It was a privilege to attend the 2023 Denver Gold Forum Europe in Zurich earlier this week with a keynote speech. Due to the pandemic, it was the first time we had been able to meet since 2019, and with the price of gold back above $2,000, there were high spirits in the room.

Some of the keynotes were given by social media gold and macro gurus such as Ronnie Stoeferle, Alf Peccatiello, Lawrence Lepard and Brent Johnson. There were two excellent panels and 46 presentations from the participating gold and silver companies. All presentations can be seen on the Denver website’s event schedule, and I’ll give the link at the end. In this note, I will summarize the seven keynote presentations.

It feels rude to discuss my own presentation first, but I was first up, so there it is. I spoke about the merits of holding both bitcoin and gold, and how they were ideally placed to protect investors from inflation.

Bitcoin and Gold are Key to Surviving an Inflationary Environment

Charlie Morris, Founder & CIO, ByteTree

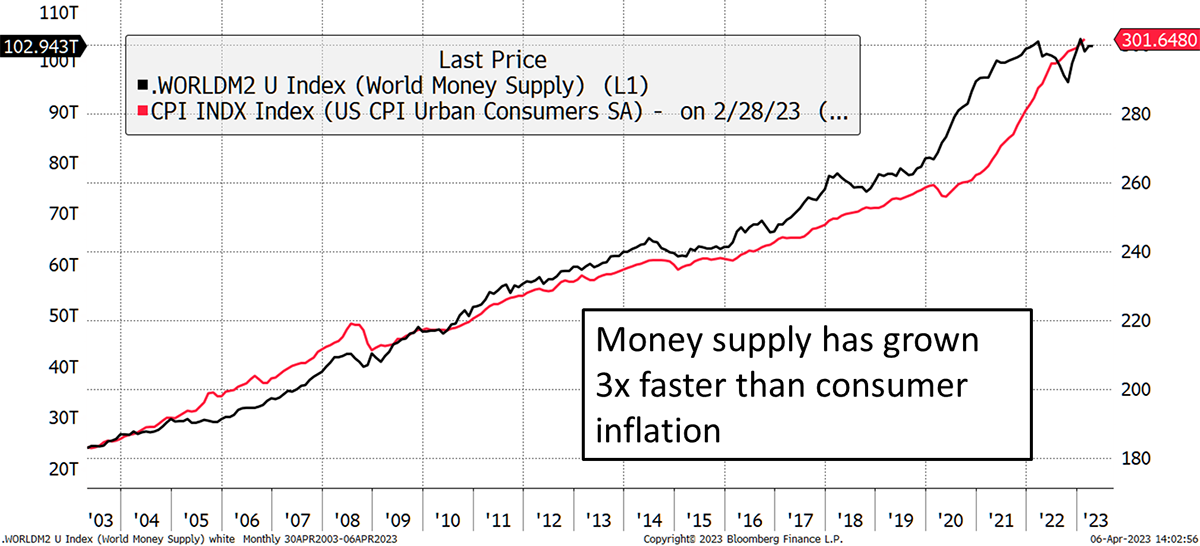

The G20 Money Supply now exceeds $100 trillion, and most of that money has boosted asset prices. Nevertheless, consumer prices have also been rising, especially since the pandemic. The money supply appears to lead consumer prices, which means when the central banks print more money, which they inevitably will, the risk is that consumer prices keep on rising.

The Money Supply and Inflation

Source: Bloomberg

Inflation hedges should be physical and liquid. Commodities are highly liquid, but since they are generally owned via futures contracts, they are not physical. Houses, art, farmland and diamonds are physical but not liquid. The world’s two most liquid physical assets are gold and bitcoin.

Not only do both tend to do better in times of inflation, but they are naturally uncorrelated. That means it is rare that gold and bitcoin do well at the same time. In 2023, both assets have performed well, but that can be explained by a weaker dollar. Look back to late 2020/21, when gold disappointed and bitcoin surged. Or in 2022, when gold was the saviour, while bitcoin collapsed. They tend to do well at different times.

Given there was already plenty of gold expertise in the room, the focus was on bitcoin. It was designed around gold, and 91.9% of the total supply has already been mined. The next halving event takes place in April 2024, and within five years, 96.9% of all bitcoin will have been mined. The next few years will start to feel the squeeze.

