I want to remind you what we are waiting for, especially in the Soda Portfolio. There are dozens of investment trusts (and closed-ended funds), some quite large and liquid, which offer compelling value. This is a follow-up to my last piece, but it has been right to hold back because the discounts are still widening. The market doesn’t trust the published valuations for private equity and other illiquid assets, and it is right to be skeptical.

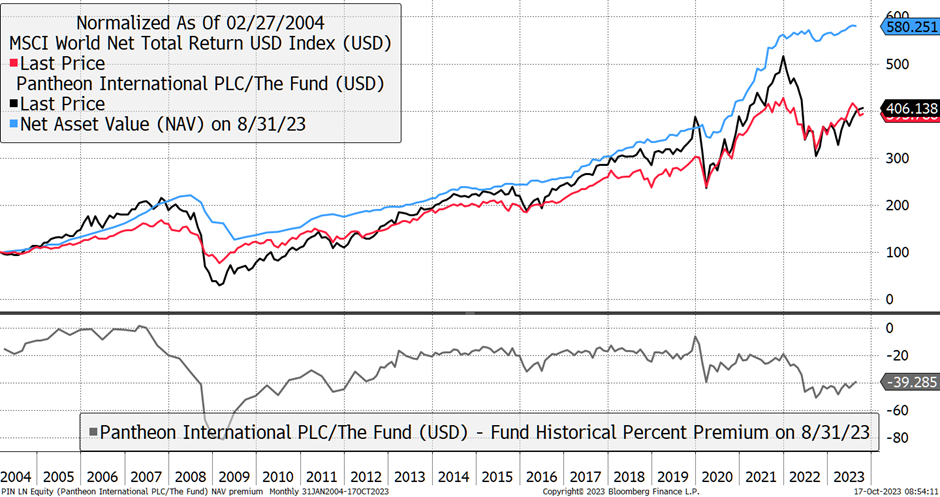

Pantheon Private Equity (PIN) is a good example. In blue is the net asset value (NAV), which is elevated compared to the share price (black). The resulting discount is 39%, shown in grey below. Interestingly, the PIN share price has followed the world index total return (red) closely over many years. That’s not surprising, given PIN is globally diversified and invests across sectors. It would be more surprising if it suddenly beat the market, given how closely they have followed each other in the past.

Pantheon Private Equity and the World Index

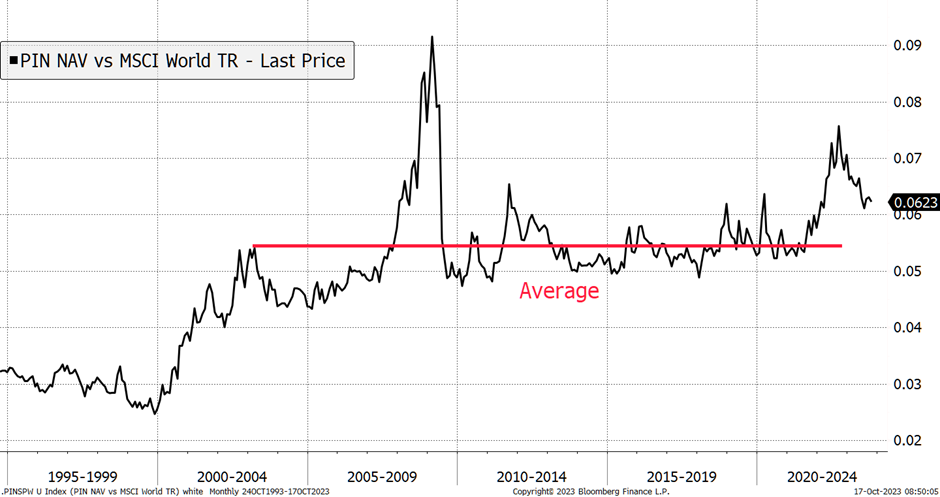

Perhaps this next chart is clearer, where I show the NAV converted into USD and relative to the world index. It is clearly a close relationship and seems to mean revert around an average. In 2008/9, PIN appeared to beat the market, but in reality, it was slow at making down their assets compared to the stockmarket. This time, the NAV is elevated again, which, to my mind, implies it is overstated.

Outperformance or Slow to Mark Down?

The board agreed to a £200 million buyback to placate shareholders. That has boosted the share price, but I doubt it achieves its aim because the discount is not as big as implied.

There is distrust in private equity because it is a highly leveraged sector, and we’ve had a savage bond bear market and a crash in junior growth stocks, yet valuations in private equity have barely budged. It doesn’t take a genius to figure out that not all is as it seems. We have owned PIN in the past and will own it again, just not yet.

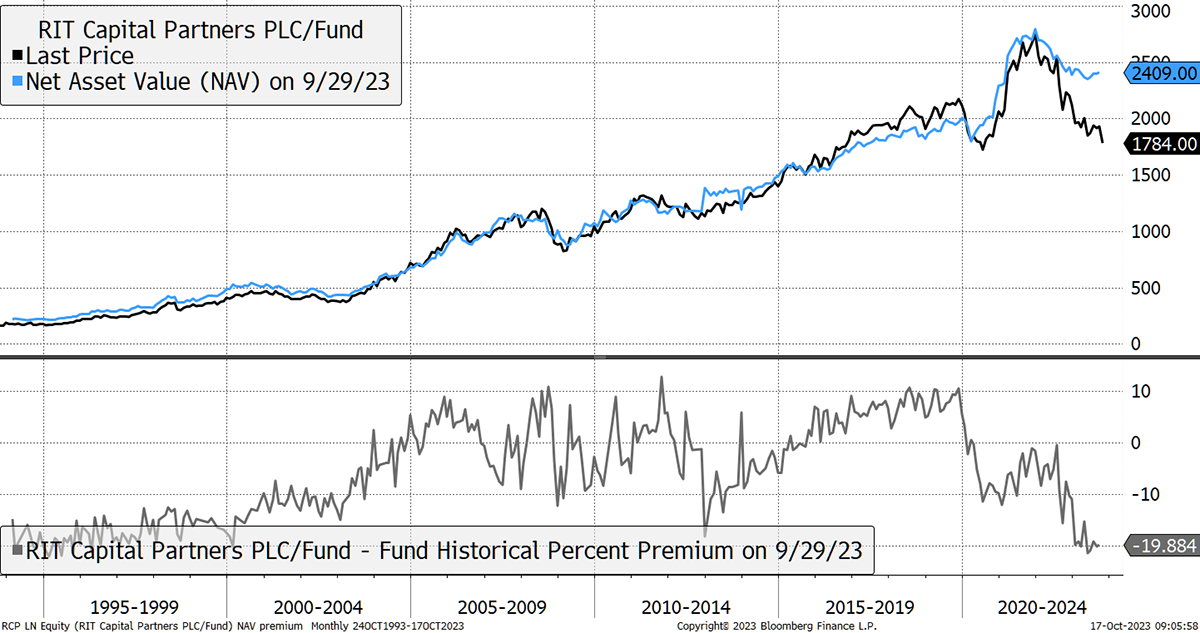

RIT Capital (RCP) is the family office to parts of the Rothschild Family. It has an excellent long-term record, but again, the price has slipped below NAV, taking the discount to 20%. It is an easy thing to own over the long term because it is diversified, but the market simply doesn’t trust private equity valuations.

The latest factsheet provides little information, but there is 40% in direct private equity and funds, which explains the discount. There’s also 26% in direct equity, but the list is uninspiring. For example, Helios Towers (HTWS) is a debt-fueled mobile phone tower business down 60% over the past two years. That’s what really worries me about private equity: their fondness for leverage. The listed companies managed to fall in price; why not the private companies?

Even the Rothschilds…

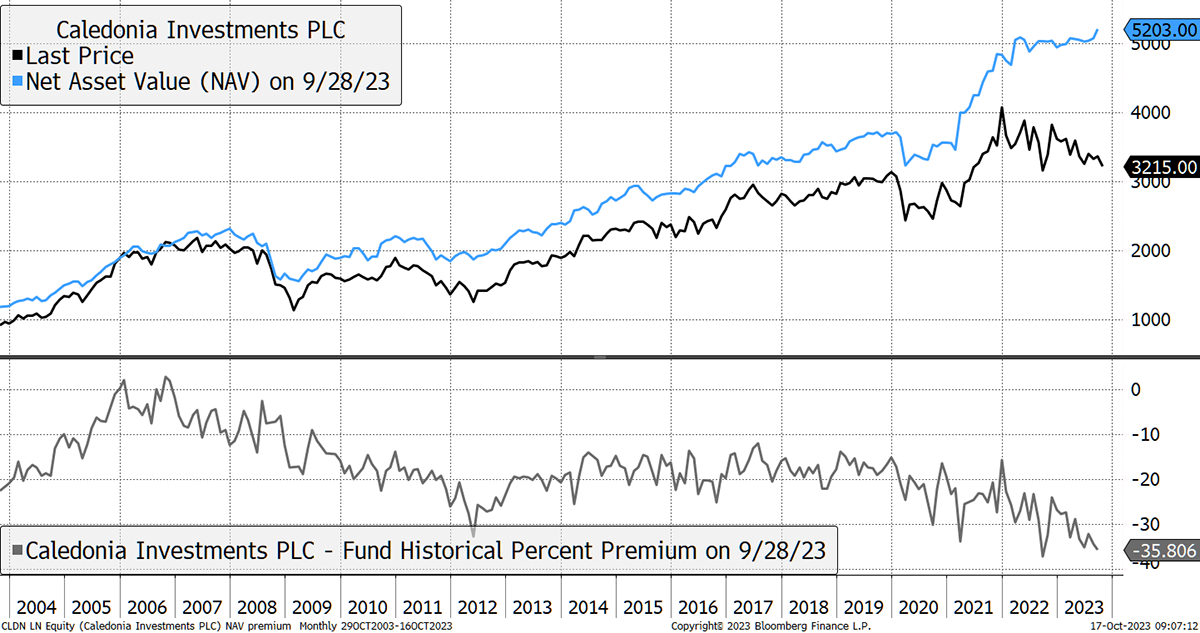

Caledonia (CLDN) is another family office. It recently had a win when they sold their 94% stake in 7 Investment Management (7IM) for £255 million, which was an uplift to their published valuation. Remarkably, and pending regulatory approval, this boosts their cash to around 9%, which, at times like this, is a strong position to be in. Yet the market slams it to a 36% discount just as the NAV makes an all-time high. It is brutal, but at the same time, the buyer’s opportunity.

Caledonia Never Before So Unloved

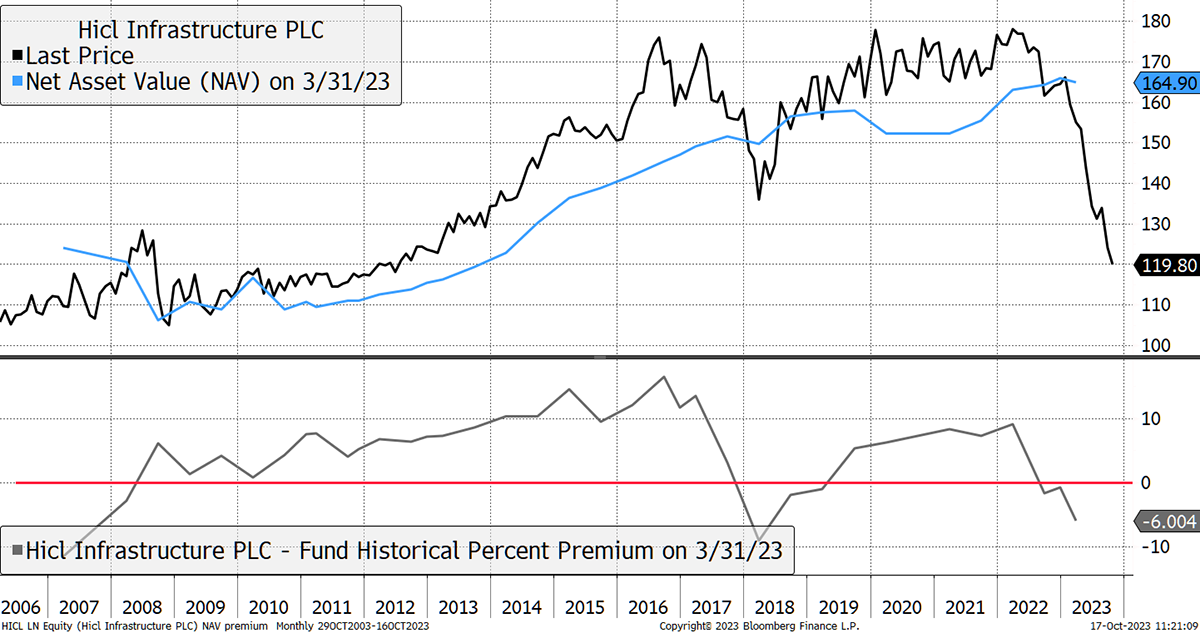

Over the years, people have asked me about the HICL Infrastructure Fund (HICL) and similar competitors, often in renewables. My standard response was never to buy at a premium, and once again, this has proven to be good advice. HICL trades at 120p, which is where it was 15 years ago. What confuses investors is that infrastructure is a leveraged business. You buy a toll road or a car park with debt, yet the increased cost of debt is not reflected with a lower valuation as it should be. You could argue the price of debt has fallen, which would support valuation, but what happens when it needs to be refinanced? Low rates were clearly good for private equity and infrastructure. How can high rates be as well?

Infrastructure Valuations Need Revision

What is true for commercial property must equally be true for infrastructure. They both earn steady income streams, are funded by debt and are made of concrete.

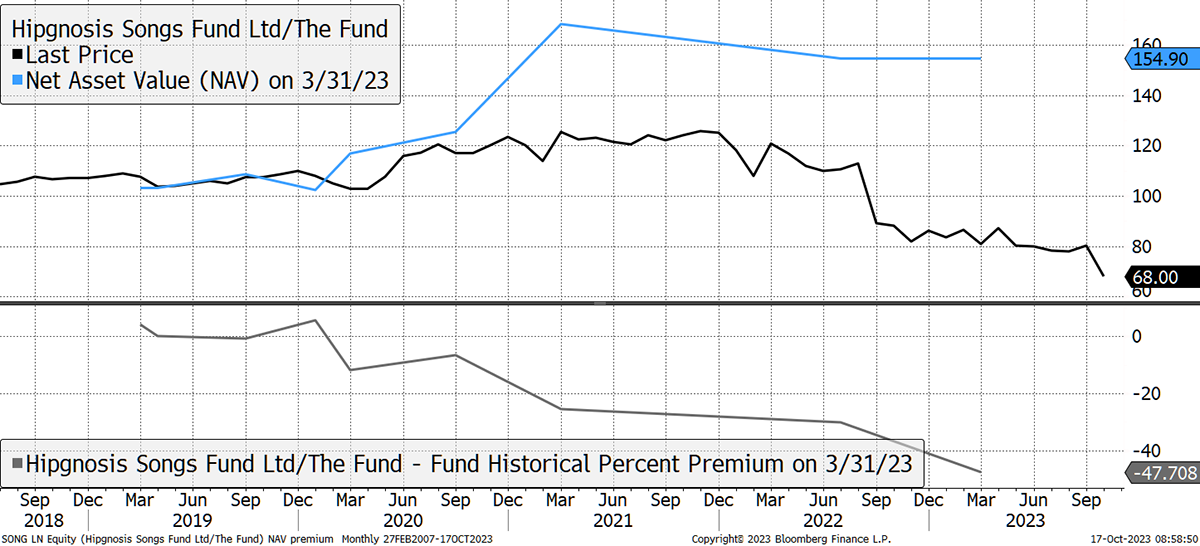

I mentioned Hipgnosis Sings Fund (SONG) last time when it was trading at 74p at a near 50% discount to NAV. It surged on the news that competitor Round Hill (RHM) was bid for, implying that SONG was undervalued. Then today, SONG cut its dividend, the primary reason to own it, as it announced, “it plans to withdraw its proposed interim dividend as it expects to receive significantly lower retroactive payments from its portfolio due to U.S. copyright royalty changes.”

Revenues are expected to fall from $21.7 million to $9.9 million. This is extraordinary, especially given how they have been talking about part selling the portfolio and buybacks and so on, just recently.

The Market Was Right

The market was right to doubt SONG, and so we have to consider that it is right about the others. Clearly, liquidity is a problem for the closed-ended fund sector, but that won’t change until the central banks start printing money again or the economy has a growth spurt.

If we don’t get those, the deep value alone should suffice the eager value investor with a sharp nose, but I believe they need to see realistic valuations, which are still some way off. There are many closed-ended funds on good discounts, and as a general rule, the more esoteric or illiquid the asset, the deeper the discount.

I want to embrace this sector for the Soda Portfolio in due course, but I just need it to stack up on all fronts, and it just doesn’t. This is why Soda embraces inflation-linked bonds because they are in a better place. They were expensive two years ago but are now cheap. They are liquid and offer attractive returns in an uncertain period. Investment trusts and other closed-ended funds are going to be spectacular at some point, but I’m not going near them until they fess up and reprice.

Action:

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd