Clever & Lazy People Win

Disclaimer: Your capital is at risk. This is not investment advice.

There was a downbeat tone from ByteTree this week but more a reflection of market liquidity than an economic slump. The dollar has started to rally again, and that has put commodities and crypto under short-term pressure. More importantly, perhaps, the largest and most liquid assets are the beneficiaries, at least on a relative basis. In commodities, gold may have slipped below $2,000 again, but other commodities have fared worse. Gold is still the best place to hide, and despite the near-term pain, I’m still on record for $7,000 by 2030.

Gold Beats Commodities

Source: Bloomberg

I wrote a short Atlas Pulse on gold. The message was that inflation was falling across the board while upward pressure on interest rates remains. The dollar has moved higher, and so the next couple of months will test gold. But let’s not forget, the Fed will be forced to cut sooner or later, and once done, gold will be off to the moon.

Speaking of moons, it’s the same story in crypto, with bitcoin being the holdout. After a horrible year, the crypto sector has much work to do in restoring its reputation, but we shouldn’t forget how quickly things can change. The release of Chat GPT has led to a renewed surge in technology stocks. When tech takes off at a time when real interest rates are rising, you can’t ignore it. That’s because it smells like 1999. The only way to fight higher rates when inflation is falling is to grow your way out of the problem; something I will be covering in The Multi-Asset Investor on Tuesday.

AI is fascinating, and just as machines replaced agrarian jobs, AI will replace white-collar jobs. The excitement around AI has helped lift the tech sector at large. But I am reminded that bitcoin is, and always has been, a growth asset that is correlated with technology. That means they rise and fall together.

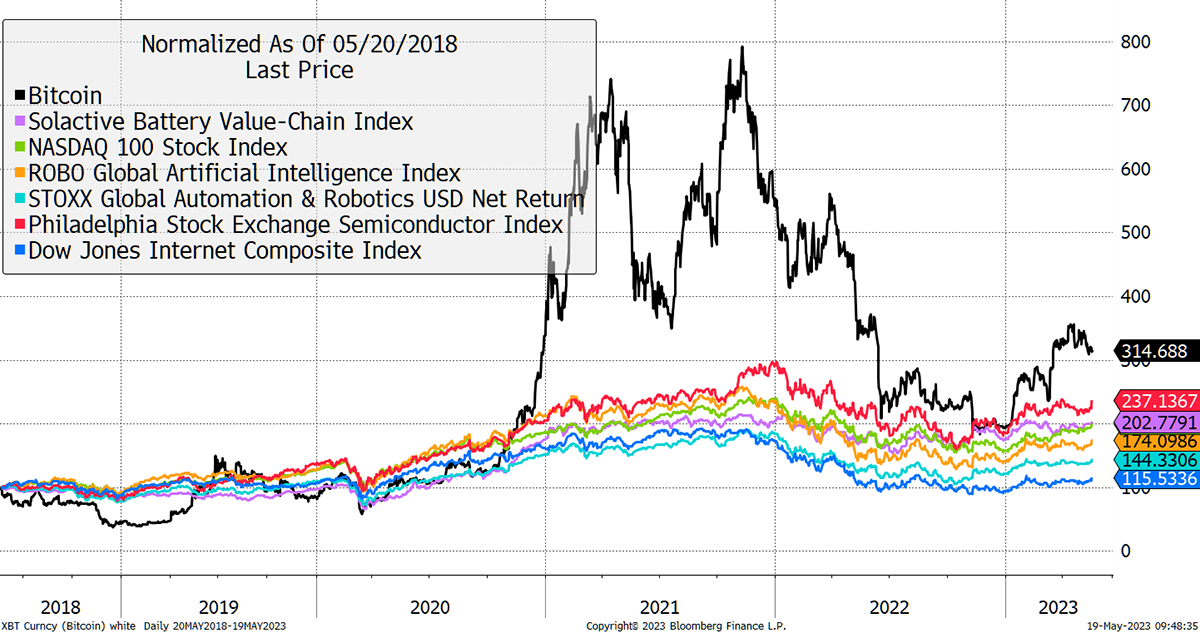

Bitcoin Beats Technology

Source: Bloomberg

It is remarkable that not a single technology-related investment theme has managed to beat bitcoin over any meaningful period. There’s logic to that because bitcoin and crypto sit at the heart of AI. Machines need to communicate with one another and prove identity. Crypto fixes this, and, furthermore, blockchain enables secure storage for the ever-growing mountain of data.

Bitcoin Is Real

Once regulators finally get their heads around this, institutional investors will embrace crypto as part of the legitimate tech trade, and they’ll be no stopping it. ByteTree’s ByteFolio research is designed to help investors on this journey.

ATOMIC this week remained in fundamentally bullish mode. It posed the question of whether the move to positive real interest rates will drive a spell of relative outperformance of ETH versus BTC. We also observe continued enhancements to the technology while remaining amazed at the ill-informed nannying of the Treasury Select Committee.

Clever and Lazy

The German General, Kurt von Hammerstein-Equord, famously classifiedthe officers under his command:

“I distinguish four types. There are clever, hardworking, stupid, and lazy officers. Usually two characteristics are combined. Some are clever and hardworking; their place is the General Staff. The next ones are stupid and lazy; they make up 90 percent of every army and are suited to routine duties. Anyone who is both clever and lazy is qualified for the highest leadership duties, because he possesses the mental clarity and strength of nerve necessary for difficult decisions. One must beware of anyone who is both stupid and hardworking; he must not be entrusted with any responsibility because he will always only cause damage.”

Commodities and technology are two of life’s essentials, and investors need to embrace them. Gold is the king of commodities, just as bitcoin is the king of tech.

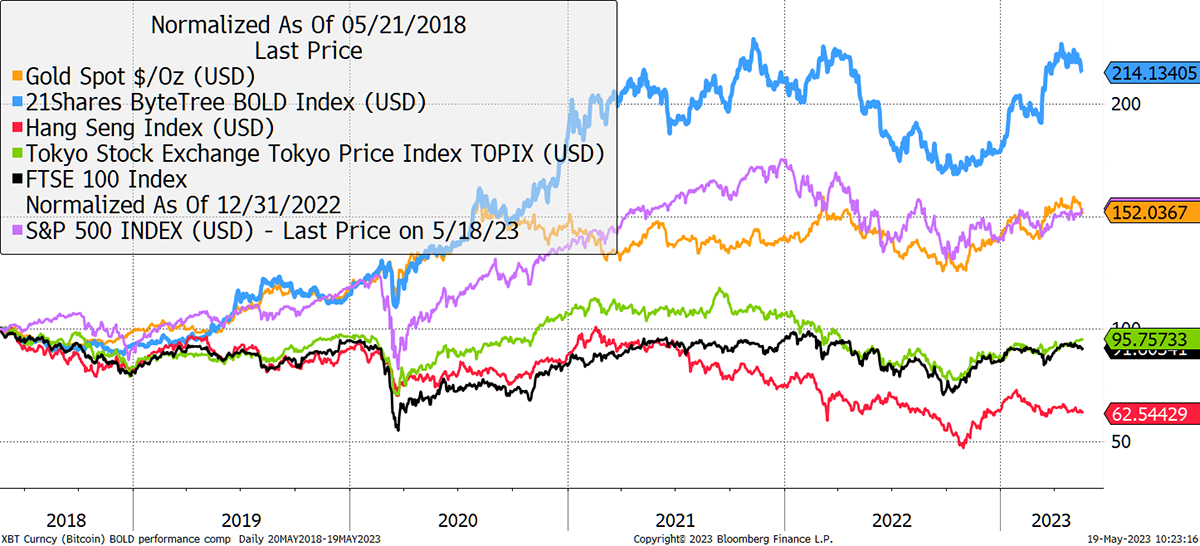

What Would General Kurt Choose?

Source: Bloomberg

Gold and the S&P have matched returns with some negative correlation benefits. The UK and Japan have underwhelmed but remained close much of the time. The recent “surge” in Japanese equities is brought back to earth when you consider the weak yen. Finally, Hong Kong, or China these days, appears to be in a spot of bother. The property loans are defaulting, and the population is declining. Maybe we should look to the East for the big risks rather than the West.

BOLD is ByteTree’s homegrown strategy which blends Bitcoin and Gold on a risk-weighted basis, roughly 22% bitcoin and 78% gold. It requires no intervention and so is ideal for clever and lazy investors. BOLD has been exemplary and, more importantly, resilient. In 2022, when bitcoin collapsed, BOLD was no worse than mainstream asset prices.

I can only imagine that General Kurt would have embraced BOLD.

Have a great weekend.

Comments ()