Where Are the Safe Havens?

Disclaimer: Your capital is at risk. This is not investment advice.

Having been the poster child of the 2023 rally, the banks are back in the doghouse as fears grow about their credit quality. This may be exaggerated, but over the years, you come to realise there is no smoke without fire.

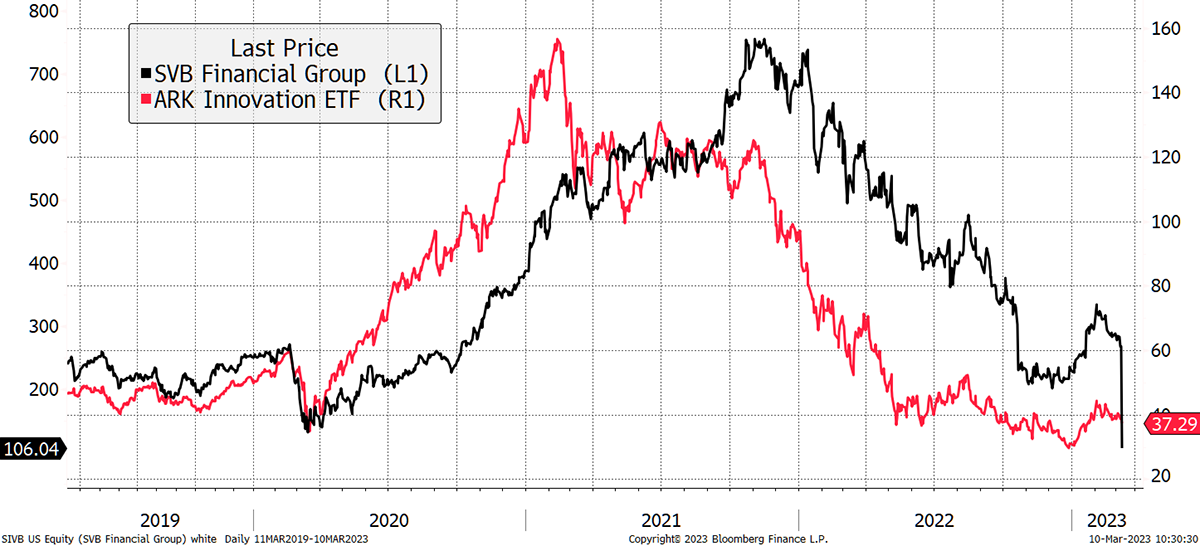

Silicon Valley Bank (SVB) has been funding the technology and life sciences sectors. These have been the engine of growth but now lack cash flow as times get tough. As a result, SVB appears to have been selling assets to boost capital and cover losses, but with asset prices down, confidence has waned. The bank’s fortunes have been closely aligned with the tech sector, which can be seen from the close resemblance to the infamous ARKK ETF.

SVB Under Pressure

SVB’s stock fell 60% yesterday, which spooked the broader banking sector, one of the strongest sectors this year. In a few market sessions, the US bank sector has cut straight back down through its 200-day moving average, with breadth collapsing. That happened just as investors were beginning to believe that the banks offered sanctuary. After all, they benefit enormously from interest rate hikes (which they fail to pass on to their customers).

Panic at the Banks

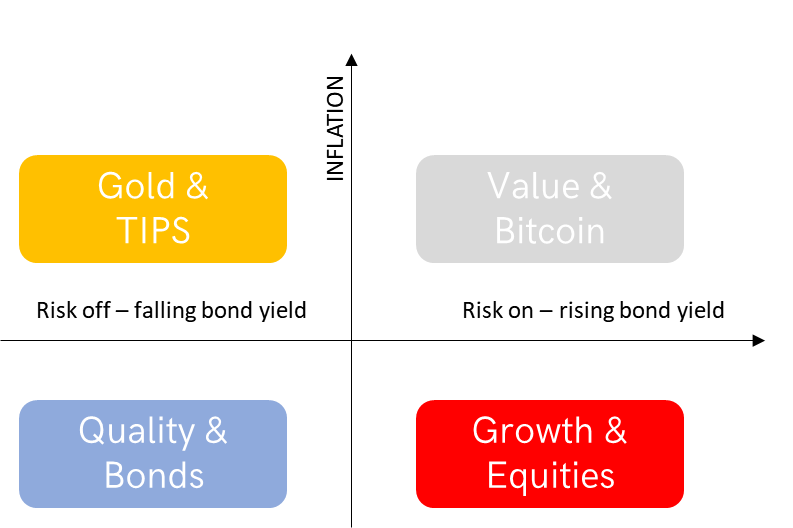

The message from the banks should not be ignored and gets to the heart of the recent conversation at ByteTree. In last week’s Multi-Asset Investor, I looked at the vulnerability of house prices, and this week, the importance of rates and inflationin guiding asset allocation, assisted by the Money Map.

Sometimes it is simple interpreting where we are, when it is clear whether inflation is either stable, rising or falling, and when monetary policy is well flagged. Today, the only thing we can be certain of is change. And lots of it.

Much confusion comes from the US yield curve, where long-dated government bonds pay less than short-dated bonds - a situation known as an “inverted curve”. Generally speaking, an inverted curve forecasts recession because there is high demand for long-dated debt, which is a precursor to a severe cut in interest rates. Yet the US Federal Reserve insists interest rates will keep on rising until inflation is tamed. Who to believe?

Germany reported inflation this morning of 8.7%, unchanged from last month, and many countries are reporting stubbornly high numbers. The USA reports next Tuesday. I cannot wait for this CPI data to return to being irrelevant, but for the time being, we have to watch it like a hawk.

Most investors prefer a calm world where you can focus on good companies and count the dividends. But at times like this, the macro takes over, which can be overwhelming. There are several ways to combat this. The most important is to allocate for the long term, which will avoid the permanent loss of capital.

As things stand, some think that means buying the long bond, which worked in 2000, 2008 and 2020. There are plenty of reasons to remain cautious on the bond market, not least that the average duration is just 3.6 years (weighted average time to maturity). That means trillions of dollars of debt will need to be refunded time and again, which ought to make investors think twice. I may well join the bond bulls, just not quite yet, as it can be very painful to fight the trend.

Our expert in trends, Robin Griffiths, wrote in last week’s Adaptive Asset Allocation Report (AAA):

“Remember, if the portfolio drawdown is 50%, then we have to double our money just to get back on side. This is hard to do but recovering from a 10% drop is easier. We say this because we are in a global bear market, see a recession coming and believe losing money against this backdrop is very easy.”

I would agree this is a time to preserve capital. The best way to remain solvent is to diversify across resilient assets. You can sit in cash, but you need to be sure you pick the right currency!

No one said this was easy.

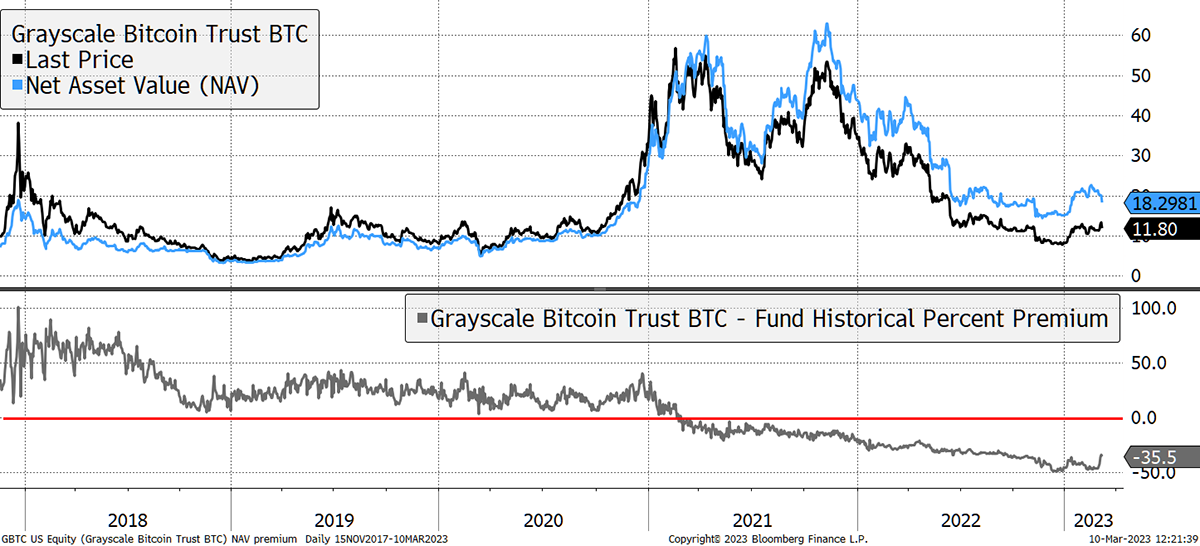

ATOMIC this week highlighted the many positives on the Bitcoin Network. While the blockchain is alive and well, the broader crypto sector faces banking problems of its own as Silvergate Bank has moved into voluntary liquidation. There are also developments at Grayscale, which has sued the SEC for rejecting an application to convert its closed-end fund (GBTC) into an ETF. The GBTC discount to NAV has narrowed from a low of 49% to 35% in short order.

The Lobsters May Escape from the Pot

The SEC’s case against GBTC’s conversion to an ETF is dubious at best, and the judges picked up on that. When it comes to the land of the free, current regulatory initiatives do not seem to be so free. The bottom line is that bad news continues in crypto, but it’s running out. When this macro storm finally comes to an end, bitcoin will still be alive and well. As with all new technologies, it will be onwards and upwards.

Comments ()