Trades in Whisky and Soda

The animal spirits have returned but with a twist. One of the biggest winners since the autumn, and despite the then crisis in UK politics, has been the pound. It started from a low level and is back to somewhere close to normal. For UK investors, this currency strength has reduced returns on overseas assets and commodities, but for the optimists, it offers an opportunity to top up. I’m exploring commodities.

To illustrate sterling strength, I show the world index in USD (red), the pound vs dollar (blue), and world equities in GBP (black). It reminds us how inconvenient a currency rally can be. Since sterling’s autumn low, global equities made 1% in GBP and 17% in USD.

A Strong Pound Reduces Returns

Source: Bloomberg

It still concerns me that the “wrong” type of stocks are rallying. The most expensive stocks are going up, while the cheapest are not. There is most likely a recession coming for the developed world, and that means investors are avoiding all but the most liquid large cap stocks.

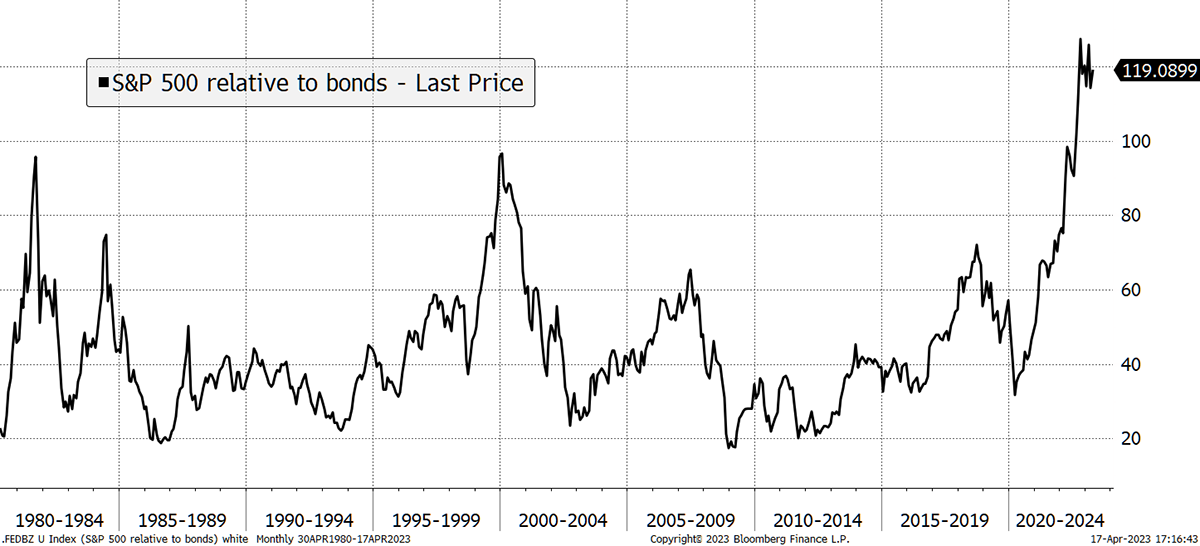

These big tech stocks are in denial and “identify” as bonds. If I wanted bonds, I’d buy bonds, and the trouble is that I don’t fancy bonds much either. Let us not forget this chart. US equities are still excessively stretched versus bonds, and bonds still yield less than inflation, meaning there is plenty of room for disappointment. If the battle against inflation cannot be won, we’ll soon find out what Armageddon looks like.

Equities Remain Stretched Versus Bonds

Source: Bloomberg

The trouble is that the Federal Reserve has backed itself into a corner in wanting to see inflation fall back to 2%. If they fail, they lose their credibility, which is their most important asset. That means rates stay higher for longer regardless of banking crises, property crashes, fallen UK governments or anything else. The only way for the Fed to hit their target is a nasty recession.

But there’s a twist. China has just reported 4.5% growth which is ahead of expectations. Presumably, the geopolitical divide that has emerged means the world becomes less correlated. That is, the East can grow when the West contracts and vice versa.

That would be helpful for an asset allocator because it would improve diversification. Furthermore, I would be much more enthusiastic about equities if this cycle was led by the emerging markets and Asia, where there is higher growth and better value. Sooner or later, that will happen, and when it does, I look forward to much higher exposure to equities.

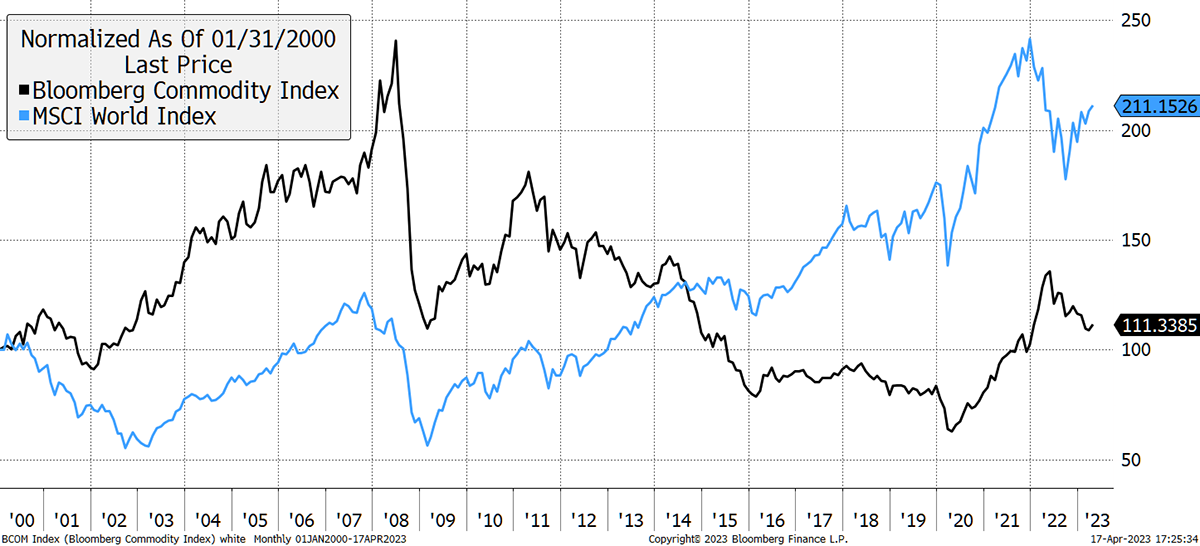

One beneficiary of a growing China is commodities. They were all the rage last year, but they have cooled off. The broad commodity index languishes at levels around the bottom of the 2001 recession or the 2008 credit crisis. The post-2013 gold slump and the 2014 shale boom will not be repeated, and the 2015 to 2020 era of cheap commodities is over.

Equities Versus Commodities

Source: Bloomberg

A lower price makes commodities less risky because they are cheaper. They also offer additional diversification benefits, which are very welcome.

Buying 6% WisdomTree Broad Commodities in Soda (AGCP)

The simplest way to invest in commodities, other than precious metals, is via futures contracts. That is one reason I have generally preferred precious metals because they can be held in physical form and are simpler investments to understand.

Commodity ETFs hold futures contracts via swap arrangements, which appear to be complex but are actually quite simple. The ETF (also referred to as an ETP “Product” or an ETC “Commodity” rather than ETF “Fund”) holds low-risk collateral (eligible liquid assets), and there is a “swap” agreement with a counterparty that is exposed to commodity futures.

The client gets exposure to commodities, as they asked for, and the collateral ensures the contracts are upheld. This is necessary because commodity futures are not allowed to be held in standard UCITS funds or unit trusts. Equity ETFs are UCITS compliant.

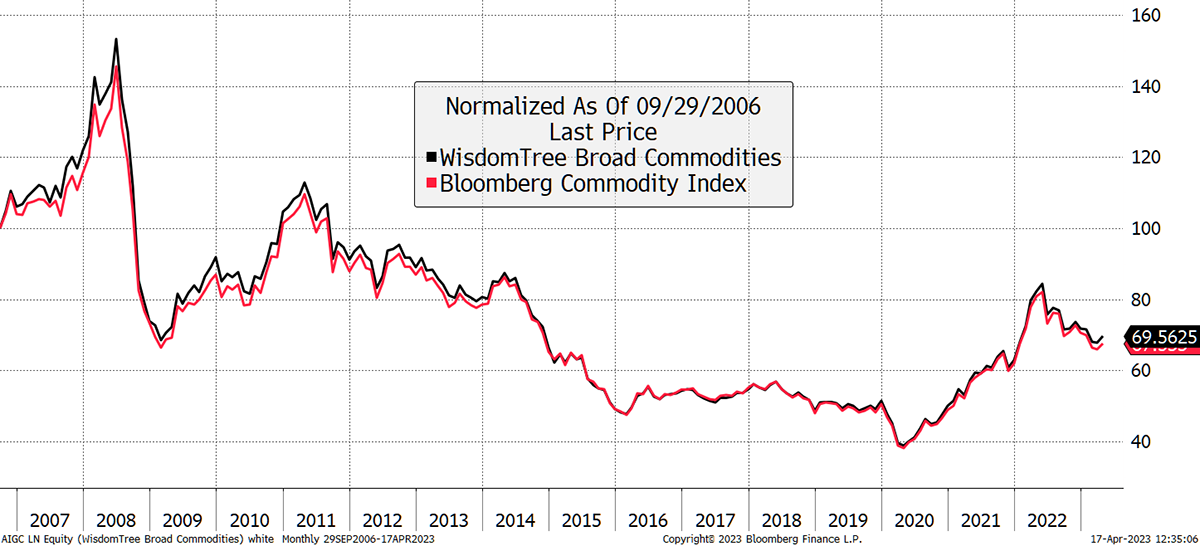

Commodity ETFs have successfully tracked the commodity indices for 20 years, albeit with issues such as roll yield, that the futures contracts must face. This means the returns from futures can differ from the change in “spot” commodity prices, but don’t worry about this because I’ve got your back.

Futures have been around for centuries and commodity ETPs for around 20 years. Back in the day, I was WisdomTree’s best customer during the 2003 to 2008 commodity bull market, and so I know my way around these products.

There was a time when they were controversial, and I chose to avoid them in The Multi-Asset Investor (and its predecessor). Instead, my approach to commodities was a mix of oil and mining stocks alongside physical precious metals. It has been simple and effective.

Having thought long and hard about this, I have decided it is time to embrace commodity ETFs to open up more investment opportunities. Commodity ETFs offer an important opportunity to gain exposure to a different asset class. At times like this, we need all the asset classes we can get.

AGCP

This ETF tracks the Bloomberg Commodity Index, which comprises 44 different contracts. The top 10 are:

| Gold | 15% |

| Brent Crude | 7.8% |

| Nymex Light Sweet Crude | 6.8% |

| Henry Hub Natural Gas | 4.7% |

| Soybean | 4.5% |

| Copper | 4.3% |

| Corn | 4.2% |

| Silver | 3.9% |

| Cattle | 3.4% |

| Aluminum | 3.4% |

AGCP trades in GBP and has done a good job in tracking the commodity index since it was launched in 2007 with an annual management fee of 0.49%.

Source: Bloomberg

I have taken the view that the pullback in commodities over the past year is overdone, and it makes sense to hold more physical assets, especially given the monetary uncertainty. Furthermore, I would doubt the pound is going much higher, so this is the time to take advantage of recent strength.

Risk

AIGC is fully collateralized, so the financial risk is relatively low but should be understood. These products had problems in the 2008 credit crisis, which proved to be temporary. They were executed by Lehman Brothers, which caused trading disruption for a few days after the bankruptcy. The collateral ensured normality resumed within days with different banks. I believe the system worked following an extreme test, and I will not attempt to disguise this risk from you. In my opinion, the financial risk is low.

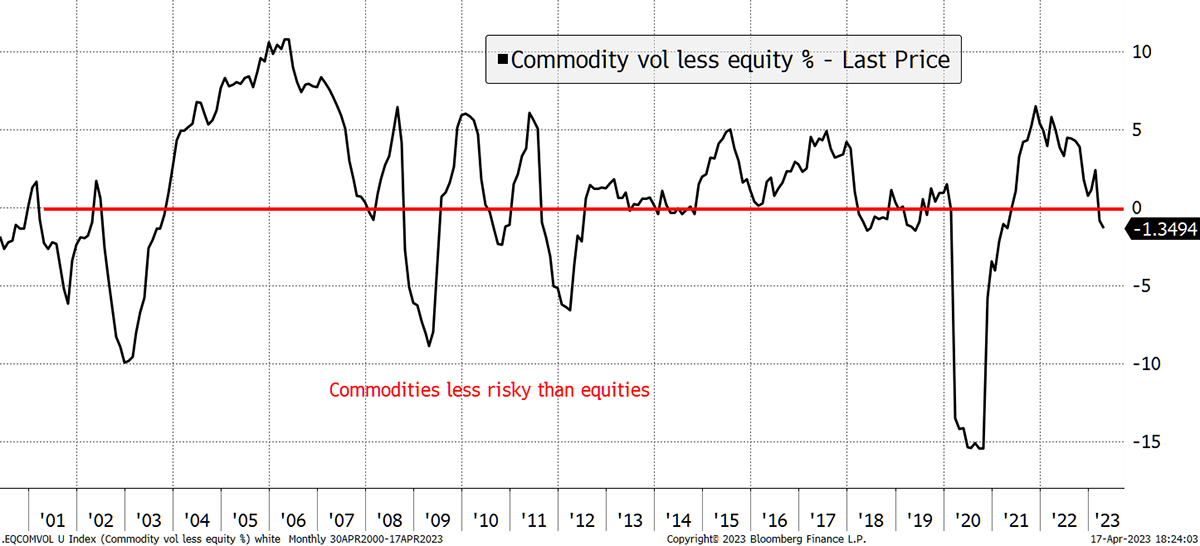

The most important non-financial risk is the exposure to commodity prices. Over the past 23 years, I have shown the difference between equity and commodity volatility. Currently, that is slightly lower for commodities, which is encouraging, and an attractive entry point. It means the hype from last year is behind us.

Commodities Less Volatile than Equities

Source: Bloomberg

Overall, I believe this diversified basket of commodities to be medium risk, and not dissimilar to a mainstream equity index.

Buying 5% iShares Palladium ETF in Whisky (SPDM)

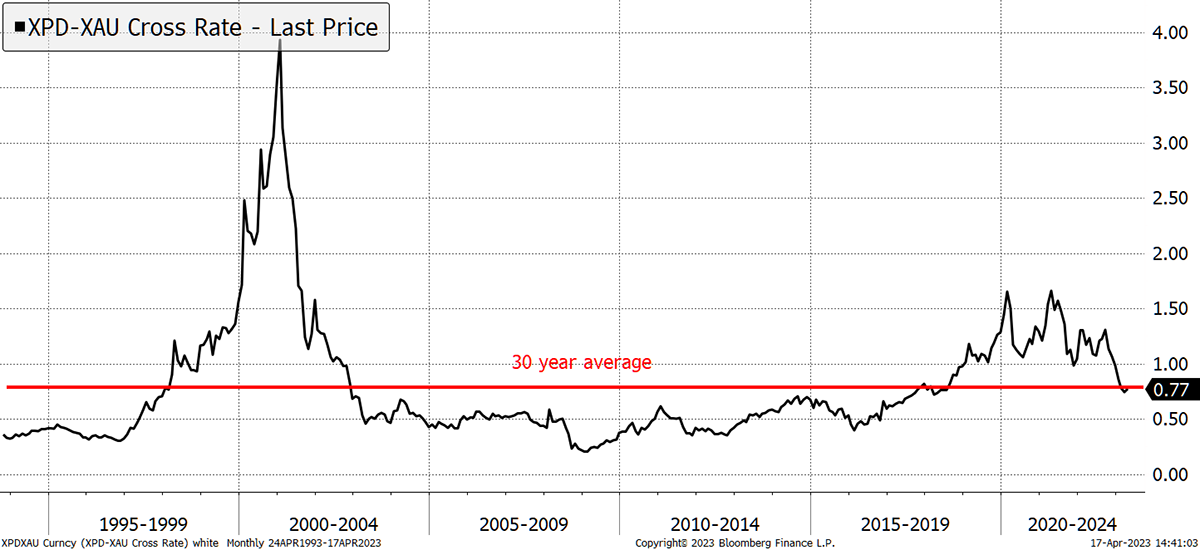

I am also intrigued by palladium. It is priced at $1,617 per ounce as I write against gold’s $2,004. That makes the palladium-to-gold ratio 0.77, which is just below the 30-year average, having been twice as high in recent years.

Palladium Versus Gold

Source: Bloomberg

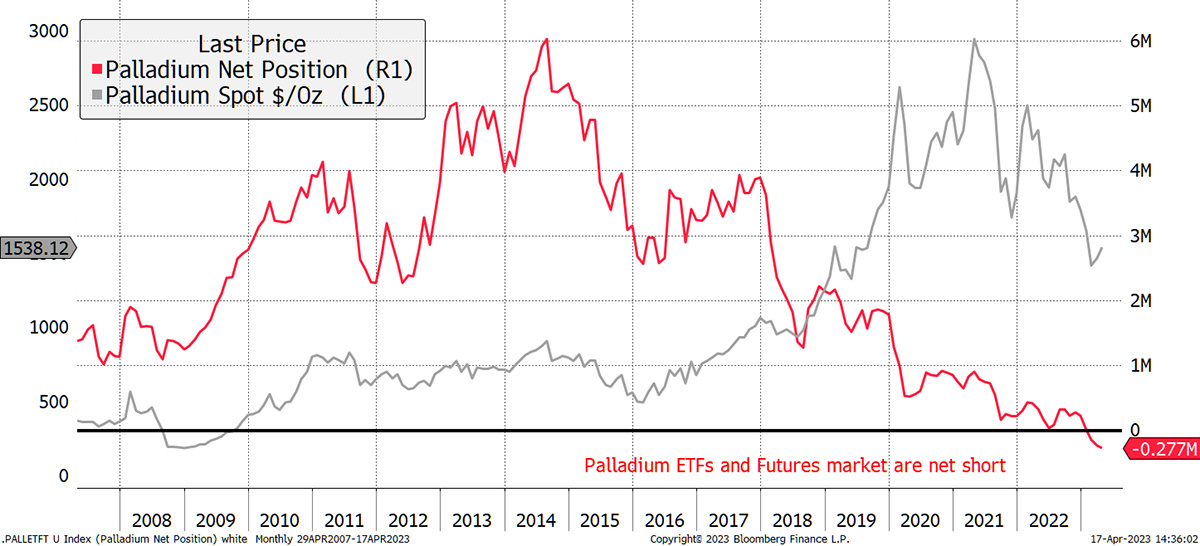

The price dip isn’t what got my attention. What is extraordinary, and something I have never seen before, is how the financial services industry has a negative holding in palladium. That is, their combined holdings in the ETFs and the futures is net short by 0.277 million ounces.

Time for a Short Squeeze

Source: Bloomberg

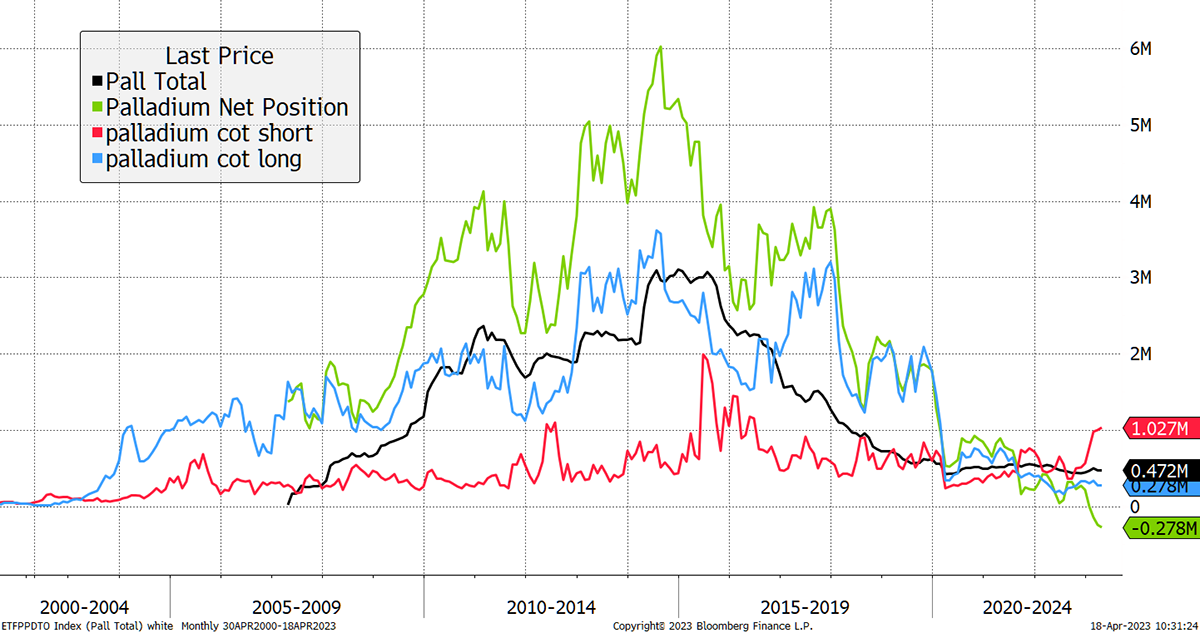

Allow me to break that down by investor group with the position size on the right scale (million ounces). The futures longs (blue) are extremely low. The shorts (red) are abnormally high. The ETFs (black) have been declining for years. The net result (green) mirrors what is seen above. The financial services industry cannot be physically net short, and so they must presumably cover at some point.

