Optimism: The Battle of the Rollups

Disclaimer: Your capital is at risk. This is not investment advice.

Optimism is a blockchain scaling solution built on Ethereum that employs Optimistic Rollups to enhance transaction efficiency and speed while upholding Ethereum's security. With its ability to deliver faster and more cost-effective transactions, Optimism has emerged as a prominent Ethereum scaling solution, boosting its operational speed. In this Token Takeaway, we will delve into the fundamentals of Optimism and assess the value proposition of its native token, OP, while drawing comparisons to another similar protocol, Arbitrum (ARB).

Overview

Founded in 2019, Optimism, like Arbitrum, aims to address the scaling challenges faced by Ethereum. Ethereum, as the largest and most widely used smart contract platform, is plagued with slow transaction processing speeds and high transaction costs. Optimism is specifically designed to overcome these issues and enable Ethereum to operate efficiently.

The governance of Optimism is managed by the Optimism Foundation, which takes charge of conducting experiments and fostering the ecosystem. The Foundation is currently guided by its co-founders Jinglan Wang and Ben Jones, but ultimately plans to dissolve, granting full control to the Optimism community.

In February 2021, Liam Horne, the former Head of Engineering for Optimism, stepped in as the new CEO of OP Labs, the software development company that contributes to the development of Optimism. To date, Optimism has secured substantial funding, including a Series B round that raised $150 million, led by a16z and Paradigm. Previous funding rounds encompass a Seed Round in January 2020, raising $3.5 million from Paradigm and IDEO Colab Ventures, and a Series A round in February 2021, securing $25 million from Andreessen Horowitz, Paradigm, and IDEO Colab Ventures.

How Does Optimism Work?

Similar to Arbritrum, Optimism utilises rollup technology to process transactions. To recap from our Arbitrum Token Takeaway, rollups refer to the technique of bundling multiple transactions together and processing them off the main blockchain, i.e. Ethereum, before storing a compressed summary of those transactions on the mainnet. This approach allows for more efficient and scalable transaction processing by reducing the computational load on the main chain. By batching transactions and verifying them off-chain, rollups can significantly improve scalability and throughput while still benefiting from the main chain’s security and decentralisation.

The primary technical distinction between Optimism and Arbitrum lies in their fault-proof mechanisms. Optimism employs single-round fault proofs, which make the process faster but may result in higher gas fees since it operates on layer-1 (L1). On the other hand, Arbitrum utilises multi-round fault proofs, which take more time.

Additionally, Optimism relies on the Ethereum Virtual Machine (EVM) and is restricted to using the Solidity programming language, while Arbitrum has its own Arbitrum Virtual Machine (AVM) and supports all EVM programming languages.

OP Tokenomics

Optimism launched its OP token in May 2022 and currently has a circulating supply of approximately 645,000,000 OP tokens, with a max supply of 4,294,967,296 tokens. This means only 15% of the overall supply is in circulation, with an annual inflation rate of 2%.

OP is a unique governance token operating under a decentralised governance model. Unlike traditional governance tokens, OP does not grant exclusive governance rights to token holders. Instead, governance rights are shared between OP holders and "appointed citizens" according to Optimism's working constitution. This approach aims to strike a balance between short-term incentives and the long-term vision of the Foundation.

Currently, the Optimism network generates revenue through a centralised sequencer, which adds and organises transactions within the network. The sequencer earns revenue by selling block space, consisting of layer-2 (L2) execution fees and L1 data fees. While the revenue from the sequencer currently goes to the Optimism Foundation, which uses the surplus to fund public goods, there are plans to eventually share this revenue with OP token holders.

The Optimism network is expected to see increased activity as more developers and users are incentivised to participate. This growth will drive up demand for block space, creating a positive feedback loop that benefits both OP holders and the overall network.

In the last 90 days, OP hit a high of $2.73 on 18 April 2023. However, the price dropped significantly in the following weeks, and the token is currently trading at $1.23. This negative price action can be attributed to the overall bearish sentiment in the crypto market.

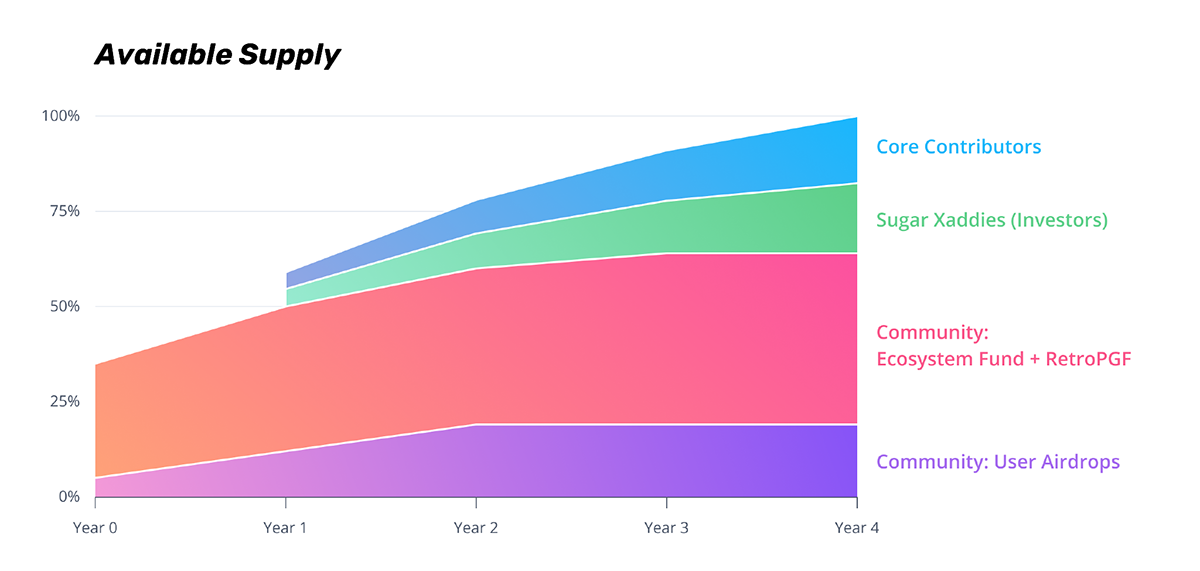

The Optimism Foundation currently holds 26.7% of the overall supply and has divided OP token allocations into several categories to effectively support the growth and development of its ecosystem. The categories include the Ecosystem Fund, Retroactive Public Goods Funding (RetroPGF), User Airdrops, Core Contributors, and Sugar Xaddies (Investors). The OP allocations are as follows:

| Category | Percentage | Description |

|---|---|---|

| Ecosystem Fund | 25% | The Ecosystem Fund is a proactive program meant to stimulate development in the ecosystem by providing funding to projects and communities. |

| Retroactive Public Goods Funding (RetroPGF) | 20% | RetroPGF is the Optimism Collective’s primary mechanism to adequately and reliably reward public goods for the impact they provide. |

| User Airdrops | 19% | A series of airdrops to reward users for specific helpful behaviours, beginning with Airdrop #1. |

| Core Contributors | 19% | The people who’ve been working tirelessly to bring the Optimism Collective into existence. |

| Sugar Xaddies | 17% | Investors. |

Source: Optimism Docs. OP Allocations.

The illustration below highlights the available supply of OP tokens, but it should be noted that the actual circulating supply will depend on governance decisions and the allocation rate for user airdrops, the Ecosystem Fund, and RetroPGF.

Optimism Ecosystem and Adoption

Since both Optimism and Arbritrum cater to the same sector and have similar technologies, comparing their respective ecosystems and adoption can be insightful to potential users. As of publishing, Arbitrum has 332 dApps deployed compared to Optimism’s 130. According to DefiLlama, Arbritrum is the current market leader by far in terms of Total Value Locked (TVL) and total dApps deployed.

Arbitrum

Optimism

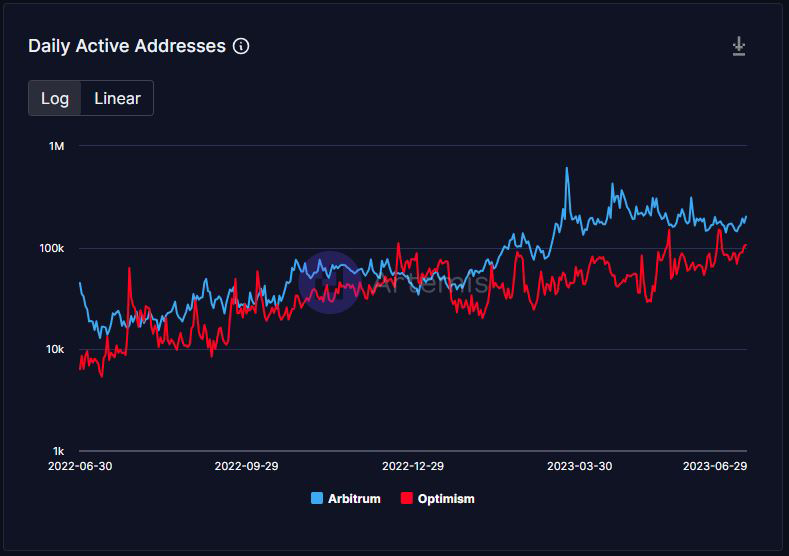

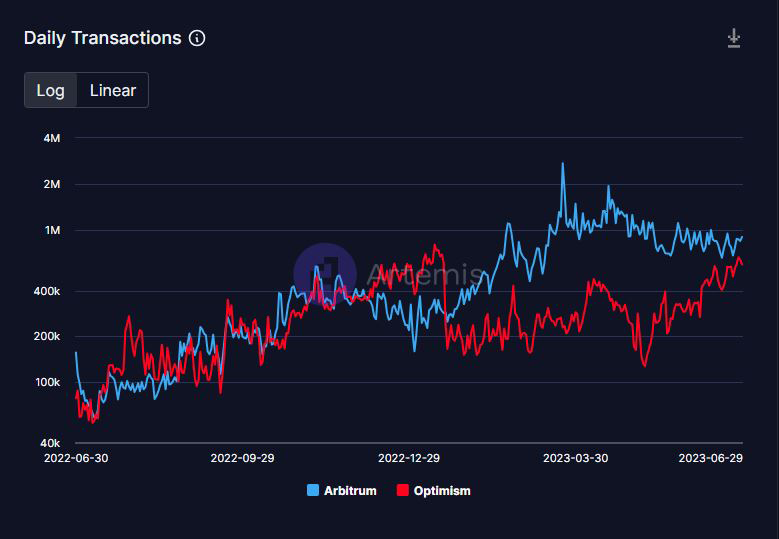

The story is no different when comparing the number of active daily addresses and daily transactions. Both chains have an upwards trajectory in the number of active daily addresses and daily transactions. However, Arbitrum boosts a larger number of active users, but Optimism is not far behind in these figures, as illustrated in the chart below:

Optimism’s Market Position and Competition

In 2023, OP Labs introduced the OP Stack, a flexible and open-source blueprint for creating scalable and compatible blockchains. It provides different modules that can be customised to meet the specific requirements of a project. Subsequently, in February 2023, Coinbase, one of the largest cryptocurrency exchanges, revealed its plans to develop its own layer-2 blockchain using the OP Stack in collaboration with Optimism.

Unlike other layer-2 blockchains, Coinbase's Base will launch as a test network. However, it is anticipated that Base will see significant activity once the mainnet is operational due to the influx of liquidity provided by Coinbase’s centralised exchange.

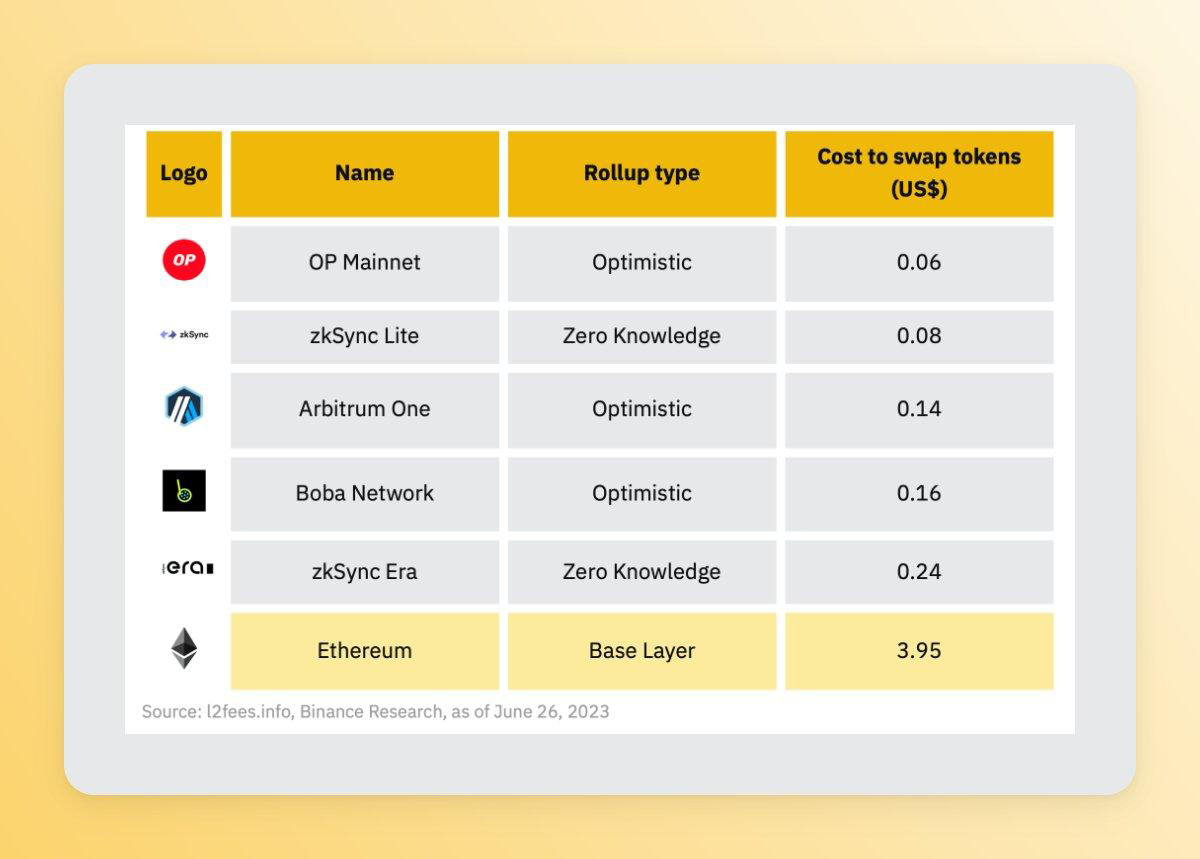

Additionally, Optimism announced the migration of their flagship L2 rollup to Bedrock, marking the official launch of the OP Stack. This upgrade makes the OP mainnet the most cost-effective Ethereum L2 rollup for token swapping.

Bedrock offers benefits such as reduced deposit time, enhanced proof modularity, and the ability to execute multiple transactions within a single rollup block. Optimism's next step is to transition to the Superchain, a decentralised network consisting of L2s (OP Chains) that share security, a communication layer, and the OP Stack.

Several projects have already embraced the OP Stack, including aevoxyz, opBNB, and the Zora Network. The Superchain will include Optimism's L2 rollup chain, Coinbase's upcoming Base L2, and commitments from Worldcoin. This marks the beginning of an exciting phase for the OP Stack.

Conclusion

In the realm of Ethereum layer-2 protocols, Optimism and Arbitrum have their strengths and are making significant progress in scaling Ethereum. While there are some architectural differences between the two chains, such as the use of single-round fault proofs by Optimism and multi-round fault proofs by Arbitrum, these variances have minimal impact on everyday users. Both protocols employ optimistic rollups efficiently, reducing network load and enabling faster transactions and lower fees.

Regarding their respective ecosystem, Arbitrum currently holds a clear advantage in market share. It has a higher Total Value Locked and also leads in terms of the number of protocols, daily active addresses, and daily transactions. However, Optimism is not to be discounted, as its collaboration with Coinbase opens doors to new users and its focus on modularity and interoperability positions it as a strong contender.

Ultimately, both solutions offer unique advantages and are actively striving to enhance scalability and user adoption on the Ethereum network. As the ecosystem progresses and new developments emerge, the dynamics between these two protocols may shift, making it an exciting space to monitor.

However, envisioning the future reveals a landscape where multiple layer-2 blockchains coexist, potentially sharing liquidity and being interconnected through common technology. These interconnected ecosystems, often referred to as superchains or hyperchains, signify a subtle shift in focus from constructing standalone networks to providing fundamental technology. The teams behind these scaling solutions aim to establish the groundwork for novel blockchain ecosystems, positioning themselves to capture a significant portion of the value.

Comments ()