Having turned defensive in late 2021, we bought the dip in the autumn and have now started to scale back. The risks have risen because inflation is not going away quietly. We find ourselves at another turning point, and we must wait to see what starts to unravel. There are two very different, yet plausible, scenarios.

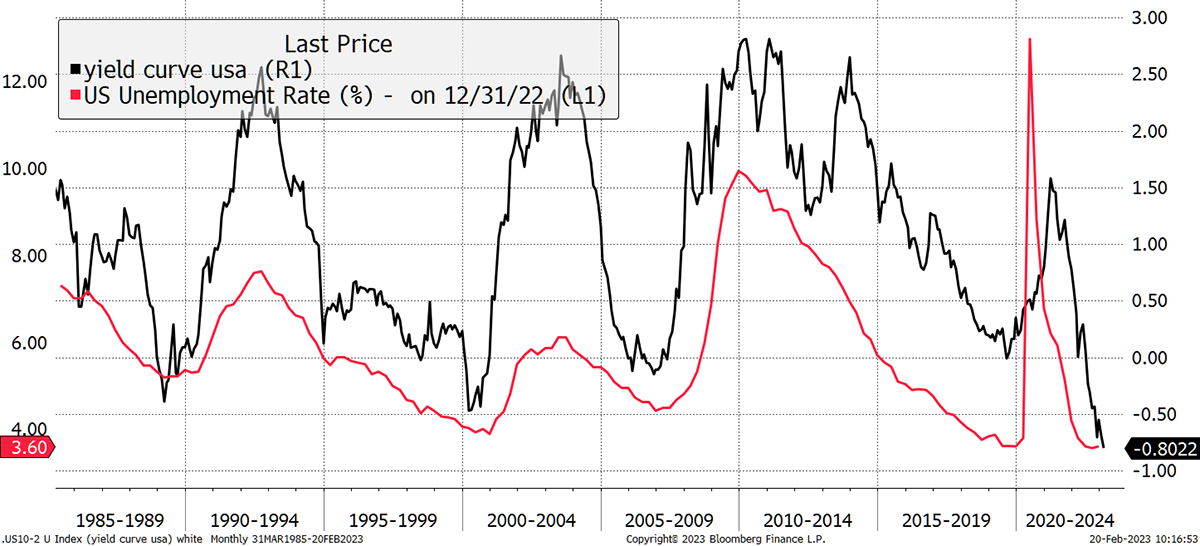

Carrying on from recent discussions about the bond market and too many jobs, the “yield curve” is inverted, which basically forecasts a recession. It is worth adding that the inverted yield curve occurs when unemployment is low, and as it normalises (rises), unemployment rises. It stands to reason that unemployment is low at the top of the cycle and high at the bottom.

A Steep Yield Curve

Some believe this inverted yield curve forecasts a deep recession, which it normally would. But I am equally aware of the enormous distortions following years of zero rates. Who knows what it means this time, but a heavily inverted yield curve should not be ignored.

What’s Going On?

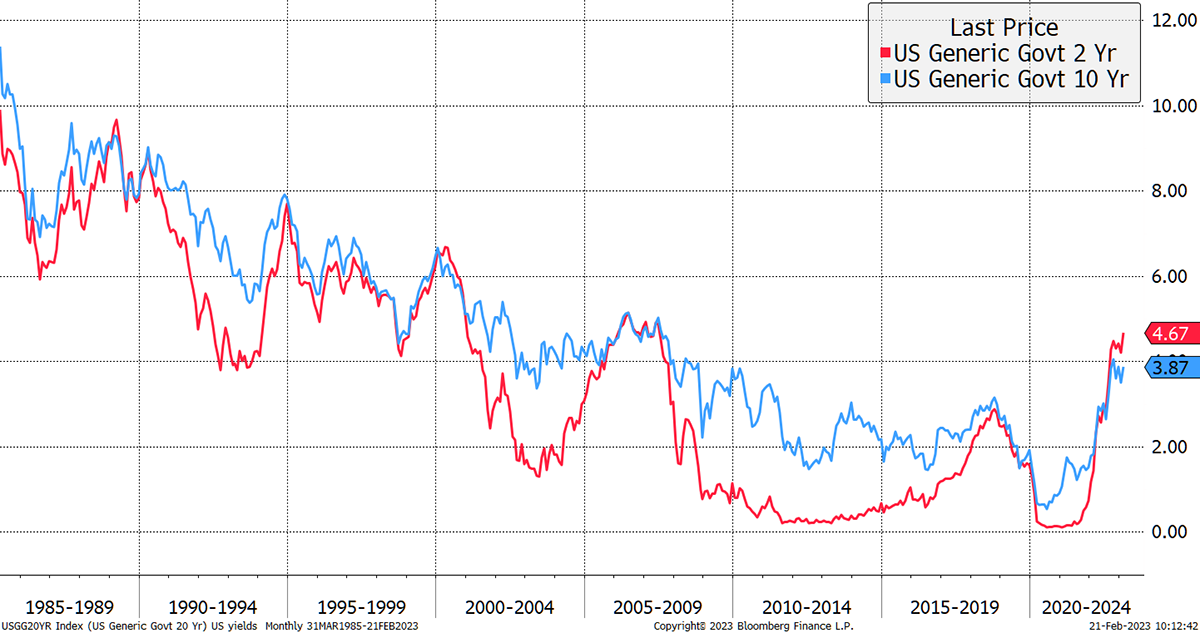

The yield curve is broken down into its constituent parts below, with the 2s and 10s shown separately. What concerns me about the level of the stockmarket is the level of bond yields. As the 10-year moves above 4%, that will put downward pressure on stocks. We saw this last year.

Taking Off

The bulls say that any downward pressure on markets would be short-lived because as soon as people start losing their jobs, the central banks will “pivot” and cut interest rates. They will declare the battle against inflation to be over. That would bring the 2s below the 10s quite quickly, as seen in past recessions in 1989, 2001, 2007 and 2020.

But even that didn’t lead to equity bull markets. You had to wait another year or more. It was a time to be patient, own bonds and ride out the storm. Buying bonds today would be a difficult decision as it remains unclear whether the battle against inflation is being won. If it isn’t, the bulls are in real trouble because rate cuts will not be an option.

Action:

No action

Postbox

Last week I asked if more overseas stocks should feature in The Multi-Asset Investor. There’s logic as it increases the opportunity set and boosts diversification. And these days, charges are no longer prohibitive at good brokers. Here is some of the feedback I received.

I believe investing outside the UK is an excellent idea. I cannot believe that we will be returning to $1.60 let alone $2.00 for a long time.

And…

My vote would be for yes. That said, I do appreciate your focus on sector/money map in choosing your stocks. However, the UK has an increasingly restricted base of listed companies, so I think it would be sensible to consider outside the UK If you can’t find the exposure.

And…

In response to the question, you asked in today’s TMAI, I would very much be on the side of embracing more global stocks.

And…

Picking up on your suggestion to revisit global stocks rather than focusing on the UK, I would definitely agree on this. Being based in Switzerland, I like UK stocks as this market is rather cheap, but I would like to avoid being almost only exposed to this one.

And…

I think it would be a great idea to embrace Global, US and European stocks along with the current ideas in both the Soda and Whisky portfolios.

And…

Most definitely yes! I don’t see any good reason to restrict our investment universe to UK listed stocks. Since you’re equally familiar (or even more familiar) with global stocks than UK stocks, I’d certainly be happy to see some global stock recommendations as part of the Soda or Whisky portfolio.

And…

I think the idea of widening the scope to good companies from around the world is a great idea. I’d love your take and knowledge of companies outside the UK to add to the portfolios.

And…

Of course I would like to see more international stocks. I was wondering, why there are just the UK ones. I think your “Byters” are well spread around the globe.

And…

There are many good opportunities in some great businesses, often in sectors badly represented in the UK market. Information on these markets is much easier now for retail investors to access, if anyone is wanting to read up a little on recommendations. A resounding yes please from me.

But…

I prefer to buy British if I can, but only if I can get a great product otherwise you end up with an Allegro. So please find us the best investments, British if possible, but if not then worldwide is fine.

And…

The only caveats I’d flag are that these equities still need to be on the major exchanges of the platforms. I think therefore you would need to make it clear to the tribe that they needed to have their capital on a major platform or robust private arrangements.

And…

Buying overseas shares and funds would add additional cost in fees so I’m not that keen on buying stocks in Europe and North America. I'm sure my holding is smaller than many of your readers. I do want the exposure to foreign markets and think your approach with ETFs and different funds (such as iShares) works well. If you were to add a few recommendations from overseas markets that would not concern me, but a larger move to the ownership of foreign shares would be an issue though and would remove the great value I see in your service.

Thank you for your feedback. I think it makes sense to venture overseas, but we will move gradually. The desire for overseas stocks is primarily motivated by having a larger pool of liquid stocks to choose from, which would be restricted to North America and Europe. Also, they are easier to access than ever before.

I have dusted off my old stock models, and nothing jumps off the page at this moment in time. It’s funny that having mentioned Vodafone (VOD) and BT (BT) the other day, Orange (ORA FP) sends the same message. Many sectors are correlated around the world, especially in areas like commodities.

This will be particularly useful in areas where the UK is poorly represented, such as technology, industrials and consumer discretionary.

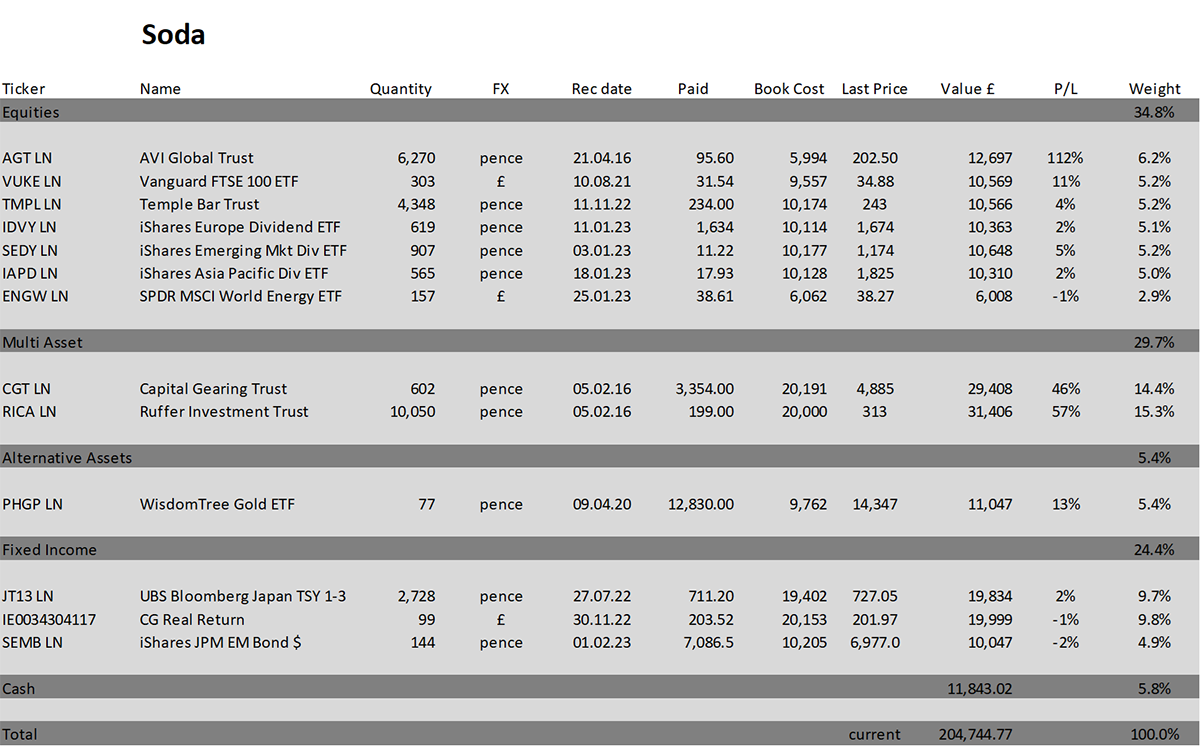

I was planning on adding to some of the positions in Soda (especially IDVY and VUKE/TMPL), until last Friday and your flash note. Would you think it may be risky at the moment and would waiting be wiser?

That is a very hard question to answer at the current time because it feels like we are at another turning point, but which way does it turn? I am certain that if the bond yield (and the dollar) rises materially from here, markets will come under severe pressure. The trouble is, I am not 100% certain that bond yields will rise. That’s partly up to the policymakers, and partly to the unknown unknowns.

In my opinion, the holdings in Soda are not particularly risky, and I plan to hold them over the long term – that is, unless things change.

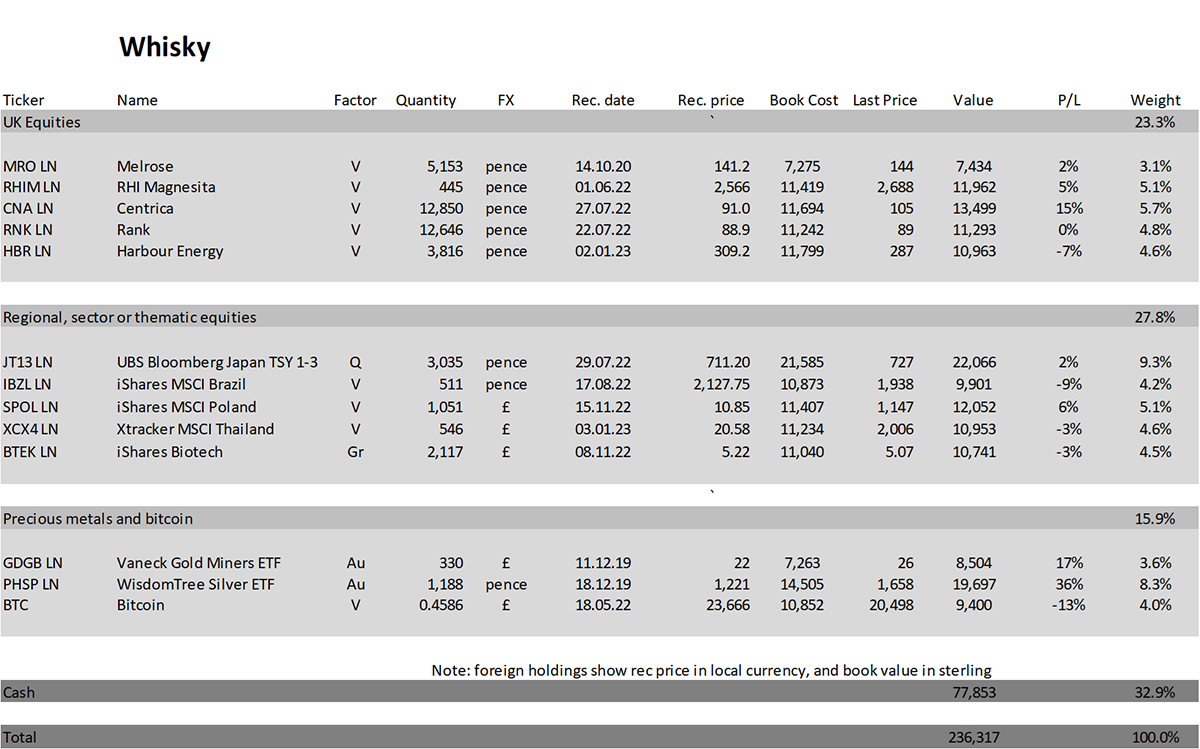

Whisky’s job is to react quickly, and it has already taken a step back. Soda doesn’t need to act so decisively because it never takes excessive risk in the first place.

A very topical question.

Directors at Harbour Energy (HBR) sold some shares recently. Thoughts?

You can’t always read too much into this. It is not unreasonable for directors to cash in some shares when outside the closed period. I have no insight here, but the main reason I hold HBR is just in case oil goes through the roof.

I’m away on a short mini break in sunny Scarborough. And I’ve been making some observations. It’s packed. Yes, I know it’s half term, but, in the face of “can we afford to eat or heat” – it’s packed. And packed with people spending money in both small and large enterprises. And at highly inflated prices. Example, a pint of best bitter (cask – Black Sheep in case you’re interested) is not an inflation matching 10% higher, but 30% higher than it was in June, when I was also taking a break in Yorkshire’s premier resort. I think companies could well be posting better figures than forecasted. The doom and gloom of the BBC doesn’t appear to be ringing true here, that’s for sure.

It will amuse you to know that a school friend (and his parents) took me for a day trip to the beach in Scarborough in 1982, and I got very badly sunburnt. Who knew it was such a tropical paradise!

It’s not just Scarborough. Prices have gone nuts everywhere. Booms precede Busts.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.3% this year and is up 104.7% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.8% this year and up 136.3% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

I feel I am harping on about this subject, but we are at a crossroads. It is unclear which way to turn. Our current positioning seems about right: neither too risky nor too cautious.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd