Filecoin: A Web3 Alternative to Centralised Cloud Storage Providers

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: FIL Token;

Filecoin is a decentralised cloud storage platform that operates on an incentive-based economic model, enabling individuals to lease out their digital storage space. Clients can securely store their data in a universal, distributed network for a fee. Filecoin’s native token, FIL, has had a great start to the year, boosted by the upcoming launch of the Filecoin Virtual Machine (FVM) and overall positive market sentiment. This Token Takeaway will examine Filecoin’s fundamentals, its significance in the space, and the value proposition of the FIL token.

Overview

Filecoin was initially released in July 2014 by Juan Benet, who also invented Inter Planetary File System (IPFS). Benet is the CEO of Protocol Labs, the company responsible for developing both IPFS and Filecoin. IPFS serves as the foundation for Filecoin and provides a decentralised, peer-to-peer network designed to store, share and access data/files such as websites, blogs and applications. Filecoin was introduced to further improve upon the IPFS decentralised storage network. It incorporates a combination of Proof-of-Spacetime (PoSt) and Proof-of-Replication (PoRep) consensus mechanisms, enabling users to rent out unused computer storage in return for compensation based on the provided specifications. Filecoin essentially creates a blockchain-based digital storage marketplace for users.

Today, Filecoin has a network of more than 4,000 Storage Providers globally, offering over 18.9 EiB (1 EiB = 1,153,000 TB) in total storage capacity. To put this into scale, you would need over 21 million laptops with 1 TB of storage each to store 18.9 EiB of data.

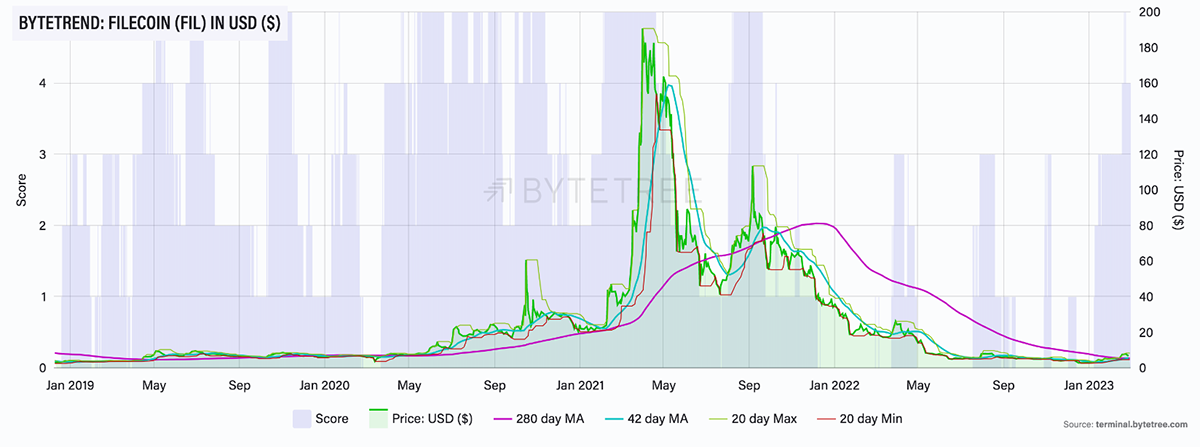

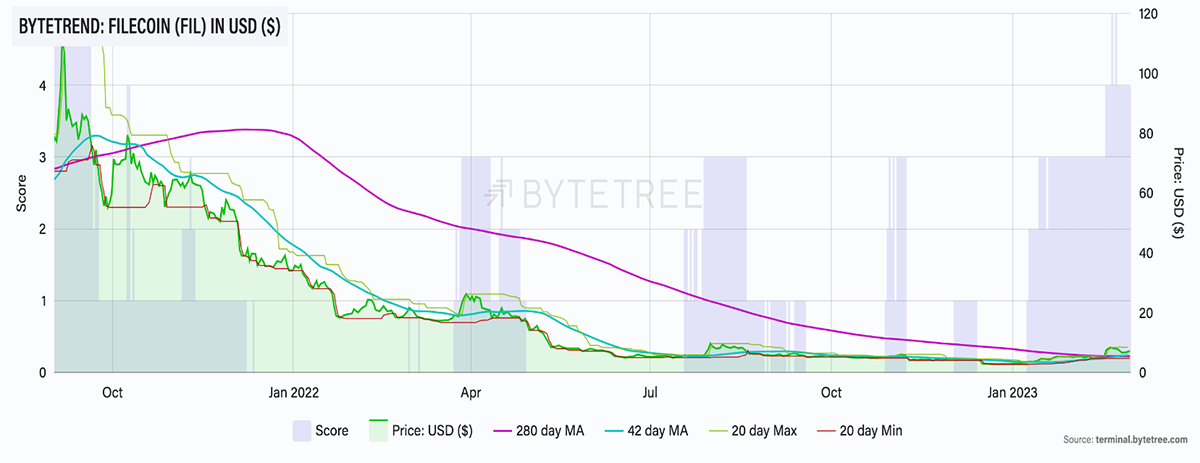

Despite this impressive network, the native token of Filecoin has performed very poorly. Its value was around $26 at the end of 2017, following which the token made an all-time high of $237 in April 2021 but has since dropped to $6.8.

Filecoin (FIL) on ByteTrend in USD

However, as we can see in the above charts, after dropping 99% from its all-time high, FIL started this year with a 120% gain. It also has recently scored a 5-star trend in USD on ByteTrend for the first time since September 2021.

What Problem Does Filecoin Solve?

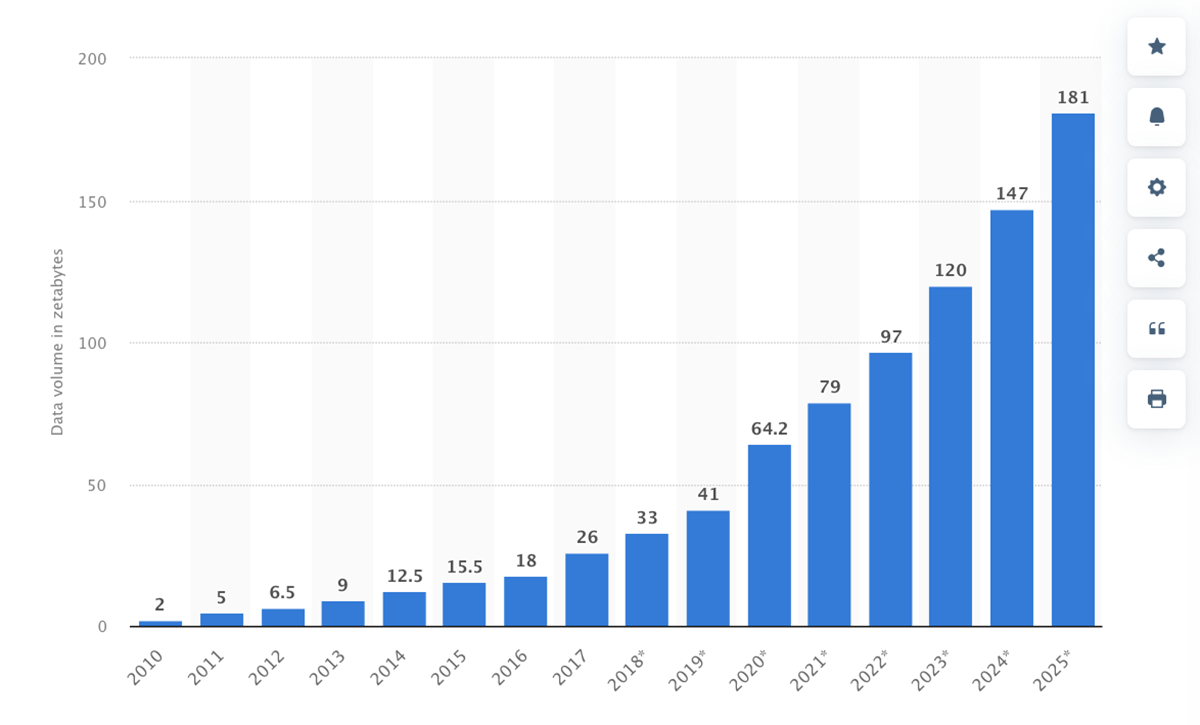

To understand the value proposition of the Filecoin network, its essential to first understand the current limitations of centralised storage providers like Amazon and Google. While it's difficult to determine with precision, it is projected that the world's data will reach 181 zettabytes (ZB) by 2025. To put this into context, one zettabyte (ZB) is equivalent to one trillion gigabytes (GB).

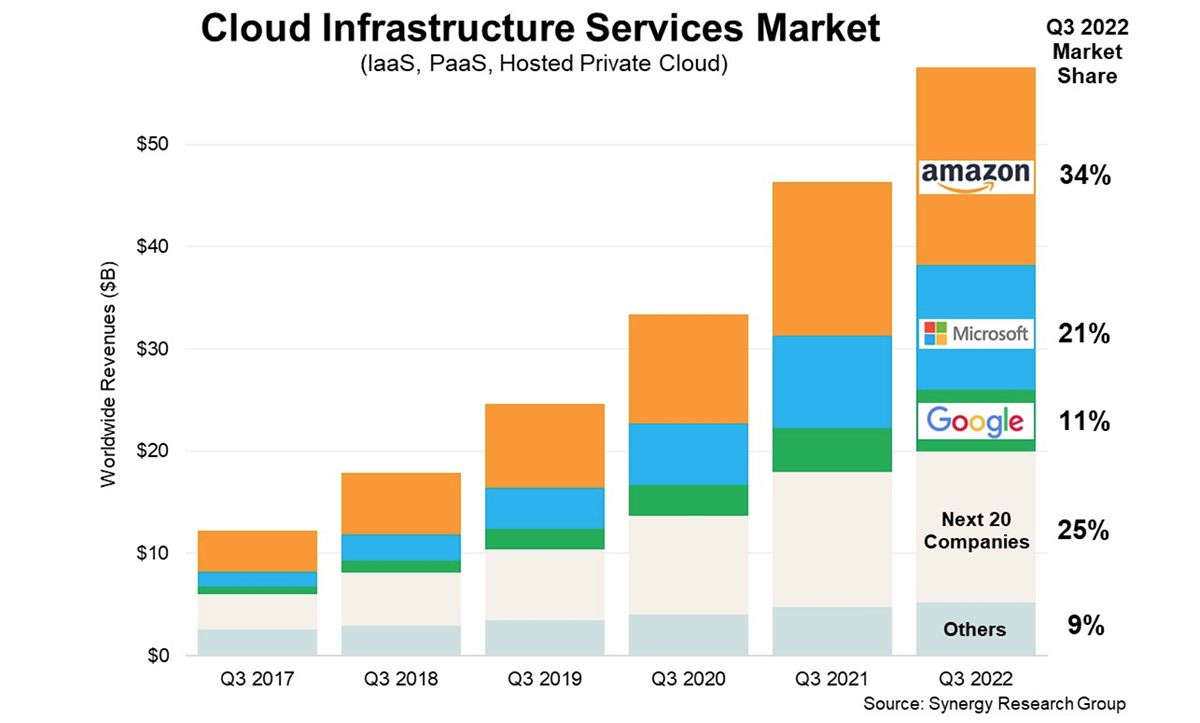

Although the scale of the internet is difficult to comprehend, what is surprising is that this vast amount of data is being stored and controlled by only a few tech behemoths, such as Amazon, Microsoft, and Google. There are several reasons why this is not ideal, but it ultimately revolves around centralisation and security.

Due to centralised companies storing vast amounts of user data, they gain unhealthy control over it. Possessing data in such quantities means that a single point of failure, even a small-scale cyber-attack or a technical glitch, can cause severe data breaches. Users are also obliged to trust centralised companies to protect their data from unauthorised access or misuse, risking data privacy. Moreover, these companies have the authority to censor websites or accounts, which not everyone agrees with.

The current practice of data storage poses many challenges in terms of centralisation, security, and user privacy. This underscores the value proposition of Filecoin. Not only does Filecoin offer a decentralised storage solution, but it also provides many benefits, including distributed storage, incentives for services, data encryption, verifiable data integrity and efficient and dynamic market-based storage pricing.

How Does Filecoin Work?

At the heart of Filecoin is an incentives-based marketplace that rewards storage providers for hosting and distributing data on the network. This network is powered by IPFS, a distributed system for storing and accessing data. You can access and interact with this market through various applications, including ChainSafe Storage, Estuary, or Lotus.

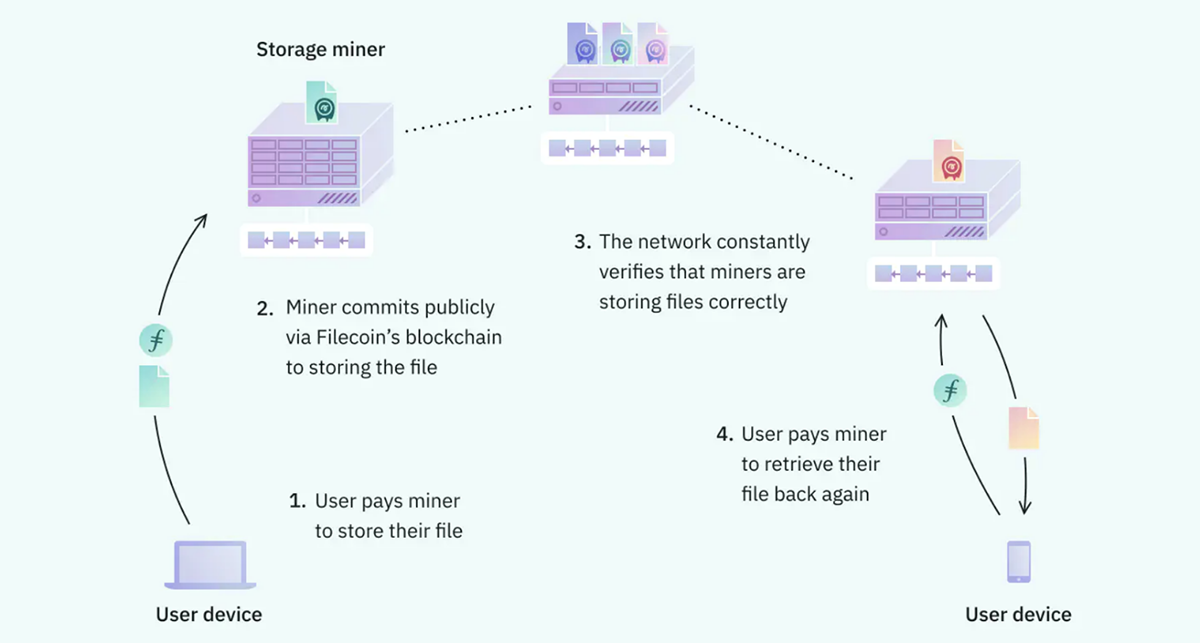

The key entities in the marketplace are clients and Storage Providers (SP). SPs are the ones that offer storage space on their hard drives in exchange for a fee. Clients are users who want to store data on the network and pay the SPs to do so.

The Filecoin Network

Filecoin uses the combination of Proof of Replication (PoRep) and Proof of Spacetime (PoSt) consensus mechanisms. PoRep ensures that the data is received by the SP and stored correctly. PoSt ensures that SPs are storing the data they claim to be storing by requiring them to submit proofs of storage at random intervals. Miners are responsible for verifying the proofs submitted by SPs to ensure they are correctly storing the data they claim to be storing.

Storing

The process of storing data on Filecoin involves several steps. First, the client creates a deal on the Filecoin network, specifying the amount of data they want to store, the duration of storage, and the price they are willing to pay. Storage providers can then bid on the deal, and the client selects the best bid. Once the deal is established, the storage provider gets their payment in FIL and stores the client data.

Retrieving

When a client wants to retrieve their data, they create a retrieval deal, which is broadcasted to the Filecoin network. Miners can then choose to retrieve the data based on the parameters of the deal, such as the price offered and the size of the data. After the deal is established, the miner then sends the data back to the client, and the client verifies the integrity of the data. If the data is intact, the client pays the agreed-upon price, and the transaction is complete.

Security

Throughout this process, Filecoin's consensus mechanism ensures that all parties act in good faith. The use of cryptographic proofs and incentives-based mechanisms ensures that storage providers and miners are incentivised to store data correctly and retrieve it when needed while also preventing bad actors from attempting to cheat the system. Additionally, the FIL pledged to set up a storage provider node helps to ensure security by incentivising SPs to act in the best interests of the network. In the event of data loss or damage, the pledged FIL is slashed as a penalty.

FIL Tokenomics

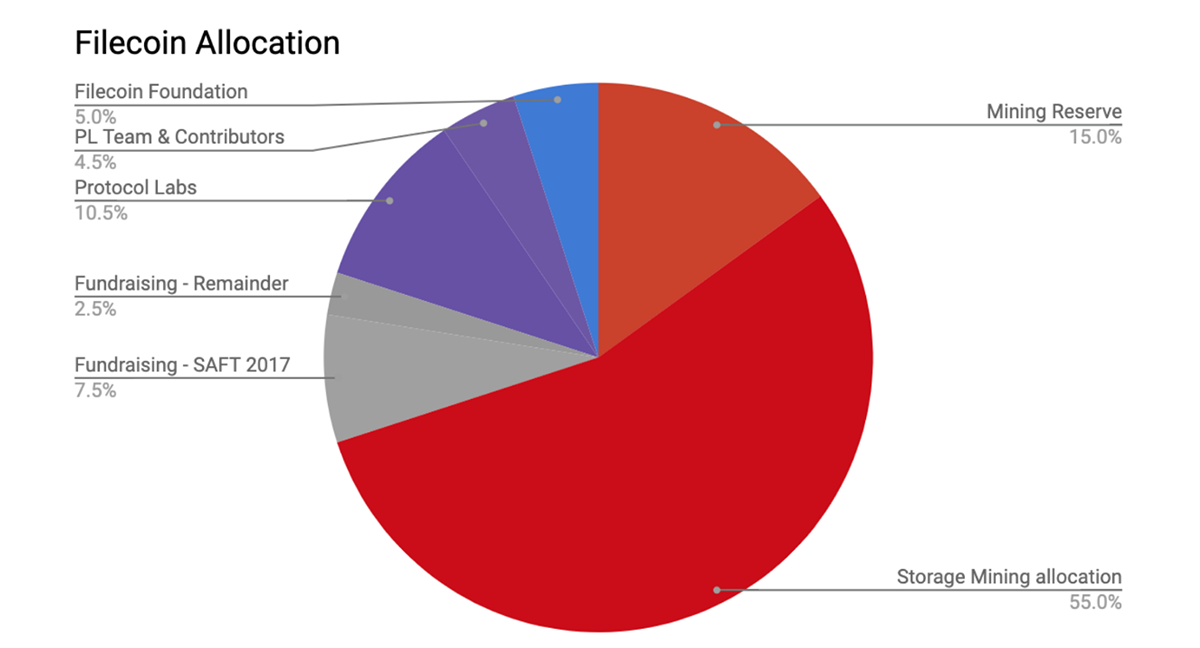

FIL, the native utility token of Filecoin, was launched in a public ICO in August 2017, raising $205.8m, making it one of the largest ICOs at that time. Moreover, Filecoin raised another $52m in a presale ahead of the ICO, supported by many big names, including Winklevoss Capital, Digital Currency Group, and Andreessen Horowitz, bringing the total capital raised to $257.8m in that period.

FIL was launched with a total max supply of 2 billion tokens, of which 445 million FIL are circulating in the market. The initial FIL allocation was as follows:

Source: Filecoin.io. FIL token allocation.

According to Filecoin docs, a large portion of the FIL supply will only be minted if the network meets certain growth, capacity, and usage goals. Specifically, up to 770 million FIL will be minted based on network performance, which means that most of these tokens will only be in circulation if the network achieves the capacity of 1 Yottabyte in less than 20 years. This may seem like a challenging objective since it's estimated that the total data available on the internet will only be around 181 Zettabytes by 2025, and 1 Yottabyte is equal to 1000 Zettabytes. But setting high goals encourages the network to strive for excellence and strengthen the tokenomics.

Since FIL is the utility token and the unit of currency, the entire Filecoin economic structure relies on it. All the entities in the Filecoin ecosystem (including SPs, Miners and Clients) interact with FIL on a regular basis. It is used to pay for services on Filecoin and incentives for miners to ensure network security. Furthermore, FIL tokens are required in order to participate in the Filecoin governance. The amount of FIL held determines the weight of the participant's vote. However, anyone can create a proposal on the Filecoin network regardless of the amount of FIL held.

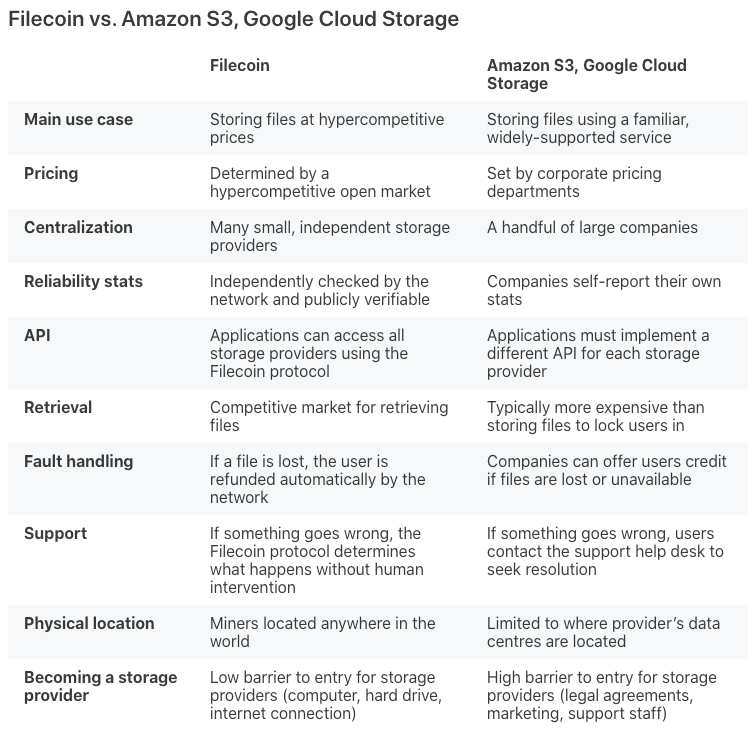

Filecoin vs Centralised Cloud Storage Providers

The primary difference between Filecoin and Centralised storage companies is decentralisation. Filecoin has no central authority, while centralised providers like Amazon and Google are controlled by a single entity (themselves). Moreover, Filecoin’s pricing is based on supply and demand, while centralised providers have fixed pricing models. Filecoin uses blockchain technology to provide a transparent and auditable record of transactions and data storage, while centralised companies may not offer the same level of transparency.

As we know, this space is severely dominated by centralised companies, so the journey ahead for Filecoin is challenging. An enormous shift in perception of the internet and digital storage will need to happen for Filecoin to gain a noticeable market share against the centralised behemoths. Since Filecoin also competes with decentralised storage providers like Arweave and Storj, Filecoin must expand beyond the function of a storage network, and they’re doing just that.

Filecoin Virtual Machine (FVM)

The Filecoin Virtual Machine (FVM) mainnet is estimated to be launched on 14 March 2023. FVM will enable the Filecoin Network to run smart contracts for creating and executing new features and rules for data storage and utility.

FVM is also set to open a new world of possibilities for the Filecoin ecosystem. Using FVM, developers can create Layer-2 applications on top of Filecoin’s distributed network. Additionally, FVM has the potential to address current limitations and pave the way for the ecosystem’s growth. The technology can be utilised to build various applications, such as DataDAOs, DeFi apps, cross-chain bridges and insurance protocols. The Space Wrap program, which includes hackathons, grants, and over $400k in FIL tokens, aims to support the FVM launch.

Conclusion

With great price performance for the FIL token and the highly anticipated launch of FVM approaching, Filecoin has had a strong start to the year. Although it's a challenge for FIL to reach back to its highs, its strong tokenomics have the potential to support such a rally.

Considering the extreme competition in the storage space, it is too early to predict the long-term sustainability of Filecoin. The project's goal of turning the internet decentralised is very ambitious and will take a long time to accomplish (if it ever does). Despite these challenges, the FIL token’s recent surge and promising developments make it an interesting project to watch for the coming months.

Comments ()