Trades in Whisky and Soda;

The highest returns over the next decade are likely to come from the developing world. A typical developed country is overindebted and has an ageing population. In contrast, a typical emerging country has less debt, a more youthful population (China excepted), and enjoys a faster rate of economic growth. It is also where we can find more attractive valuations, which is the primary driver behind long-term equity returns.

I recommended Brazil in Whisky last August while still at Southbank. It was a simple value situation where both the stockmarket and the currency offered good value. I believed that inflation had peaked and confidence would return, despite the reelection of President Lula. The price hasn’t moved much, but the 8% yield has been helpful.

Brazil is sensitive to commodities, and that is perhaps why the stockmarket seems to be so cheap. While prices might be soft in the short term, I suspect this will change in the next cycle. In contrast, Mexico manufactures goods headed for the USA, which is a nice position to be in, considering the deteriorating relationship with China. One advantage of the Americas is that they are protected by two oceans from the escalating arguments on the other side of the world.

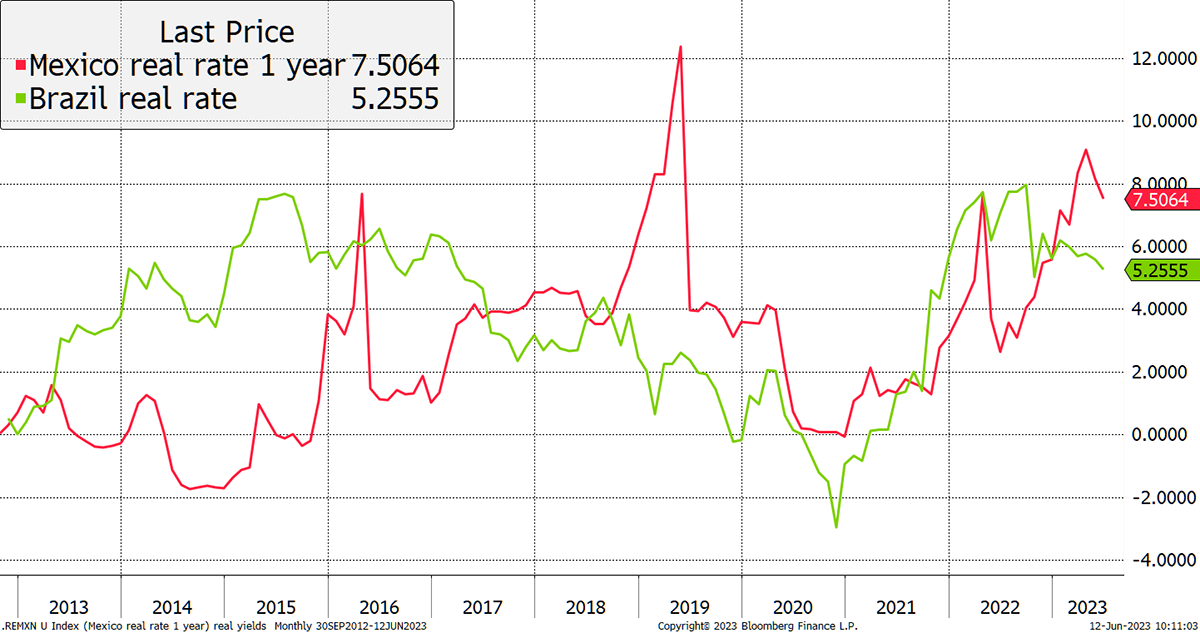

We could find fault in Latin America (LATAM), but it is a compelling situation. The valuations have been held back by the highest real yields in the world. The Mexican 10-year bond pays 8.8%, and in Brazil, 11.1% when inflation is falling. This is attracting foreign capital, and both the Mexican Peso and the Brazilian Real are rising. Brazil’s central bank chief, Roberto Campos, indicated an improvement in market conditions, “it makes room for an action on monetary policy ahead.” That’s code for rate cuts, which will boost growth.

Historically, when real rates have fallen in LATAM, the stockmarkets have done well. 2016 was a spectacular year for Brazilian equities. Real rates fell, and the Bovespa doubled in sterling terms.

High Real Interest Rates in LATAM

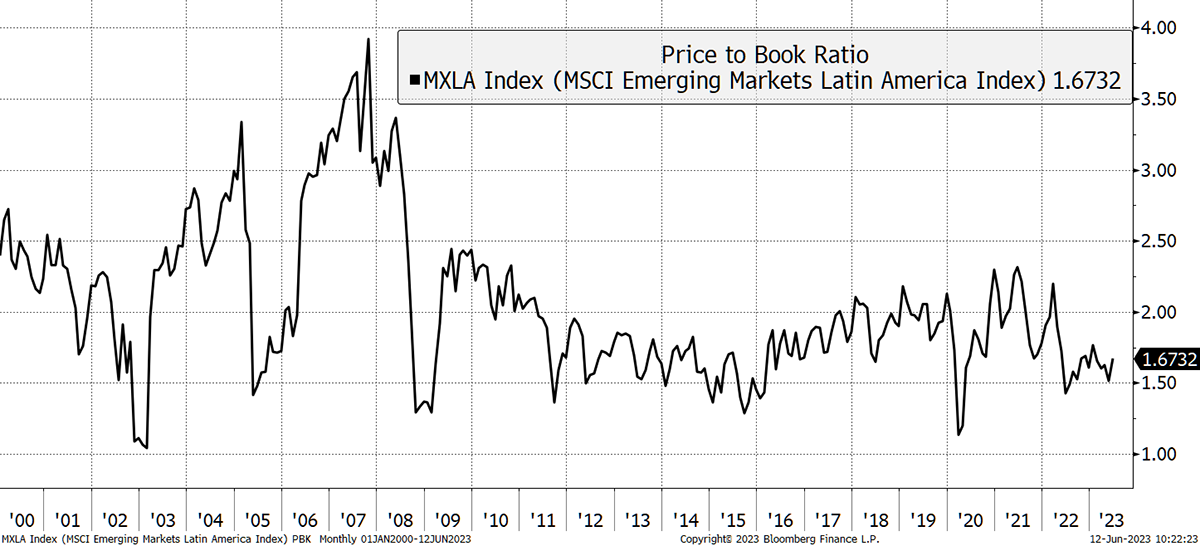

With inflation seemingly under control, we have a catalyst for capital inflows and an equity bull market. We also have low valuations. The LATAM index trades at 1.7x book, which is commensurate with bear market lows. This is a good entry point on value grounds.

Low Valuations in LATAM

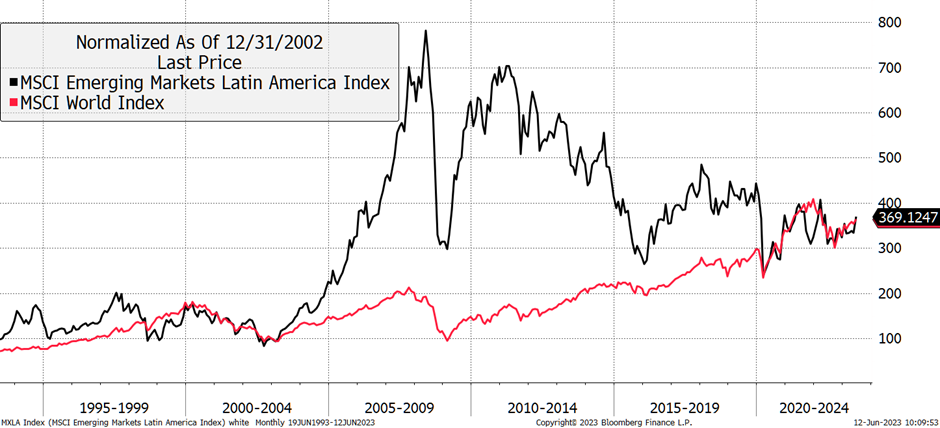

The journey of LATAM equities versus the world over the past 30 years in dollar terms is shown. After a surge in the 2000s, they are ready to go again.

LATAM and Global Equities

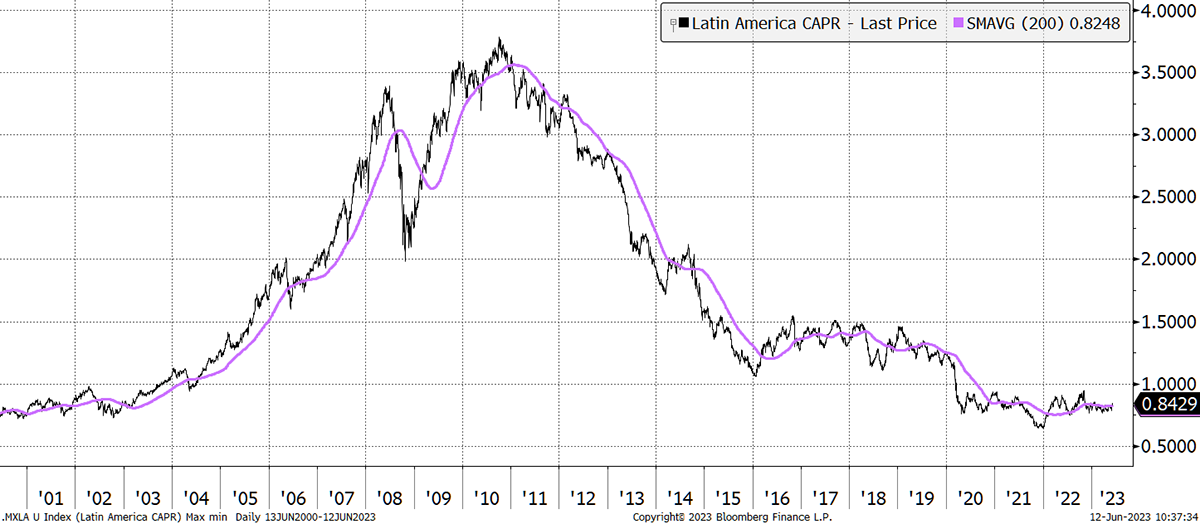

I now show that same chart relative to the world. 2016 excepted, it has been a decade plus of misery.

LATAM Relative to the World

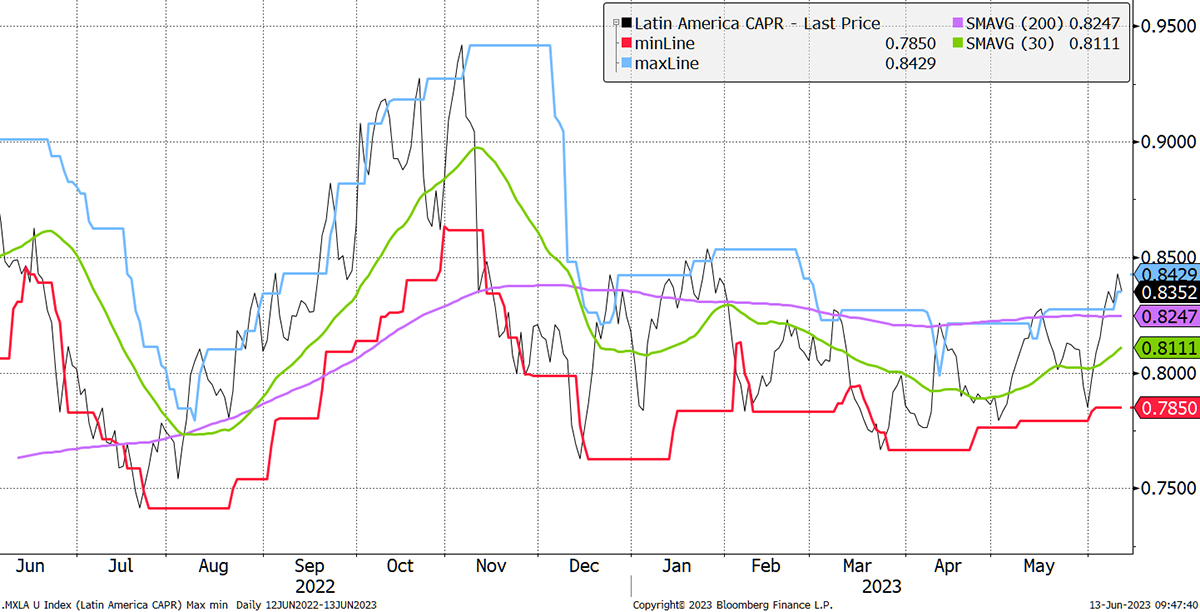

Zooming in on the past year, and adding a ByteTrend overlay, LATAM may have begun a new upward trend.

LATAM 5-star Tend Relative to the World

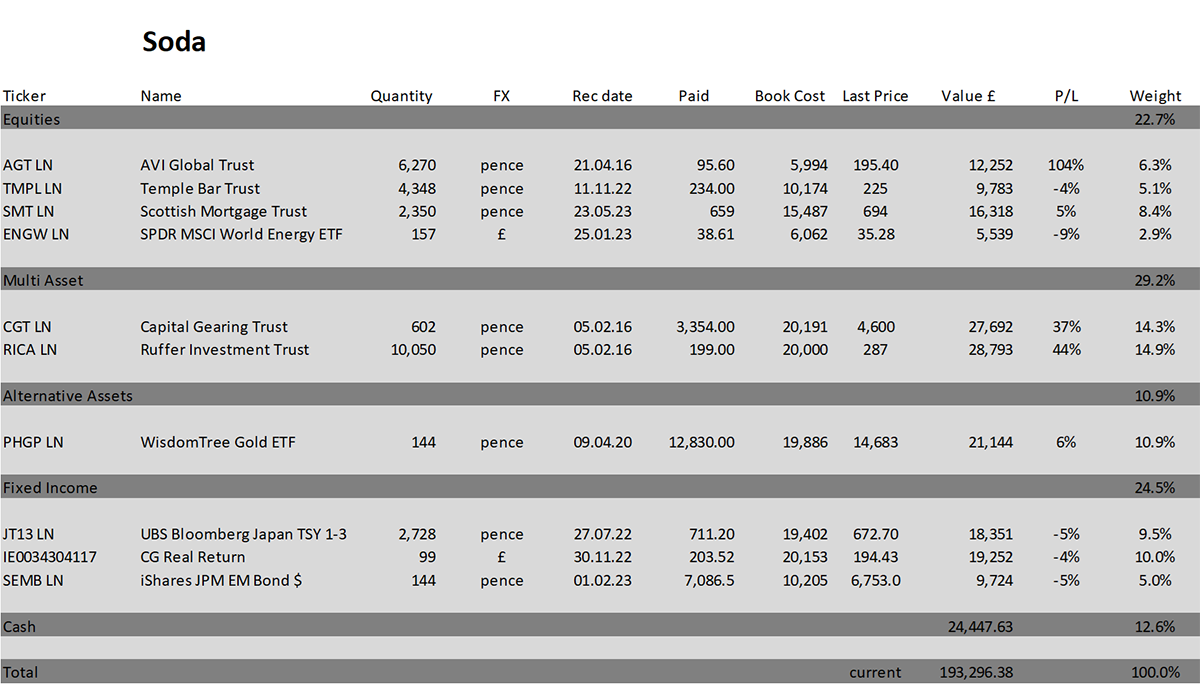

Buying 8% HSBC Latin America ETF (HMLA) in Soda

I have selected HMLA because it is cheaper than the iShares product LTAM. HSBC charges 0.6% per annum, whereas iShares charge 0.74%. Other than that, the holdings are effectively the same. According to the factsheet, the fund is 58% invested in Brazil, 30.4 % in Mexico, with the rest in Chile, Peru and Colombia. There are 88 companies, and the expected dividend yield is approximately 6%. HMLA trades in GBP.

The iShares LTAM ETF is an alternative if HMLA is not listed on your broker’s platform. That also trades in GBP.

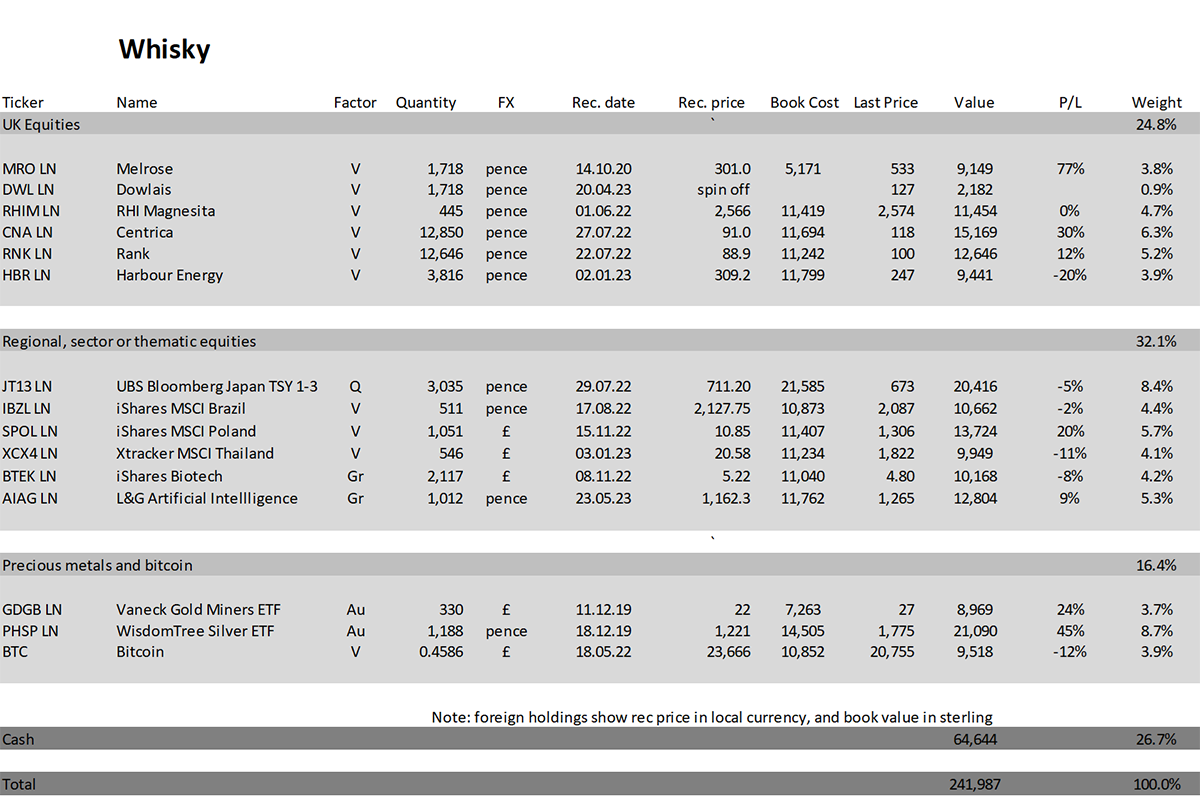

Adding 5% HSBC MSCI Brazil ETF (HBRL) in Whisky

We currently hold IBZL by iShares, which charges 0.74%. HBRL charges 0.5%, so a win for the cost-conscious. Other than that, they track the same index and so will have the same outcome. According to the factsheet, there are 48 companies held in the fund.

I am doubling exposure because this is a very good opportunity. Brazil has more upside, and I believe this is one of those rare moments in life when the investment case jumps off the page. Even if it remains a slow burner, the yield is 8.5%, and so we are paid to wait.

Risk

Given the diversification and the value in both the equities and the currencies, I believe Latin America is medium risk. Brazil is more concentrated and has higher volatility (25% vs 21% for LATAM), but I still deem it to be medium risk. Political risk is higher than in developed markets.

Deflation in China

Ambrose Evans Pritchard wrote a piece in the Telegraph “Forget inflation – deflation is the real danger”.

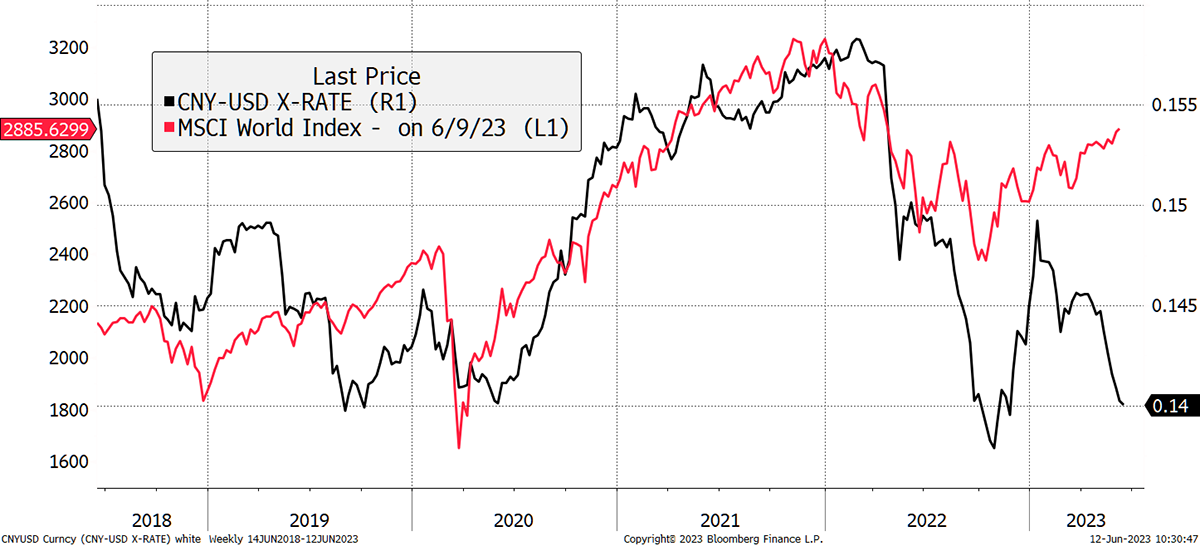

He highlights how producer prices are falling sharply, and the threat is debt deflation which could be spread around the world. China needs to export their way out of their situation and will not hesitate to devalue their currency. The point for us is that stockmarkets have tended not to like a falling Renminbi. Might this be yet another relationship in markets that is breaking down?

China and Deflation

He’s inevitably right about China, but I am less certain is how far it spreads. If we get deflation, they’ll start printing money again.

Action:

Buy 8% HSBC Latin America ETF (HMLA) in Soda

Buy 5% HSBC MSCI Brazil ETF (HBRL) in Whisky

Postbox

It’s good to have you back! Or for me to be back with you, to be more accurate. I still held my Whisky and Soda, but only with access to Fleet Street advice. I see that there are some differences.

Nice to have you back. Please understand I cannot legally give personal investment advice. Much has happened over the past year, and the only way to get the portfolios back in line is to buy and sell accordingly. I appreciate it means quite a few changes over a busy period. The Soda trades are always the most important to follow. Whisky tends to move faster, so you can wait for new ideas to emerge, which they always do.

I have the bulk of my money in an Aviva pension fund exposed to poorly performing bond funds. When I asked them for low-risk solutions, their lowest risk offering hadn't beaten its benchmark or sector average over the last 5 years. Can you identify any low-risk options which could actually break even or potentially show a return, then it would be great to see what I've missed.

I don’t want to delve into independent financial adviser territory, but that is where you will get “advice” on your personal circumstances. Sadly, the system believes that bonds are low risk and equities are high risk, and advice follows that principle. Bonds have done very badly, and unfortunately, that has impacted the lowest-risk investors more than the risk-takers. Ironic but true.

I would point to Ruffer (RICA) and Capital Gearing (CGT) for the low to medium risk options. But even they have struggled in the current climate. If you treated them as bonds funds, which I sort of do, they’d be at the top of the pack. But recent performance has been frustrating. It’ll improve.

How does a UK investor buy BTC or ETH, and which brokers will sell it?

No traditional brokers in the UK sell BTC or ETH. You need to use a specialist crypto firm. The easiest option is Coinbase, but their US operations have come under attack from their regulator, the SEC. If the UK lifted the ban on crypto ETFs (ETPs), life would be much simpler.

What risk rating would you give to BOLD?

The regulator thinks any crypto exposure, no matter how small, means the product should be disallowed on UK investment platforms, although it is not illegal to own. The regulator takes the view that crypto exposure is ultra-high risk, and you should be prepared to lose all of your money.

My view differs. I think Bitcoin is a class above crypto and is on its way to becoming a mainstream asset. Crypto is risky, and much of it is worthless, but there are hidden gems, and the crypto space will lead to many new applications. Bitcoin is well established alternative asset and should not be ridiculed as just another crypto.

Let’s say gold is medium risk because it has volatility similar to the FTSE 100 or S&P 500 (circa 15% on average), is highly liquid and is the king of alternative assets.

Bitcoin is still evolving, and as it does, its risk will fall. It was once ultra-high risk, but its volatility has fallen from 150% a decade ago to 45% today, less than listed companies such as Volvo, Vestas, Tesla etc. Bitcoin is less liquid than gold but more liquid than silver. I believe Bitcoin is medium-high risk or, being cautious, high risk. When you have 80/20 weights spilt across gold and bitcoin, you are 80% medium risk, and 20% high risk. The result is medium-high risk until you consider the assets are generally uncorrelated, and so risk is further reduced by the diversification benefits. I therefore believe BOLD to be medium risk.

The regulator/system strongly disagrees with my thesis.

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 3.4% this year and is up 93.3% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 8.3% this year and up 142.0% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

The thing I like about LATAM is that it is relatively insulated from geopolitics, dirt cheap, and unquestionably a diversifier while still being a good opportunity.

Let’s do the Cha-cha.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd