Capital Gearing Trust Interview

Disclaimer: Your capital is at risk. This is not investment advice.

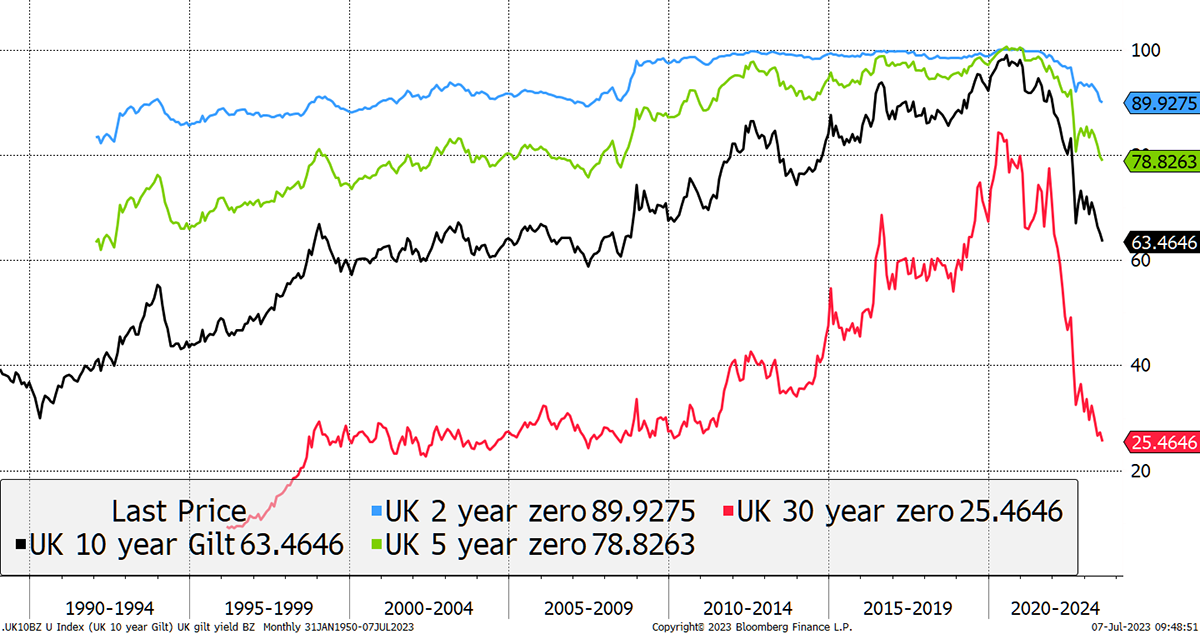

In theory, government bonds are risk-free because they pay an income guaranteed by the government, but that doesn’t mean that prices can’t be volatile, as markets showed last year. To demonstrate this, I show the synthetic prices of UK Government bonds, known as Gilts, since 1990. The 2-year bond is relatively stable, with low “duration”, while the 30-year bond is a beast, with high duration. From the mid-1990s to 2020, it rose 8-fold in capital terms, as well as paying an income. Then in the last two years, it has fallen by 70%. As the financial textbooks state, government bonds are risk-free. Eh?

A Harsh Lesson in Duration

This hammers home how extraordinary these times are for financial markets.

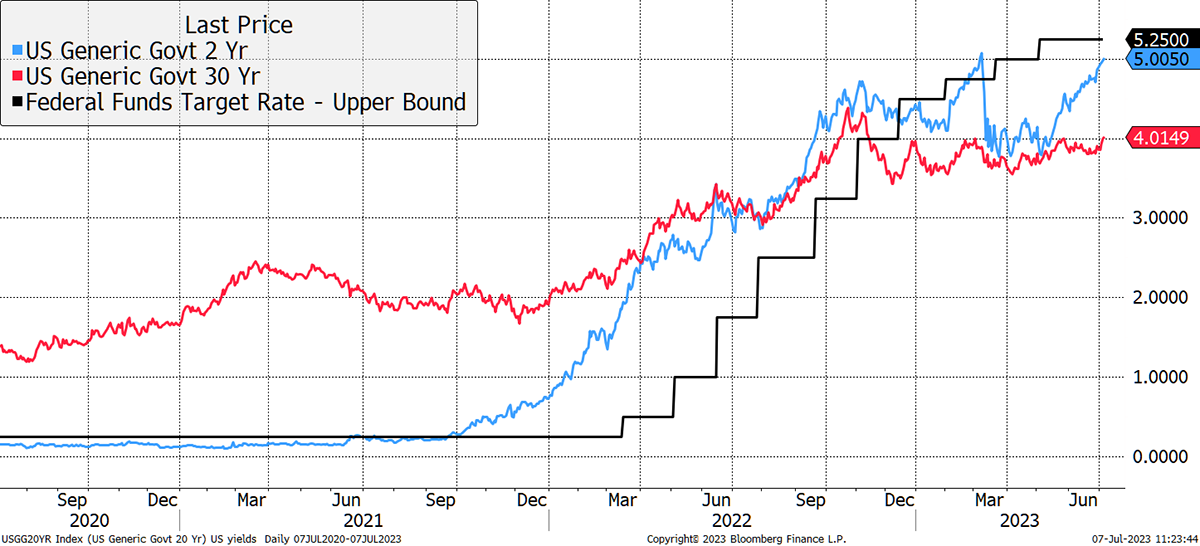

Bond yields were back in the news because yesterday, the US economy reported 497,000 new jobs in June, which was over twice expectations. That means the US recession isn’t happening anytime soon, and Jerome Powell will keep on squeezing by hiking rates further after what has already been the fastest pace of rate hikes on record.

That has put the long bond yield back above 4%, which dangerous territory. The last few occasions brought down the UK government and then, earlier this year, a handful of banks. Looking at US interest rates (“rates” black), the 2-year yield (“2s” blue) and the 30-year yield (“longs” red), the yield curve is still inverted as the longs yield less than the 2s and rates. That forecasts a recession, but with all those jobs, where is this recession? If there isn’t one, the longs should be the same or higher than the 2s. That would mean another 30% drop in the value of the US long bond.

The US Long Bond Could Fall 30%

I can’t tell you how many questions I have had suggesting we buy the long bond because it benefits from recession because rates fall. The trouble is you’d need to see rates collapse for it to make decent money, and that won’t happen because those days of zero rates are surely over. It would be even more remarkable than it has already been if this inflation storm was just a blip. We can be reasonably confident that inflation is falling, but we still don’t know where it will land. The US job market also reported an average 6.4% pay rise last year. Inflation isn’t dead yet.

In Europe, the long bond is even more risky as it yields a paltry 2.6% when rates are 4%. If the long bond yield rose to 4%, prices would fall by another 45% from here. In contrast, the 2s would fall by less than 4%.

European Longs Could fall 45%

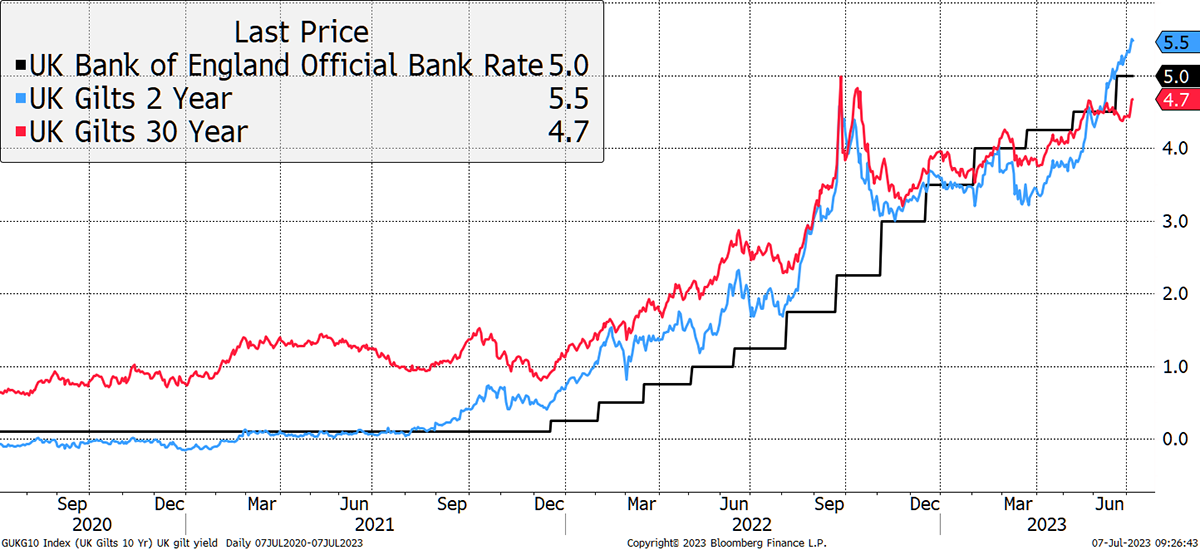

Then we cross La Manche to the UK, where the longs are just 0.3% behind rates, and the 2s are already above rates. That means the Gilt market already anticipates another 0.5% of rate hikes, making it the least risky bond market of the three shown. Since yields are already the highest, it is only new rate rises, which are not currently anticipated, that will lead to a material downside for Gilts.

The Long Gilt Has Less Downside

I mention bonds because diversified portfolios own bonds, whereas equity portfolios do not. That explains my own investing experience in 2023, where the lower-risk balanced Soda Portfolio has fallen in contrast to the higher-risk Whisky Portfolio, which has made good money. Normally we associate losses with risk, yet financial wisdom clearly states that equities are riskier than bonds. Not so in 2023.

A good manager of diversified portfolios will sense higher rates are on the way and reposition the portfolio by reducing the duration of their bond portfolio. That means having fewer bonds, which are shorter-dated and behave more like cash than the long bond.

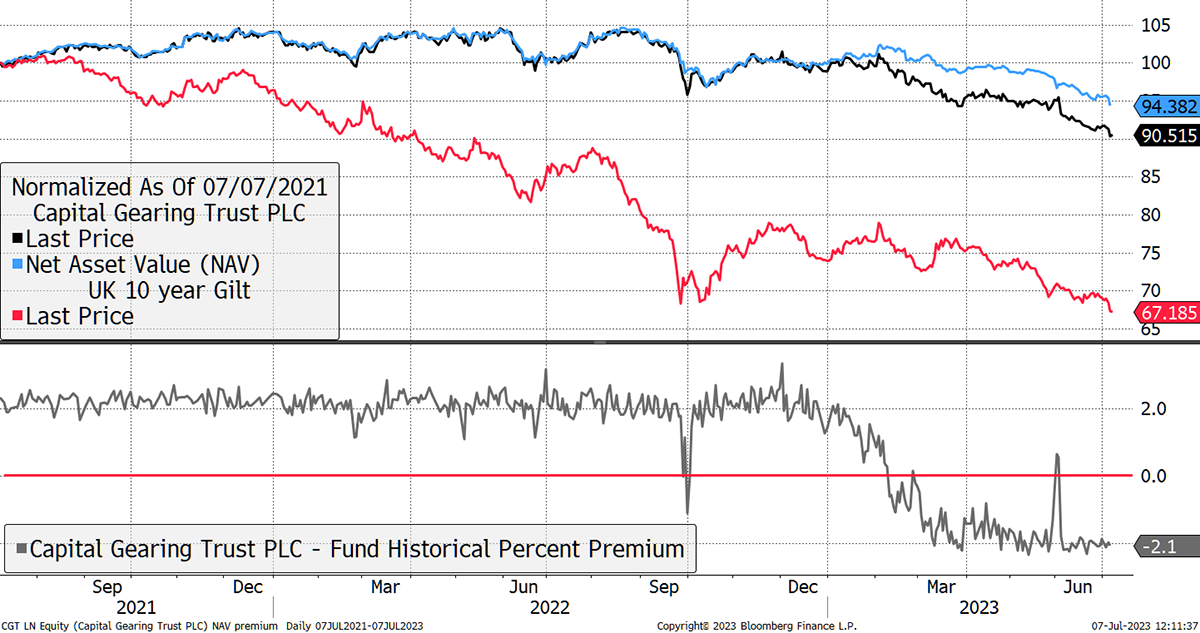

A good example is the Capital Gearing Trust (CGT), which has had a tough year. But as the charts above show, even having a low-duration bond portfolio has not been enough to ride this storm in the bond market. The CGT portfolio has lost 6% in capital terms (-3.5% including income) over the past two years, which compares to a 33% loss for the 10-year gilt. They had very low duration, but even that wasn’t enough to escape from the dark side.

Capital Gearing Trust

I am referring to the blue line, the net asset value (NAV) of the portfolio. The black share price has fared worse as the shares have swung from a discount to a premium. I think I am right in saying that this is the first discount for CGT in 40 years. The good news is that you own the NAV, and sooner or later, the share price will return to its usual premium, presumably when this rate cycle is behind us.

Anyone who has held CGT for a long time is very comfortable, but those who have purchased it in the past couple of years are wondering why a cautious fund can be one of their laggards. I am going to do a deep dive into the CGT portfolio and strategy in Tuesday’s issue of The Multi-Asset Investor. Then next Friday, 14 July at 11:30 BST, I am hosting a webinar with Chris Clothier, the co-manager of the trust. You will be able to ask him anything, so please register to attend by clicking the button below.

ByteTree This Week

It has been a busy week. The ByteTree BOLD Index released its rebalancing report. At 23.8%, Bitcoin has the highest weight in the index’s history as volatility keeps on falling (doubters, that means it’s real!). BOLD is storming this year, with the index up 20.5% with volatility not dissimilar to the stockmarket.

The Multi-Asset Investor bought its first international stock, one I am very excited about. The company is dirt cheap, with cash coming out of its ears. Stick that in your pipe and smoke it.

ATOMIC highlighted the renewed flows into Bitcoin. The network looks good, and the big money is coming.

Have a great weekend, and don’t forget to register for the CGT webinar next week. If it goes well, I’ll follow up with a Ruffer webinar.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()