Zozobra

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report Issue 83;

The annual In Gold We Trust Report has become the most keenly awaited publication in the gold world. It is fact-filled and covers every aspect of the market. In this issue, I edit the highlights. I also look at the melt-up in stocks, the gold regime, the Yuan and the Yen, and so much more.

| ARTICLE HIGHLIGHTS: | |

|---|---|

| Highlights | In Gold We Trust Report |

| Inflation | Equity Boom, Bond Bust |

| Macro | Yuan, Yen and Gold |

| Regime | Hike 'til Gold Breaks |

| DGLD | Gold on the Blockchain |

In Gold We Trust Report Highlights

Our friends at Incrementum produce the In Gold We Trust Report, a 415-page monster on everything relevant to gold. It’s a big read, and I am going to cover the highlights that I believe are the important takeaways from an investment perspective. There are other fascinating sections covering history, exchanges, and geopolitics, which I will leave to you. One thing you can be sure of, the IGWT Report is reliably and unapologetically bullish gold.

Debt and Demographics Drive Structural Inflation

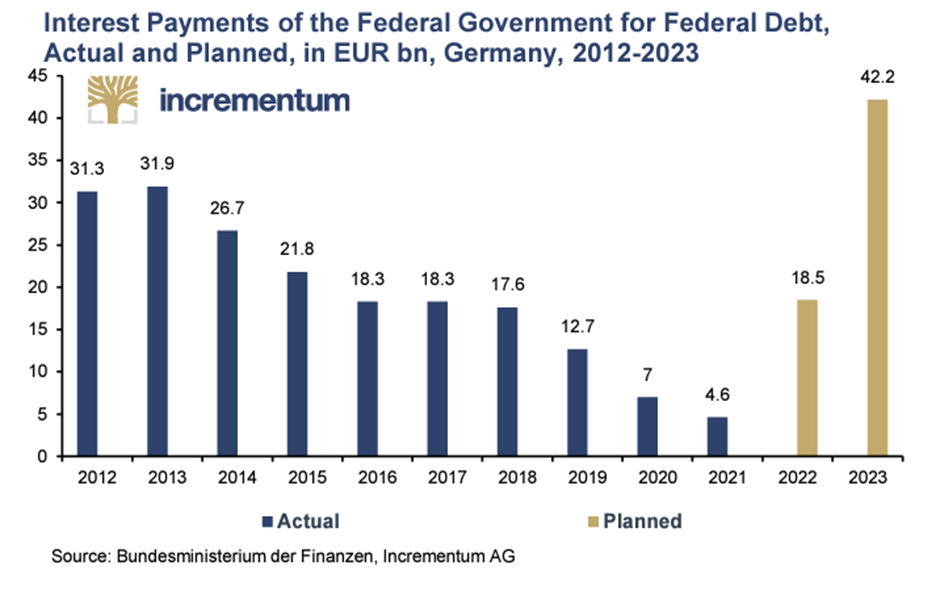

Global debt levels are off the scale and nowhere more so than in the Western developed economies. Society doesn’t discuss this much because it is too frightening to bear. As an example, interest payments in Germany are skyrocketing, while interest rates are still only 3.25%.

One problem has been the issuance of inflation-linked bonds, which have become a fiscal own goal. Although inflation-linked bonds account for only 5% of total German bond issuance, they make up 25% of total German interest payments on government debt.

In the USA, the national debt is now USD 31.4 trillion, or 121% of GDP. The idea that an economy can grow out of debt has always been dubious. To ease the burden on sovereigns, central banks could soon use the instrument of yield curve control (YCC). There is precedent in Japan.

For the federal budget of the USA, the refinancing requirements in the coming years represent a considerable burden. According to calculations by Horizon Kinetics, the USA will have to refinance half of its national debt of more than USD 35trn by 2025. Should the financing and refinancing succeed at an average rate of 4.4% and the remaining interest on the national debt remain at around 2.4%, the interest service would more than double to USD 1.2trn by 2025.

In the words of Mohamed El-Erian,

“The world’s most powerful central bank is now confronted with two unpleasant choices next year: crush growth and jobs to get to its 2 per cent target or publicly validate a higher inflation target and risk a new round of destabilized inflationary expectations.”

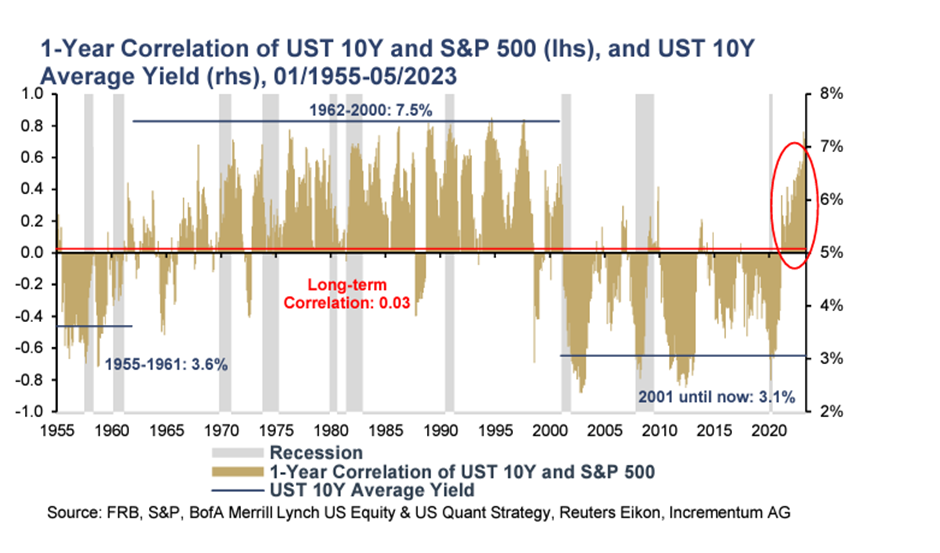

IGWT showed the bond-equity relationship since 1955. When interest rates have been low, bonds and equities have moved in opposite directions. And when rates have been higher, they have moved together. If rates remain high, then equities and bonds are in competition for capital, and given only equities provide some protection against inflation, bond yields will have to rise further.

They see inflation as structural. The demographic change where the population is ageing means there are fewer people in jobs, and they will demand higher wages. Zoltan Pozsar believes the labor market is ridiculously tight, and unlike El-Erian, he doesn’t think unemployment is going to go up much during this hiking cycle. He added,

“people go on strike not because the price of flatscreen TVs goes up, but because the prices of food, fuel and shelter go up and you can’t make a living… low inflation is over and we’re not going back.”

There’s also deglobalization and friend-shoring, as the West turns its back on China. Whatever you think about China, they seem to be able to make things more cheaply than anywhere else, meaning prices will have to rise as the world rebuilds supply chains. This transition, including the vast investment in green technologies, will require capital, all at a time when geopolitical tensions remain high. According to Russell Napier, we need to rearm, re-shore, restock and rewire. That sounds expensive.

Bringing it back to gold, IGWT said we live in times of “Zozobra”, a Spanish term for a specific fear, with connotations reminiscent of the swaying of a ship that is about to capsize. The term emerged as a key concept among Mexican intellectuals in the early 20th century. Zozobra refers to the feeling of losing one’s footing, of feeling out of place in the world, or of not being able to make sense of what is happening.

From West to East

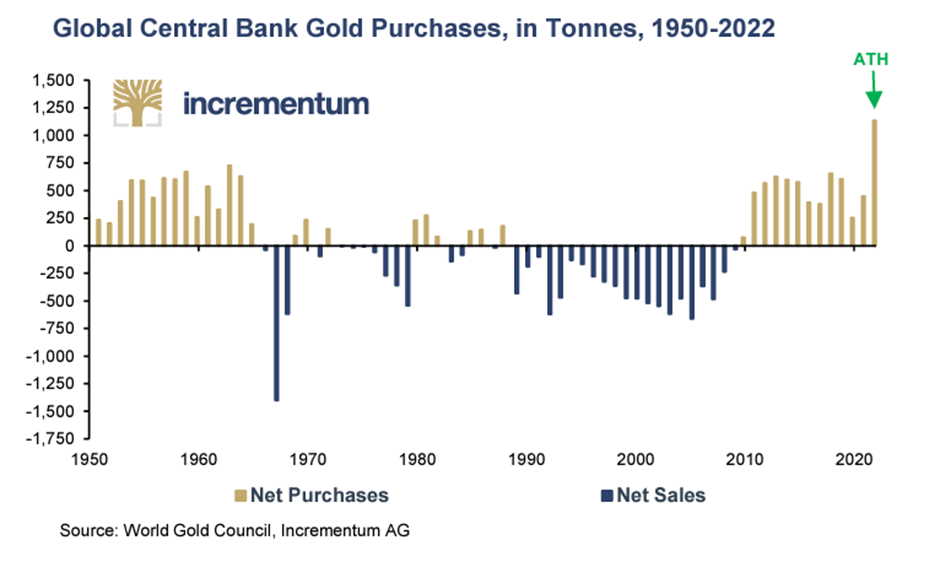

This chart says it all. The central banks bought gold until the late 1960s when it played an official role in the financial system. When that came to an end, they couldn’t unload it quickly enough. That lasted until 2009, the aftermath of the great financial crisis, when the central banks resumed their purchases. No one told them to buy gold, nor was there a collaboration. They figured it out by themselves, and last year saw record gold demand from the central banks.

Who’s buying? The list includes Egypt (47t), Qatar (35t), Uzbekistan (34t), Iraq (34t), India (33t), the United Arab Emirates (25t), Oman (2t), the Kyrgyz Republic (6t), Tajikistan (4t), Ecuador (3t), the Czech Republic (1t), and Serbia (1t). The World Gold Council reported “substantial” unreported purchases from institutions, amounting to roughly 50% of all purchases. Not all countries report their gold purchases regularly, including China and Russia.

Who’s not buying? The over-indebted countries in the developed world and professional investors.

The IGWT Report told the story of how, when visiting Saudi Arabia, China’s President Xi was met by a grander reception than US President Biden received. This symbolizes the change in world order, and when the Western military left the Middle East, there was peace.

Collectively, the emerging markets account for 87% of the global population, 76% of the total land area, 44% of global GDP (up from less than 20% in 2000), 76% of global GDP growth over the past 20 years, and 76% of global foreign exchange reserves. A respectable chunk of those reserves will find its way into gold.

The gold is flowing from west to east. The West seems to have less influence and less relevance. The dollar remains the reserve currency but not everywhere. We will see more trade being carried out in other currencies, especially the Chinese “Petroyuan” and in the CBDC that follows.

We still think of the gold market in terms of London’s physical LBMA market and the US Comex futures market, but new exchanges are popping up all over the world. The center of gravity of the gold market is moving eastward.

Digital Gold and Intrinsic Value

Incrementum, like ByteTree, proudly sits in the Bitcoin AND Gold camp. Just as ByteTree has its Bitcoin and Gold Index (BOLD), Incrementum has a Digital and Physical Gold Fund. Our companies were twinned at birth.

For many, it is a battle of Bitcoin OR Gold, where there can only ever be one answer. IGWT points out that these assets are complementary, with each having advantages and disadvantages over the other.

IGWT considers Bitcoin to be a ground-breaking monetary invention that they expect to continue to gain significant relevance. They want to address some of the misconceptions that gold investors hold regarding Bitcoin, and vice versa, thereby highlighting the positive aspects of both assets. Ultimately, they aim to strengthen the case for investing in both assets to bridge the gap between the two communities and contribute towards harmony and collaboration within the sound-money camp.

Peter Schiff, the vocal gold investor, said that Bitcoin can never be money:

“Bitcoin has all the properties, except the most important one. Without that property, gold would never have been money. I’m talking about value. Intrinsic value of the metal itself. You see… Bitcoin doesn’t have any.”

In my opinion, Bitcoin has no intrinsic value if you believe the network has no value. On the face of it, Bitcoin, the thing, the reference in the cloud, the bunch of numbers, is worthless. That is until you realize that many other people want that reference, deem it to be valuable, and furthermore, there is a deep and liquid market for Bitcoin in both bull and bear markets.

Schiff overlooks that it is much harder to create a vast and lasting network than it is to create physical intrinsic value. Everything in the real world (trees, cars, broken spoons) has some intrinsic value, but only a few things can brag about having a deep and liquid market. Most assets are hard to schifft.

To attribute gold’s value to its physical attributes is to miss the point. Its beauty, conductivity and shine have broadened its appeal over time, and no doubt gold the element has significant value. What makes gold even more valuable as a monetary asset is its scarcity and its liquidity (network). The value of gold-the-monetary-asset is substantially greater than the intrinsic value Schiff refers to.

Gold is a hugely liquid market, which is another way of saying it has a vast network. The gold price comprises the intrinsic value of gold in addition to the monetary premium on top. If the world’s central banks didn’t own gold, and its liquidity declined, the price would be a lot lower than it currently is. Without liquidity, the price of gold would fall until it reached its intrinsic value.

I believe Schiff is accrediting too much value to gold’s beauty and physical qualities. Gold’s real value, just like Bitcoin’s, comes from its network and role in the financial system.

Incrementum’s Mark Valek said, “Owning Bitcoin and Gold means being short fiat.” I like that. There is much more in the IGWT report, and I thank the IGWT team for yet another excellent edition. And a Happy 10th Birthday to Incrementum AG.

Equity Boom, Bond Bust

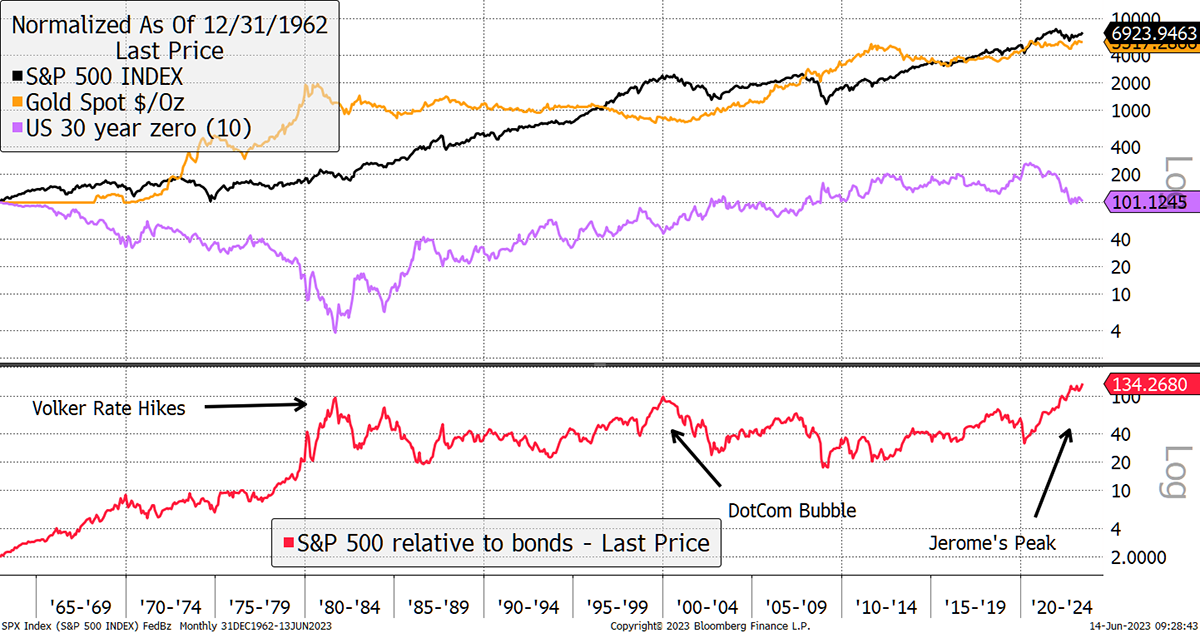

The long-term charts of equities, bonds and gold allow us to focus on the big picture. For bonds, I show price, as opposed to total return, which is simply a synthetic zero-coupon bond. Over the past 60 years, shares have risen 69x, gold 55x and bonds 1x. I agree that excluding dividends is mean on both bonds and equities, but this is about levels and correlations. 1x for bonds is simply saying the long bond yield is the same today as it was back then.

The Equity Bond Spread Just Made an All-Time High

The red line shows equities relative to bonds. It enables us to identify periods of excess, such as 1982, 2000 and 2018. Perhaps even today, as it is at an all-time high. I highlight this chart because historical extremes should not be ignored.

It also reminds us that during inflationary times, such as the 1960s and 1970s, bonds fell while gold surged. Equities fare somewhere in between, but crucially, they outperform bonds, as seen by the red line rising at the time. Furthermore, there are times when equities and bonds have moved together and times they have moved apart. As said in the IGWT report, they become correlated in a higher-rates and inflation environment.

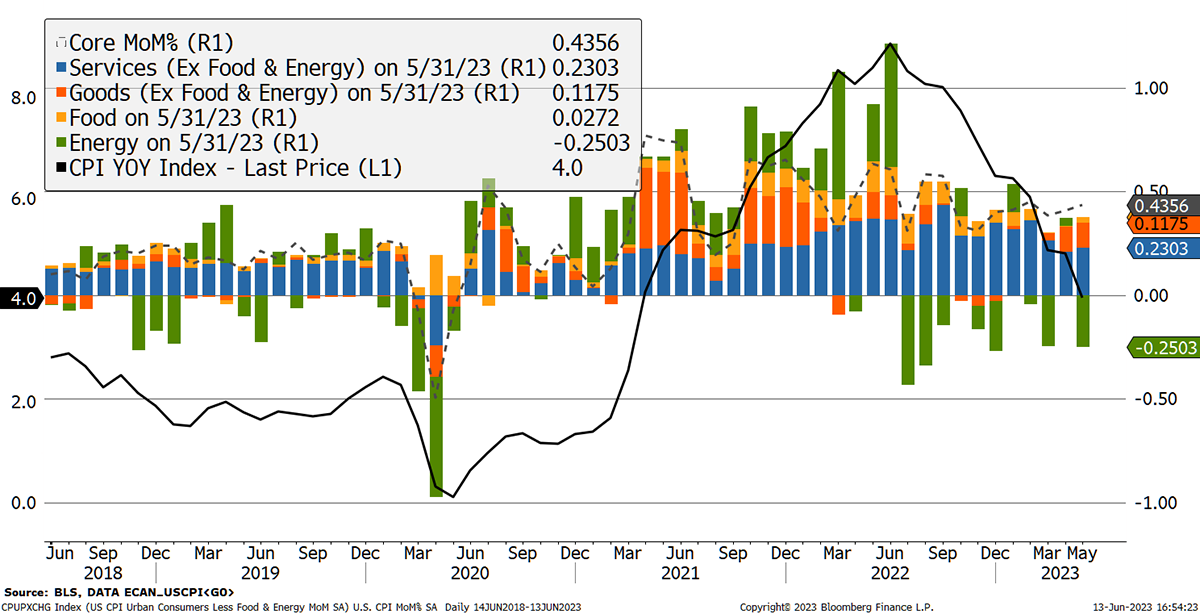

I hear some say inflation is over, while others think it’s just resting. The recent US inflation data was published broadly in line with expectations. CPI over the past year is a mere 4%.

US CPI Monthly

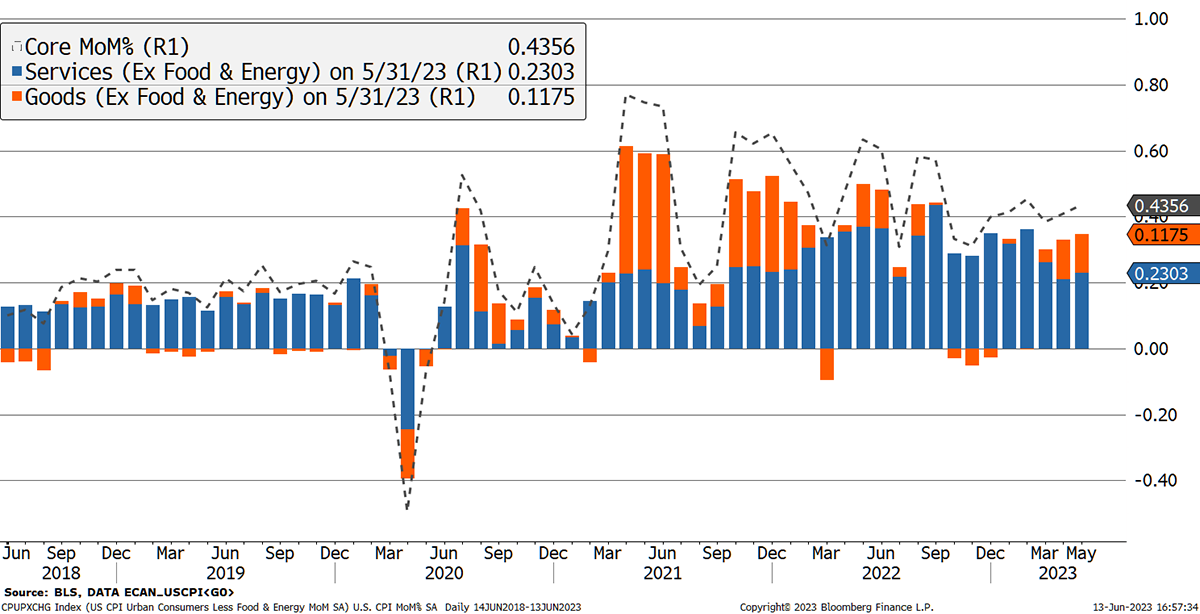

I will separate out the two types of inflation. Firstly, core, which is services (wages) and finished goods. This appears to be sticky, as Zoltan told us it would be.

US Core CPI Monthly with Goods and Services Shown

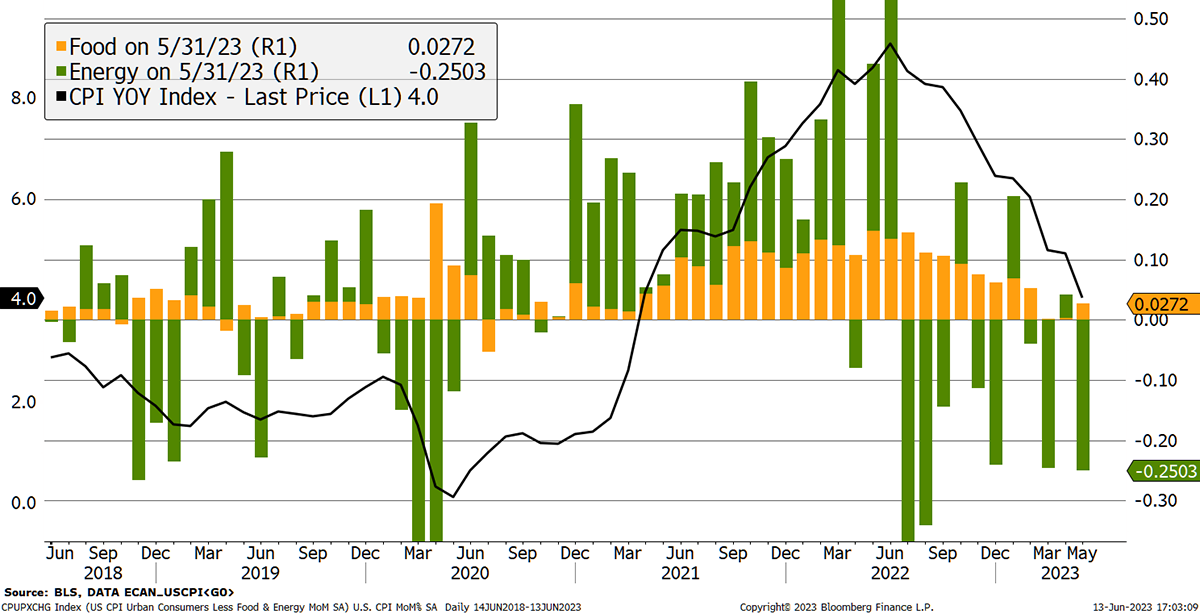

Then there’s food and energy, which have fallen. CPI for food and energy is essentially zero because commodities are in a bear market. That won’t last forever, and the next up cycle will see them buoyant again.

US CPI Monthly with Energy and Food Shown

It’s going to be a long fight for the central banks. To get services and goods prices (reshoring from China) down, they’ll need a recession. Or a Chinese devaluation.

Yuan, Yen and Gold

A Chinese devaluation is underway, and the question is how far it will go. China has a debt crisis, and according to Ambrose Evans Pritchard, who wrote a piece in the Telegraph, “Forget inflation – deflation is the real danger”.

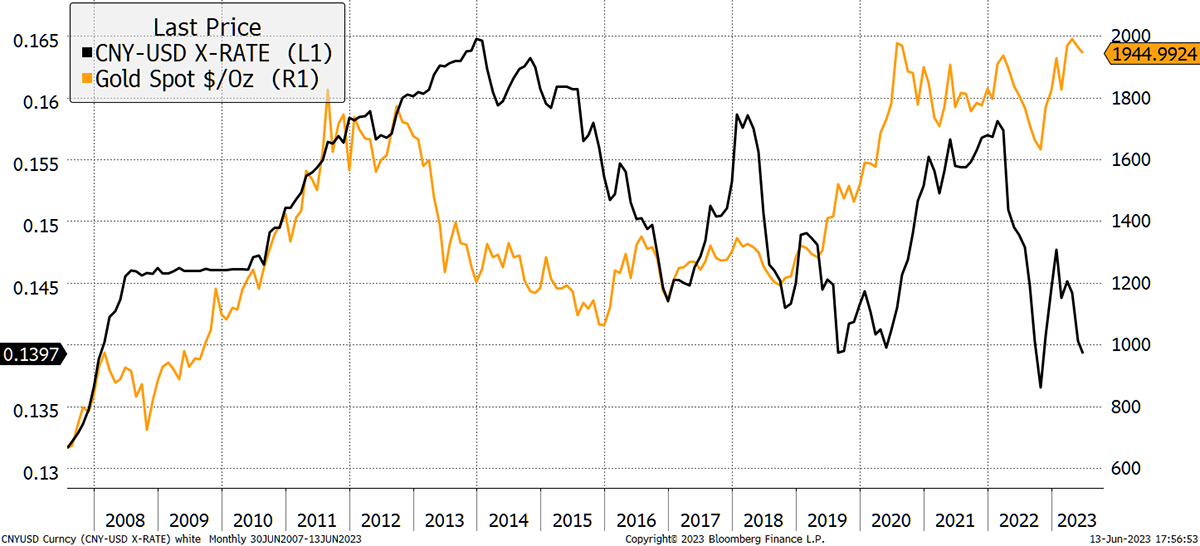

He highlights how Chinese producer prices are falling sharply, and the threat is that China spreads debt deflation. China needs to export their way out of their situation and will not hesitate to devalue their currency to sell more goods. As more gold has moved east, the correlation between the Yuan and the Gold price has risen.

A Yuan Devaluation May Not Be Good for Gold

He’s inevitably right about China, but I am less certain about how far it spreads. If we get deflation, they’ll start printing money again, which will drive a wedge between the east and west. Gold will like that. Besides, Chinese wealth will surely buy gold in size to protect themselves. After all, it is working in Japan, where gold is +14% this year in local terms. Here in the UK, it’s up a mere 2%, as the pound is on a tear.

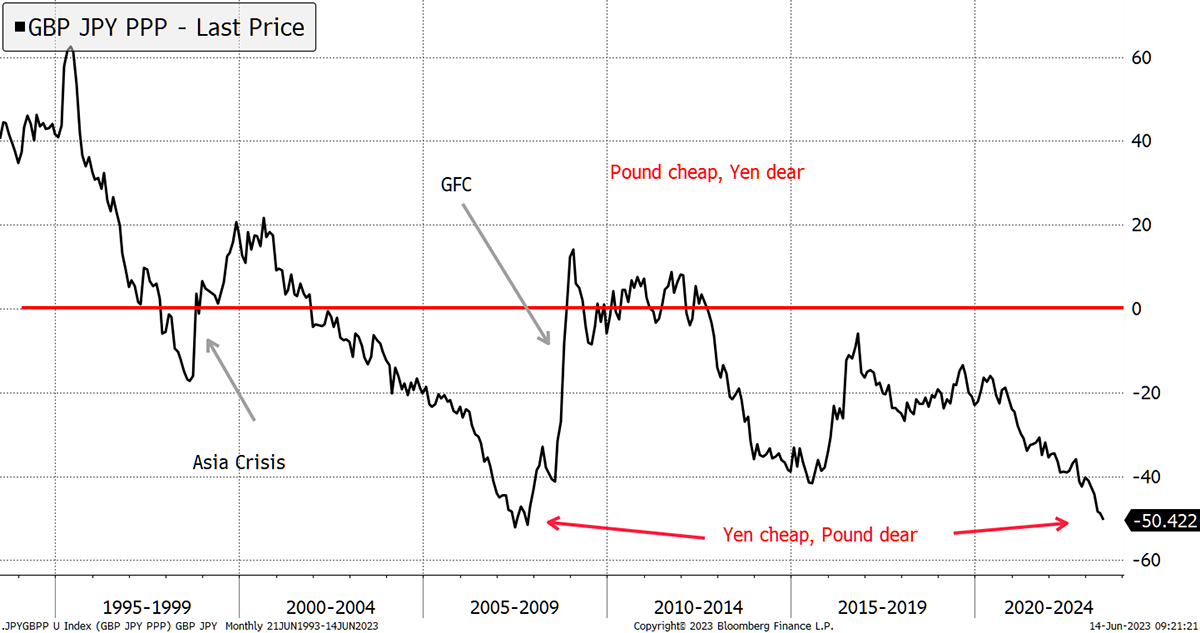

The pound vs yen is back at a level that should frighten us. The last time the yen was trading at a 50% discount to its purchasing power was in 2007. Like today, the yen fell while Europe and the US hiked rates. The emerging banking crisis saw rates collapse, and the yen smelt that coming. By the end of 2008, the yen had rallied 89% against the pound, and 105% by the end of 2011, when gold peaked.

Buy the Yen

In markets today, there are too many of these extreme relationships, and they should rightly keep investors level-headed. Own some gold, own some yen.

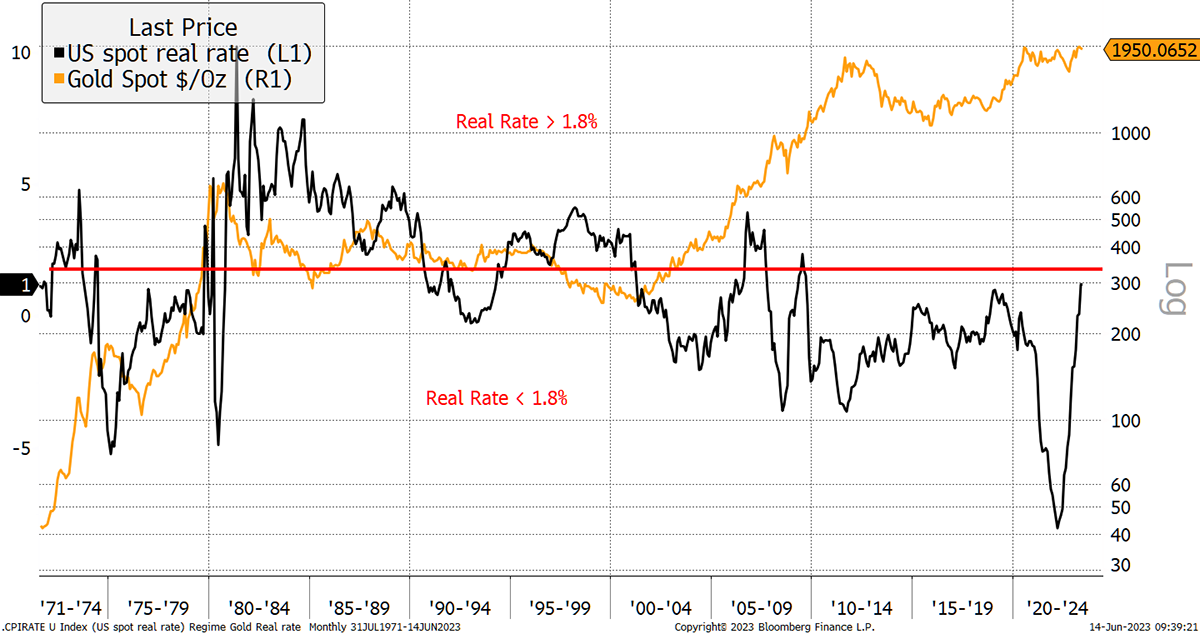

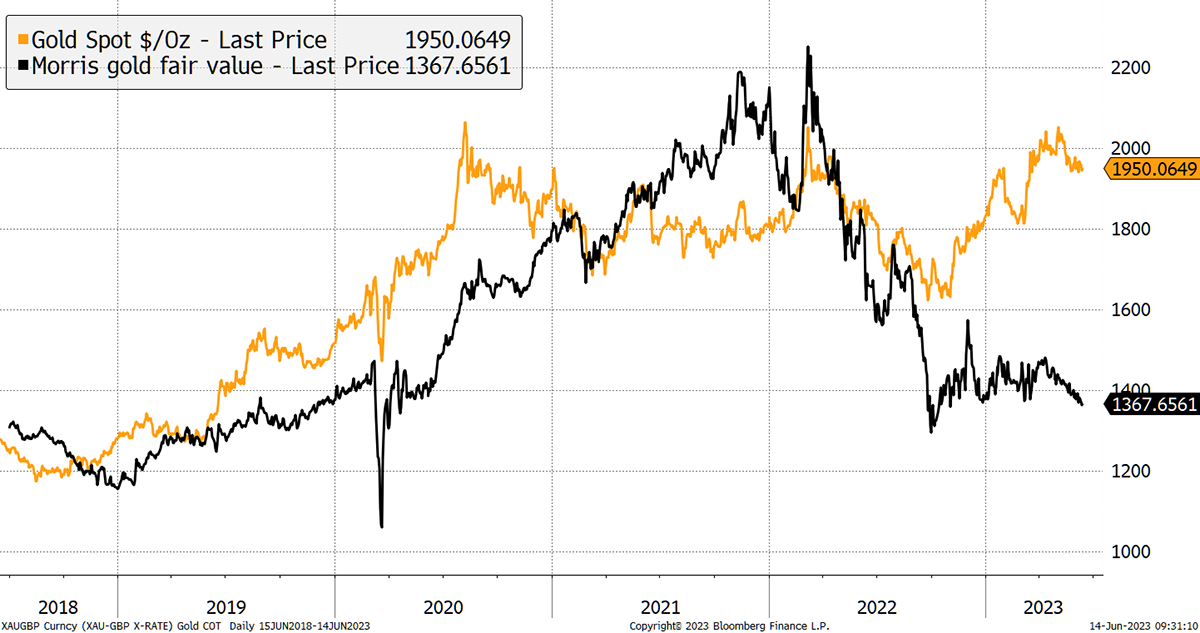

Hike ‘til Gold Breaks?

I don’t know what the Fed believes, but it could be that they want to see gold break as evidence that they are done with the rate hikes. With CPI down to 4% and rates at 5.25%, the real rate is 1.25%. When I studied this a few years ago, I concluded that gold stalled when the real rate was above 1.8%. We are close.

Gold and Rates

Of course, if the Fed pivots instead, then the downward pressures on gold will subside. Gold will then break back above $2,000, and the bull market will resume.

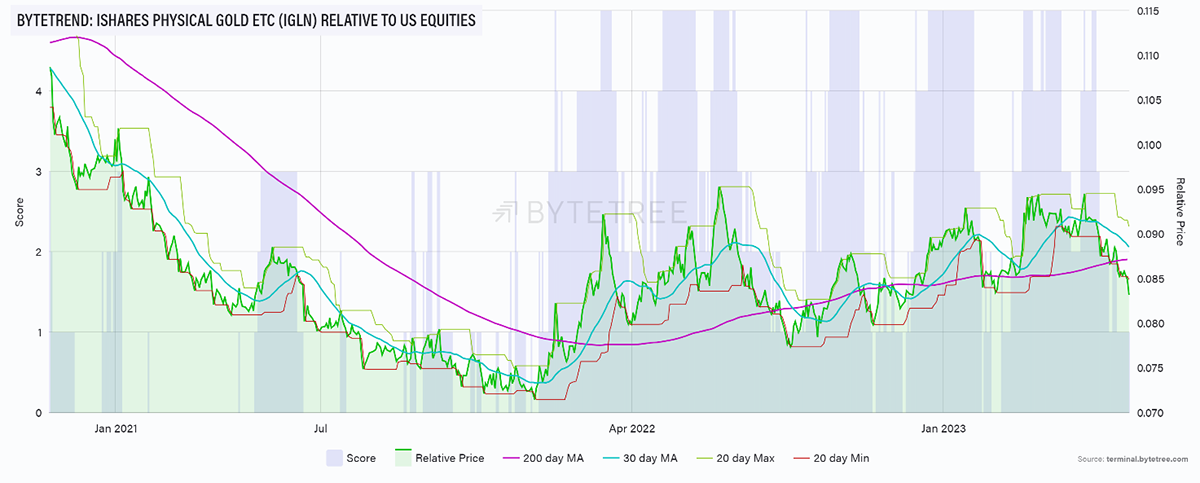

Right now, equities have it. The S&P 500 is inching higher, and the ByteTrend score for gold vs equities has dropped from a 5-star trend to a 1-star. In late 2012, this indicator gave the first warning of danger ahead for the gold price.

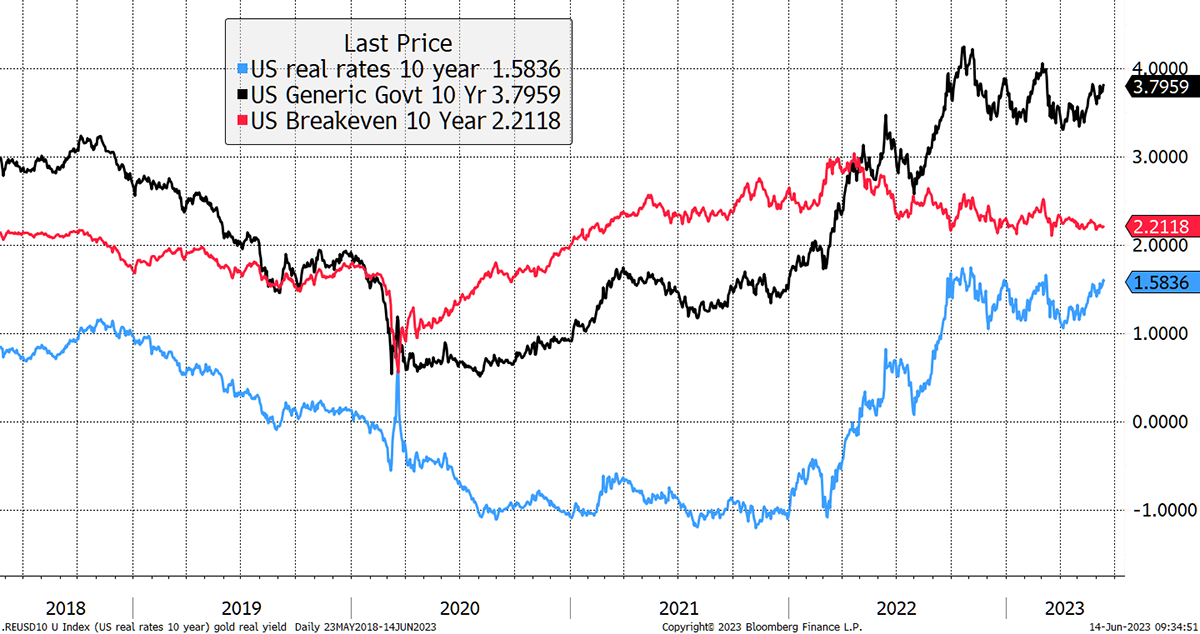

Looking at the 10-year bonds, the yield is 3.8%, while interest rates are at 5.25%. Another sign of madness in markets. If there’s no recession, then that 10-year yield will push above 5%, and that would surely see not only the gold price crash but equities and the yen too. It’s a strange thought but in keeping with the everything bubble narrative.

Tightening Conditions

Of course, gold would not mind the 10-year at 5% if only inflation expectations would follow. It’s all about long-term real rates (blue line), which are rising. That makes gold uncomfortable.

At 43%, the gold premium to TIPS (inflation-linked bonds) is substantial. This premium blew out as Russia invaded Ukraine, and so we can only assume the gold premium represents a divided world.

A Divided World or a True Picture of Inflation

Either that or gold is telling us that TIPS are plain wrong and long-term inflation will be 3.5% rather than 2.2%. That seems to be quite likely, especially when you hear that inflation swaps are priced according to Fed forecasts. Imagine that.

I believe we should assume that gold is the more accurate inflation barometer than TIPS. But if Jerome Powell manages to hike ‘til gold breaks, then the world will be in real trouble.

Gold on the blockchain

Congratulations to Gold Token (SA) on the relaunch of their Digital Gold token (DGLD). DGLD is tokenized gold that provides digital proof of ownership of gold bullion bars, starting from as little as 0.01g. All of the gold is held physically in a vault in Switzerland, off-balance sheet, and is fully insured. This means you can swap or redeem your token for physical gold.

I asked James Bennett, CEO, and incidentally ByteTree’s former CEO, what the benefits were of tokenizing gold. He replied,

“Financial infrastructure in DeFi brings efficiency to the markets. We need to bring real assets into digital finance. Equities, bonds and other financial securities face regulatory hurdles in being tokenized. Gold is different because it can be held in allocated physical form.”

If you are following the chaos in crypto over the pond, caused by the SEC, there is still much confusion as to what constitutes a security. It has caused major firms such as Silicon Valley VC and Andreessen Horowitz to establish their crypto operations in London. Remarkable but true that the UK prime minister is a crypto fan (I bet he’s long DOGE). He should send a signal to the City that crypto is real and reverse the ban on crypto ETPs, starting with the excellent BOLD SW.

I then asked James what differentiated DGLD from the other gold tokens.

“There are lots of gold tokens out there, but they fail to recognize the opportunities. DGLD is specifically designed to interact with DeFi by being the simplest form of gold on the blockchain. There are no fees for transfer or custody. We make money by being a conduit between the physical and the digital gold, and trading operations.”

DeFi, or decentralized finance, is the future. DGLD is well timed because London is a growing crypto hub. I believe all securities will end up being tokenized, along with currencies (CBDCs and stablecoins). This is the future of finance. What Andreessen Horowitz know, yet most people still don’t, is that sooner or later, we won’t need the banks anymore. That’s DeFi.

ByteTree Premium

ByteTree research stands out as it embraces the old world with the new. We cover traditional assets, including equities, bonds, FX and commodities, alongside the new world of crypto. We believe the world is changing, and we aim to change with it.

ByteTree Premium is where you’ll find our most valuable insights and, above all, the portfolios. There is plenty to choose from, and we deliver results across the risk spectrum.

Summary

Gold works well during times of Zozobra. Somehow, I can’t see that going away anytime soon.

I have been writing Atlas Pulse since October 2012. If you wish to receive the next issue of Atlas Pulse ahead of the rest, then subscribe here.