Bitcoin Leads the Way

Disclaimer: Your capital is at risk. This is not investment advice.

It is becoming apparent that crypto is settling down. The weak projects are on their way to zero, but a new leadership group is emerging. I am interested in Chainlink (LINK), Solana (SOL) and TRON (TRX). They have good charts, having suffered significant price and price-relative (in BTC) corrections over the past two years.

The trouble is that Bitcoin is in the sweet spot. News over the weekend was encouraging. The SEC are not going to appeal the court decision that Grayscale could convert its trust into an ETF. This potentially clears the way for the first BTC ETF in the US. That would open the floodgates and be very positive for Bitcoin, and crypto more generally.

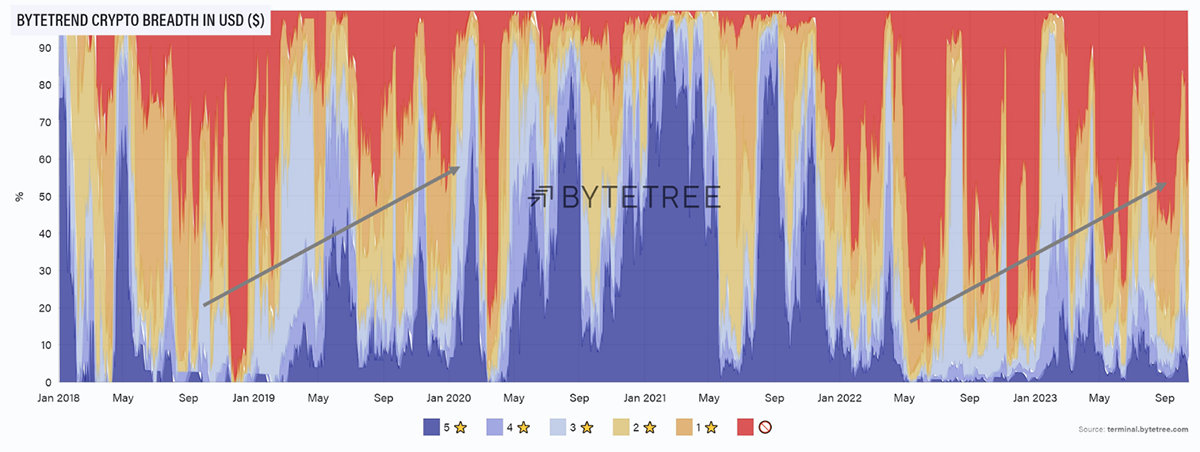

The question is the crypto breadth in USD vs BTC. The former seems to be improving nicely, but the latter is uncertain. Our instinct is that crypto is in much better shape but that Bitcoin still leads the way.

I very much hope that at some point next year, ByteFolio ceases to have a dominant holding in BTC and holds 10 or more tokens. That time is getting closer, as shown by the breadth charts. There’s a beat to the crypto sector, as shown, and the good news is that the red periods are contracting, with each correction softer than the last. We saw this in 2019, following the 2018 bear market. Admittedly, the crash in March 2020 was a covid shock, but the red continued to retreat thereafter.

Crypto is much less risky today than at any time over the past two years. But, with halving close at hand, we sense Bitcoin still has the upper hand for a while longer.

Shakers

Arbitrum (ARB)

The Ethereum Layer-2 (L2) scaling space is fiercely competitive, with projects like Arbitrum vying for dominance by continually evolving their ecosystems. One effective strategy to stimulate ecosystem growth involves offering grants and financial backing to projects within the network.