Blackrock Says It’s Time for Bitcoin

Disclaimer: Your capital is at risk. This is not investment advice.

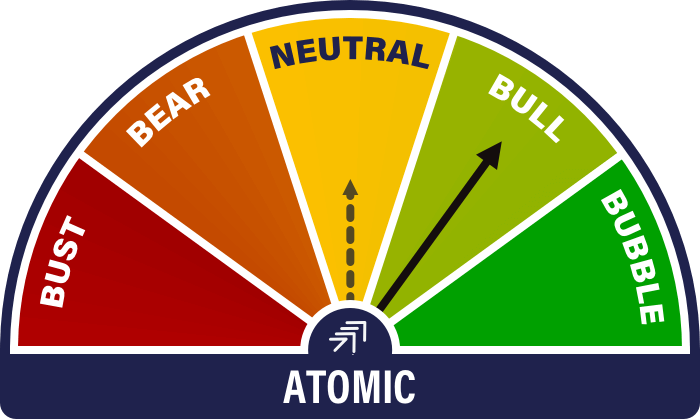

ATOMIC 86;

The entrance of Blackrock into the bitcoin space is a game-changer. It is another step towards the institutional legitimisation of bitcoin as an investable financial asset. Our bullish stance is retained.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Powerful move off critical support level |

| On-chain | Activity remains in an uptrend |

| Macro | Asian currency weakness increases the case for hard money |

| Investment Flows | Grayscale discount narrows |

| Cryptonomy | Blackrock and Stacks |

| Postscript | Farewell |

Technical

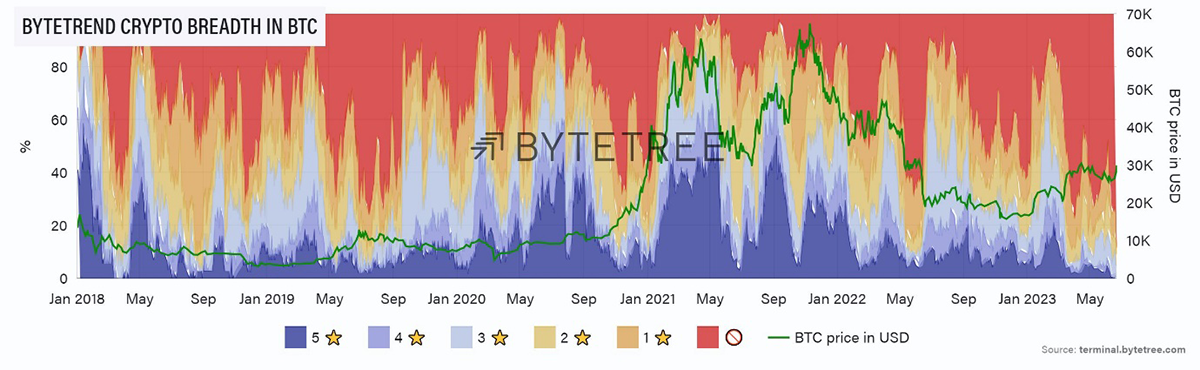

Bitcoin has regained a ByteTrend 5-star rating in US$. The stunning recovery in the last couple of days has pulled the price back from the US$25,000 level, which was important support, as shown below. Obvious near-term resistance is in the US$30,000 to US$30,500 area. If the bull market case is intact, expect high-level consolidation before a breakout.

BTC is also showing remarkable strength relative to the rest of the space, shown in the “breadth” chart below. We haven’t seen this level of dominance since October 2018, which preceded a dip in the BTC price, so it’s not necessarily an auspicious sign. It is what we would expect to see at the bottom of the cycle as investors start with the most liquid asset in the space. It is also somewhat extreme, and it would be of little surprise to see the altcoins catch up in the near term.

On-chain

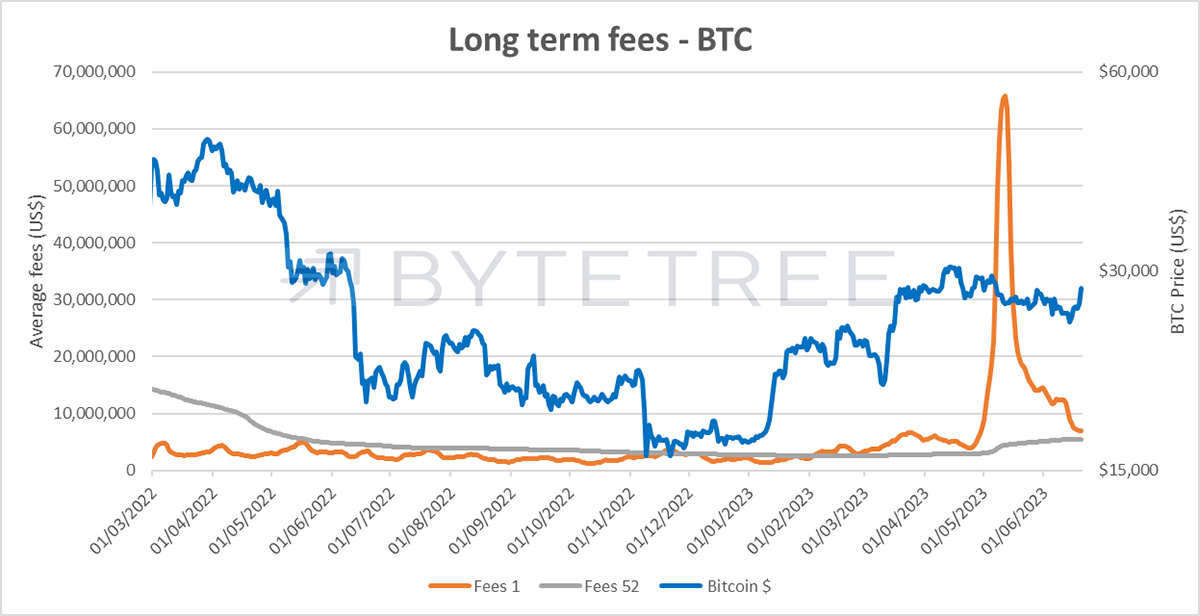

The burst in fees we recently witnessed has subsided back to normal. It’s been an interesting experiment and points the way to further enhancement of the technology. However, it goes to show that if there’s no commercial market for a project, in this case, Ordinals, the hype will soon peter out. All the same, it’s been a nice little earner for the miners.

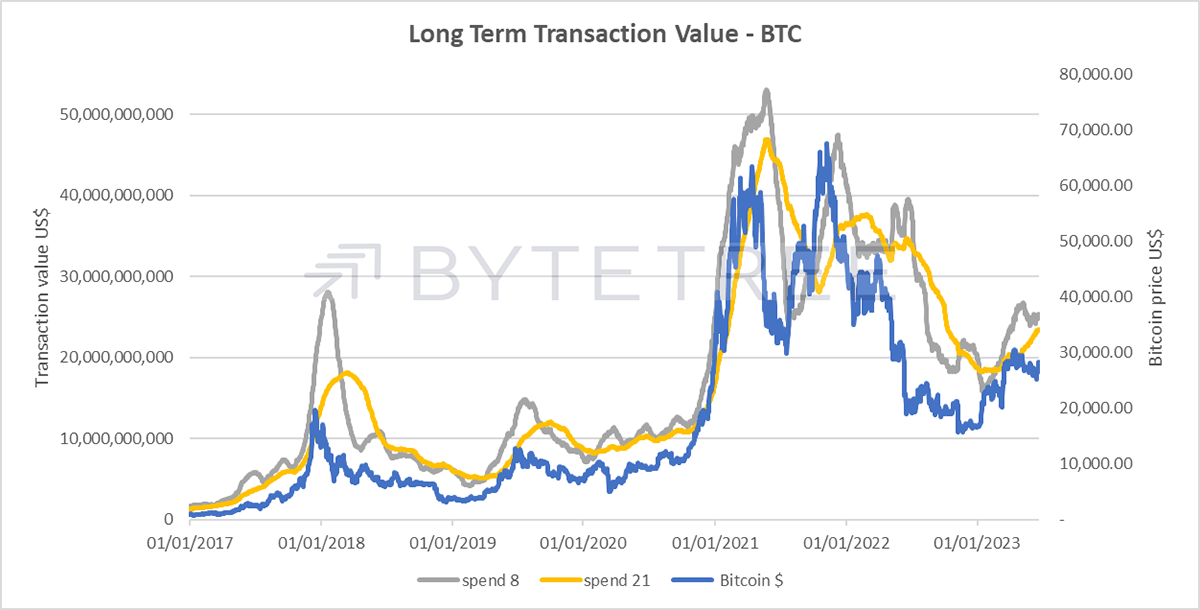

Otherwise, on-chain activity remains firm. As shown below, the value transferred over the Bitcoin Network is in a medium-term uptrend, and this latest price move will provide a further impulse.

Macro

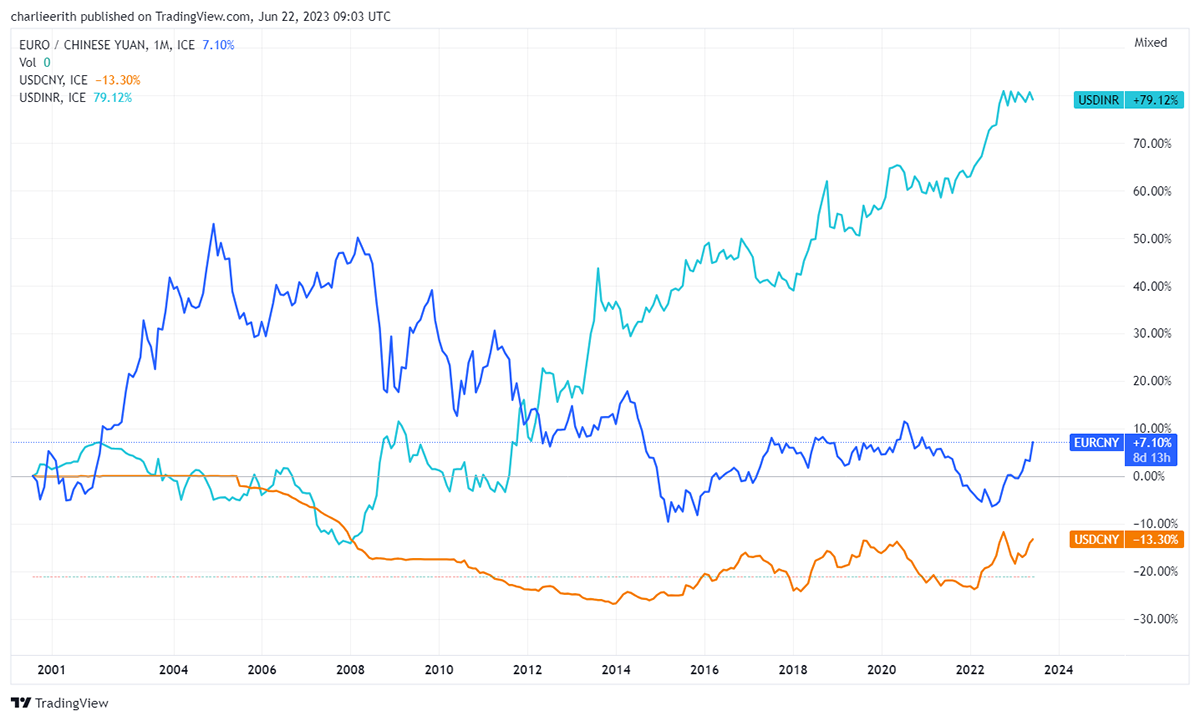

The recent strength in the British pound is mirrored by weakness in Asian currencies. The decision by the Japanese central bank to stick to yield curve control looks like a deliberate devaluation policy. Perhaps unsurprising given the economic weakness in neighbouring China and what looks like an old-style mercantilist-managed devaluation (orange and blue lines below). The years of a strengthening Renminbi appear to be behind us.

If we believe Asian currencies are heading for a period of structural decline, it theoretically underpins demand for hard assets from the most populous part of the planet. It is why gold has always been such an important part of domestic wealth in India, for example. As shown in the light blue line above, the purchasing power of the INR is almost guaranteed to decline relative to the US$ over the long term.

Western observers of Bitcoin are, unsurprisingly, fixated on the US$ price. It’s the most quoted price and is generally seen as the benchmark. But for a Japanese investor, this latest move looks like a comprehensive breakout (see below). It’s important because it’s this sort of price behaviour that accelerates adoption.

It is no wonder that Hong Kong is so assiduously trying to turn itself into a crypto hub.

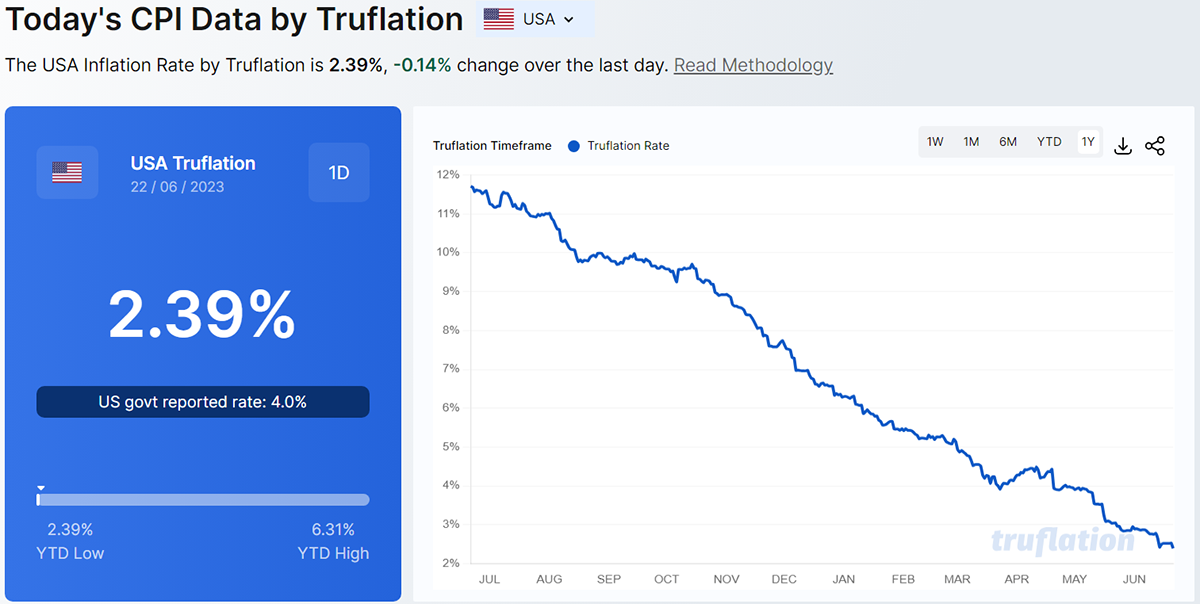

It also looks like the Fed has brought the US economy back to the right sort of glide path. While the reported rate of inflation in the US is 4.0%, as measured by Truflation (which collates multiple data points and provides a daily reading), US inflation has fallen to 2.39%.

This suggests that we’re at the tail-end of the rate hiking cycle, but it’s debatable how important interest rates are for BTC anyway, for the long-term investor.

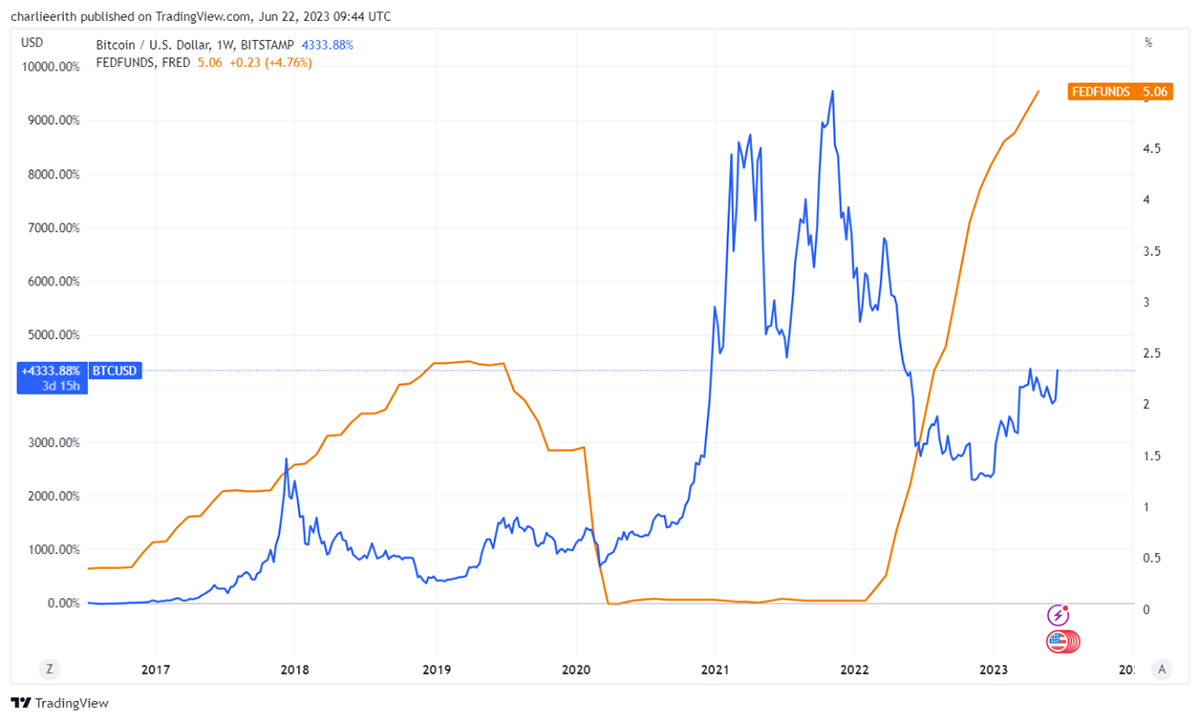

That might sound contentious when looking at the following chart, which shows the 2021 BTC spike undeniably correlated with the pandemic cut in the Fed Funds rate to zero. But the 2017 spike took place in an environment of rising rates, which suggests that interest rates are less important than perceived. Correlation doesn’t mean causation. The commonality between both these moves was, of course, the halving event. As the next halving event approaches in April next year, it is likely to be a far more important factor in bitcoin’s price than economic settings.

That is not to say that interest rates don’t matter. In ATOMIC’s view, the second spike of 2021 was a consequence of policy remaining too loose for too long. Free money allowed bad actors to gear up and speculate to an unprecedented degree, which all came tumbling down as soon as the cost of money started to rise. We are far from that environment now, which should be seen as a very positive starting point for bitcoin at this point of the cycle.

Institutional Flows

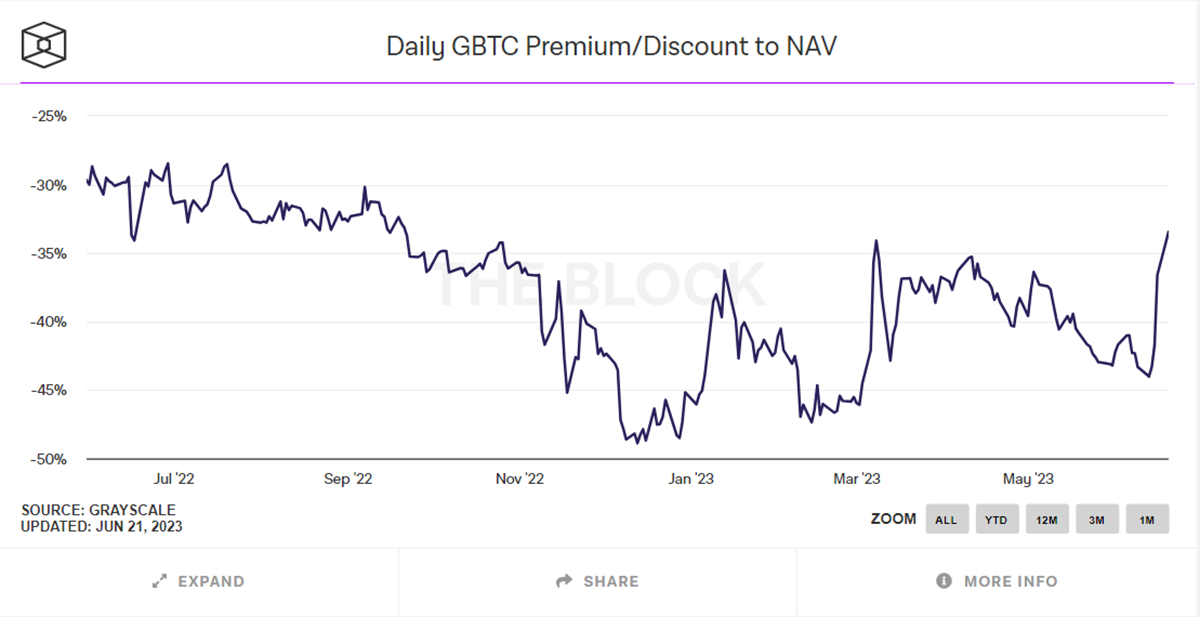

Blackrock’s application for a spot Bitcoin ETF has had a dramatic impact on the price of the Grayscale Bitcoin Trust. The discount has narrowed from 43% to 33% in a matter of days, suggesting that the market thinks we are drawing closer to a time when the Trust will be able to convert into an ETF, thus allowing redemptions. As it stands, it’s an absurd vehicle for holding BTC and was more of a hedge fund plaything than anything else. The sooner it is permitted to convert, the better.

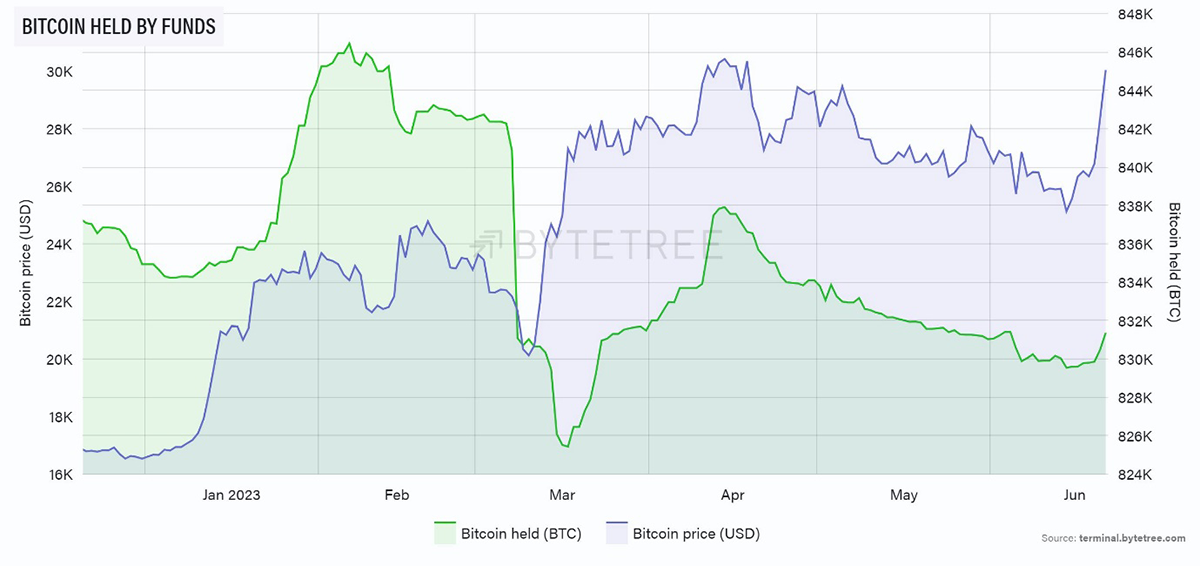

We have seen small inflows into the BTC ETFs that we follow, but nothing that moves the needle. One thing that will be worth watching is whether the ProShares BITO ETF, which only contains BTC futures, will see outflows if a spot ETF is approved.

Cryptonomy

The big news driving the space has been Blackrock’s application for a spot BTC Exchange Traded Fund. That it comes directly in the wake of the SEC’s regulatory actions against Coinbase is intriguing. It suggests that the large asset managers believe there is regulatory clarity as regards Bitcoin in the US. This marks the bottom of the US regulatory purge in our view and is thus a significant moment for the asset class. Cleverly, by directly addressing Gensler’s principal objection to previous ETFs, namely that the spot price could be manipulated, Blackrock makes it harder for this application to be turned down.

While, of course, the application could be rejected, pressure on this door to open will now remain indefinitely. It is only a matter of time. If the application is approved, it will send a powerful signal to other jurisdictions that bitcoin has become an investable asset. This will have a transformational effect on the global ownership of bitcoin.

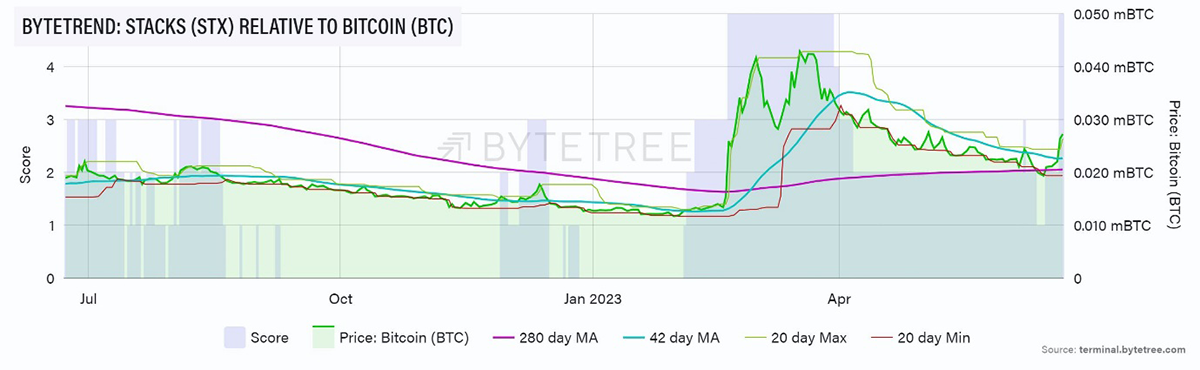

Stacks, (STX). Finding something that is outperforming Bitcoin at the moment is like a hen’s teeth, so well done Stacks. Actually, it makes perfect sense for STX to be on a five-star rating on ByteTrend when BTC is roaring since Stacks is a Layer-1 smart blockchain platform that uses Bitcoin as a base layer. We have seen from the Ordinals episode that there’s demand to expand the use case for Bitcoin. Stacks is a scaling solution that enables this. We wrote about STX back in April; you can read more about it here.

Conclusion

The Blackrock ETF application is an important marker on bitcoin’s journey to broader adoption. The regulatory fog is clearing, and the next halving moves closer. Since upgrading to bull back in November 2022, ATOMIC has advocated accumulation through this part of the cycle. That view remains unchanged.

Postscript

This is my final piece for ByteTree. Thank you for reading my work over the last two years, which I hope you have found useful. This is a great moment for selective investing in crypto, but there’s a major lack of understanding and sympathy for this new asset class, some justified, much not. This needs to be addressed before it is more widely adopted. I am heading off to fully immerse myself in crypto education, research, and fund management, and I will continue to manage the Bitcoin & General Fund. My aim will be to provide a calm and reasoned journey through what can be hysterical and baffling waters. It will certainly be interesting.

You will be able to find me on LinkedIn, where I will reveal my new coordinates in a few weeks’ time.

Take care, thank you again, and have a great summer.

Charlie Erith

Comments ()