Over the past year, what was good for the US dollar was bad for the stockmarket. The world’s reserve currency lubricates (or seizes up) financial markets. A weak dollar is bullish, and a strong dollar, bearish. The dollar was strong (the euro weak) until September, and that put downward pressure on stocks. When the dollar turned down, stocks rallied. It was all going so well until two weeks ago when the dollar turned up again. Stocks have stumbled, and I’ll briefly explain why.

Dollar Strength Stalls Stocks

The recent inflation report was not as dovish (interest rates to fall) as expected, and, as a result, the US treasury bond yield has risen. Higher rates in the US attract foreign capital, and that pushes up the dollar. To financial markets, it’s a bit like a vampire sucking the blood from its helpless victim.

Dollar Strength Driven by Rising Treasury Yield

So what?

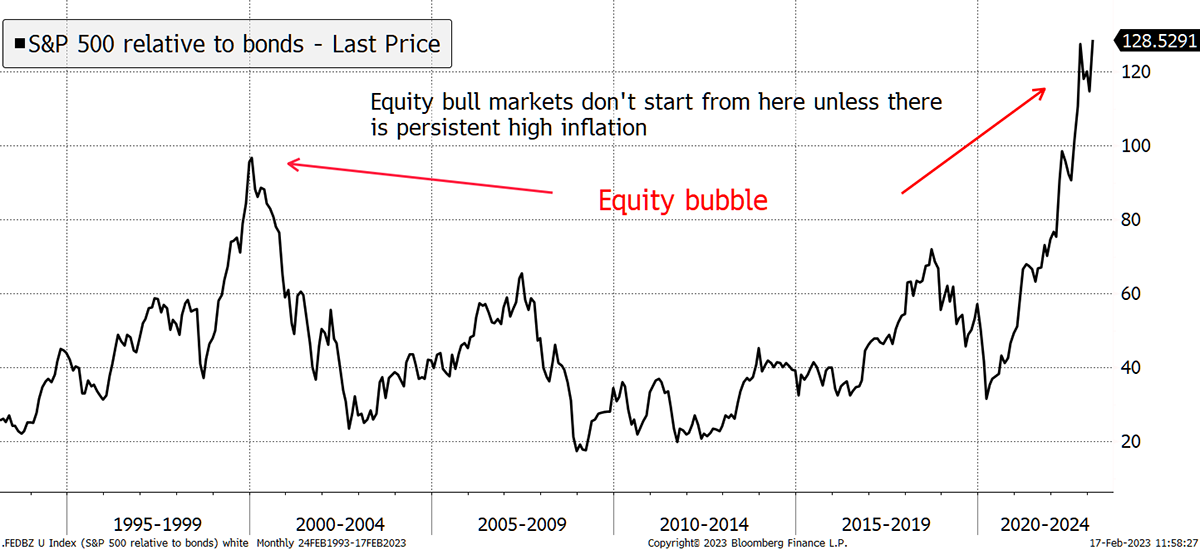

Well, there’s this chart which I published last week, and it is so important that I am showing it again. Over the past year, the long bond has fallen by nearly 50% while the S&P 500 is down by a mere 10%. That’s quite a difference. You could justify it if we were entering an era of very high growth, but we clearly are not.

Unusual Times

We could be entering a period of high inflation, and if so, you would accept this chart because equities will continue to beat bonds. But you would still expect equities to fall, just much less than bonds. That’s because equities enjoy growing profits over the long-term, in contrast to bonds where the pay-out is fixed. Equities are therefore a much better bet than bonds when inflation is eroding the purchasing power of money.

This Week at ByteTree

Moving onto crypto, the ByteFolio Team were concerned about the direction of US crypto regulation. It is increasingly clear that a coordinated effort to asphyxiate crypto is underway in the US. Dubbed “Operation Chokepoint 2.0”, the basic idea is to strangle the industry by cutting it off from any access to the traditional banking sector. More detail in an article by Nic Carter. As he says:

“…in recent weeks, the intensity of efforts to ringfence the entire crypto space and isolate it from the traditional banking system have ratcheted up significantly. Specifically, the Biden administration is now executing what appears to be a coordinated plan that spans multiple agencies to discourage banks from dealing with crypto firms.”

It is a worrying development, but I would remind people that crypto is global, and while having regulators offside is unhelpful, they can only delay the inevitable. The crypto space is not going away, and what doesn’t kill you makes you stronger.

Ali covered Lido (LDO) in Token Takeaway, which is the most favoured liquid staking platform in crypto.

Have a great weekend,

Charlie Morris

Founder, ByteTree