Trading Places

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report; Issue 78

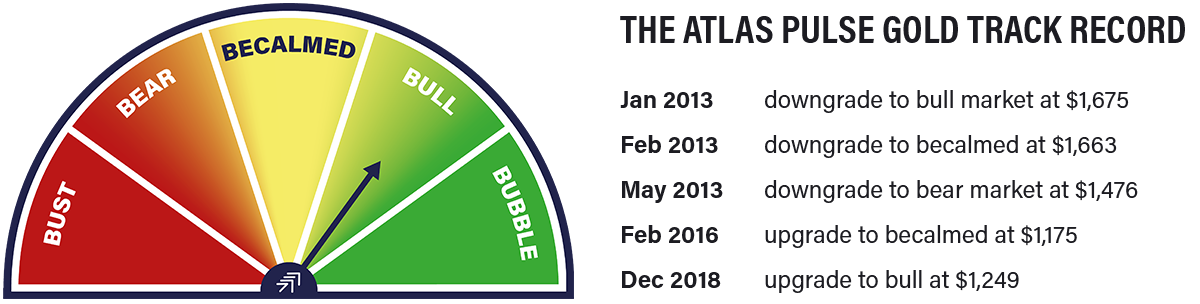

In a year where gold held its ground while TIPS collapsed, I explore why the yellow metal has, once again, proved to be the world’s premier store of value. But are TIPS a better bet in the short-term? I also show how ETFs drive the gold price and consider alternatives for 2023.

Highlights

| Macro | Bonds do not forecast inflation |

| Valuation | Gold is 30% dear vs TIPS |

| Tactics | What to do? |

| Flows | Who moves the gold price? |

Macro

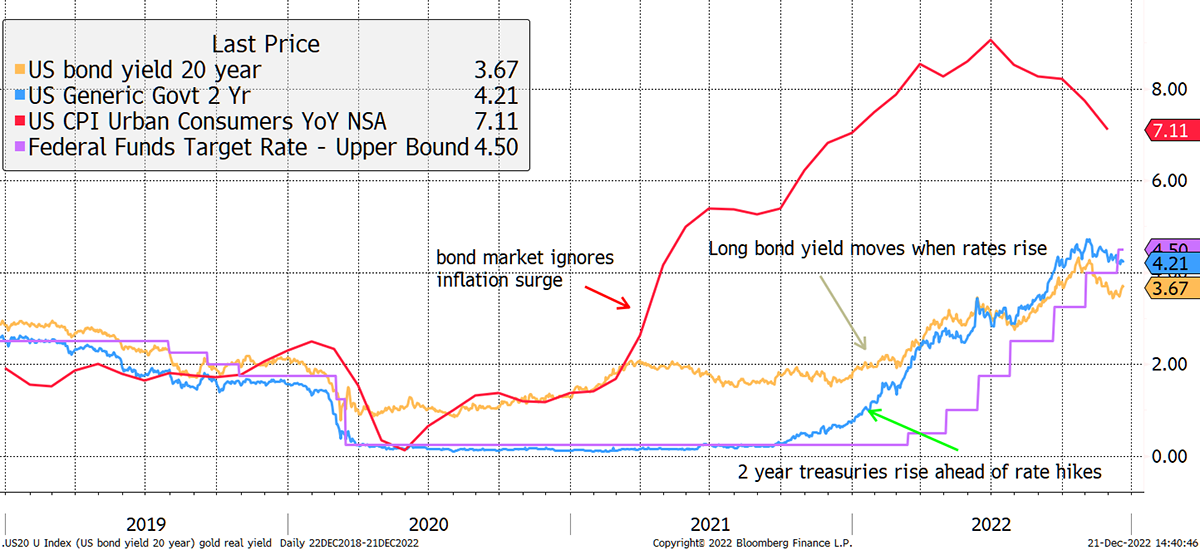

We can now confirm what we already suspected; bonds do not forecast inflation. They merely respond to interest rates. I have mentioned this in recent issues, and this chart illustrates the point. Looking at the past four years, US inflation (red) took off in Q1 2021, while the 2- and 20-year yields ignored the early surge. That was the “transitory” era. The 2s (blue) moved in Q4 2021 once the Fed had stated that rate hikes (purple) were coming.

Bonds Do Not Forecast Inflation

Source: Bloomberg

The bond market did nothing to compensate investors for the loss of purchasing power caused by inflation, which conflicts with what’s written in the textbooks. Bond yields remained low until the Fed signalled rate hikes were coming in late 2021. The 2s were quick to react, while the 20s (gold), which I believe is the most important indicator for the gold price, took longer. Today, we see the 2s below interest rates again, which is a clear message that the hiking cycle is essentially done.

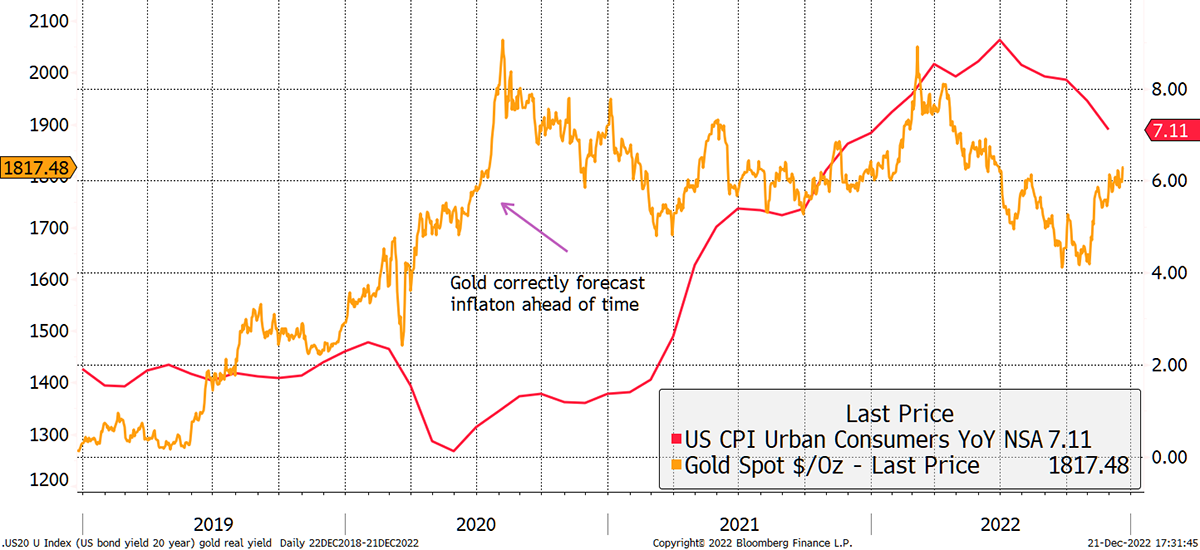

While higher bond yields didn’t forecast inflation, gold did. The covid crisis saw a surge in the gold price, which preceded inflation by six months. The naysayers who said that gold failed as an inflation hedge were simply behind the curve. By late 2020, gold had already done its job, and the price fall in 2022 sent a message that inflation had peaked.

Gold Correctly Forecasts Inflation in 2020

Source: Bloomberg

With a 42% return over the past four years, gold has more than compensated investors for recent inflation, which has totalled 18%.

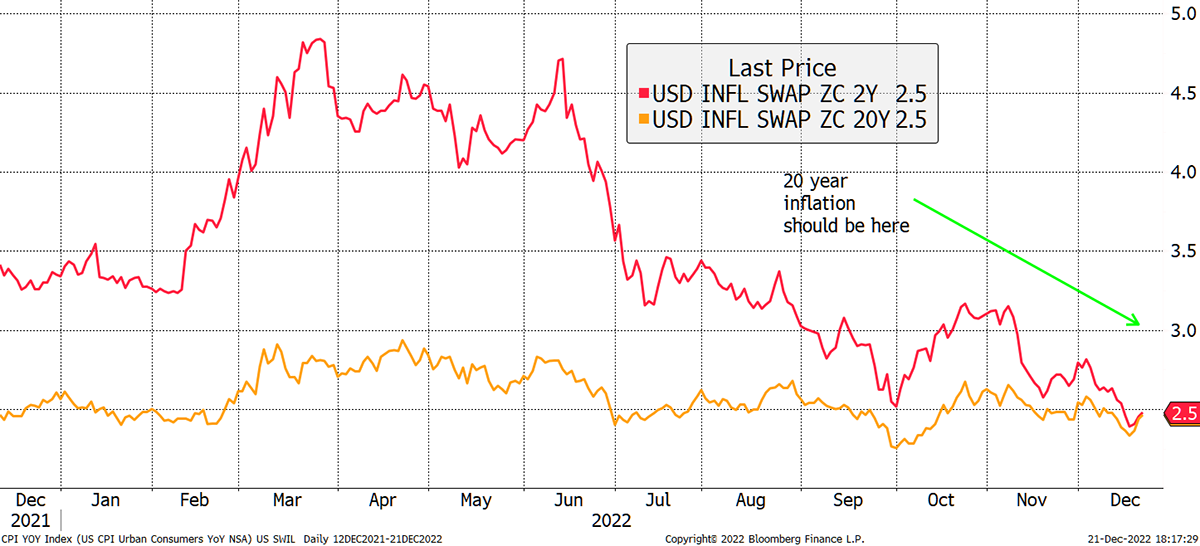

If bonds can’t forecast inflation, there is no reason inflation-linked bonds (TIPS) can either. If the $1,800 gold price is right and TIPS are wrong, the message is that breakevens (inflation expectations) should be 2.9% as opposed to 2.3%. If you are dealing with billions or trillions, that’s quite a big deal. It implies $100 will have a purchasing power of $56 in 2042 as opposed to $63.

Gold’s Inflation Forecast

Source: Bloomberg

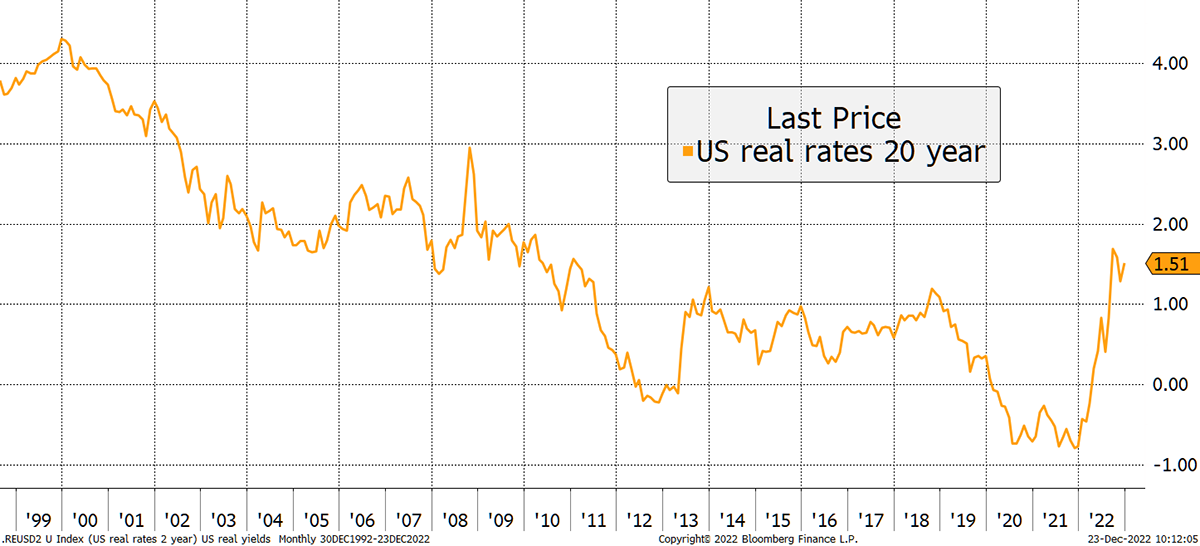

If gold is a better inflation forecaster than TIPS, that’s good to know, but it also implies TIPS are undervalued. In any event, as we look forward to 2023, it is remarkable how gold has shrugged off the greatest reversal in real interest rates in living memory. If you’d polled the audience a year ago and shown them this chart, they might think gold would have a -30% year. It hasn’t.

The Economy Will Struggle with Tight Money

Source: Bloomberg

Gold was too cheap a year ago, but now it is dear. But maybe it doesn’t have to fall because TIPS will rise instead. Moreover, real interest rates must surely be close to a peak. And as soon as the Fed bottle it, which they will, gold will be off to the races again.

Valuation

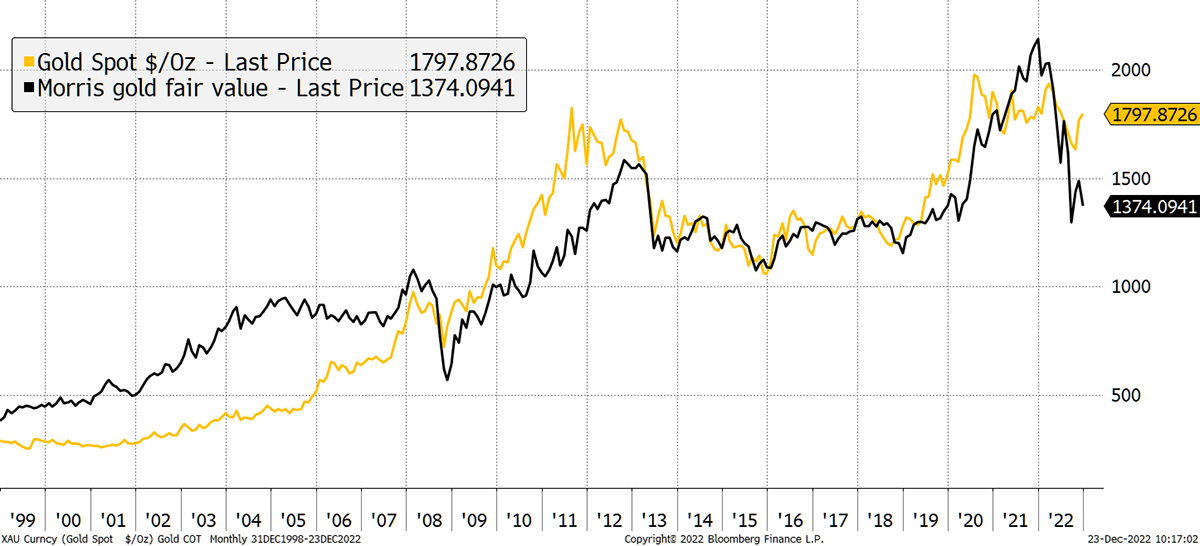

My valuation model has seen gold jump to a 30% premium. We have seen a 45% gold premium over TIPS in 2011, and a 25% premium in 2020. 30% is therefore notable and deserves attention.

Gold Holds While TIPS Struggle

Source: Bloomberg

Gold and TIPS have been highly correlated since 2008, and at times like this, you consider the possibility of decoupling. I believe that to be unlikely because they both do the same job, but in different ways.

TIPS are contractually obliged to deliver returns aligned with inflation. Inflation may or may not be understated (I don’t believe it is), but TIPS will deliver on their contract. In contrast, gold doesn’t have an obligation, but it does the same thing quite naturally. When you look at the maths behind TIPS, you soon realise that they protect real wealth over the long run, which is precisely what gold does too.

TIPS and gold have the same objective.

Some believe gold is superior because, in the event of hyperinflation or the “great reset”, TIPS would be left behind, which implies default. I suppose a US government default is possible one day but unlikely to happen anytime soon.

Leaving aside the extreme, a multi-asset investor should embrace the pricing differentials when they occur. If gold is cheap, like it was 12 months ago, own gold. When TIPS are cheap, own TIPS. This is simple active management, but the bulk of bond investors do not exploit this opportunity.

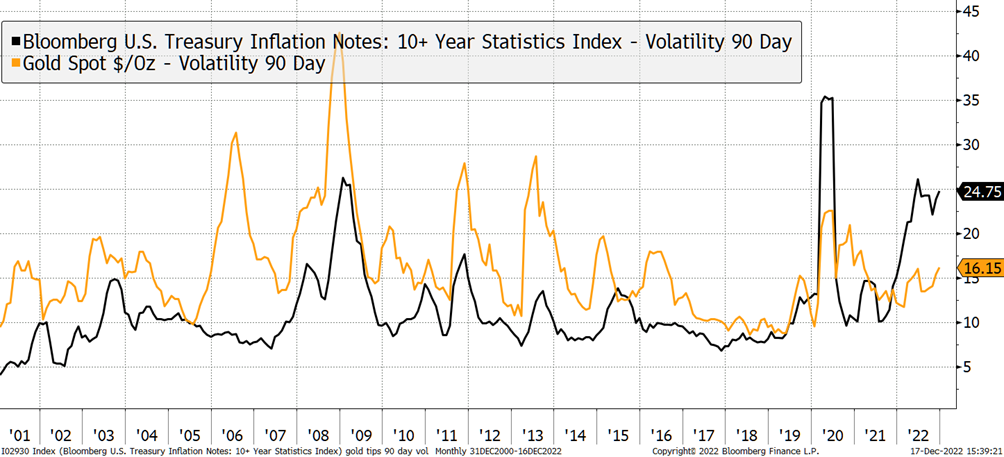

They should because things are getting tougher for bond markets. Following years of QE, and despite now offering better value, they have become less liquid and more volatile. This comparison between TIPS and gold volatility demonstrates this point. The index shown has had a slightly lower “duration” than gold and hence shows lower volatility pre-2018, but that has recently spiked regardless.

TIPS Are More Volatile Than Gold

Source: Bloomberg

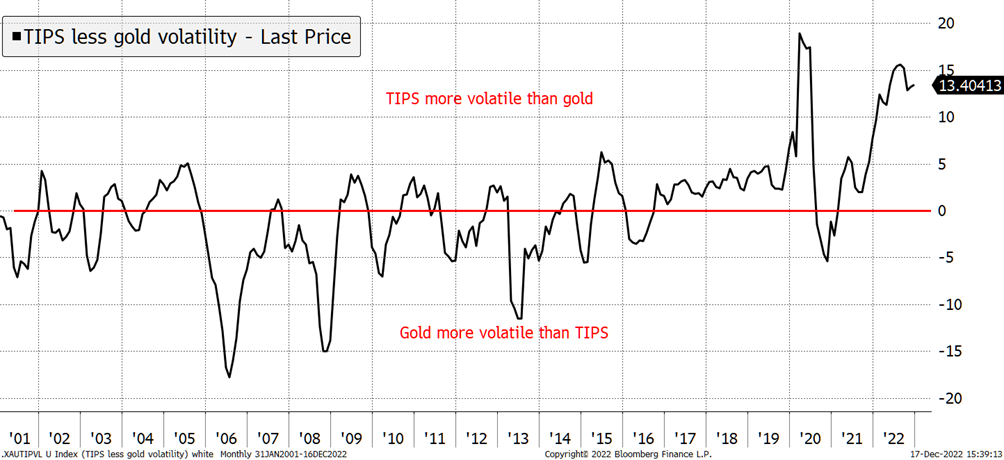

Gold has remained calm over the past two years, with volatility similar to its 20-year average. TIPS, on the other hand, have seen volatility surge. That is well illustrated when looking at the spread from the chart above.

Trading Places

Source Bloomberg

Something has gone wrong in the bond market, beyond the obvious. A year ago, it was clear that gold would beat TIPS this year. In 2023, I suspect that will reverse. Let’s see what Jan has to say.

Flows

I had a brief exchange on Twitter with a gold guru and friend, Jan Nieuwenhuijs, analyst at Gainesville Coins. I posted a chart of gold ETF flows and Jan replied, “ETFs are not the only game in town.” He then sent over these beautifully crafted charts from his recent piece.

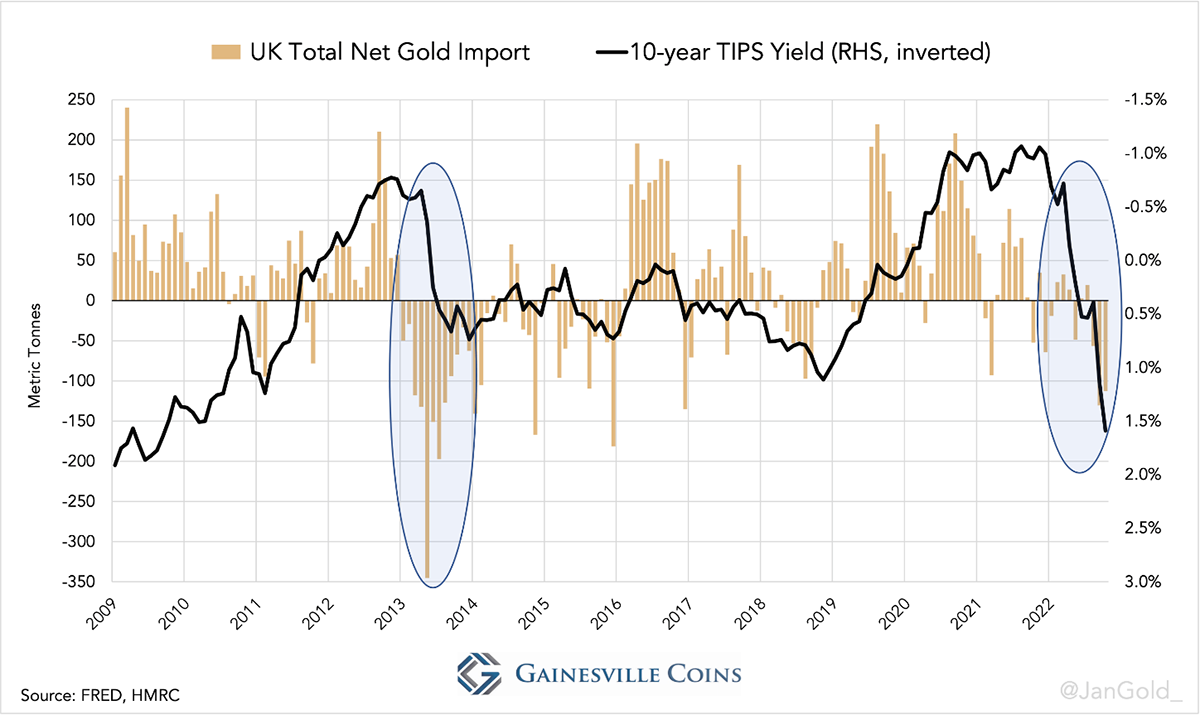

His point is that real yields (bond yield less inflation) drive gold flows from the west to the east and vice versa. Yields are shown inverted (LHS). When yields rise, the London bullion market is happy to import gold, and when they fall, London exports gold to the east.

With 200-tonne monthly swings, the quantities he is talking about are quite large. Undoubtedly, the investors dealing through the London market are sensitive to real yields, and their actions result in physical flows. It is a convincing and logical fit.

But we are making different points as I was highlighting the importance of gold ETF flows in setting the gold price, in addition to real yields.

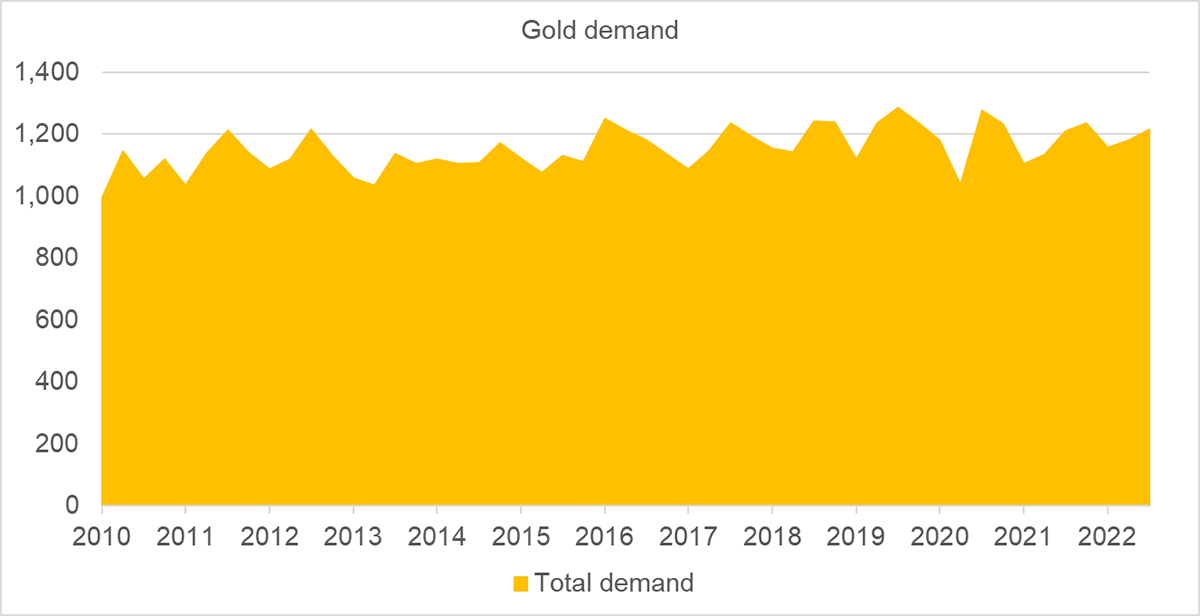

I fully accept that ETFs are a relatively small part of the gold market, but they appear to be the most important influence on price. According to the World Gold Council, gold demand was 1,215 tonnes last quarter. That demand is relatively stable over time, which reinforces the underlying stability, and low-price volatility, of the gold market. In contrast, demand for other commodities is all over the place, and hence they are much more volatile.

Source: World Gold Council

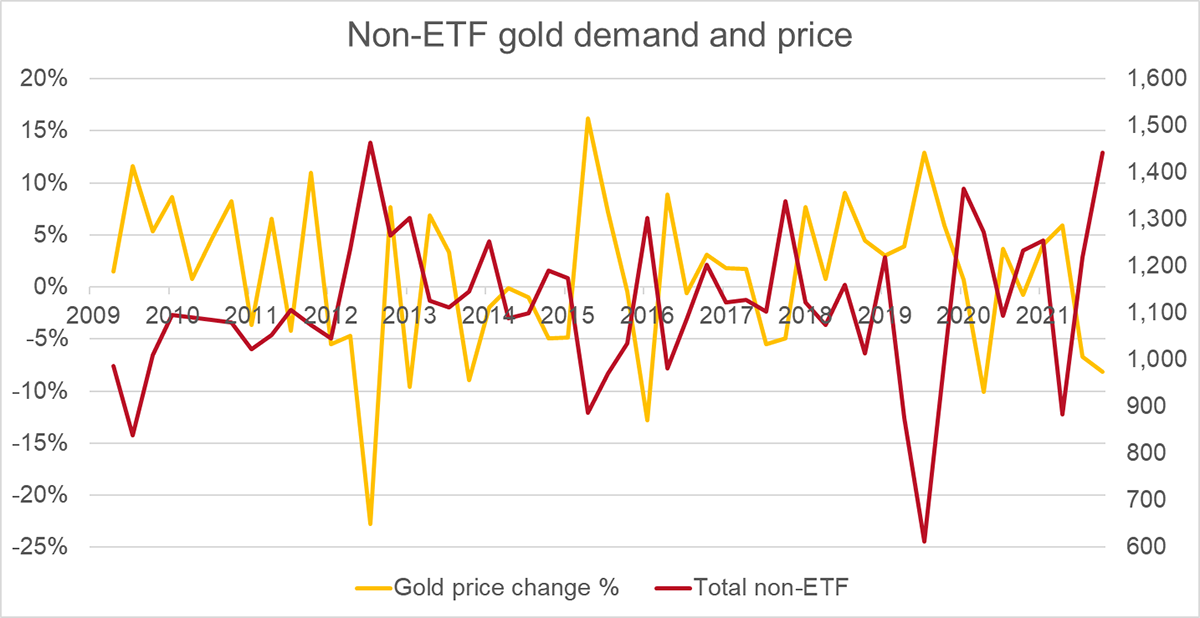

Now I will strip out ETF demand, which moves with investor sentiment. What remains are jewellery, technology, central banks and other investment such as bars, coins and medals. This group dominates gold demand by a wide margin, but despite that, changes in demand do not explain price moves.

Source: World Gold Council

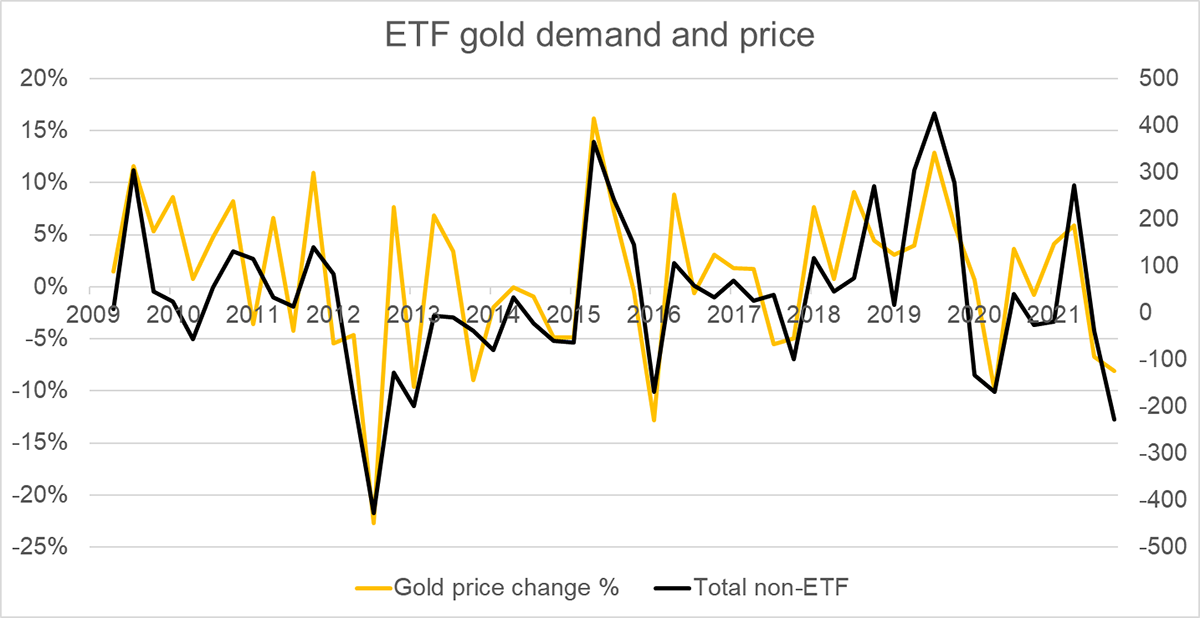

Contrast that with the ETFs, which saw outflows of -227 tonnes last quarter, and there is an extremely high correlation with price, as has always been the case. This is presumably because they are the marginal buyer and therefore the price setter.

Source: World Gold Council

Financial buyers like ETFs because they are cheap, simple and liquid. ETF flows are driven by momentum, and understanding their behaviour is important in forecasting the gold price. In contrast, the bulk of the market are value buyers and respond to low prices as opposed to trends. This group delivers price stability.

This ETF daily gold fund flow data is freely available on our website and reaffirms what we see above. Over the past month, something has changed. For the first time in over a decade, financial investors haven’t bought this rally. At least, not yet.

Source: ByteTree

Are investors behind the curve, or has something changed, such as US ETF taxes?

I titled this “Trading Places” because something is happening in the gold market as several relationships are moving out of whack, and we should take note. Gold has traded places with TIPS as it has remained calm in a storm. Gold has also performed well despite not attracting financial investors. Last month I showed how the central banks had bought a record 399 tonnes in a single quarter.

More questions than answers, which can only mean something’s up.

Tactics

An excellent question arrived in my post box.

I have a group of investors who want me to confirm if we should stay in physical gold to ride out the current economic disruption or look at alternative trading options to earn more yield. We are currently leasing the gold and getting paid some yield (paid in gold) but I have been asked to look at some alternative trading options given gold's failure to increase in price recently as expected despite the current inflationary environment. Three-month US treasuries currently yield more than we are getting on the gold leases. We are considering the following options:

1. trading the gold silver ratio

2. **collateralize the gold and buy 3-month T-bills

3. place trades on the XAUUSD (Gold) currency pair

4. invest in BOLD

What are your thoughts?

Don’t be harsh on gold for not being an inflation hedge. I think what’s happened has been fairly rational.

Trading the Gold Silver Ratio (GSR)

Potentially interesting, but there is a low chance of higher returns after risk is taken into account. I like the GSR, but it isn’t easy to forecast. Currently at 75, there was an opportunity in silver, but now it’s closer to mid-range. The easy money is already behind us. Of course, under the right conditions, GSR could fall below 60, which could easily happen when the Fed pivot.

Gold Silver Ratio Headed for Mid-range

Source: Bloomberg

Maybe you have a short-term magic model, but I know many who have tried and failed to make something from trading the GSR. It’s difficult, and the short-term moves can be painful.

There is a risk that you underperform gold.

Collateralize the Gold and Buy 3-month T-bills

This means you keep the exposure to the gold price, as it’s still yours, but you get a secured loan at favourable rates and invest in three-month treasuries. Looking at gold lease rates and 3-month treasuries, you’ll get around 0.3% plus exposure to the gold price. It is low risk but is it worth the hassle?

O.3% never excited me very much. If I was considering treasuries, I’d switch some into TIPS.

Place Trades on the XAUUSD (Gold) Currency Pair

Potentially great, but you need a magic model, which is the same problem you’ll have with trading GSR. I don’t know which strategy you’d use, but the outcome is again unknown.

Invest in BOLD

Now that’s a good idea.

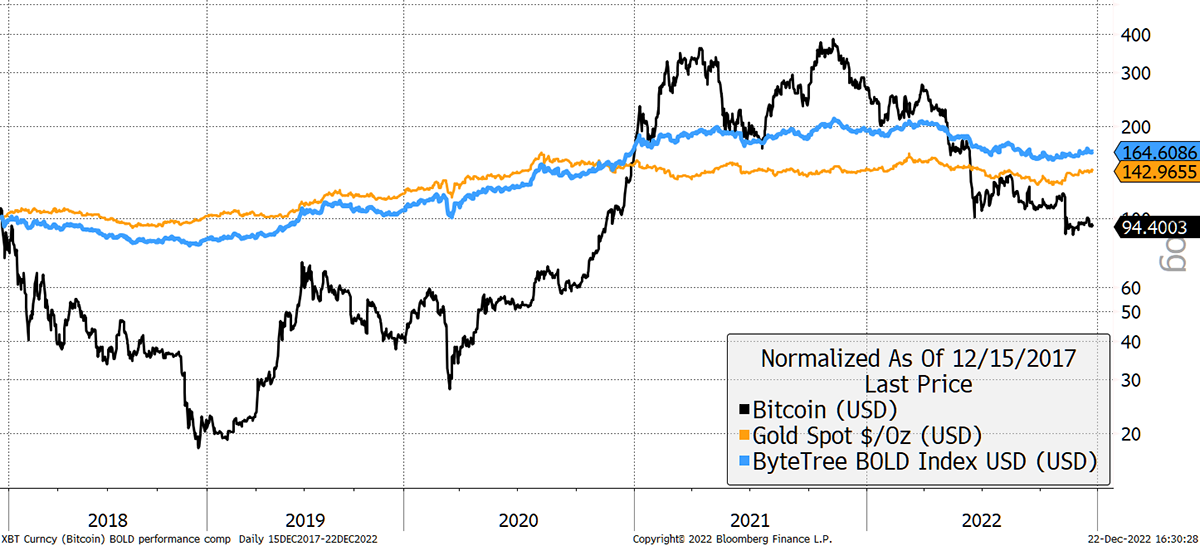

BOLD combines bitcoin and gold on a risk-weighted basis. That currently implies around 20% in bitcoin and 80% in gold. BOLD is a simple rebalancing strategy which delivers a magical outcome because the assets are naturally uncorrelated and have high dispersion. This is the perfect combination for this strategy. If you rebalanced gold and silver, there would be no magic because they are highly correlated and normally have low dispersion.

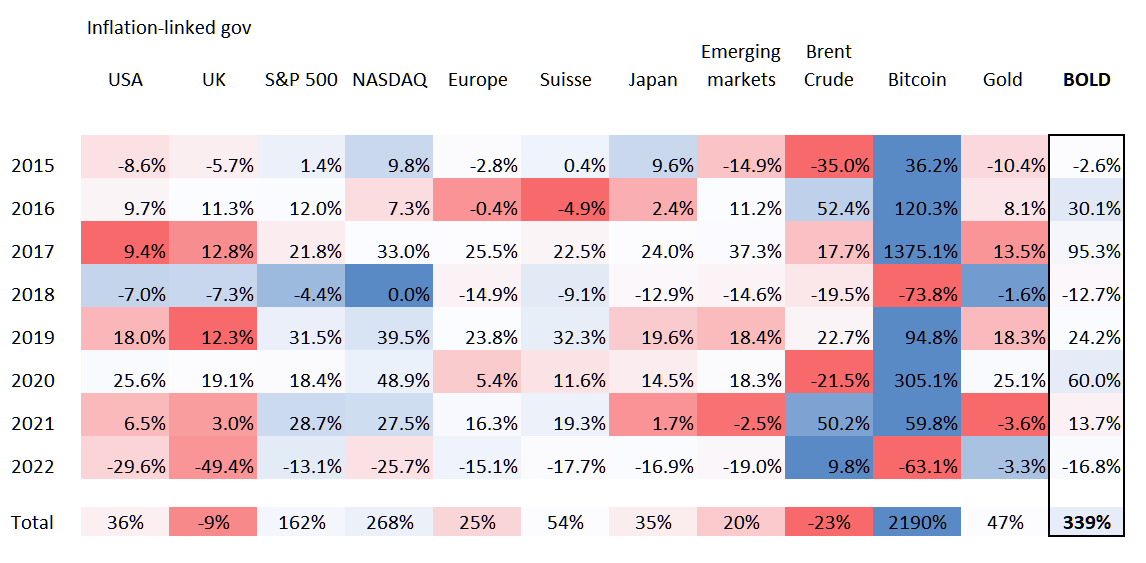

This is demonstrated over the past five years, where BOLD has beaten both bitcoin and gold, despite bitcoin being down over the period. Monthly rebalancing has delivered alpha.

