China and The Money Map

Trade in Whisky;

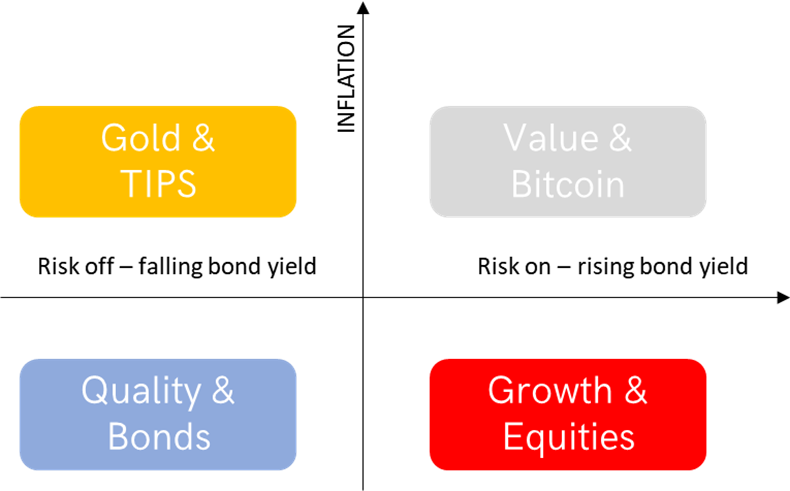

The Money Map helps us understand what types of asset work best in different environments. If you can predict where inflation and bond yields are headed, which isn’t always easy, then the Money Map tells you where to invest. And more importantly, where not to invest.

If inflation is rising, then gold and value assets will outperform. If inflation is low or falling, stick with equities and bonds. Similarly, if the economy is strong and bond yields are rising, then Growth and Value will beat Gold and Quality. It is logical and helps to explain what performs best and worst given the macro conditions. Right now, bond yields are rising, which puts us on the right-hand side, while inflation (future expectations) is broadly flat or falling.

That’s the simple implementation, but we can also consider the diagonals. Real rates, which are bond yields less inflation, are illustrated by the top left bottom right diagonal (orange). High real rates favour growth, while low real rates favour gold.

The other diagonal, bottom left to top right (green), follows the “heat” of the macro conditions. Here we add inflation and yield together and get a sense of market heat, which could be described as a proxy for nominal GDP growth. A very low number is ice cold, such as in 2008 when interest rates were dropped to zero, while inflation was briefly negative. A very high number is fiery and means rates and inflation are getting out of hand, as they are in places like Turkey and Argentina.

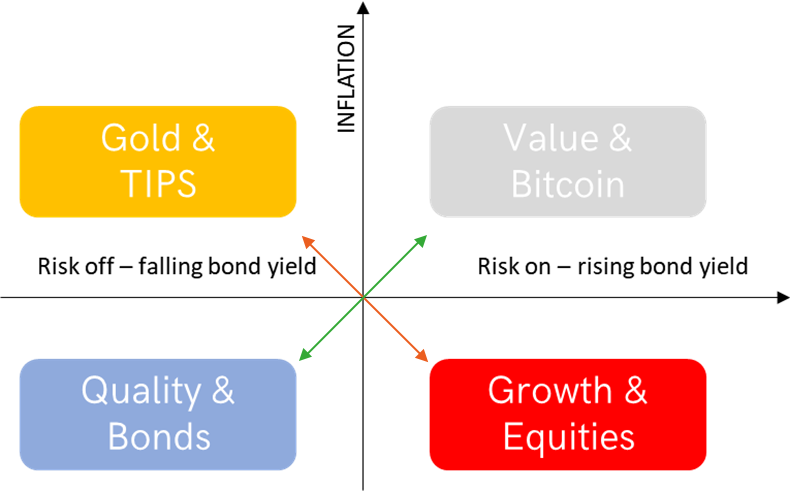

I will go through the key rates and inflation in major countries for comparison. It may surprise you that while Europe and the US have an inflation problem, China recently dipped into deflation.

Inflation by Country

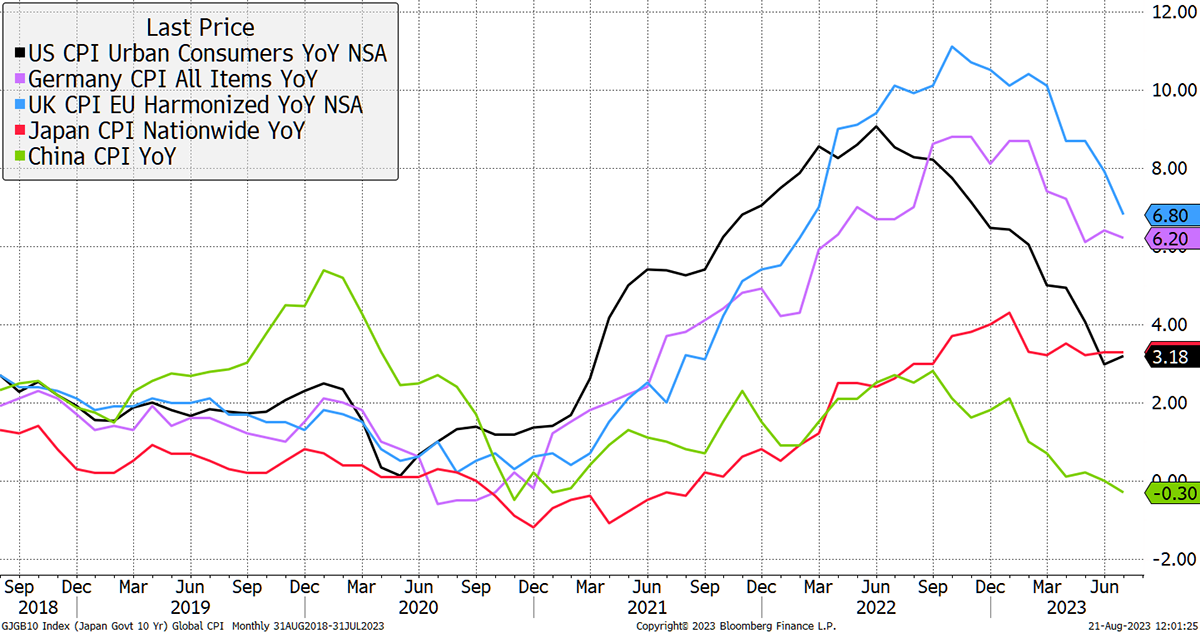

Looking at bond yields, the US and UK are by far the highest, with Europe stubbornly catching up. Meanwhile, Japanese yields remain contained by policy, while Chinese yields are falling. That is, Chinese bond yields have historically been correlated with the rest of the world, but something has changed.

10-year Bond Yield by Country

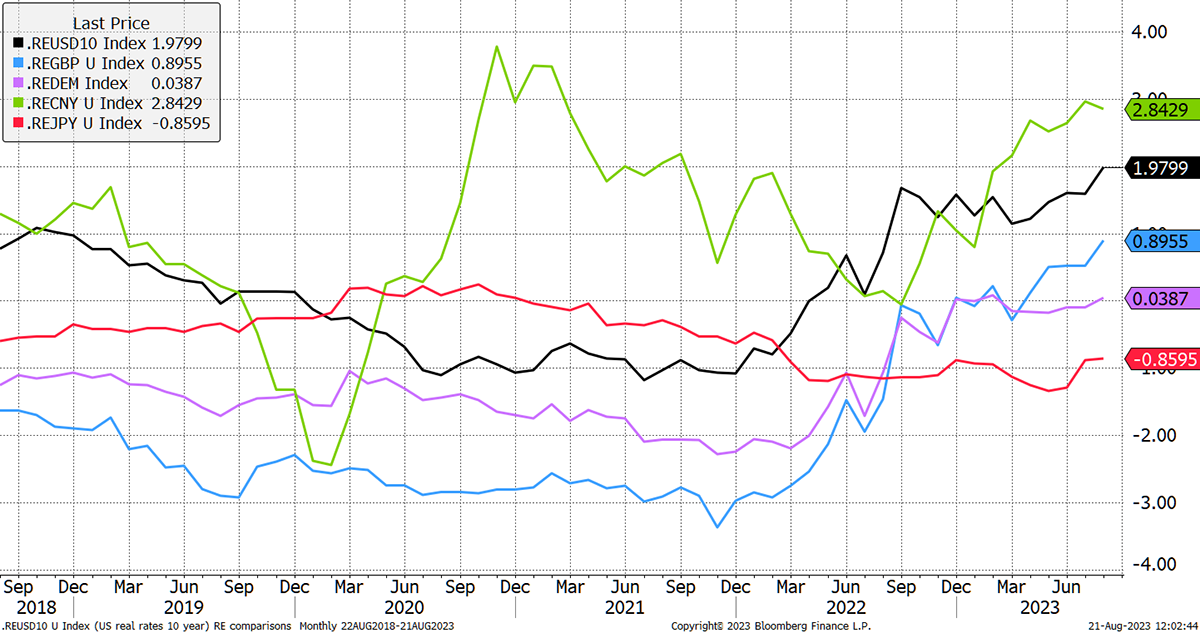

Real yields, the bond yield less inflation, is alarming. The real yield in the US is already very high at 2%. The UK is similar because although it appears to be 1.1% lower, that can be accounted for by the indexing against RPI instead of CPI, which is around 1.2% (on average) higher. So the UK and the US are about the same. Europe is still at zero, with Japan at -0.8%. What is remarkable is how China is 2.85%, which is a very high number and is bound to be stalling the economy.

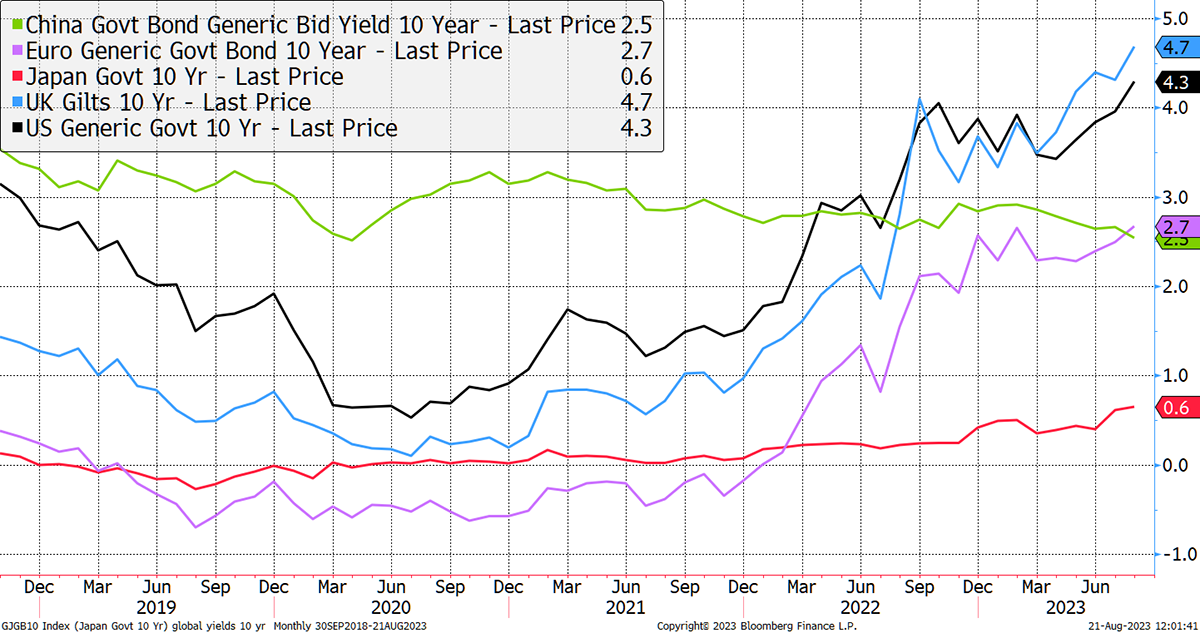

Real Yields

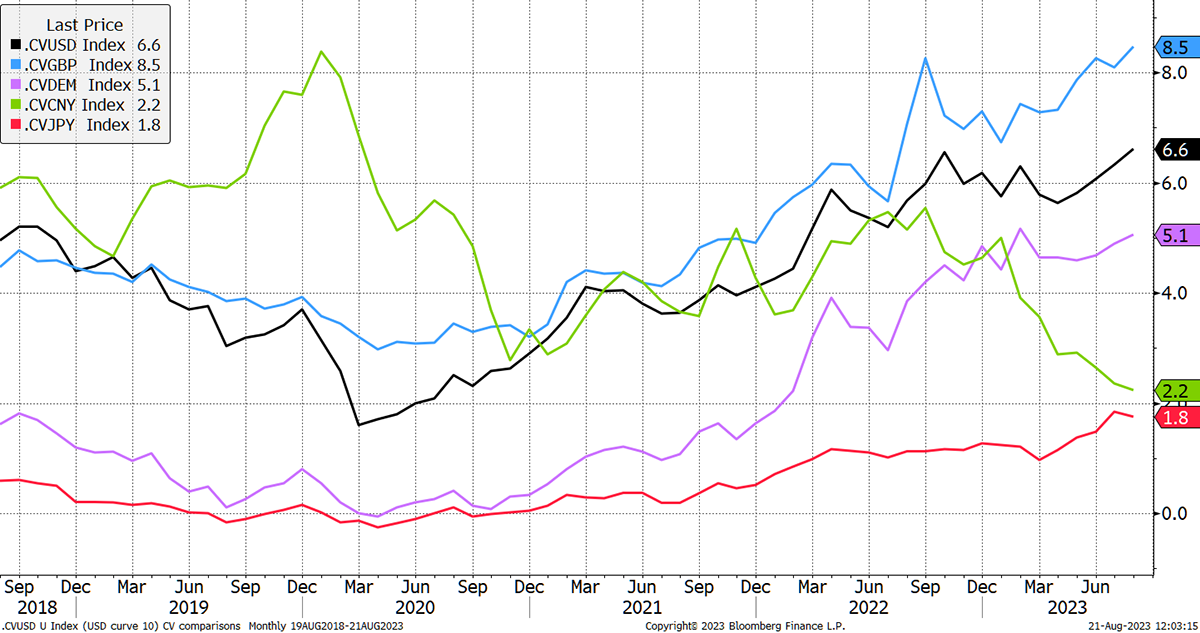

Finally, I show the heat, where the yield and inflation are added together. The West tears away into the stratosphere, with Japan very low but rising. The standout is China, which has fallen from 8% in late 2019 to just 2.2% today. As I said, think of the heat to be a proxy for nominal GDP growth. The USA touched 2% at the depths of the 2008 credit crisis. Could China’s situation be much worse than we currently realise?

Market Heat

The Chinese economy is slowing rapidly, and with the major property developers defaulting on loans, the domino effect cannot be ignored. This is a clear risk for global markets because these things are rarely contained. This could spread as exposure to bond defaults tends to end up in all the wrong places around the world. The other development is how China used to be correlated with the global financial system, but that no longer seems to be the case. It is inevitably a cause for concern.

I am very conscious of these developments and am keen to ensure we are prepared for the worst. That is not to panic, but to remain cautious.

Trade in Whisky

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd