It is nice to get through a week without a bank failure. The authorities have plugged the hole, reassuring depositors that all is well, at least for the time being. But just as the banks have been saved (again), problems arise in commercial real estate. Another asset class comes under pressure, and the search for safe havens continues.

Property

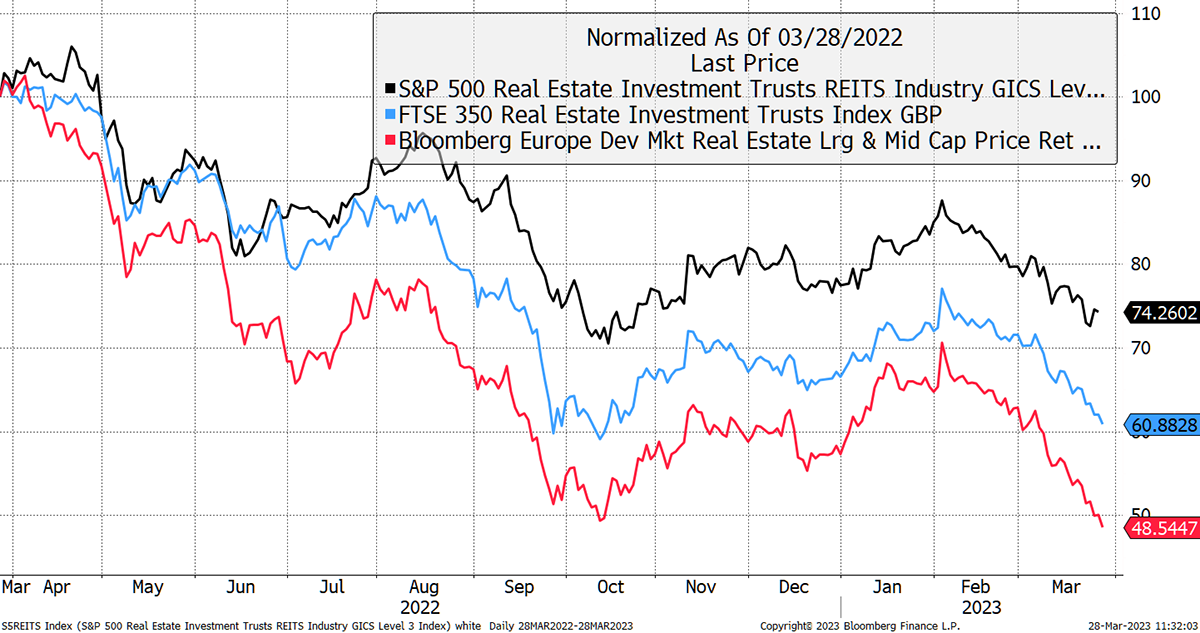

A few months ago, I wrote about UK-listed property, which had fallen too far following the Truss/Kwarteng fallout and was due a bounce. It did, but it hasn’t lasted long. No sooner than bond yields hit that treacherous 4% level, property shares started to fall. I recently highlighted how it was the American banks that had fared worse than European. But this time, it is Europe that has come under greater pressure.

Commercial Property Falls

Source: Bloomberg

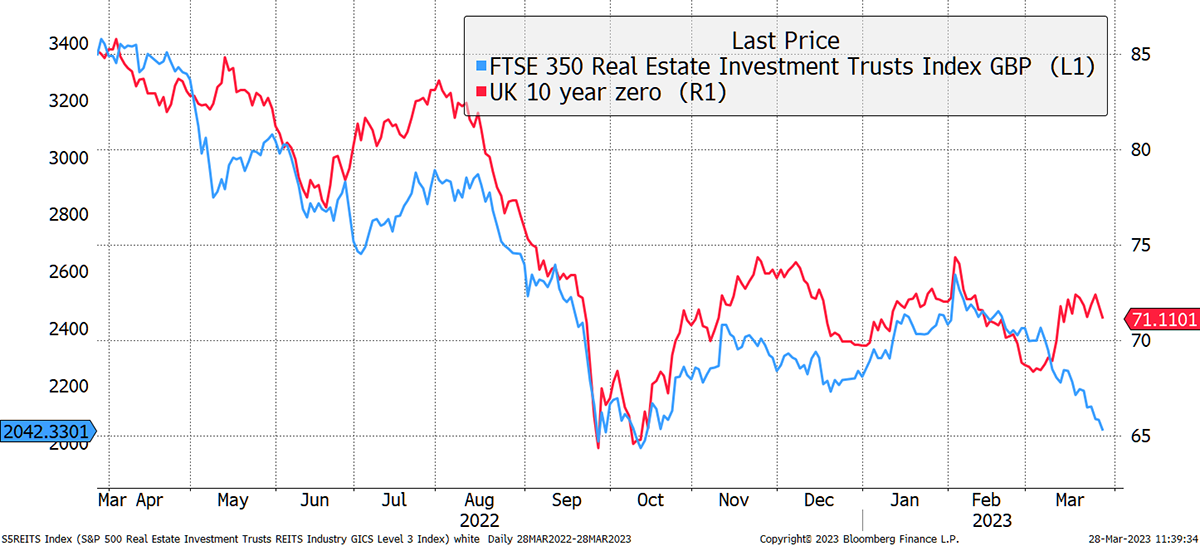

What’s interesting is how property was highly correlated with bonds, but that has now changed. The recent banking crisis saw government bonds rally, but this time property didn’t follow. The message from property is that the “safe” income stream we have become used to, is under pressure.

Property and Bonds Diverge

Source: Bloomberg

Is property a real asset? That question is often asked. In my opinion, the land is a real asset, the building depreciates like plant or machinery, the income stream is economically sensitive (although often inflation-linked) while the financing is sensitive to credit conditions. Property, as an investment, is part real, part nominal (or financial). It would certainly survive hyperinflation (it’s physical), but the economic sensitives cannot be ignored during the interim. When the going gets tough, the challenge is hanging on to your property.

According to Elon Musk, the next five years will see more than $2.5 trillion in commercial real estate debt mature, which is more than any 5-year period in history.

It is a reminder that more expensive refinancing into a slowing economy is a toxic combination, and that is what the property market is worrying about. The stockmarket will inevitably overshoot to the downside, with the most leveraged companies faring worse.

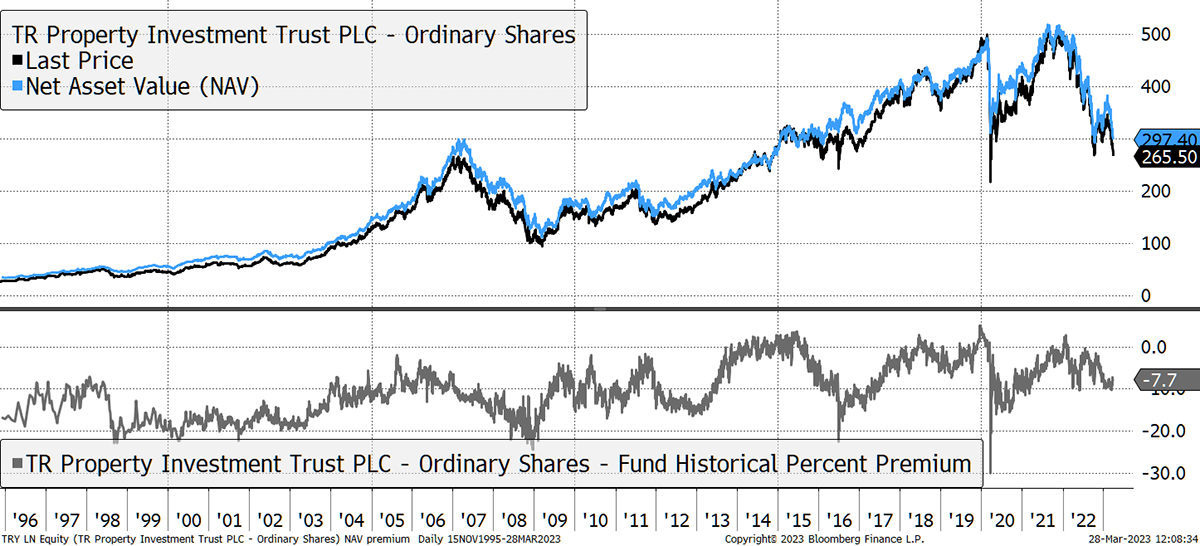

TR Property (TRY) is a well-managed diversified investment trust of listed property shares. It’s an old favourite, and I look forward to adding it back to the portfolios at some point. It is nearly 50% off the highs, and yet the yield is still just above 5%. How high might that get?

TR Property

Source: Bloomberg

Especially when you consider the discount to net asset value has plenty of room to widen from here. 7% seems to be on the low side.

Commodities

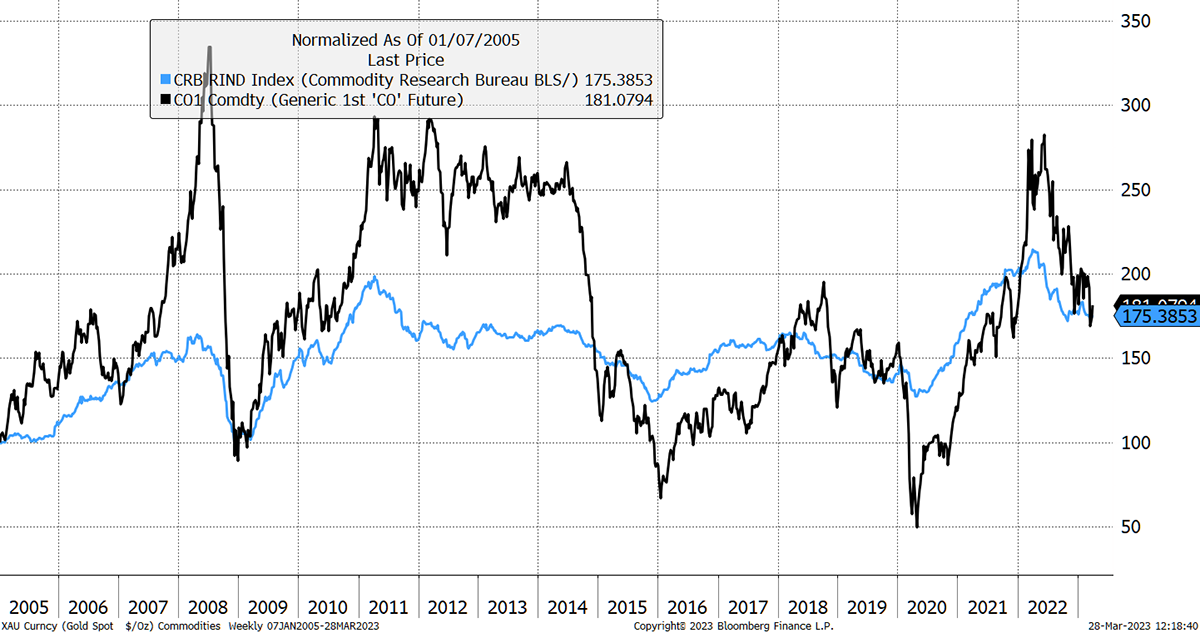

Commodities are unquestionably a real asset and a proven inflation hedge over the years. However, they can be highly economically sensitive, as we have seen in recent downturns.

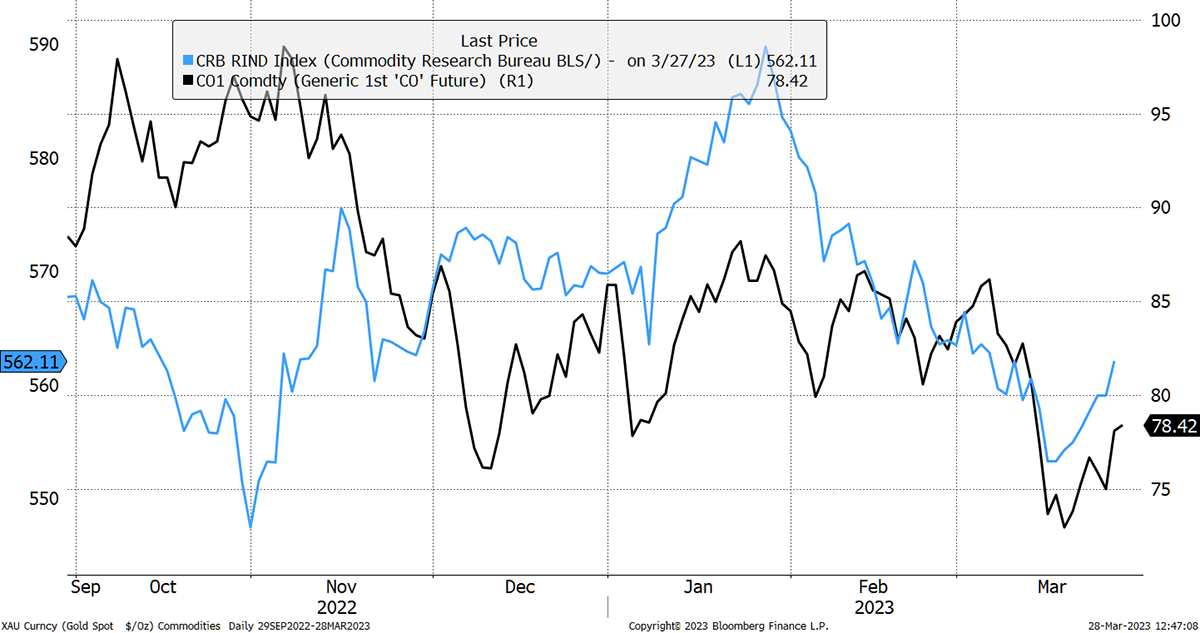

Here I show the oil price and the CRB Rind Index, which combines the less actively traded, yet still important, commodities. For example, scrap copper is still copper but too messy to trade as a futures contract. I like the Rind because it smooths the madness of the commodities cycle, as demonstrated by the likes of oil.

Rind Smooths the Cycle

Source: Bloomberg

What’s got me excited, and I’ll zoom in to show you, is how the Rind has just made a higher low compared to its low point from last October. This could turn out to be nothing, but it occurred during a banking crisis, which is the perfect opportunity for an asset to get dumped. That it didn’t is very interesting.

A Higher Low

Source: Bloomberg

Property is falling, which is telling us to be wary of the economy. Yet commodities are not sinking like it’s 2008, 2015 or even 2020. They are showing early signs of resilience, and this is important for those seeking safe havens.

Could commodities be our saviour? I shall be watching this like a hawk.

Action:

No action.

Postbox

After reading your newsletters for the last four years, my wife and I have concluded that your advice is much better than anything else we’ve read. You’ve beaten our performance in all but one of the years since you started writing the Fleet Street Letter (now the Multi-Asset Investor). Considering the current high-risk environment, it may be best to wait until the banking crisis settles down (that might be a long wait…) [before mirroring the portfolios]. An exception to this could be JT13 and CGT, i.e. increasing holdings in these straight away. Do you think this approach makes sense? Would you recommend this to someone who is new to TMAI at this turbulent time in the market?

Thank you for your kind words.

Excess returns in investing tend to come in bursts. Being correctly positioned ahead of key events is the most important thing. I am sure there will be more years when things don’t go according to plan, but by steering away from troubled spots in markets, and not worrying too much about missing out on the story du jour, that holds us in good stead over time.

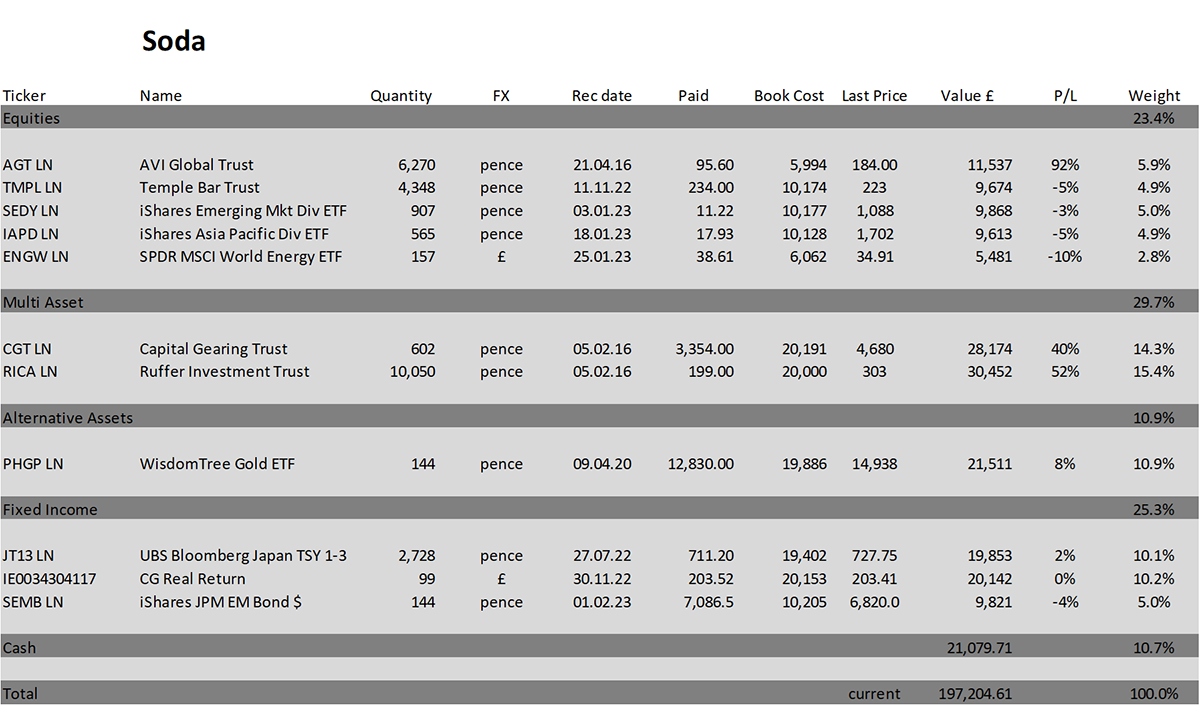

The Soda portfolio holds a diverse range of assets positioned for an unknown future. If it was obvious that the market would turn down, then the likes of JT13, which may prove useful in a market crash, would be the answer to our prayers. But markets rarely do what we expect. Expect the unexpected, which is why the portfolios are diversified to handle a wide range of outcomes. No one knows what’s coming, but we can assess risk and be prepared.

CGT (and I would also include RICA) will prove useful if this market bores us to death. That is another scenario that we should not eliminate. But if markets do well, these funds will rise modestly, and if they should fall, we can be fairly sure they will prove resilient. Gold is another story, which may even surge in this environment, but I hope it just plods on.

The longer I have observed markets, the more I have come to realise that sitting on cash, and waiting for the good times, is not the answer. Much better to accept the markets for what they are, find the opportunities and remain diversified. You won’t be disappointed in the end, but a few sleepless nights come with the territory.

As I mentioned previously, having been so impressed by your advice and the information you provide, I followed you from Fleet Street Letter to ByteTree. In your latest update, you point out the periods when gold begins a strong upward climb and detail the economic situation at the time. Are there any sectors that correlate with gold?

Thank you for saying so.

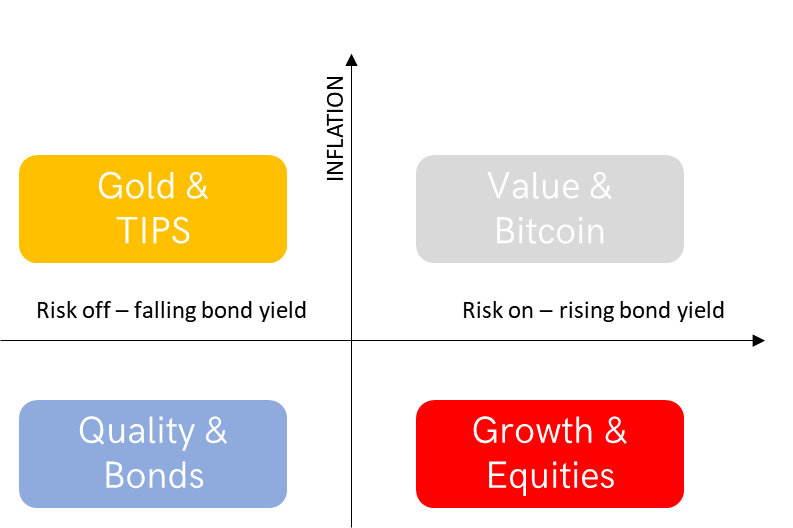

As you know, index-linked bonds (inflation-linked) and the friends of gold (silver, platinum, gold mining shares) are closely related assets that do well when gold is strong during “risk-on” market conditions. Other than that, the top left is the relatively quiet corner of the Money Map.

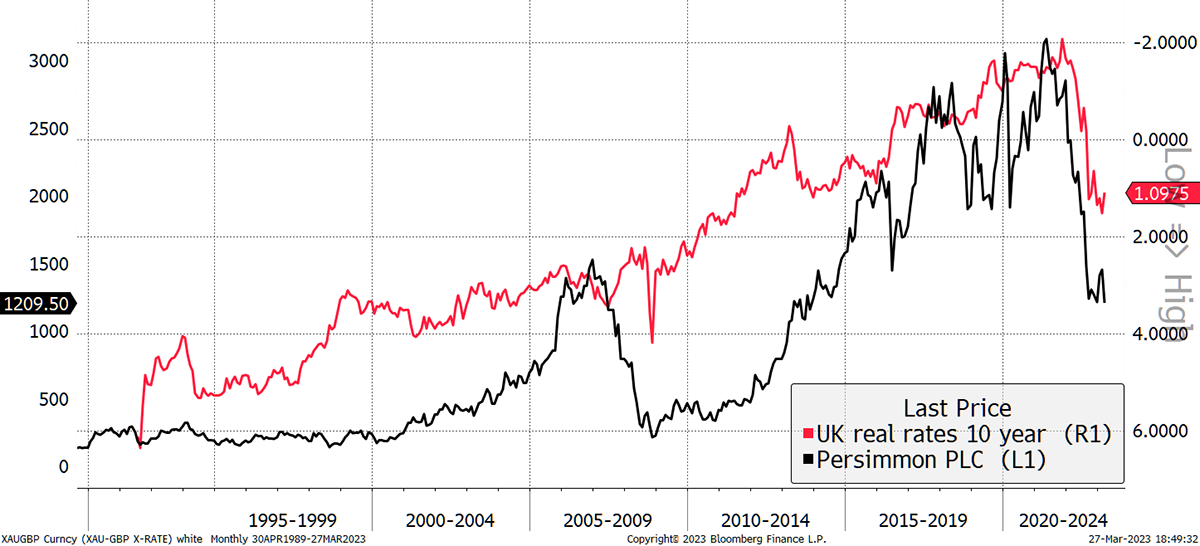

There is one exception, and I will only tell you if you promise to keep it to yourself. That is house builders. The relationship is tenuous, but I think the long-term link is well made between the price of a home and monetary conditions. I show Persimmon (PSN) against real interest rates (inverted).

A Golden House

Source: Bloomberg

As I said, it’s long-term, so please don’t encourage me to swap gold and silver for the likes of Persimmon (PSN) at this point in the cycle. But it is logical that demand for houses increases when financial conditions are easier. The trouble is that the great easings tend to coincide with economic malaise, so there is a time lag. A house could perhaps be described as risk-on gold, bearing in mind the links to the financial economy (and the depreciating building). Given what’s going on in property, it’s a bit early to switch, but a great idea for the future.

Right now, I will opt for gold.

CG Real Return holds a variety of index-linked bonds, which they can adjust as market conditions change, whereas the iShares TIPS ETF (ITPS) holds only US Dollar index-linked bonds. Should a more dovish Federal Reserve result in a weaker USD, this would presumably reduce the value of these bonds in GBP. Since you don't show ITPS in the portfolio, how are those of us holding these going to know when it may be time to sell these, when perhaps the CG Fund is still a good hold? Could you please either show ITPS in the portfolio somehow, or at least commit to issuing a sell action or alert if conditions change sufficiently?

I have not recommended ITPS, merely provided an alternative for those who found buying the CG unit trust cumbersome on their platform. It therefore does not get booked in Soda, and when the CG fund is sold, ITPS should follow suit. I will endeavour to remember!

ITPS and the CG Real Return Fund are similar. CG holds 31% of assets outside the USA, mainly in Germany, Canada and Japan. The details are here. My reason for an active manager is so they can pursue real yield around the world in a way an ETF can’t. The difference so far hasn’t been noticeable, but it becomes clearer over time. What CG are doing isn’t complex, but the important point is that they are carrying out a useful role.

To your point about the US dollar falling, CG would be in a better position because it holds some foreign bonds. But please bear in mind this was an opportunity to diversify the position in gold at a time when I felt the risk of a price correction was high. If and when real yields start falling again, then index-linked bonds will do very well. Sooner or later, that is inevitable. It is an attractive area of the market where good things will happen.

Portfolios

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 1.5% this year and is up 97.2% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

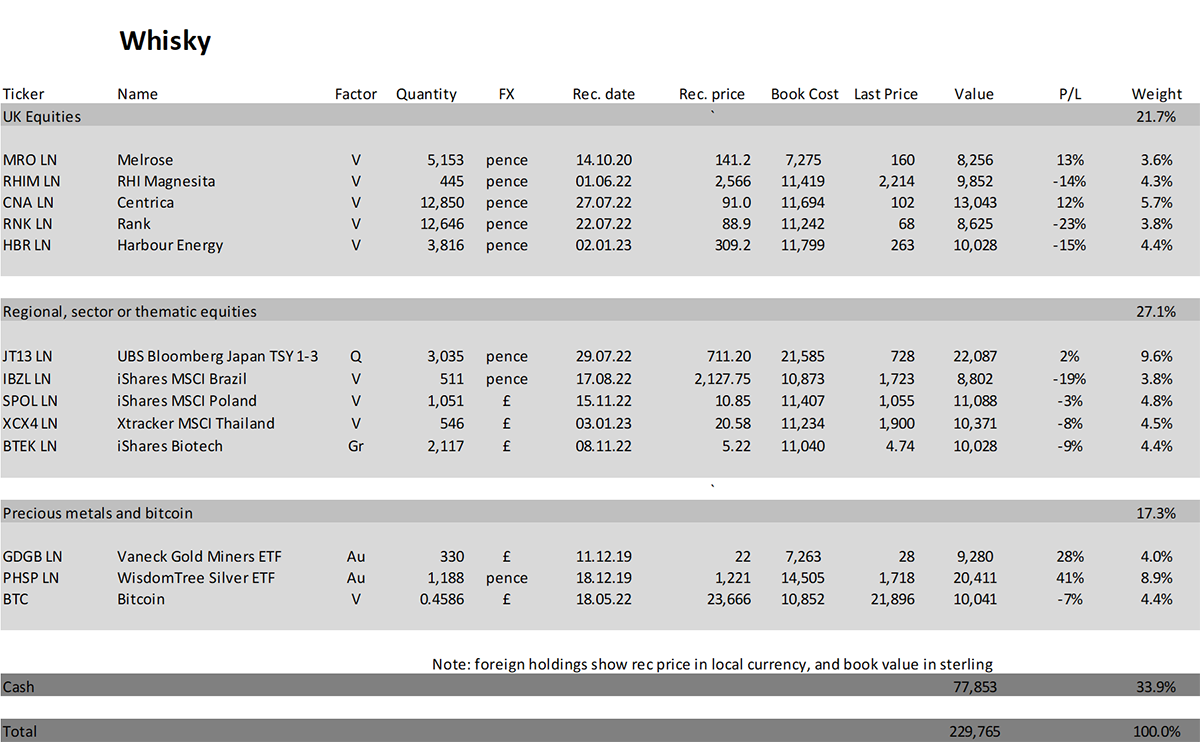

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 2.9% this year and up 129.8% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

The Ruffer Annual Review can be read here. With lots of illustrations, it’s not as long as it looks. It is certainly thought-provoking.

I liked the story about Bayesian probability on page 52.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd