Gold's Big Breakout - US$2,000 and Beyond

Disclaimer: Your capital is at risk. This is not investment advice.

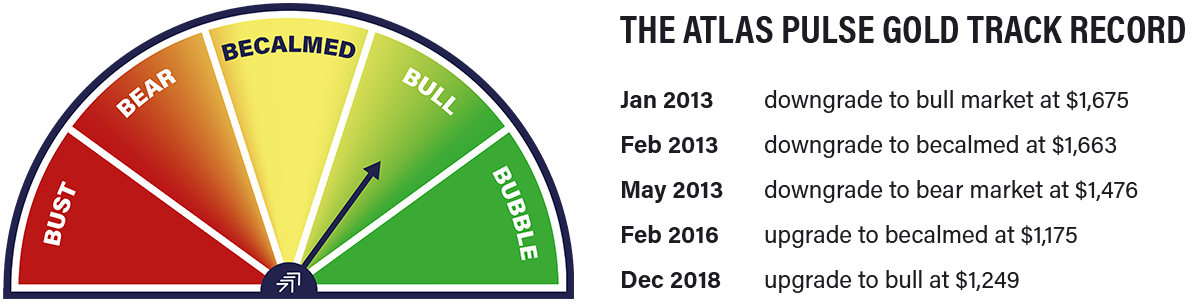

Atlas Pulse Gold Report; Issue 81

Last month, I wrote how the last time government bond yields rose above 4%, it brought down the UK government. It happened again, and five banks, including the almighty Credit Suisse, failed. As a result, an old driver of the gold price has re-emerged, which is Sovereign risk. Get used to a sustained gold price above $2,000 and beyond.

Highlights

| Macro | Sovereign Risk |

| Inflation | Goldilocks Is Just a Fairytale |

| Melt up | $8,000 Supersedes My $7,000 Price Target |

| The Charts | The Great $2,000 Breakout |

| Own | The World’s Most Efficient Inflation Hedge |

Sovereign risk

Five banks have failed since the last issue of Atlas Pulse. Some say it was just a blip, but when you raise interest rates in a highly leveraged system, at the fastest pace in history, something was going to blow. The solution, as always, is more money printing. Apparently, it wasn’t quantitative easing, but in any event, billions of dollars appeared out of thin air. Most of us would call that printing.

Gold is strong because money printing and sovereign risk are in a bull market. Sovereign risk has risen because we now assume there is no alternative but for the US government to stand behind all deposits.

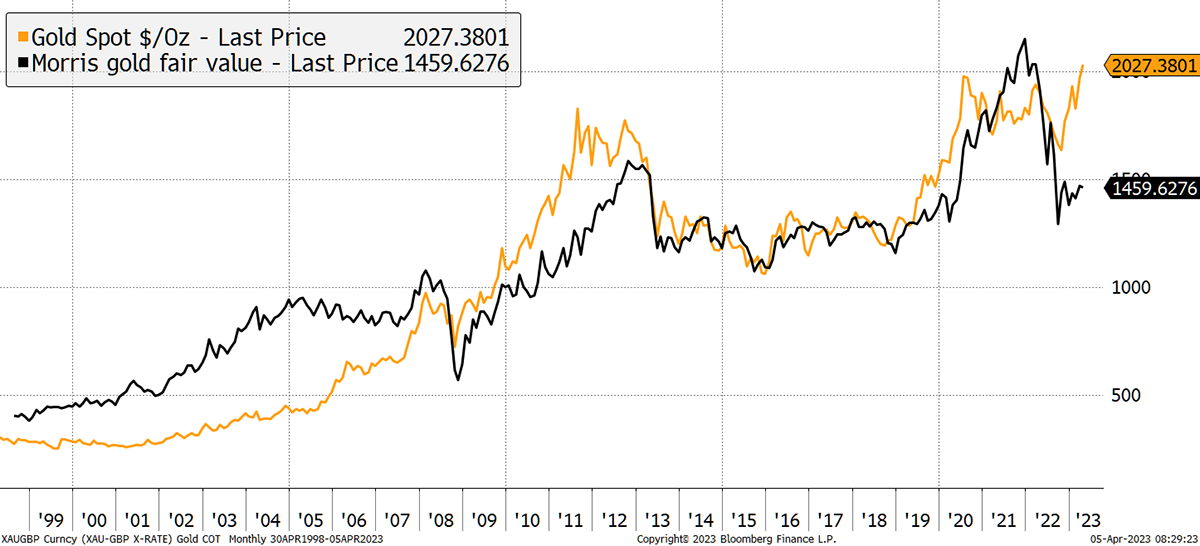

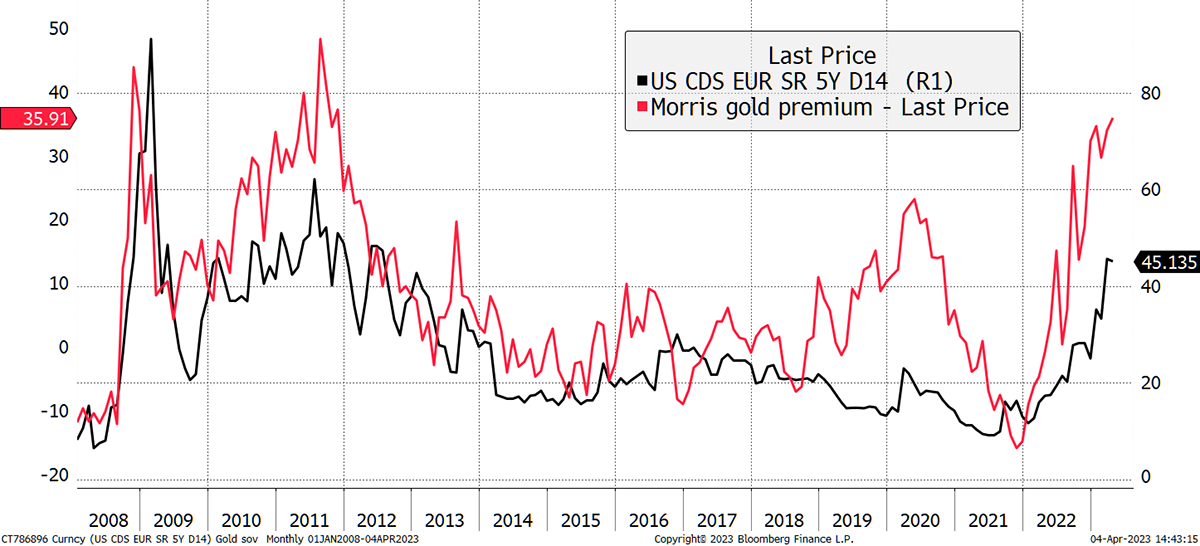

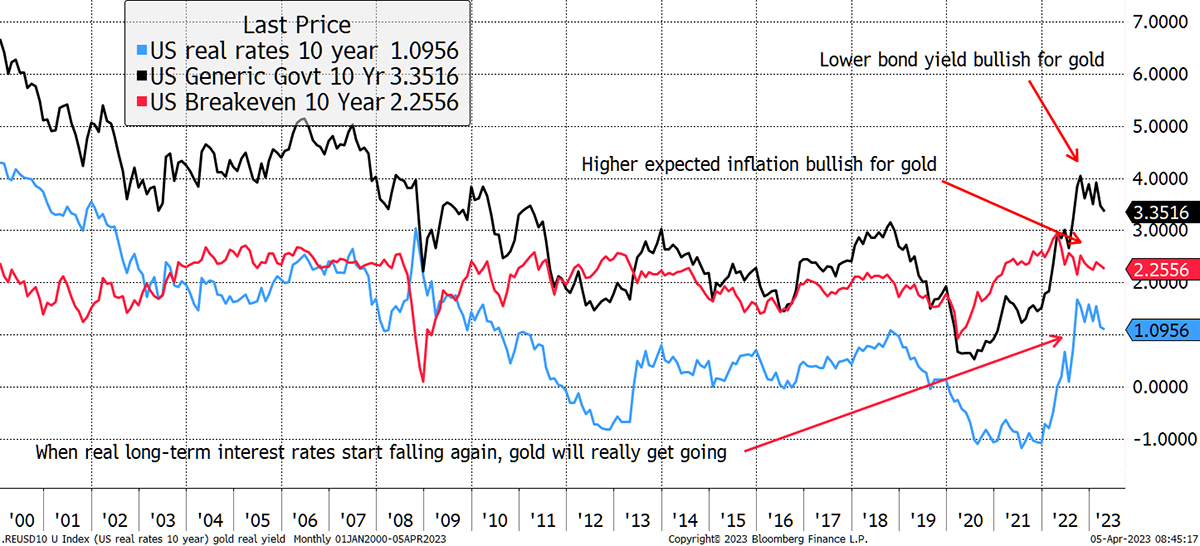

As I have been highlighting for over a decade, during normal times, gold trades in sync with TIPS, but today gold trades 32% higher. In recent issues, I have been questioning this premium, and it is finally starting to make sense.

Regime Change

A gold premium is either telling us that gold is overvalued or that the world has changed. I believe the latter for these reasons:

- For many countries, US treasuries are no longer suitable reserve assets because they have been weaponized following the war in Ukraine. Instead, they choose to buy gold. For example, China is accumulating gold reserves at pace.

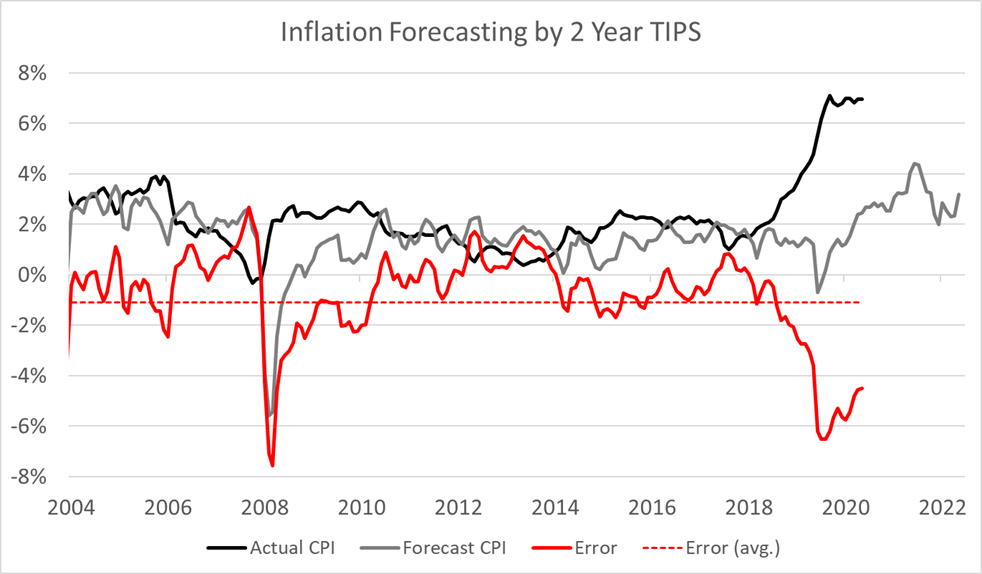

- TIPS are understating long-term inflation because there is low demand (see 1). In addition, it turns out they have generally understated inflation. Since 2004, two-year expected inflation has lagged 2-year actual inflation by an average of 1.1% per annum. Besides, gold smells future inflation like nothing else.

- The gold premium is being driven by an increase in sovereign risk. We saw this in 2008 (credit crisis), 2011 (Euro Sovereign Debt Crisis) and to a lesser extent in 2020 (lockdown crash). This is a result of a de facto central bank underwriting of all bank deposits.

Sovereign Risk Fires up the Gold Price

- The market now assumes interest rates will crash back down to where they came from. That is hopeful because inflation isn’t as dead as they’d like it to be. The world has changed, and excess stimulus will see it rocket again. Inflation is only resting.

The Interest Rate Framework

- Last year we felt the pain associated with a strong dollar. This year we get the relief. That has boosted gold in USD and in other currencies too, albeit to a lesser extent.

A Weak Dollar Floats All Boats

The recent bank bailout 2.0 reminded us all how easy it is for the powers that be to create more money at the touch of a button. The economy is thought to be at risk of recession, and the general view is that more things will blow up. Inflation may be cooling in the short term due to “base effects”, but don’t let that fool you. The world is more fragile these days, and things will change quickly.

Goldilocks Is Just a Fairytale

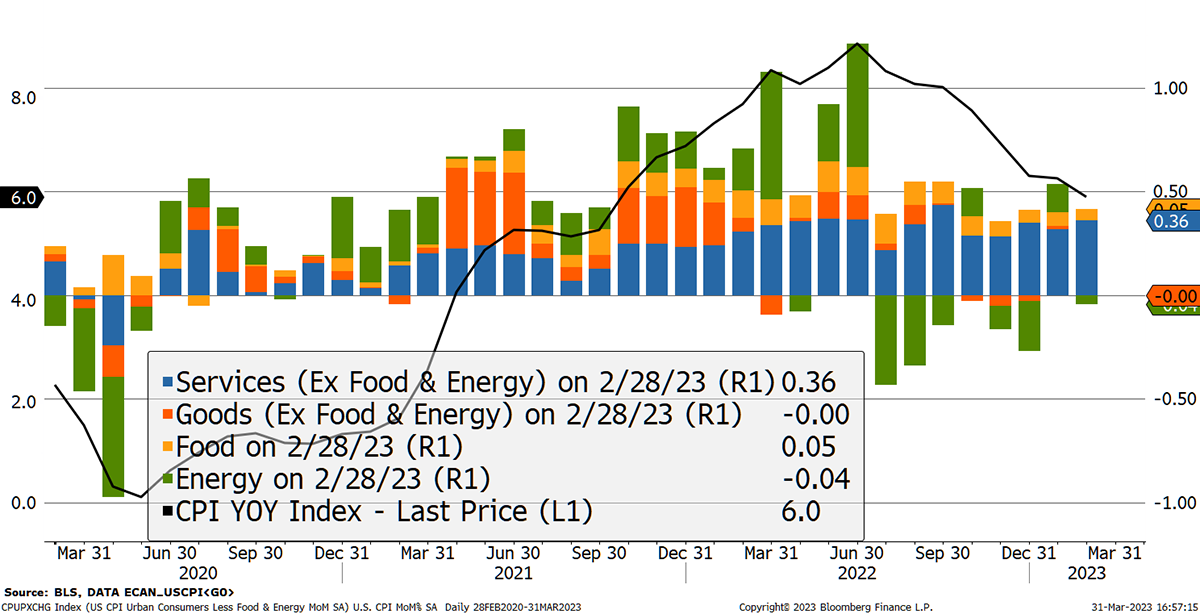

By convention, inflation is measured year over year using 12 monthly readings. If the monthly price of goods and services a year ago was abnormally high, that keeps the annual numbers elevated until those months fall out of the calculation. This is what is meant by the base effect.

The period from March 2022 to June 2022, which captured the shock from the war in Ukraine, was unusually high. That four-month period saw an annualized inflation rate of 11%, but over the next four months, these outliers will fall out of the annual number. Whatever happens, inflation will cool because a price shock from a year ago will soon leave the calculation.

Base Effects See Inflation Cool

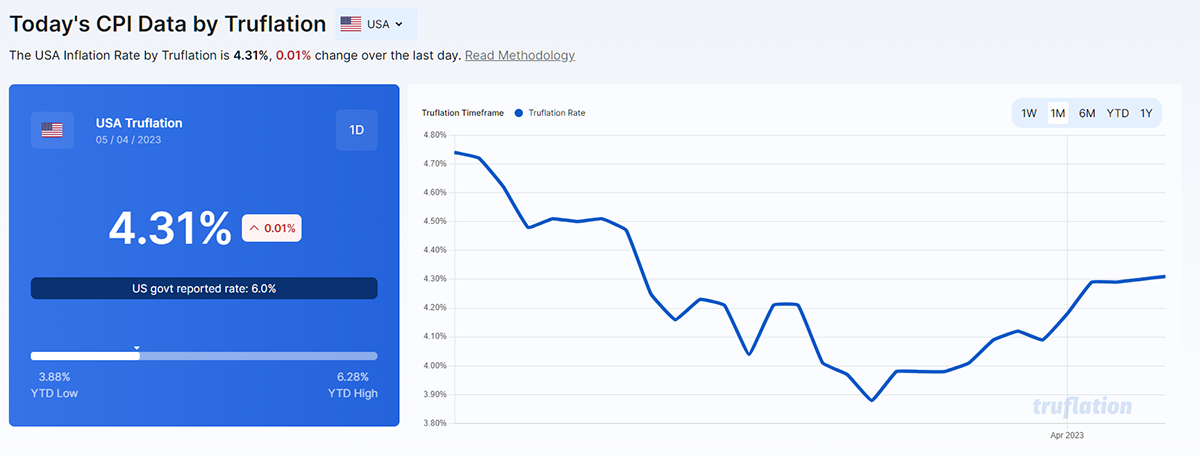

The annualized rate of inflation since July 2022 has been a more modest 3.6%. That ties in with Truflation, which scrapes daily prices off the internet in a mass sampling exercise. (Not before time, the costly PriceStats from State Street has a free rival). Truflation sees US inflation at a rate of 4.3%, which is back on the rise.

Ruffer, the UK’s leading large active investment manager, which cleaned up on bitcoin in 2020, talks about inflation volatility, which is not the same thing as inflation. In their eyes, inflation is the inevitable end game, but first, we must endure a system that swings between hot and cold. It’ll be tough, but their advice is to ditch the 60/40 and embrace active management.

Henry Maxey, Chief Investment Officer, wrote in the excellent Ruffer Review:

“Unfortunately, political authority is weak in the West, consensus on what the fair distributions of financial outcomes and welfare should be is frayed, and the ideological divide between China and the US is growing. Policymakers will be forced back into monetary financing mode very quickly if threatened by recession and distress… these are fertile conditions for inflation to get rooted in.”

It is time to ditch the 60/40 equity/bond portfolio, which failed miserably in the 1970s, and do things differently. The 60/40 works well in what is often called the “Goldilocks Scenario”, where inflation is neither too hot nor too cold. There is precisely zero chance of Goldilocks returning anytime soon. The porridge will swing from too hot to too cold on a regular basis. Besides, it’s just a fairytale.

I concur with Ruffer’s thinking. I also write The Multi-Asset Investor at ByteTree. The Ruffer Investment Company has been one of my holdings over the past seven years, which has appreciated by 58%, including dividends. I like them, but wish they could keep up, because the rest of my portfolio is up 99%, with lower volatility.

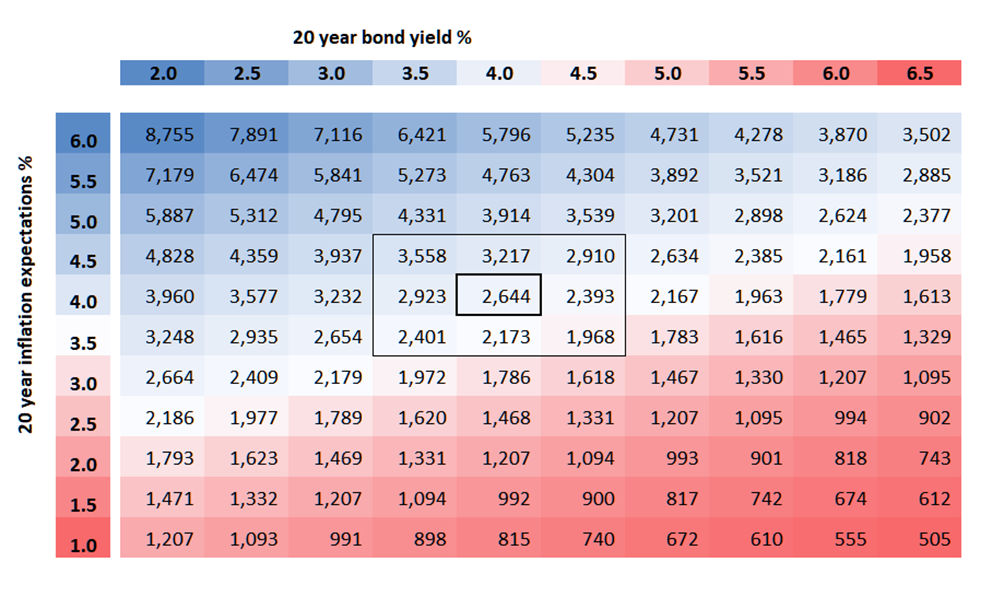

4% Bond Yields and 4% Inflation Would Boost Gold

Going back to the gold-TIPS comparison, 4% inflation over the long term gets us into the middle of the box below. As soon as you start talking 4% inflation or higher, with similar bond yields, there are no scenarios below $2,000 gold. That is in the absence of the likes of Paul Volcker, but they don’t make central bankers like that anymore.

Imagine if bond yields were lower. Whoosh.