On the demand side, the bitcoin network has grown at 80% CAGR since 2015, and Q1 2023 was up on Q4 2022, which provides evidence that the bear market is over. 2023 will likely see $2 trillion change hands over the bitcoin blockchain.

Bitcoin is the perfect fit alongside gold. Ray Dalio, the master of asset allocation, had seen that bitcoin was volatile while gold was calm. Given their low correlation, there was a benefit in combining them together. He said:

“I would take the gold… I would like to sprinkle a little bit of bitcoin into that mix too.”

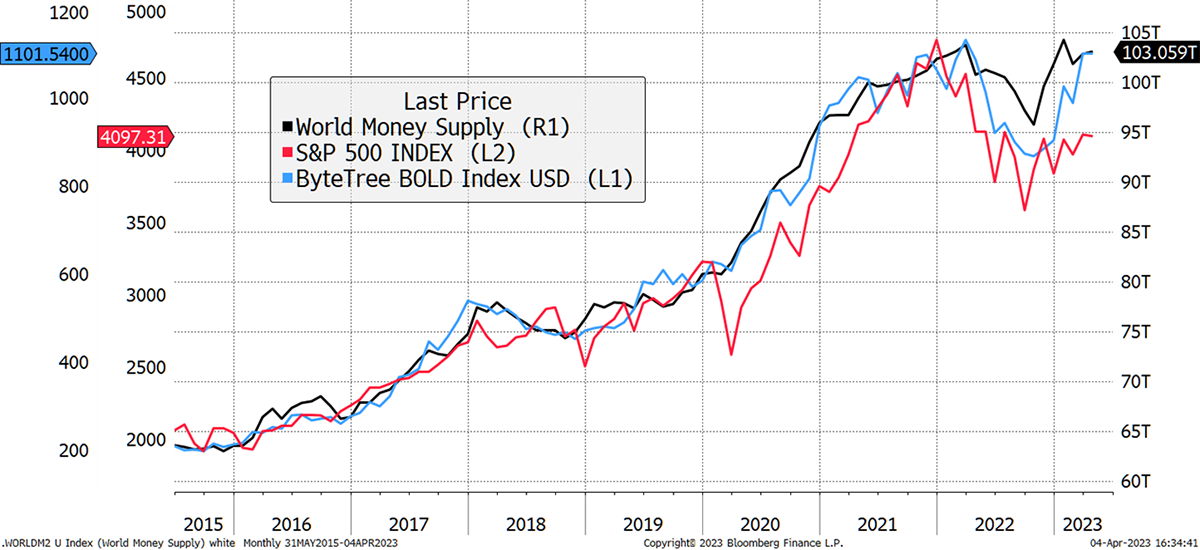

ByteTree has created a Bitcoin and Gold Index, BOLD. It turns out to be the world’s most efficient hedge against monetary inflation, even more so than the S&P 500. Gold has an 88% correlation with the G20 money supply, and bitcoin 85%. Yet put together on a risk-weighted basis, that becomes 99% or 7% better than the S&P 500. Moreover, the S&P seems to have lost its lustre of late.

BOLD Is the World’s Most Efficient Inflation Hedge

Source: Bloomberg

The current weight in the BOLD index is 78.5% in gold, and 21.5% in bitcoin. That allocation comes from a simple process called “inverse volatility”, where there is the same amount of “risk” invested in each asset. Having $78.50 in gold is approximately the same risk as having $21.5 invested in bitcoin. And by rebalancing each month, BOLD delivers a higher return than the sum of the parts. Over the past year, the BOLD Index is 7.3% higher than the return of the two assets in the same proportion. That comes from rebalancing transaction, which in the case of these two assets, is extremely high.

Where Are We On The Gold Price Curve?

Ronnie Stöferle, Managing Director, Partner and Fund Manager, Incrementum AG

Ronnie talked about gold relevance in an age of macro complexities and de-dollarisation. The 2% inflation target used to be a ceiling, but in the next twenty years, it will become a floor. He mentioned the deflationary versus inflationary forces, with the bias shifting towards the latter. He sees easier monetary conditions ahead because there is no alternative.

There is a deep recession on the horizon. The indicators are clear as the yield curve is inverted, and the ISM (manufacturing indicator) has turned down sharply. In addition, geopolitics have turned nasty with declining trade between the major powers.

