Trade in Whisky;

In 2023, equities are up while bonds are down. The big tech stocks have been in the lead, driven by artificial intelligence, animal spirits, and short covering. With bonds selling off again, risk is rising again. I also look at the strength in sterling and the weakness in the yen and sell the spectacular Melrose.

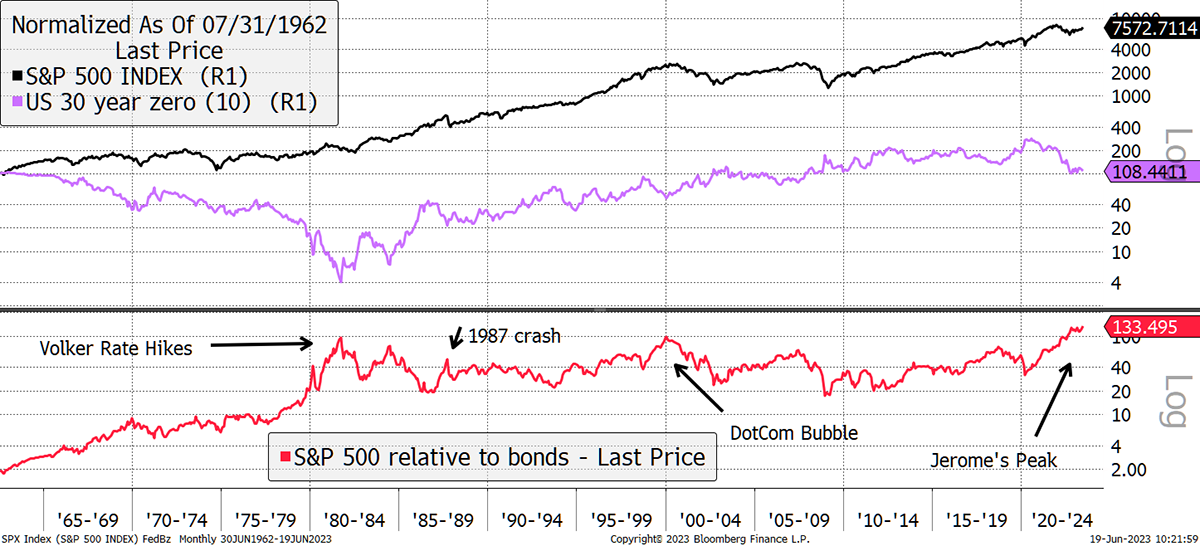

$100 invested in US equities during the Covid market meltdown in March 2020 is now $197, while $100 invested in the long bond has become $48. The sheer scale of this divide is frightening, shown by the red line. I highlight four occasions, including the 1987 crash, that showed similar extremes.

Equities Moving Against Bonds

If the bond market keeps falling, it will put downward pressure on equities at some point. It is not that rising interest rates are a problem for the economy or the stockmarket in the long term, but the speed of change. Rates are rising too quickly for comfort, and the relationship between equities and bonds is stretched.

In contrast, there are near-record levels of short sellers who believe share prices will fall. Normally a buoyant stockmarket would be associated with speculators having many long positions, but today it is the other way around.

As the market rises, being short gets expensive, and the speculators must buy the market to close their short position. This has been a significant driver for equities in recent weeks. What’s most interesting is how the speculators added to their short positions in recent weeks, to the lowest levels on record. The futures market is telling us speculators are short to the tune of $5.6 billion. It’s expensive being a bear.

US Equities Are Heavily Shorted by Speculators

Yet US equities trade on 20x earnings, with a dividend yield of 1.6%, when bonds yield more than twice as much. US equities are hardly enticing.

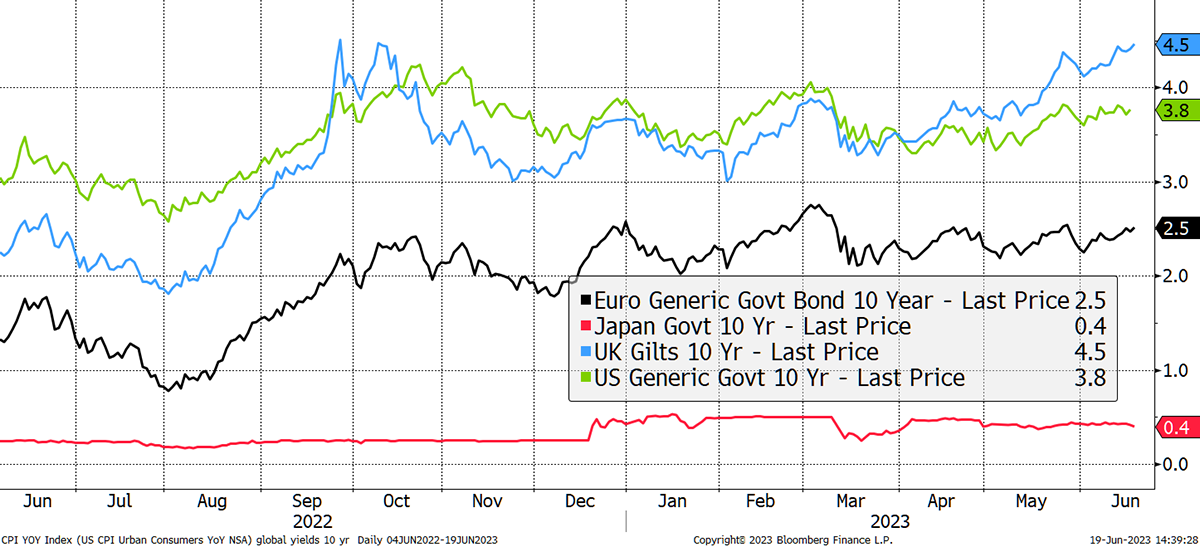

Bond yields are the highest in the UK and the lowest in Japan, where they still refuse to hike interest rates despite rising inflation. Instead, they maintain a policy of yield curve control (YCC), reiterating that last Friday, when the Bank of Japan (BOJ) had been widely expected to tighten policy. With bond yields rising around the world, this puts them at odds with the crowd.

Bond Yields Rise Except in Japan

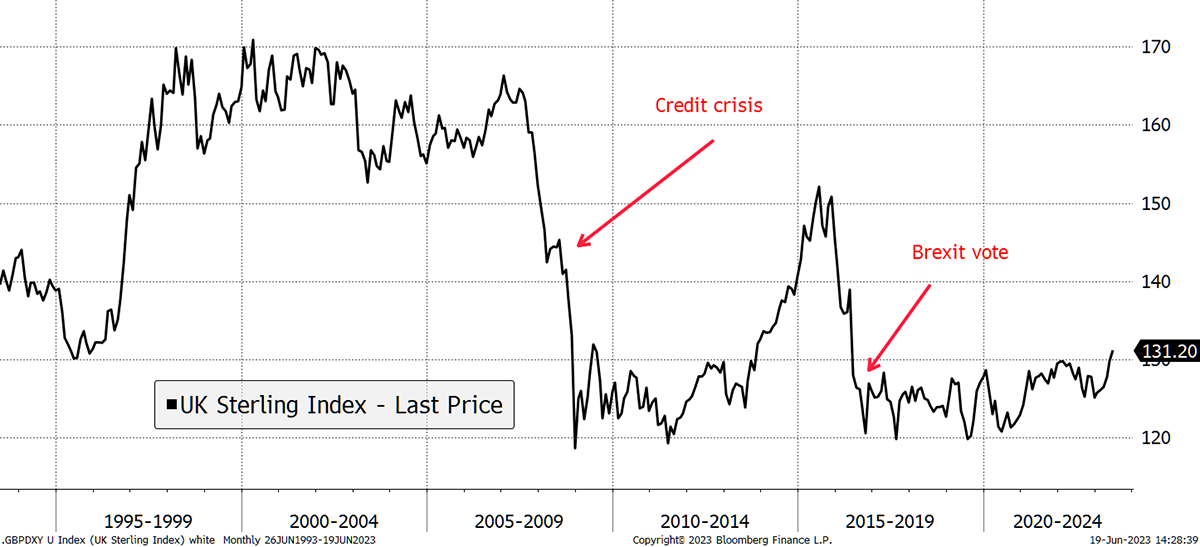

High UK yields have buoyed the pound, which is now higher against a global currency basket than at the time of the Brexit vote, and at the same level as in 1995. The pound tends to rise in equity bull markets and fall during bear markets, probably because the UK is a financial centre.

Pound Is Strengthening

A rising pound hurts gold, foreign bonds and equities. It is a negative for portfolio performance, but it hopefully won’t last forever. But it can continue as long as interest rates keep on rising faster than elsewhere.

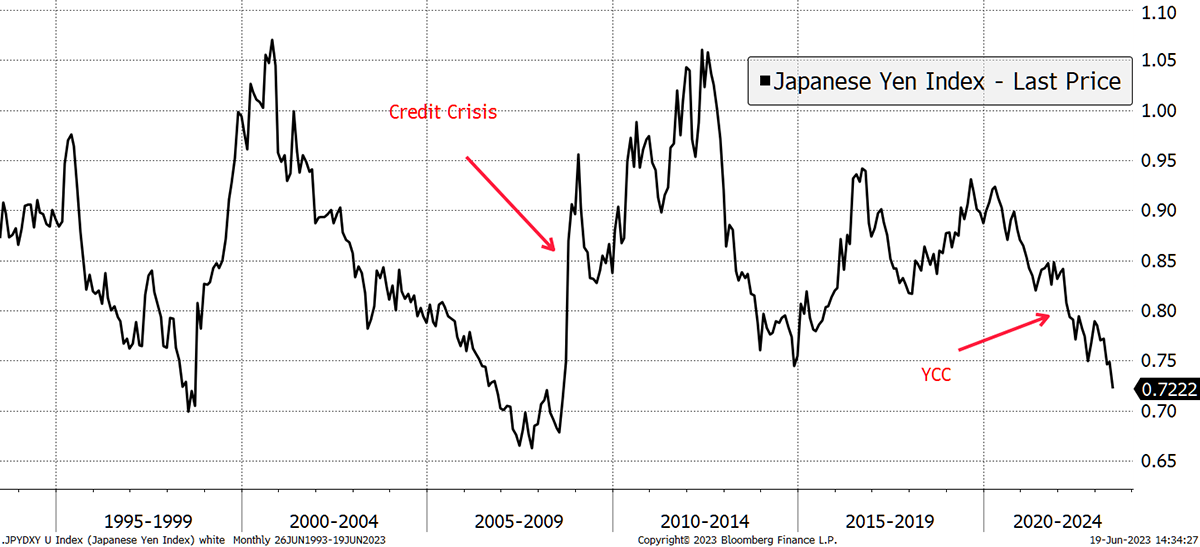

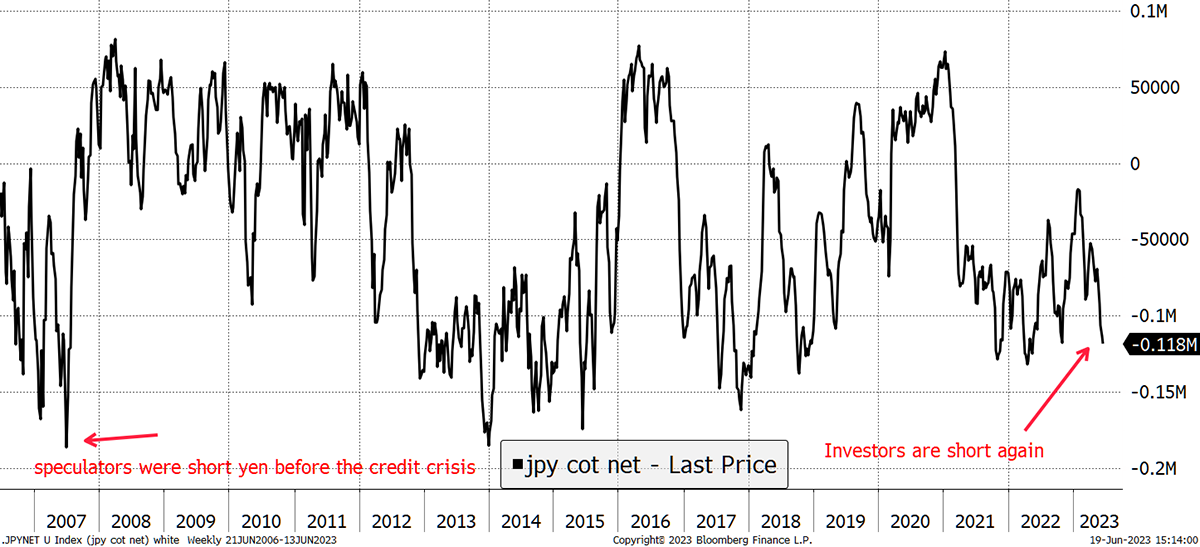

The yen is weak. Last summer, when I recommended JT13 as a hedge (an asset that offers protection during a stockmarket fall), I felt it was already significantly undervalued. To remind you, the yen would need to double against the pound to have the same purchasing power. If the pound rises during bull markets, and the yen rallies during bear markets, then we should not be surprised that it has fallen against the pound in recent weeks, given the strength in equities.

Yen Is Weakening

Still, I am dumbfounded why the BoJ’s decision to maintain YCC when the world is hiking rates. It makes me wonder if they actually like having a weak yen as a way to boost exports. It’s possible because China is devaluing, and perhaps Japan is trying to stay competitive in a currency war.

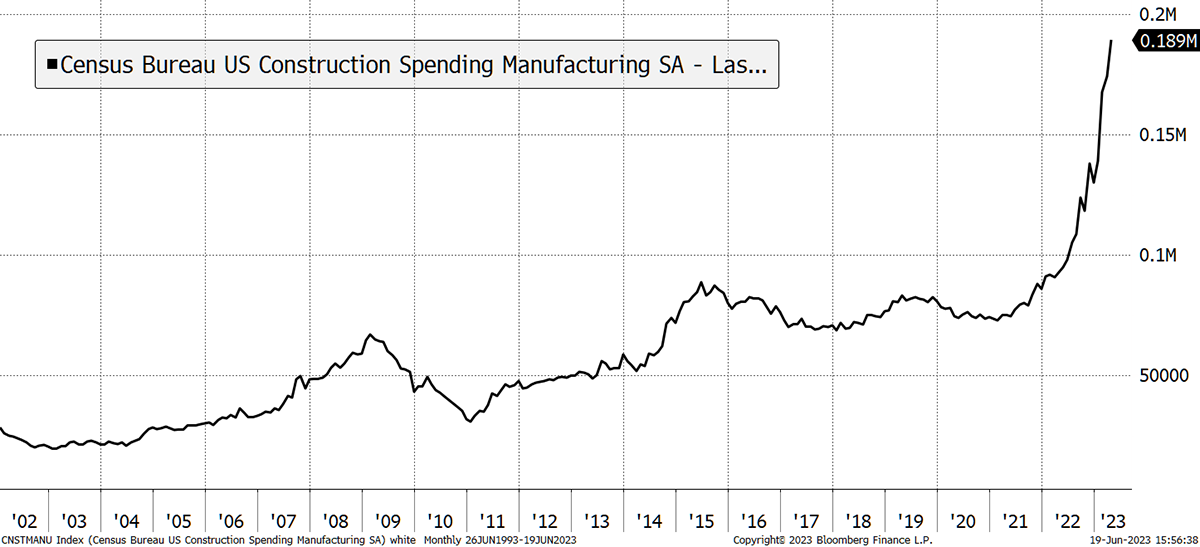

Then you consider US manufacturing which seems to be booming. They added 800,000 manufacturing workers since 2020, taking the total to 13 million. The growth in reshoring is so vast that they’ll need another 2 million skilled workers that don’t exist. This is another example of wage pressures in skilled work, making the inflation targets tough to meet regardless of interest rates.

The driver has been The Inflation Reduction Act (ironic) and the Chips and Science Act, both providing a huge fiscal boost to the economy. While construction is down in offices, retail and housing, it is booming in factories. This recent surge is remarkable as America reindustrialises.

Boom in New Factories in the US

I have no doubt that the yen is dirt cheap, and now would be an excellent time to visit Japan. But recent decisions by the BoJ seem fishy. I suspect that whatever their policy really is, they will not be able to stop the yen from surging when the time comes. Besides, the speculators are short to the tune of $10.5 billion dollars. With numbers like that, things can change quickly.

Heavy Shorts on the Yen

I am unhappy with the fall in the yen, but I strongly believe we should hold our nerve for the time being. If things go wrong, which they may well do, the yen will soar.

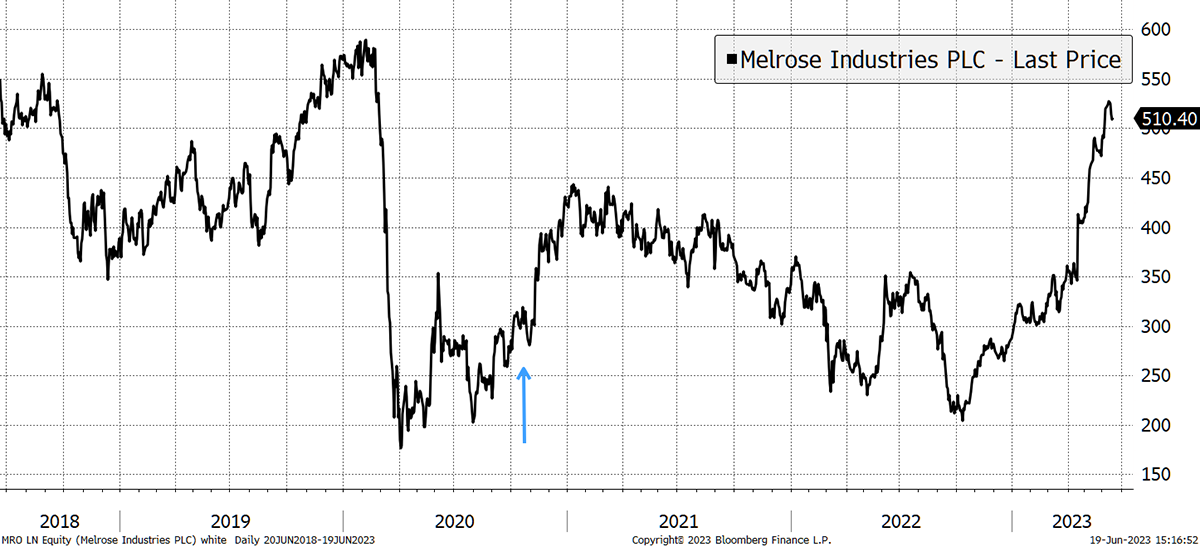

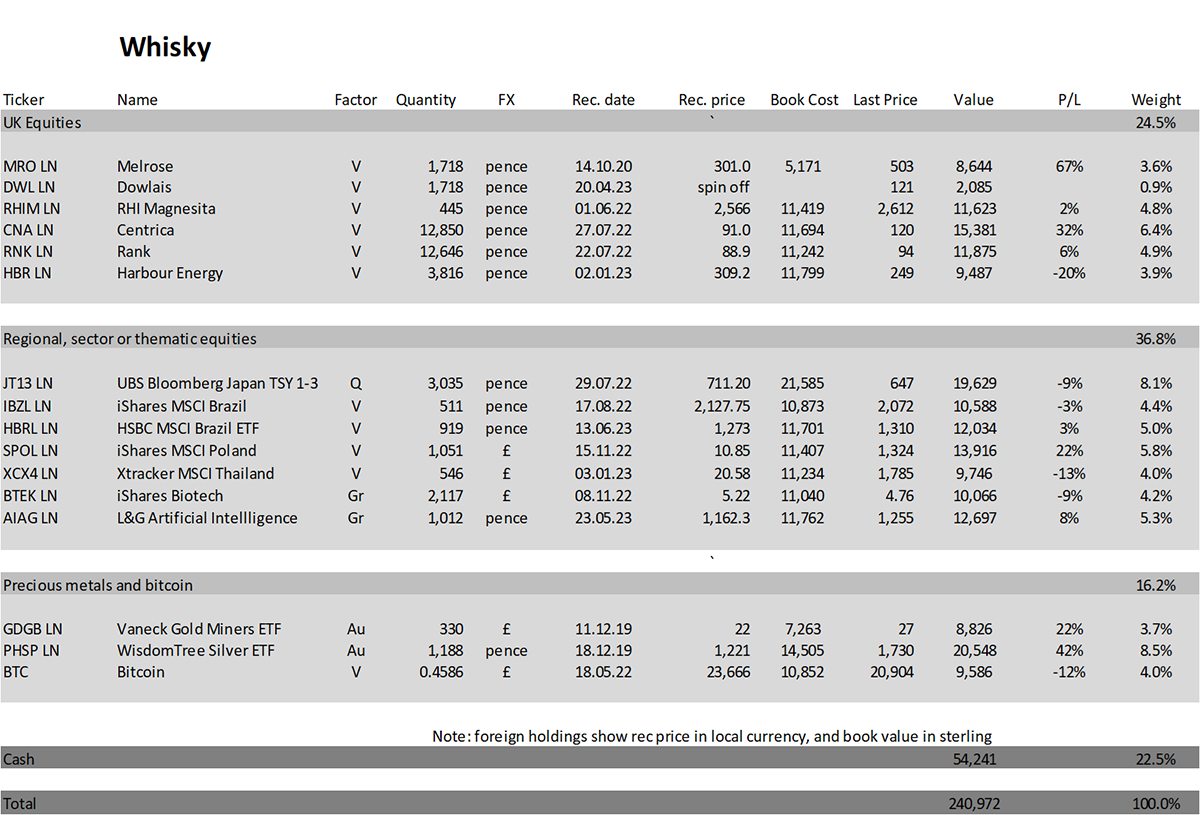

Selling Melrose (MRO) in Whisky

Unlike the yen, this has gone very well. It was purchased in October 2020 and, despite some frustration, has rallied hard following the demerger. The management acquired GKN in 2018 and restructured the business with a spin-off in Dowlais (DWL) this year. The market liked the deal, and the shares have been re-rated. The price is now above expectations, and I think it’s time to take profits. We should hang onto DWL, which I may add to at some point.

Melrose

I keep on looking for good, cheap stocks, but I am not finding them, neither here nor in Europe or the US. That said, I am deliberating over PayPal (PYPL), which is down 80% since 2021 and trading on 12x earnings. It seems simple enough. Am I missing something?

Action:

Sell Melrose (MRO) in Whisky

Postbox

Thank you for your fantastic & consistent investment service. As an ex-City trader (buy & sell side) who has had a rather cavalier attitude to investing in the past I look forward to your sound investment process & ideas each week & wish that I had found your service years ago. Selfishly, as I become more reliant on your work, I have been wondering if you have any succession planning in place? I know this is very difficult to achieve & possibly expensive in money, time & effort but …? Obviously, there’s only one Charlie Morris but even The Great Sage has his sidekick & a process for the changing of the guard. Hopefully you will outlive me but I have a little niggling concern that what if, God forbid, you pop your clogs before time? Apologies for bringing this up, but I think it’s a reasonably valid concern & actually a backhanded compliment. Best wishes (for a long life) & please keep up the great work.

Crikey. Thank you for the compliment, and I assure you I have no plans to wither away. I am 52 and in good health.

I’m not feeling like the great sage at present, as Soda is down this year, but the pound will run out of steam sooner or later, and things will improve. To have won in 2023 would have meant a pile of big tech and little else. On that note, it’s unusual that stock picking in Whisky has worked nicely, yet large allocations haven’t. It shows us how markets are very narrow at present. We’ll be right in the end.

I take your point that I should have a team and succession. When I take on managed accounts, that would be a good time to recruit youngsters. To start that we would need pledges of £50 million of assets to manage. We are halfway there, and maybe we could launch this next year.

I have been investigating ByteTrend and I think it could be a very useful tool, but I wonder if one improvement could be made. I think we would be looking to get in on a trend when it’s at approx. 3 stars, but looking at the list of commodities for example, it is not quickly apparent if those commodities on 3 stars have come down from 5 stars or have come up from zero stars. It would be really useful to be able to easily identify those that have come up from zero stars because that’s the direction we are mainly interested in but the reverse could also be useful also to short. The daily change has its uses but if a longer timeframe such as monthly trend or an overall bullish or bearish direction could be indicated then i think this could be really useful. Apologies if I have misunderstood the concept here at all, in which case please correct me.

The point of trend following is not to anticipate trends but to jump on board when they are established. Strong trends can go on for much longer than you’d normally expect. It isn’t the case that a new trend predicts high returns, but vice versa. High returns start with a trend. If you make a habit of buying strong trends, you’ll inevitably stumble upon winners. This is why momentum investing works, but it requires relatively high turnover and discipline.

Most trends flip-flop around with 1 to 4 stars. Only 0- and 5-star trends stand out as weak or strong, very much in keeping with the AAA report. Naturally, prices have already moved lower or higher in order to establish the trend, so it isn’t always perfect, but it identifies the leaders (and laggards) through filters, which is valuable information in understanding markets.

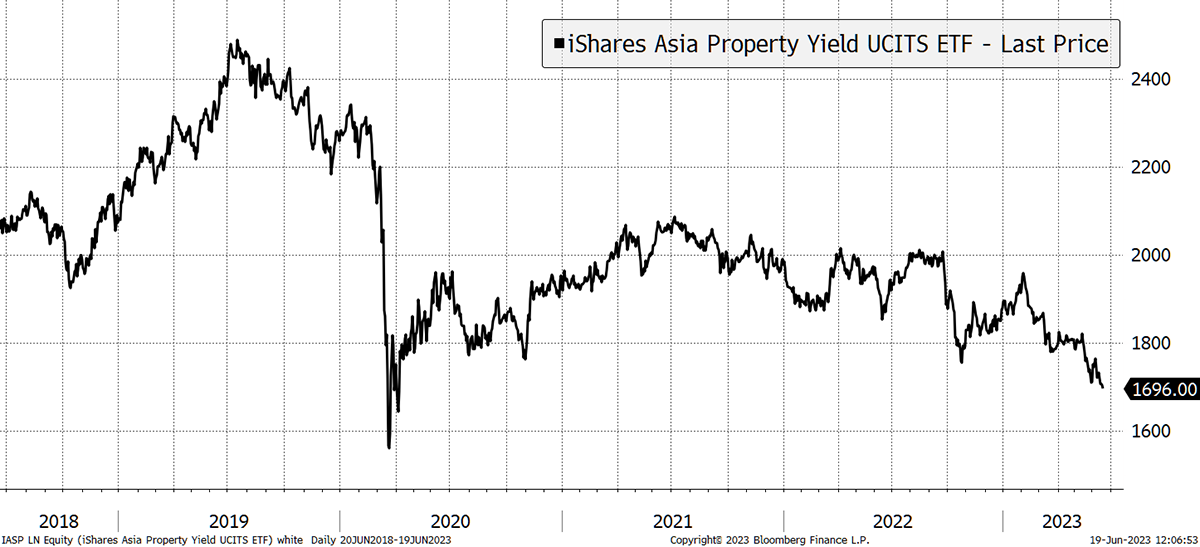

Trend following doesn’t give us all of the answers; it is a process. It is also useful for idea generation and understanding markets. By looking at countries and sectors relative to world equities, I can see that rate-sensitive sectors, such as healthcare, property, and consumer staples, are laggards, while tech and industrials are winners. Banks are currently neutral. In countries, the weakness is mainly in Asia, especially China. In themes, one of the weakest groups of stocks is Asian property. That tells us that the region is weak, which is why I have been backtracking in recent weeks.

Weakness in Asian Property

There is so much going on in markets, and a 2-minute glance at ByteTrend is a highly efficient way to stay on top. And sometimes it highlights the great outliers. I believe Brazil is a good example.

On purchasing Bitcoin, readers have written in:

You can easily buy Bitcoin in the UK via PayPal.

And …

If your readers want to easily exchange their money for mainstream crypto tokens then Kinesis Money offers the facility to do so, and to buy exposure to gold and silver in a sort of crypto format too. Seems to work well, and the physical metals they hold against the tokens are audited four times a year by the Aussies (I’m in the UK and hold mine in their Aus account to balance off some degree of confiscation risk. I do not work for KM.

Thank you. Revolut is easy as well.

Portfolios

New readers, please find a note at the end after the summary.

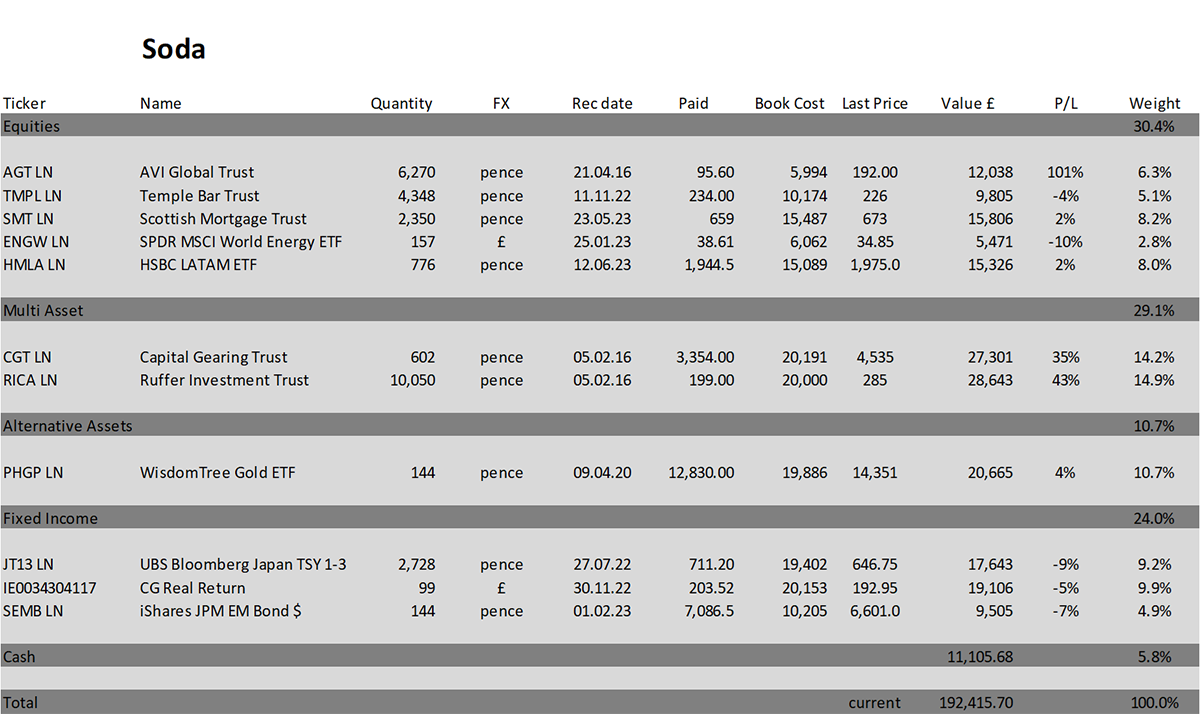

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 3.9% this year and is up 92.4% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 7.9% this year and up 141.0% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

The US manufacturing revival is really quite something. What are we doing here in Europe?

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd