Radix: Redefining Blockchain Scalability and Security for DeFi?

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: XRD;

Radix is a Layer-1, smart-contracts development platform that can create scalable and secure DeFi applications. With its innovative consensus mechanism, Cerberus, Radix aims to overcome the scalability limitations of other Layer-1 platforms while ensuring security and decentralisation. Its native utility token, XRD, has surged over 100% since the start of this year. This Token Takeaway will delve into the fundamentals of Radix, explore its significance in the space, and analyse the value proposition of the XRD token.

Overview

Radix is a Layer-1, smart contracts development platform particularly focused on revolutionising the DeFi industry. Before being rebranded as Radix, it was known as eMunie and was introduced by its founder, Dan Hughes, on Bitcoin talk in May 2013. Radix is an alternative to 1st generation DeFi development platforms like Ethereum and offers a purpose-built DeFi-programming environment for secure and scalable development. As outlined by its whitepaper, the mission is to overcome the technological barriers that restrict the growth of DeFi by constructing a Layer-1 protocol designed to fulfil the long-term requirements of DeFi on a global scale for the next century. DeFi currently makes up about 0.05% of the entire global financial market, so there’s plenty of work to be done.

In July 2021, Radix successfully launched its Mainnet named Olympia. Olympia introduced several features, including low transaction fees, a transaction processing speed of 50 transactions per second (TPS), and a finality time of 5 seconds. While Radix's TPS surpasses Ethereum's TPS range of 10-15 by a big margin, it is worth noting that numerous similar platforms can achieve a significantly higher TPS than Radix - more on this in the “Competition” section below.

Radix makes some bold claims as it states that “it is the only decentralised network where developers will be able to build quickly without the constant threat of exploits and hacks”. It claims to achieve that by using a unique programming language called Scrypto, the Radix Engine, and a consensus mechanism called Cerberus.

Radix’s claim to offer a development environment free from exploits does sound like a very appealing unique selling point. However, there is currently no track record to support such a claim. And even if Radix did have a spotless track record, there is no guarantee that it would stay that way. For now, we will have to assume that it’s a marketing stunt, but that’s not to say that the prospect wouldn’t attract many developers and dApps to the ecosystem.

Radix Architecture

DeFi Lego Bricks – Composability

DeFi composability refers to the ability of various protocols and smart contracts to interact and connect in a modular and interchangeable manner. It allows developers to combine different DeFi building blocks, such as lending protocols and DEXs, to create new and more complex DeFi dApps.

In this case, DeFi Lego bricks represent Radix’s foundational building blocks, including token standards, smart contract templates and other open-source pre-built tools. These bricks can be combined and interconnected like Lego pieces to construct various DeFi applications and protocols.

Cerberus Consensus

Cerberus is a Byzantine Fault Tolerant (BFT) consensus algorithm used by Radix to maintain network security. Cerberus ensures that the network can withstand Byzantine faults, such as malicious or faulty behaviour from one or more validators, while retaining the usual operations and safety properties.

Cerberus offers two unique features, Practical Infinite Linear Scalability and Cross-Shard Atomic Composability. Simply put, Cerberus allows Radix to constantly scale to meet the network demand while maintaining Cross-Shard Atomic Composability. This means that if any part of a transaction fails or encounters an error, the entire transaction is rolled back, leaving the system in its original state.

Radix Engine

The Radix Engine, akin to Ethereum's Ethereum Virtual Machine (EVM), operates as the application layer responsible for executing smart contracts on the Radix platform. Just as game engines like Unity and Unreal simplify game development by providing ready-made solutions for things like in-game physics and graphics, the Radix Engine is a financial engine that automates key tasks such as secure asset management. This relieves developers from the complexities of handling vital financial elements, enabling them to concentrate on creating exceptional DeFi applications and fostering innovation in the industry.

Scrypto

Based on Rust, Scrypto is an asset-oriented programming language used to build smart contract blueprints and components on Radix. By leveraging the capabilities of Scrypto, developers can direct their attention to crafting the essential logic of their dApps with increased confidence. This is made possible as they are not required to personally implement asset behaviour and conduct error-checking, effectively mitigating risks and reducing complexity.

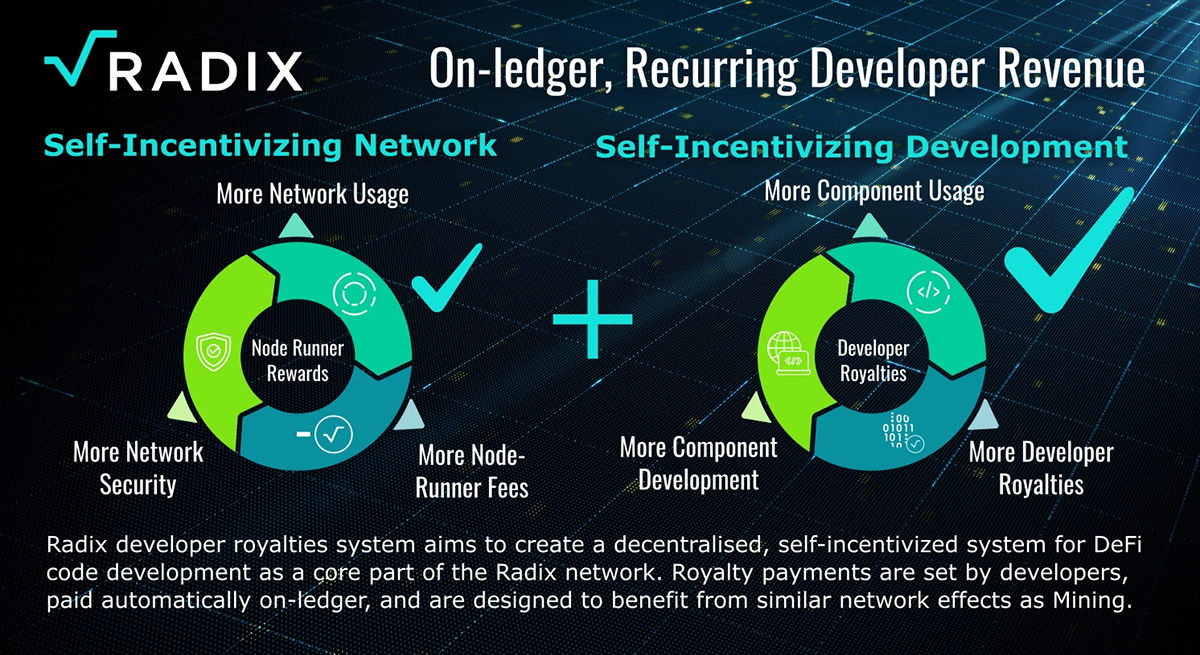

Developer Royalties System (DSR)

The Radix Developer Royalties System (DSR) is an innovative mechanism that enables developers to earn royalties for their contributions (building smart contracts) to the Radix ecosystem. It rewards developers for their creative work, incentivising them to build high-quality applications and contribute to the growth of the network. On top of DSR, Radix also implements a developer grants program to foster ecosystem expansion.

XRD Tokenomics

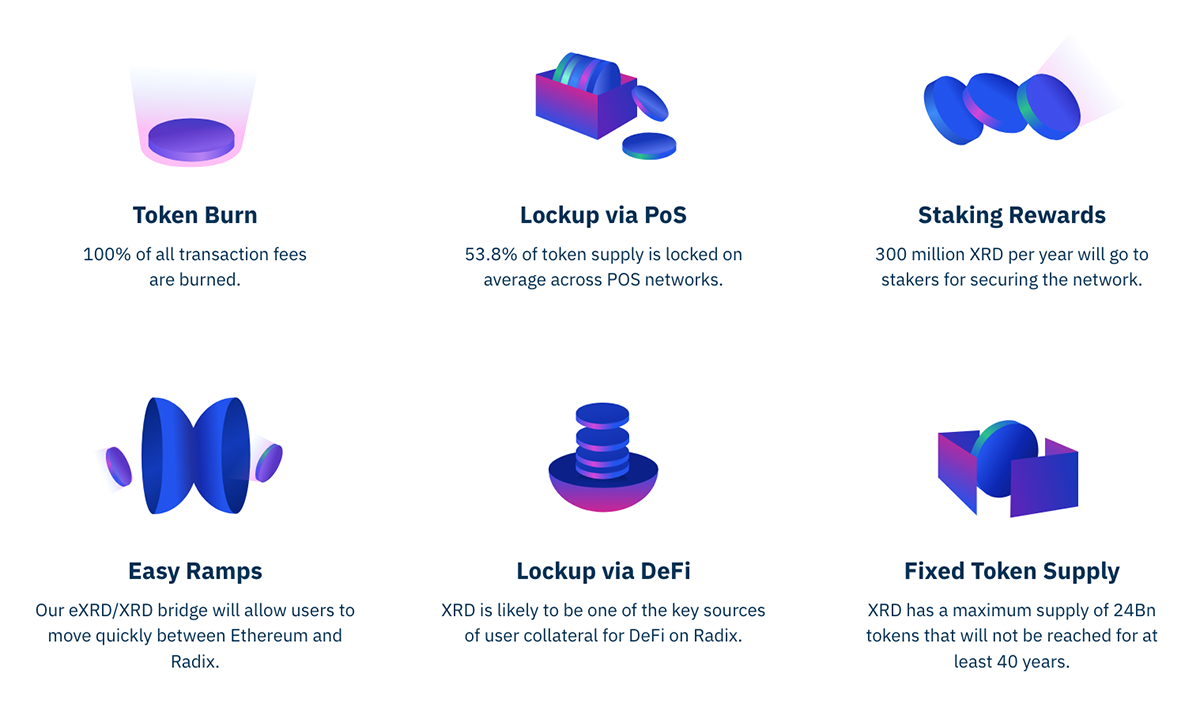

XRD, the native utility token of the Radix blockchain, was inaugurated following the launch of its Mainnet. XRD has a max supply of 24 billion, with 10.1 billion currently circulating in the market. Moreover, 2.4 billion XRD tokens are locked in a stablecoin reserve. Every 10 years, the Radix community will review and assess the need for this reserve to back one or more stablecoins in the ecosystem. If there is no necessity for these 2.4 billion tokens determined in that 10-year period, these tokens will be locked indefinitely.

According to Cryptorank, eXRD is an ERC-20 version of the XRD tokens (i.e. compatible with Ethereum), which were launched in an ICO in October 2020, raising $12.7m. Moreover, Radix raised a total of $16m in a seed funding round and two venture rounds, as shown by data from CrunchBase. The most recent venture round, held in March 2023, was backed by DWF Labs and raised $10m.

XRD is used for staking, securing and paying for gas fees on the network. A fixed 300 million tokens are emitted each year to reward stakers. Moreover, 100% of the transaction fees are burned. According to Staking Rewards, 28% of the circulating tokens are locked for staking. According to Radix, it will take approximately 40 years for the token supply to reach its cap.

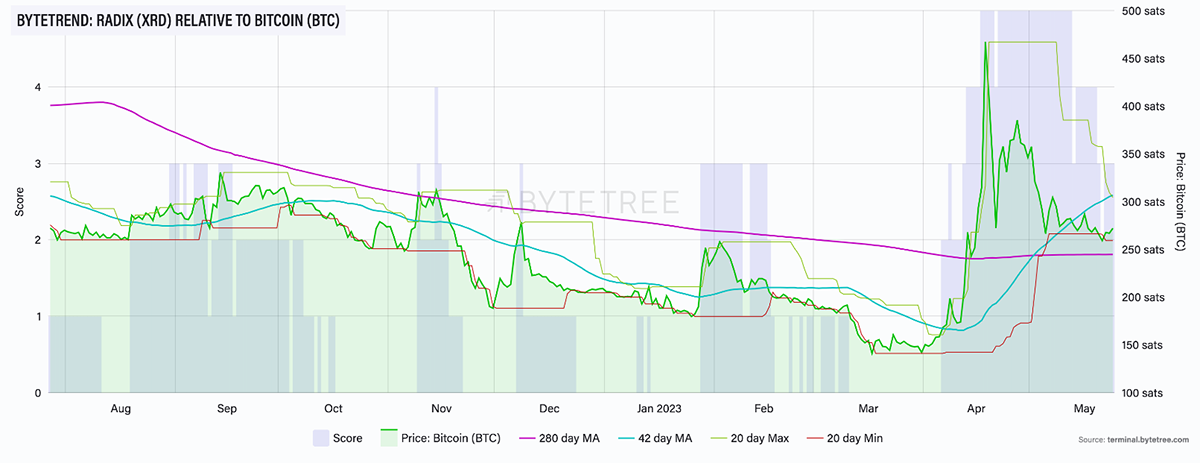

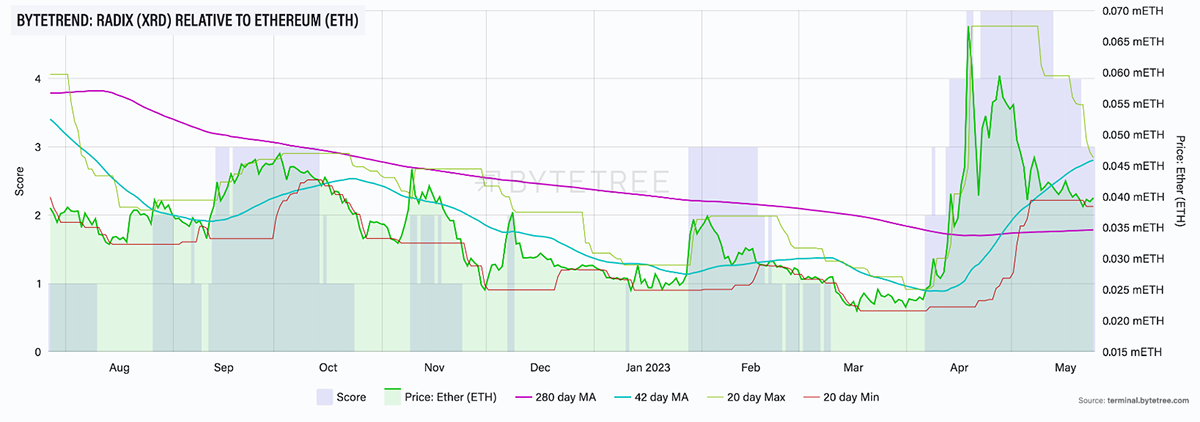

As illustrated in the below ByteTree Terminal charts, XRD scores a 3-star ByteTrend score against both BTC and ETH, showcasing a neutral price trend.

Notably, the XRD token is currently down 88% from its all-time high in November 2021.

This year’s bullish move can mainly be attributed to two key factors: its recent fundraiser and the upcoming launch of the Babylon upgrade.

The Radix Roadmap

Five months after the Olympia Mainnet launch, the Alexandria upgrade was rolled out in December 2021. During the Olympia phase, the network offered limited functionalities, such as XRD storage on the Olympia Radix wallet, token transfers, and staking. However, with the Alexandria upgrade, developers gained access to enhanced features, including Scrypto programming and the Radix Engine V2 smart contract processing experience. This phase enabled developers to experiment with a range of Scrypto tools and features, providing them with the opportunity to familiarise themselves with building and operating DeFi dApps using Scrypto.

The forthcoming upgrade, Babylon, is scheduled for launch in July 2023 and aims to bring Olympia and Alexandria together. This major Mainnet upgrade will enable the deployment of Scrypto code on the Radix network, bringing comprehensive DeFi capabilities to Radix, and, thus, the true beginning of its journey as a Layer-1 platform. Assuming Babylon successfully launches this year, it is noteworthy that Radix has taken 10 years to bring full DeFi capabilities to the platform. Considering that Radix did not have smart contract capability from the end of 2019 to early 2022 means that it has missed out on major industry development trends like DeFi, GameFi, NFTs, and the Metaverse. Suffice to say that entering a saturated market at this stage poses a challenge for the platform. We sincerely hope that they have made good use of the past decade.

Scheduled for launch in 2024, the final upgrade highlighted in the roadmap is Xi’an. At this phase, the Cerberus consensus will reach its full capacity and achieve linear scalability, allowing Radix to reach unlimited scalability and composability.

Competition

Layer-1 platforms launched to address the shortcomings of Ethereum have boldly been named ETH-killers. Radix is one, but there are plenty of similar platforms, like Solana, Cardano and NEAR that are already well-established in the space.

| Marketcap | Mainnet Launch | TVL | Staking Market Cap | Unique Addresses | |

|---|---|---|---|---|---|

| Radix | $0.74bn | 2021 | - | $0.25bn | 0.16 million |

| BSC | $49bn | 2020 | $6.7bn | $7.3bn | 332 million |

| Cardano | $12.9bn | 2017 | $0.2bn | $8.1bn | 4 million |

| Solana | $7.8bn | 2020 | $0.84bn | $5.6bn | - |

| TRON | $7bn | 2018 | $5.8bn | $3bn | 161 million |

| NEAR | $1.4bn | 2020 | $0.07bn | $0.86bn | 25 million |

Source: CoinGecko; Staking Rewards; DeFiLlama. Comparing Layer-1 platforms.

In terms of TPS, Layer-1 platforms like Solana (65k TPS) and NEAR (400-2000 TPS), and Layer-2 scaling solutions like Polygon (7k TPS), can process significantly higher TPS than Radix. In fact, the theoretical TPS capability assumptions for these projects are astronomical compared to their current speed.

These platforms not only offer exceptional speed but also provide an incredibly developer-friendly development environment. Collectively, these protocols have already deployed thousands of dApps, amassing billions in total value locked (TVL). While Radix boasts a few unique features, including Scrypto and Cerberus, which deliver a distinct development experience, its focus is primarily on DeFi use cases. Although having a niche purpose is often favourable, the aforementioned Layer-1s are general-purpose protocols, which limits Radix’s market exposure compared to the broader industry.

Conclusion

After 10 years in the making, Radix's efforts to create an efficient and user-friendly platform for DeFi development will soon materialise in the upcoming Babylon upgrade. The Radix community’s enthusiasm has not gone unnoticed, showcased by the XRD token’s positive price performance this year. However, competing against already well-established players in the market poses an immense challenge for Radix, especially considering that Radix missed out on the previous bull market.

While it is too early to make definitive predictions about Radix's future, it is evident that the road ahead will be bumpy. Nonetheless, coupled with its already decent tokenomics, if Babylon succeeds in fostering ecosystem growth, and increasing network activity and demand, then Radix has the potential to emerge as a prominent Layer-1 protocol. Until then, it's worth keeping an eye on it and reassessing after the Babylon upgrade launches and progresses.

Comments ()