Atlas Pulse Gold Report, Issue 87;

It is remarkable how things can change in markets. Since 1999, when gold was “peak irrelevant”, we’ve come to understand what makes gold tick. It likes low rates, and high inflation, but it also likes a booming money supply and strong global demand. We know that because interest rates are surging, and the gold price couldn’t care less. Gold is sending a message.

Highlights

| Money Supply | Gold Is Undervalued vs the Money Supply |

| Macro | Gold Ignores Rates |

| Flows | Gold Is a Contrarian Trade |

| Regime | Gold Bull Market |

| BOLD | A Natural Fit |

Gold Is Undervalued vs the Money Supply

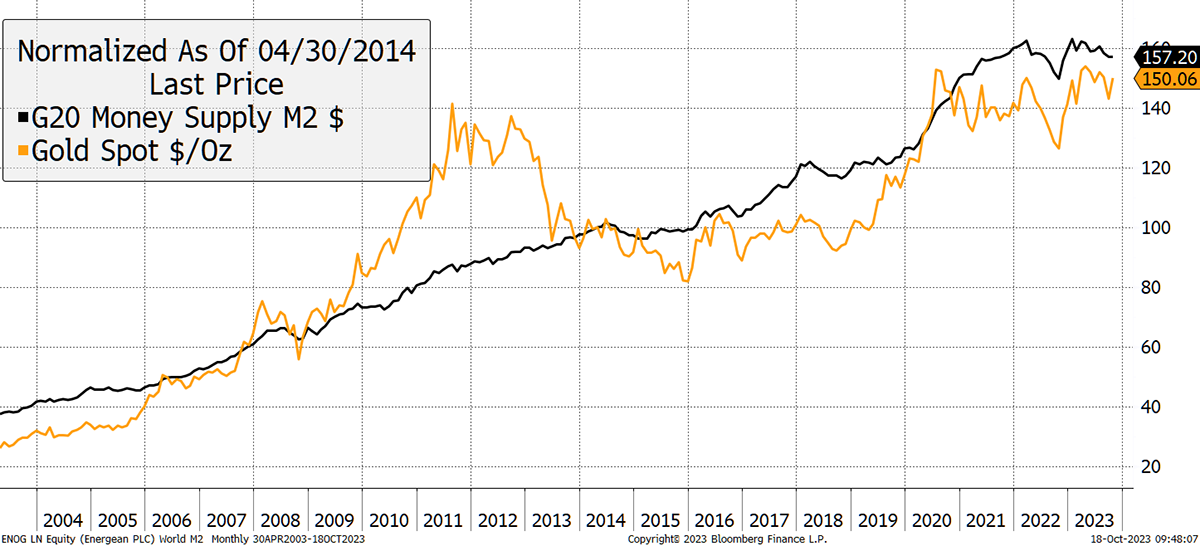

We’ll get to why gold is ignoring rate hikes and surging bond yields, but first, I want to show how the gold price is becoming more closely aligned with the global money supply (effectively G20 nations). Here, I show gold and Global M2 going back to 2003.

Gold and the Global Money Supply

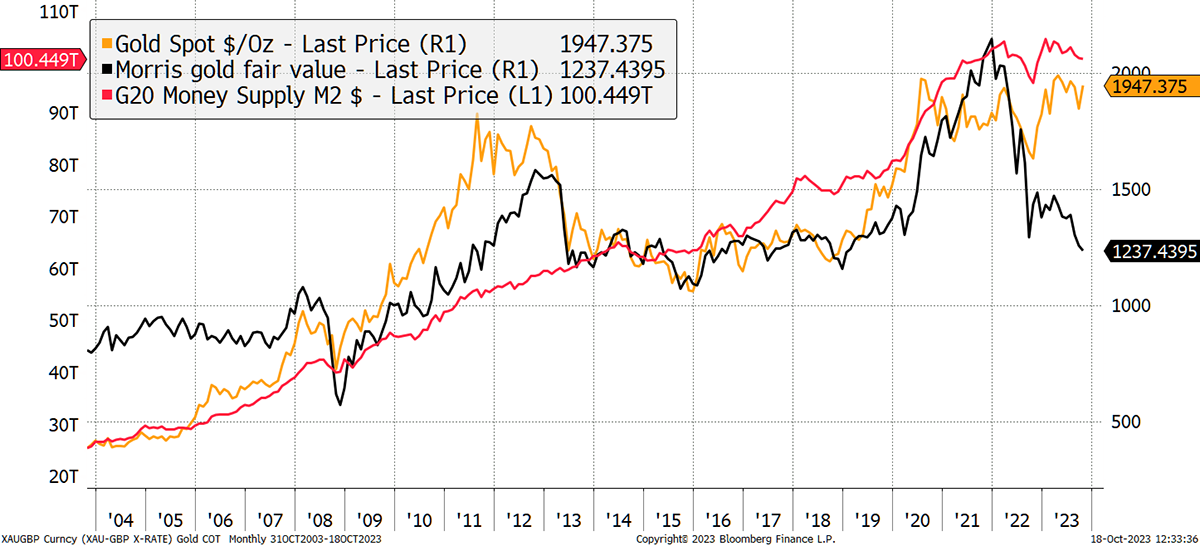

Regular readers know how I like to show global M2 against ByteTree’s BOLD Index with its perfect fit. The difference is that while BOLD has a closer fit, it doesn’t match M2 but exceeds it by 3.7x.

Over the past two decades, the global money supply has grown by 7.1% per annum, and it has a good fit with gold. There was a gold bubble in 2011 and a crash in 2013, but many would say the 2013 crash came about as real interest rates surged during the Taper Tantrum.

I won’t dispute that, but maybe gold was simply overvalued, and hence the shock when the tide turned. Given the credit crisis was a couple of years earlier, it’s no great surprise that gold enjoyed a period of excess demand as investors sought safety in the aftermath of a banking crisis. Currently, the chart implies gold is around 5% undervalued against the global money supply. It’s a different way to think about it.

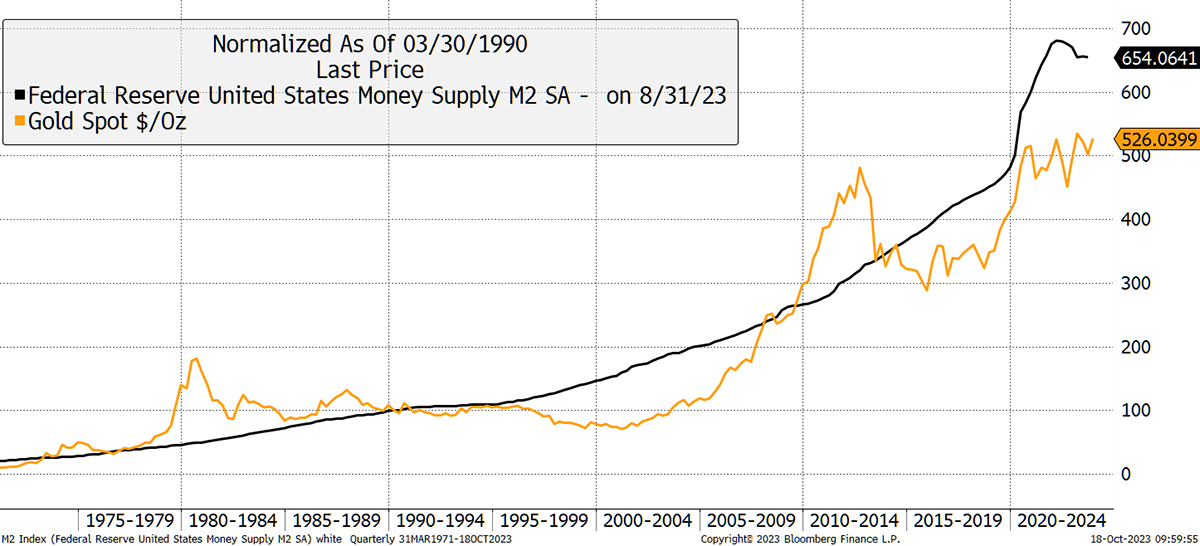

The point about global money supply is that gold is a global asset. Traditionally, we have used US data for many things, mainly because the US is the largest economy, but more importantly, it has the best available data. It’s not as good a fit as the global M2, but at least it has history.

Gold and the US Money Supply

While the Gold and US M2 have enjoyed a good fit over 50 years, albeit with booms and busts, the US was 40% of global GDP in 1960 and 26% today. Leaving out 74% of the picture for financial analysis, no longer cuts the mustard. But still, gold has a 20% upside vs US M2.

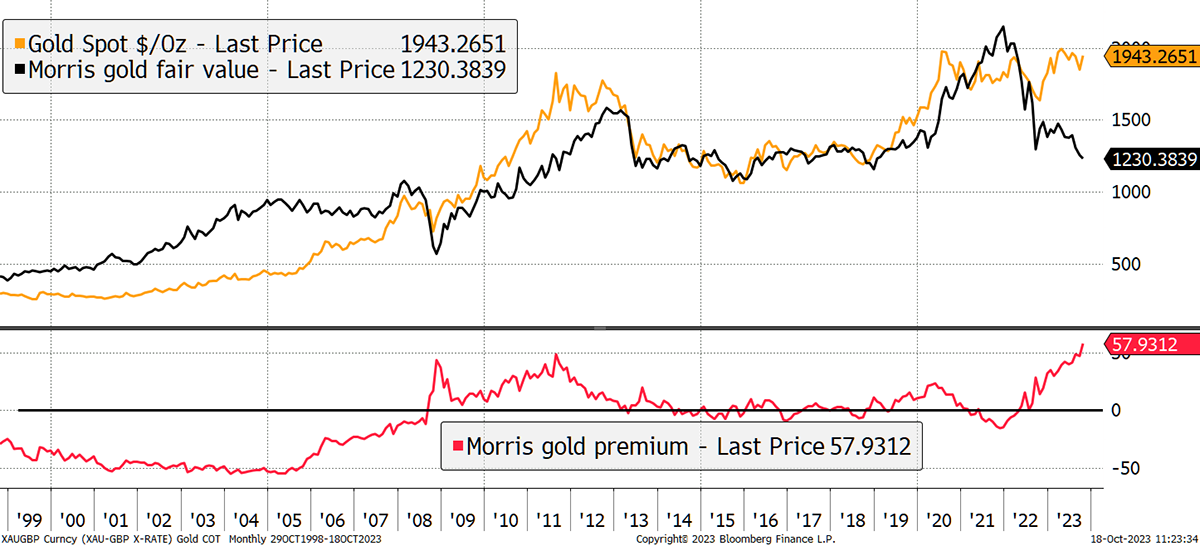

Gold Ignores Rates

I had been concerned about the surge in interest rates and bond yields. These have eased inflation (or have they?) and caused a drop in real rates (rates less inflation). This is normally bad for gold, but this time seems to be different (never say that). My modeling against 20-year TIPS shows an extraordinary divergence, implying gold is 58% overvalued.

Gold Ignores Rates as it Diverges from TIPS

In trying to explain this, I have explored geopolitics, central bank demand, mispricing of TIPS, and a bubble. My conclusion is that gold is going through a transformational period. It’s not a bubble, but TIPS are mispriced (too cheap) and understating inflation. Geopolitics are precarious, and the central banks are right to rank gold above Treasuries. At least there’s a limited supply.

As a result, gold is more closely aligned with the global money supply than inflation as the long-term price determinant. Real rates will continue to be the most important influence over the medium term, but we are living in transformational times. Longer-term factors currently outtrump shorter-term factors.

Inflation vs Money Supply

I accept that the long-term driver of gold should be the money supply over inflation because M2 expands with the economy, whereas inflation only rises courtesy of economic mismanagement, which is theoretically optional. Gold is not just an inflation hedge; it’s an important asset, and its value must keep up with wealth creation, even if that is counter-cyclical. But real rates have been the convincing driver of the gold price over the medium term, and if temporarily overlooked, they will return. Gold is telling us that things are far from normal.

Gold Smells Rate Cuts

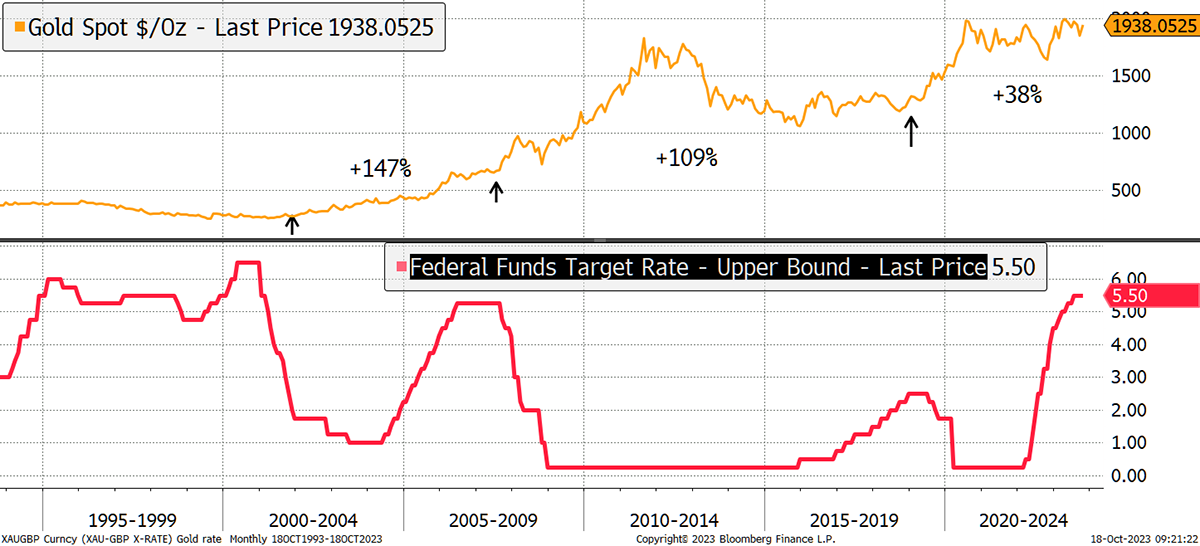

Yet there’s another reason, and that is the end of rate hikes is close at hand. In recent decades, we’ve had three surges in interest rates, which haven’t been bad for gold, but the cuts that followed were triumphant.

Gold and Rate Cuts

Don’t forget, gold has a cup and handle chart pattern. That gets some people very excited indeed!

With global house prices sinking and many developed countries facing elections in 2024, the politicians will go back to the printing press, just as they always do. This tightening cycle has gone on for too long, and gold knows it.

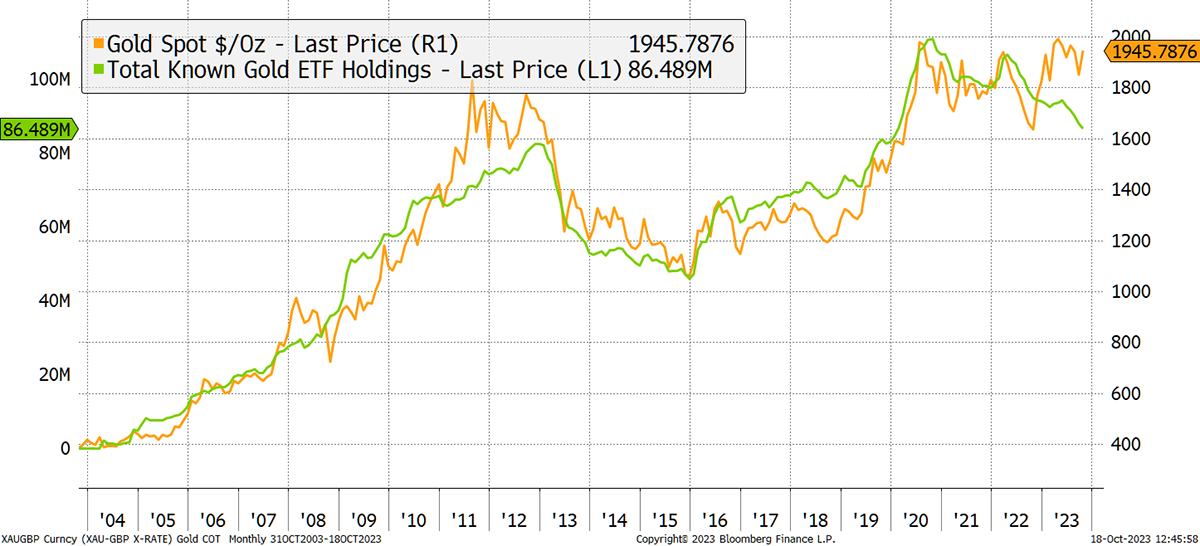

Gold Is a Contrarian Trade

The strangest piece of the gold puzzle is how light positioning is among institutional investors. The emerging central banks have been keen buyers, but Wall Street and global wealth management haven’t. They have been dumping gold since late 2020.

Wall Street Sells Gold

This group aren’t the sharpest tools in the box, but even for them, this is a shocking divergence. It means that when gold breaks to an all-time high, there will be huge demand.

Gold Bull Market

The Atlas Pulse bull market call isn’t just a hunch. It is dependent on three tried and tested indicators. Gold, in non-dollar terms, just made an all-time high. That is bullish.

All-Time High - Gold Price in non-Dollar Terms Remains Strong

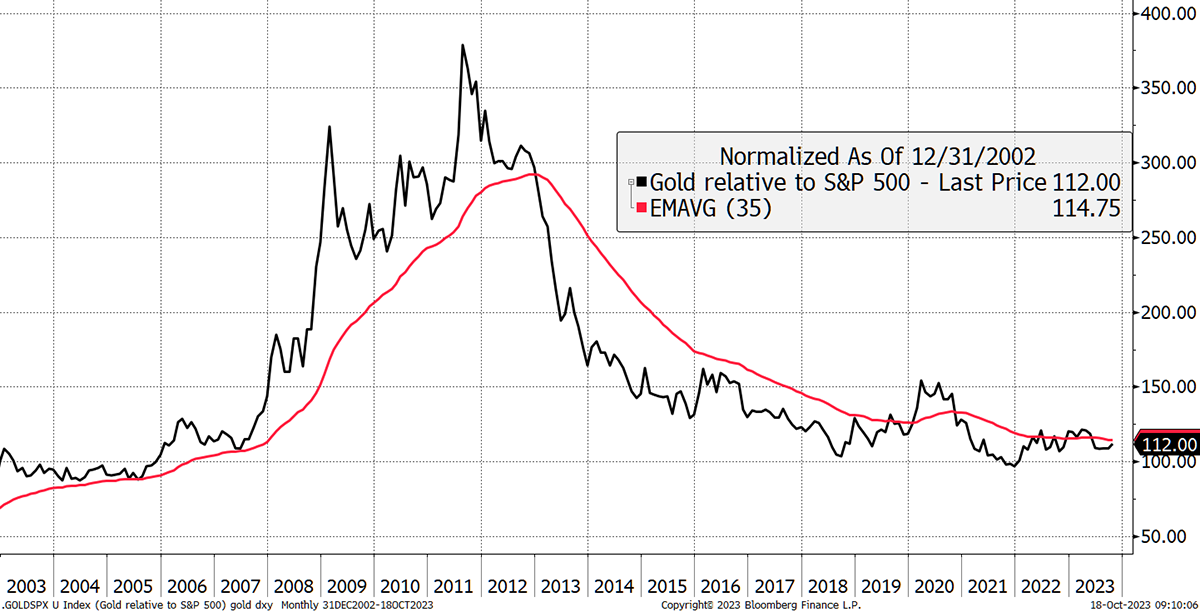

Compared to the stockmarket, gold is also doing fine. It is still in a range, but that will do.

Gold Firm vs Equities

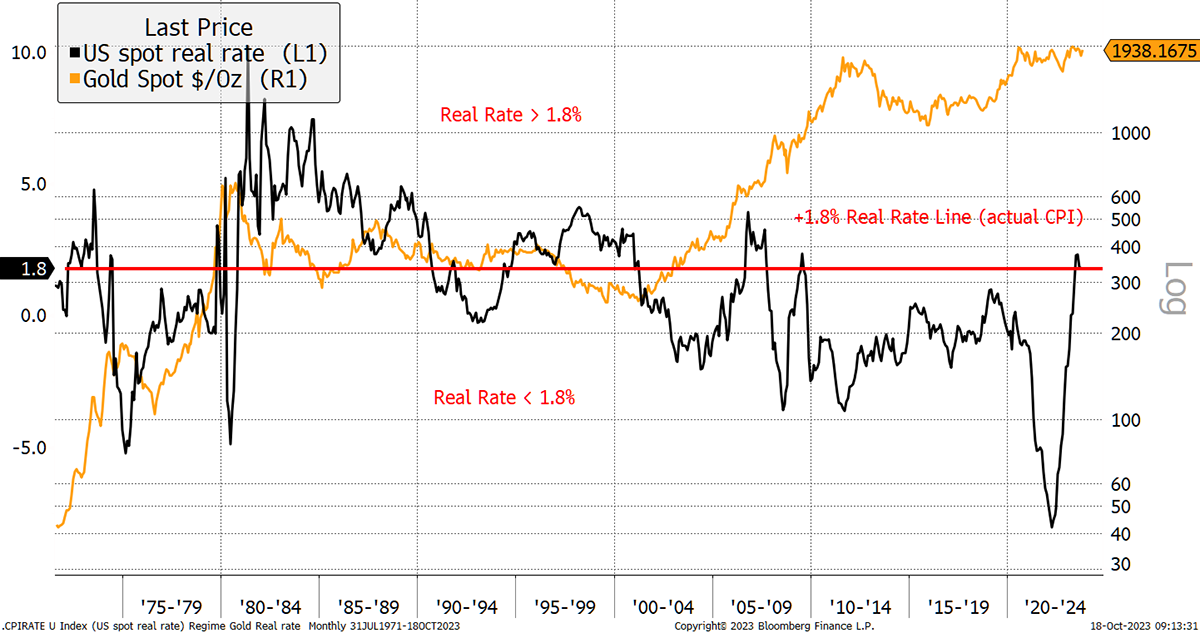

The final test is more worrisome for gold because the real interest rate (the base rate less inflation) is 1.8%, which is the threshold level. Historically, when real rates have been above 1.8%, gold has been in a bear market. But notice how after the Fed’s last CPI number (3.7%), this has turned down.

Real Rates Are a Little High

In conclusion, gold is telling us what we intuitively already know. That is not all is as it seems, and investors should own gold.

Physical Gold and Silver

If you are interested in buying physical gold, our recommended bullion dealer is The Pure Gold Company. You can take delivery of your metal in the UK, US, Canada and Europe or leave it in their safe custody. The trading costs are low, while the quality of service is high, as shown on Trustpilot. For more details on The Pure Gold Company, please visit their website.

BOLD Is a Natural Fit

The ByteTree BOLD Index is being replicated in the real world. This gold dealer in Turkey sells Bitcoin alongside gold bullion. The customers are presumably trying to keep up with the money supply.

Summary

These are exciting times for gold as it steps into a new regime. I accept that silver is cheaper, Bitcoin will rise faster (Larry Fink called it a safe haven!) and the miners can do wonders, but gold does its job with certainty.

The Gold Dial Remains in Bull Market.