Don’t Panic Until They Cut Rates

There are plenty of cheap securities that will inevitably deliver good results in the long term. Yet in the current environment, finding opportunities that are appreciating in price while being fairly valued and insulated from the risks are severely limited. What the market gives with one hand, it takes away with the other.

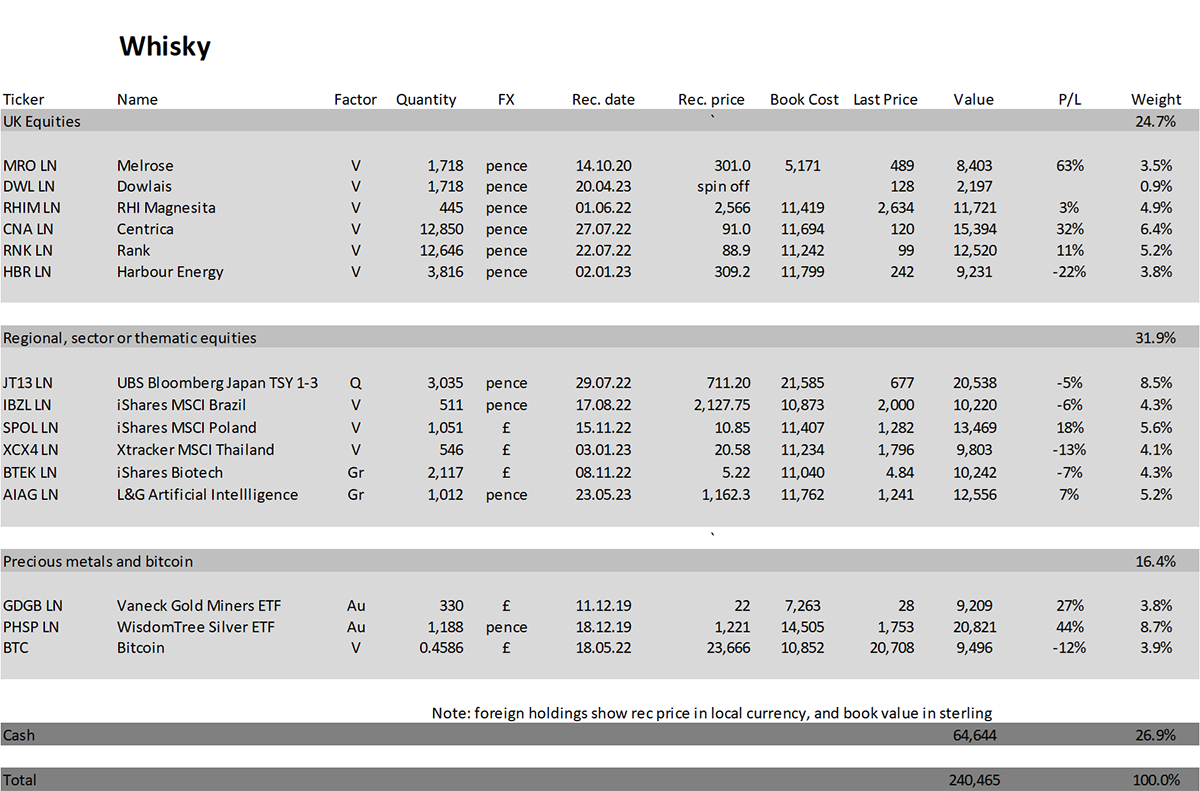

Our Whisky Portfolio has held three of the leading stocks in the FTSE this year. Melrose (MRO) has been the best UK-performing stock in 2023. Centrica (CNA) is in 12th place, with JD Sports (JD) in 13th, which we sold in February during the banking crisis. Having success in Whisky comes as a relief because it reminds me that I am actually pretty good at this, most of the time.

Trouble in the Ranks

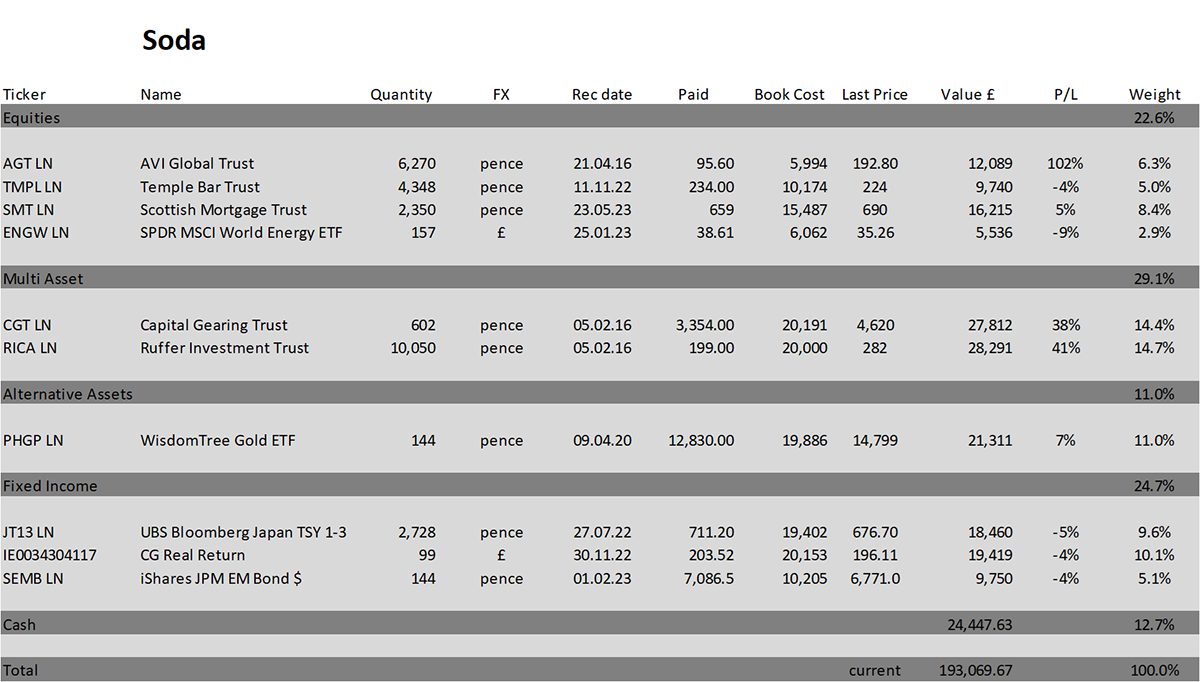

Having beaten the market by 9.4% in 2022, the Soda Portfolio has struggled this year. It is still down 3%, which isn’t much, but certainly an irritation. 2% of that 3% comes from holding the Capital Gearing Trust (CGT) and the Ruffer Investment Company (RICA). The other 1% comes from the modest exposure to index-linked bonds and the Yen, and the about turn on the Chinese-led economic recovery.

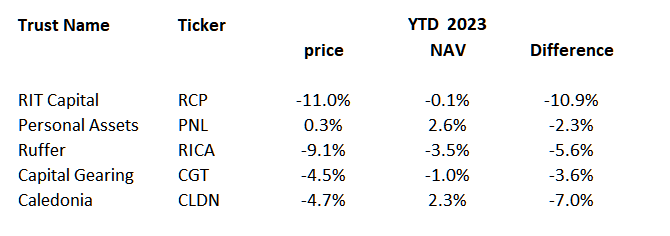

CGT and RICA are not alone. The UK’s leading defensive investment managers have all come under pressure this year, whatever their strategy. Some of these funds couldn’t be more different. Yet what they have in common is they are all total wealth or family office strategies. That means they are designed to be fully diversified portfolios. I show net asset value (NAV) and share prices in 2023.

PNL has held up because it owns some big tech and has the most effective discount control mechanism so that deviations between price and NAV are modest. RCP fared worst as the discount widened the most. CLDN saw an increase in net asset value, yet the price lagged by 7%. RICA has seen a 1% drop in NAV, while RICA has seen a 3.5% drop. Both funds would have seen losses in bonds, despite them having defensive portfolios. Basically, any exposure to bonds, even short-dated, has continued to be negative, which is one reason we have seen a surge in tech. Where else is there to go?

The fall in NAVs hasn’t been tragic. The fall in prices has been much more painful and is down to heavy selling pressure from the wealth management sector. The likes of Rathbones and Brewin Dolphin have been heavy sellers. I am convinced this is because these firms have become too big, and the risk departments are forcing the investment strategies towards index tracking.

Private investors have also been sellers as holdings registered with Hargreaves Lansdown and AJ Bell have fallen for these funds as well.

As you know, discount widening is not permanent. When better times return for these strategies, prices will stabilise. As for their positioning, I have little doubt that all of these funds will do well in the long term.

As for CGT and RICA and their defensive stance, I believe their logic is right, just early. Most likely, when the masters cut interest rates again, we’ll be glad we own them. That can’t be too far away because OPEC+ just cut oil production by a million barrels per day, and the oil price barely moved at all. Mounting evidence of a slowing economy.

Beware of Rate Cuts

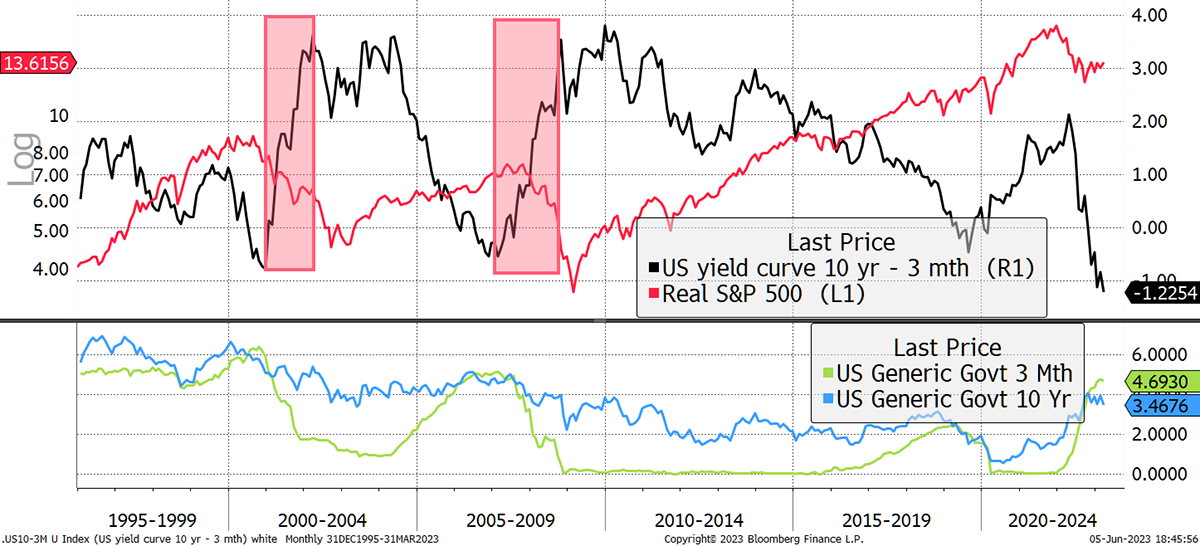

This chart shows the yield curve – the difference between long- and short-term interest rates. Conventional wisdom has it that an “inverted curve” (short rates above long rates) forecasts recession. The banks don’t like that because an inverted curve makes it unprofitable to lend. It is considered to be dysfunctional because, in normal times, investors should be rewarded for taking a longer-term view. Currently, investors are 1.2% better off in bonds that expire in 3 months rather than in bonds that expire in 10 years.

The red line is the S&P in real terms (less inflation). You might think that the great stockmarket crashes occurred when the yield curve was inverted (black line below zero), as there’s a recession coming, but more damage was done after the rate cuts began. It transpires that the worst of the equity bear markets occurred when the yield curve was “steepening” (black line rising), thus forecasting economic recovery.

Bond versus Equity and the Yield Curve

We have seen two good examples in the past 30 years.

- In late 2000, the inverted yield curve correctly forecasted recession, but the stockmarket didn’t show signs of panic until the Fed started to cut rates in early 2001.

- In 2007, once again, the stockmarket didn’t panic until the Fed did. Evidence of an economic slowdown, courtesy of a housing crisis, caused interest rates to be slashed in late 2007.

- The 2020 steepening of the yield curve didn’t put the stockmarket under pressure because it had already crashed, and the largest stimulus in history followed. A good excuse.

It is an imperfect relationship, but we should consider that expectations of a severe recession are not the problem. The economy is slowing, yet the major economies are still experiencing near full employment. Perhaps we shouldn’t panic until the Fed does.

Action:

No action

Postbox

Ignite Lux Holdings offers the shareholders of RHIM a tender offer at £28.50 per share.

I am very pleased I followed you from Southbank to ByteTree because I continue to highly value your analysis and recommendations. Could you please let me know whether you think the offer is a good deal regarding the tender offer for RHI Magnesita (RHIM).

Barclays is the lead advisor in this deal, and before they ceased coverage after the announcements, they had a £29.50 price target. The other five analysts, with recently updated forecasts, range between £26 (RBC) and £45 (Peel Hunt). RHIM is cyclical and may struggle in a recession, but I think what it went through last year with high energy prices is as bad as it gets. I will ignore this tender offer and sit tight.

Excellent update, as usual. What an interesting time to be an investor...

I understand the rationale for selling SEDY - I was quite relieved by your sell instruction as the China headwinds do seem significant. With emerging market value looking like a reasonable bet I wondered what you thought of adding more Latin America exposure to replace it? For example, Blackrock Latin America (BRLA) offers a near 6% yield and the numbers on Morningstar suggest it may be about as cheap as SEDY, plus it's on a double-digit discount. Thoughts?

BRLA is a great idea, but I will not recommend it because it is small, with £117 million of assets and daily liquidity of £200k. It is a great idea for an individual but a bad idea for a TMAI recommendation. If I were to recommend Latin America, which is mainly Brazil, then Mexico and a little Chile, I would choose the iShares Latin America ETF (LTAM) as it is highly liquid. Performance is similar.

Currently, we hold Brazil in Whisky. I take your point about LATAM, which benefits from US reshoring and the next commodity cycle (?), but I am not in a hurry to make any more major decisions after the recent strategy reversal.

We have Melrose with a book cost of £5,171 and Dowlais (DWL) with no cost at all. My understanding is that conventionally the original cost is spread between the replacement holdings in the basis of the ratio of their first trading day closing values, about 78/22 giving costs of £5675 and £1600 respectively. This is slightly complicated by the fact that you would have received one less share than you are showing as, I believe, the fractions were paid in cash and you have rounded up. Sorry to be a pedant!

I could show it that way, and it would be technically correct. But to a lesser expert, we didn’t pay for DWL as it was spun off. You can take the opening price on 20 April as the book cost, but that was set by an investment banker, not the market. It was clearly wrong, as the price fell by 20% that day.

I may add to DWL in due course (buy the rump in a spin-off), but I am biding my time. If I do, I promise to come up with a reasonable book cost that makes sense.

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 3.5% this year and is up 93.1% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 7.6% this year and up 140.5% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

High cash positions are getting easier to defend. It’s going to be a long summer.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()