What the Money Map Is Telling Us

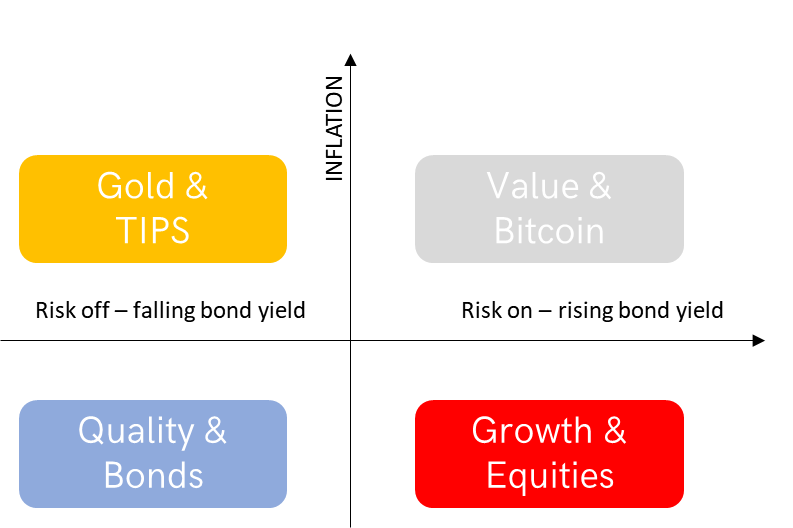

Just like the real world has seasons, financial markets have regimes that favour certain asset types over others at different times. To better understand this, I created The Money Map, which tells you how to invest according to conditions created by interest rates and inflation. It has been a faithful companion for nearly 15 years, and that has helped me to make better decisions.

I mentioned the Money Map in Atlas Pulse last week. Given that I haven’t done so in detail since moving over to ByteTree, it is high time for a refresher. This is especially relevant since rates and inflation are back on the move.

The basic idea is that inflation is plotted vertically and interest rates horizontally. If inflation is rising, “hard” or “real” assets do better than “financial” assets, and vice versa. Similarly, when the economy is growing, interest rates tend to rise, and economically sensitive assets, Value and Growth, tend to do better than safe assets such as Gold and Quality.

Money Map Regimes

Quality includes government bonds and high-quality assets where the future cashflows are highly predictable. High-quality equities include healthcare, utilities and consumer staples, where future profits are relatively predictable. The state of the economy is not particularly relevant to the asset returns.

Environment: Low inflation, falling interest rates, risk off markets.

Growth includes most equities and corporate bonds, which have credit risk. Growth assets face a less certain future, but in aggregate, these companies make money and grow over time. Yet they grow faster when the economy grows and more slowly, or potentially contract, during recessions. In that sense, they are cyclical, although high-growth stocks can be less economically sensitive. Generally speaking, they benefit from stable macroeconomic conditions where the economy is expanding.

Environment: Low inflation, rising interest rates, risk on markets.

Value includes hard assets, industrial companies, commodities and financials. They do best when the economy is expanding, and inflation is rising, conditions that some would describe as overheating, leading to currency depreciation. Commodity prices tend to be buoyant, along with industrial goods such as chemicals. Financials also do well because rising interest rates increase their income. In my opinion, bitcoin behaves like a value asset.

Environment: High inflation, rising interest rates, risk on markets.

Gold does best when inflation is rising, with interest rates lagging behind. That is, gold likes real interest rates to be falling. Under such conditions, which can be very bad for growth assets, gold becomes a safe haven and attracts investors from all over the world.

Environment: High inflation, falling interest rates, risk off markets.

Current Conditions

With inflation and interest rates rising, we are in a Value environment.

