, AAVE holders are entitled to discounts on trading fees. In July 2022, one of the most significant proposals was voted on by the Aave community to launch its own stablecoin, GHO. The vote ended with 99.9% of voters backing the proposal.

Tokenomics

The circulating supply of AAVE is approximately 14.1 million, with a max supply of 16 million. At the time of publication, AAVE has a market cap of approximately $900 million, placing it in the top 50 crypto projects by market cap. This makes the TVL on the DeFi protocol higher than the token’s market cap, which means that the token is undervalued at its current price.

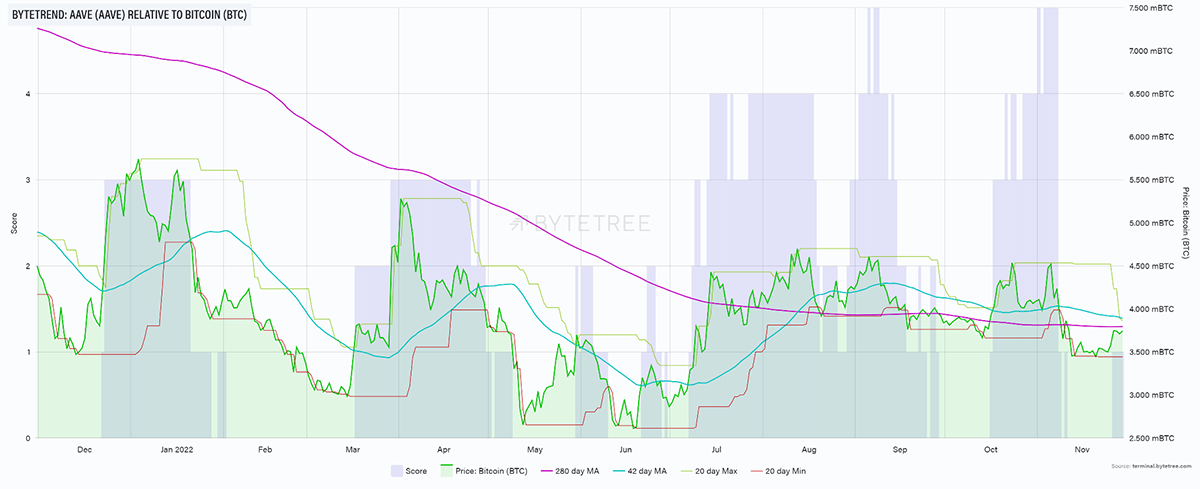

The chart above shows the price action for AAVE since the start of the year. As we can see, it has been quite mediocre, showing moments of strength that quickly dissipated. The most recent sign of bullish price movement was in early November 2022 when Stani Kulechov’s tweet confirmed that JP Morgan had executed its first DeFi transaction using a modified version of Aave and verified credentials on Polygon.

While the news of JP Morgan signalling Aave as its go-to DeFi protocol is definitely bullish, the price action has not been in agreement, which is due to the Aave Ecosystem Grants programme. Through this programme, approximately 400,000 AAVE was introduced into the circulating supply to fund various projects through community consensus. This creates strong selling pressure, which hints at why AAVE's price action has been unimpressive. However, what could potentially change this downward trend is the introduction of their over-collateralised stablecoin, GHO.

The GHO Stablecoin

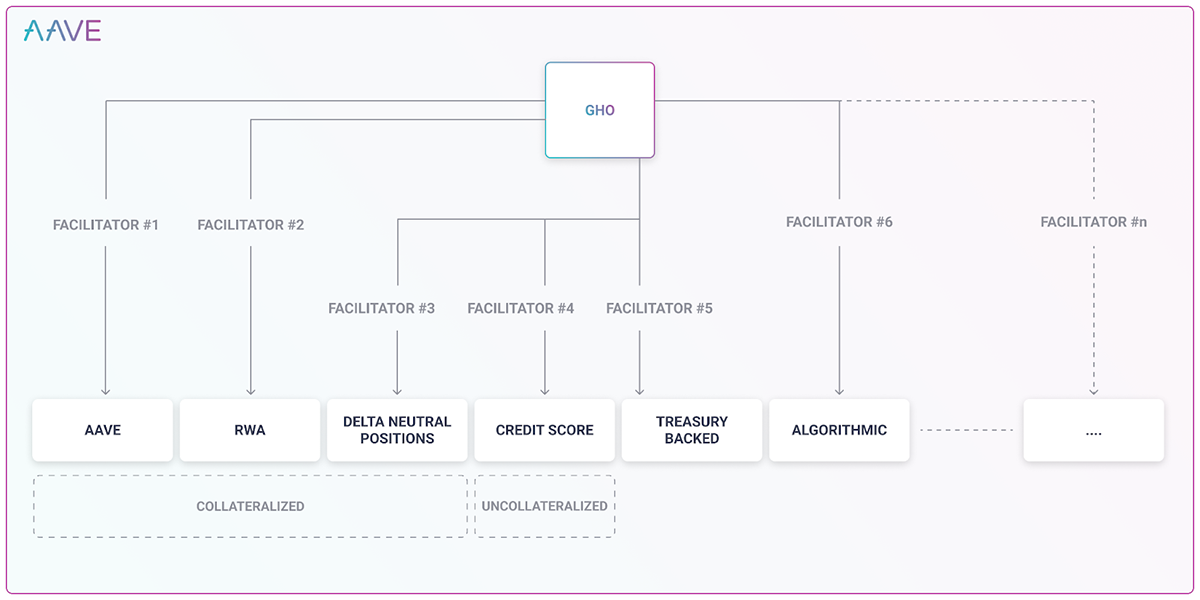

GHO is a decentralised, collateral-backed stablecoin pegged to the US dollar. The stablecoin will be launched on the Aave Protocol, allowing users to mint GHO against their supplied collaterals. GHO would be backed by a diversified set of crypto assets on the platform while borrowers continue to earn interest on their underlying collateral.

While borrowers can create GHO, they must supply collateral to mint it. When a borrower repays a position or is liquidated, the GHO protocol burns that user’s GHO. All the interest payments accrued by minters of GHO would be directly transferred to the Aave treasury, in contrast to the standard reserve factor collected when users borrow other assets.

Aave introducing its own stablecoin would make the protocol more competitive in the DeFi space and generate additional revenue, as 100% of the interest payments will be sent to the treasury. This makes GHO very similar to DAI, another collateral-backed and decentralised stablecoin pegged to the US dollar. DAI is issued by MakerDAO, which is Aave’s main competitor and currently the largest DeFi protocol with $6.6 billion in TVL. The successful launch of GHO would be a very bullish sentiment for Aave while also providing an alternative to DAI’s market dominance in the decentralised stablecoin space.

GHO will be entering a large and competitive market. According to CoinMarketCap, stablecoins account for $143 billion of the $860 billion global crypto market cap. Like Aave and MakerDAO, DAI, with a current market cap of $5.65 billion, will be GHO’s primary competitor. At the time of publication, the exact release date of GHO has not been announced.

Concerns

After Terra LUNA’s catastrophic algorithmic stablecoin, UST, the regulators will be hot on the case of new stablecoins. While GHO is an over-collateralised stablecoin and not algorithmic, the regulator’s spotlight will be on Aave as the issuer, which could either make or break the protocol.

Additionally, concerns have been raised on community forums that Aave might have spread its resources too thin by allocating funds to developing new features instead of improving on the base protocol. While this may be speculation, it does raise the question, will the protocol be more susceptible to a potential hack as more variables are needed to be accounted for?

Conclusion

Despite the concerns listed, Aave is undoubtedly among the best DeFi protocols available on the market. What particularly can either make or break Aave is its own stablecoin, GHO. If implemented successfully, GHO will either push AAVE to new all-time highs or attract heavy regulation. The latter outcome could be quite bearish for Aave, as regulation means KYC, which is against the ethos of DeFi. Regardless, if finance goliaths like JP Morgan have shown interest in the protocol, they must be doing something right.