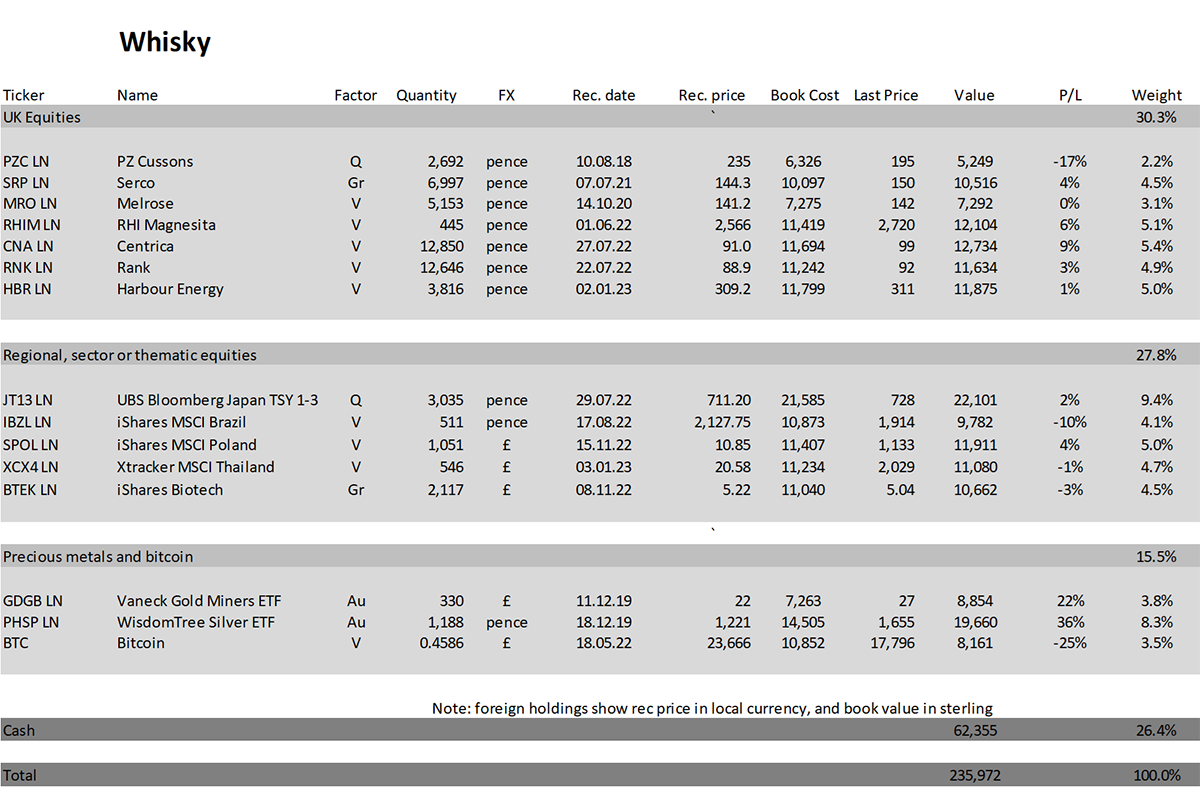

Trades in Whisky

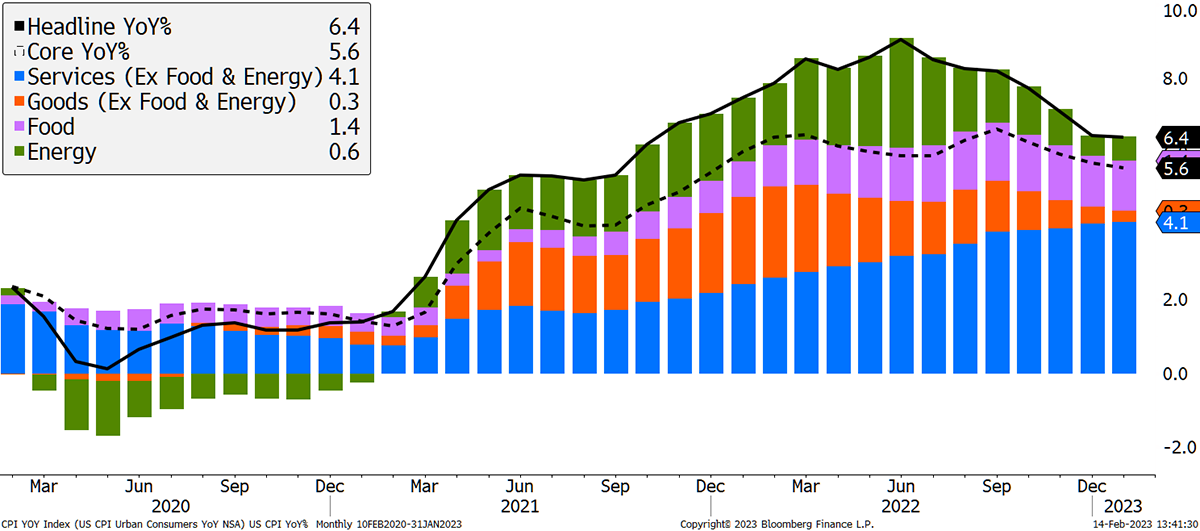

The long-awaited US inflation data came out today at 6.4% for the year. That is 0.1% below last month, but 0.2% above the consensus forecast. This is not what the “transitional” crowd hoped to see. Inflation is falling but slowly. Too slowly for the Fed, and the risk of interest rates staying higher for longer spooked the market.

It is true that the Covid supply shock has more or less disappeared, but commodity prices are not falling by much, and services (wages and housing) are keeping the cost of living high.

Sticky Services

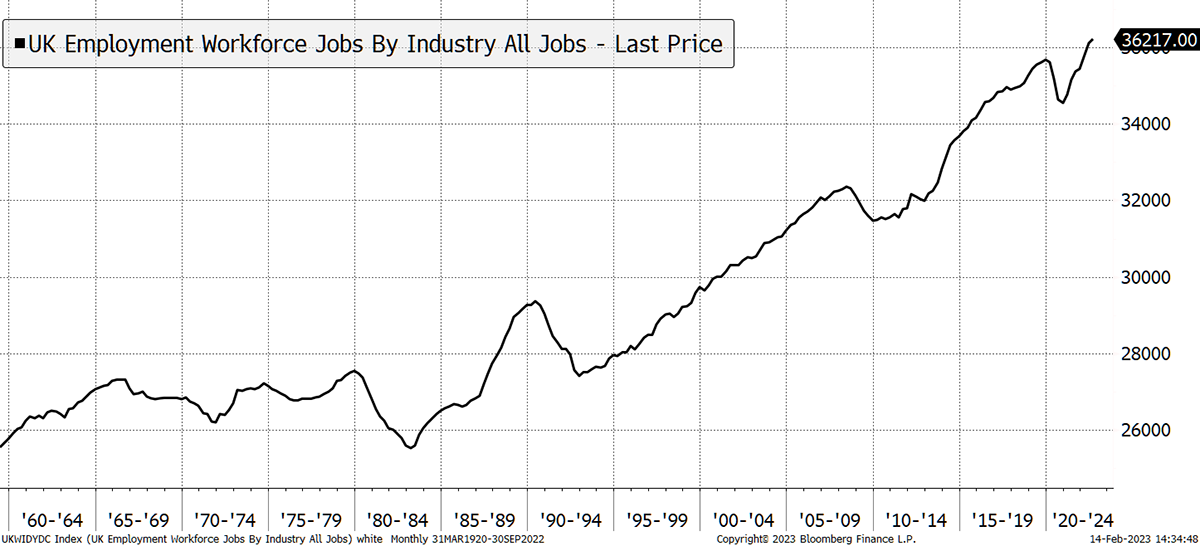

Whichever side of the Atlantic, we live in a world of full employment. Put simply, there are more people employed than ever before in world history. Makes you think.

I remember the news in the 20th century with politicians squabbling over jobs. Somehow, the UK has created 8 million jobs since 1995, bringing the total employed to over 36 million. That compares with employment that had stagnated at around 27 million since the 1960s.

Too Many Jobs

It is extraordinary how we have shifted from too few jobs to too many. At least too many jobs in the eyes of the central bankers who’d like to see us work extra hard and not get paid at all. All these employed people create demand for food, energy, housing and goods, and this part of inflation may prove sticky.

Higher rates quash demand. Next time you hear a central banker say they wish inflation fell, what they actually mean is that they would like to see unemployment higher.

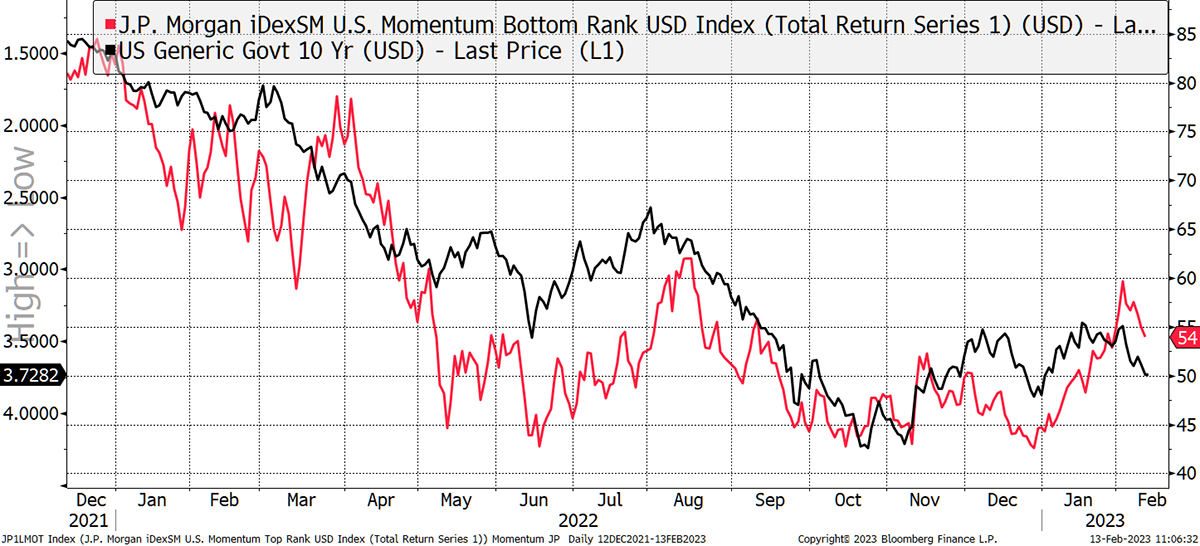

Inflation expectations have been rising in recent weeks, and that continued today. That will freak out the Fed, but could this be enough to boost our gold, silver and TIPS?

Inflation Expectations Rising Again

Probably not, because the bond yield rose as well, and so the two balance each other out, keeping real rates flat. Looking at it over the long-term really brings it home. Is it still realistic to say that all is well and we are heading back to the pre-Covid era of monetary policy? I doubt it.

Something Has Changed

The stocks I bought in the autumn momentum crash are unquestionably highly correlated to interest rates. Here I demonstrate that, with the 10-year yield alongside the momentum losers. If that means nothing to you, fear not. I shall return to momentum another day.

Bouncing Losers and Bouncing Bonds

Following the Flash Note last Friday, I am selling two more stocks in Whisky which are rate sensitive.

Selling Serco (SRP) and PZ Cussons (PZC) in Whisky

I have held PZC since 2018 in an attempt to prove that investors get rewarded over the long-term. Is five years long-term? Probably not, but it is in Whisky. PZC keeps disappointing, and the recent results reported lower than expected margins.

SRP is rate sensitive, and following the retirement of CEO Rupert Soames, the price has been easing back. I cannot find a catalyst for it to turn, but I am grateful that SRP was one of the good guys that got us through 2022.

Action:

Sell Serco (SRP) in Whisky

Sell PZ Cussons (PZC) in Whisky

Postbox

Thanks for what you are doing at ByteTree and for the flash note. Selling UK property and a few stocks that have done well in Whisky seems wise. If the Fed keeps hiking and bond yields keep rising, isn’t this going to be bad for virtually every position in our portfolio? In other words, isn’t the base case for most or all of our positions the fact that rates and yields are going to come down?

After a certain point, excessively high rates are very bad for most things. That said, there are exceptions. If higher rates are accompanied by even higher inflation, then the likes of gold and TIPS could do very well. Higher rates might also be accompanied by higher growth which would also be fine for stocks. But right now, inflation seems to be stubborn, and growth is underwhelming, so excessively tight conditions will be painful. I don’t see how we can escape that.

I see this as DEFCON 3, down from DEFCON 4, as the bond yield has started rising again while equities have been unreasonably strong. It is not just the rising yield, but the combination. This heightens risk, and so the right thing to do is reduce exposure which I have done. If yields rise further, I can reduce risk further, and quickly. They may not, but we just don’t know.

Last week, when I started getting concerned about the rise in yields, I realised that if the inflation data this week was strong, then it would be too late. And if the inflation data was weak, then perhaps equity prices have already risen too much in anticipation. I felt the best course of action was to bank profits in areas that had the most to lose from a shock result. In any event, I can’t see the likes of JD Sports (JD) doing great things in the short term from here. We’ve had the good bit.

Hope you are well. Thank you for your ongoing excellent analysis in these interesting times. I'm very impressed with ByteTree thus far. There's clearly a strong value tilt in the portfolios currently, especially Soda, with the recent regional ETF additions, along with TMPL. Have you thought of adding exposure to smaller companies where there may be some value opportunities emerging?

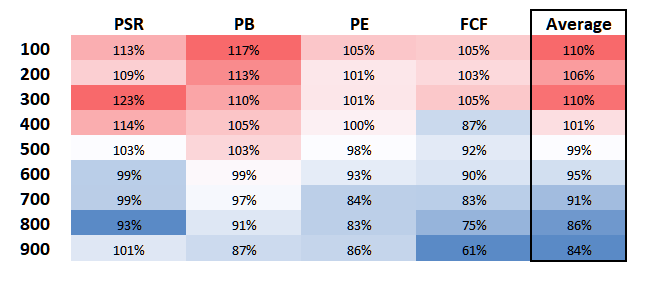

Smaller companies are generally trading cheaper than larger companies, as I show below. These numbers show the current median valuation for price to sales, price to book, price to earnings and free cash flow yield over 10 years for the largest 1,000 US and European companies.

Valuations Across Size Bands

Table explanation. For example, 400 on the left shows the 301stcompany by market cap to the 400th. On row 400, PB is 105%. That means the average price to book ratio is 5% above the ten-year average for the 100 companies ranked >300 <400 by size.

The table on the right is remarkable as each group of 100 companies by size, seems to neatly fall into line by valuation. The largest 100 companies are 10% above their 10-year average, while the smallest 100 companies are 16% below average.

The conclusion is that the top 500 companies by size are valued at, or above, average compared to the last decade. After the 600th company, a discount starts to appear, which exceeds 10% after the 800th company. That implies companies valued above around $10 billion are typically in higher demand from investors than smaller companies, and so trade at a premium.

Is that premium unusually large?