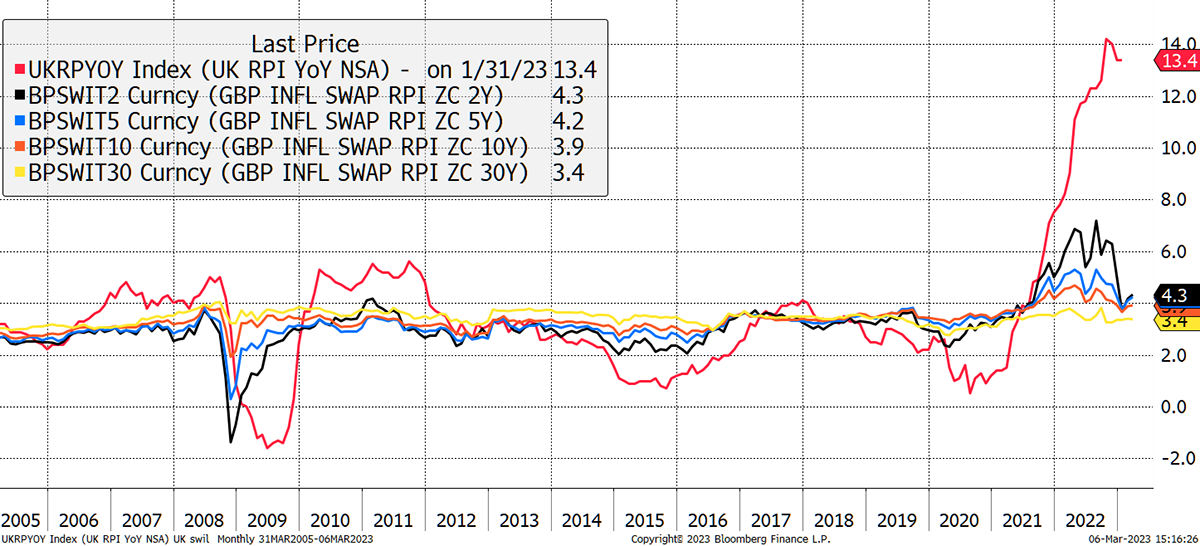

Looking at the UK, reported inflation (red) is shown against expectations, which have been derived from inflation-linked gilts aka “linkers”.

Between 2013 and 2020, inflation was low and occasionally zero. Yet expectations always implied that inflation would return to around 3%. In the 2008 crisis, it briefly turned negative but soon recovered to more normal territory.

Inflation Surge Ignored by Linkers

The outlier seems to be the post-pandemic world. Inflation expectations briefly followed inflation higher, but did so reluctantly, and lagged. Over the past two years, UK inflation has been 21.3% or 11.1% per year, yet the two-year forecast never managed to rise above 7% and has already fallen back to 4.3%, as if all is well. In understating inflation, the forecasts have been wrong, which is perplexing. If inflation was going to collapse, it would already be falling by now, and it isn’t to any material degree.

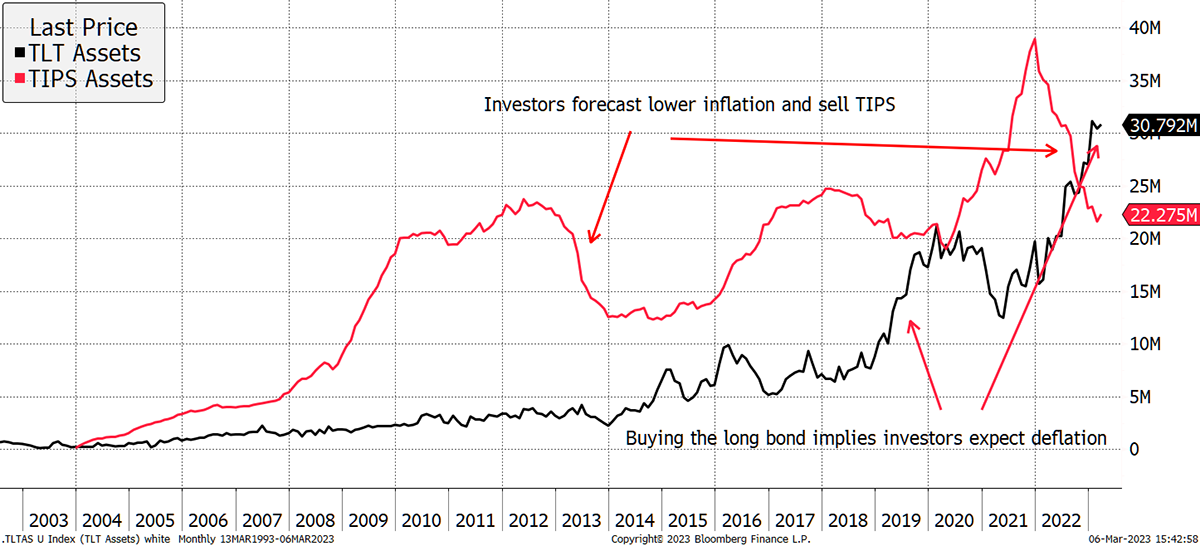

One answer comes from pricing. The implied inflation forecast comes from bond prices. If investors are prepared to pay high prices for TIPS or linkers, they expect high inflation, and so a high inflation expectation results. On the other hand, if they shun TIPS, low inflation forecasts will result. In 2013, investors were right to dump TIPS, which correctly forecasted a fall in inflation.

Not only are they dumping TIPS, but they are piling into the long bond, which is the riskiest interest-rate sensitive asset. As representations of the long bond and TIPS, respectively, I show the iShares 20+ TIPS ETF (TLT) and the iShares TIPS ETF (TIPS). Since the peak in 2020, TIPS is down around 15%, and TLT around 40%. The y-axis is assets in billions $.

Investors Are Not Worried about Inflation

Investors are buying the long bond as if supply is running out (I can promise you, supply is plentiful). Remarkably, the number of shares in issue for the TLT ETF (long bond) has trebled in a little over a year. Combine this with the outflows from TIPS, and investors are highly confident that inflation will collapse.

I believe these investors are optimistic, but you can’t blame them for listening to the Federal Reserve and other central banks, as this is the official line.

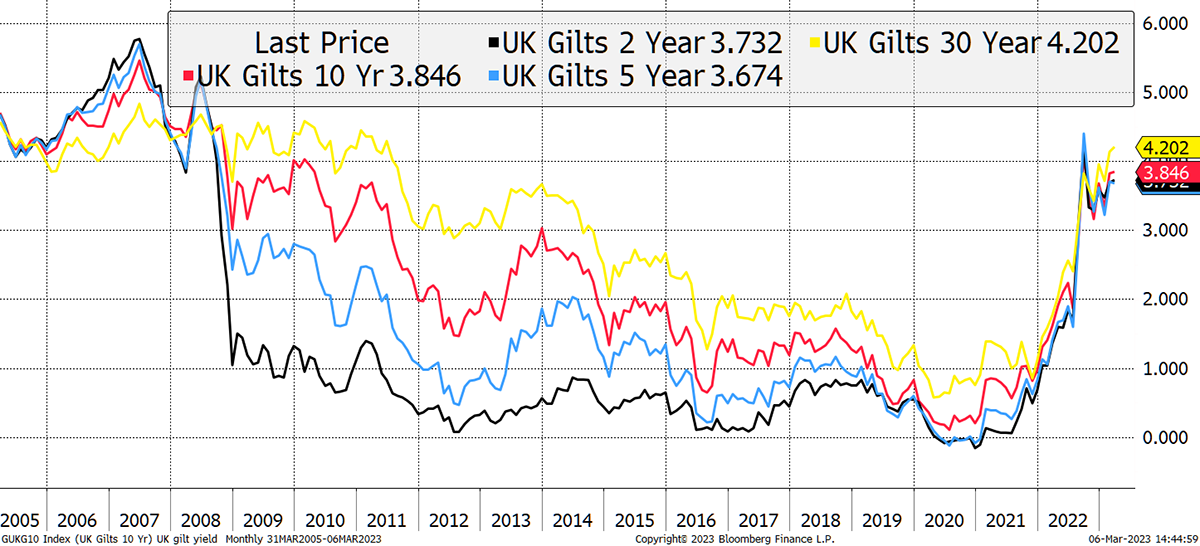

Bond Yields

Turning to bond yields (the horizontal) on the Money Map, let’s examine interest rates, which have risen sharply. The driver has been eight interest rate hikes from 0.25% to 4.75% in the USA and ten hikes in the UK to 4%. This is the fastest monetary tightening on record, and it isn’t over yet.

Interest rates heavily influence bond yields, and you will recall the spike to 4.5% last October, which was enough to bring down the Truss Government. I have heard all sorts of anecdotes from insiders since then, including from Kwasi Kwarteng himself, the then Chancellor. By most accounts, the government had little idea of what was going on and failed to understand the importance of the bond market.

Big Hikes

Two years ago, you could get 0% “risk-free” from HM Government; you can now get 4%. As that rises, it puts downward pressure on bond prices and other high-quality assets, which are “bond-like” in nature.

It may sound odd, but all assets are in competition. If gilt yields rise, and so become more attractive, they would see the price of competing assets fall so that their yields rose in proportion. Examples might be a lease on a doctor’s surgery, or a manufacturer of toothpaste. Despite no change in their operations, a higher gilt yield reduces their valuation.

What if yields keep rising? This is the big risk facing markets, as I will illustrate.

All Assets Are in Competition

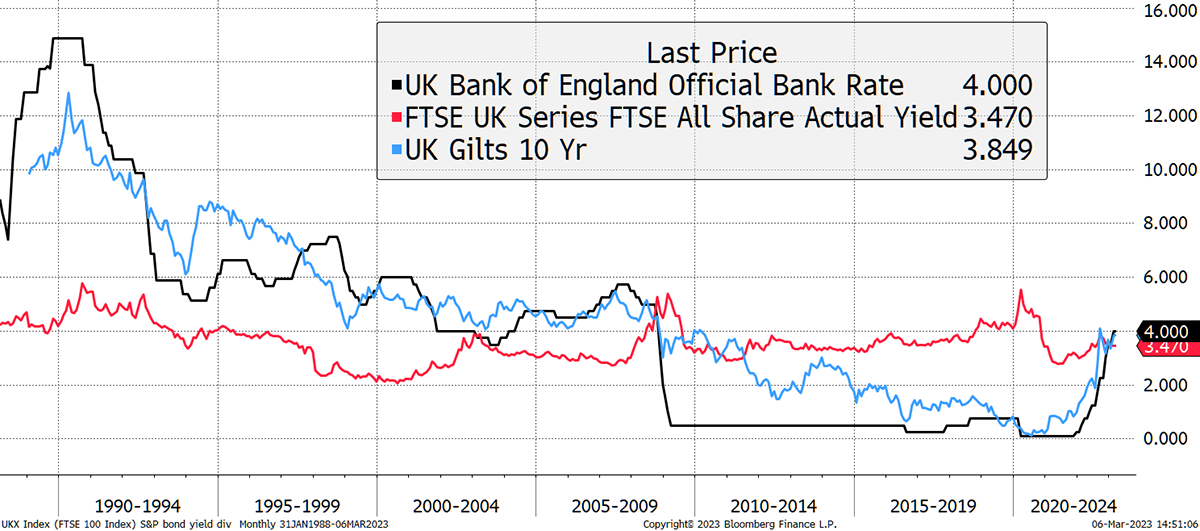

I compare UK interest rates to the 10-year gilt yield and the dividend yield from the FTSE All Share. The beauty of cash over assets is that the yield can go up while the price remains flat. In contrast, for equities and bonds, a rising yield means a falling price, at least at the index level. Going back to 1990, we have seen 15% interest rates on occasion, and we have also seen zero. I prefer the high numbers because the fun begins when they start to all. The 1990s were a great time for investors.

It is remarkable how the 10-year gilt, cash and the FTSE currently all seem to offer a similar yield. This happened momentarily in 2008, and perhaps in 2003, but it’s unusual.

