Driving Through the Valuation Gap

Disclaimer: Your capital is at risk. This is not investment advice.

Over the past decade, the world’s automotive stocks have been valued at a trillion dollars up until the pandemic. Then, the central banks printed money like never before, and by late 2021, the value exploded to $2.5 trillion before settling back to $1.8 trillion today.

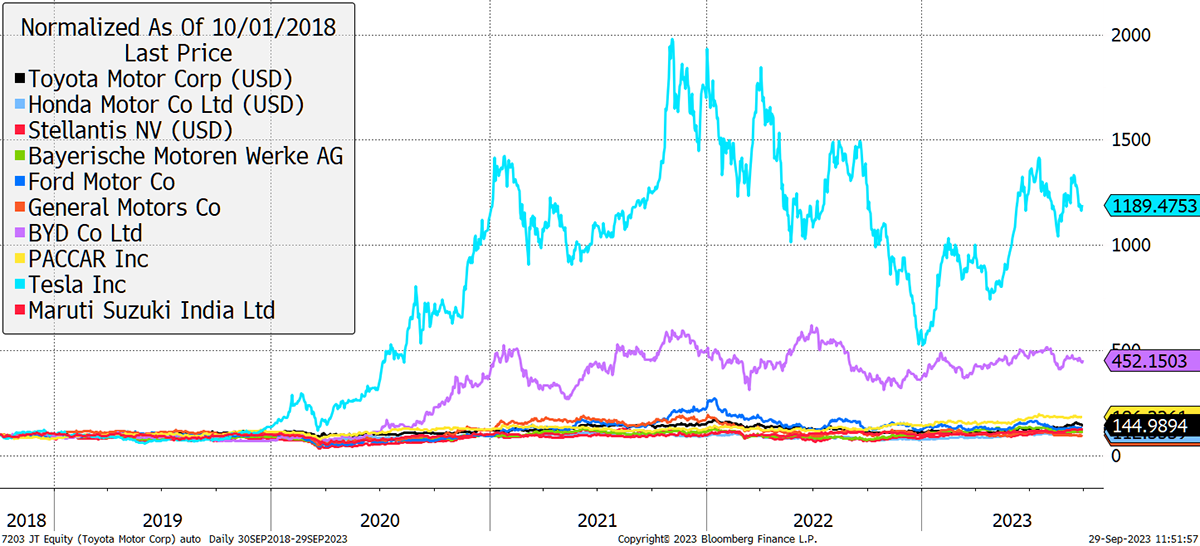

The Top Ten Auto Stocks – Past Five Years

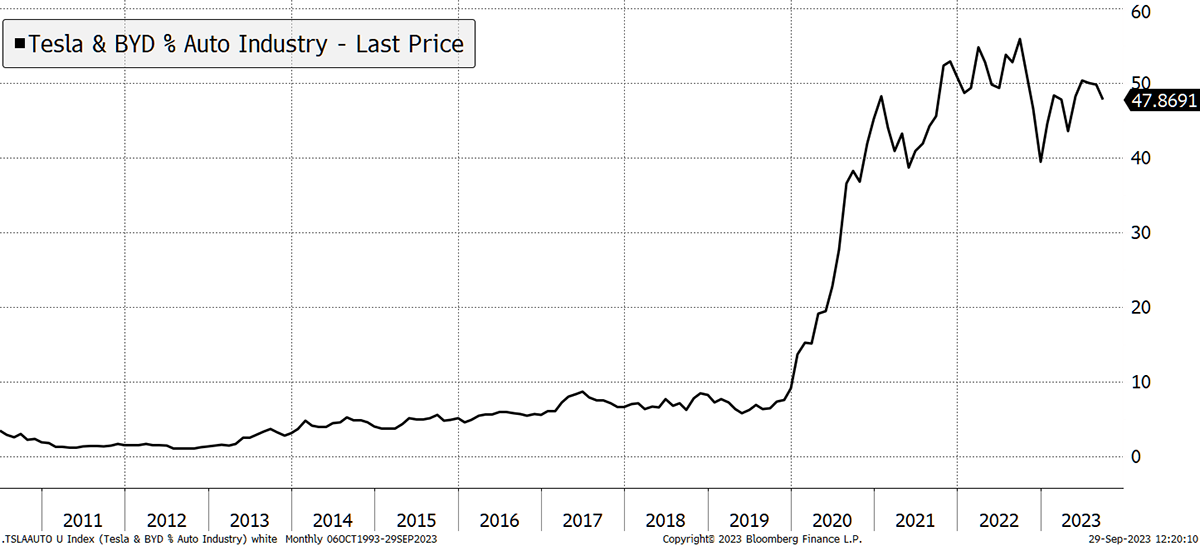

Tesla (US$782 billion) has been the best performer, with China’s top electric vehicle maker, BYD (US$92 billion), in second place. The combined value of these two EV makers makes up 48% of the entire auto sector despite accounting for less than 10% of total sales. This is an extraordinary situation and one that has raised eyebrows among value investors for a while.

Tesla and BYD Share of the Automotive Industry by Market Capitalisation

To my mind, that chart finally appears to be rolling over.

It is well known that TSLA shares are highly priced, but less discussed is how cheap the old guard are. In 2023, we expect to see 70 million cars sold, with 3 million of them built by Tesla and BYD. To put it another way, the EV companies are valued at $291,333 per car sold each year, which is more than 10x the rest of the industry. That compares with a more modest $25,714 per car sold for the old guard. Looking at PE ratios, Tesla is on 65x and BYD 25x. That compares with Ford 7x, GM 4.6x, Toyota 10x, Volkswagen 3.9x, Stellantis 3.1x, BMW 5.6x, Honda 8,5x.

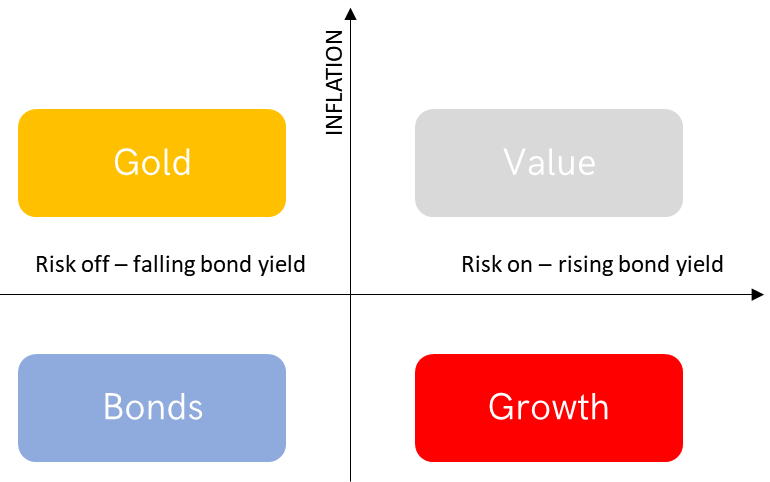

After an extended period of relative weakness for Value stocks, the low is in, and a new rally has begun. I expect Value to take the lead for years to come while Growth flounders. This has little to do with the next best thing in technology but the efficient allocation of capital. Holding Tesla has been hugely successful, but when you can buy the old world for a song, it’s time to change tack. I’m wheeling out this chart again as a new Value leg is underway.

Value versus Growth

The EV makers are expensive, while the established automakers are cheap, something that has been obvious for some time, but now we have another catalyst for change, which is rising bond yields. As my reliable Money Map reminds us, rising bond yields and stubborn inflation favour a Value environment. That includes commodities and heavy industry, and manufacturing, such as the auto sector.

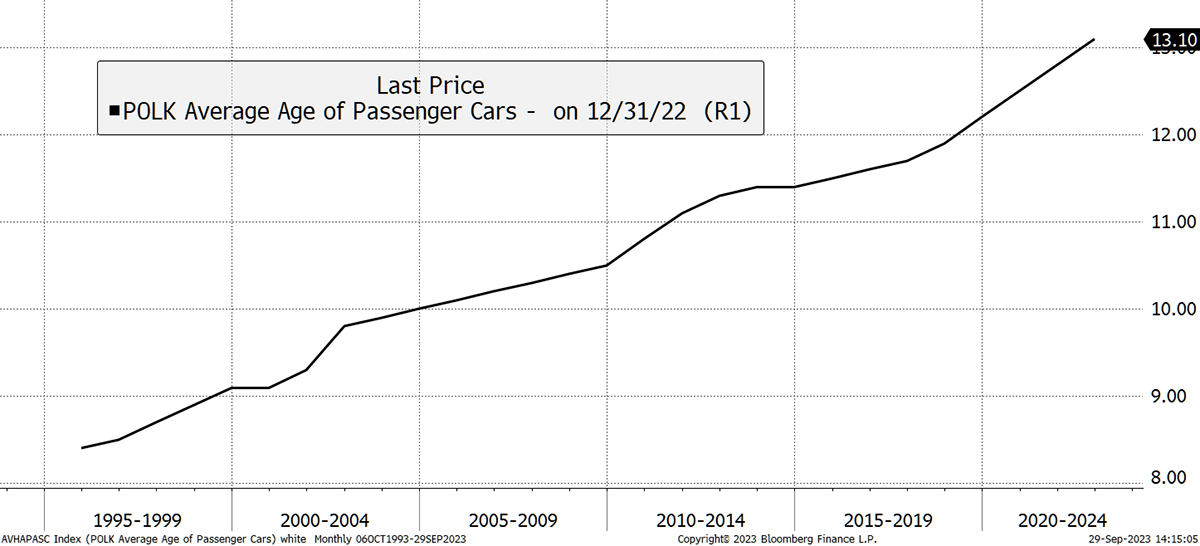

It’s not just the macro-economic environment and the valuations, but the outlook. Despite fears of recession, the car companies are doing well and are seeing their profit forecasts being upgraded. I suppose it’s not that difficult when they are so cheap and supply chains have been so badly disrupted over the pandemic. Furthermore, the average age of a car in the US, the largest market, is now 13.1 years, which is an all-time high. Whatever the weather, old cars eventually need replacing.

Our Cars Are Ageing

I am not saying that Tesla and BYD are troubled. I am sure they will make many more cars in the future and be a lasting force in the auto sector. But as investors, that’s not our fight. It’s the value gap, which you can drive a truck through, that we should be more focused on. It’s not only how much you can make from value stocks, but how much safer they are than Growth stocks. In 2023, Growth is back in a very dangerous place.

One counterargument is that the big automakers are on strike in the US, something unlikely to happen at Tesla because robots are generally obedient. But that is often a sign of the good times, and the workers want their fair share. They’ll get it, as their employers can afford it, but the next factory will require fewer workers. In the end, they’ll all resemble Tesla. Making electric cars can’t be that hard.

A Week at ByteTree

The highlight of the week was Robin and Rashpal’s Higher for Longer. Their momentum models continued to be choppy, and Robin reminded us, “we are still in the seasonally weak period of the year for equity markets, and it stays like this until the very end of October − heading into November. We stay invested but are watching closely for a change if economies weaken into recession”.

Rashpal added how rates would stay higher as the easy part in the fight against inflation was done. The hard part carries on.

I wrote Monetary Versus Fiscal, which described the extraordinary situation we find ourselves in. The central banks hike rates and crush the money supply, which they created. Then, on the other side, governments are spending money like rockstars. Little wonder markets are trapped between a rock and a hard place.

We congratulated Grayscale on 10 years of managing their $13 billion Bitcoin Fund. They hope to convert it into an ETF, but the regulators drag their heels. Why? Because they believe their authorization would legitimize the space. They have been stalling in the hope that crypto would quietly die a slow death. It hasn’t, and it won’t.

Ali wrote an excellent piece on THORChain (RUNE). This allows traders to see improved liquidity on decentralized exchanges. Some of the centralized exchanges, such as Sam Bankman-Fried’s FTX, failed its users as it controlled client money at the time of failure. Decentralized exchanges solve this but have lower liquidity. RUNE comes in to solve this problem, and you can read more here. My point is that crypto is a very long way from death, and every hurdle ends up being solved. RUNE is yet another example of that.

If you enjoyed ByteTrend, we are testing a new version on X (Twitter). Please follow us and we’ll let you into our secret den. Your feedback will be appreciated.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()