Positioning in Palladium

Source: Bloomberg

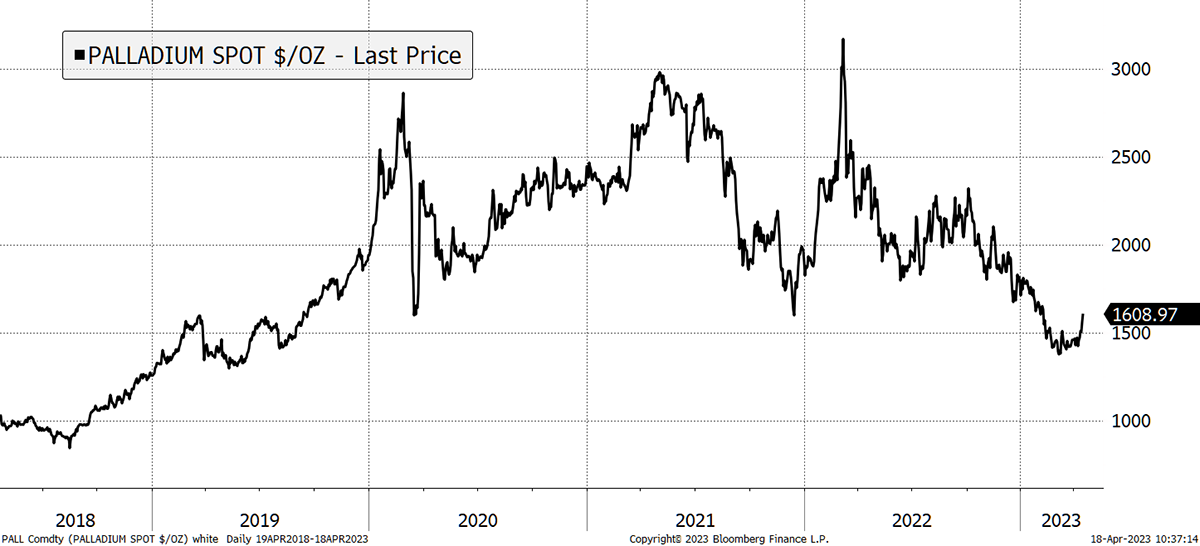

A rally has begun, and I think it’s an interesting trading opportunity. Given the buoyancy surrounding precious metals, and the huge, short positions, there is an opportunity to catch up. This is not for everyone, but if you are going to do it, move quickly.

Palladium Rally Has Begun

Source: Bloomberg

Risk

Palladium is more than twice as volatile as gold and is riskier than silver. This is a trade rather than a long-term investment, and I have not focused on fundamentals which makes this high risk. I believe this short squeeze will play out quickly, and I hope to take profits soon. But should it fail, a stop at $1,400 on palladium, or £32 on SPDM is prudent.

Action:

Buy 6% WisdomTree Broad Commodities in Soda (AGCP)

Buy 5% iShares Palladium ETF in Whisky (SPDM)

PostBox

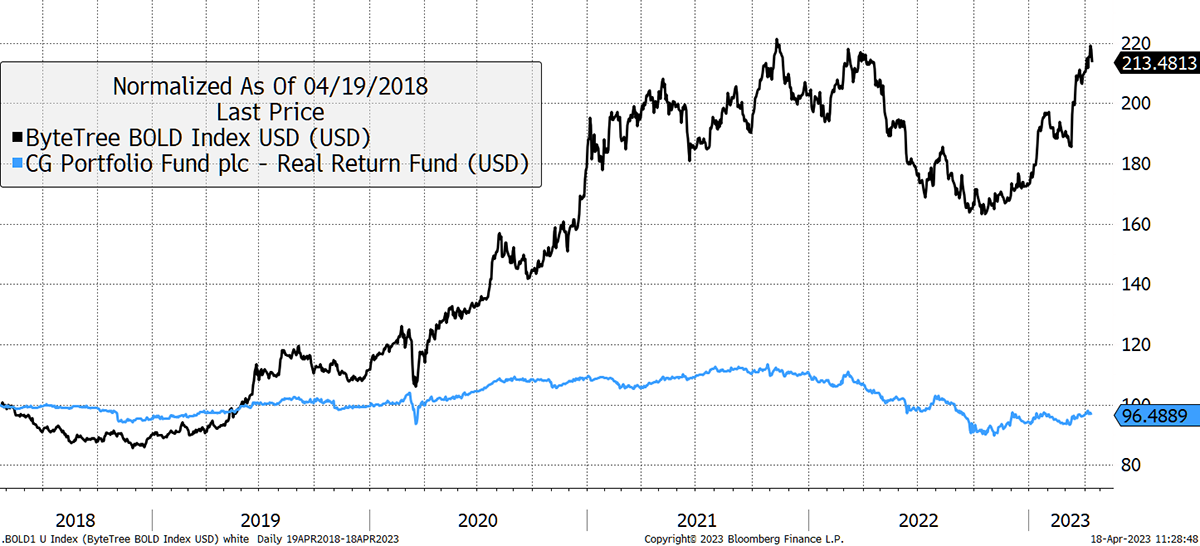

There’s none so evangelical as a late convert, but as a BOLD investor I’m wondering whether there’s a need to be invested in the CG Real Return Fund? I recognise they are not the same, but the long-term track record of BOLD is better and also your hands are tied to a certain extent with regard to the Multi-Asset Investor portfolio, and I’m certain it would feature if you were unconstrained.

BOLD and TIPS are very different. Clearly BOLD is expected to deliver higher returns, but that comes from investing in bitcoin which (some/most) people believe to be extremely risky. Certainly, the establishment takes that view. ByteTree is more open-minded.

BOLD Versus TIPS

Source: Bloomberg

BOLD is truly special. I do not have my hands tied in the sense that I would own BOLD instead of TIPS. But certainly, if BOLD was easily accessible, it would prominently sit within the Soda Portfolio, but I would also hold TIPS.

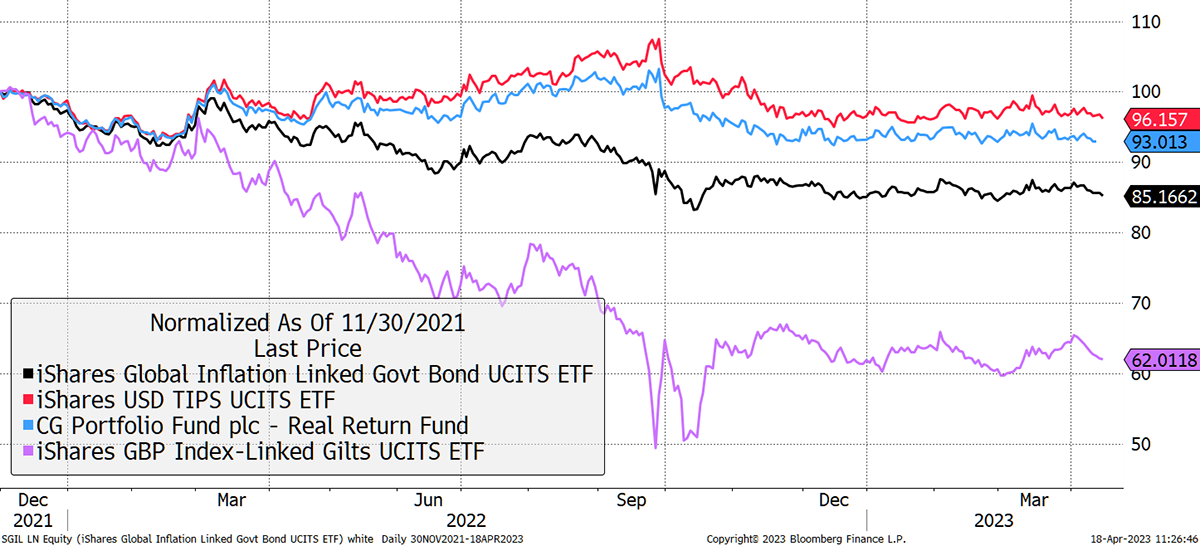

The CG Real Return Fund has not made money since 30 November for a few reasons. It invests in overseas index-linked bonds, mainly US Treasuries, when the pound has gone up. More generally, bonds haven’t done anything recently, with most categories flat or down.

Index-linked Bonds

Source: Bloomberg

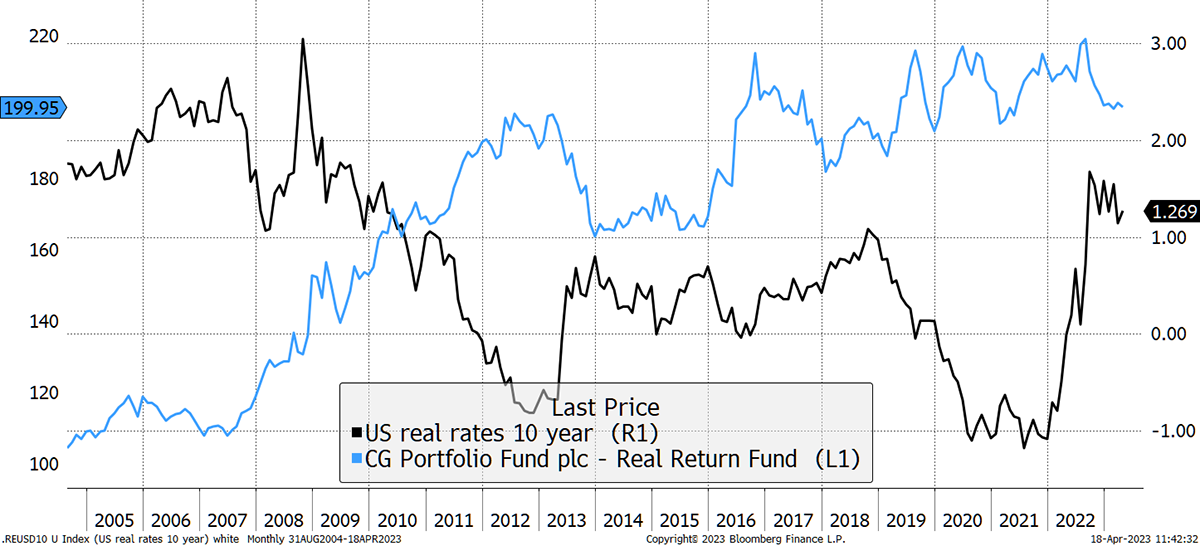

Soda has a modest exposure to TIPS because they now have positive real yields that are government guaranteed. If real yields are 1.2%, that means inflation plus 1.2%. That 1.2% might bore you but look what happens when real interest rates collapse as they did from 2007 to 2012.

Index-linked Bonds Fly When Real Rates Cool

Source: Bloomberg

Real rates cool when the Fed “pivot” and cut rates, which may take some time. Or alternatively, they fall when long-term inflation expectations rise. If the low is in for commodities, which I think it is, then inflation expectations could start rising before the pivot.

There are no boring or dull trades in the portfolios. Everything has a purpose, even the Yen. In fact, especially the yen! I would gladly hold BOLD, but I believe index-linked bonds also have their place.

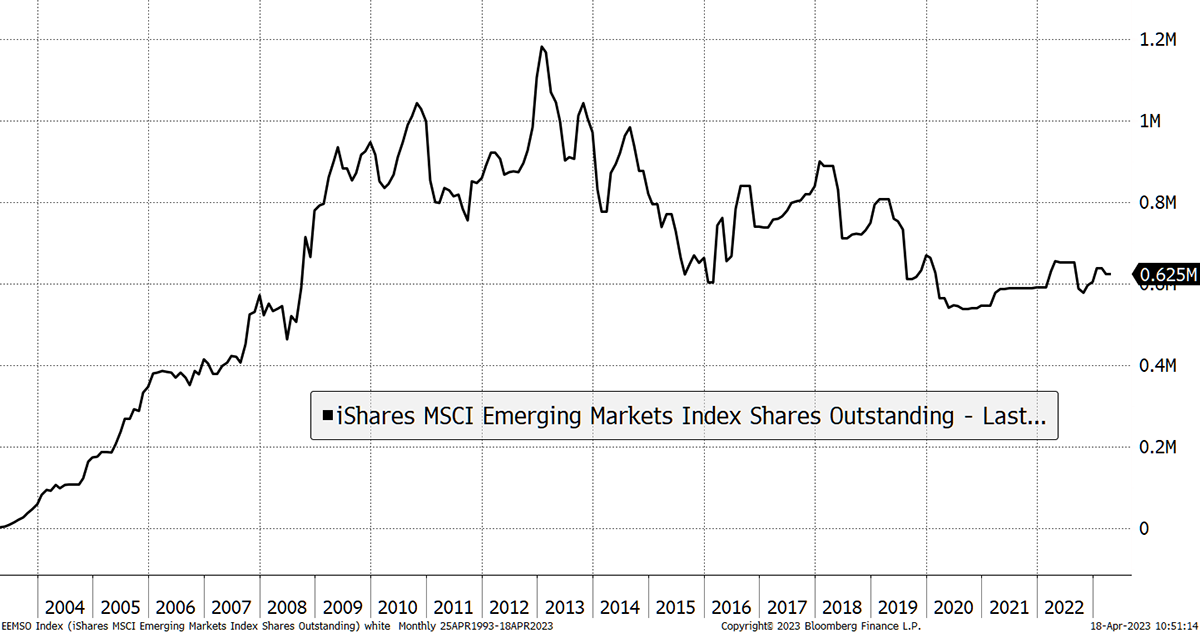

Jim Rickards is bearish on emerging markets. Do you think he is right? How does this fit in with our iShares EM Dividend?

He’s saying that rates will stay higher for longer. Historically that has indeed hurt emerging markets (EM), but these days emerging markets are undervalued, so things will behave differently than in the past. For example, EM was resilient in the 2000 to 2003 bear market when US equities halved. Why? Because EM was cheap and under-owned by investors.

Rickards mentioned the EEM, the $25 billion US-listed iShares EM ETF. Look at the flows over the past decade. Investors have stayed away.

Allocations to EM are Low

Source Bloomberg

Over the same period, the iShares US ETF (IVV) grew to $309 billion. That is 13x in terms of assets, and 4x in terms of fund inflows.

As for SEDY, and SEMB, I believe we have quite low exposure to EM equities given the more attractive longer-term outlook. Whether Rickards is right or wrong is the most important consideration. Our EM exposure is already modest, but I hope it will one day be much higher. Just need the stars to align.

Thank you for the notes and link to the presentations at the Denver Gold Forum.

My pleasure. If you missed my piece from last Friday, you can catch up on the seven keynote speeches here.

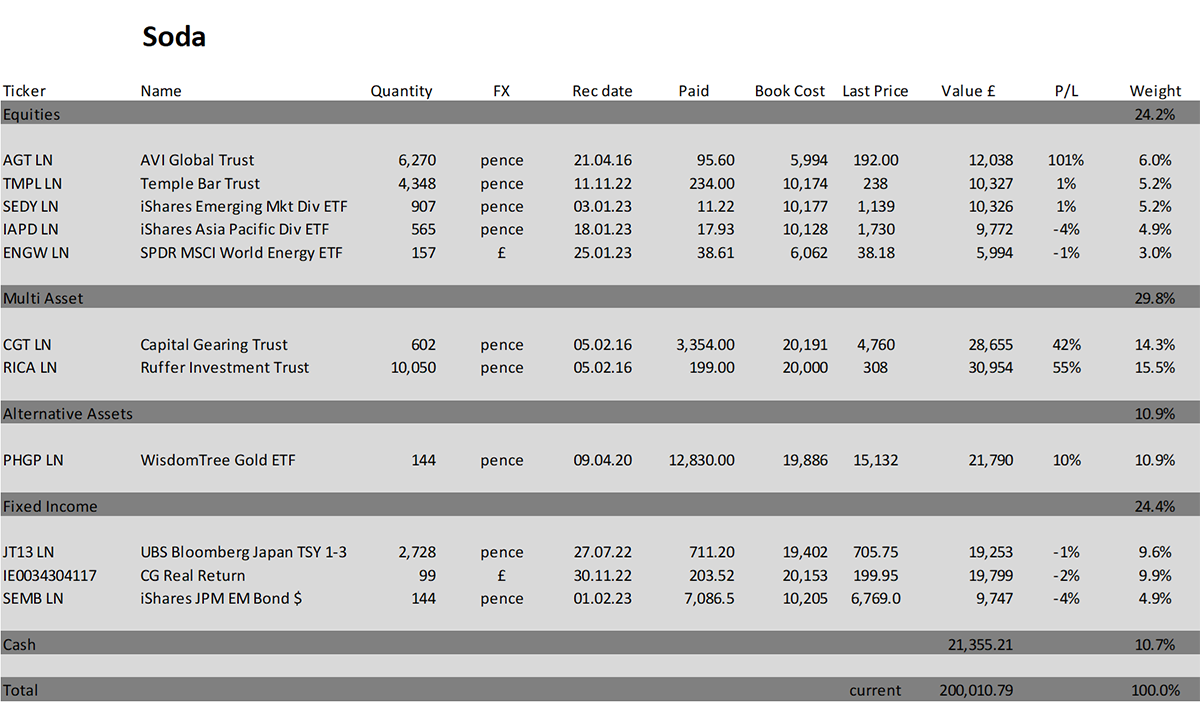

Portfolios

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

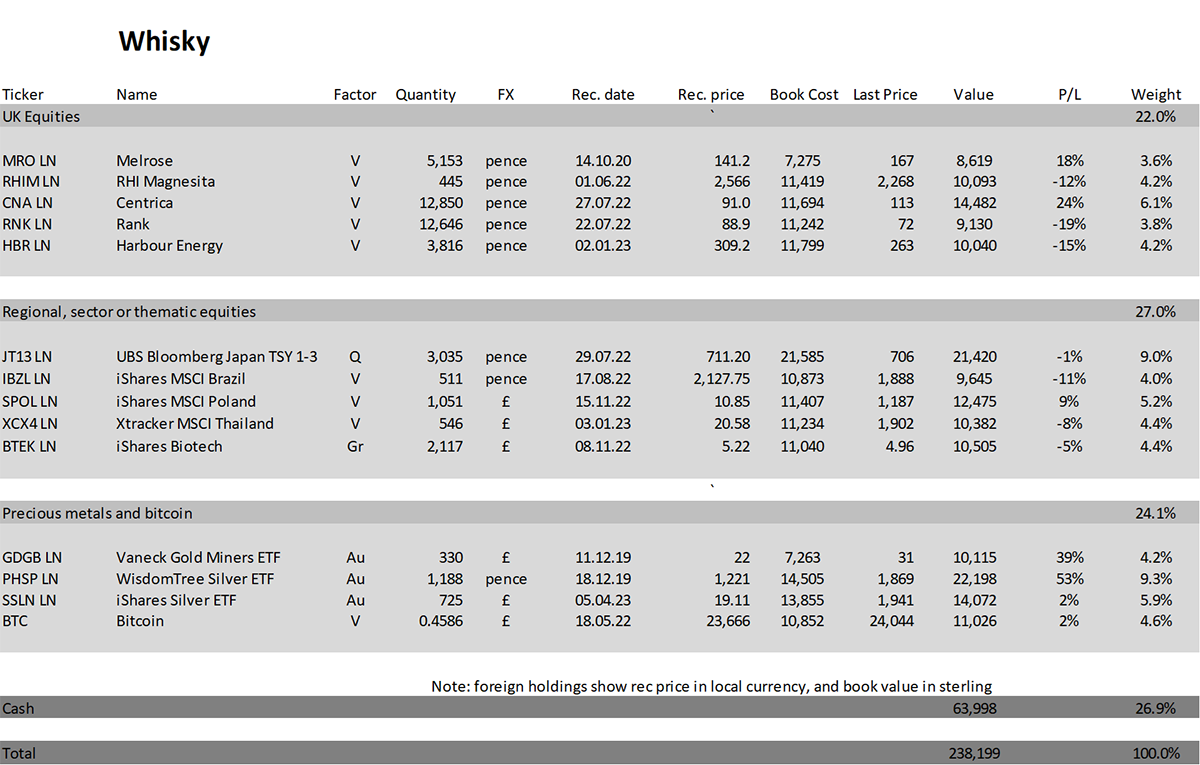

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 0.1% this year and is up 100.0% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.6% this year and up 138.1% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

I am conscious that the Soda Portfolio has lagged the market this year while Whisky has matched the FTSE 100. Soda has lagged by not owning global large cap equities. Both portfolios have materially less risk than the market and I hope you understand my reasons for keeping things that way. We are comfortably ahead of the market over the long term, and to keep it that way, we must only ever do the right thing.

The next big opportunity will most likely be avoiding the storm and buying the dip. But since the banking crisis didn’t seem to have much impact, we must equally be aware of the continued government stimulus and money printing. That can come from anywhere, not just the developed world.

By embracing commodities, we open up new opportunities. Soda will keep it broad and diversified. Whisky will embrace individual commodities as and when they look attractive.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd