Buffett Sells Stocks, Holds Cash

I have long been a Buffett observer, and back in 2011, I was worried that his vice Chairman, Charlie Munger, was getting on a bit. If I wanted to attend the Berkshire Hathaway (BRK) annual general meeting in Omaha, I had better get on with it. I went, and it was a thoroughly enjoyable weekend, although I needn’t have rushed. Last weekend, some 12 years later, Buffett, aged 92, was joined on the stage by Munger, now aged 99. They plod on.

They share their views and throw in a few jokes. This year the message was slower growth for his companies, with many reporting lower profits next year. The succession plan is no longer a mystery, with the next CEO confirmed as Greg Abel, who will take over when the time comes.

Munger disliked current market valuations, and as a result, BRK has been a net seller of stocks over the past few months. In preference, they have been buying back their own stock to the tune of $5 billion over the quarter. Berkshire’s cash pile has grown to $130 billion. They are waiting to pounce.

It was interesting to hear that they were not getting involved in the banking sector despite it trading at distressed prices. Banking has been one of their go-to sectors over the years, especially during the 2008 credit crisis. Munger said there was too much real estate debt out there, and the speed at which deposits can move was a concern.

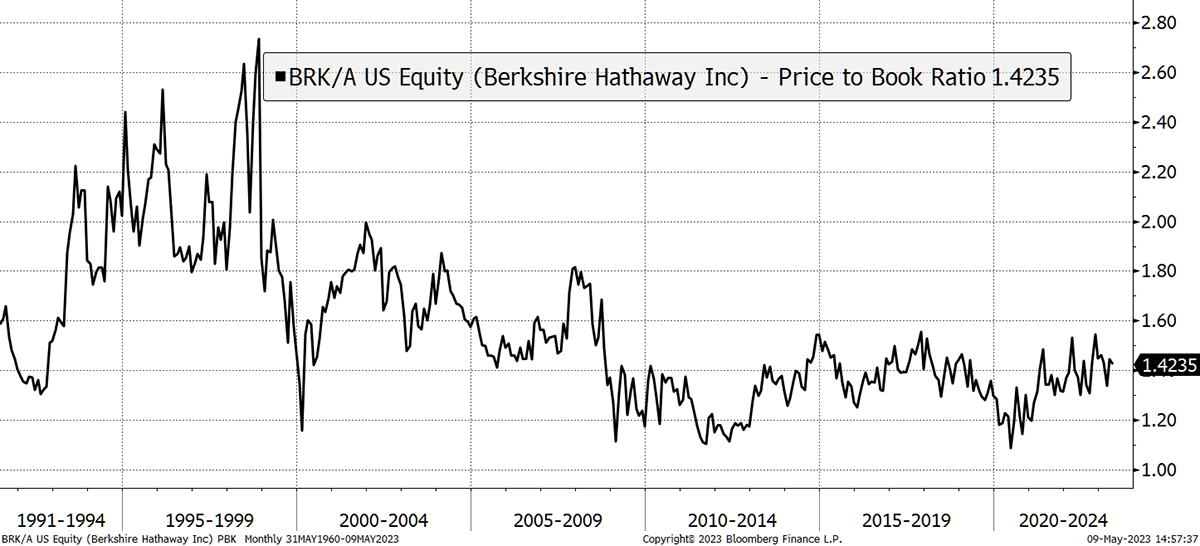

I like Berkshire Hathaway, but I have always treated it as an investment trust that is a sober alternative to the S&P 500. Using price-to-book value as a proxy valuation tool, it has been beneficial to buy at 1.2x book and sell at 1.5x. I last sold it in December, and it is roughly the same price today.

Berkshire Hathaway

Source: Bloomberg

It is no longer the go-go stock it once was, and so it is right to assume it currently trades towards the top of the range. I am not surprised it does because it is one of the world’s most valuable companies, and in this market, the biggest companies trade at the highest prices.

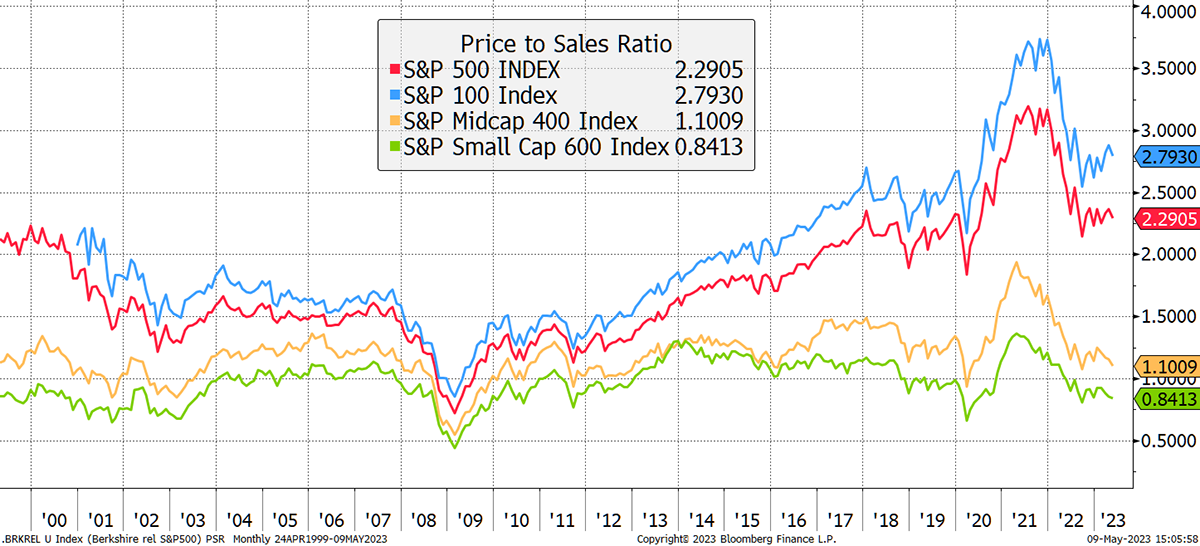

I showed this relatively recently, and it needs to be shown again. In the stockmarket, we can clearly differentiate between very large, large, mid and small cap stocks with unusually wide valuation differences.

The Bigger the Better

Source: Bloomberg

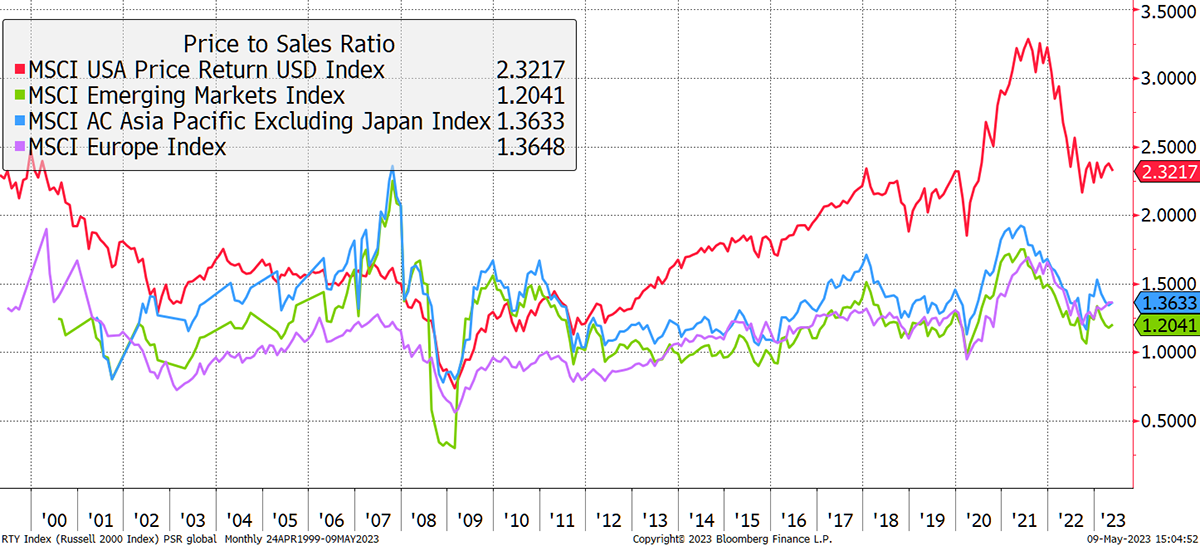

This valuation gap is global too, as there are US large caps and there’s everything else. Look how Europe, the Emerging Markets and Asia are valued at half the level of US large caps. It’s a striking gap.

The World Offers Value

Source: Bloomberg

It is blindingly obvious that the cheaper markets will beat the larger markets over the coming years and do so with less risk. Sadly, we just have to wait because the issue is liquidity. This is nibbling away at the investment trusts, inflation-linked bonds, emerging market bonds and commodities. Nothing is doing badly enough to be of concern, and when the market turns, you can be fairly sure we will have plenty of market leaders.

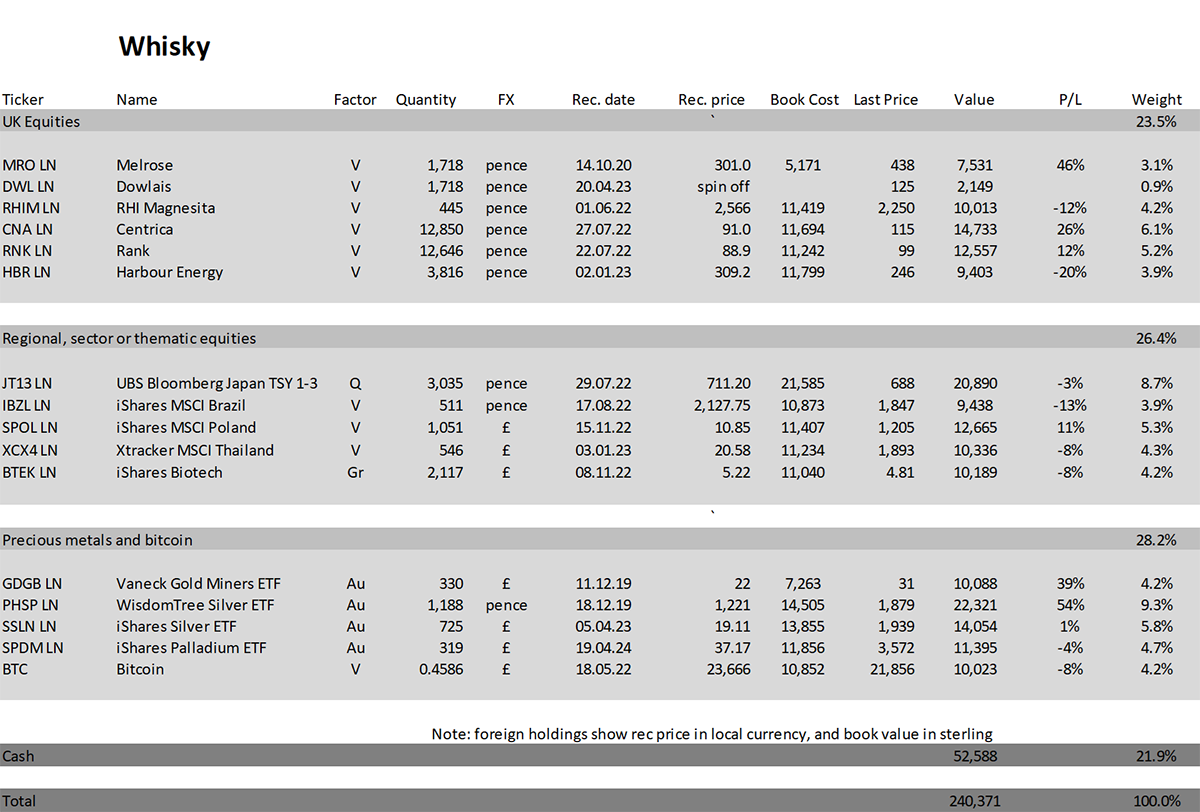

But in the meantime, the Whisky Portfolio is 10% ahead of Soda this year, which is quite the gap. Why? Simply because Whisky has had a few winners, such as Melrose (MRO), gold miners, bitcoin, and Centrica (CNA). In contrast, Soda hasn’t. Soda’s diversified, value-seeking approach is not currently being rewarded, but I do not believe we should change it. I believe we wait, and when the tide turns, we add more equities and corporate bonds. The alternative is to be in cash, splitting the proceeds between GBP, Yen, dollars and gold. A bit extreme when you consider that any portfolio damage in the assets we hold will, at worst, be temporary.

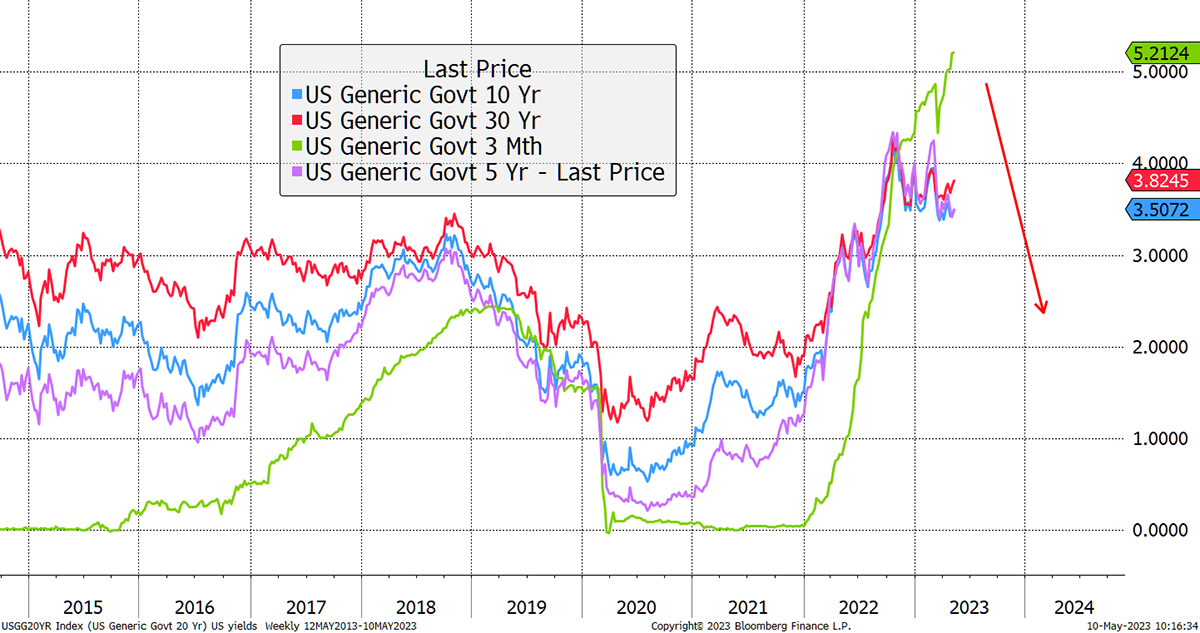

The Red Arrow Is What the Market Expects for Interest Rates

Source: Bloomberg

Besides, you can’t do that with the big bucks.

Action:

No action.

Postbox

You have been saying that the Japanese Yen is a safe haven asset – does this mean you advocate purchasing and holding some yen or does JT13 cover that base? Also, what is your current view on JT13 as my holding has been heading south in value in recent times which wasn’t part of the plan!

Yes, the yen is held in short-dated Japanese Government Bonds (JGBs) as it is the simplest and safest way to do so. We do not have any material exposure to Japanese interest rates, just the currency.

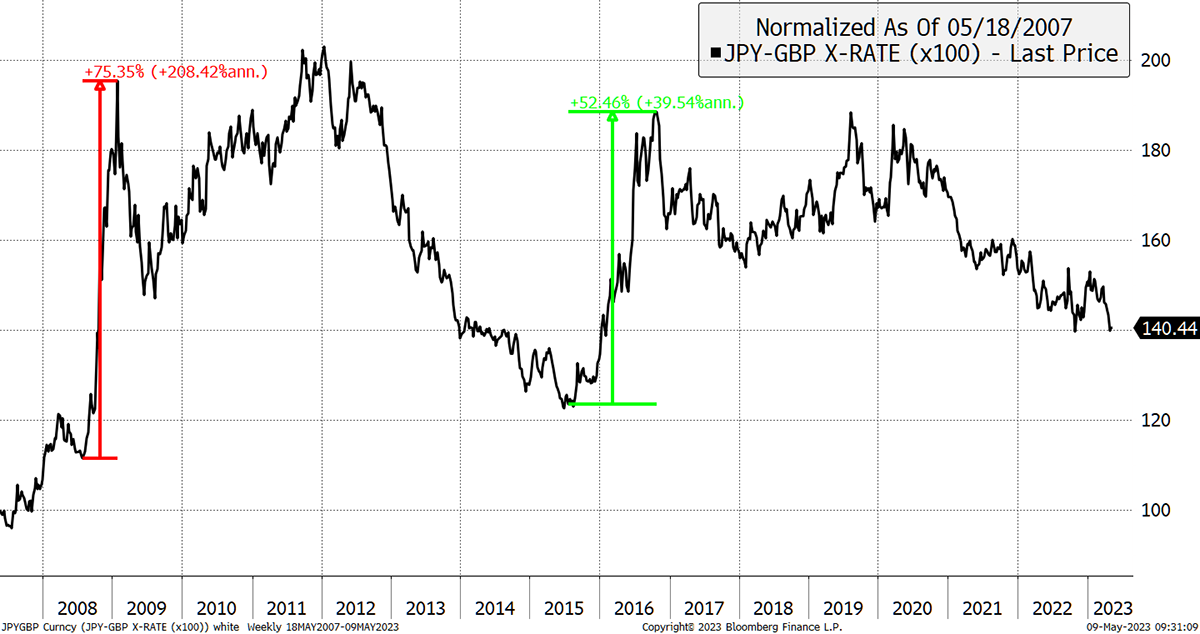

It is never the plan for a holding to head south, but it’s only down 3% in GBP, and there are two reasons for that. First is that financial markets haven’t yet blown up, despite trying their best. And the second is that the pound has been rallying hard. If things turned nasty, we would be extremely grateful for holding yen. In 2008, it promptly rallied 75% vs GBP and in 2016, during the China slowdown, by 52%. The yen knows how to move.

The Yen Is an Under-Priced Safe Haven

Source: Bloomberg

The other reason we might make money is that the Bank of Japan changes their yield curve control policy. At some point, a change is inevitable, but the market has been disappointed by delays. Because the yen has no yield, it is preferable to hold other currencies that do. That means if we do have a bad recession and see rates cut around the world, a super-strong yen will follow.

JT13 is an important part of the portfolio that could turn out to be the hero.

I hope you have been having an enjoyable break. I've been hesitating over gold when the USD is generally thought to be in a medium-term downtrend. Any gains in gold are likely to be reduced or wiped out for the GBP investor if GBP continues rising against USD as it is at the moment. What is your view on a gold ETF hedged to USD, e.g. WISDOMTREE PHYSICAL GOLD - GBP DAILY HEDGED (GBSP)? Do you think this might be a better bet than the vanilla unhedged version (PHGP). I would be keen to hear your views on the pros and cons of each version. Many thanks as always.

I really dislike the idea of hedging gold because the primary reason for holding gold is to protect you from a currency collapse in your own country. If you held GBP-hedged gold, that would boost your returns if the dollar collapsed but prove miserable if sterling collapsed. Gold is gold, and I think it should be held simply and safely. Over the years, it seems to do pretty well in all currencies.

But I agree; returns in GBP are reduced by GBP rallies. I am afraid that is something we have to live with.

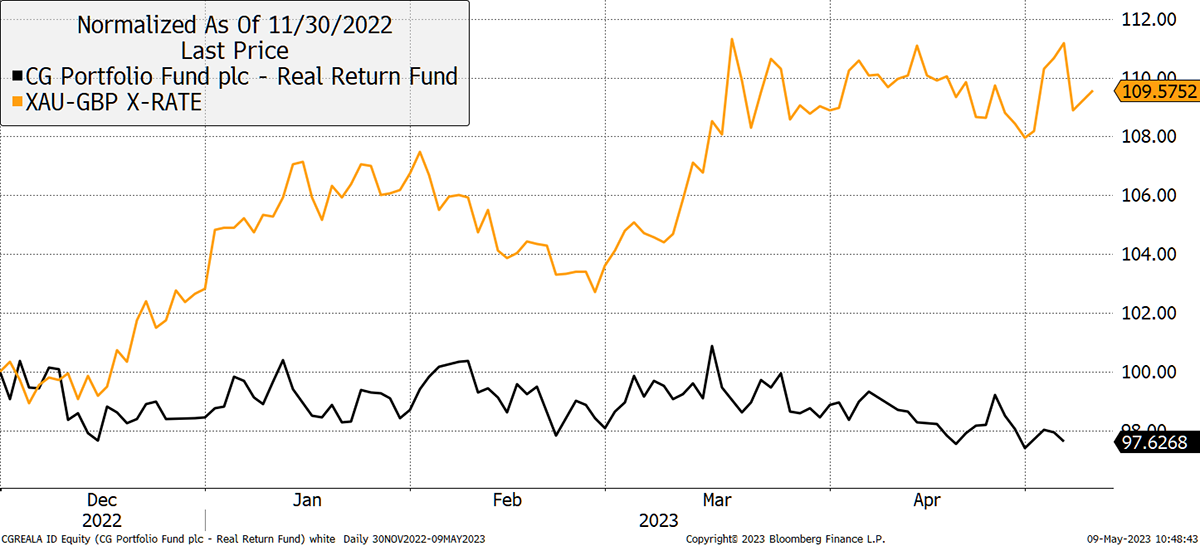

Can I ask you please to provide a small update on the “switch from gold to index-linked bonds” undertaken a while back? I switched probably more than I should have being impressed with your well-presented description of the benefits of holding the CG Real Return Fund instead of Gold at that time. Up to now, it seems that the value of CG Real Return has fallen slowly but surely, while Gold is still plodding upwards in fits and starts. What I can’t figure out is if there is any hidden accrued interest held within the holdings within the CG Real Return that may be added to the value of the fund at some time, or if this is built into the price? There is a stated Income distribution date of 30th November 2023. Would this be the date when any accrued interest is distributed? And if so would it therefore be unwise to sell any of the holding before the ex dividend date of 1st November? Do you still feel that CG Real Return is a worthwhile hold compared to Gold? Asking the impossible probably, but do you foresee a scenario when it may increase in value? Because despite inflation remaining high, it doesn’t seem to have had a positive impact on CG’s price.

Good question, and as you all know, my deep dive on gold is in Atlas Pulse.

Background

We held 15% in gold in Soda. On 29 November, I recommended a partial switch into index-linked bonds.

I switched 10% to TIPS, keeping 5% in gold. Then when the banking crisis escalated, I added back 5% gold to Soda, so we had 10% in gold and 10% in index-linked bonds. The switch is yet to reward us.

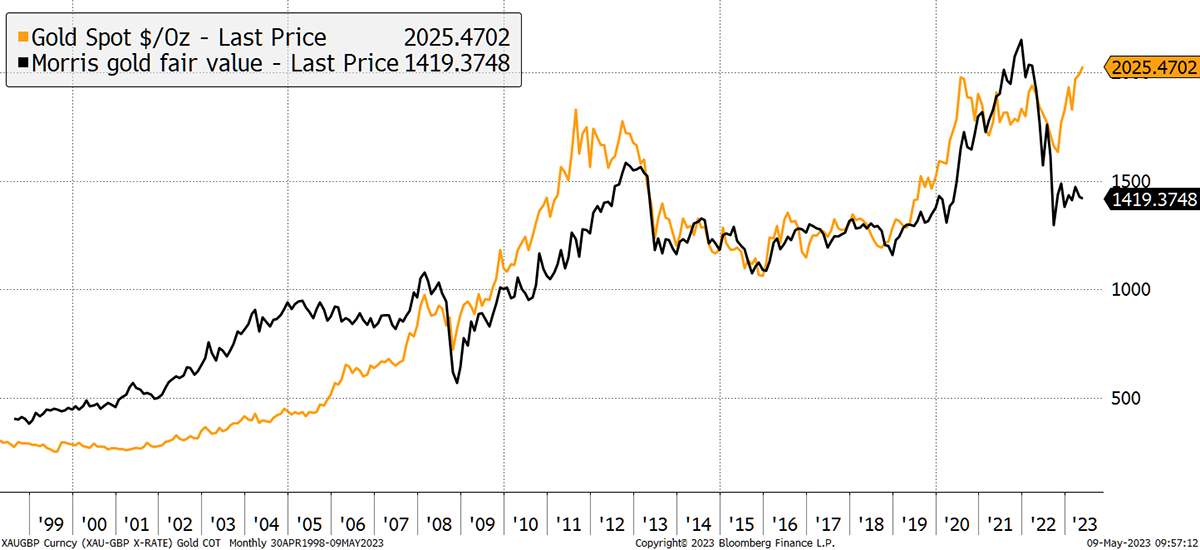

My gold TIPS model has worked so well for so long. There was overexcitement in 2011 and 2020, which resulted in a pullback for the gold price.

Gold Rich Versus TIPS

Source: Bloomberg

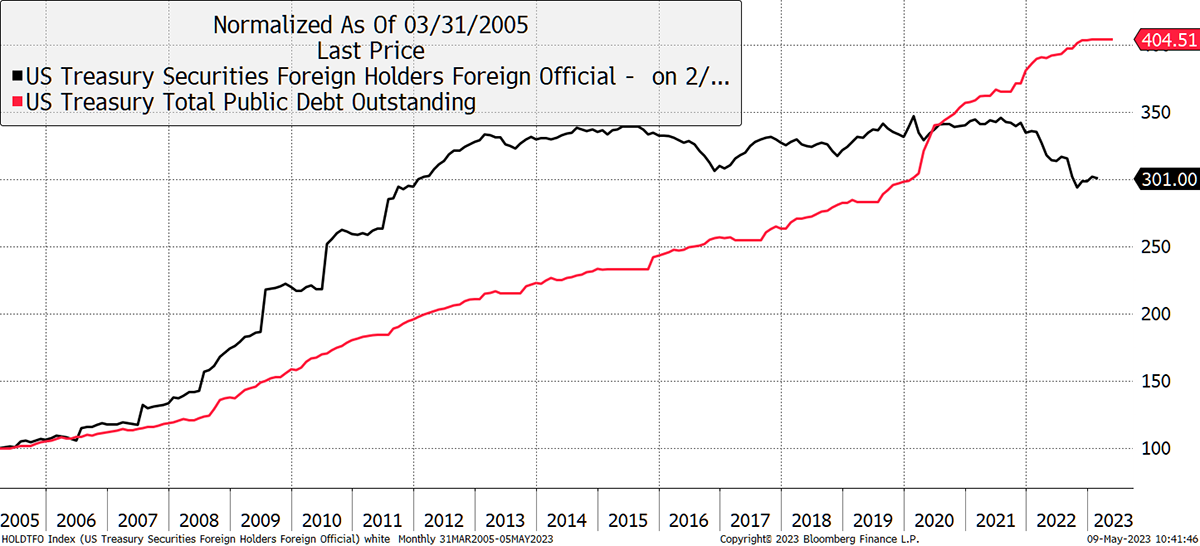

The premium that has emerged over the past year requires explanation. The most likely cause is the high demand for gold from central banks instead of Uncle Sam’s bonds. Foreign demand for US Treasuries peaked in 2013 and has slipped while supply has increased 4-fold. Foreigners owned 24% of US Treasuries ten years ago and less than 12% today.

Lower Demand for Treasuries

Source: Bloomberg

The low demand for government bonds probably explains their poor performance. TIPS were off 2% in GBP since November, while gold rose 10%, widening the premium in the process.

Gold Has Beaten TIPS Despite the High Valuation

Source: Bloomberg

It could be that the time has come to tear up the TIPS model, but I believe the relationship between gold and real rates is entirely logical and long-lasting. That said, the calibration that has worked for 20 years might be wrong, and gold may deserve a one-off jump due to its newfound role in the post-Ukraine world.

The other explanation is that gold is telling us that true long-term inflation is more like 3.5% than the 2% implied by TIPS. If this turns out to be true, TIPS will enjoy a steep catch-up trade, which will kick off in the next up cycle; a time when gold is unlikely to perform. These are difficult decisions, but having half in TIPS and half in gold strikes me as prudent.

As for yield, the CG Real Return Fund pays an annual coupon in November. It will be around 2%, but more importantly, the total return will be higher because investors get the rate of inflation plus the real yield. This isn’t a particularly exciting trade, but it should perform well over time.

I hope you enjoyed [the Coronation] as much as we have. Zadok was the highlight of the service, but I think relegated to second place overall after the salute and 3 cheers in the Buckingham Palace gardens afterwards - brilliant stuff by the military as usual. Loved your picture too and thought it a nice analogy to investing - you know what you are doing even if at times to others it may not look like it! Keep up the great work.

It was a difficult balancing act trying to please everyone, many of whom would complain in any event. I felt they got a good balance. It was interesting to hear the (new) New Zealand PM, Chris Hipkins, being interviewed by Laura Kuenssberg, who described himself as a “technical republican”. He wouldn’t invent it this way, but the alternatives are complex, and the system works.

Portfolios

New readers, please find a note at the end after the summary.

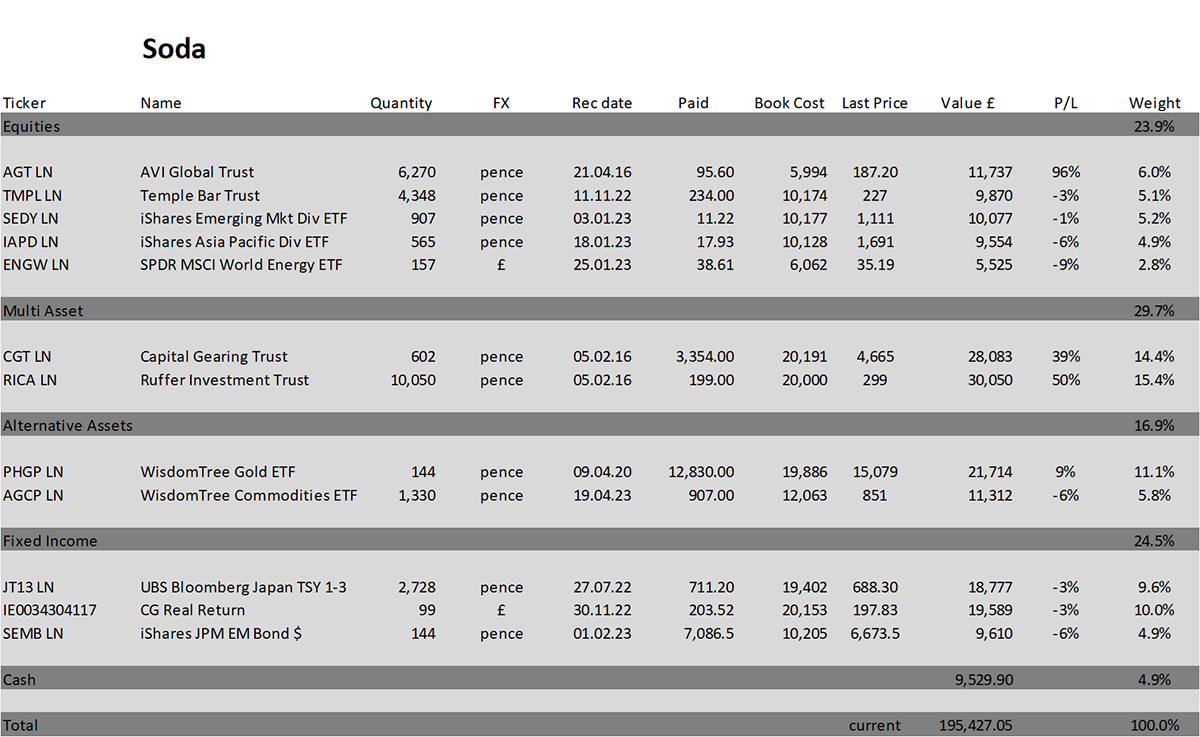

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 2.4% this year and is up 95.4% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 7.6% this year and up 140.4% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

The worst time is always the waiting game. There is a sense that things will go wrong but no certainty. We wait.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()