Understanding Gold’s Intrinsic Value

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report, Issue 84;

Gold is a monetary asset and, as a result, is valued above and beyond its intrinsic value. To put it another way, if gold didn’t have an important financial role and didn’t have liquidity approaching that of the S&P 500, would it still be worth around $2,000 per ounce? I very much doubt it.

| ARTICLE HIGHLIGHTS: | |

|---|---|

| Feature | Understanding Gold’s Intrinsic Value |

| Inflation | University of Michigan vs TIPS |

| Macro | Powell is Too Tight |

| Regime | Still Bullish |

Gold’s Intrinsic Value

There can be no doubt that gold has intrinsic value, as it is a rare commodity. But even if it wasn’t rare, like sand or manure, it would still have intrinsic value, just much less than it currently does. The question I have been asking is how much of the gold price reflects its intrinsic value, and how much is something else?

Gold is a monetary asset and, as a result, is valued above and beyond its intrinsic value. To put it another way, if gold didn’t have an important financial role and didn’t have liquidity approaching that of the S&P 500, would it still be worth around $2,000 per ounce? I very much doubt it.

I believe the gold price is made up of parts, one of which is the intrinsic value of the metal, probably linked to commodities, while there is an additional monetary value sitting on top. This is derived from gold’s global role as a financial backstop and the vast liquidity that goes with the territory. Gold provides insurance against the failure of the financial system, which just so happens to be an inflation hedge to boot.

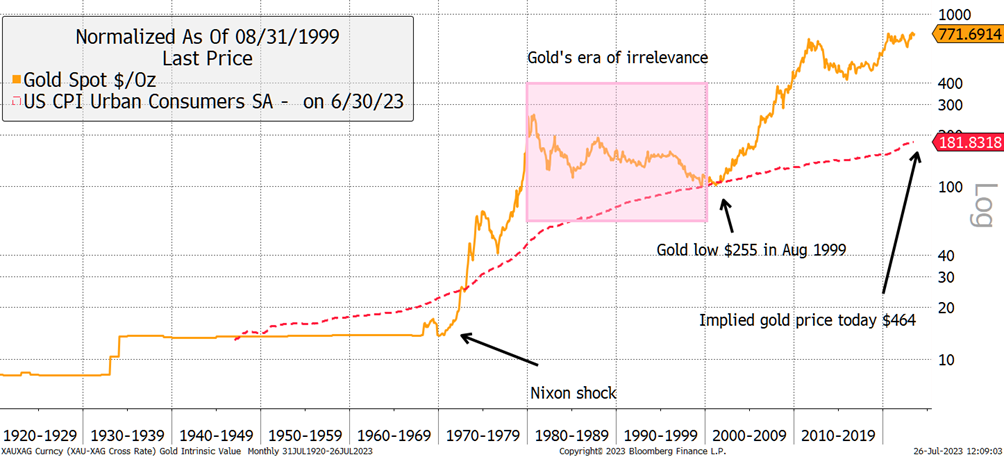

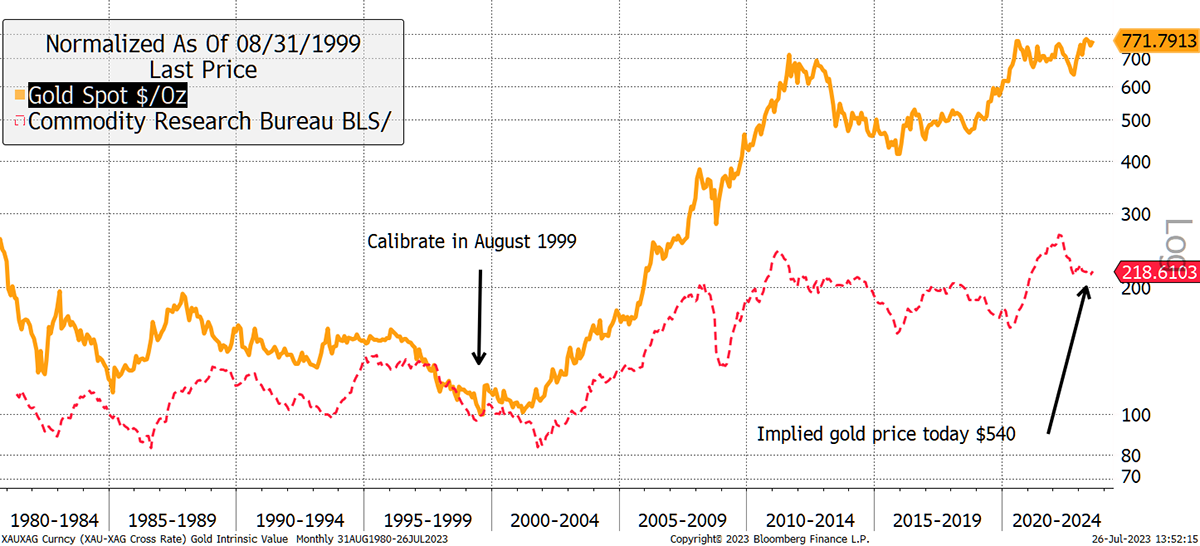

There are various ways to address this question, but I’ll start with the simple idea that in recent history, gold was peak irrelevant when it traded at $255 per ounce in 1999. Prior to 1971, as you all know, gold had a formal role in the financial system for centuries. Then in 1971, as modern communication technology enabled, Nixon took the dollar off the gold standard, paving the way for the system of fiat currencies that followed. That could not have happened until data and telephony were up to the task.

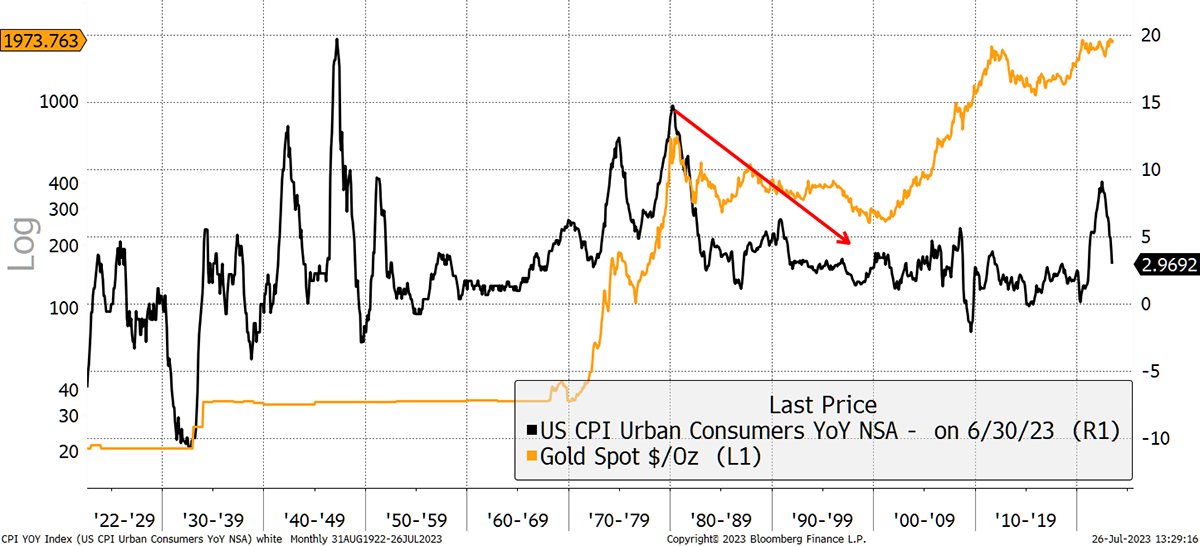

In 1971, gold was significantly undervalued as the price vs the dollar hadn’t been adjusted since the 1930s while inflation marched on. The price soared, buoyed by the bursts of inflation throughout the 1970s. By 1980, inflation had peaked, and gold’s job was done.

Gold and Inflation

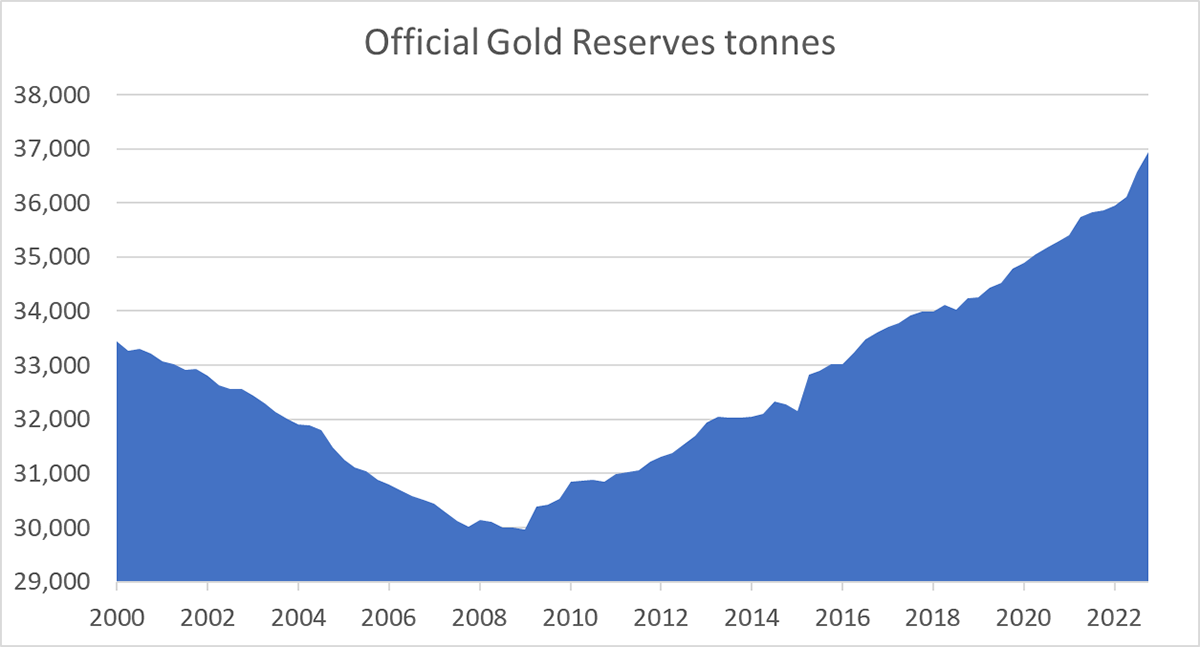

For the next two decades, the fiat monetary system seemed to work well, at least in the developed world. Gold spent the period in the doghouse, in a period of irrelevance. During that time, the central banks, especially European Central Banks, were queuing up to sell their gold in a somewhat orderly fashion. This carried on until 2009 when mainly non-OECD nations restarted their gold purchases in the aftermath of the global financial crisis.

Since then, the central banks have been increasing their holdings and never more so since the Russian invasion of Ukraine.

The remarkable thing is that the gold standard withered in the 1970s, and other than the recent rumors surrounding a gold-backed BRICS currency, there has been no official need for central banks to own gold. They do so out of choice. It is remarkable how an informal gold standard of sorts is returning despite it being formally vanquished half a century ago. It means that gold is once again relevant despite that not being written down in the statute books.

To summarize, gold was relevant pre-1971 and is relevant again today. In the former period, there was no price discovery because the price was fixed against the US dollar. In contrast, the price today is free and has settled at approximately $2,000 per ounce. The lowest point, in 1999, was the point of gold’s least relevance, and so presumably approximates its intrinsic value (it probably undershot). If we run US CPI through that $255 print in August 1999, the implied “intrinsic” price today is $255 x 81% inflation = $464.

Gold’s Period of Irrelevance

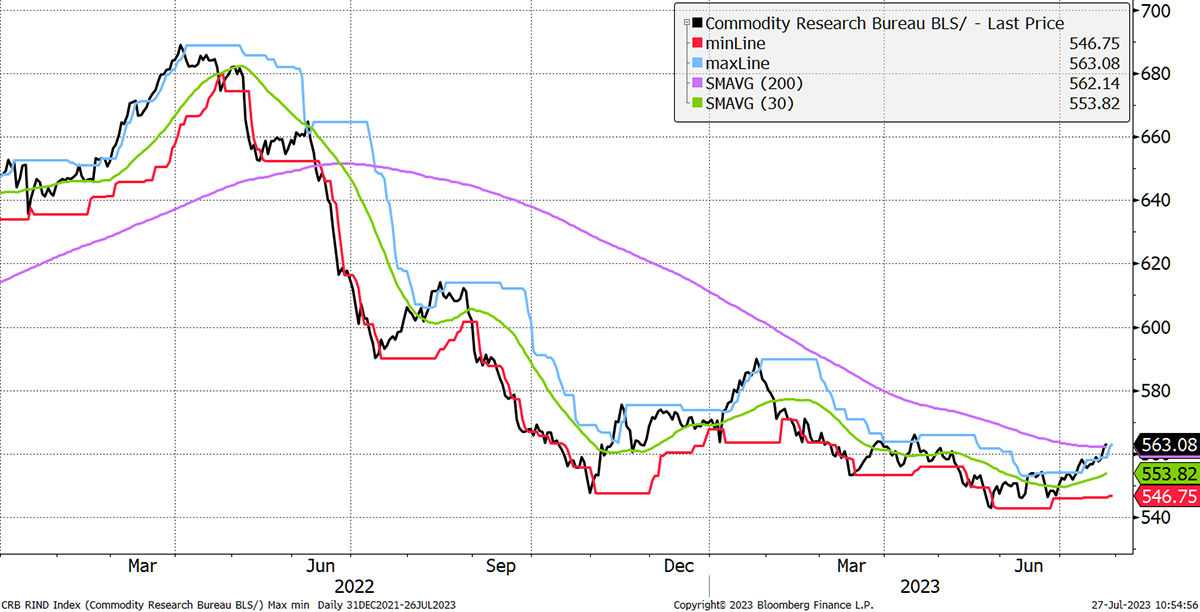

If you wanted to use commodities instead of CPI, you’d get to $320, but that’s a little harsh as the commodity index has a negative roll yield (futures contracts can effectively have a “negative dividend” known as contango). Much fairer, perhaps, is to use the CRB Rind Index, which looks at spot commodities that trade in the real world. These include wool, wax, oats, eggs, hides, etc., as opposed to oil, copper, soybeans, and corn. The implied price jumps to $540, which is still a long way below the current price.

Gold and Off-Exchange Commodities (CRB Rind)

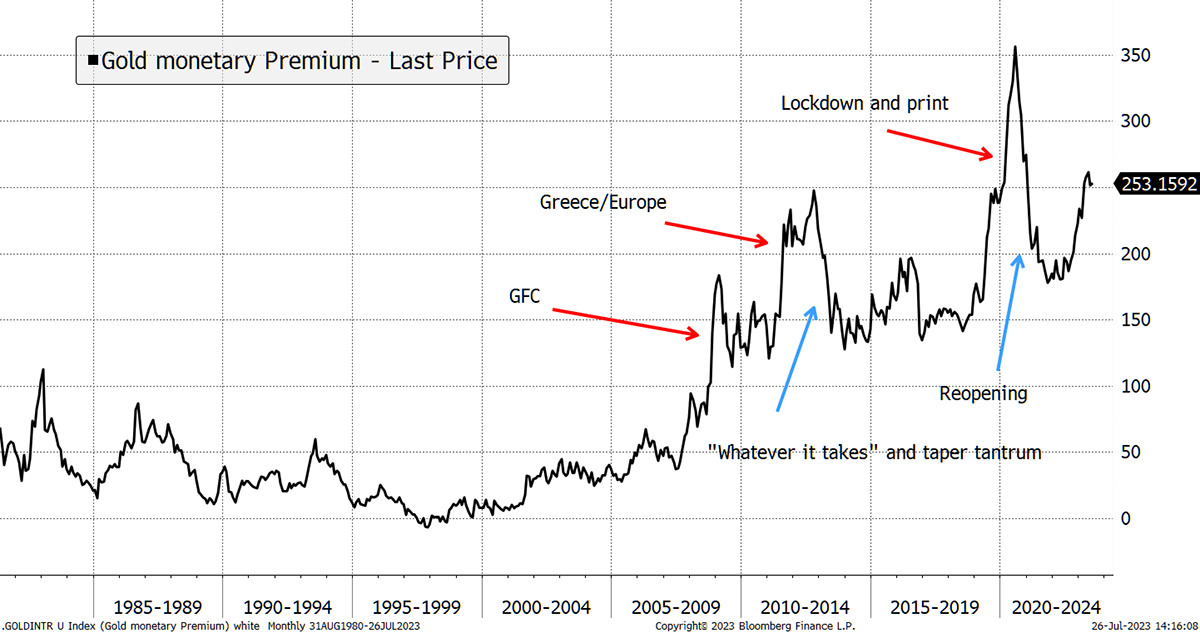

Expressing the chart above as a premium helps to better understand why gold has been advancing ahead of commodities since 2000. The big moves are generally associated with negative economic events, where gold rose and commodities fell. The downward moves came as economic relief.

Gold’s Monetary Premium

If gold was merely a safe haven, it would go up with bad news and come back down with good news, but it doesn’t. It seems to go up much more than it retraces. Observe the monetary premium post the GFC, which turned out to be the support at 150 ever since. Might the post-Covid low at 200 be the new line in the sand, even if the economy returns to low inflation growth, aka Goldilocks?

An alternative explanation is this is the mother of all bubbles because gold, the metal, is highly priced. But I would argue there is a need for a lasting and growing monetary asset in an uncertain world. And this idea really kicked off once we discovered in 2008 that the banks were no longer a reliable choice to grease the wheels of the economy in a responsible manner.

Other than jewellery, where romance is priceless, it makes little sense to purchase gold simply because it’s tangible. If all you want is an inflation hedge, you’re better off having enjoyment from collectibles such as art, clocks (avoid the Swiss watch bubble), musical instruments, or baseball cards. Gold is a liquid inflation hedge, which makes it much more valuable than its simple physical form.

You can also use TIPS, but they only hedge inflation and no more.

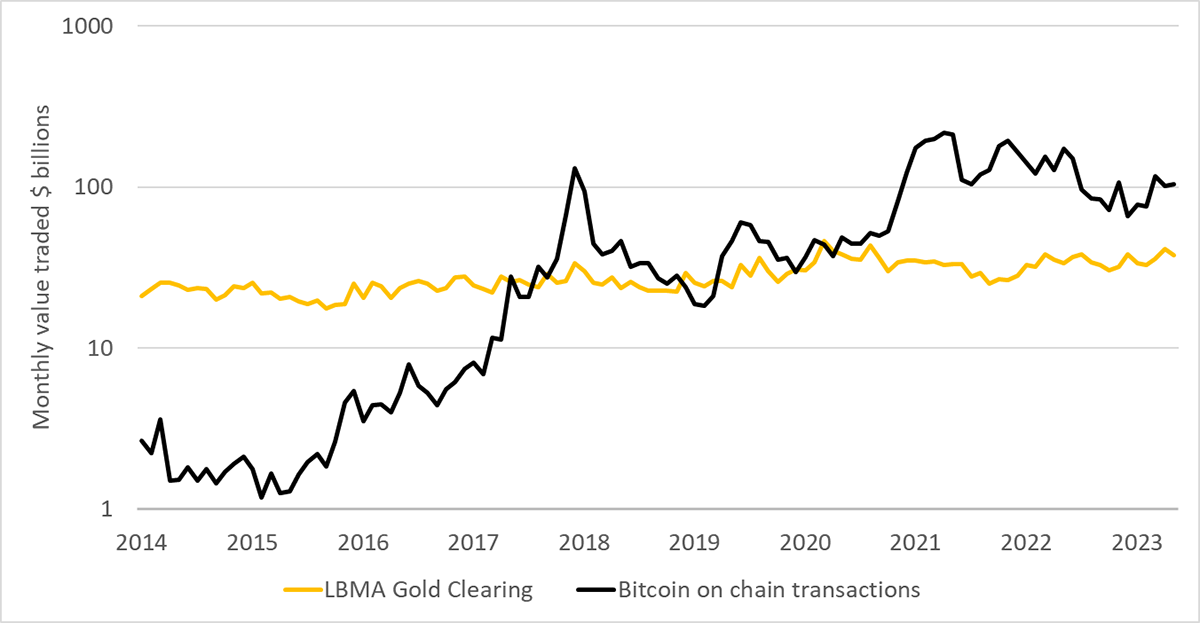

If you agree that gold has intrinsic value, with additional monetary value on top, then understanding why Bitcoin has value becomes a whole lot clearer. What Satoshi Nakamoto has done is to skip the intrinsic bit and created a valuable network, which, as the social media companies will confirm, is a lasting moat.

It’s hardly like for like, but I compare Bitcoin on-chain transactions with the LBMA’s Gold clearing data, which shows the value of gold moving between vaults. Bitcoin is on the move much more than gold because portability is its main advantage. Since the 2018 Bitcoin bear market, cleared Bitcoin has remained above cleared gold.

Bitcoin Monetary Value

Bitcoiners shouldn’t dine out on that, and in no way am I suggesting that Bitcoin has overtaken gold, but my point is that the network of both assets thrives in both bull and bear markets. That endless and reliable liquidity makes both Bitcoin and Gold real monetary assets, regardless of price.

Invest in gold (and Bitcoin) because you believe it is an important part of the global financial system and a highly sought-after liquid alternative asset. I would argue that even though gold is beautiful, rare, dense, and inert, the financial network is worth more than gold itself. Those great physical qualities made it a natural choice for the job, and as you know, there can only be one monetary precious metal. Silver doesn’t come close, but that doesn’t mean it can’t be a good trade (I’m still bullish), but it should be obvious why the central banks leave it alone.

I have spent more time than probably anyone on this planet talking about Bitcoin and Gold and the relative merits of the combo. I regularly see clients in Europe to discuss the 21Shares BOLD ETF (BOLD), which ByteTree created. Last week it was Frankfurt and Munich. In late August, I’ll visit Helsinki, Copenhagen, and Stockholm (get in touch for a meeting). I see family offices, wealth managers, and some banks, all of which are fascinated by this subject but are yet to engage professionally with crypto for regulatory reasons.

The next 1971 is coming.

University of Michigan vs TIPS

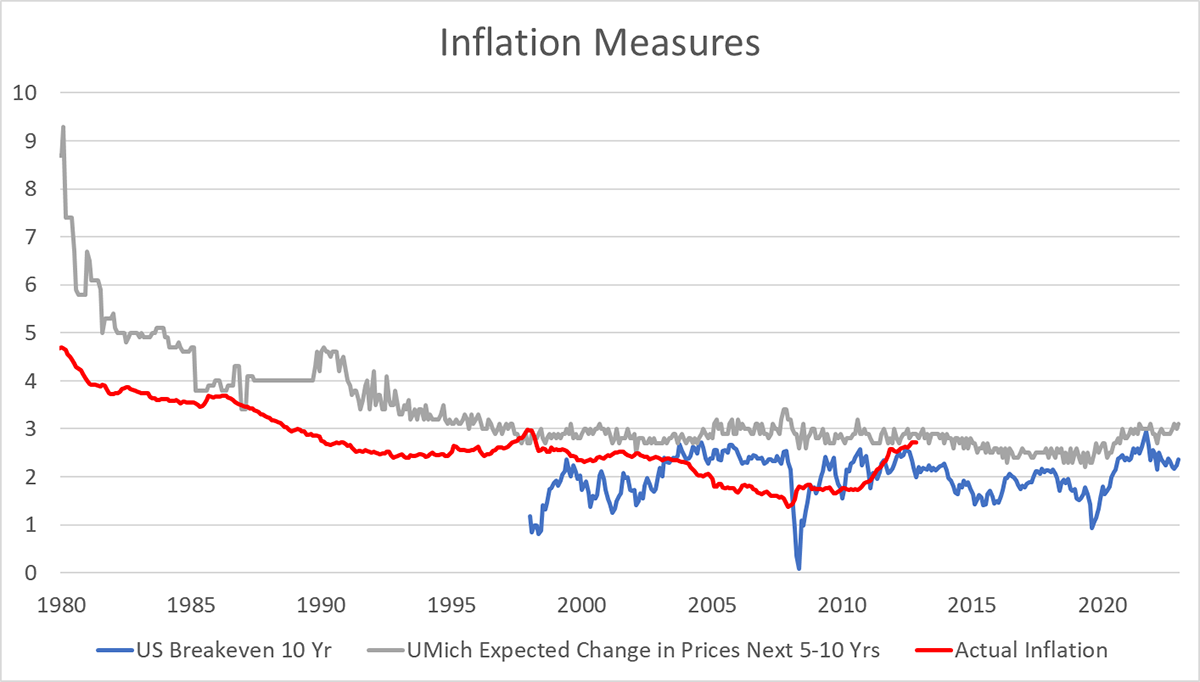

Back to gold, where we can be sure that at least one of its drivers is inflation, at least to some degree. I prefer forward-looking inflation measures, but the last couple of years have made us question the effectiveness of breakeven rates, which are derived from index-linked bonds. They seem to be a little soft and have a tendency to underestimate inflation.

I show the University of Michigan inflation expectations for the next 5 to 10 years, which have been published since 1980. Compared to the red line, which shows you what actual inflation we experienced, the Michigan numbers have been a little high but respectable and a nice complement to breakevens.

Referring to the intrinsic vs monetary argument, gold wouldn’t be so responsive to the bond market if the value was simply intrinsic. Its high sensitivity to monetary matters is conclusive evidence that it is so much more than a commodity.

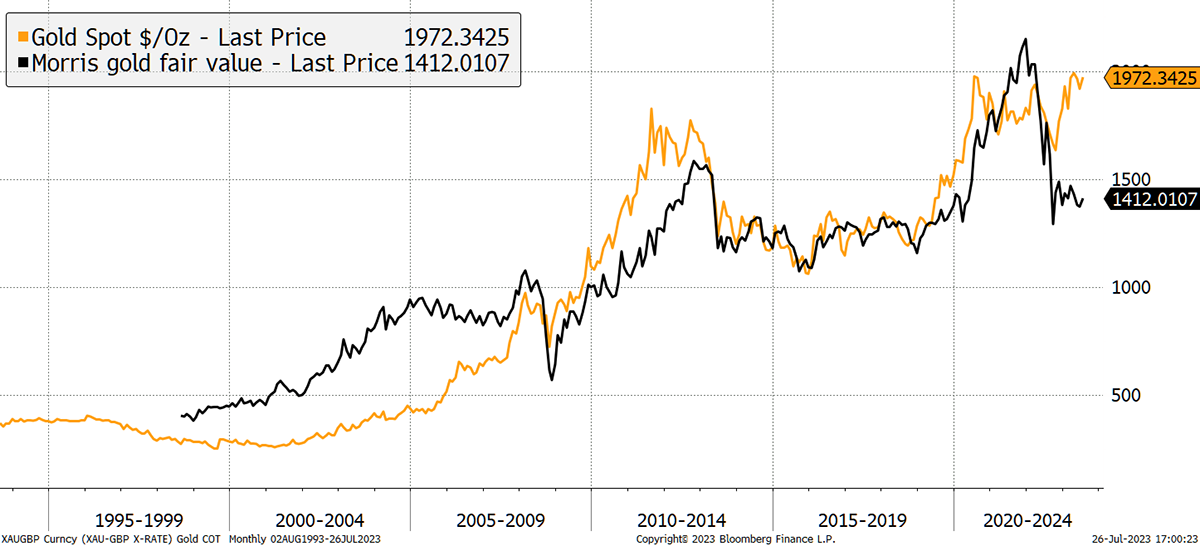

Regular readers know my TIPS model (the 2012 original among the many today). One explanation about the gold premium, which makes gold look expensive, is that it is a better measure of inflation than TIPS.

The Gold Premium

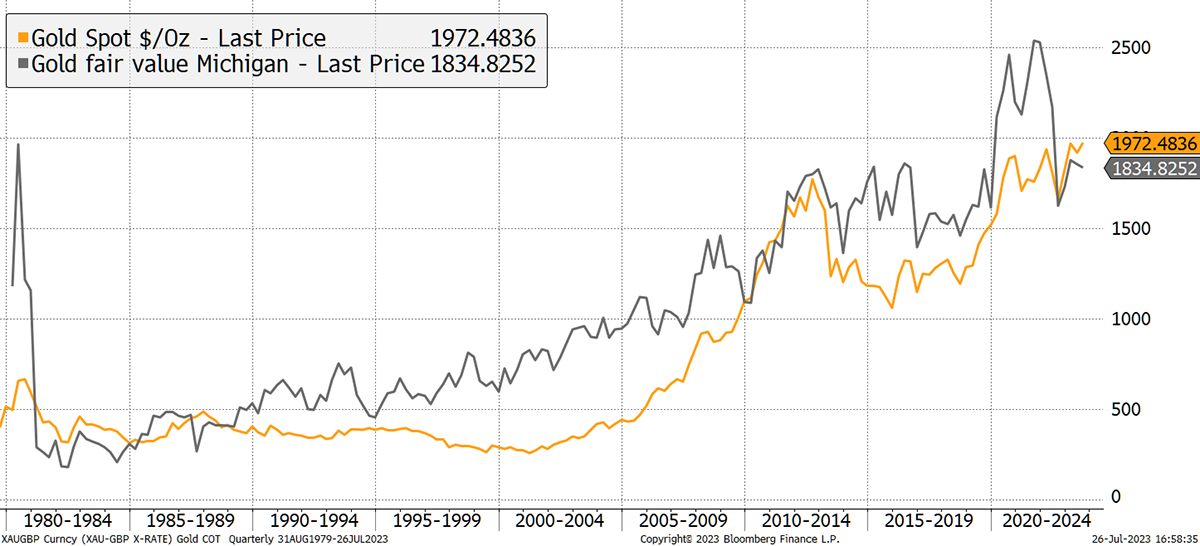

If I replace breakevens with the Michigan 5-to-10-year inflation forecasts, we get some magic. You only need to believe the next decade sees inflation at 3%, as Michigan does, instead of 2%, and the current gold price is completely underpinned.

Gold Fair Value Using University of Michigan Data

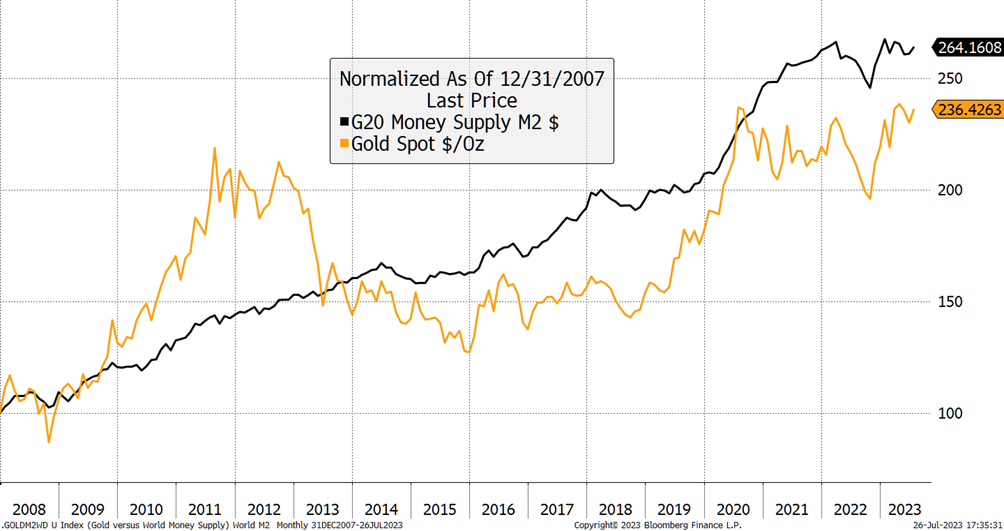

The conundrum as to where inflation will land remains one of the great market mysteries. Certainly, if you look at the global money supply, gold still lags, which presumably means the market is not yet tight.

Gold Lags the World Money Supply

Moreover, while the US money supply may be falling, globally, it is on the verge of an all-time high. Something has changed.

Macro

Yesterday, the Fed Chair, Jerome Powell, hiked rates for the 11th time since March 2022. He said that it was possible that “they would go again” at the September meeting if the data warranted. He’s still fighting inflation, and if I were him, I’d ditch the Fed’s academics and models and watch gold. To really fight inflation, he has to hike rates until gold breaks. If he can’t do that, inflation continues. Harsh but true.

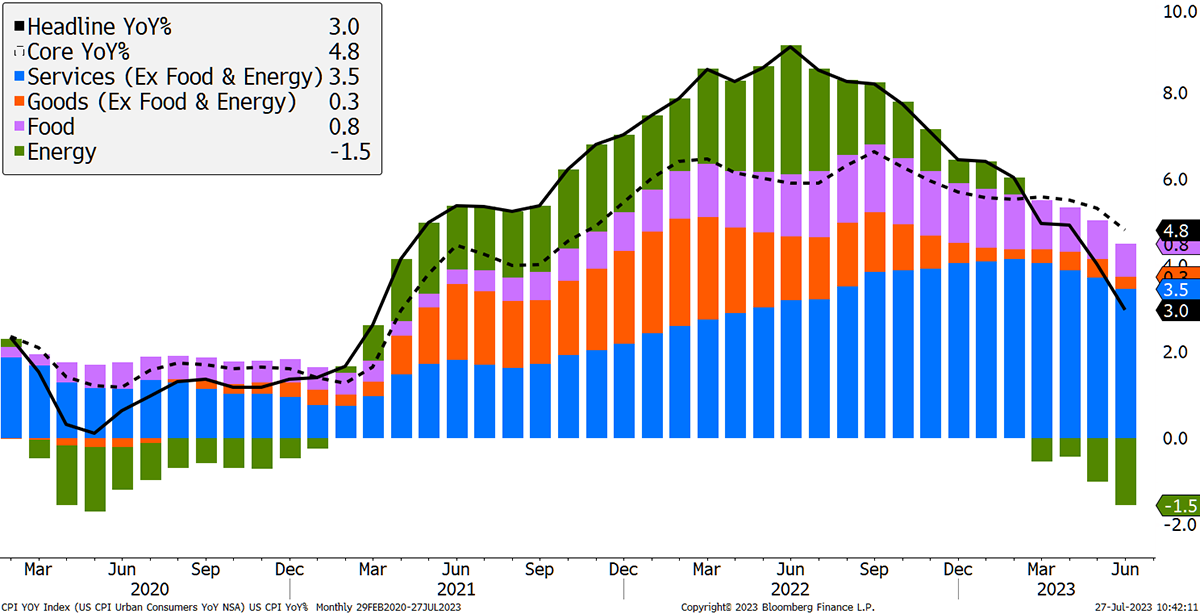

Although markets cheered the recent inflation prints in the USA and Europe, especially in the UK, the bad news for the doves is that much of the inflation drop has come courtesy of falling commodity prices.

Inflation has Eased

Some of the fall is down to the recovery of post-lockdown supply chains. But the rest has come about due to softer commodity prices. Looking at the CRB Rind Index, it wants to break out.

Commodities Rally

Furthermore, you would normally associate buoyant commodities with a soft dollar. How can the dollar be sinking when rates are shooting higher? The dollar index is in a bear market. Powell must be tearing his hair out.

Dollar Bear Market

Regime

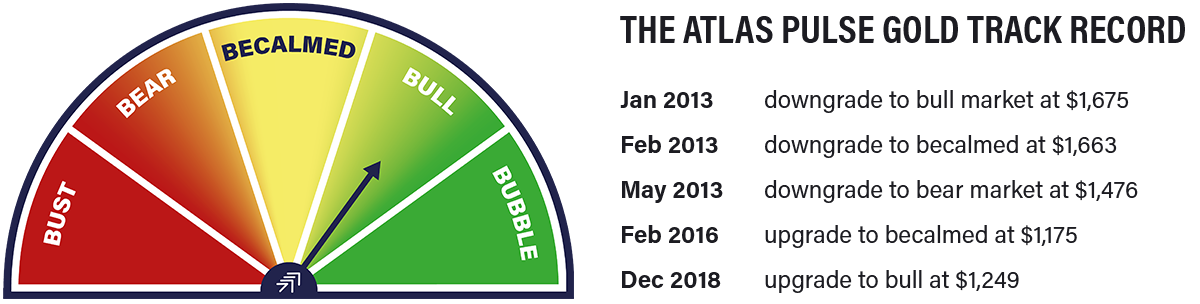

What does all of this mean for my three gold tests?

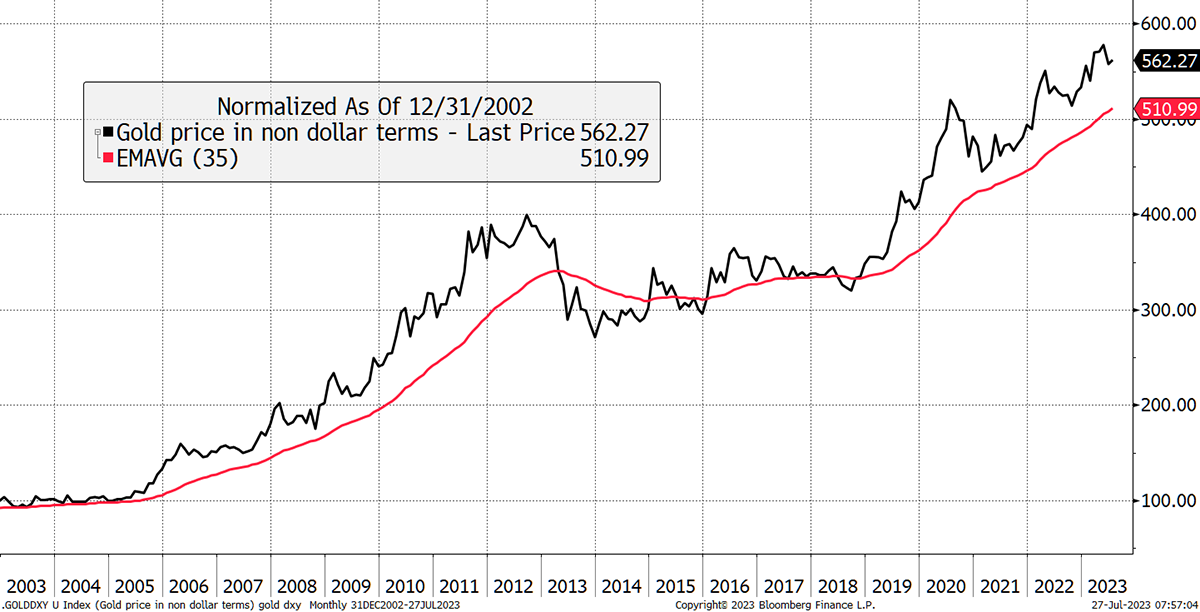

First up is the gold price in a global currency basket. That is unquestionably bullish.

Gold Trend is Strong Around the World

The second test is gold versus the S&P 500. This is neutral, although you can downgrade the impact of the big tech stocks, which went nuts earlier this year, using the equally weighted index. This would still confirm that gold is ahead of stocks, and the same would hold true if you used global equities. Mmmm.

Gold Holding Firm Against Equities

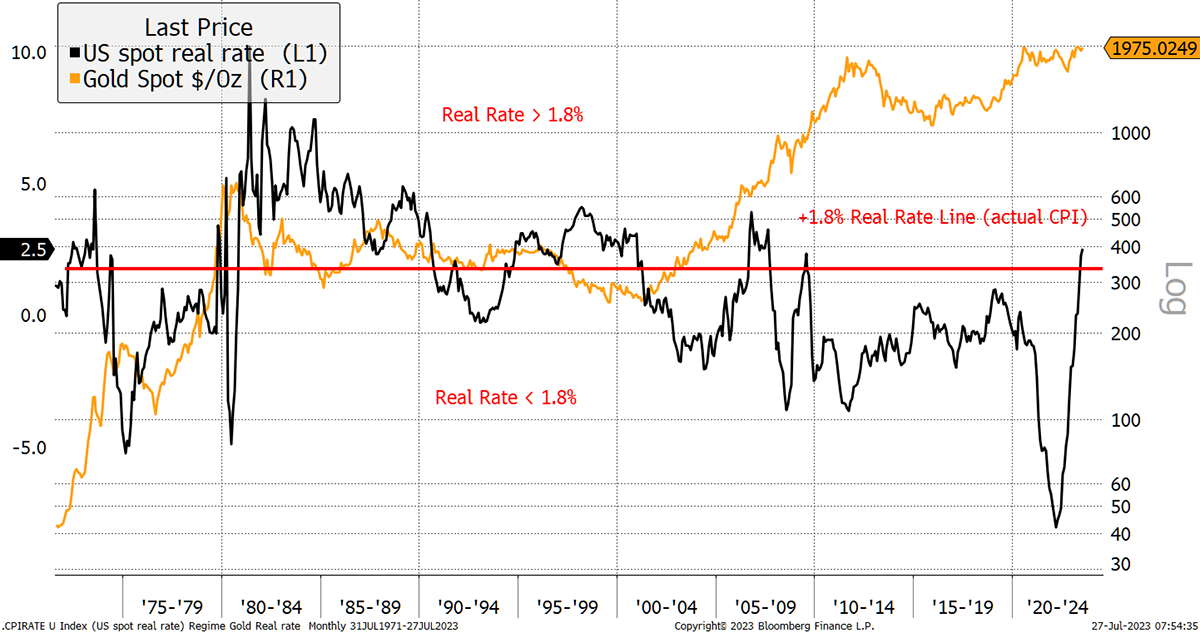

The bad news comes from real rates. Powell hiked rates to 5.5% while CPI is 3%. That’s a hefty 2.5% real rate which hasn’t historically been good for gold.

Feel the Squeeze

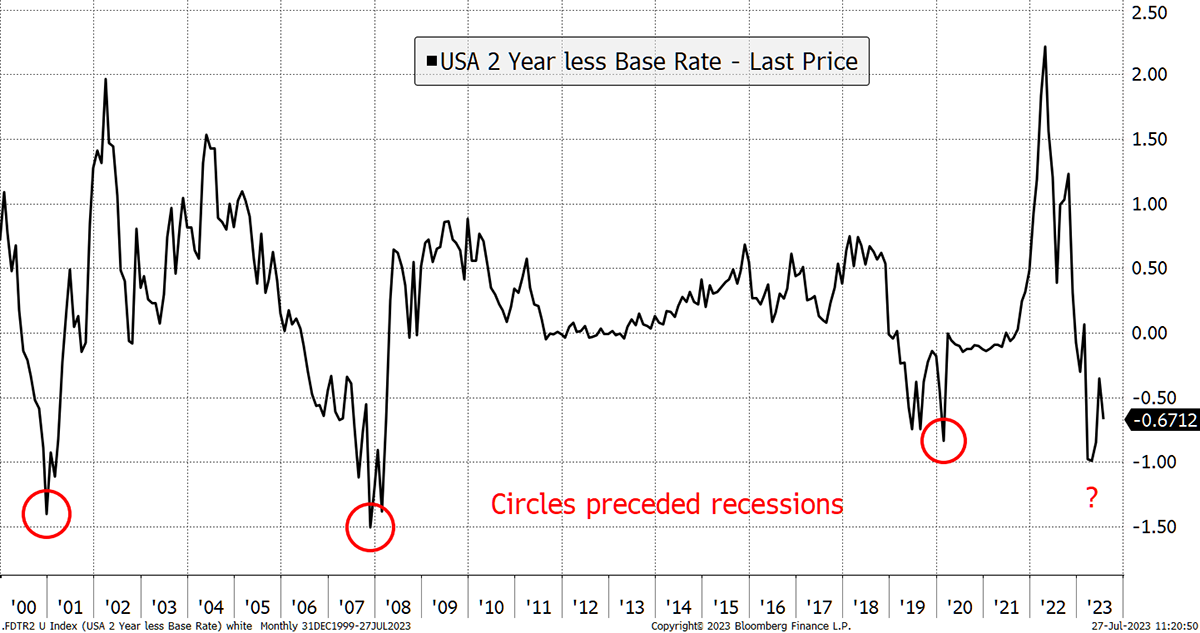

The caveat is that the 2-year yield is still at 4.8%, and CPI, which faces rising commodities and rising import costs from a weak dollar, has its work cut out, bringing this model back into neutral territory. The point here is that the gold market doubts the Fed’s metal and sees them backing off when the economy breaks. But Uncle Jerome is no longer forecasting a recession. It’s just everyone else, and the bond market, that still is. Maybe gold too.

Jerome Says No Recession

Summary

Having been a reliable source for years, US data has allowed us to understand the global economy. But these last couple of years have seen aggregate global data supersede it. Look no further than the world money supply chart above. In the US, it is falling, but globally, it is edging higher. My challenge over the next couple of years is to get a handle on how gold fits into a global financial model as the dollar’s influence wanes.

I didn’t mention the BRICS, who are looking at a new gold-backed currency. I will do, but right now, there are lots of rumours and few facts. Maybe next month.

The Gold Dial Remains in Bull Market.

I have been writing Atlas Pulse since October 2012. If you wish to receive the next issue of Atlas Pulse ahead of the rest, then subscribe here.

Comments ()