Macro-Chicken

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 85;

The bitcoin price stays in a range, but the way it is behaving is consistent with a cyclical bottom. The network remains active, and there is continued regulatory progress and institutional experimentation with use cases. Policy error might be the next big catalyst.

Highlights

| Technicals | Low exchange volume and low volatility |

| On-chain | Strong network score |

| Macro | Macro-chicken, the models didn’t work |

| Investment Flows | Virtually nonexistent |

| Cryptonomy | HK opens its arms, and Fund Managers toy with the tech |

Technical

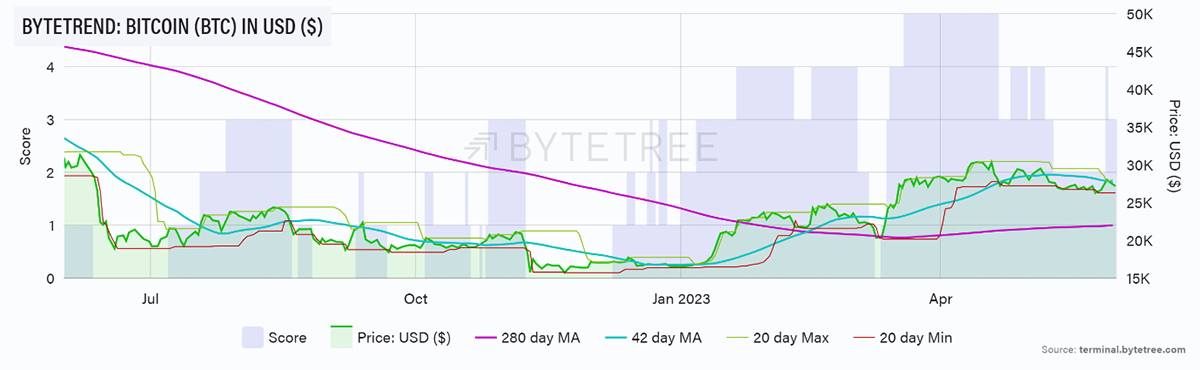

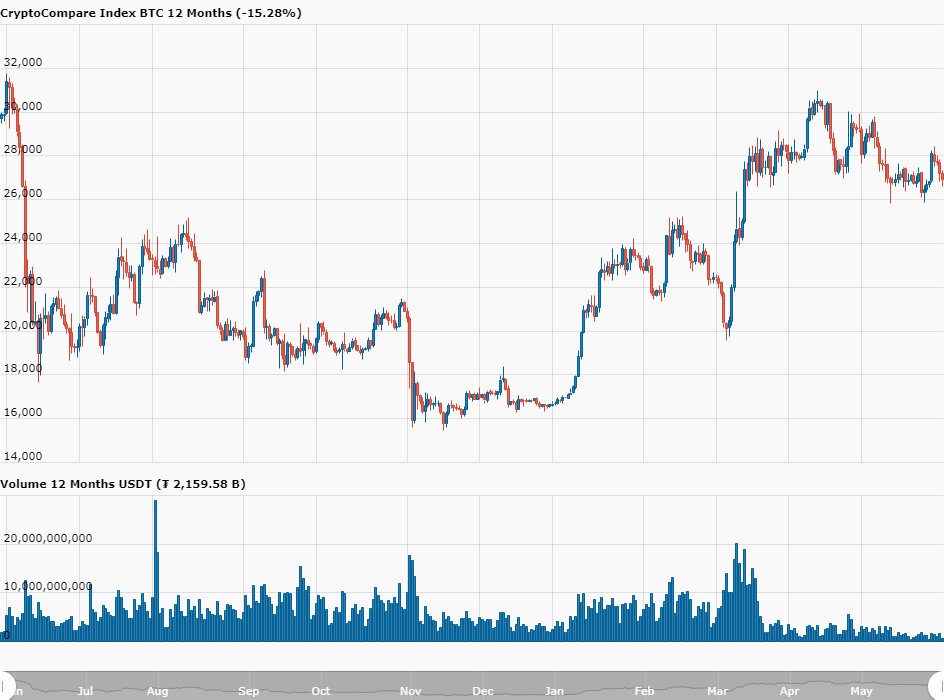

Bitcoin remains in a range, finishing down 7.3% on the month. Since breaking in mid-March, the price has more or less tracked sideways. In terms of momentum, it has come off the boil, reading a 3-star trend on ByteTrend. The two stars that are “off” revolve around the shorter-term moving average since the price is now below that level, and the line is sloping downwards. However, we remain comfortably above the longer-term moving average.

Note also that 18 June 2022 marked the interim bottom after the Celsius collapse. In a couple of weeks’ time, we’ll see favourable year-on-year comparisons.

One aspect which is a little unnerving is the continued weakness in traded volumes, as shown below. This is probably due to the multiple closures of trading operations in the US, with the likes of Bittrex, Jane Street and Jump Crypto stepping aside until there is more regulatory certainty.

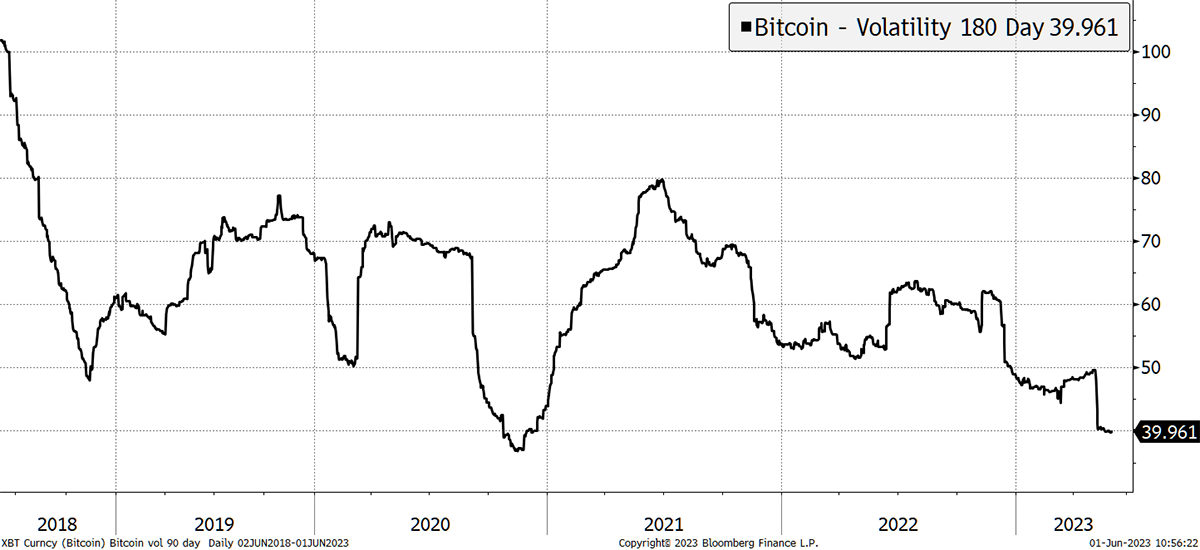

Normally you’d expect to see a more volatile market when large liquidity providers such as these pull out. As it turns out, it’s been pretty much the opposite, with volatility continuing to decline. Indeed, on 180-day volatility, we are back to levels not seen since the price took off in the third quarter of 2020.

Steady price behaviour in low volume is a characteristic of a cyclical asset that is bottoming out. The next flurry of activity will confirm whether BTC is repeating the behaviour of past halving cycles.

On-chain

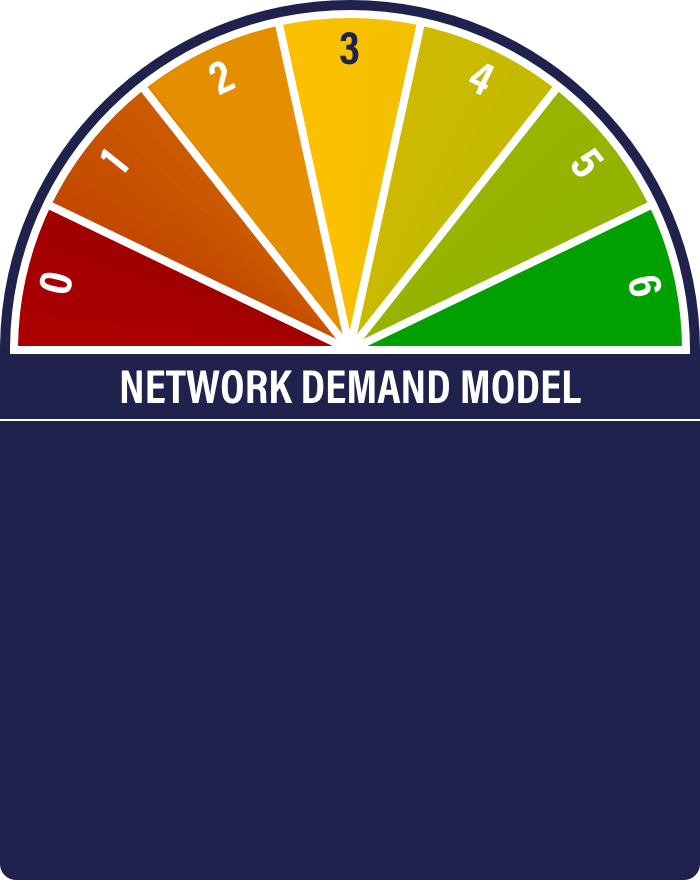

The Network Demand Model finished the month with a maximum score of 6/6. There is nothing to worry about on-chain. While traded volumes on exchanges have fallen, on the chain itself (which really tells us about its value), activity is robust.

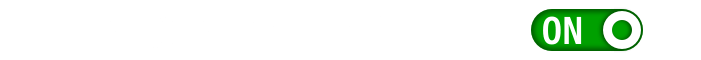

Fees have drifted back from the recent spike driven by Ordinals. However, they look to be steadying out at a higher level than they were pre-spike. That’s good news for miners and network integrity, not so good for traders, and an incentive for the bitcoin ecosystem to accelerate Layer-2 scaling solutions.

Macro

It’s tough for central bankers. The most important task they have at the moment is to re-establish credibility that they mean what they say. The problem is that markets don’t really believe them. Hence, we have had a running game of macro-chicken. Who’s going to be the first to blink?

Unfortunately, it might be the markets, if only because Central Bankers’ obstinacy is liable to break things. This obstinacy is driven by two things: the need to demonstrate they are serious, and because the models tell them to be. Like many investors, they make decisions with great reliance on models. The problem with models is that while they tell us everything about the past, they aren’t great at analysing events, and their extrapolations tend to be linear. They have no more capacity to predict the future than Mystic Meg.

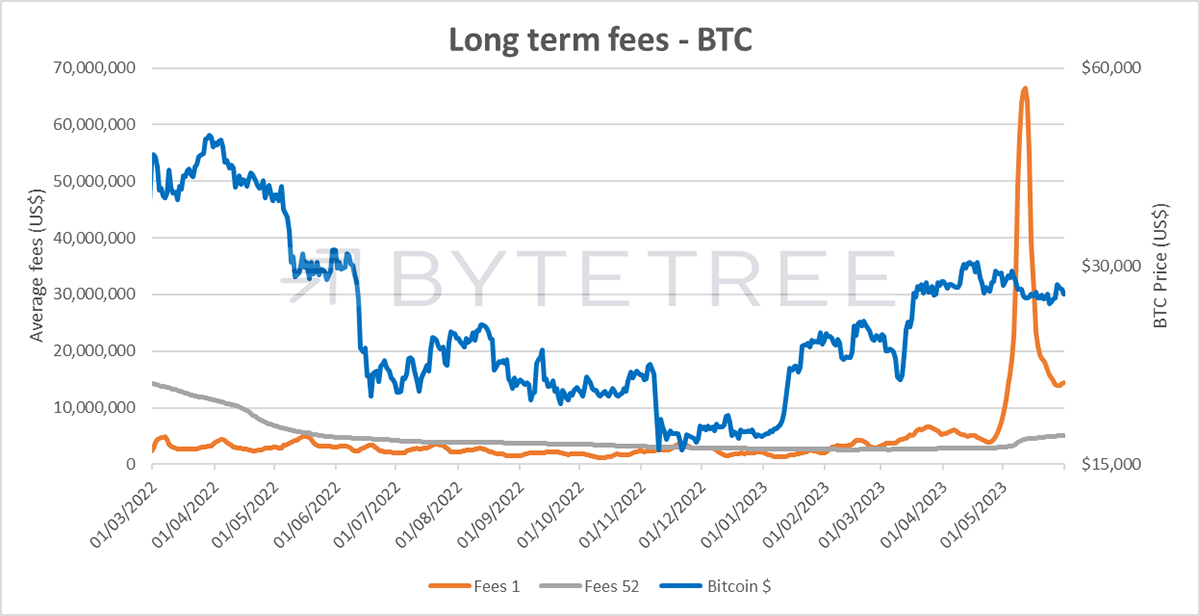

That much was recently disclosed by none other than the Governor of the Bank of England to the House of Commons select committee on 23 May, who confessed that the model they were using didn’t work very well. It had predicted that inflation would fall faster than was actually the case.

So now they have stopped relying on the model. But he added that they have “…got to…get inflation down”. Which presumably means tightening until they see a number of 2% again, given that interest rates are the only instrument at their disposal.

But suppose the model was right after all and just got its timing wrong? Let’s face it, most of the leading indicators, particularly energy prices and commodities (hard and soft), are pointing lower. And property prices don’t look pretty either.

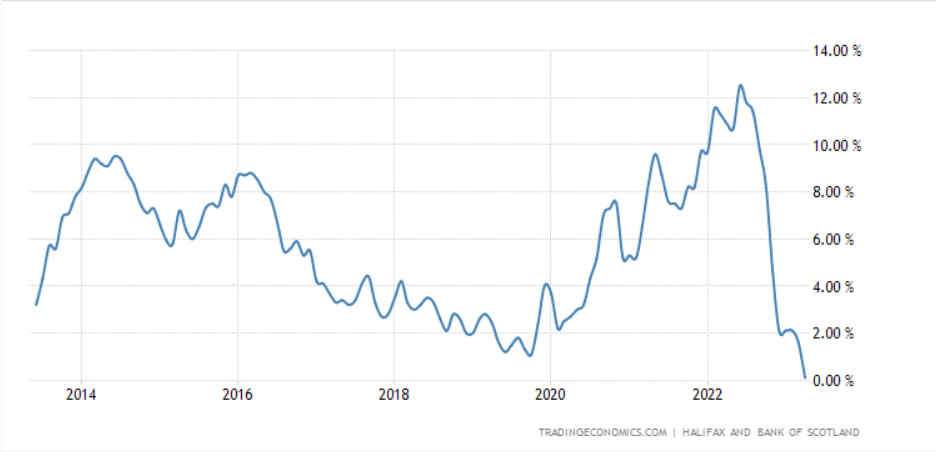

The better news has typically centred around jobs, with markets obsessed by the somewhat inadequate monthly US Non-Farm Payrolls, which reported a strong April number (+253k), and yet elsewhere, we see higher-than-expected job cuts, as shown below.

Stepping away from models and bringing in that reckless imposter “anecdote”, various conversations suggest that there are a great deal of businesses struggling for funding at the moment. Cash calls are rife. In a stubbornly high-interest rate environment, much of that won’t be met, and employment indicators – which are typically a lagging indicator – will start looking nasty.

ATOMIC’s guess is that having been wrong about the strength and duration of inflation, not least by failing to comprehend its root cause, Central Banks will be wrong about how quickly it unravels. Outside a handful of tech mega-caps (which seem to be more akin to US$ holding bays for institutional money), markets are fretting because they sense policy error. The potential good news is that if inflation dissipates faster than expected, the remedial policy will be quick to follow. And that is likely to be the next big catalyst for bitcoin.

Investment Flows

Nothing is happening in either BTC or ETH.

Cryptonomy

Regulation

Good news from Hong Kong, where Bloomberg announced that from next month retail traders will be able to trade digital assets. Strict rules around onboarding, security, liquidity and the eligibility of coins that can be traded are being introduced, which seems eminently sensible and the sort of model that could be followed elsewhere.

It’s a reminder that regulators do not exist to eliminate risk; they are there to enable investors to understand it. Investors will make mistakes, but this is a part of the learning process, and it is the fundamental right of anyone to do what they like with their money. It is how fortunes are made as well as lost. At some point, personal responsibility has to come into the equation, otherwise capitalism is in a sorry state.

Fund Management

Despite the fact that we are in a crypto winter, and crypto is an uninvestable asset class for virtually all institutions, ATOMIC was intrigued to see an A-list line-up of fund houses represented at the recent Digital Assets Conference in London. Among others were Schroders, DWS, Man Group, Invesco, Fidelity and Franklin Templeton. All were exploring use cases for both the front end (tokenisation of funds) and back end (settlement, composability), which at the very least, demonstrates the utility of the technology. Reasons cited for slow adoption included lack of education, reputational risk and the need to get in-house sponsorship.

It is worth noting that when asked whether they envisaged the technology being on public or private blockchains, the responses were non-committal. Early test work is being done on private chains, but they were conscious of limitations in terms of their ability to reach a broader audience and scale. It’s a reminder that we are still very early in the construction of this technology, but for those who think it has no worth, this suggests they will be proved very wrong.