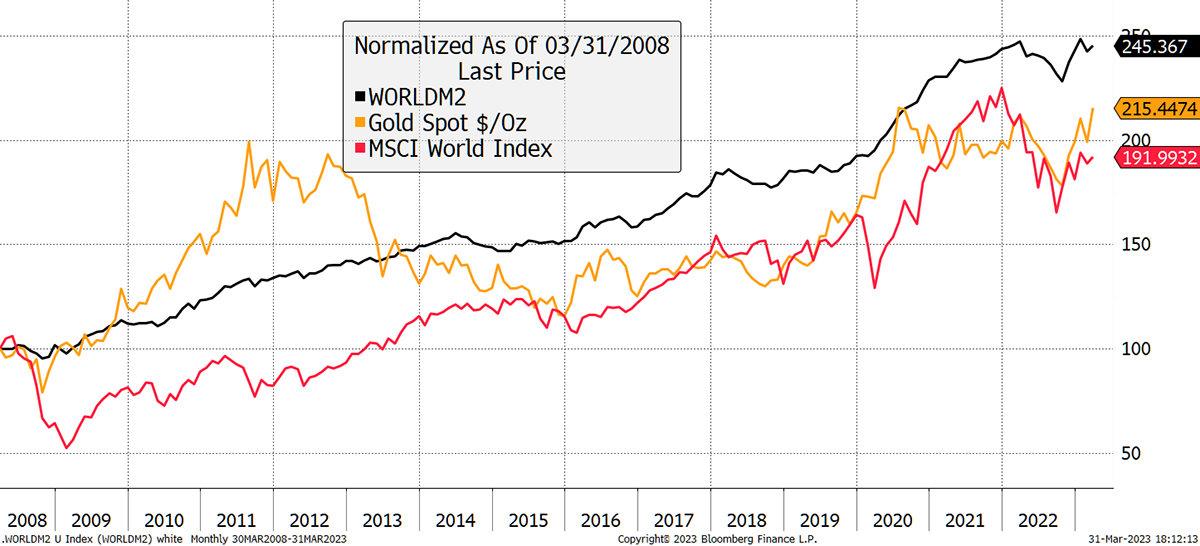

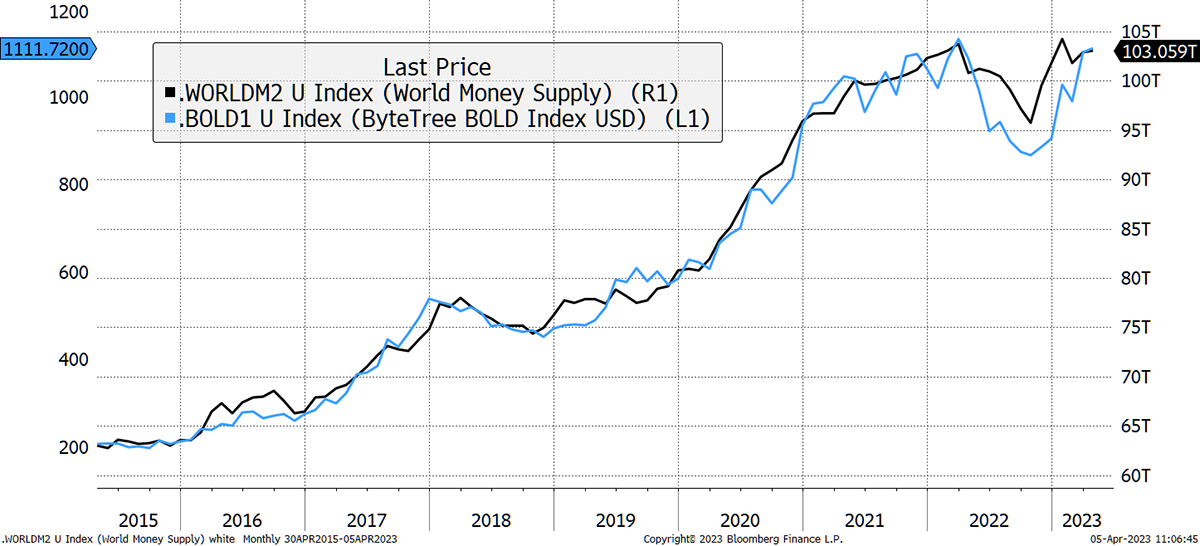

It is not so much if or when we see 4% inflation, as it’s already here. It is more a question of the long-term average we can look forward to and when financial markets recognize that. Furthermore, you can be confident that any recession will be short-lived because, as Maxey says, they will keep on printing money. I show the world’s money supply against gold and the stockmarket. The link is clear, with gold back in front of stocks.

A Bull Market in Money Supply

Despite the Federal Reserve’s attempts to tighten financial conditions, the world money supply has risen from $95.8 trillion to $102.9 trillion, or 7%, since October. Most of that came from China, Europe and Japan. It’s funny how no one seems to be in charge anymore.

$8,000 Supersedes My $7,000 Price Target

Three years ago, I wrote “The Rational Case for $7,000 gold by 2030”. I have seven years left, and it’s looking up.

Fellow gold analyst from Gainsville Coins, Jan Nieuwenhuijs, has “bigger dicked” me. For those who didn’t know, bigger dicking is an Australian verb. I was once in a meeting when an Australian told someone in the room, “Now mate, don’t bigger dick me on this, but...”, I feel deflated because $7,000 felt so out there, and I have been gazumped.

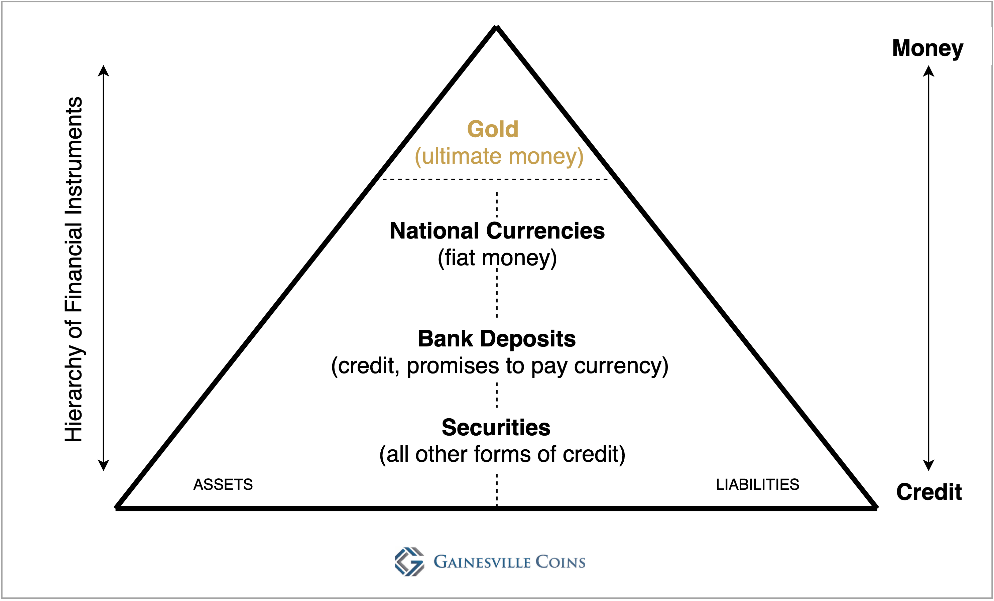

In his piece The Hierarchy of Money and the Case for $8,000 Gold, Nieuwenhuijs has looked back at decades past. After severing the gold standard in 1971, there was a massive increase in the supply of fiat money, credit, and securities. As a result, the pyramid is out of shape with a tiny tip and a fat debt belly. Global debt to GDP is near its all-time high established in 2020, and a reset needs to happen.

Nieuwenhuijs writes:

“In the old days, coins were debased by lowering their bullion content, resulting in more units of national currency. Since the gold standard was abandoned in 1971, fiat money can be created by the stroke of a key, aimed at boosting growth, or revitalizing the base of the pyramid. But the top inevitably follows. The price of gold has to go up to reset the shape of the pyramid. Now—given war, inflation, and systemic risk—will be one of those moments for the gold price to adjust.”

I congratulate Jan for his brave new $8,000 price target. Somehow, I sense we will both be BD’ed before too long.

The Great $2,000 Breakout

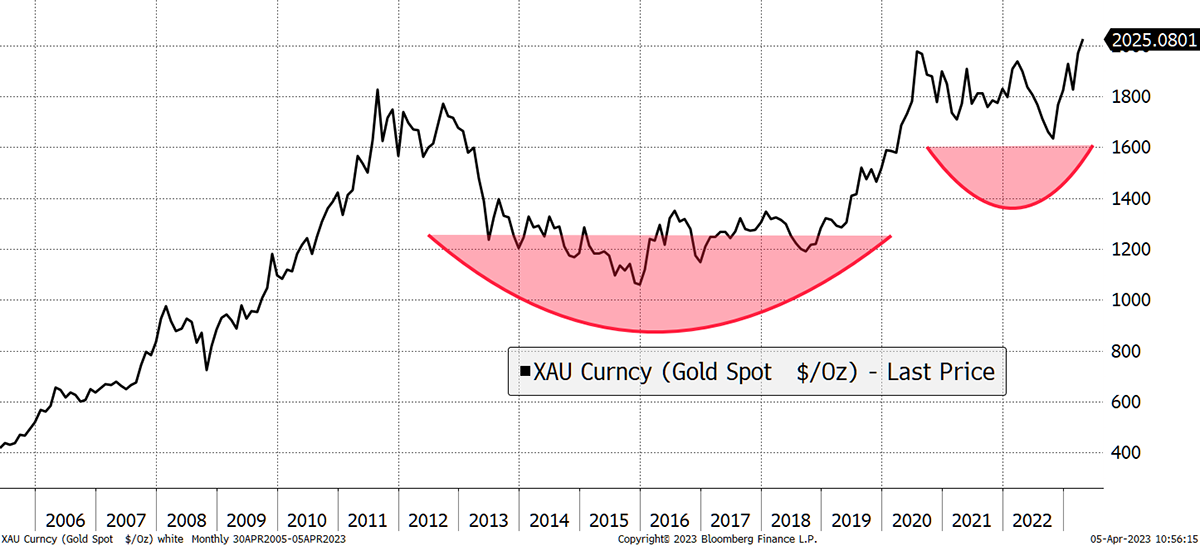

The technical setup is wonderful and obvious to the eye. Gold is at an all-time high in all currencies, bar the likes of Singapore, Switzerland and the USA (at least for a few more days). For the others, gold trades in resistance-free “fresh air”.

All-Time Highs

The longer-term setup is a “cup with a handle pattern”, which is 12 years in the making. It’s as bullish as it gets.

Cup and Handle

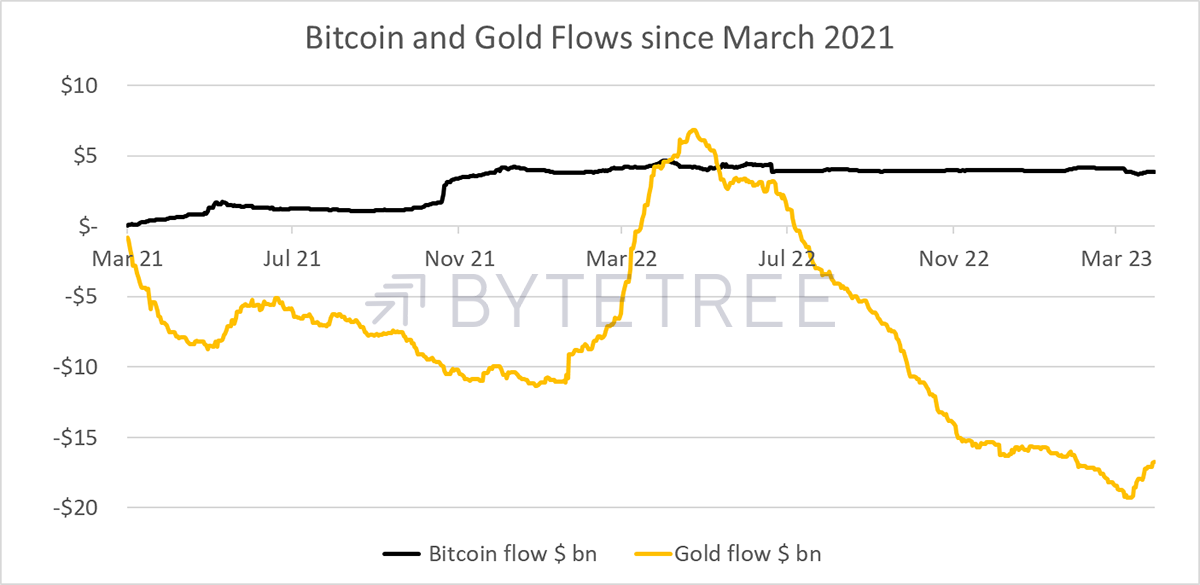

Investors Are Finally Buying Gold (and Bitcoin)

Remarkably, investors are just waking up. The past two years have seen huge outflows from gold, but finally, they are coming back. Surprisingly, bitcoin never had outflows in any meaningful size in comparison to gold, which saw $20 billion of redemptions. That tells me there was never much institutional money in there in the first place. Both bitcoin and gold will justifiably see increased inflows over the coming months.

Returning to the world money supply chart, it never quite fitted gold as well as it might. Gold is a “risk-off” asset, so it is easy to understand why it doesn’t match the money supply during the good times. The S&P 500, which has been a better fit, has been an efficient hedge against monetary inflation, but that won’t last because it is a bubble, and earnings will turn down.

The world’s most efficient hedge against monetary inflation would need to blend two assets, one risk-on and the other risk-off, in the correct size so as to balance risk. Voila. That is why ByteTree created BOLD, which blends bitcoin and gold on a risk-weighted basis.

The World’s Most Efficient Inflation Hedge

See the 21Shares BOLD ETF.

Summary

If all bank deposits are underpinned by the state, then the risk shifts to the state. To the rational investor, that makes alternatives to the state ever more attractive.

In all the years I have been writing Atlas Pulse, I have seldom been more bullish. This is gold’s time.

Join Our Mailing List

Charlie Morris is one of the world’s most highly regarded gold analysts and has been writing the Atlas Pulse Gold Report since 2012. Charlie’s gold valuation model, which is published through ByteTree, has served as a consistent reference point for investors ever since.

We have made Atlas Pulse free to readers, so they can sample the quality of our work. If you would like to receive our free research, please register below.

Comments ()