BOLD Has Beaten Both Bitcoin and Gold

Source: Bloomberg

Yet BOLD doesn’t always beat gold. Bitcoin bear markets are unhelpful, and in 2018 and 2022, BOLD lagged gold by 17% and 19%, respectively. This is a risk, but these relative drawdowns are not particularly high. Silver routinely sees 40% + drawdowns against gold.

BOLD versus Gold

Source: Bloomberg

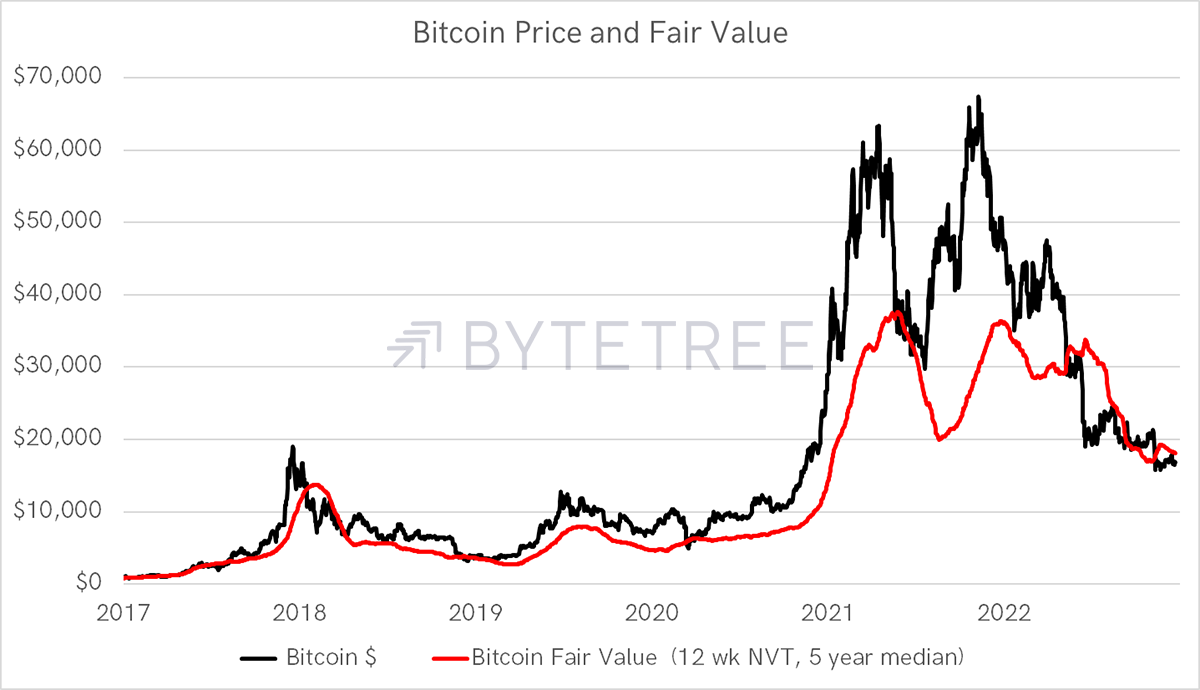

For BOLD to beat gold, you simply need bitcoin to behave. Bitcoin doesn’t even need to rise, as there is still excess return from rebalancing transactions. In 2023, I believe bitcoin will beat gold.

Bitcoin has had a brutal year, yet the underlying network remains stable, and the price is back in line with fair value following another bubble in 2021. Only 71,000 more blocks to go before halving on 25 April 2024 (est.). That reduces supply by half. Can’t be bad.

Source: ByteTree

Gold and bitcoin have a habit of interlocking. Once again, gold does well whenever bitcoin turns red, just like we saw in 2018.

Source: Bloomberg. Total return in USD.

BOLD is down 15% in USD for 2022 and near flat in GBP/EUR/JPY etc., which compares to -20% for the S&P 500. A loss is never impressive, but given the misery in bitcoin, it isn’t bad at all. Moreover, BOLD’s volatility has averaged roughly half that of the S&P. BOLD really is the 60/40 of alternative assets.

In summary, I would avoid anything that requires trading skill, because it’s unreliable. Collateralising the gold for a yield pick up strikes me as a tedious exercise for little gain. But on the bond side, consider switching some into TIPS. You will increase volatility but lock in positive real returns.

You want to spice up a large holding in gold. My view would be 50% BOLD and 50% TIPS. Both alternatives lock in relative value and are likely to outperform gold over the medium term.

The Multi-Asset Investor at ByteTree

The Multi-Asset Investor is where you’ll find my best ideas. We have some fabulous UK deep value stocks, which I believe are set to storm. I am excited about revisiting emerging markets next year, which I have largely ignored for over a decade. The US story is over. It’s time to swot up elsewhere.

You’re probably too busy, in which case I’ll do it for you.

The Multi-Asset Investor is part of a ByteTree Premium subscription, which is just £25 per month, with no obligation. Many readers tell me it is underpriced. Great. It makes it available to a much wider audience who want to take greater control of their savings.

Summary

Gold has had an excellent year. The price may only be flat, but when the bond market has collapsed, equities have struggled, and the dollar has surged, I’ll take that.

I hope you had a Happy Christmas, and I’ll see you again in 2023.

Comments ()