All Yields Seem to Be the Same

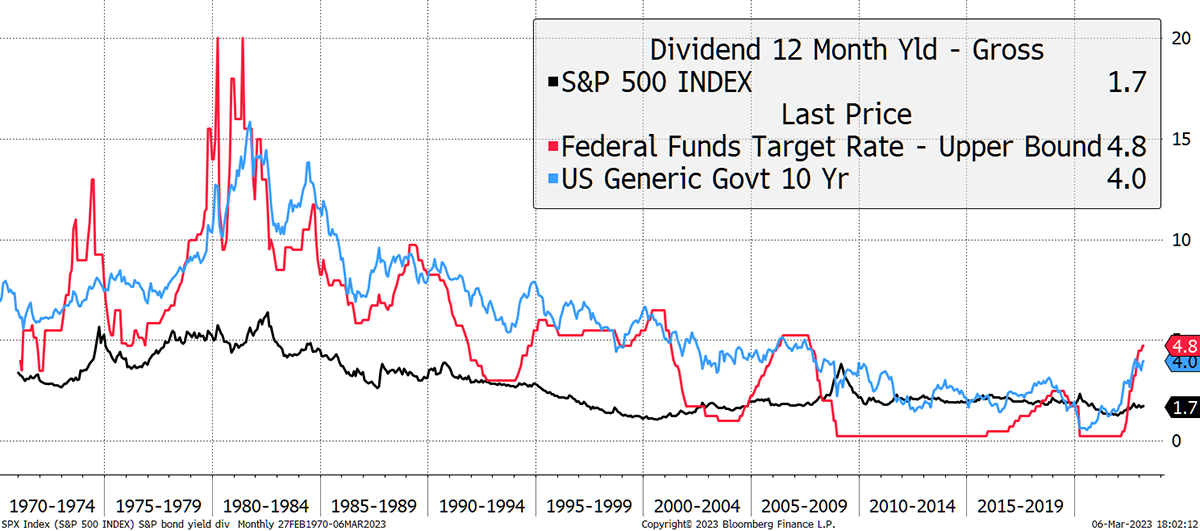

Itching to go further back, I will switch to US data.

A falling yield means a rising price and vice versa. Equities normally yield less than cash and bonds, which makes sense because you get an additional capital return via growth. It transpires that the historic norm, before this era of post-2008 financial stimulus, was that US treasuries paid 4% more than equities. Currently, that number is 2.2%, despite a surge in interest rates.

Cash and Bonds Pay More than Equities

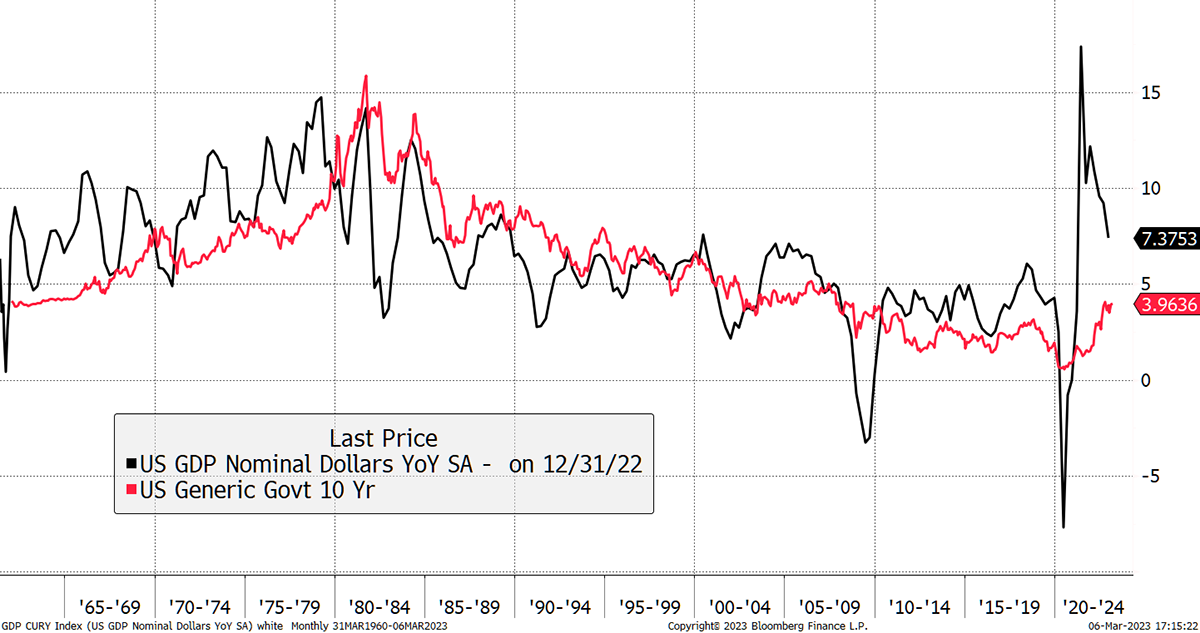

I leave you with my final chart, which links the ten-year bond yield with nominal GDP growth. That means real growth, that policy makers talk about, plus inflation. The old “Wicksell Rule” is that the 10-year yield should approximately match nominal GDP growth. We know from the last chart that the yield could easily be 2% higher in a “normal” environment, and this chart reiterates it.

Wicksell’s Rule Sees Bond Yield Too Low

The bull case that emerged late last year hinged on returning to low inflation with the central banks firmly in control. I have my severe doubts about that, and I think it is a very brave and dangerous assumption to make. Naturally, the head of the Bank of England believes it, along with the rest of the establishment. Should we trust them?

The risk is that they are wrong, something that the people in charge seem to be good at. The Money Map continues to point towards higher rates and inflation, meaning that Value is the best place to be. Gold and Growth are neutral, while Quality is to be avoided.

But if it turns out that inflation is returning to normal, and the rate hikes are reversed, then it’ll be an about turn and back to Quality. There’s only one problem with that; high Quality stocks still offer poor value. Furthermore, the regime is unlikely to change until investors are on the wrong side. With them currently chasing the long bond over gold and TIPS, it does seem a little early.

Action:

No action.

Postbox

Can I please ask, do you regard short-term US Treasury Bonds (less than 1 year) as a good place to hold cash, or perhaps a short-term UK gilt fund? If so, are there any funds you like?

Yes, short-dated government bonds are the best place to hold cash. The rate isn’t the highest, but it is the safest. Right now, the 0.125% UK Gilt expiring on 31 Jan 2024, pays 4.1%. Your capital may move around a bit, but the result is guaranteed. In the USA, the Treasury 0.125% expiring 15 Jan 2024, pays 5.1%.

The brokers and banks are enjoying this moment. The rates they receive on your cash are significantly higher than what they pay out, meaning there is an incentive to seek out higher rates. There are many considerations as to what works best for you, and that makes recommendations for excess cash difficult.

The ETFs are not great for ultra-short-dated bonds. You can buy the iShares 0 to 5-year gilt ETF (IGLS), but it is still quite volatile relative to the income received. You really need 0 to 2-year bonds, and better still, 0 to 1-year to get rid of the volatility. There are no ETFs that do this.

The other solution is a money market fund. These should remain stable (no price volatility) and pay an income. Here’s the key point. If the income is higher than the 4.1% paid by short-dated gilts, there’s a risk you may not have considered because the fund is investing in things like bank debt. In the 2008 crisis, the higher-yield money market funds got into trouble. I doubt that happens again, but in my opinion, cash should be invested in a risk-free manner, or else you may as well stay in the market.

The best bet for interest-seeking investors is short-dated government bonds in their chosen currency.

Another US newsletter I follow is a big advocate of this for a significant chunk of their portfolio, and they buy Treasury Bonds directly from Treasury Direct. They also state that buying TIPS is a mistake which is strange as they also think that inflation will be higher for longer which I would have thought is a reason to buy TIPS. They advocate roughly a third cash (US short duration bonds), one third high income value stocks and one-third gold. Interestingly they also regard traditional energy as a big play over the coming years.

Buying from Treasury Direct saves commissions for US investors, so that makes sense. Personally, I would rather keep my holdings in one place for convenience.

The three thirds was presumably inspired by the Talmud.

“Let every man divide his money into three parts, and invest a third in land, a third in business and a third let him keep by him in reserve.”

Where stocks are business, and gold has replaced land. It is a highly defensive strategy that would have a reasonable outcome whether inflation soared or collapsed.

I can only assume they prefer gold to TIPS from an idealistic perspective, as gold cannot default. My view is that gold and TIPS are interchangeable over time, depending on pricing, and the current environment favours TIPS. Either they are underpriced and do well, or gold is overpriced, and TIPS are less risky.

On energy, it is hard to disagree. I cannot see an alternative, and people are finally talking about this again in the mainstream. Net zero is a fantasy, but sadly it remains a UK government policy with a totally unrealistic timetable.

Have your views on Japanese 1-3 year treasuries changed?

No, but the trade is yet to work. Basically, when Japanese bond yields rise, the yen will rally significantly. If yields around the world rise, as I believe they might, this puts pressure on Japan to change their monetary policy which currently caps interest rates. I feel that if things turn ugly, this is the sort of position we will be very glad we held.

The Bank of Japan next meet on Thursday. Recent meetings have resulted in no change to policy, but this is looking ridiculous.

Is it reasonable to expect Ruffer to continue to deliver "returns meaningfully ahead of the return on cash" (quoted from website) in the current rising interest rate environment?

They build portfolios around fear and greed so that they can cope with the good times and bad. They would argue they were put on this planet precisely to deal with times like this, as inflation has forever been their obsession.

That is not to say that they will do well in the short term; I very much doubt they will because their positioning is very defensive. That makes them safe but also prevents them from doing well in the short term. They also have a hedge book which aims to mitigate risk. Last year they were short the long bond, and in 2020, they were “long volatility”, which profited from the March 2020 crash. They are competent investors.

In the short term, they will inevitably lag cash, but with managers like this, you embrace them over the cycle. They win by not losing – that is their mantra. I would be very surprised if, five years from now, they haven’t done a good job in this environment.

Portfolios

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

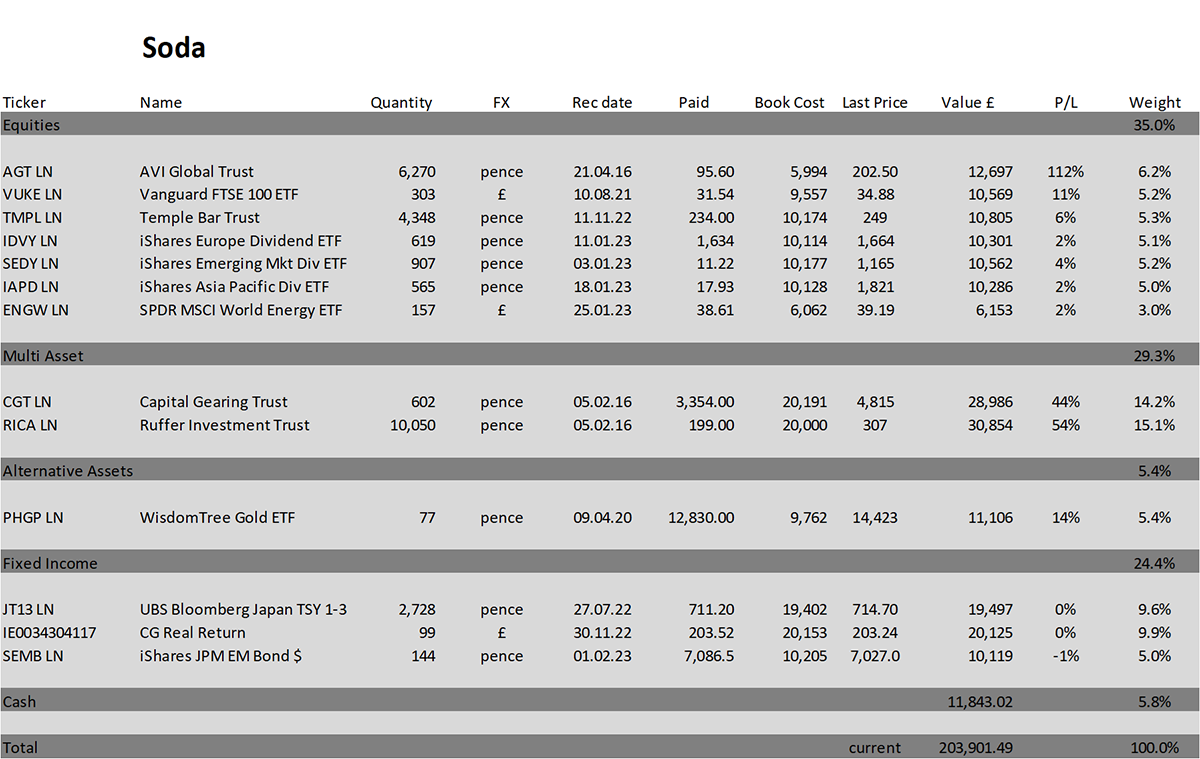

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 1.9% this year and is up 103.9% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

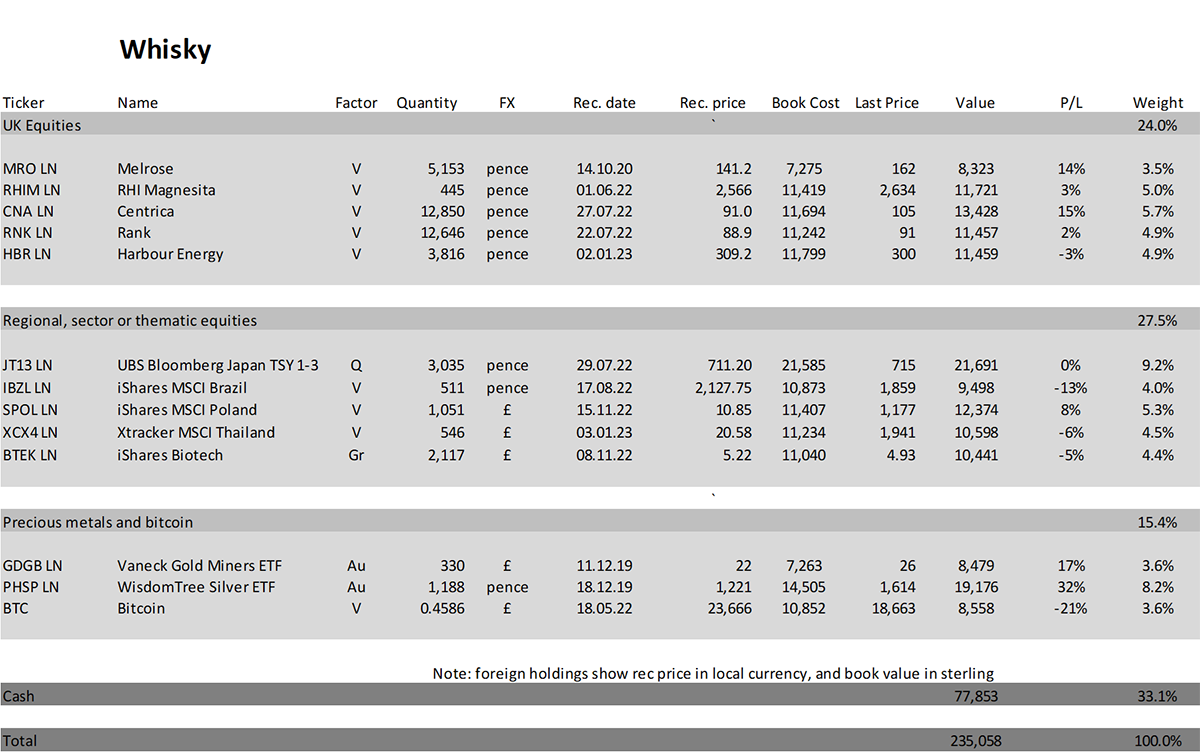

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.2% this year and up 135.1% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

I hope this Money Map refresher was helpful. It shows how we are at a critical point in markets where a new regime will emerge. I have been concerned about a surge in the bond yield, which hasn’t yet materialised but remains a heightened risk.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()