Emerging Market Bonds

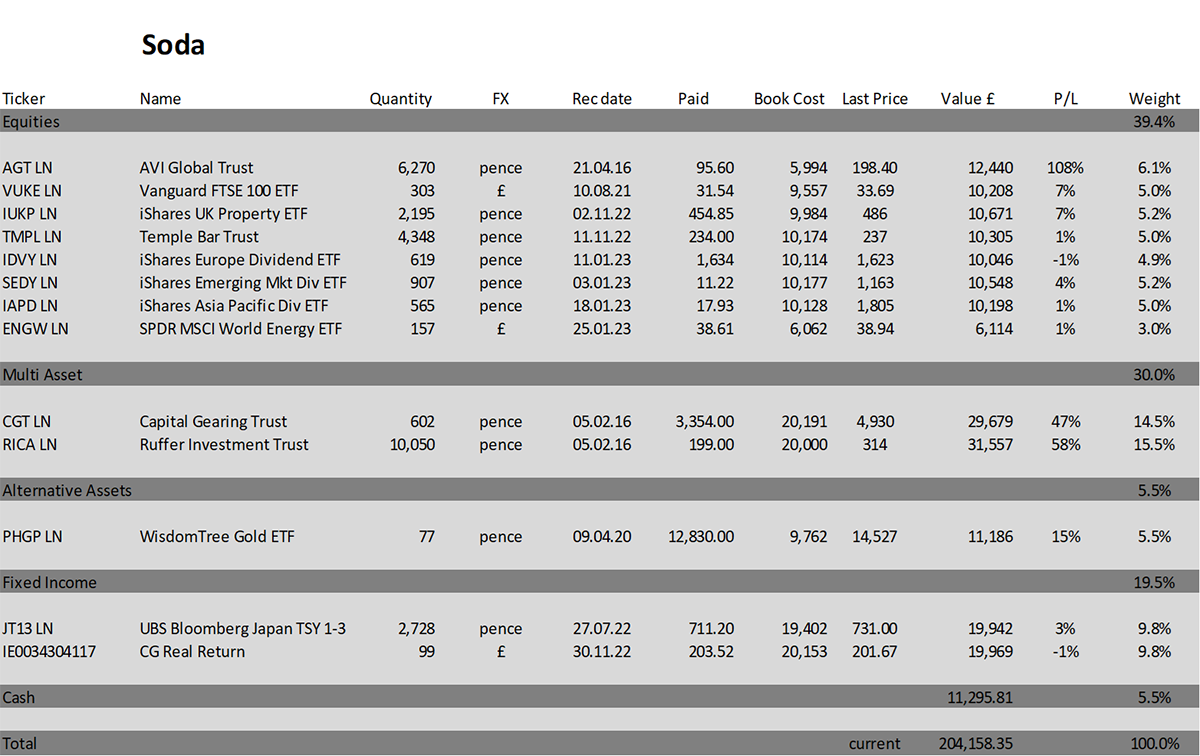

Trade in Soda

The postbox is bulging with gold-related matters, so please read that further down. In recent pieces, I seem to have confused the audience. I love gold, always have, and always will, but there are tactics around trading it. My actionable investment views on gold are expressed here in the Multi-Asset Investor. Atlas Pulse is a free ByteTree publication and merely discusses the medium to long-term trend.

I am adding emerging market bonds via the iShares JP Morgan USD Emerging Bond Market ETF (SEMB). This will round off the process for Soda being fully invested in the market following a defensive 2022. The Whisky Portfolio got there much quicker, but that’s fine. I hope being invested is not a contra indicator that a major top is impending. I don’t think it is, but I do expect choppy waters this year.

In recent months, I have been focused on getting our investments right for 2023. A reader kindly gave me the nudge to have another look at emerging market (EM) bonds. Hungry for yield, I can understand why. Robin and Rashpal have recommended global high-yield corporate bonds in the AAA Report, which is linked to improving financial conditions. What’s good for corporates is good for EMs too.

To demonstrate the improvement in credit conditions, both Vodafone and BT share prices have perked up following a miserable few months. They are cheap but highly indebted companies which have gone ex-growth. The most important consideration for them is not data or telephony but the cost of credit. In the aftermath of a major credit event, indebted companies can be the best performers, as seen in 2009, where companies that narrowly escaped death were the best performers. If credit conditions improve, then Vodafone and BT will do well.

Corporate bond yields have risen a great deal over the past year. We last saw 8% at the depths of the credit crisis, so 6% is attractive compared to recent years.

Corporate Bonds Are Cheaper, but Not Cheap

But as you will see, we can do even better than that. In Soda, we currently hold the following bonds:

- global inflation-linked bonds via the CG Real Return Fund

- short-dated bonds in Japan (short-dated bonds are basically cash) via JT13

- various other bonds in the multi-asset funds.

Emerging market (EM) bonds are issued by EM countries and tend to have higher yields than developed market bonds. In 2010, EM bonds had the same yield as developed corporate bonds above, whereas today, they yield 3% more. That is appealing.

Emerging Debt Is Attractive

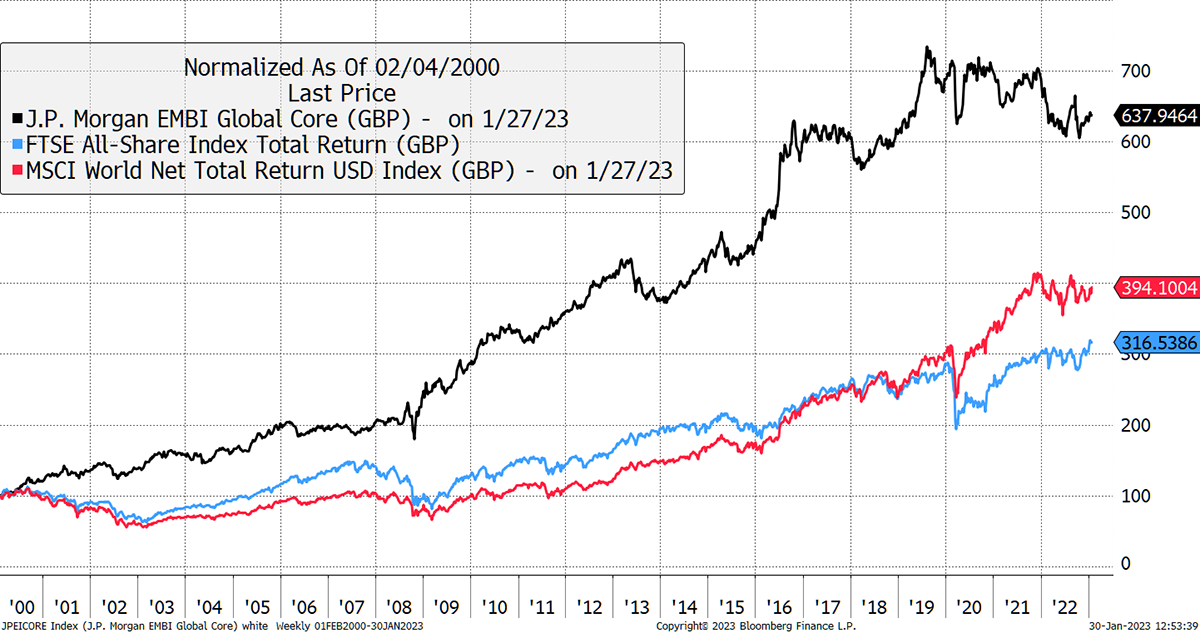

Compare the JP Morgan EM Debt Index (EMBI) with the FTSE All Share and global equities, including dividends. It would surprise many how EM debt was spectacular before 2008, mainly because it started off dirt cheap and went on to have several crisis-free years.

EM Debt Beat Equities

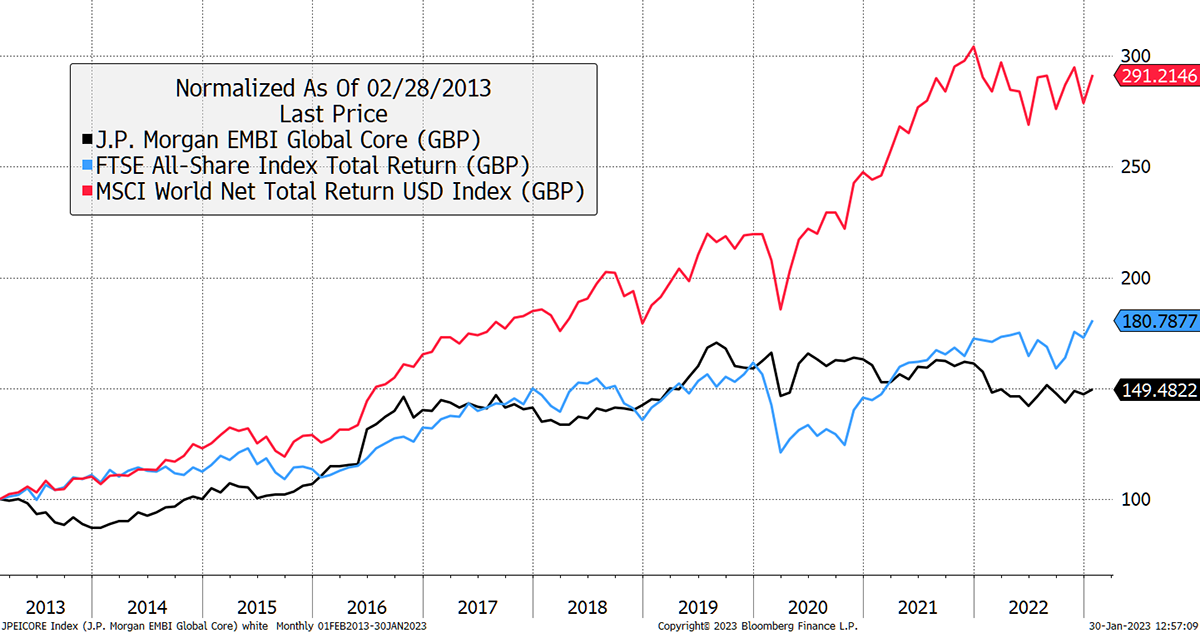

As I have written before, EM equities and bonds peaked in 2010/12 and have lagged the world since. This same chart since 2013 shows how EM debt has delivered poor returns in contrast to the preceding years.

EM Debt has Lagged since 2013 as it Cheapened

This is another very simple catch-up trade to an asset class which has lagged for a long time and is undervalued.

Buying 5% iShares JP Morgan $ EM Bond UCITS ETF (SEMB) in Soda

SEMB tracks the JP Morgan EM Bond Index. This holds 592 different dollar-denominated bonds from around 50 different EM issuers. It trades in GBP and is unhedged. The portfolio yields 6.8% (average yield to maturity) with a “duration” of 7.5 years.

Duration is a bond term. Cash has zero years’ duration and no volatility. Long bonds can have duration of 30 years or more and are volatile - around twice that of the stockmarket. 7.5 years’ duration implies the portfolio has approximately 70% of the volatility of the stockmarket.

The annual fee is 0.45%, which isn’t too bad considering how complex the strategy would be to replicate yourself.

To Hedge or Not to Hedge?

SEMB holds US dollar-denominated bonds. On the face of it, and as a sterling investor, a rising dollar benefits holders of dollar bonds. But then consider; when the dollar rises the EM issuers’ ability to repay is reduced as their currency falls. What giveth with one hand, it taketh with the other.

In contrast, if the dollar falls, credit risk falls, and the price of the bonds goes up. All things being equal, we are normally better off being unhedged unless the pound is severely undervalued. It was last year, but above $1.20, less so.

There is another factor that comes in. Hedging currency exposure comes at a cost (or a benefit). With UK interest rates at 3.5% and US rates at 4.5%, you’d have to pay the 1% difference to hedge the dollar. If a US investor wanted to hedge the pound, they’d get paid 1% a year to do so. In other words, hedging works better for them than it does for us, as things currently stand.

I have decided to purchase SEMB, which is unhedged.

Risk

The index is highly diversified across many bonds and issuers. There is the possibility that a single country could default, but this is quite rare. The maximum exposure of a single country is approximately 5%. The asset class is liquid, and the volatility is less than the FTSE 100. I deem SEMB to be on the low side of medium risk.

Action:

Buy 5% iShares JP Morgan EM Bond UCITS ETF (SEMB) in Soda

Postbox

After the recent carnage in bonds, it would be great if you would give your current view on the emerging market bonds which we used to own some time back. I recall, the chart looks interesting and it pays monthly dividends. Thanks for your great call on RHIM, keep up the great work.

You are absolutely right, and I thank you for inspiring today’s recommendation. We are getting some ByteTree mugs made, and you are our first winner. Claim it, and I will send you one when we have them.

You have just written that ‘the bulls have it’ about Gold, yet advised we reduce our exposure recently (PHGP). I’m confused can you explain please?

And…

For my investments I am following a strategy to have 50% in Bold (80% Gold and 20% Bitcoin) and 50% following the Multi Asset Investor. Therefore, I have a fair amount invested in gold and friends of gold. Following your input recently on the multi asset investor I have reduced holdings in silver and gold miners. However, when I read the latest version of Atlas pulse your verdict is still bullish…

And…

In Bullion Vault’ s daily market report, they said that yesterday was a record day for money flowing into silver ETFs …

And…

There’s a piece about Central Banks’ gold buying etc. A case for holding more gold in the portfolios?

And…

Very interesting to read your shifting views, current concerns. I am very curious to know what your opinion is on gold sniffing out the pause in rate hikes… I am very torn around gold and miners right now.

I have confused you all on gold, which is hardly surprising given I too, and the entire gold market is currently confused on gold. I found writing last week’s Atlas Pulse to be therapeutic because it has helped make things a little clearer. There are two mysteries. The first is the TIPS dilemma, and the second is the lack of flows.

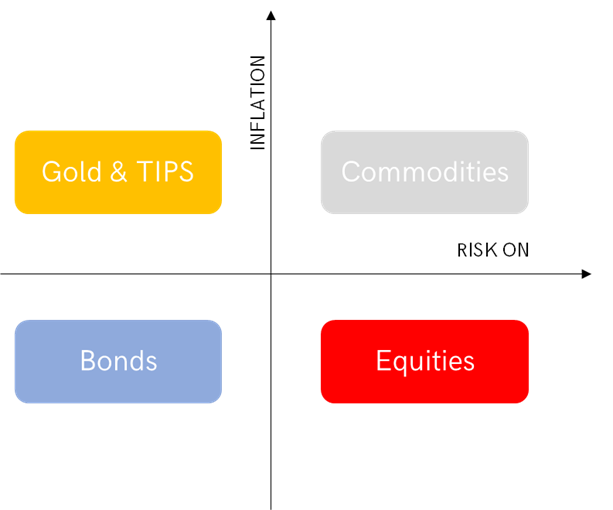

Starting with TIPS, you will know that I believe TIPS are an alternative to gold. They are inflation-linked, just like gold, and sit in the top left of the Money Map. TIPS are very much a friend of gold.

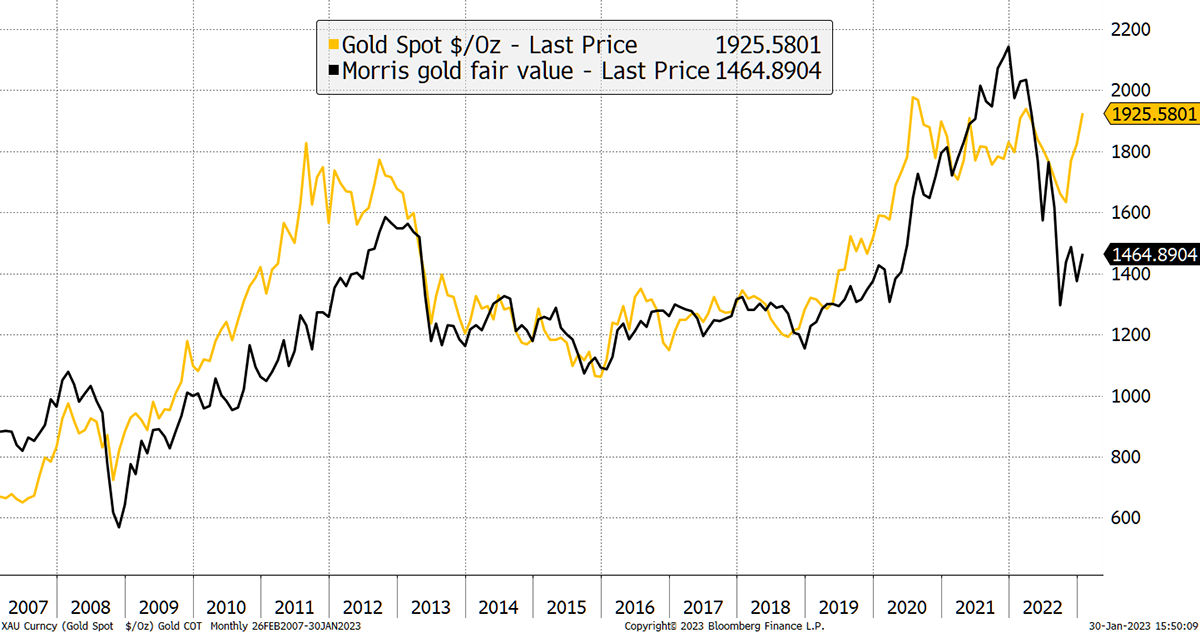

In late November, I became concerned about the chart below. The black line is a proxy for 20-year TIPS, and their price has closely mirrored gold for years. In 2011 and 2020, when gold moved ahead of TIPS, it was a good time to reduce, as justified by prior occurrences. In 2013 gold fell by a third, and after 2020, gold stalled for 2.5 years. It follows that with such a strong signal today, I should either sell gold or, better still, switch to TIPS and therefore maintain exposure to the top left of the Money Map. Doing nothing would be to ignore this strong signal. I think this time will resemble early 2020, when gold surged and TIPS caught up.

Gold-TIPS Divergence

I suppose the confusion was whether gold was going to crash down to TIPS or whether TIPS would surge up to gold. I believe it is the latter. But either way, it is currently less risky to have more money in TIPS than gold.

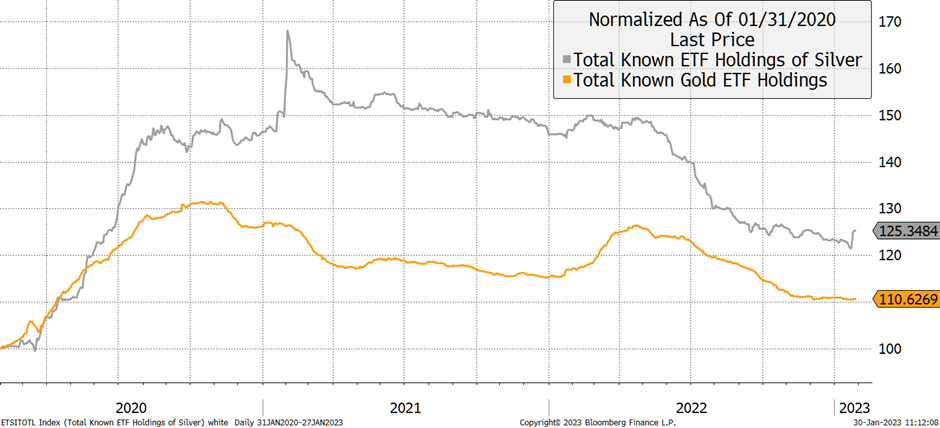

The other question is why investors have been net sellers of gold and silver funds over the past two years. I agree that silver had a decent buyer last week, but one swallow doesn't make a summer. There is a long way to go before you can say this rally in precious metals is underpinned. Right now, the explanation is foreign central bank buying, such as China, Turkey, Qatar etc., as I have been writing about in Atlas Pulse.

Gold and Silver Remain Out of Favour

But no central bank is buying silver, nor are ETF investors, it seems. But against that, supply hasn’t grown in ten years, and bar and coin demand are robust.

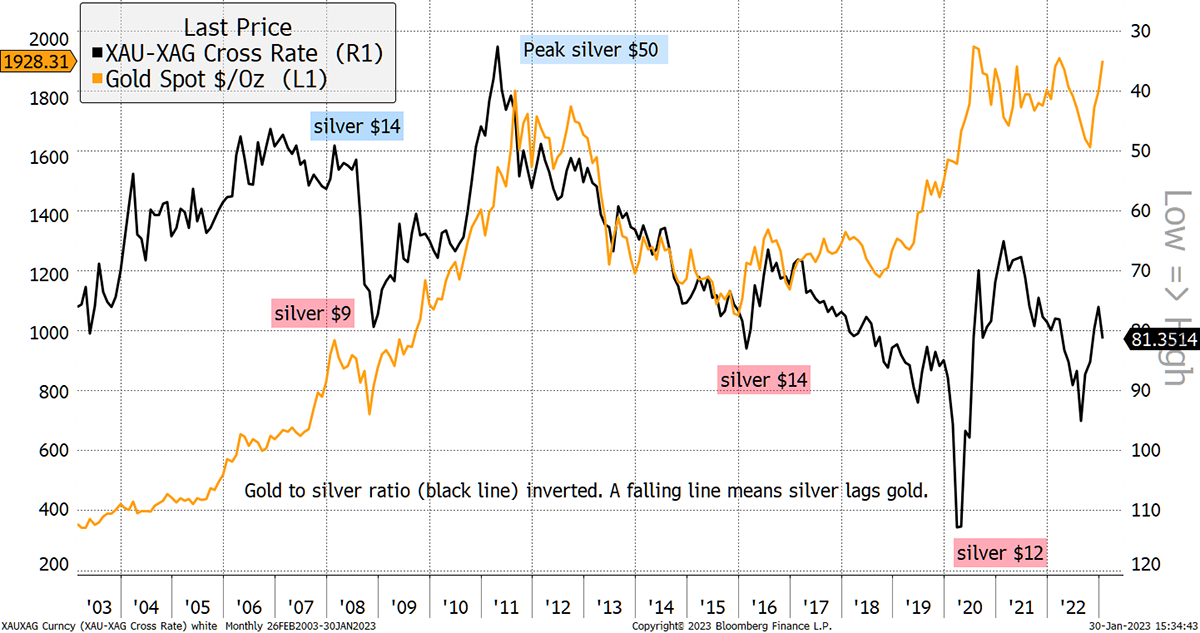

You would normally expect silver to be stronger than gold in a bull market, which means the gold-to-silver ratio (GSR) should fall. I show the GSR inverted, so a rising black line shows silver strength and vice versa. It is around 80, which is where it was in 2008 and 2016. The reason for holding silver instead of gold is that the GSR moves to 40 or 50, resulting in twice the returns of gold. It still hasn’t happened.

What Changed in 2016?

Holding silver in Whisky is supposedly a cheaper alternative to gold, and it should do better. Holding TIPS in Soda is also a cheaper alternative, which should also do better. The bottom line is that I strive for higher risk-adjusted returns, which means better returns for less risk. Sometimes I get it wrong, but these trades virtually always require patience.

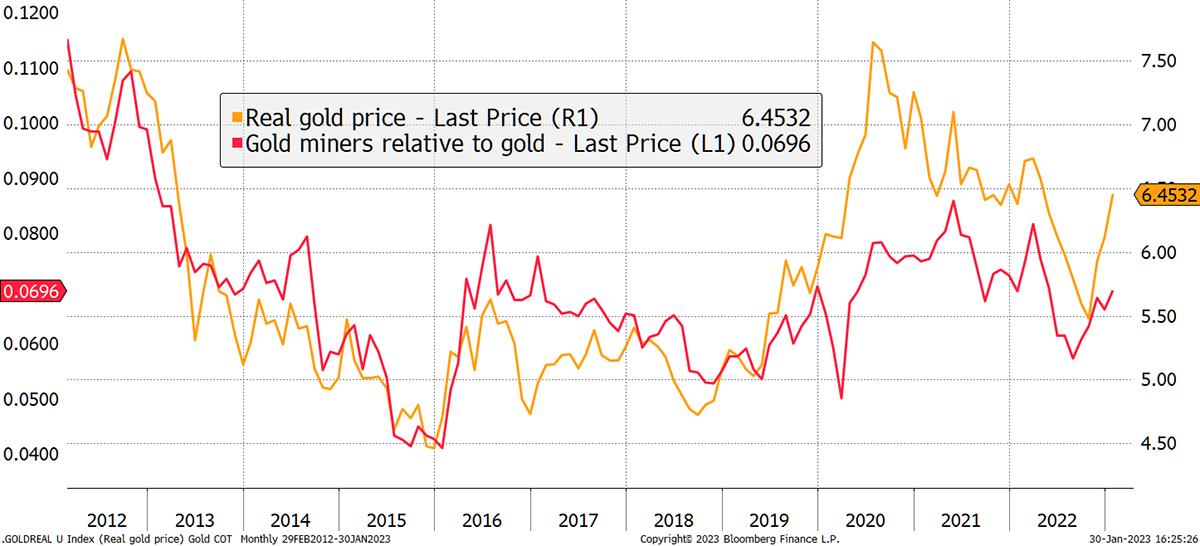

As for the gold miners, they worry me a little as costs are high. I sold Fresnillo last week (FRES). It has fallen, and I don’t regret it. We still have modest exposure to the gold miners ETF (GDGB).

I show gold relative to the gold miners (red) and the real gold price (or gold relative to inflation in gold). It is a simple idea, but gold needs to be rising in real terms for the gold miners to beat gold. That is, the gold price must rise faster than the cost of extraction. If that’s not happening, you can’t expect the miners to beat the gold price.

Real Gold and Miners’ Outperformance

In summary, I like gold but currently prefer TIPS and silver on relative value grounds. The miners need the gold price to surge more than inflation, or else they’ll remain unexciting. I am happy to keep exposure light. As I have been saying for months and months, for gold to really move, we need long-term inflation expectations to move much higher. But even then, TIPS will beat gold.

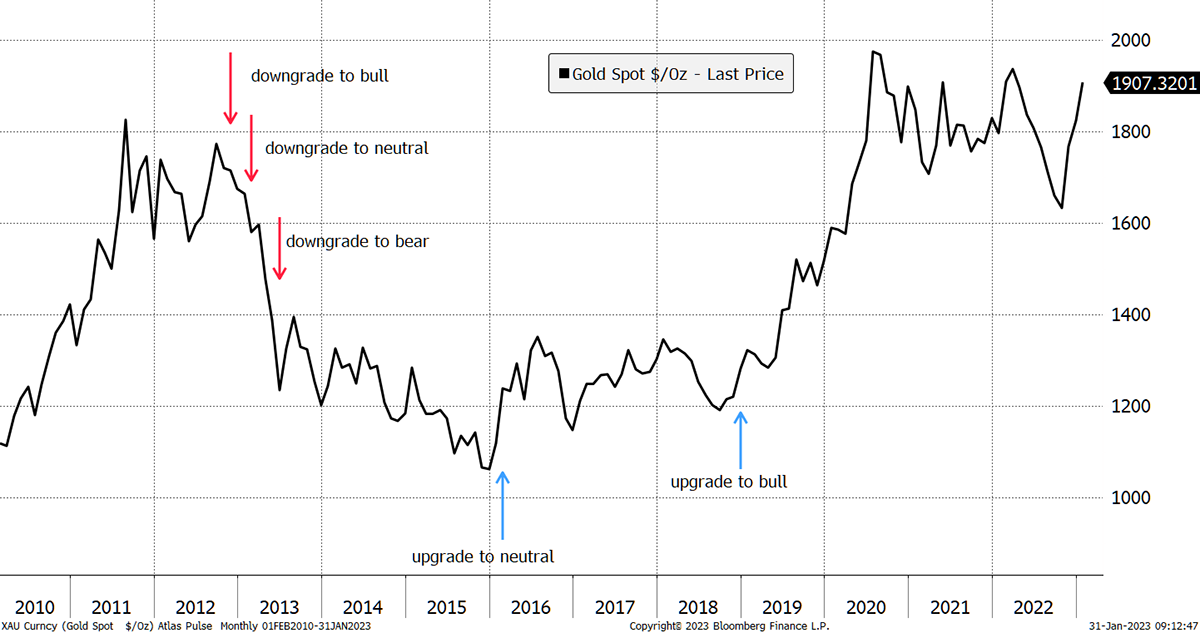

Atlas Pulse is not part of ByteTree Premium. It is free and does not make recommendations, it merely points to bull or bear market conditions in gold. The record is excellent, and while I see short-term risk in gold, as described, I do not see it to be weak enough to downgrade to neutral or bear. That would be a signal that gold is irrelevant for the next few years. I do not believe that is the case, but it is perfectly reasonable to expect more volatility. My actionable views on gold, and anything else, are here in The Multi-Asset Investor.

Atlas Pulse Track Record

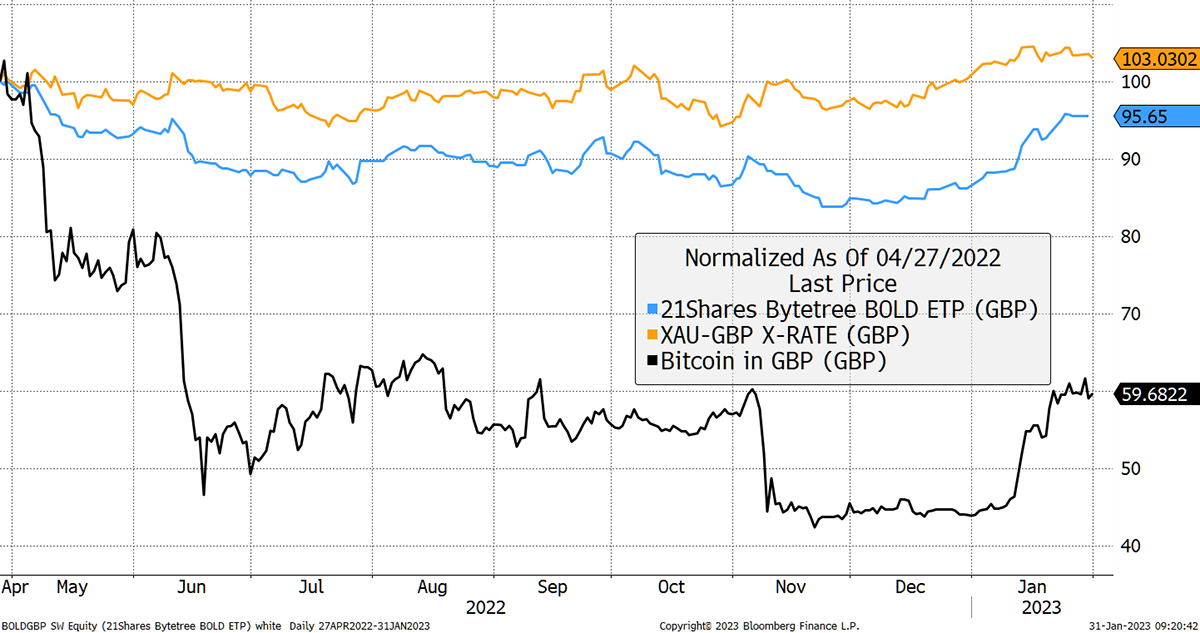

As for BOLD (bitcoin and gold), that is a long-term strategy that holds both assets. The Swiss ETF (ETP technically) is down 4.3% in GBP since its launch in April last year, which isn’t bad considering what has happened. Many would think it would be much worse than that. The BOLD index methodology has around 80% in gold and 20% in bitcoin. The idea is that there is the same amount of risk in each asset. That means having £80 invested in gold is about as risky as having £20 in bitcoin.

BOLD Survived 2022

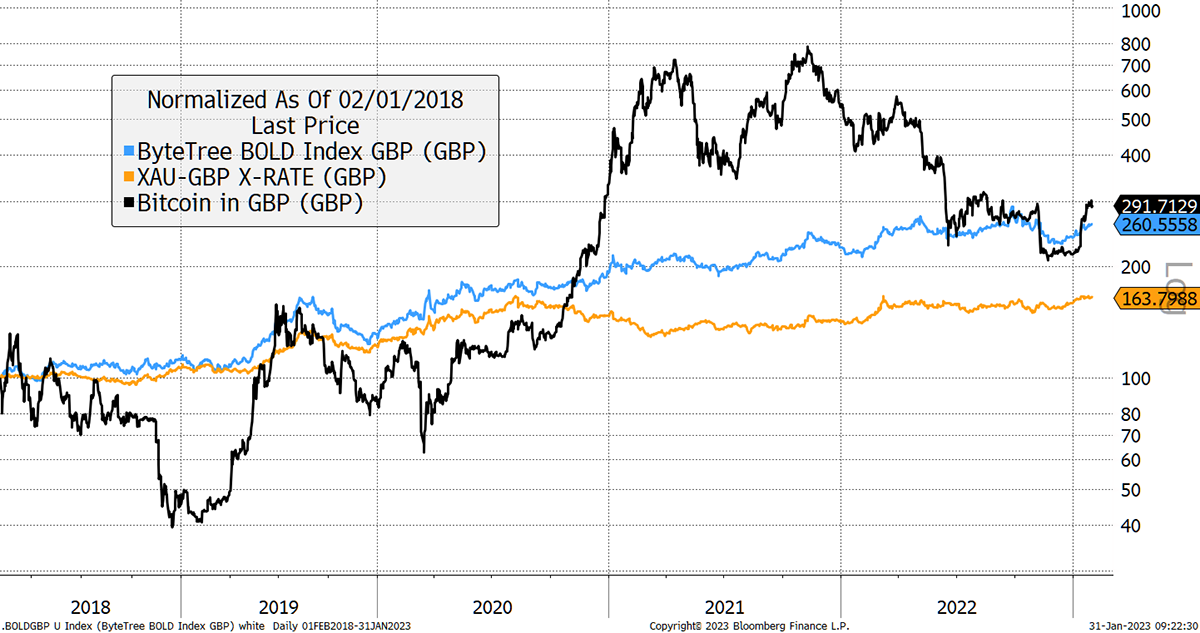

It wouldn’t be the first time the BOLD strategy survived a “crypto winter”, as it held up well in 2018. The second half of 2019 was one of the rare occasions where both bitcoin and gold fell at the same time in GBP, as the pound rallied.

BOLD Also Survived 2018

BOLD is a long-term strategy, and when gold has fallen, bitcoin has tended to do well. This won’t always be true, but I suspect it will be true more often than not.

My short-term tactical views do not impact the BOLD Index. I believe it will prove to be superior to both gold and bitcoin over the coming years, and unquestionably so on a risk-adjusted basis.

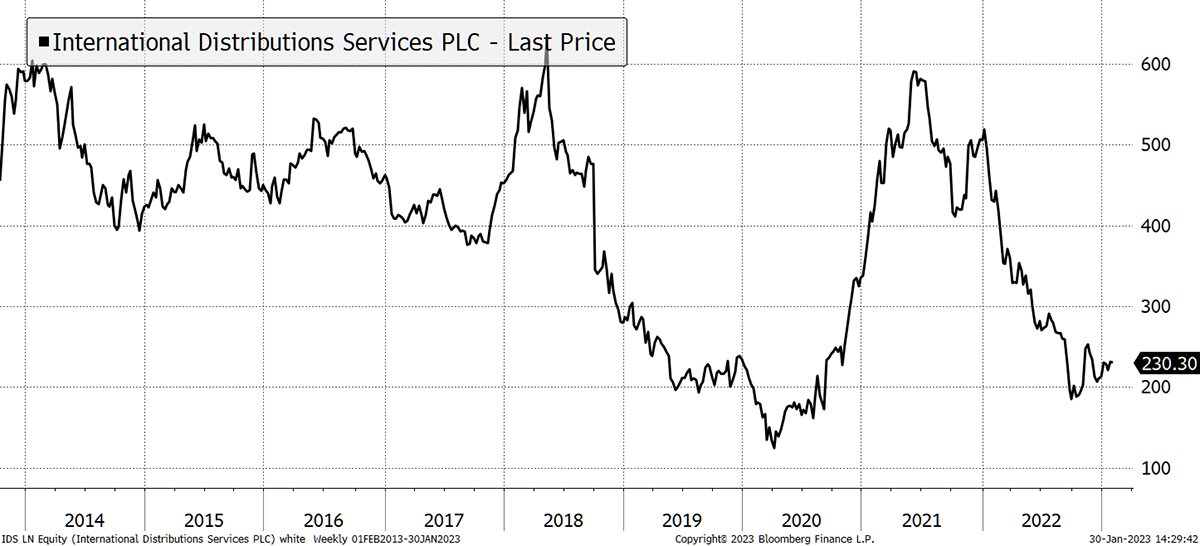

International Distributions Services (IDS) aka, Royal Mail. I know you haven’t recommended them, but they do make up just shy of 5% of Temple Bar (TMPL). I was reading an article by a financial journalist whom shall remain nameless. He was suggesting that they could imminently go bust. Any thoughts?

I am not close to IDS, although you can’t miss the postal strikes in the papers. I considered recommending it for the 2020 recovery trade but sadly didn’t. Some get away.

Royal Mail is Volatile and Political

The probability of default, according to the price of company’s bonds, do not imply default is imminent, but profit forecasts are falling into loss-making territory. Debt levels are not outrageous, and I would disagree with the journalist. IDS is more of a buy than a sell at these levels.

In any event, TMPL has 95% in invested in other companies, and they are very much on point in identifying UK value stocks. I like IDS and TMPL.

Getting Hargreaves to include ENGW on their site is harder than expected. Their response was negative. Perhaps when more of your readership ask for ENGW they may relent and we should just invest in WNRG.

And then miracles happen…

Result! After I complained to HL re them not listing this stock, they escalated my concerns to management and, lo and behold, they can have more than one class of a stock on their system after all. ENGW is now available to trade on HL so you can pass that good news on to your readers.

It is our duty to kick these platforms into shape. As you know, WNRG and ENGW are the same, but GBP ETFs do not have the opportunity to add an FX charge. I will always opt for a GBP share class when it is available. Very well done, and thank you to all who helped, but I gather there is still an issue. Keep fighting the fight!

I’ve done the review on Trustpilot. Hope it does you some good.

Thank you. Some readers have been blocked as an algorithm on Trustpilot assumes some ratings are fake. Thank you all for trying, and we now have 41 very agreeable reviews. Still room for a few more.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.0% this year and is up 104.2% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

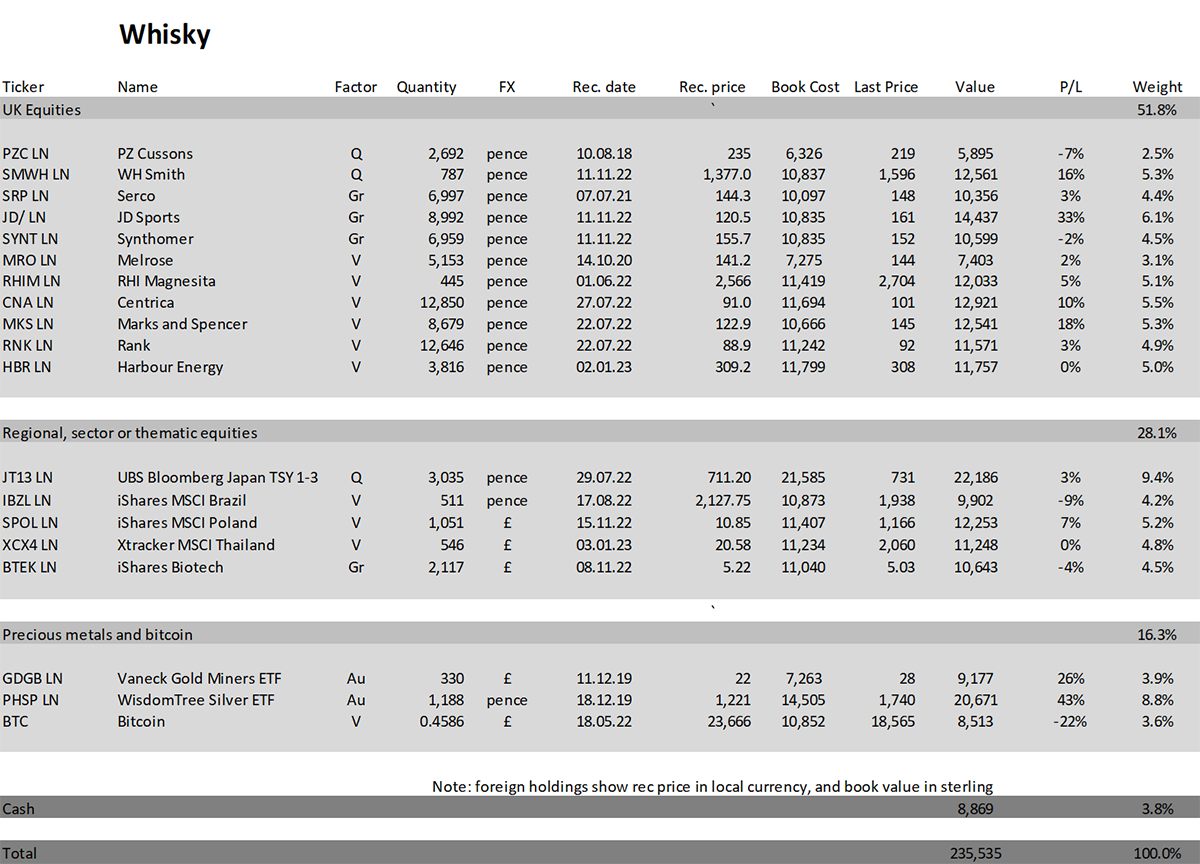

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.4% this year and up 135.5% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

Soda is fully invested and highly diversified. The tilt is away from the US and growth equities and towards the rest of the world and value. There is a stream of dividends coming in, and I believe that is a good place to be in 2023.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()