Dollar Down 10%? Expect Bitcoin up 54%

Disclaimer: Your capital is at risk. This is not investment advice.

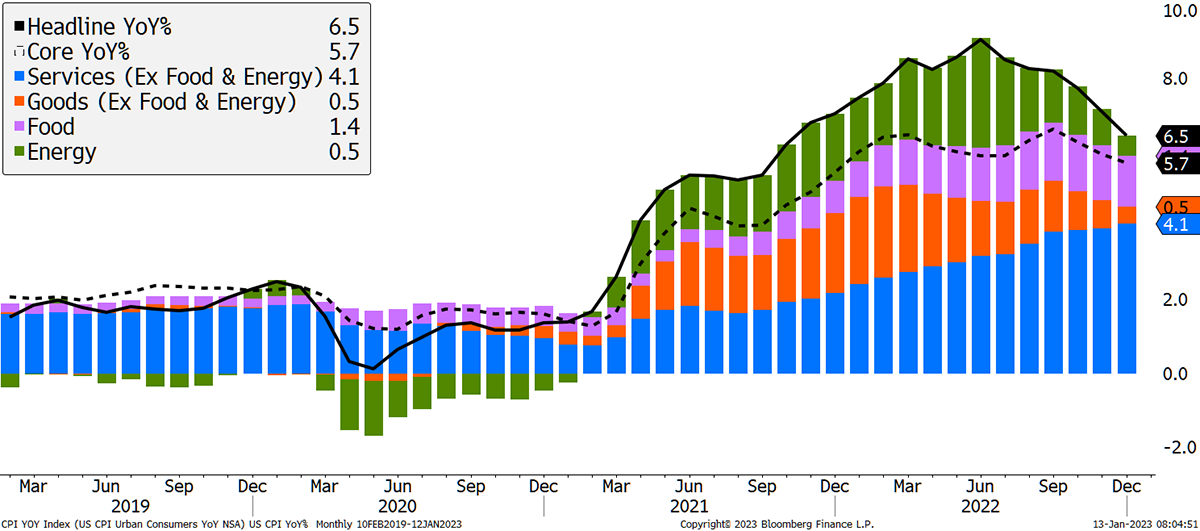

Our favourite two alternative assets are off to a good start this year, with gold up 4.1% and bitcoin up 13.8%. These past 13 days have been eventful, and yesterday we saw the much-anticipated US inflation data. It has slowed to 6.5%, with goods, energy and food either lower or stable. The supply crunch, typified by the Ever Given getting stuck in the Suez Canal in March 2021, appears to be largely over.

Rising Wages

Services are more stubborn, and the message is that people want a pay rise. Assuming they work for the government, they will get one. Wages will be a harder nut for the central banks to crack, and with services making up 4.1% of the 6.5% CPI pie, they are two-thirds of the problem.

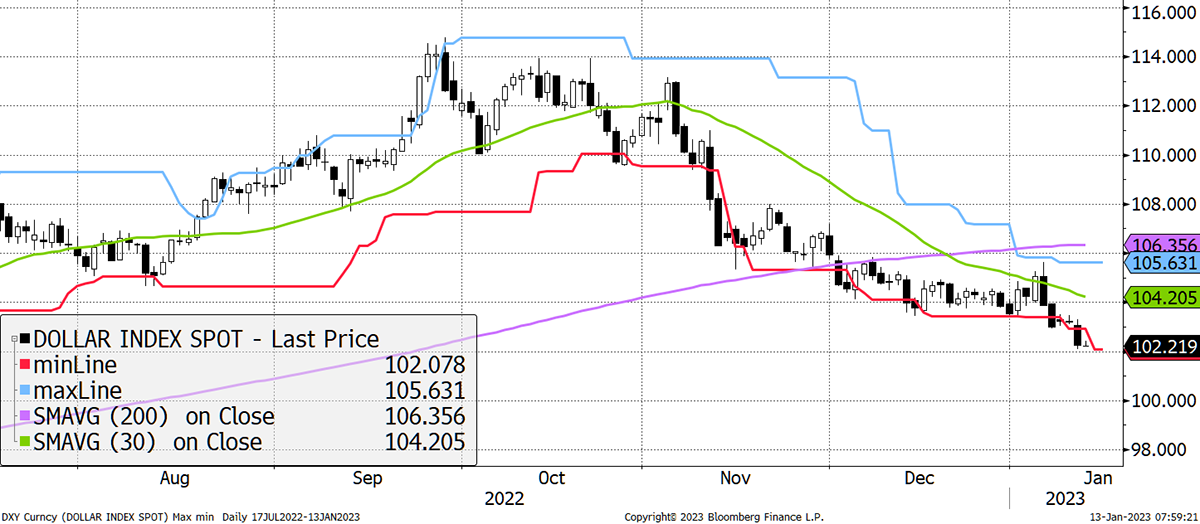

In any event, the markets seemed happy with the result because the assumption is that rates don’t go much higher from here, paving the way for bonds, equities, gold and bitcoin to have a good day. But against that, the almighty dollar fell by 0.9%, reaffirming its downward trend. You cannot underestimate how important this is for financial markets. It’s like selling lemonade on a hot day.

In contrast to the pain we have felt in recent times from a surging dollar, yesterday it made a six-month low. The 30-day moving average is falling, and the 200-day moving average will follow within weeks. At ByteTree, we call this a 1-star trend (5 strong, 0 weak). This is a set-up for a major move lower, which will float investors’ boats. It will be especially well received by alternative assets such as gold and bitcoin.

The Dollar Slides

We can measure an asset’s sensitivity to the dollar (or anything else) using a simple concept called “beta”. It measures how much you’d expect an asset to move against the market. It should come as no surprise that some stocks move much more than the stockmarket – both on the way up and on the way down.

For example, if the S&P 500 rose by 10%, what would you expect a stock to do? The answer for a high beta stock such as Tesla (beta 1.7) would be a powerful 17% rise, and for a low beta stock such as Johnson and Johnson (beta 0.6) a more sanguine 6%.

With gold, we can look at beta versus the dollar instead of the stockmarket. The answer is simple, yet widely misunderstood. Gold’s beta against the dollar is -1. If the dollar fell by 10%, you would expect gold to rise 10% in dollar terms. Yet if the dollar fell by 10%, presumably the euro would rise by 10% (keeping it simple), and so the gold bugs living in Strasbourg just made no money as the price in euros would be unchanged. A falling dollar will cause the gold price to rise in dollars but will not create value.

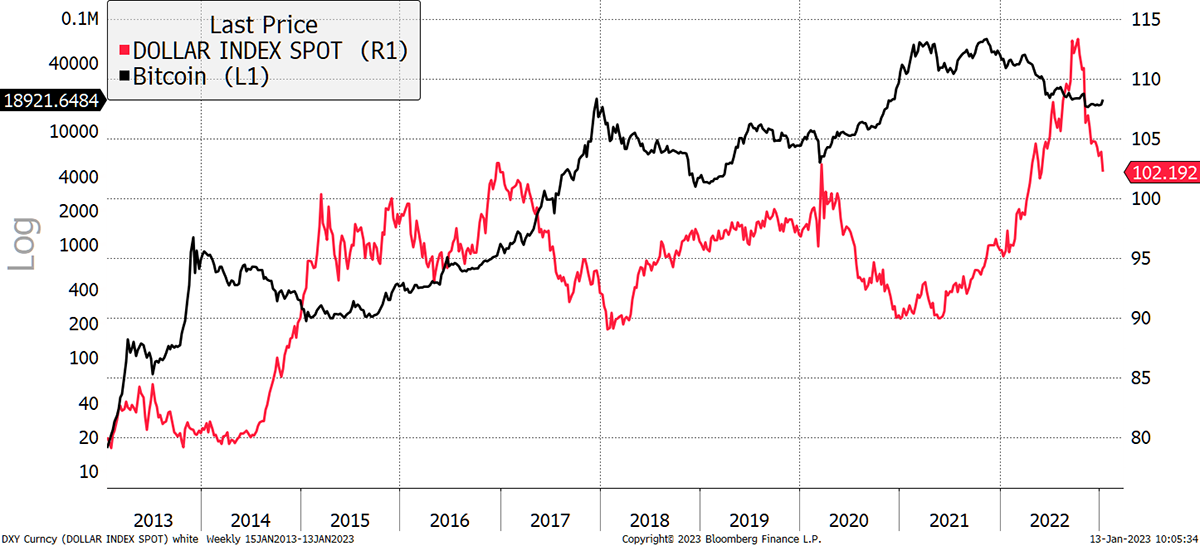

Bitcoin, on the other hand, has a beta of -5.4 against the dollar. That means if the dollar fell by 10%, bitcoin would likely rise by 54%. Those bitcoiners living in Strasbourg just made 44% (assuming euro +10%). They’re having Alsace Kougelhopf tonight. In other words, a falling dollar causes the bitcoin price to rise in dollars and creates value.

The inverse nature of the relationship between the dollar and bitcoin is crystal clear. In the years past, a 10% fall in the dollar probably meant at least 10x for bitcoin. These days it’ll be lesser, but still very much a thing.

The Dollar and Bitcoin

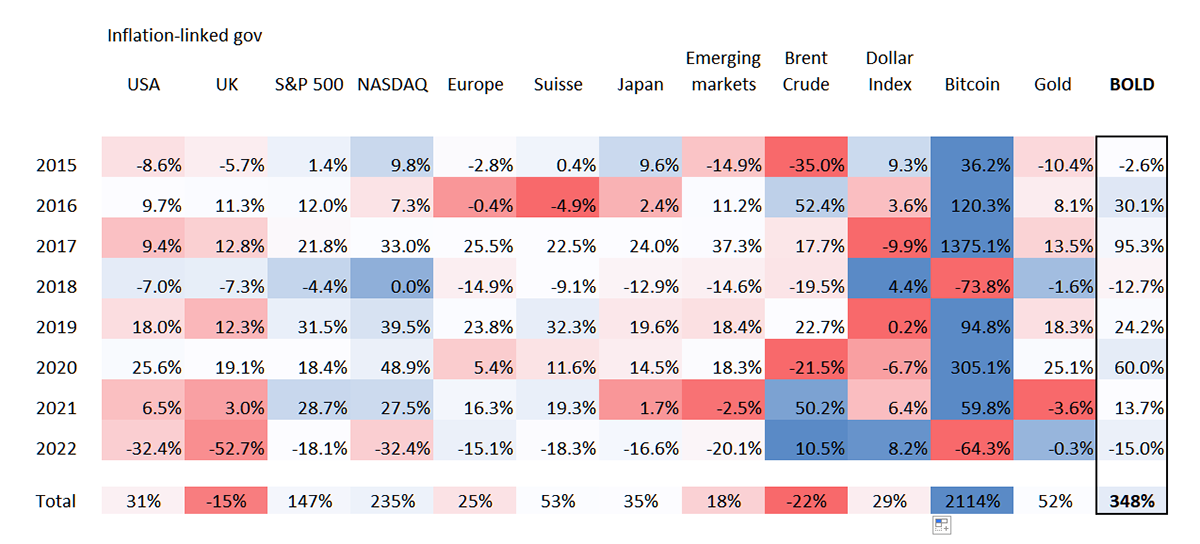

You may have seen this table before, but please look again as I have added the dollar index next to bitcoin. It becomes clear how much stronger the dollar’s influence is on bitcoin over gold. It’s an important point to understand for 2023.

A Red Dollar is Bitcoin’s Delight

Also, notice how gold is often close to the inverse of the dollar, except in years such as 2019 and 2020 when real interest rates collapsed. That was a period when gold’s rally was being driven by rocket fuel. That could happen again, but we’d need to see rate cuts combined with rising inflation – the opposite of today’s scenario.

In conclusion, 2023 looks likely to be a down year for the dollar, and if so, the highest beta (in $) assets will fly. I know of no better choice than bitcoin.

Have a great weekend,

Charlie Morris

Founder, ByteTree