The answer is to hold gold, and he sees the market shifting to the east. They mine more in the east, consume more, own more, and their governments buy more. The gold market has shifted, and the west needs to wake up.

In the 1980s, gold made up 75% of central banks’ reserves, whereas today, it languishes below 20%. There is plenty of room for increased demand from all investor groups. This compelling presentation clearly argued why everyone should hold gold.

With his 20-strong team, Ronnie and his colleague Mark Valek have been publishing the excellent “In Gold We Trust Report” since 2007. The next issue will be published on 24 May. It is free to read and highly recommended.

Mark Valek also manages the Incrementum Gold and Digital Assets Fund, which combines bitcoin with gold. What an excellent idea that is.

The Art Of Macro Portfolio Construction in a Chaotic World

Alf Peccatiello, CEO, The Macro Compass

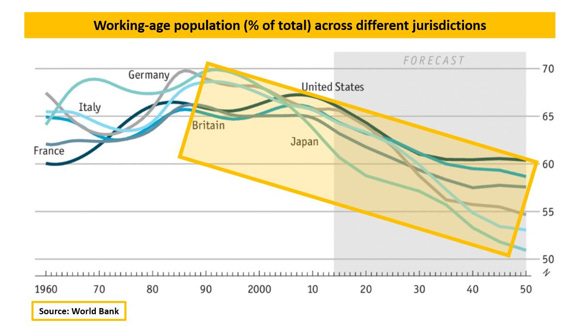

Peccatiello, commonly known as “Macro Alf”, gave a concise summary of the problems we face today. The elephant in the room, which ByteTree’s Robin Griffiths has been talking about since the 1990s, is the demographic timebomb. Alf terrified us with this chart. It is something we are all aware of but choose not to discuss.

To grow the economy, we need more people of working age. Instead, we have an increasing number of retired people being supported by ever fewer workers. That wouldn’t be a problem if we could grow our economies with higher productivity (output per worker) as we have managed to do over the years. Sadly, and despite better electronic gadgets than ever, productivity is falling too.

Alf says that if we can’t grow with fewer workers and less productivity, we still have a third choice, which is to borrow vast amounts of money. The problem here is we have already done that, and the game is up. This explains why we need ever-falling real interest rates because that is the only way to manage the debt burden.

The debt doesn’t just come from the governments, but corporates too. The major economies have seen total debt grow from around 100% of GDP in the 1990s to over 300% today. The result is an ever-more fragile system, which will lead to a Minsky moment. The greater the amount of debt, the lower the real interest rates need to be. For the system to function, we will need ever-lower real interest rates. But there’s a limit, and at some point, it doesn’t work.

Alf sees an era of painful deleveraging ahead, and it’s not pretty for asset prices. He sees the need to rethink the financial system, which will see gold play an increasingly important role.

Gold Miners and Capital Allocation

Sean Fieler, Chief Investment Officer, Equinox Partners

Sean started on a sour note. His career in gold mining investing since 1996 has overseen 0.65% annualized returns in the Gold Bugs Index (HUI) versus 8.97% in the S&P 500. He struggled to find a sector where the long-term returns were worse (other than airlines, which notoriously destroy value). Having grown up in Silicon Valley, he wondered why he had chosen a career in gold mines as opposed to technology.

Why has gold mining been such a bad investment, when the factors were positive? The macro backdrop has been excellent, and the gold price has done well. Gold has appreciated much faster than CPI, so if CPI was an approximation for mining costs, the returns from gold mining would have been substantial.

Yet the costs in the mining industry have broadly followed the gold price, and in aggregate, there has been no free cash flow. When gold goes up, so do costs, and when costs go down, gold goes down. He painted a grim picture of the industry.

He then compared gold mining to copper mining, where returns have been much more respectable. He believed the copper mines have shown better judgement in capital allocation. Interestingly, the value of their output was similar, with gold miners producing $195 billion per year versus $219 billion for copper. In other words, the industries are of similar size.

One major problem is that the life of gold mines tends to be shorter than copper mines. This has led to the gold industry making more rash decisions, while copper has provided relative stability. Furthermore, shorter mine life requires more mines, and so exploration costs in the gold industry have been double that of copper. Finally, although capital expenditure in the copper industry has been higher than gold, it has still led to higher returns.

A problem was that investors often overpaid for gold mining stocks. He said the gold price would need to rise to $3,000 per ounce for many projects to be economically viable. Yet even if that happened, the gold mining industry would find new ways to spend it.

One initiative to increase returns in the sector was to ensure boards had more skin in the game. They launched a site “Directors Without Stock” to name and shame board members that held less than two years’ compensation in the company’s shares. Not a bad idea at all.

The Case for New Gold Production

John Reade, Chief Market Strategist and Head of Research, World Gold Council

John came back with a very different message. Capital discipline aside, he wanted to see more gold mines that complied with the high standards set by the World Gold Council.

Gold is a force for good. It is essential for technology ,and without it, electronic devices would be much bigger and break more frequently. It is also needed in jewellery, savings and central banking. He demonstrated how a modest 5% to 8% allocation improves portfolio returns and why it should be considered a mainstream asset.

A high gold allocation was even more important in portfolios with a high skew towards equities, where its defensive qualities were most welcome. Gold is also highly liquid, trading around $150 billion per day, which is close to the S&P 500.

The gold industry provides a social good, and we should continue to mine despite the pressures from environmental bodies. It brings wealth and jobs to developing countries and does so with best practices. A gold mine is often the catalyst for a new road, water source or power plant, and the industry aspires to become carbon neutral and has readily embraced renewables.

In 2021, WGC members contributed $57 billion to their host economies. 40,000 employees were paid $11.7 billion, and local taxes amounted to $10 billion. Due to the multiplier effect, each job in gold mining supports six more elsewhere. It is a force for good in the developing world.

John also talked about the above ground gold supply, which the WGC states to be 208,874 tonnes, mined since ancient times. The new supply from mining in 2022 was estimated to be 3,612 tonnes. If gold mining ceased, gold would become less liquid and more volatile, perhaps reducing its value. Worse still, gold mining would continue regardless, just without the current high standards. The environmental record would deteriorate rapidly along with safety, which would be devastating for the developing world.

Convincing arguments were made about why gold mining should continue and how it was a force for good.

Gold Stock Selection Techniques

Lawrence Lepard, Managing Partner, Equity Management Associates

Having been involved in the gold mining industry since his 2008 wake-up call, Larry likes gold stocks because they are streams of present and future cashflows. They are also call options on the gold price with long duration. The premium you pay is the cost of keeping the company alive when they are not making money, but crucially they are asset-backed.

Gold works best when there is high uncertainty and high systemic monetary risk, which are the conditions we have today. If gold is up 10%, gold stocks ought to do 30%. There’s a 3x multiplier.

But he then told the harsh truth. As Mark Twain said, “a gold mine is a hole in the ground with a liar standing at the top”. He described the industry as a “shitty” business and how Wall Street was right to stay away. Stock picking was important, but the macro environment much more so. In summary, his message to aspiring gold mining investors was “don’t try this at home”.

The positives were that there was an enormous upside. 100x your money was possible in exploration stocks, either driven by rising gold prices or large discoveries. There’s no fever like gold fever.

His portfolio was diversified across 150 stocks in five buckets:

- Producers: 50%

- Developers: 15%

- Drill Stories: 15%

- Optionality: 8%

- Bitcoin: 12%

The gold is diversified across different risk/reward categories, with an additional allocation to bitcoin. He gave lots of suggestions on the pitfalls of investing in each sector, along with a list of his favourite stocks.

He believes in bitcoin as a monetary asset, but not the rest of crypto. He had gotten to the same conclusion that Ray Dalio, Mark Valek (Incrementum Digital and Physical Gold Fund) and I (BOLD ETF) had come to. That is bitcoin and gold fit neatly together, and we all have funds that do just that.

In all three cases, we have a large allocation to gold and a much smaller allocation to bitcoin. They say great minds think alike, and so I had to capture the three of us on camera.

Bitcoin and Gold Fund Managers

Larry’s main point was that the next phase of this gold bull market will be stunning, and the next gold mania is upon us.

An Inconvenient Truth

Brent Johnson, CEO, Santiago Capital

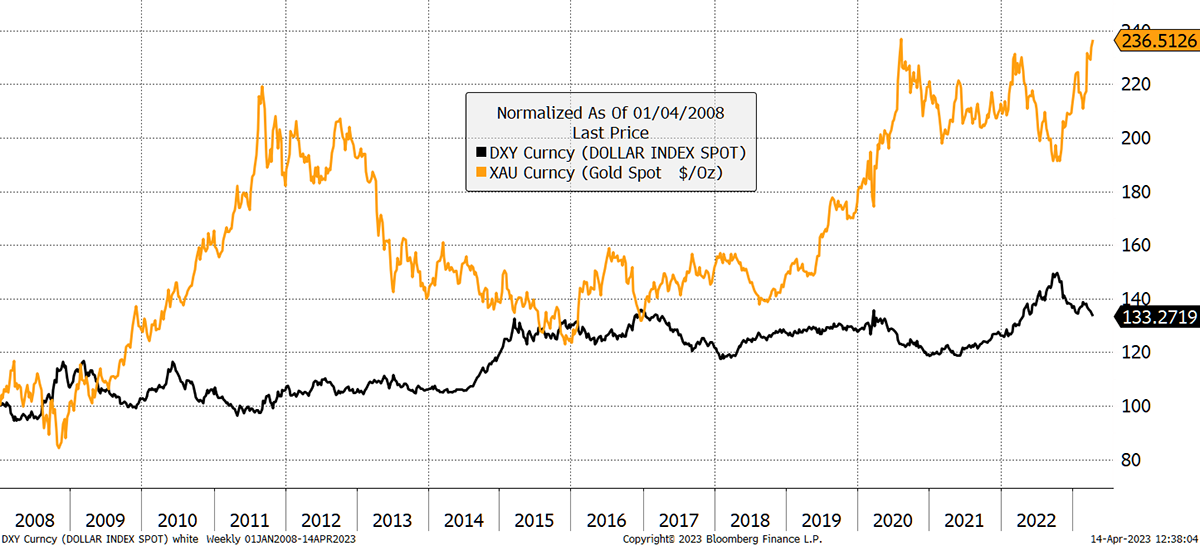

Brent believes there will be a sovereign debt and currency crisis, and the dollar will be the beneficiary. The popular view in gold circles is that the dollar is going to zero, but Brent reminds us how it will go to zero last. Before the dollar dies, the other currencies will have to die first. That makes the dollar the “least dirty shirt”.

This is what he calls his “Dollar Milkshake Theory”. It is not just about the dollar going higher but an accompanying debt crisis. The dollar will be the safe haven when everything else comes under pressure, with only one other asset being even stronger. Gold, he says, will be the ultimate winner.

The theory stacks up and is basically an extrapolation of what has been happening for several years. The financial system has been buoyant when the dollar has fallen and strained when it has risen. The dollar is the dominant currency and the main driver behind financial markets. People remark on how the Fed prints too much money, and that’s true, but so does everyone else.

The US will not give up the global reserve currency because this isn’t about economics but power. When the BRICS are said to be considering pooling their currencies to make a competitor, Brent reminds us that putting together a few low-quality assets doesn’t make a high-quality one. The 2008 crisis taught us this with CDOs.

It is called Milkshake Theory from the Daniel Day-Lewis film, “There Will Be Blood”. An oil explorer doesn’t need to buy the land next door because he can suck out the oil from his side of the fence. The US dollar is sucking the life out of us all. He doesn’t even like his Milkshake Theory and wishes it wasn’t true, but he stands by it because it is logical.

Milkshake like Dollars and Gold

Source: Bloomberg

In my opinion, it makes sense because it simply describes what is already happening and has been for years. When the going gets tough, the dollar has spiked. Perhaps we should be thinking about buying a few dollars in the current dip.

Denver Gold Forum

An excellent and informative conference with some big ideas. There were also 46 talks from the miners and two panels. I was on the first panel on Day 2, with Alf and Ronnie, moderated by John. I then moderated the second panel on Day 3 with Larry, Sean and Brent. You can watch all the presentations here.

It is a very exciting time for gold investors. The world has rarely been so confusing, and it is strange how many investors seem to be lightly positioned. No doubt they’ll wake up before too long. You can read my recent Atlas Pulse gold note here.

Many thanks to Tim Wood from Denver Gold Forum and his team for an excellent conference.

Join the ByteTree Mailing List

Charlie Morris is one of the world’s most highly regarded gold analysts and has been writing the Atlas Pulse Gold Report since 2012. Charlie’s gold valuation model, which is published through ByteTree, has served as a consistent reference point for investors ever since.

If you would like to receive our free research, please register below.