Absolute Return Funds – The Showdown

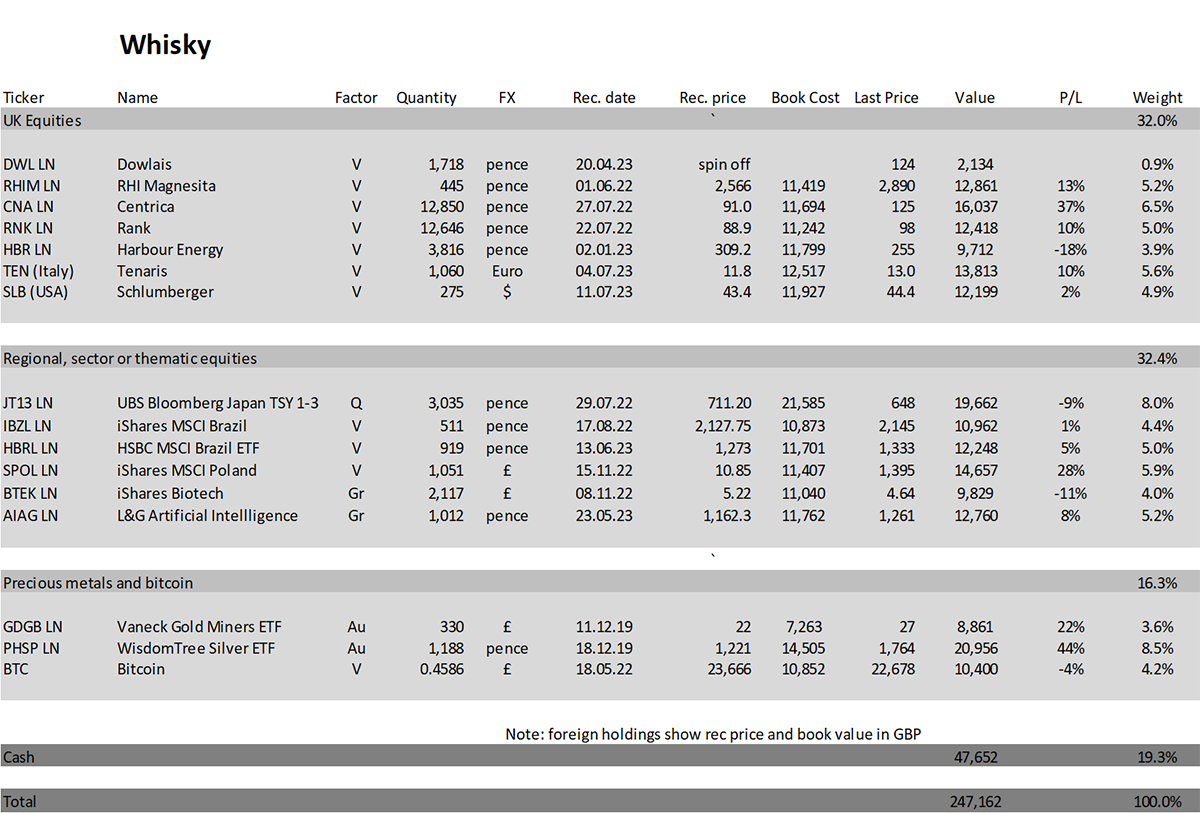

Trade in Whisky;

A characteristic of 2023 is how the risk-averse funds have lost money while the stockmarket has roared away, at least parts of it. These fund managers, with absolute return mandates, see dark times ahead and have been positioned for a bear market. It hasn’t come, at least not yet, and those defensive positions have lost money.

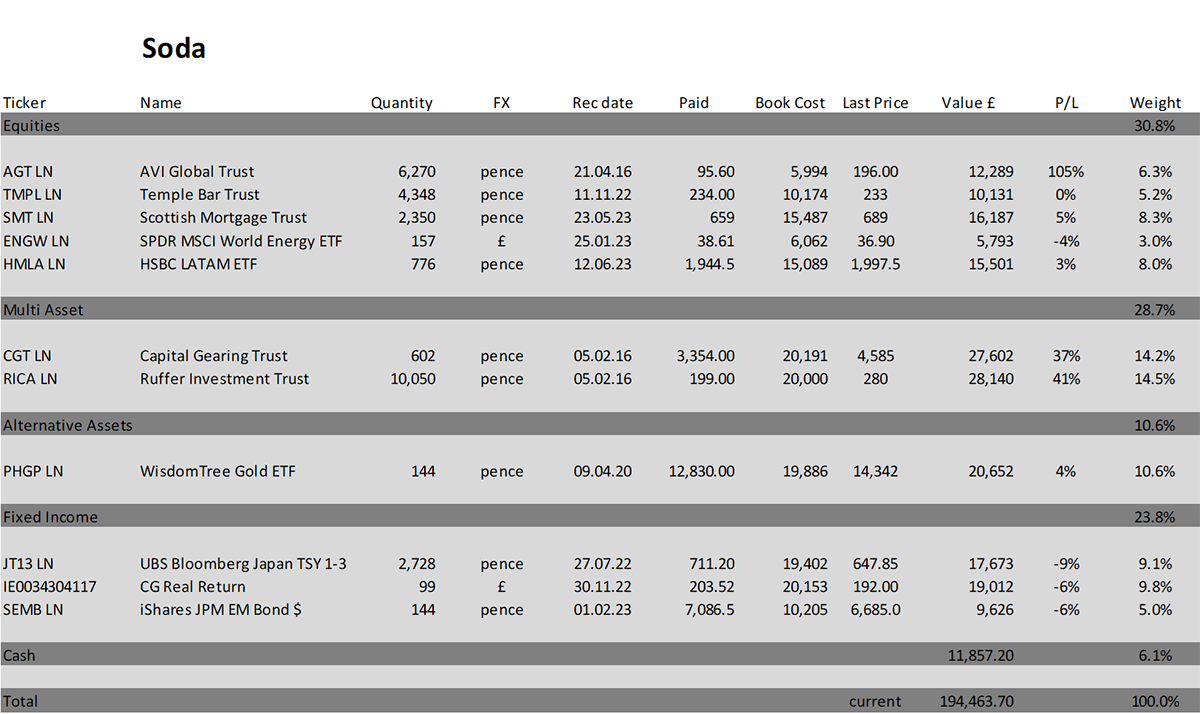

In recent weeks I have looked at the Absolute Return Multi-Asset Investment Trusts and interviewed both the Ruffer Investment Company (RICA) and the Capital Gearing Trust (CGT). Last week I gave my revised opinion on CGT, and this week, I will do the same for RICA. What is remarkable is how CGT, RICA and even my own Soda Portfolio have all sought portfolio downside protection from normally reliable safe havens.

Now that bond yields are higher, and particularly real yields, bonds are much more appealing than they were two years ago but are yet to reward investors. Better still, real yields (bond yields less inflation) are back to pre-credit crisis levels. That is compelling, but the money is only made when those yields start to turn down, thus sending prices higher. I do not think this trade is wrong, just a little early, but the rewards will come.

Attractive Real Yields

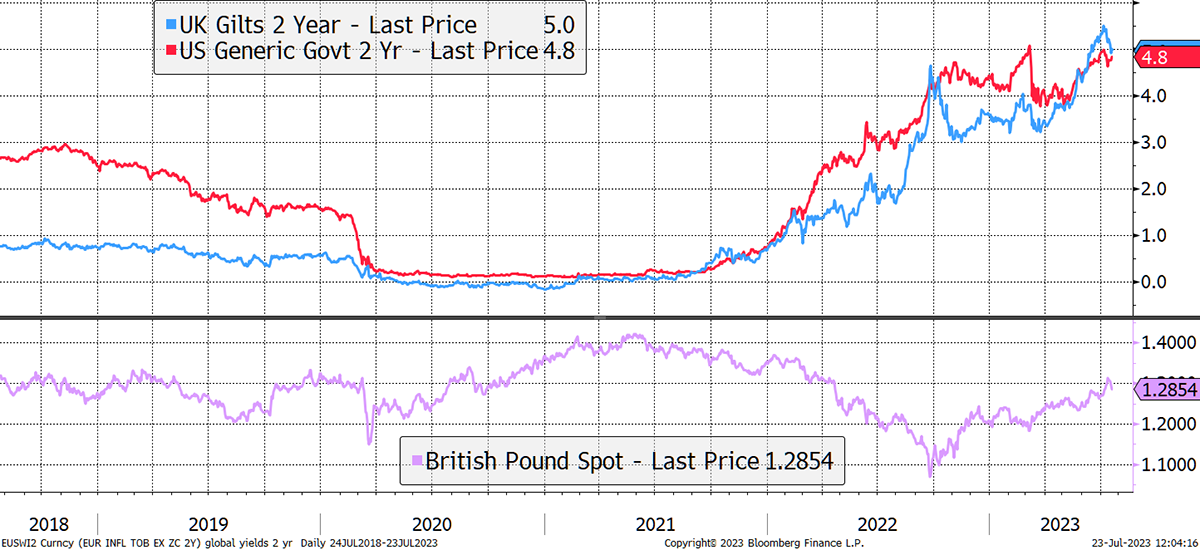

UK bond yields have risen in recent months as the Bank of England has tried to prove their metal by raising rates aggressively, causing a surge in the pound. In contrast, US bond yields have been relatively stable since the autumn. The pound’s surge is somewhat alarming, but it did rally from low levels (Truss/Kwarteng) and is currently trading at the five-year average. Perhaps the surprise is unsurprising.

Rising 2-Year Yield Boosts the Pound

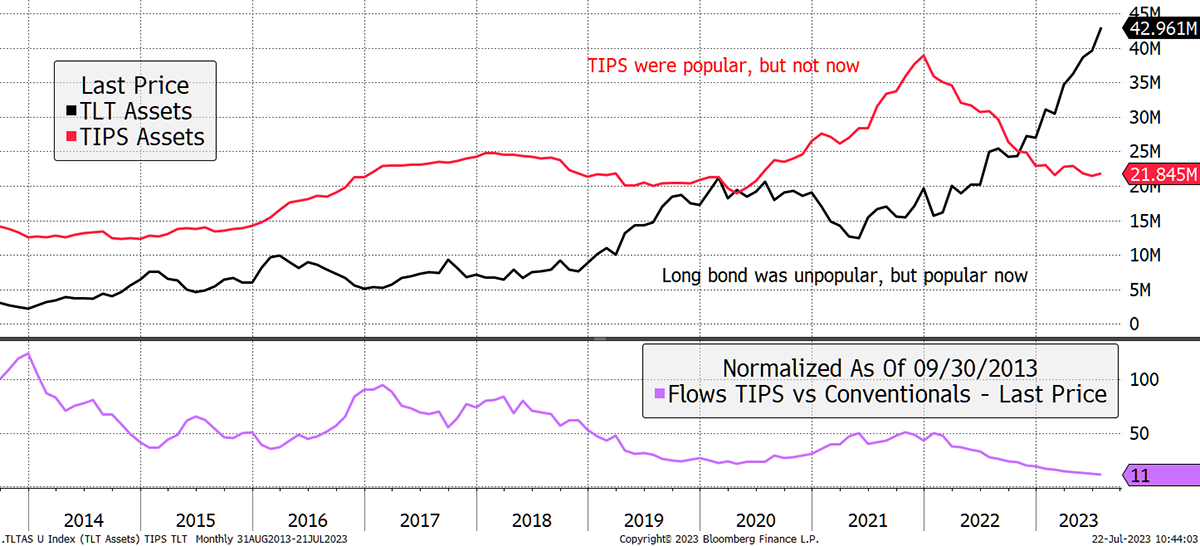

As I said, index-linked bonds are yet to reward investors, and I show the extraordinary repositioning via the US bond ETFs. I compare the asset flows into the popular TIP US (with $21 billion of assets), which invests in US TIPS, and the TLT US ($43 billion), which invests in long-dated US treasuries. TIP was more popular than TLT until the inflation peak in 2022. Since then, investors have dumped TIP (sold $15 billion) and piled into TLT (bought $30 billion). That is despite TLT paying a lower yield than TIP and cash and having no inflation protection.

The Extraordinary Popularity of the Long Bond

For these billions of dollars switching from inflation to deflation, the implication is that the crowd believes inflation is dead and a recession is imminent, which will see interest rates crash back down to earth. Why else would you buy the long bond when the yield curve is inverted? There must be a strong feeling out there, backed up by billions, that inflation was transitory after all. Suffice to say, both CGT and RICA disagree. As do I.

When we include the next economic recovery, there is no guarantee that inflation will have settled below or around 2%. While inflation is cooling today, and may continue to do so, I very much doubt the return to the old normal. I would choose TIPS, and linkers (UK TIPS), over conventional bonds, hands down. This view is shared not only by me, but by the teams at CGT and RICA as well.

The yen is the other common stumbling block, which Ruffer has a punchy 16% exposure (CGT 9%). The yen is a funding currency, which means investors borrow it because it has a low yield. As they do, with vast sums, that sends the yen down. Then when the markets become stressed, the resulting margin call makes investors repay the loans. This is one of the mechanisms that sends the yen soaring when the market stumbles. As RICA stated in the interview, there are other drivers too, such as a long-overdue policy shift and deep value in terms of purchasing power.

I recommended both funds into the Soda Portfolio in February 2016 with a 20% weight each. They have both delivered similar returns and now have a little over 14% each. That means they have lagged the Soda Portfolio quite significantly, but I have taken comfort that they were both reliable hands during a troubled period for fixed income over the 7+ year period.

Last week I gave my opinion on CGT, and this week, I will do the same with RICA. On the surface, the investment objectives are the same, but the implementation is different. They both sit on a large pile of cash/short-dated bonds, and both have a penchant for index-linked bonds and foreign currency. There is a very clear 2/3rds overlap, but with the other third, they differ wildly.

Opinion on the RICA

I hope you watched the video where I interviewed RICA’s manager Duncan MacInnes. There can be no doubt that Ruffer is a great firm, full of sharp minds. They have tried to perfect the idea of absolute return investing, almost as an art form. Pre-2008, they did well using bonds and currencies for portfolio protection, but over the past decade, “the other third” is starting to resemble a macro hedge fund.

Ruffer sailed through the 2000 to 2003 bear market, which wasn’t that difficult, as real yields were high, and you just needed to stay diversified and avoid tech. 2008 was much harder, but they succeeded by holding large positions in government bonds, dollars, yen, and Swiss francs. That kept their heads above water while many competitors slumped.

Their good crisis cemented their reputation, and in the aftermath of 2008, their assets went from around £1 billion to around £20 billion in short order. Remarkable. Beating the bear is seen to be much more skillful than beating the bull, and their pitch to clients is to beat inflation over the long-term rather than beating the market in the short term.

However, as rates went to zero post-2008, which made their bonds soar, they needed new thinking to tackle the next bear market. Bonds would no longer be a reliable source of portfolio protection, and so they started to embrace derivatives. These strategies can be costly as you have to pay away time value on options, effectively paying away insurance premia.

Technically, RICA’s exposure to “illiquid strategies and options” is 15%. I say a third when it is half that because of the gross exposure of their underlying positions. This strategy lost 4.3% in the first half of 2023, which is a large loss for a 15% position, implying more exposure than meets the eye. To call it a third would be about right. Ruffer portfolios have far more protection than they need, especially since their exposure to equities is a modest 14%.

The Ruffer strategy in 2023 is not so much protecting you against a market crash but betting on one. In contrast, the CGT strategy is receiving 6% per year in interest receipts while choosing to lightly participate in financial markets, keeping their powder dry for a time when value is more compelling.

RICA is swerving away from the gentlemanly approach opted by CGT, which is to avoid the puddles when it is raining, to becoming a full-blown macro hedge fund. They are betting on bad outcomes because they want to make money from the resulting economic carnage. As you heard, the portfolio already has its lowest-ever exposure to equities, so why do they need so much additional protection at all? At Ruffer’s Monday Investment Committee Meetings, I imagine they are all on their hands and knees praying for economic carnage.

I am not tempted to add to RICA, but nor am I keen to sell or reduce. After all, they may be proved right with their bearish positions. Higher rates take time to bite, and with the autumn market crash season just weeks away, we should at least wait for that to pass before making any radical changes.

The big risk to RICA is that the market doesn’t crash; it just hovers. That will cause their portfolio to bleed slowly as those protection payments mount up. But I cannot see how this fund will nosedive, as most of the money is invested cautiously. Indeed, if they do lose money, it will be a shallow decline because the income from the bonds will subsidize the costs of the derivatives.

I am tempted to increase CGT to the 2016 target weight of 20%, but given we already have additional exposure to index-linked bonds, and yen, we should wait. Perhaps when those positions have played out, it would be a good time to reconsider. As for RICA, we hold and reevaluate later this year after the crash season has passed. RICA wants a crash, whereas CGT can stomach one.

In any event, having downside protection makes it much easier to carry on adding cheap stocks to the Whisky portfolios.

Buy 5% Drax (DRX) in Whisky

The story here is unusual, but the opportunity has enormous potential at a very low valuation. DRX started as a coal power station near Selby, Yorkshire, and in 1974 was the largest coal-fired power station in Europe. It was floated inside National Power in 1990 and bought by US utility AES in 1999. That went wrong, and DRX was floated again in 2005. As you can imagine, coal is yesterday’s fuel and DRX has re-emerged as a renewable energy company. It wants to become the world’s largest carbon removal company and leading producer of biomass pellets. To some, it seems odd to ship wood pellets across the Atlantic to burn over here, but they argue the wood is surplus and sustainable, as the wood is scrap and not harvested.

Today DRX operates a portfolio of biomass, hydroelectric and pumped hydro storage generation assets across the UK. It is also the second-largest sustainable biomass producer globally and the UK's largest source of renewable power by output. The company also operates a global bioenergy supply business with manufacturing facilities at about 15 sites in the US and Canada, producing compressed wood pellets for its own use and for customers in Europe and Asia. The remaining coal plants have been closed. The company is split into three businesses: generation (47%), customers (electricity and gas 48%%), and pellet production (5%).

A major part of the investment case is that the market fails to capture the potential for their Bioenergy Carbon Capture and Storage (BECCS) business, which will make them the world’s largest carbon capture company. They basically burn pellets, generate electricity, and then capture the carbon and store it underground. Perhaps future historians will think we were all mad, but it’s happening. The UK government has signed various commitments, and companies like DRX will be essential in delivering these promises. DRX aims to be carbon negative by 2030.

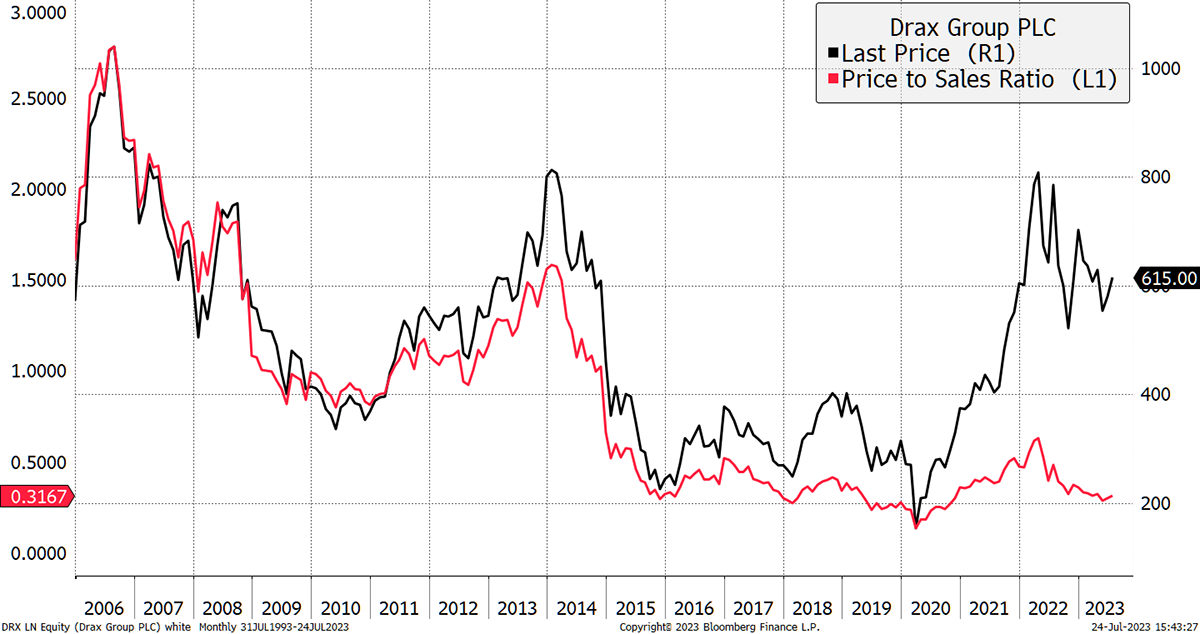

The investment case is that the legacy business is worth more than the current share price. Barclays believe it is 779p in the absence of any growth. Better yet, the shares trade on a 4.5x PE ratio for next year and a 4.3% expected yield. The company also announced a £150 million buyback which is a vote of confidence. This is dirt cheap. Assuming these carbon capture plans and pellets consumption take off, the consensus price target is 908p, with one analyst at £10.7 and two at £12. In years past, the price has followed revenue, but not this time. I feel a catch-up is coming.

Price Lags Sales Growth

I like situations that are underpinned by assets with significant potential upside. In this case, I take comfort that Orbis and Dimensional, renowned value investors, rank prominently on the shareholder register.

Risk

The DRX shares are liquid and trade on average of £8 million per day. The balance sheet is in good health, and the price volatility is 26%, which is on the verge of quality. The risk with utilities in general is policy, which we have no control over. There is also the possibility that the government backs away from the green agenda, but I see the shares underpinned by the legacy business. DRX is a liquid cyclical stock that I deem to be medium to high risk.

Action:

Buy 5% Drax (DRX) in Whisky.

Postbox

Just reacting to the changes on Bytetree Premium. Indeed, content was very cheap, probably too cheap, given the amount of newsletters. Furthermore, I imagine no one is fully interested in all of them and I guess it makes sense to split them. But from a personal point of view and being primarily interested in TMAI, Atlas Pulse and to a lesser extent the AAA report, staying subscribed to those would mean a 3-fold price increase, around 100% for two of them, or 20% for only one. I find this disappointing and a bit excessive, but I guess I will have to make a choice and pay more for a lot less. On another note, keep up with your excellent work, as always. I keep finding TMAI very helpful in those challenging times.

The unbundling of ByteTree Premium has been postponed as we reconsider options following your feedback. There is no action to take right now, and we will let you know when this happens.

One problem is the excellent AAA is independent of ByteTree, and we have to share revenue without really knowing how it ranks in the mix. That is published once a month, alongside roughly 16 other pieces from ByteTree. What is a fair split? There is no right answer, and we have no choice but to separate it. Some clients only want AAA, but we do not know who they are. Others have asked for AAA and TMAI bundled. We could put AAA on its own website. There are many potential options.

What are your thoughts?

We need to better understand what our clients want. Currently, when we have asked people to select their preferences, the majority have signed up for everything and seem to read (or click on) most of it. Payment is the only way we can truly understand what our clients really want.

If you select TMAI only, I will continue to cover gold and bitcoin in the portfolios, just in outline rather than in detail. You may have noticed I rarely tackle either subject in TMAI, so we avoid repetition and focus on mainstream assets. Furthermore, Atlas Pulse has a large free readership built over the years. Asking them to stump up will hopefully reduce pressure on other products.

For what it’s worth, an issue of Atlas Pulse, in terms of my time and research, is equivalent to 2 or 3 TMAIs. It’s not the writing but the preparation. ATOMIC is about the same because there are seemingly fewer variables.

All ByteTree Premium publications older than four weeks are freely available on our website, so things like Atlas Pulse or AAA will always be available. Premium clients are paying for the timeliness, the recommendations, and the flash notes, which is fair enough. With Mr VAT stealing 20% before we get started and other mounting costs, ByteTree Premium has been too cheap. I have done my best to keep it accessible by breaking up the Premium bundle and sharing the load. The alternative would have been to materially increase the Premium bundle price for all.

Compared to the wealth management industry, ByteTree is dirt cheap and vastly superior.

Just a note to say how useful those interviews were in providing different perspectives on the current state of the markets and the recent problems faced by the respective trusts: I feel more encouraged!

Thank you. I think the interviews were a useful exercise, but fear not; we are not turning into a TV station. I’ll do them when something relevant pops up.

I spotted a couple of minor errors in the Whisky portfolio table. At the foot of the table the note states "foreign holdings show rec price in local currency." However, I believe the rec prices shown for Tenaris and Schlumberger are in Sterling - 11.8 and 43.4 respectively. Should be about 13.79 and 56.05 respectively. Also, rec date for SLB is 2023 rather than 2024 :)

Thanks, I have changed the note to GBP as it makes more sense to be consistent. I have corrected 2024 to 2023.

In response to the Larry Summers quote, former US Treasury Secretary, who quipped back in 2020 that “Europe’s a museum, Japan’s a nursing home and China’s a jail.” What does that make the UK? Your suggestions.

- A Reality TV show set in a refugee camp. Soon to become Animal Farm.

- I would assess the UK as more akin to 18th century Australia, but without the need to present proof of someone else's potato to gain entry.

- Back to the ‘70’s.

- A wind farm.

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts. The Soda portfolio is down 2.8% this year and is up 94.5% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 10.6% this year and up 147.2% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

Last week’s UK CPI number caused relief, and the portfolios had a good week. I have little doubt that we are doing the right thing, which always pays off in good time.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()