Seeking Alternatives

Disclaimer: Your capital is at risk. This is not investment advice.

The Multi-Asset Investor dives into commodities this week. Recent weakness in the sector gives us an opportunity to add, particularly with the Pound so strong. Charlie has found an excellent vehicle for the Soda portfolio to deliver broad sector exposure, while Whisky takes a more nuanced, single metal approach. Believe it or not, the financial services industry has a negative holding in this particular commodity.

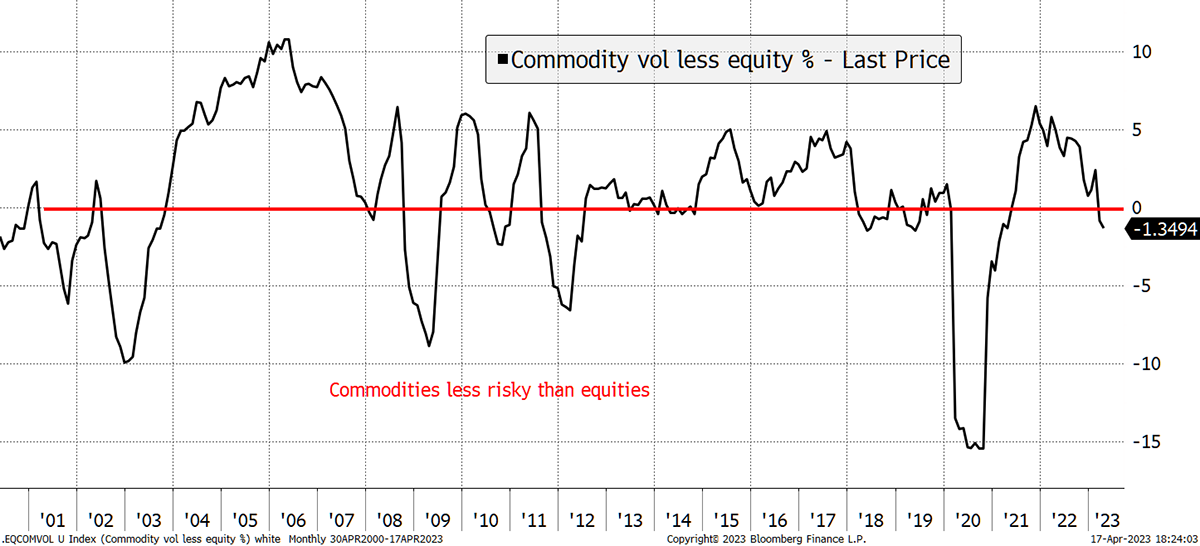

Importantly the allocations also help to diversify both portfolios, a subject close to our hearts in these times of heightened political and economic certainty. Of note is that commodity volatility is lower than equities, which hints at an attractive entry point.

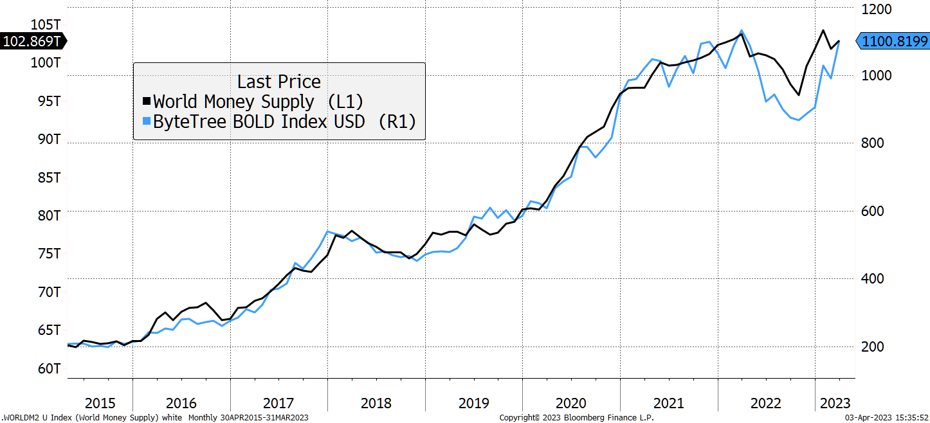

Speaking of portfolio diversifiers, the monthly Bitcoin and Gold Chart Book was published this week. What is fascinating is that, looking at bond positioning, a deflationary outlook is now the consensus. The idea that inflation might linger is contrarian. And yet history tells us that inflation can be highly volatile in periods of uncertainty. The risk in markets is surely that there is a sharp slowdown without inflation having been defeated. If that is the case, do politicians reach for the easing/printing button, or do they maintain their resolve and watch things come unstuck? We suspect the former, in which event these two assets will thrive. The correlation of our BOLD strategy with the world money supply, shown below, speaks for itself.

I also make the case that crypto should now be part of a genuinely diversified portfolio in its own right. In “Asking the Right Questions About Bitcoin”, I reveal the questions I regularly ask myself to counter any biases. My conviction remains that this is an asset class that is here to stay, and for that reason alone, it deserves a small place in a wealth portfolio.

Continuing with the store of wealth theme, Charlie Morris was a keynote speaker and panel moderator at last week’s Denver Gold Forum(confusingly held in Zurich). He wrote an excellent summary of the best talks, and some of his involvements can be seen below:

- Bitcoin and Gold Are Key to Surviving an Inflationary Environment

- Summary session: Fund Managers Go Around the World in 45 Minutes

- Market, Money, Metals and Mines

ATOMIC, which focuses on bitcoin only, highlightedthat there are several reasons for the leading digital asset to trade in a range of around US$29-30k for the time being. Network activity has cooled, and this price area has provided both resolute support and firm resistance in the past. It has been interesting, however, to watch the progress of different regulatory bodies around the globe. The EU and the UK appear to be progressing in a constructive and conciliatory manner, while the Chairman of the SEC, Gary Gensler, has been receiving something of a grilling in front of the Congressional House Financial Services Committee. It might just be that the regulatory tide is starting to turn.

ByteFolio this week increased exposure to Ethereum. This follows the recent Shapella upgrade, which was successfully completed. The portfolio now consists of six names, with a large leaning towards the big two.

Have a great weekend,

Charlie Erith

CEO, ByteTree Asset Management

Comments ()