Trade in Soda

Markets continue to surprise this year. Inflation is falling, especially in Europe, where electricity and natural gas prices are collapsing. North Sea gas prices are down over 50% over the past month and are 80% lower than they were last August. Despite still being twice the ten-year average, cheaper energy means lower inflation, which reduces the speed of rate hikes, and likely reduces their peak.

We also have a Chinese economy that is back on the move, which is a hugely counter-cyclical force to offset the expected recession in the developed world. Yet so many investors seem to doubt this rally, which began with a momentum crash in Europe in October, soon followed by one in the US in November.

I am a believer and will continue to add equity exposure. Carrying on from recent trades where I added European and emerging dividend-paying stocks, today I will add the equivalent ETF in Asia Pacific.

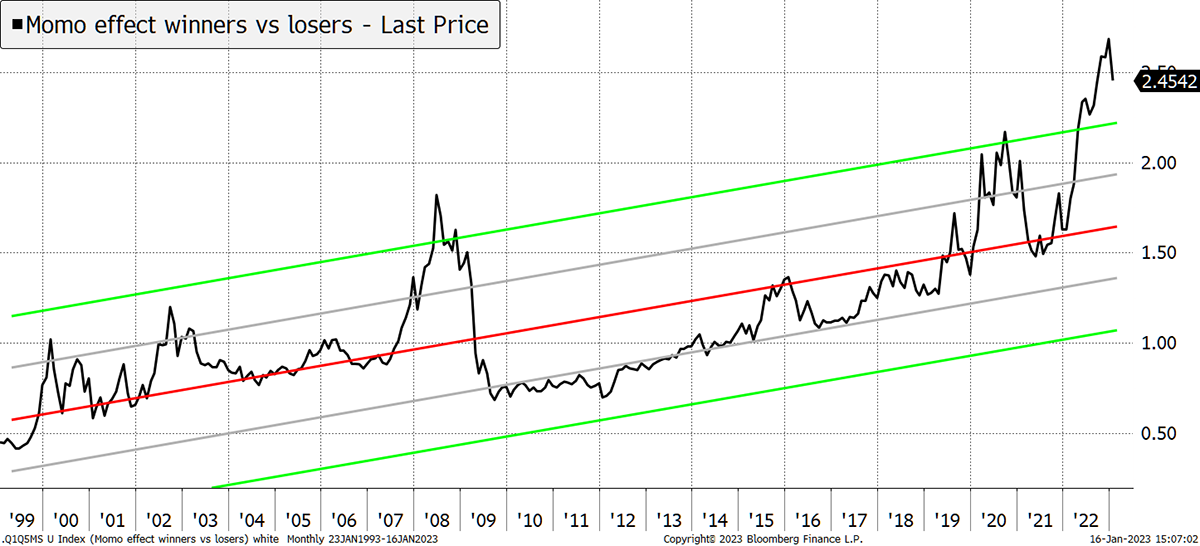

The recent momentum (momo) crash is poorly understood by investors, both professional and retail alike. But they should take time to understand it because momentum crashes are an important force in markets. The recent surge in momo was quite literally off the scale. We haven’t seen levels like this since 2009.

Surge in Momo

Source: Bloomberg

There is nothing scary about a momo crash – it is more of an opportunity. They have occurred in 2003, 2009, 2016, 2020, and recently, and they can be associated with new bull markets. The mechanism is that in the preceding bear market, some assets collapsed while others held up well. The crash occurs when the situation reverses. Thereafter the oversold (and dirt cheap) stocks catapult higher while the defensives lag (although they don’t necessarily fall).

Now that the momo line is falling sharply, we should assume the stockmarket is underpinned. That is not to say there can’t be further market wobbles, which are always possible, but this provides additional evidence that the bear of 2021/2 is over. Other evidence includes:

- Coppock indicators

- Improved market breadth

- Bitcoin strength

- The recovery of dividends

Dividends

I have recently recommended two ETFs focused on dividends, one in emerging markets (SEDY) and the other, Europe (IDVY). I remember when these funds were launched many years ago and being dismissive of them at the time. My view was that dividends required skilled fundamental analysis and should not be left to a simple screening tool. The danger was that investors would end up in companies with high dividend yields, which isn’t necessarily a good thing.

The Dow Jones Index dividend methodologyisn’t bad and makes an effort to find sustainable dividend payers. Companies must:

- Have paid dividends in each of the previous three years

- Dividend per share must be greater or equal to the 3-year average

- Dividend cover must be greater or equal to two-thirds of the 5-year cover

- Last year’s earnings must be positive

- Market cap above $400m with average daily volume above $3m

These screening rules seem sensible to me, and you can be sure Dow Jones will have tested them thoroughly. In recent times, when I have researched ways to allocate to markets on a geographic basis, these dividend ETFs keep coming out on top. I have found two main reasons why.

First, under current market conditions, the stocks best avoided are the growth and defensive stocks. Growth stocks pay little or no dividend yield, which removes them from the mix. Defensives are highly priced and therefore have low dividend yields and so don’t get much of a look in either. Given the index seeks out higher dividend yields, so far, so good.

The second reason is even more important, which is that dividends had their annus horribilis in 2020, when they were slashed across the board. These dividend ETFs were slaughtered during the March 2020 Covid market crash alongside income funds such as Woodford.

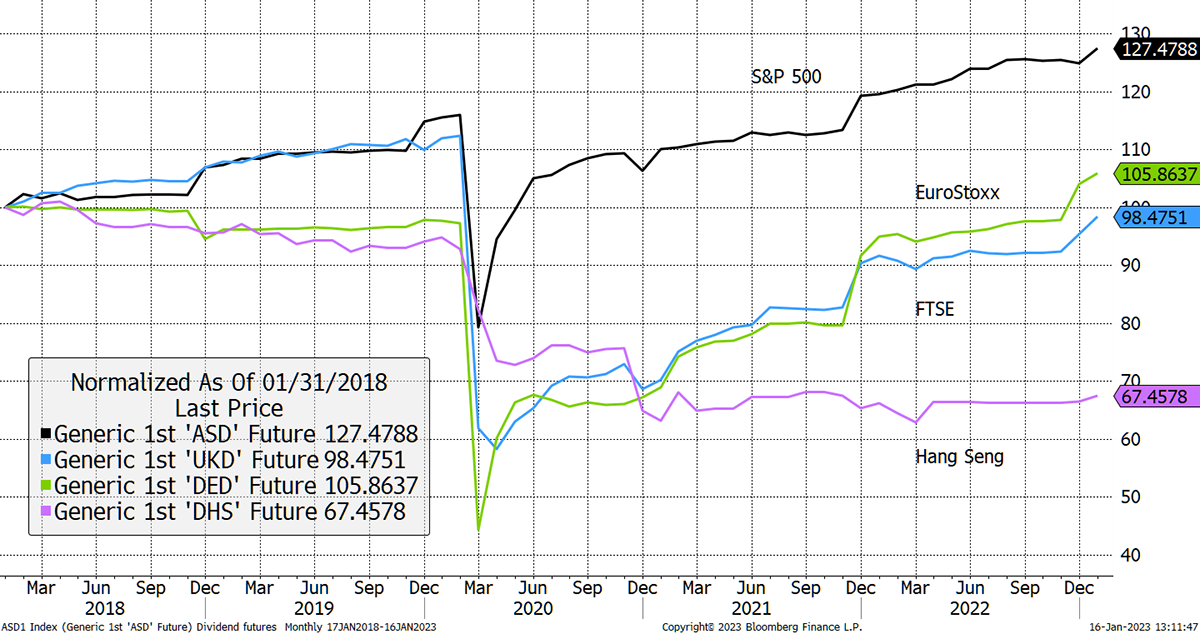

The 2020 pain can be seen through dividend futures, which measure future dividends as opposed to share prices. It is generally cheaper to buy dividends than the whole stockmarket because some companies do not pay dividends. But as a quid pro quo, you are less likely to get as much long-term growth.

In March 2020, government lockdowns caused many companies to slash their dividends. The US had an advantage because all things internet were unaffected. Tech was a high weighting in the US, which helps explain the boom that followed. Notice how UK dividends (blue) slumped from following US dividends (black) in 2019 to looking more like the European dividends (green) or Hong Kong (purple). It was a period of carnage for income investors.

Dividend Futures

Source: Bloomberg

But over the past two years, dividends are practically back to where they were in 2019. The US is a little higher, the UK a little lower, and the Hang Seng is yet to catch up. But with the reopening, it soon will.

The main point is that pre-2020, a dividend ETF was risky because it had high exposure to companies with overly high dividends, even if they looked secure at the time. Post-Covid, it is the other way around as the risk has been flushed out.

During Covid, many companies that didn’t even need to cut their dividends did so in the interests of caution, and so today’s dividends can be considered to be relatively rock solid. This won’t be true in a few years’ time, as the market will drift back to its old ways, but right now, this is an ideal way to capture income, dividend recovery, and value all in one go.

Hence my recent affection for dividend ETFs, which I promise you will not be a long-term affair, but I’ll give it a few years. And as an aside, you have probably noticed that recovering dividends have been one of my major investment themes in Whisky.

This cycle, I want to focus on Europe, Asia and the Emerging Markets, leaving the US market underweight. This is another important slant which I believe will pay off over the coming years as markets normalise.

When I look at the Soda Portfolio, it has 31% in equities, plus whatever we can find in the Multi-Asset Funds, which is not very much because they are cautious. I will continue to boost equity exposure in Soda. Recall that our long-term average equity exposure should be around 60%. This next move takes us to around 45%, all things considered.

Buying 5% iShares Asia Pacific Dividend ETF (IAPD) in Soda

With the UK, Europe and Emerging Markets covered, Asia pacific is the missing piece. IAPD is basically a third in Australia, a third in Japan with the rest in Hong Kong (with a little New Zealand). Having previously complained about Asia Pacific Indices, I can now see how this dividend family fit together quite nicely when you own the gang.

Sector exposure is mainly financials, real estate (which has fallen significantly) and industrials. The average price to book ratio is 0.77x, and the average price earnings is 6.7x, according to the factsheet. There are 49 holdings, the published yield is 6.9%, and the fee is 0.59%.

I know what you are thinking. Hong Kong Real Estate? He’s lost the plot. These are the property companies with their price to book values and their weights in IAPD. These stocks are even cheaper than the bunch we bought in the UK.

| Ticker | Name | Price to book | Weight |

| 19 | SWIRE PACIFIC LTD A | 0.40 | 2.56 |

| 14 | HYSAN DEVELOPMENT LTD | 0.37 | 2.56 |

| 16 | SUN HUNG KAI PROPERTIES LTD | 0.52 | 2.25 |

| 83 | SINO LAND LTD | 0.49 | 1.96 |

| 683 | KERRY PROPERTIES LTD | 0.23 | 1.88 |

| 1972 | SWIRE PROPERTIES LTD | 0.43 | 1.71 |

| 17 | NEW WORLD DEVELOPMENT COMPANY LTD | 0.27 | 1.69 |

| 12 | HENDERSON LAND DEVELOPMENT LTD | 0.42 | 1.68 |

| HKL (Singapore) | HONGKONG LAND HOLDINGS LTD | 0.32 | 1.34 |

Risk

This fund is exposed to the Asia Pacific region, including Hong Kong, which is a part of Greater China.

I have increased equity exposure in the Soda Portfolio by another 5%, moving slowly but steadily. I am comfortable with this as it seems to take us into value with attractive income streams. If this bull market turns out to be lacklustre, which is entirely possible, then at least we have some dividend income and get “paid to wait”.

I believe dividends are currently interesting and are most unlikely to suffer the same fate they did in 2020. These are diversified equity funds holding blue chip stocks, and I deem them to be medium risk, not dissimilar to the FTSE 100.

Action:

Buying 5% iShares Asia Pacific Dividend ETF (IAPD) in Soda

ByteTree Managed Accounts and Fund Raising

ByteTree, or more formally, Crypto Composite Ltd, was founded to crunch blockchain data. It has since evolved into a research business with a wholly owned subsidiary in asset management – ByteTree Asset Management. There are two things that may interest you.

- We have been asked by several clients if we would manage their investments. We will build a book, and when interest exceeds £50m, we will launch this service. If you are interested in a managed account, please let me know stating the portfolio size and your preferred allocation between Soda, Whisky and AAA. This is indicative, confidential and non-binding.

- Following ByteTree’s transformation over the past year (BOLD, Multi-Asset Investor, AAA Report, ByteTrend, ByteFolio etc.), we are undergoing an investment round to fund future growth. If you would like to invest in ByteTree, please contact me, and I will send you details.

Postbox

I’m in the process of investing in the portfolios and noticed that UBS Bloomberg Japan TSY 1-3 (JT13) is in both Soda and Whisky. Is this correct? If I’m applying a 75/25 split, do you suggest investing in both contributions? Many thanks for your advice over the years.

It is correct that JT13 sits in both portfolios. At the time of the recommendation, we were in an equity bear market, and the portfolios had lots of cash. That explains the trade in Whisky, and I am happy to keep it there for the time being. Besides, this trade has finally caught peoples’ imagination. It is buzzing in the financial press.

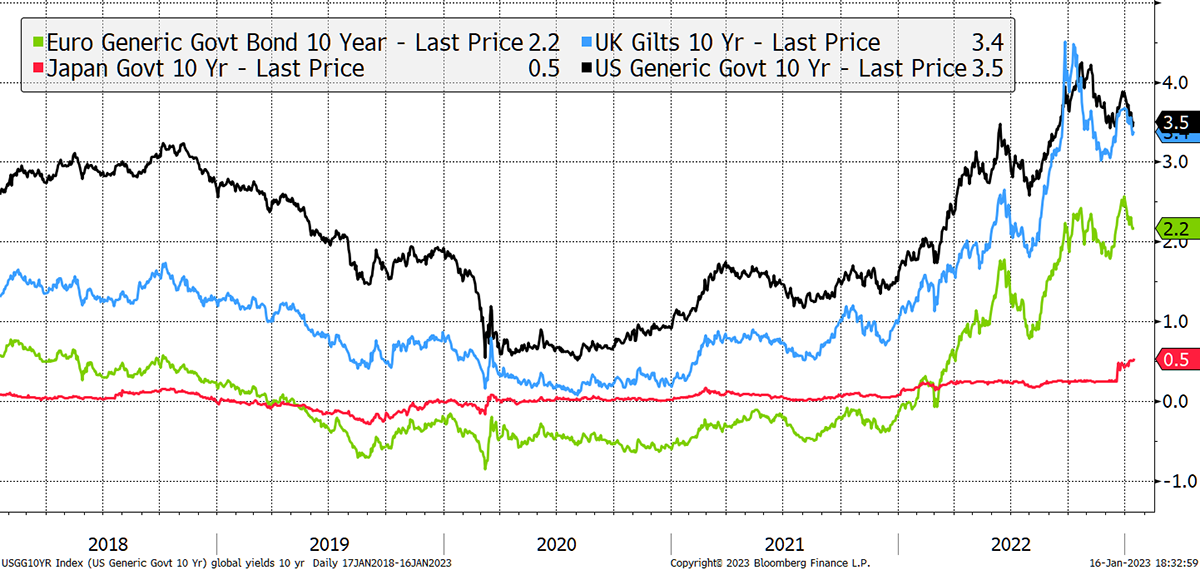

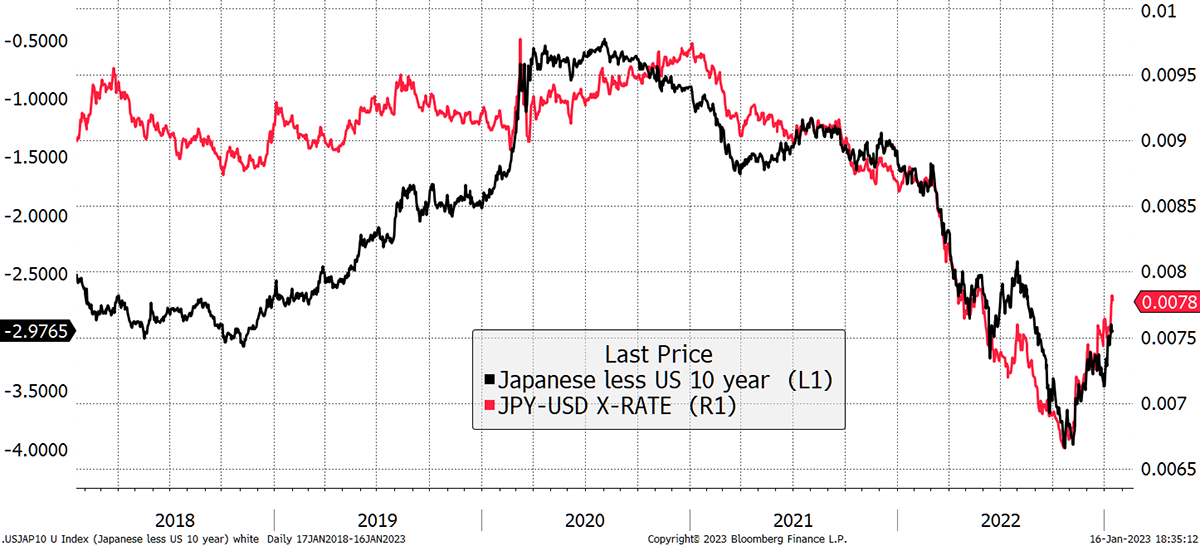

The yen could do very well as it is severely undervalued because their bond yield has been held down by yield curve control (YCC). This policy is struggling, and the expectation is the Bank of Japan has their “inverse ERM moment” whereby the bond yield rises quickly, to a more natural level, and the yen surges.

Spot the Odd One Out

Source: Bloomberg

Japanese yields have been managed by the Bank of Japan (BOJ). They are rising, despite heavy intervention from the BOJ to keep them low. Their YCC worked when the rest of the world had zero or negative rates, but the world has changed. The BOJ must admit defeat and end this policy. When they do, the yen should rise significantly, and JT13 should do very well. The bonds are short dated (1 to 3 years) and so will not be heavily impacted by a rise in yields. It’s all about the currency.

When YCC Goes, the Yen Should Surge

Source: Bloomberg

The allocation is calculated as follows:

With 75%/25% then: Soda 75% x 9.9% = 7.5%, Whisky 25% x 9.2% = 2.3%, Total = 7.5% + 2.3% = 9.8%

The Banks are on the move again. The likes of Lloyds and Barclays look interesting on the chart. Time to re-visit?

Too true. I seem to have been jinxed by the banks over the years – either working for them or investing in them. They do look good but consider that some financial exposure has found its way into Soda through the dividend ETFs. I think we are covered, but it is certainly something I am watching closely.

Does Bytetree have a recommended way of purchasing Bitcoin and in the case of the Multi-Asset portfolio would BOLD, if we can buy it, be a suitable alternative? I think there might be quite a lot of subscribers who would dip their toes into the crypto space via a trusted source of advice as they are uncomfortable with some of the potential technical issues and risks as opposed to the ordinary investment risk. As ever your guidance would be greatly appreciated. I am enjoying Bytetree Premium very much.

And…

Given that Bitcoin, rather than the wider crypto market, is included in the Whisky portfolio, is it worth considering one of the following in order to get a closer representation of Bitcoin itself XBT Provider Bitcoin Tracker One (BIT-XBT), or XBT Provider Bitcoin Tracker Euro (BIT-XBTE).

They are excellent ideas, but sadly they have been banned by the UK regulator. Our BOLD ETF has also been banned. UK citizens will struggle to invest in crypto ETPs or ETFs. If you live outside of the UK, you can.

That said, where there is a will, there’s a way. There is a contact on the ByteTree Asset Management website who will take an order for BOLD in the UK. You will find them by scrolling down this page. It is important that you self-certify you are an accredited investor before doing so.

I would love to have BOLD recommended because it is such a good product and is proving to be a better option than gold or bitcoin alone.

Is a Bitcoin Equity ETF a reasonable way to gain exposure such as VanEck Digital Assets ETF (DAGB)?

Yes, but it is much riskier than bitcoin itself. That said, not a bad time as crypto stocks have fallen a long way. Also, consider Invesco CoinShares Global Blockchain (BCHS), which is a little calmer.

There are no simple answers to finding safe ways to invest in crypto. The system has deliberately made things difficult.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

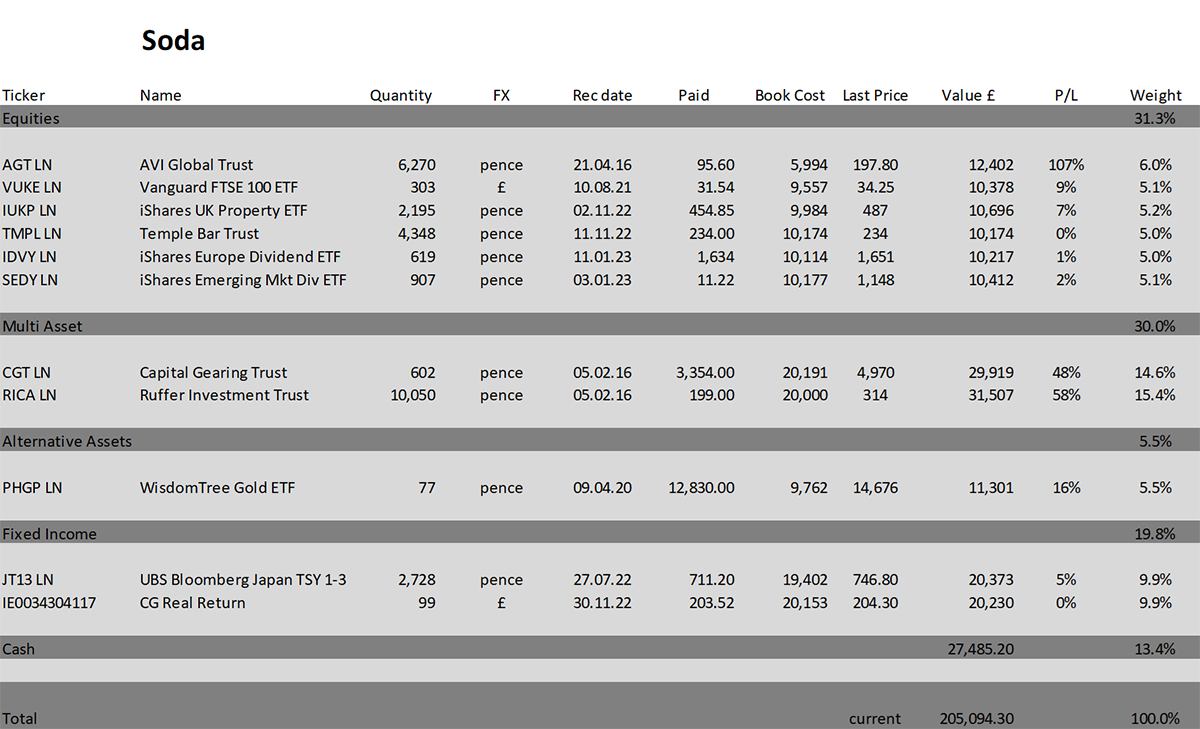

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.5% this year and is up 105.1% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

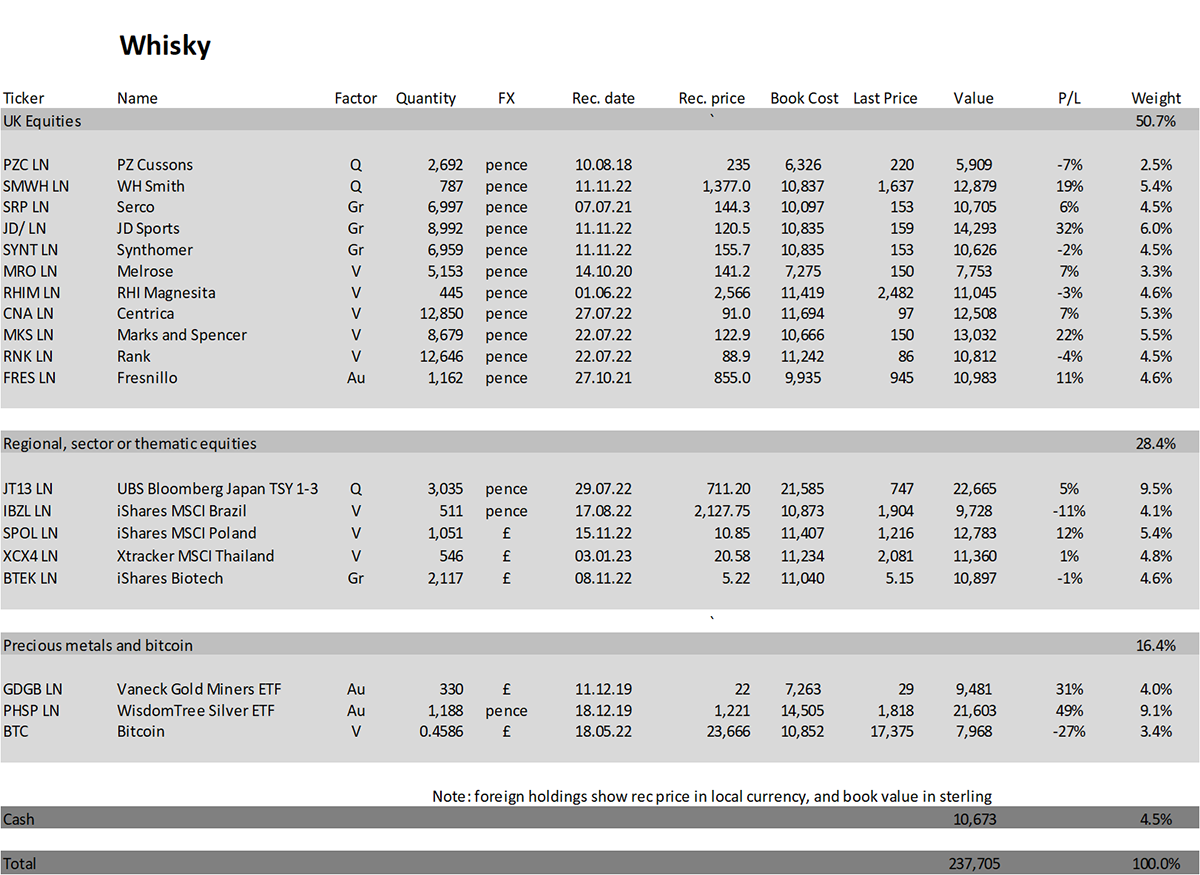

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.4% this year and up 137.7% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

I would be extremely grateful if you would review ByteTree on TrustPilot. It only takes a moment to leave a (5-star) rating and a short review. This will help us in attracting new subscribers, which will keep our prices down.

I am a bit worried that things are going a bit too well. Whisky up 6.4% this year? Too much too soon. Let’s look at that next week.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd