Ideas to invest your cash

Where is it safe to park cash? After 15 years of zero interest rates, followed by the fastest tightening cycle in history, something was going to break. The irony is that it was the banks. As Buffett once said, “what you find is there's never just one cockroach in the kitchen when you start looking around.” In recent days we have seen the 14th largest bank in the US fail, and the market senses it is not alone.

Just last week, we were discussing where to park cash until this storm passes. All eyes were focused on jobs and inflation and how high rates would end up, and what pain it might cause. My fear was they would tighten too much, and the stockmarket would come under pressure as things broke. Something did, and once again, it was the banks.

The idea was that if the higher interest rates were not passed onto customers, the banks would be fine, despite having losses on their bond portfolio. Much of this would be “hedged” using interest rate derivatives, similar to what Ruffer did last year. They held inflation-linked bonds, and “shorted” conventional bonds against them, therefore keeping the inflation protection without the duration risk.

Silicon Valley Bank, the 14th largest US bank, which you will have read about in recent days, did not hedge their interest rate risk. The result was that when the bond market collapsed, so did their asset base (customer deposits are invested in bonds).

The market was spooked by events, especially so because it was a bank failure, which has the ability to spread pain across the economy. The market reaction looked like this:

What Went Up?

- Pound, Japanese Yen, Chinese Renminbi

- Bonds

- Gold and silver

- Bitcoin

- …and therefore BOLD (+5.2% over the weekend was the largest recorded daily gain since 2014)

What Went Down?

- Dollar

- Credit (corporate bonds)

- Banks (all banks down)

- Stockmarket (few stocks rose, but big tech fell less)

- Oil (downtrend resumes – weak signal for the economy)

There is a lot to unpack here, but it feels like a market that fears a recession. The US dollar fell, which is different from recent market falls. Gold and bitcoin surged, which could be the market is starting to recognise that alternative monetary assets, which are independent of the banking sector, will see increased demand.

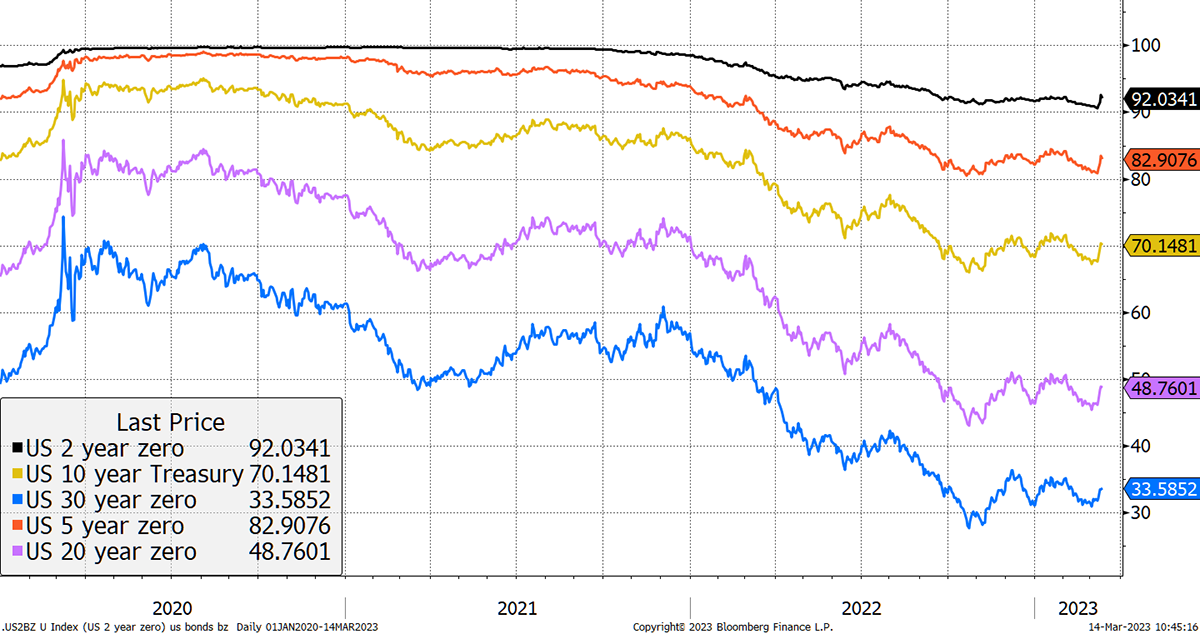

The bond market immediately reacted with memories of 2008. I have shown (synthetic) bond prices, as opposed to yield, because it brings the moves to life.

Bonds Rallied Last Week

Source: Bloomberg

Recall that a 30-year “zero coupon” bond that costs $33 today will return $100 in the year 2053.

If you believe this move in bonds continues and we are headed back to the old days, then there could be upside. Personally, I doubt it, and I will explain why.

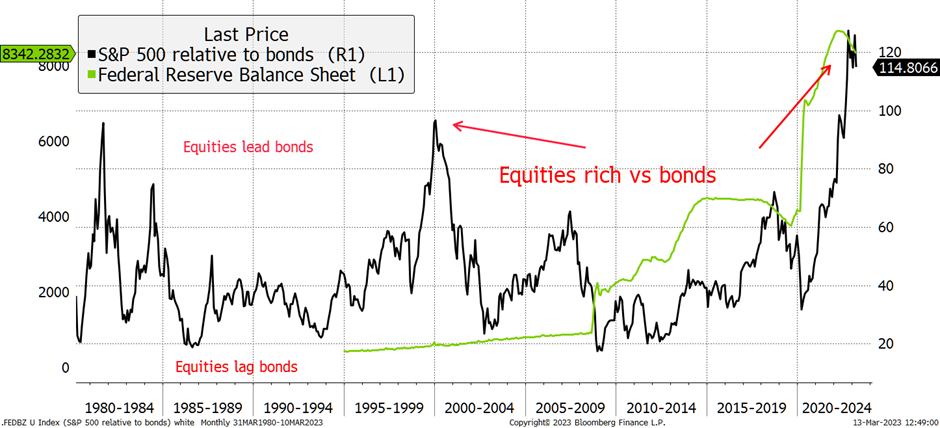

My favourite equity versus bond chart supports the idea of bonds over equities, at least when the equity proxy is US large caps. On previous peaks, it has been right to switch to bonds. I have added a green line showing the Federal Reserve’s Balance Sheet, which is now contracting. They tried this in 2018, and it didn’t end well. They are trying it again.

Equities Extended Versus Bonds

Source: Bloomberg

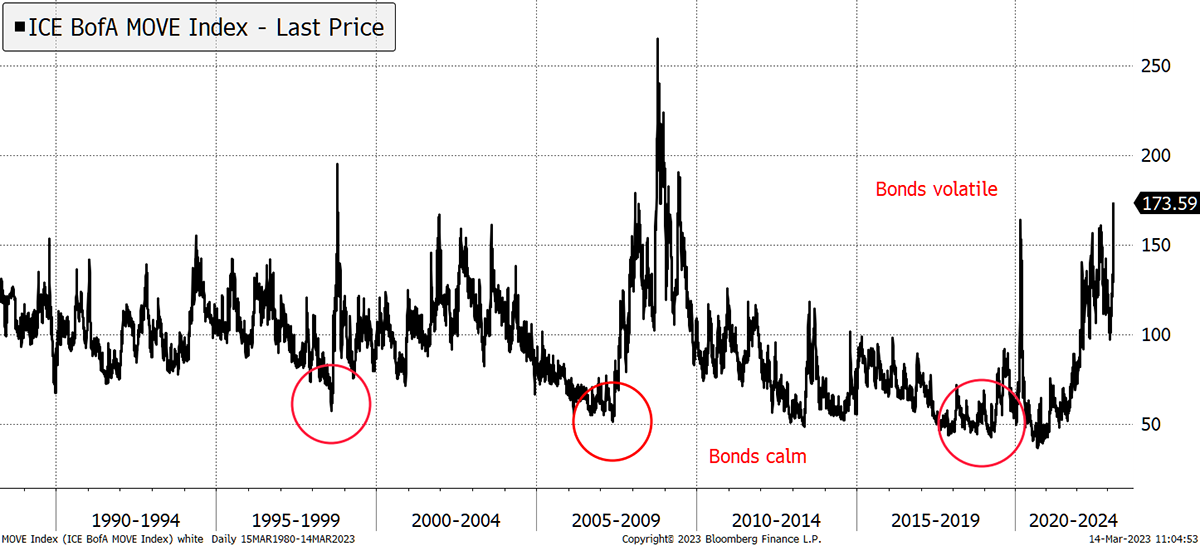

The trouble is that in past circles, bonds were calm when they presented an opportunity. Today they are anything but. The MOVE Index measures bond market volatility, and it has rarely been higher than it is today. To buy short-dated bonds is one thing because they remain calm. But the long bonds are frankly dangerous because the outcomes are unknown. You have to hope that despite all that has happened, the old rules (pre-pandemic) still apply.

Bonds Are Historically Volatile

Source: Bloomberg

Following the increased cash position in Whisky, readers have rightly been asking how to invest cash. Now the banks have stirred again, there is a pressing need for alternatives.

Invest Your Cash

The Multi-Asset Investor portfolios will not be investing the cash into cash proxies, because I do not want you to feel obliged to follow. My aim is to reinvest in the markets as soon as I can find things I want to buy.

But that doesn’t mean you shouldn’t invest your cash into cash proxies. There are so many possibilities for investing cash, and many of you will have your preferred choices depending on your circumstances. That might be cash ISAs, another currency, interest from your broking account, direct short-dated gilts or treasuries, and so on. One size doesn’t fit all.

That said, UK-based GBP investors might consider the following if they are dissatisfied with the interest received on their platform.

Invesco US Treasuries 0-1 Year GBP (TIGB)

This invests in ultra-short-dated US Treasuriesand hedges the return into GBP, so you have no currency risk. The yield is 1.45% (paid out as income), but the total return (yield to maturity) is 4.76%. The fee is 0.1% per annum. This is low risk.

iShares 0-5 Year Gilt ETF (IGLS)

Short-dated gilts are normally low risk, but this fundfell 10% peak to trough over the past two years, making it more realistically low to medium risk. The yield is 0.8% (paid out as income), but the total return (yield to maturity) is 3.85%. The fee is 0.07% per annum.

Flash Note Sale of iShares Europe Dividend (IDVY)

I sold IDVY via a flash note yesterday primarily because it seemed to be the most impacted investment we held. I do not like selling into market weakness, but my tried and tested process is to ensure that when the risks rise, the portfolios have less exposure to markets. Right now, the Soda Portfolio is around 70% as risky as a traditional 60/40 balanced portfolio, and the Whisky portfolio is around 50% of a fully invested equity portfolio.

Action

No action

Postbox

Would the Invesco US Treasuries 0-1 Year GBP (TIGB) do the trick?

I was unaware of TIGB, so thank you for highlighting it. It is an ideal solution for many.

Isn't there a case for some exposure to long bonds as a play on the high likelihood of a recession at some point in the next year or so. This reasoning overlaps with, but is rather different from, the one based on an expectation of a Fed pivot. The recession case suggests the Fed may reduce rates not as business as usual but because they are forced to by recessionary and/or deflationary conditions. Unlike the pivot scenario this would not be a signal for stocks to surge. Nevertheless, the capital appreciation on long bonds would be impressive.

I agree. The pivot implies all is well, inflation was beaten, and the party carries on. The recession would be triggered by something like a banking crisis. Funny that!

I am yet to be convinced this bond bear market is fully behind us. Even if inflation keeps on falling. Is there a point where governments can issue too many bonds in the face of never-ending deficits? If so, it is hard to believe we aren’t close, and investors will demand a higher yield like they did in the old days. We seem to bounce from one crisis to the next, and I doubt we can return to the pre-pandemic world.

I take your point, and I accept that I may be wrong. But from a risk versus reward perspective, I do not find the long-bond attractive as it is currently at the heart of the storm. I prefer to steer clear.

What do you make of Russell Napier’s view that Japan will very soon start financial repression rather than raise interest rates, and that this will cause immediate downsides on the bond markets worldwide because Japanese institutions will sell their other bonds in order to make up required quotas? If he’s right, this looks like the Japanese bond being a bad bet (?), and CG Real Return being in for at least a short-term drop, or at least turmoil (?). Question marks here because I don’t know how to navigate the bond markets. An assessment by you of the underlying factors, and risks, would be great.

Napier is one of the great thought leaders in the investment industry. I have known him for many years, having attended his financial history course a decade (or two) ago. He has repeatedly shown great economic foresight, but even he would admit his nose for markets, and especially timing, is limited.

Napier shifted from the deflation camp to the inflation camp after the pandemic. He believes financial repression is, or will be, a managed state of affairs where governments “steal from old people slowly.” They do that by maintaining interest rates below the level of inflation for sustained periods until the debt to GDP ratio falls back to more manageable levels. He believes inflation will be both volatile and sticky.

Napier’s views on Japan selling bonds were something to worry about because the fear was that bond yields would spike higher. Then came a banking crisis, and yields have done the opposite. As a result of the plunge in yields, it is ironic that this would be a good time for the Bank of Japan to sell foreign bonds if they wanted to.

In Soda, we hold the UBS 1-3 year ETF which holds “short-dated” bonds, similar to cash, which has minimal exposure to interest rates price swings that you would get from “long bonds”. JT13 is basically yen in government custody which means it is free of credit risk, which we would be exposed to in a bank or a structured product. The risk we carry in JT13 is the JPY exchange rate, which is widely believed to be undervalued. I am not sure what Napier’s view is on this, but I would be surprised if he disagreed, as he is a value investor.

The CG Real Return and the iShares Emerging Market Bond Fund (SEMB) are the main exposure we have to proper bonds/interest rates. CG behaves like gold, which Napier approves of. He also approves of emerging markets. There is additional bonds exposure in the multi-asset funds.

We really have minimal exposure to bonds. Let’s not forget the time to avoid them was from 2020 to when Liz Truss resigned. They could fall from here, but in the absence of persistent high inflation, we must have seen the worst.

Robin Griffiths in the February AAA report suggests a 10% stop loss on investments. Should this be adopted over the Whisky and Soda portfolios?

Stop losses are a very simple way to embrace risk management, and it is better to have a simple plan than no plan at all. The aim is to have less painful bear markets because a 50% loss requires a 100% gain to get you back to square one. That is a good incentive to manage risk, and it is much easier to do well over the long term if you can avoid material losses during the interim.

My approach is to reduce exposure to financial markets in market downturns and increase it back to normal levels once those risks subside. There is no magic number, 10% or otherwise, that triggers a reduction in market exposure. It is more of a holistic assessment of the risks built on 25 years of experience.

Robin is a technical analyst by trade, not a portfolio manager. When he says to use a 10% stop loss, that is a simple way of communicating that he won’t be back for another month. If things turn pear-shaped in the meantime, make sure you protect your capital.

But yes, successful investors should have a risk management process to avoid losses.

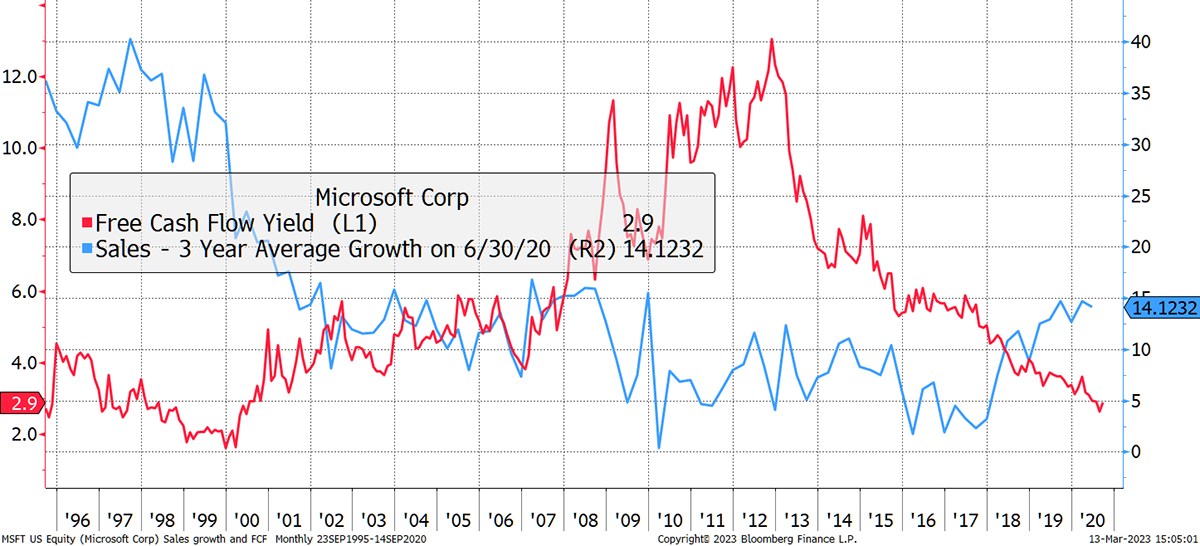

I wonder if Microsoft could be regarded as a potential opportunity at this point? I am highlighting this primarily on the basis of the long-term chart which looks constructive right now. Appreciate your thoughts.

Microsoft is a great company, and without it, I would struggle to do my job. But as an investment, the world’s second most valuable company is no bargain. Today it has a 2.9% free cashflow yield, a bit like it did in the late 1990s. Yet back then, it was growing at 30% per year. From the $60 peak in 2000, it fell to $15 by 2009 before turning the corner. Today the shares are an impressive $250, having retreated from $350 last year, but that free cash flow yield is still only 2.9% with a growth rate of 14%.

Price Without Growth

Source: Bloomberg

I would think if they executed well, the share price could be maintained in a low rate environment, but should they put a foot wrong, finally discover some competition, or face higher rates, another 75% drop is plausible. I like their products, even though they were all stolen from other companies (word, excel, PowerPoint etc.), but as an investment, it represents what’s wrong with markets. Investors are overpricing high-quality companies, leaving little room for a good outcome.

Very large companies by market capitalisation are highly unlikely to do wonders for your portfolio, but I do agree it could remain expensive for a while should bond yields remain low.

As a RICS member I have a duty to tell you it's The Royal Institution of Chartered Surveyors not The Royal Institute good Sir!

My apologies. To an Englishman, these things matter a great deal!

Portfolios

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

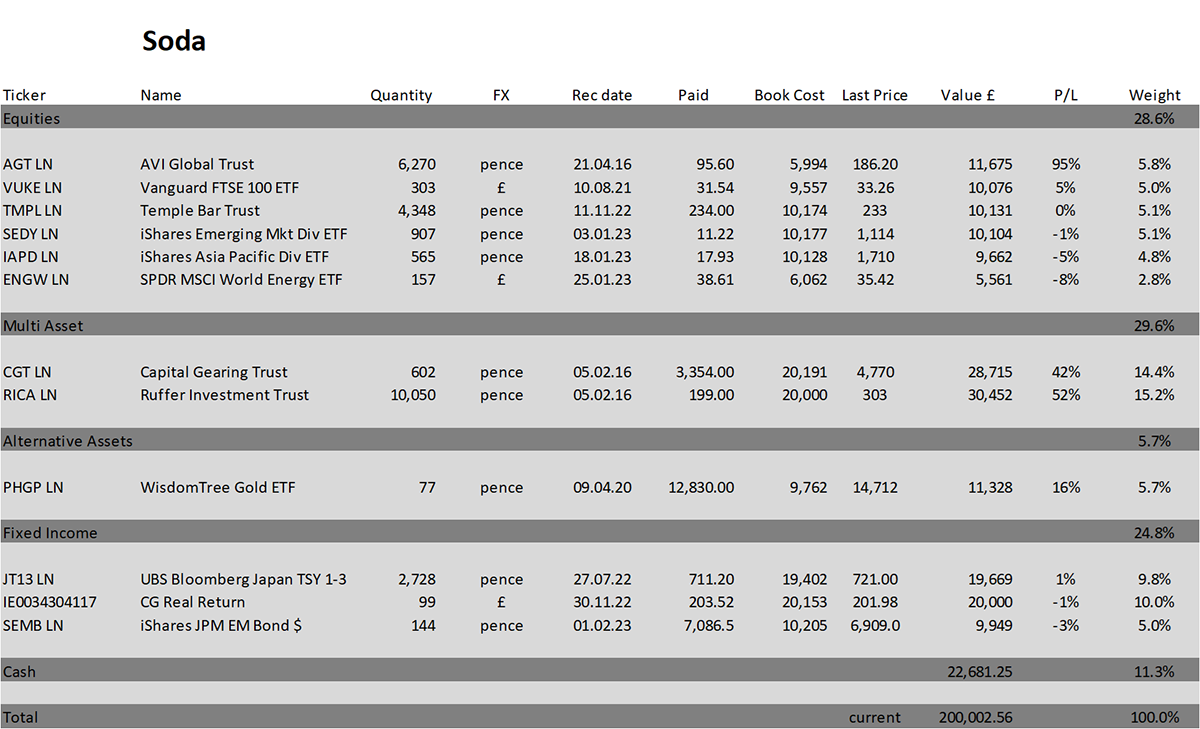

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 0.1% this year and is up 100.0% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

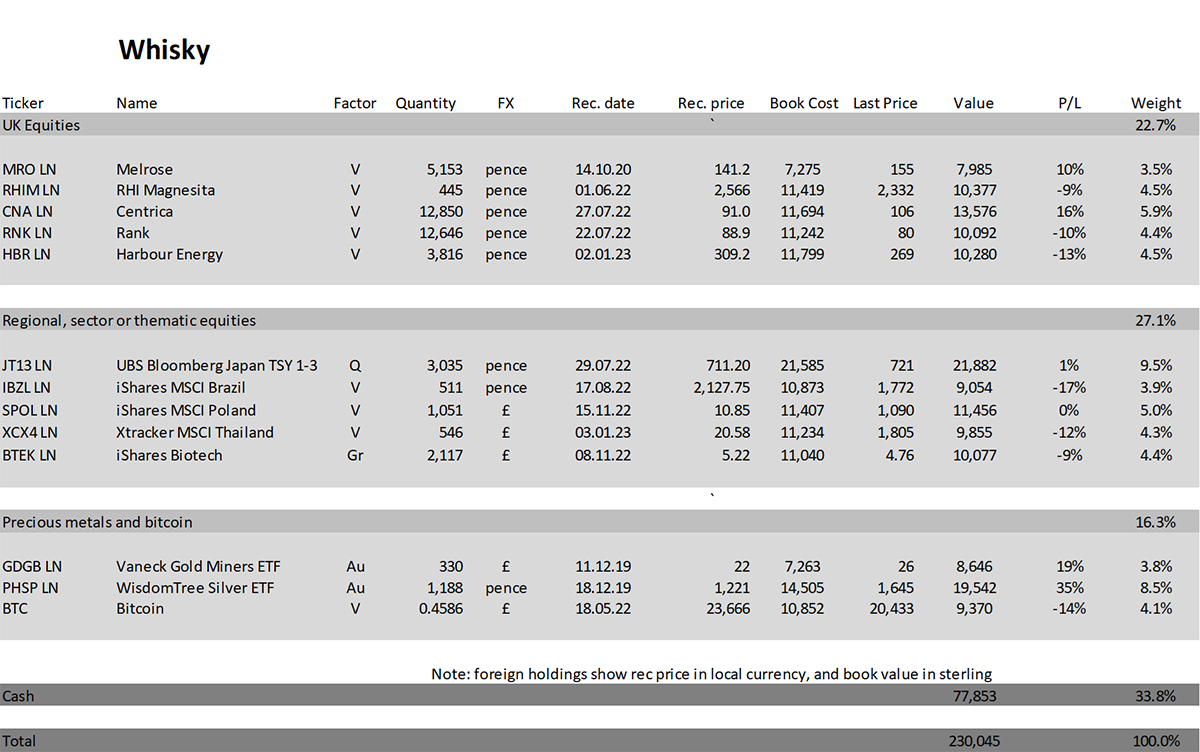

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 3.0% this year and up 130.0% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

Volatility has returned, and although the fears associated with the SVB failure, along with two crypto banks, may soon pass, we should be on the lookout for more cockroaches. The Fed announce interest rates a week tomorrow and the Bank of England the day after. The ECB will announce this Thursday.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd