Going for Gold

Disclaimer: Your capital is at risk. This is not investment advice.

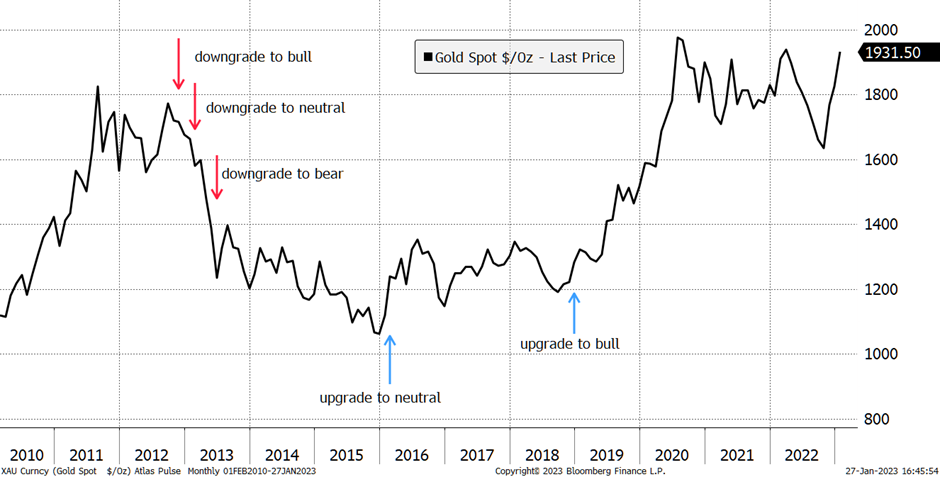

With stocks up while the dollar is down, 2023 continues to surprise. It was supposed to be the great recession, but the market says otherwise. That is one of the confusions around gold. In this week’s Atlas Pulse, I compared the bull vs bear arguments. The track record has been so good that I felt difficult questions needed to be asked.

Atlas Pulse Track Record

There are good points on both sides, but if I had to pick one thing, the two-year real rates would be it. Low to high is bad for gold, while high to low sees boom time. I’m gunning for the latter.

When Real Rates Drift, Gold Breaks Higher

I suspect gold will break out to a new all-time high this year.

Robin Griffiths is back with Rashpal and the AAA Model. You could feel their pain as they reported the model was increasing exposure to equities while selling commodities. There is an emerging theme here - equities rising ahead of a recession which isn’t supposed to happen.

Maybe there isn’t a recession, maybe it’s much shallower, or maybe we spend too much time looking at US-centric data while ignoring the rest of the world. Or maybe the weak dollar is just great for asset prices. So many possibilities.

What I liked was how their model was starting to look more like the Soda Portfolio! Nothing wrong with that, and it was interesting to see them avoid US equities, just like Soda. That contrasts with their love for them for much of the past decade.

In the Multi-Asset Investor, I was re-examining oil. Having been bullish until mid-last year, it was time to revisit as this recovery is more about 100 million Chinese people having a foreign holiday than building new mega structures. That ought to move the dial, and I felt it was right to boost exposure to oil in the portfolios. The increase was modest but felt right. Soda added exposure to the majors, while Whisky added a dirt-cheap exploration company.

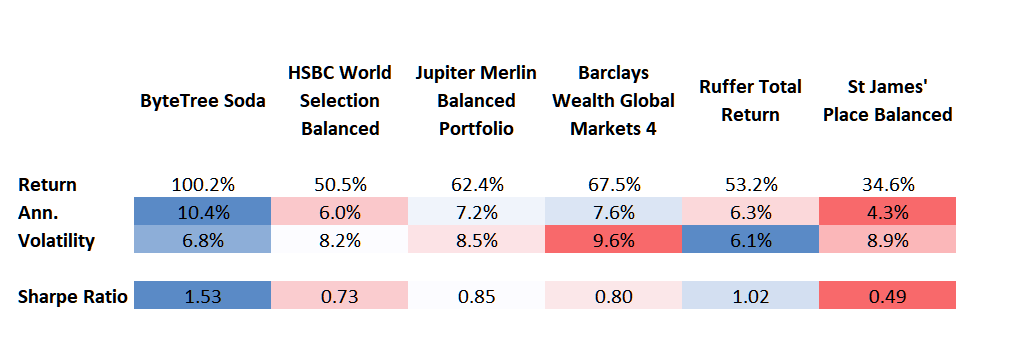

Soda has done remarkably well, and ByteTree Premium clients should be delighted they took control of their own financial affairs. The Sharpe ratio shows risk-adjusted returns and is calculated by taking the annualised return and dividing it by volatility. It makes Soda stand out head and tail above the rest.

Soda versus competitors since 2016

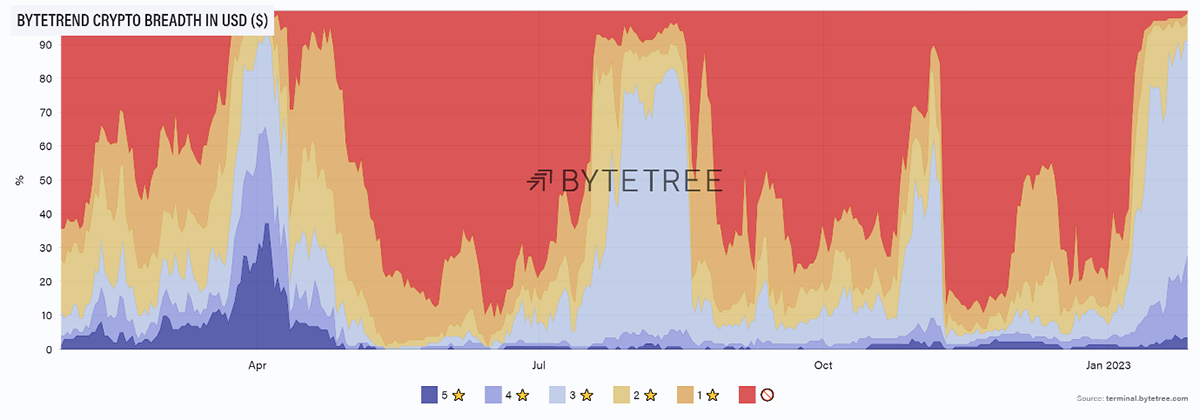

In crypto, it’s looking good. ATOMIC sits on “bull”, and after a horrible year, it is now getting hard to find downtrends. We can only find one.

The bitcoin blockchain is firing on all cylinders. That confirms that risk is back, and we are even seeing investors buy funds again. Long may it continue.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()