Risk, Recessions and Melrose

This week, I discuss risk management and update you on developments on Melrose. Economic and market indicators are telling us that a recession is getting closer, which inevitably leads to a decline in earnings and a tough environment for stockmarkets. In this issue, I look at the latest warning signs and stress test our portfolios, which are much less risky than the market. The strategy this year isn’t to make you rich but to keep you safe.

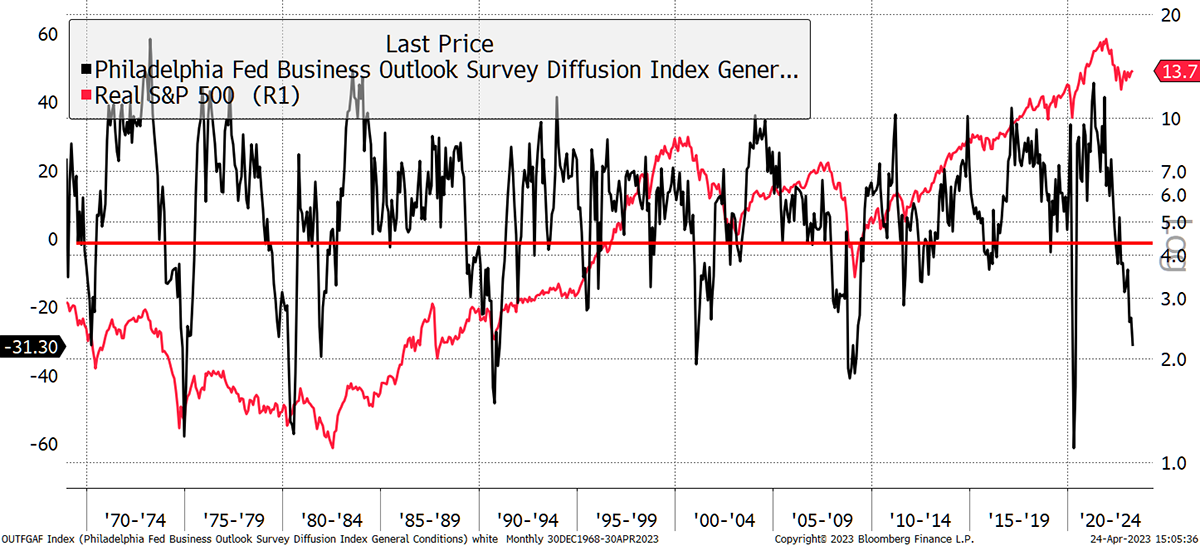

Whether you look at the likes of the Institute of Supply Manufacturing (ISM) or the Philadelphia Fed Business Outlook Survey (Philly Fed), you get the same picture. The Philly Fed has fallen to -31.3, which is in the lowest decile in 50 years. Below zero implies contraction, and the message from business is that things are getting tough. If it’s not already here, a downturn is coming.

A Recession Is Inevitable

Source: Bloomberg

When The Philly Fed is weak, stocks have tended to be weak. I used a Real S&P 500 Index (after inflation) AND a log scale to try and flatten the stockmarket for visual comparison over 53 years.

Another Historical First in the Bond Market

The recent hikes in interest rate rises have not been matched by the banks. This has caused savers to withdraw funds from the banks and buy money market funds. A typical money market fund buys bonds that redeem in 26 days (or so I am told). That has led to a never-before-seen situation in bond markets. There’s a scramble for “short-dated paper”.

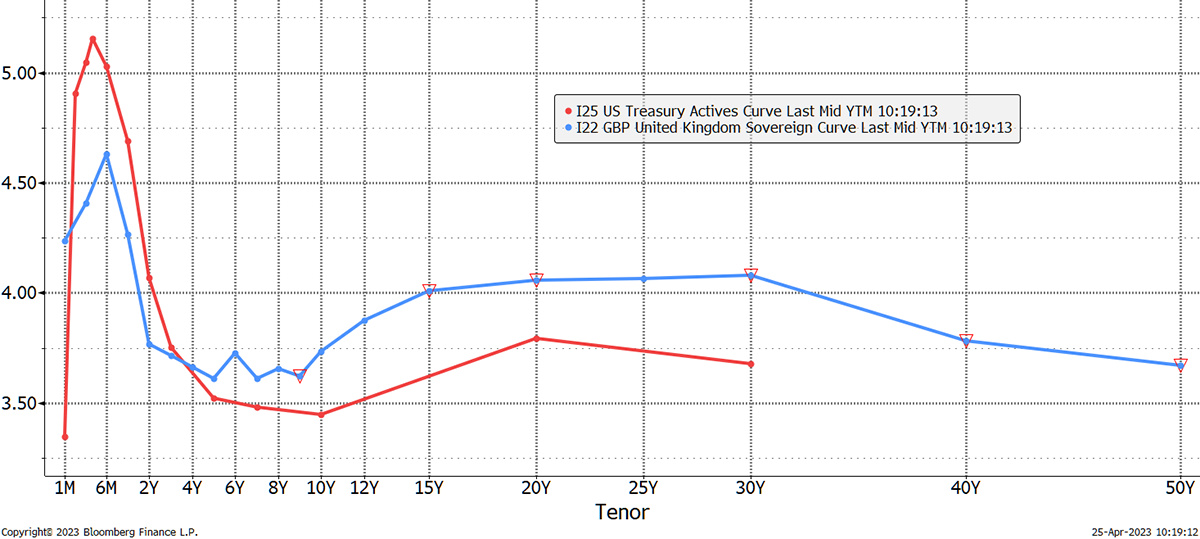

The yield curve shows you how much yield you get from the US government (red) or the UK gov (blue) for different bond maturities. Between 4 to 6 months pays much more than any other time frame. Not just a bit more, but loads more. Recall that interest rates are 5% in the US and 4.25% here.

The Yield Curve

Source: Bloomberg

Some market watchers claim all is well because it can be explained away by a scramble to money market funds and probably some concerns over the debt ceiling. As normal, US politics holds a gun to the heads of global financial markets as politicians squabble over spending plans.

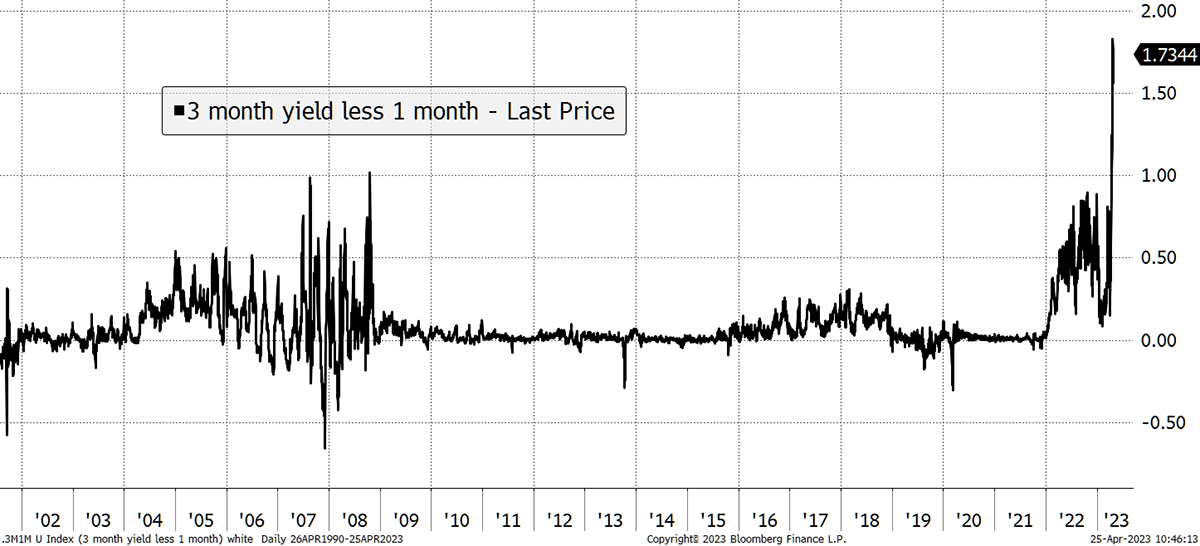

But underlying this is the bleeding obvious, which is that markets are not functioning normally. The UK yield curve makes more sense than the US, which is unparalleled in history. Currently, you get 1.7% more in 3-month bonds than in 1-month bonds. Even during the mayhem of the credit crisis, spreads were never this wide.

Another Historical First

Source: Bloomberg

If markets were working, sophisticated investors would borrow 1-month bonds and buy 3-month bonds. They would if they could, but presumably, they can’t; otherwise the situation would be arbitraged away. This tells us that market liquidity is being stressed.

Portfolio Risk

Recessions are inevitable. That is obvious, but what we want to know is when, why and how bad will it be? As you know, my belief is not to sell up because cash is hardly the best option either. For starters, which currency? Get that wrong, and you’d better off being fully invested. But being fully invested doesn’t have to be risky.

I wanted to go over where we are in the portfolios and show you a couple of metrics that I find helpful.

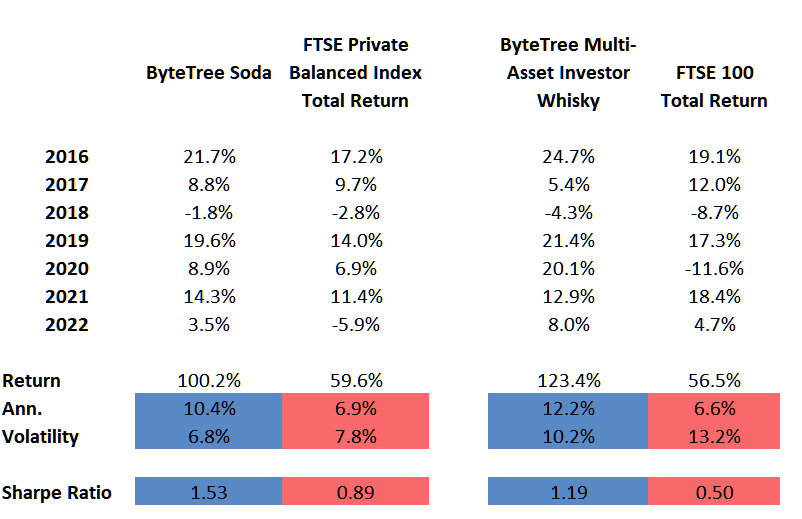

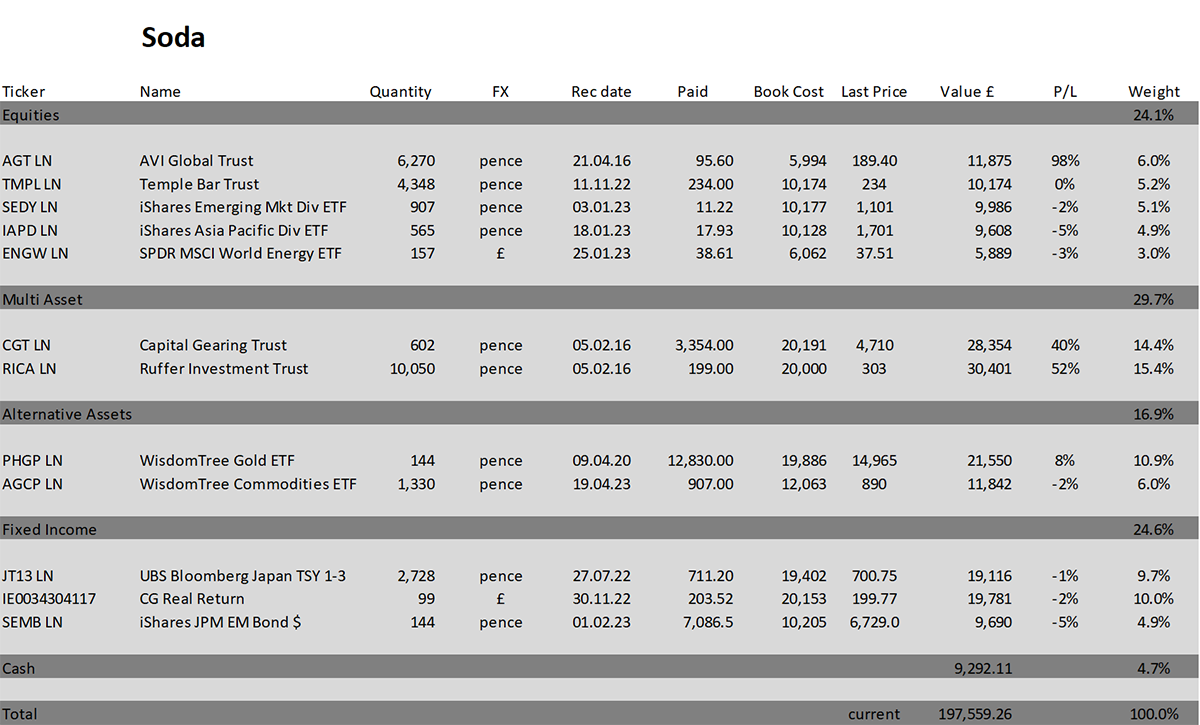

Soda

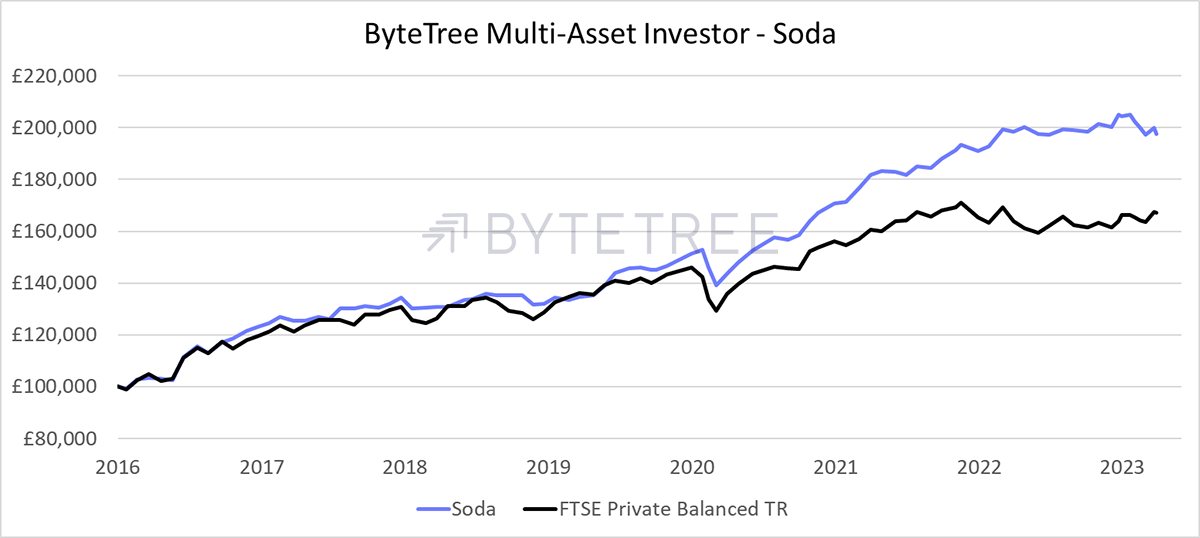

Since 2016, Soda is ahead of the FTSE Private Balanced Index, as shown, with volatility of 6.7% compared to 7.5% for the index.

Source: Bloomberg; ByteTree. 1/2/2016 to 24/4/2023.

The main reasons for Soda’s higher returns with less risk have been from avoiding bubbles and crashes over the years. I was right to be wary of bonds, and the simple piece of information was low bond yields. I also avoided the various stock bubbles that have cropped up from time to time, and despite having a few rough trades, have stayed out of trouble. It is not an exciting story, but one that works over time.

Something less noticed is that I try not to worry about a few things that are going wrong, provided the exposure is modest and the reasons for owning it haven’t changed. Diversification is a beauty in that sense.

The fixed income part is currently quite interesting because it is so different. Soda holds no gilts or treasuries. Instead, emerging market bonds yielding 6.3% spread across 50+ nations, some of which have better credit than the developed world (Qatar etc.). This position is underwater, in part because it is a dollar trade. I am more likely to add than sell, although I would consider local currency bonds as well. The yen is the safe haven that should do well in a downturn, and inflation-linked bonds will surge when real rates fall again. That seems inevitable at some point.

Equities are simple, and Soda is underweight. The market index holds 60%; we are half that when you include the equity held within the multi-asset funds. The funds, along with gold, can look after themselves.

I am aware that recent performance has seen Soda stall while the market has been slightly stronger (+3% YTD). That is mainly down to a strong pound and a light position in equities. If market conditions deteriorated, that would reverse rapidly, and the market would be much worse off. Soda is in good shape and quite defensive.

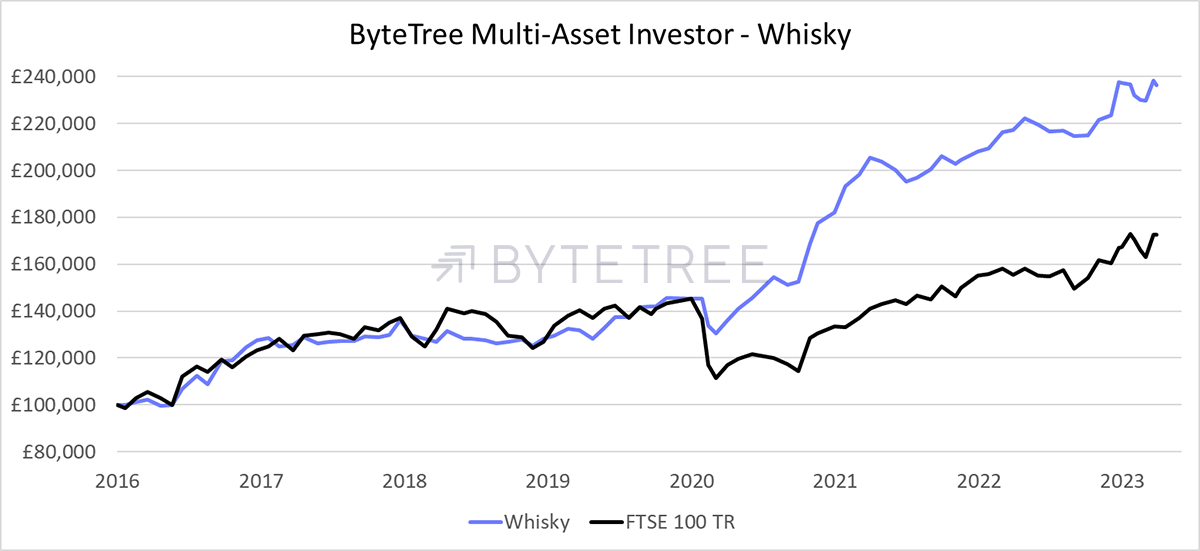

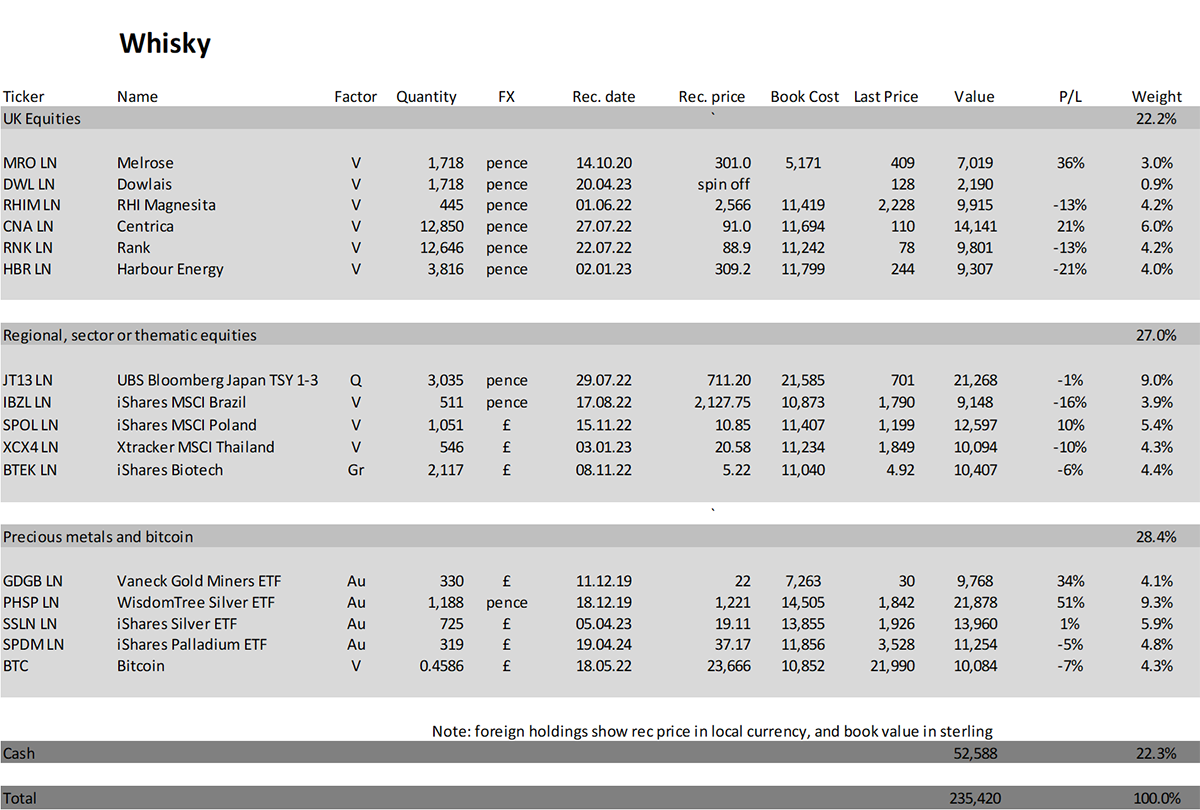

Whisky

Since 2016, Whisky is ahead of the FTSE 100, as shown, with volatility of 10.0% against 12.9% for the index.

Source: Bloomberg; ByteTree. 1/2/2016 to 24/4/2023.

I called the market low in October, which was great, and took profits in on several stocks in February as bond yields surged, signalling trouble ahead. We had a few bank failures, but the market didn’t seem to mind for more than a few days, which is odd.

But while the likes of JD Sports (JD) went spectacularly well, my enthusiasm for Asia and the emerging markets hasn’t been rewarded. The winners have been Europe and big tech. When I say Europe, I mean Hermes (HMS FP), LVMH (MC FP), L’Oréal (OR FP), or the things Europe can sell to Asia. And when I say big tech, I mean a few leading NASDAQ stocks, not the likes of the Scottish Mortgage Trust (SMT), which has slumped to a 20% discount to net asset value.

Melrose has been great (note below), and the UK value situations are fine, but we need to be patient. We also have quite a large position in precious metals, which I have recently increased with more silver and palladium. That might take time, but when the next stimulus comes, I expect prices to move quickly. That is the danger of staying out of the market when you know good news lies ahead.

Not to forget a little bitcoin. On that note, BOLD celebrates its first birthday on Thursday when I rang the bell at the SIX Exchange in Zurich last year. I am extremely pleased with how well it has done.

Statistics to End 2022

Source: Bloomberg; ByteTree. 1/2/2016 to 31/12/2022.

Current Risk

When I ran the numbers on the simulated portfolios, as of today, Soda has volatility of just 5.4%, against 8.2% for the FTSE Balanced Index. Whisky has 7.4% volatility compared to the FTSE 100 of 14.4%. This exercise looks at the current holdings held together and gives a good guide to how risky the portfolios are. Currently, that is not much.

Melrose Spinoff

I was asked about the recent spinoff. You will see that Melrose (MRO) has demerged Dowlais (DWL). Shareholders had a 1 for 3 split and then one share in DWL for each share held in MRO.

Example: You held 300 shares in MRO, and you now have 100 shares in MRO, but the price trebled. You also receive an additional 100 new shares in DWL.

MRO was purchased in October 2020 at 127p for £7,275. From that, there were £233 in dividends and a special dividend in August 2021 of £953. The holdings are worth £9,150, so the return has been 41%.

This is a classic value stock that appears ragged much of the time but turns out well. In this case, the spinoff led to value creation. The larger MRO (mkt cap £5.5bn) is the part the market seems to like, while the newly created DWL (mkt cap £1.75 bn) is the “rump”.

Spinoffs are one of those areas in markets where the rump normally wins. A sort of hare and tortoise situation. MRO is the “sexy” aerospace business, whereas DWL is the “dull” auto business (formerly GKN), which Melrose acquired in 2018. That dull old business is killing it with parts for EVs. I will look at this more closely and decide what to do.

Action:

No action

Postbox

I had a problem trying to buy the commodity ETF with Bestinvest. It wasn’t listed, so I asked for it to be made available and received the following response:

“I’m getting in touch in response to request to have WisdomTree Broad Commodities ETC added to our platform. Unfortunately, we are unable to provide this fund as WisdomTree have marked is as unsuitable for execution-only clients (retail investors).”… Bestinvest

If this is correct, then I imagine that other readers will have the same issue. Are you able to confirm this with your contacts at WisdomTree that you could recommend? As this isn’t the first issue I’ve had buying shares and funds, I’m beginning to wonder whether your readers should have a straw poll on which platforms offer the widest availability.

I suspected we’d hit a wall with these products on some of the platforms, and I have had similar messages. That is one of the main reasons I have avoided commodity funds, not because I don’t like them, but because some genuinely are complex and others are hard to access.

I reiterate that in an uncertain world, the diversification benefits, especially cross asset class, are compelling. I checked with Hargreaves Lansdown, which is my standard test, and they allowed AGCP to be traded. I wrote to WisdomTree to better understand why some platforms disallowed it. They replied:

“Thank you for your email regarding WisdomTree Broad Commodities (AGCP). WisdomTree Broad Commodities is available to retail investors. However, as the fund is a derivatives product, MIFID II requires that AGCP is labelled as a complex product. As a result of this, retail investors are required to undergo appropriate testing to determine whether they can invest in the fund. Some platforms offer this “appropriate testing” to investors and others do not. Hargreaves Lansdown does offer testing, but unfortunately BestInvest currently does not.”… WisdomTree

I had not appreciated that WisdomTree has another broad commodities fund that is identical in performance but not considered complex and therefore should be able to be added to the BestInvest platform. That is the WisdomTree Broad Commodities UCITS ETF (PCOM in USD, COMX in GBP). They told me that Bestinvest, like all platforms, are demand led. If you would like exposure to commodities, then COMX is a good alternative to AIGC. The performance is practically identical.

We should do a survey to compare platforms when things quieten down.

My palladium trade was stopped out by AJ Bell. It may be of use to other subscribers. I received the following update from a helpful customer service person. Basically, they have cancelled the stop loss orders but stress that in future this might not be possible if the same “gapping” happens again:

“I have spoken to our Dealers, and they have managed to get your two Stop Loss orders cancelled. In this instance, the spread gapped which caused the Bid price to drop to roughly 2810p for a few seconds before returning back to around 3700p. As our system has no way of determining if this price drop is the stock gapping or dropping, it triggered the order and executed the trade. Unfortunately, this is a risk of placing Stop Loss orders and going forwards, we may not be able to cancel orders that execute as such.”

I still don’t quite understand why the spread would gap so hugely, but I would hesitate to use stop losses on the platform again. Regards and thanks for the excellent ByteTree service.

I do not like automatic stops because you are handing control to a market that wants to eat you alive. I have no idea how the stop was triggered since the price didn’t seem to get close, but market makers can behave badly and move prices around to “clear the stops.” When I say stop loss, I mean a mental one, not a hard-coded one. Use them at your peril. That said, I am glad AJ Bell made good.

The palladium trade hasn’t got off to a good start. The thesis was a short squeeze, but it’s not over yet.

Palladium in GBP

Source: Bloomberg

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 1.3% this year and is up 97.6% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.4% this year and up 135.4% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

There are three bank holidays in May. In those weeks, I will publish The Multi-Asset Investor on Wednesdays.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()