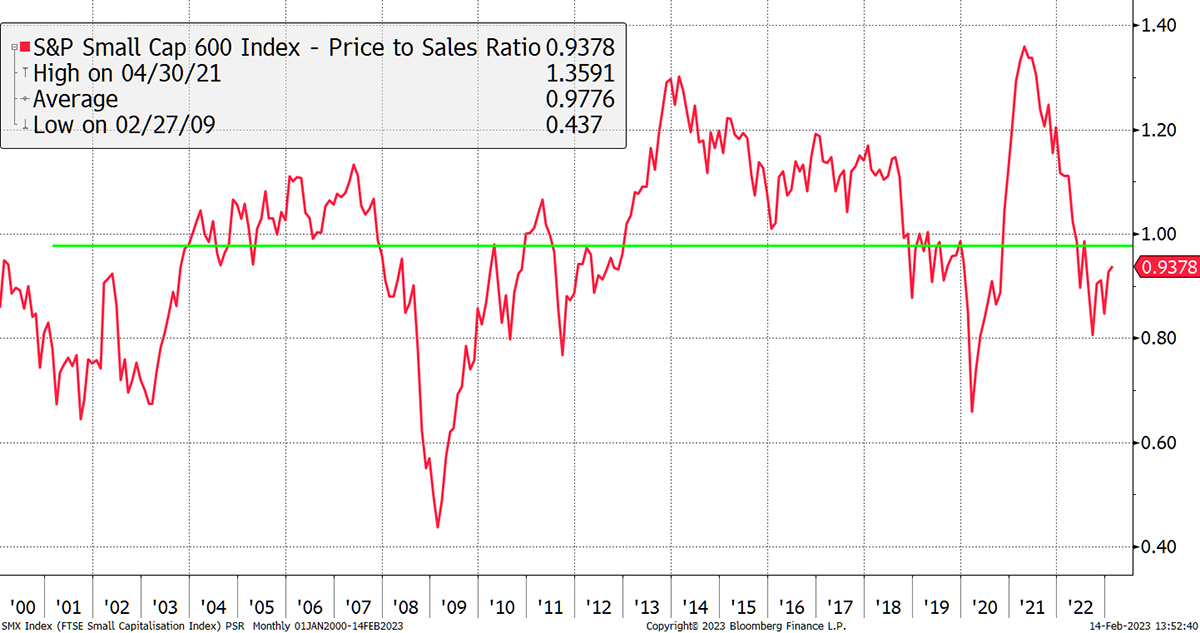

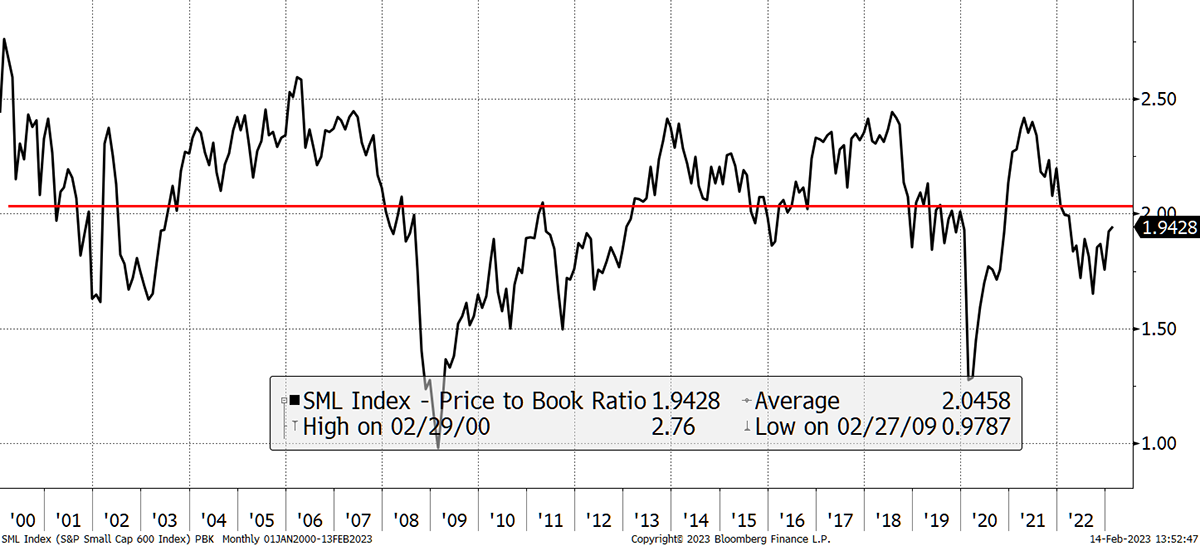

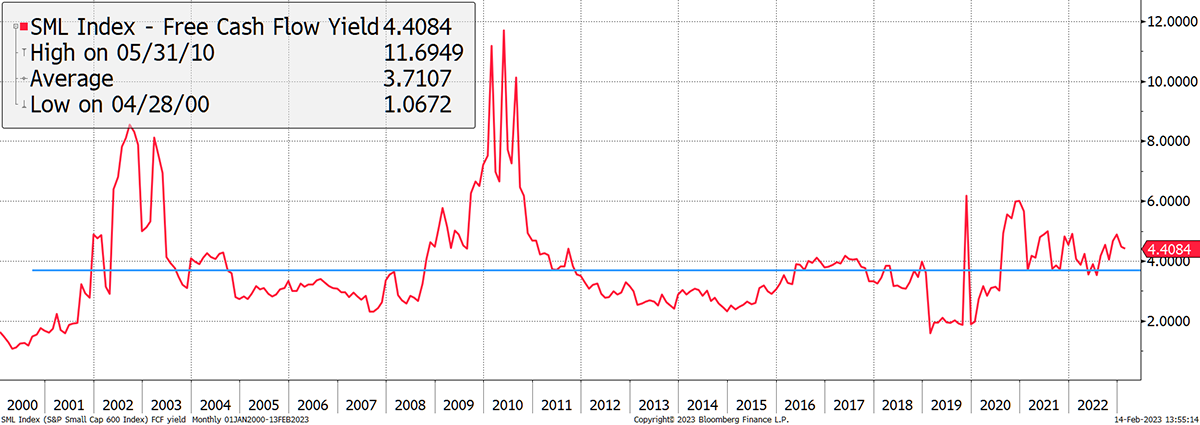

Smaller companies unquestionably offer better value than large companies, but then they should do as they are less liquid. Is the discount wide enough to embrace smaller companies over all companies? Let’s look at the S&P US Small Cap 600 Index on price to sales, cash flow and price to book in absolute terms.

Price to sales is slightly below the 23-year average, but this isn’t 2001, 2008 or 2020. The gap is small, but I agree there is some upside.

Price to Sales

Price to book repeats the message from price to sales.

Price to Book

Cashflow is slightly above average, but we are exiting from a low-rate environment. This is bound to fall when these companies refinance their debt at higher yields.

Free Cash Flow Yield

I would say the discount is not sufficiently attractive to embrace smaller companies on a large scale. I hope that I am right in pursuing the dividend strategy, which is much more liquid, and also offers better value than the market. Liquidity is essential should things turn sour and dividends pay us to wait.

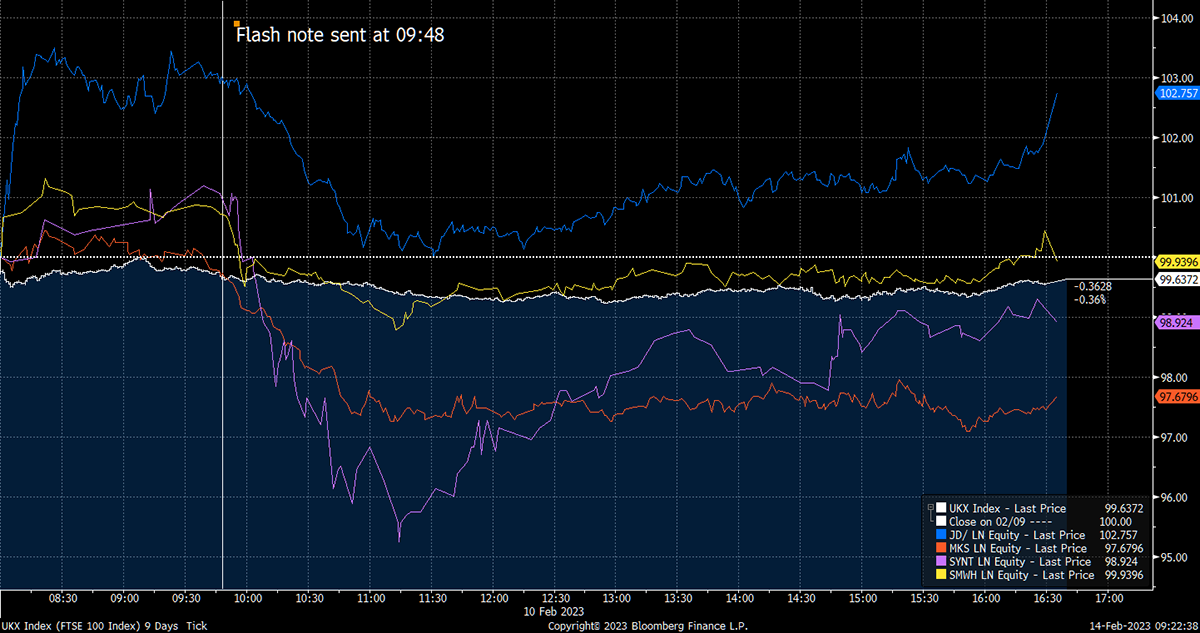

Thanks for the flash note which hit my inbox at 09:48 on Friday. The prices for all 5 sells dropped noticeably starting around 10am (with most recovering later in the day). Do you think this was a coincidence or are your recommendations actually moving the price of these stocks?

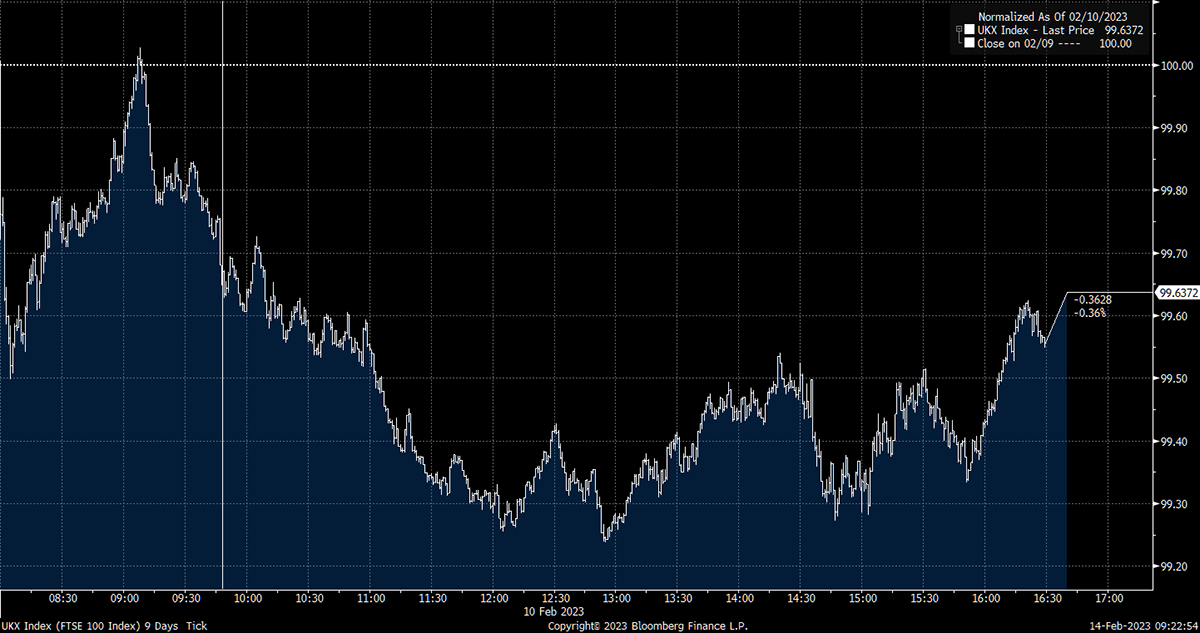

Some recent recommendations have been moving prices, and that is why I have increased my liquidity threshold. However, last Friday, the market fell in the morning, so that will not have helped.

FTSE 100 Friday 10 February

Next, I’ll add the stocks.

SYNT and MKS fell the most and are the least liquid. SMWH is much more liquid and was barely impacted by my sell recommendation. JD was in between.

FTSE 100 and Flash Note Sells Friday 10 February

I don’t want to be influencing prices, and this demonstrates the importance of holding liquid investments. It would be a good reason to start hunting for opportunities overseas. There are 3,000 or so liquid stocks around the world, but perhaps just 100 to 150 here in the UK.

Over the years, I have spent more time on global stocks, and I only started focusing on UK stocks when I started writing the Fleet Street Letter because I was advised that is what the clients wanted. There are lots of great companies around the world, and it is probably a good time to investigate this idea.

Stocks like Moderna (MRNA) are down by two-thirds, and are changing the world, and luckily, we hold some in BTEK. Shall I embrace more global stocks listed in Europe and North America? Your thoughts are appreciated.

What’s your anticipated holding period for AVI Global (AGT) in the Soda portfolio? Looks to already have provided some good returns - is there any plan to sell?

I plan to hold AGT forever, although it was trimmed in 2018. It exploits global value and special situations, which is a process that keeps on giving. AGT today is unlikely to own the same securities it did ten years ago because when value is realised, AGT take profits and finds something else to buy that is undervalued.

Repeat, repeat, repeat, and the long-term results of this strategy have been spectacular, and I don’t see how this will change. One area they specialise in is investment trusts and “holding companies”, which trade at deep discounts. These would not be liquid enough for us to pursue, and so they perform a valuable service.

The fact that it has done well doesn’t make it expensive. Au contraire.

With a smaller pot it’s sometimes difficult to replicate the two model portfolios without getting smashed with lots of dealing charges. What would your focus be on? With my platform I can buy OEICs for no charge so things like CG Real Return look to be a good option but buying multiple ETFs less so.

OEICs may pretend to have no charges, but I would have my doubts. I find them clunky. When I recommend an OEIC, I get dozens of questions about share classes, currencies, income, retail, platform, and so on. They seem to confuse people.

ETFs are simple and are normally a highly efficient way to trade, with tight spreads and low dealing charges. I accept that (example) Thailand XCX4 has a wider spread than normal (0.75%), but that is unsurprising as the market is closed when we trade. But VUKE has a spread of 0.05% which is practically zero, and IUKP sold last week is just 0.13%. Liquid stocks have tight spreads as well, and so I think these charges are very low.

If you are worried about costs, then bear in mind that Soda has low turnover by design, and so you might focus more on that and pay less attention to Whisky, which is unapologetically active. I take your point that costs are important, and I do my best to minimise them.

What is your opinion on alternative asset investment trusts and private equity? Too illiquid?

Generally, that is the problem. When I have longer-term confidence in the market, I would embrace private equity where the discounts are wide, but we can’t be sure their valuations are honest. It all comes back to low rates and inflation. If they return, we should embrace private equity, infrastructure, green energy and even the likes of Hipgnosis Songs. But if higher rates are here to stay, this strikes me as a bad idea, as we should not give up portfolio liquidity.

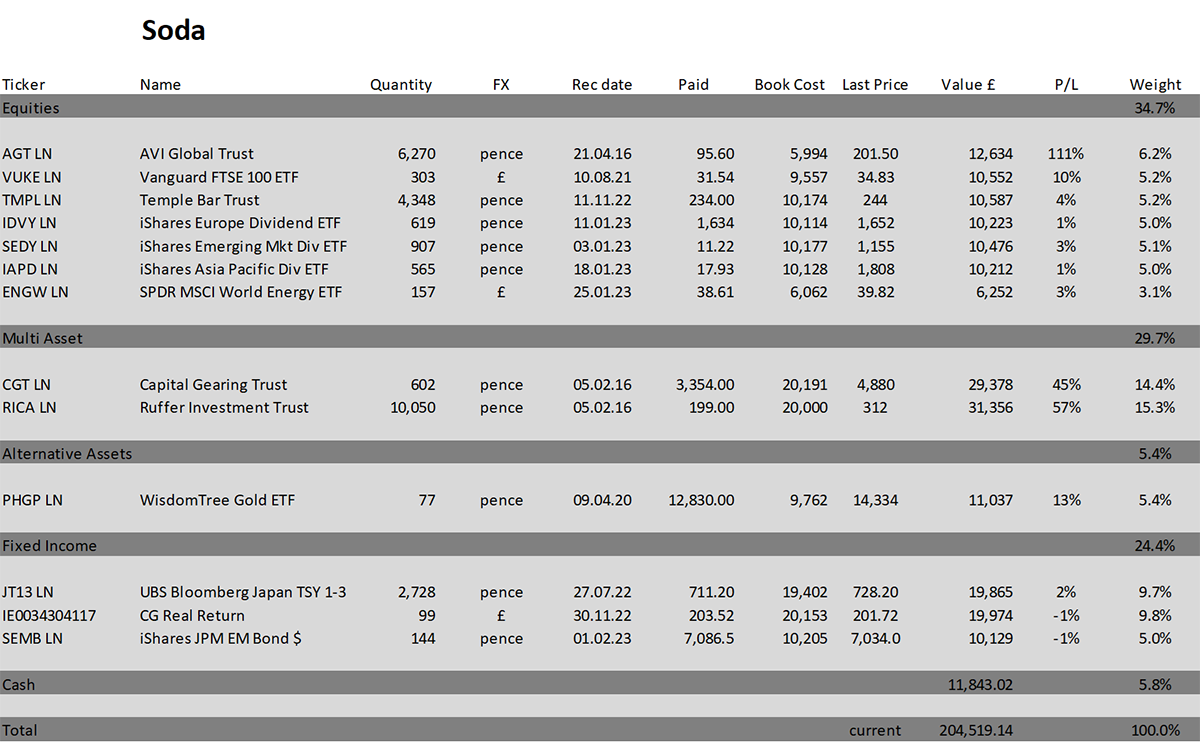

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 2.2% this year and is up 104.5% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.6% this year and up 135.9% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

Happy Valentine’s Day. A Byter sent this in. Can I call you Byters on Valentine’s Day? More importantly, and if you are confused, there is no romance to be found in quantitative analysis. No one tell Rashpal.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd