Trade in Soda;

It’s been another few red days for markets, which has spread beyond bonds. I want to look at the pound, inflation-linked bonds (again), and precious metals. Equities are down, but not by nearly as much as you might think. The pound has fallen 8% against the dollar since July, which has acted as a cushion, while precious metals have experienced pain.

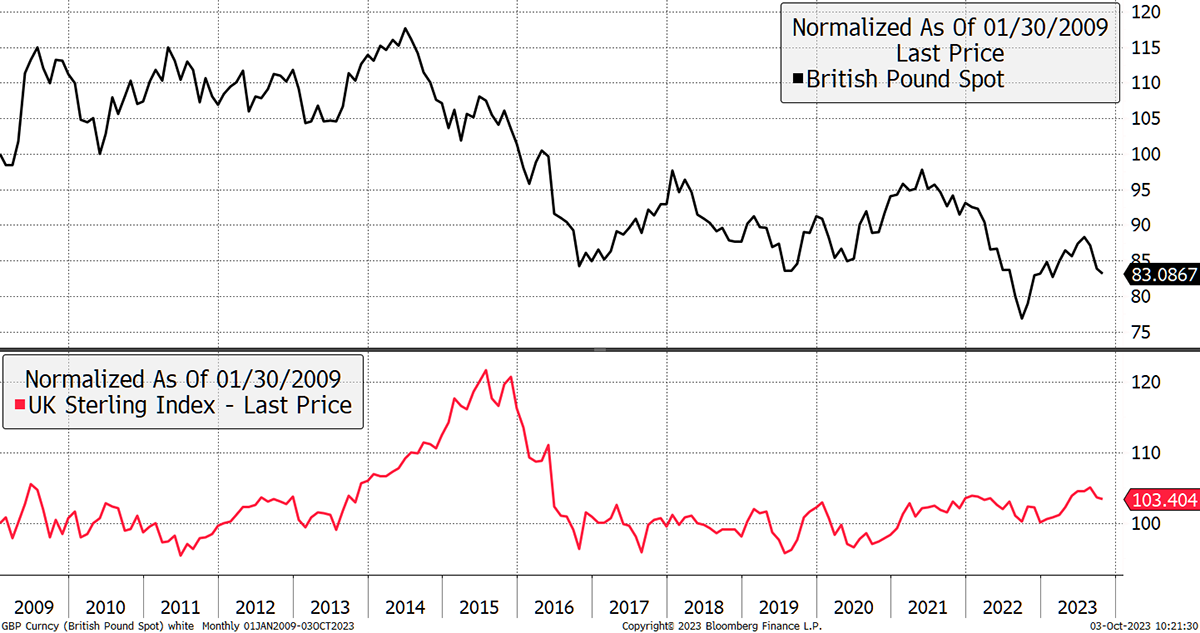

This chart of sterling since the credit crisis looks grim until you look closely. The black line shows GBP vs USD or “cable”, which has lost 17% since 2009 (rebased scale to 100). The red line shows the pound versus the rest of the world, excluding the dollar. It’s up by 3%.

The Pound in the 21st Century

I am not suggesting the pound is the new Swiss Franc; it’s not. But it’s not nearly as bad as commonly believed. It goes up when financial markets are strong and tends to fall when they are weak. That cushions UK investors from much of the pain when foreign asset prices fall, at least in notional sterling terms. The bottom line is that we hear the euro is dying, or the pound, but it’s a dollar story. We are amid another dollar rally, which is generally associated with stress in the financial system. It doesn’t end until the Fed cuts rates or signals that is coming.

As an investor, the question is: how many dollars to own? You want them when things are going badly, but not during the recovery. Currently, we hold dollars in Soda through the funds, mainly via US index-linked (inflation) bonds. There are also dollars in the multi-asset funds. You never have enough on the way down and too many on the way up. This never used to matter as much as it does today because bonds used to rise during dollar rallies. No longer alas, and the dollar seems to be the only remaining safe haven. Suffice to say, I believe we have enough, and it is now late to add more.

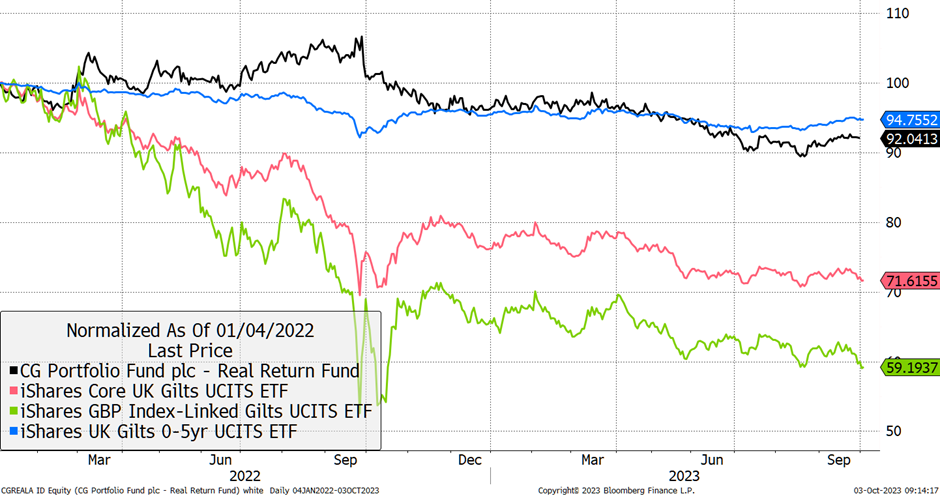

I remain very comfortable holding index-linked bonds because they will do very well when this interest rate pain comes to an end. In this bond bear market, they were much earlier to fall than conventional bonds, with most of the damage in place by last October. I show the different major UK bond groups since January 2022.

UK Government Bonds with CG Real Return

I hope this demonstrates that while I was slightly early in buying TIPS in late November, CG Real has done an outstanding job in this brutal fixed-income bear market. They hold mid and short-dated bonds but also have exposure to the dollar. They didn’t guess their strategy; they invested in the highest real yields they could find around the world. It is no great surprise that it has been a better bet than the bond market.

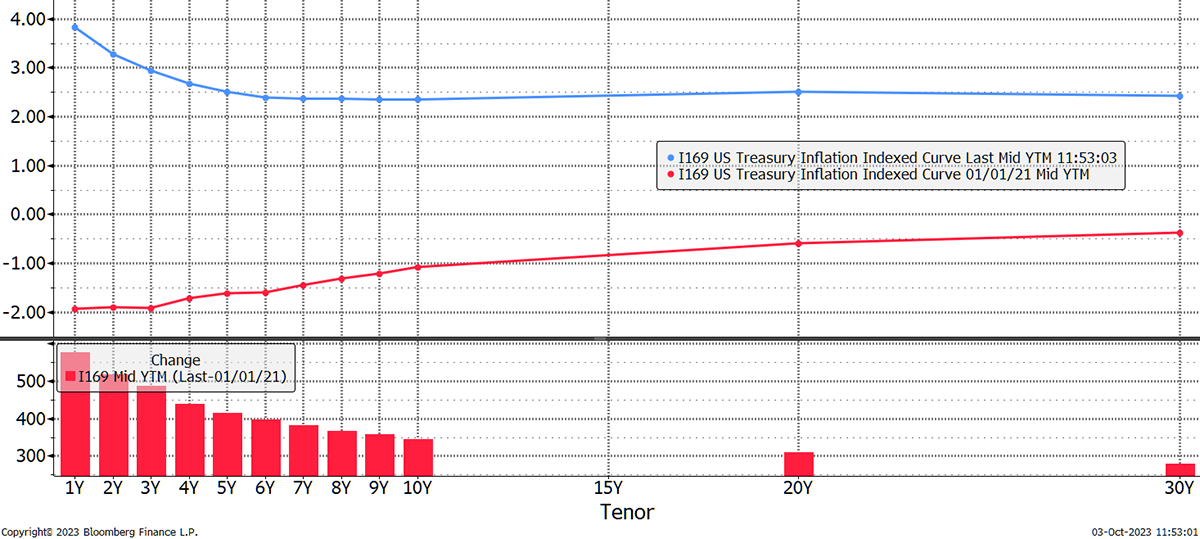

This chart is geeky and complex but important. At the end of 2020, the real yields on TIPS are shown in red. The short-dated TIPS offered -2%, which is why we didn’t own them. Today, that’s around 3%, which is huge. To be clear, that is 3% per year, plus whatever inflation turns out to be. The lower bars show the move between then and now. 1-year TIPS pay out 6% more today than back then. These are historically high levels.

US Real Yields

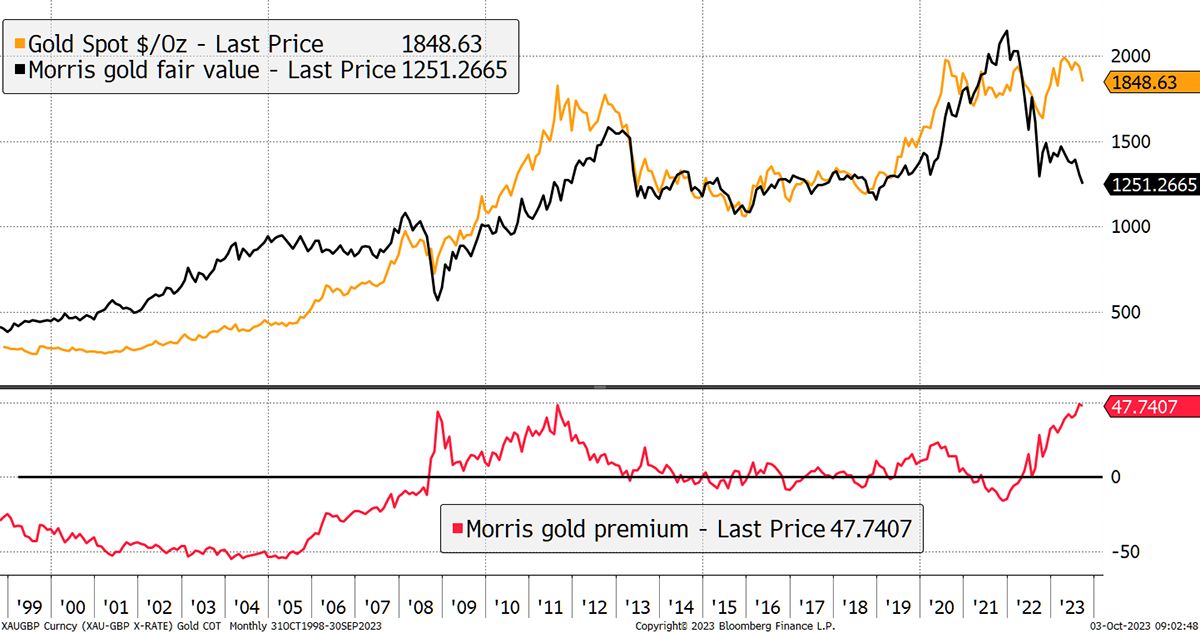

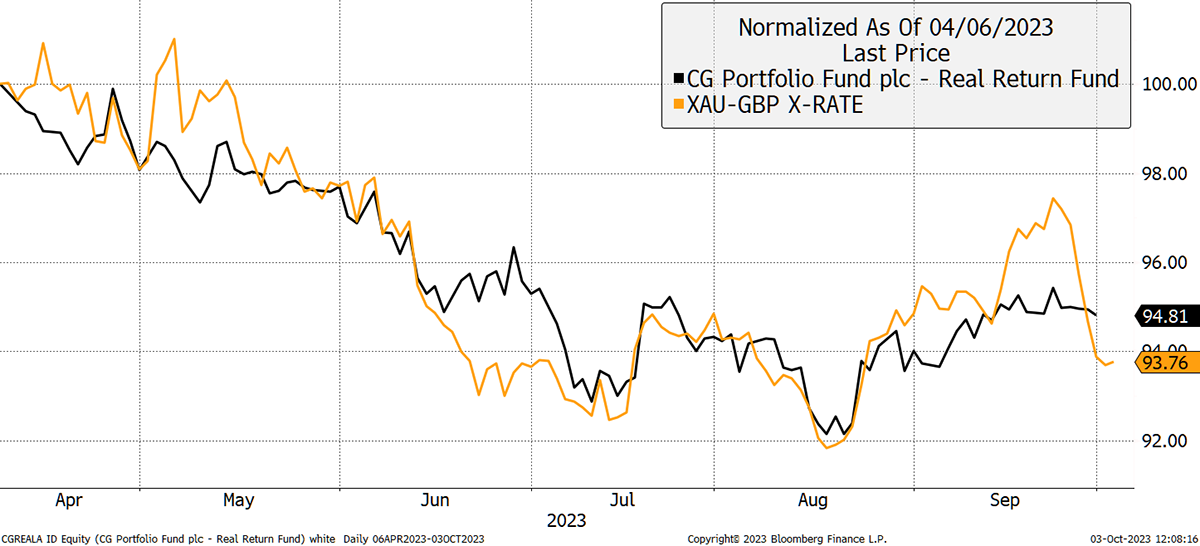

I also want to revisit why I reduced gold last year in favour of TIPS. It always feels wrong to reduce your gold, but TIPS offered better value. Yet long-dated TIPS continued to be weak versus gold, most likely buoyed by the uncertainty surrounding the war in Ukraine.

The Gold Premium

Holding both Gold and TIPS made sense, at least from a diversification perspective. It is true that gold carried on rising into March this year, making the switch appear painful. But since then, the correlation has returned, and CG is less volatile. I believe with these attractive real yields, it’s hard to imagine things getting much worse for TIPS from here, especially short-dated TIPS.

CG Real and Gold in GBP

I have decided to increase exposure to short-dated TIPS in Soda. But before we get to that, I want to look at gold and its friends. I show returns in GBP. Gold is flat, silver is -5%, the miners are flat, and I have added BOLD, which is most definitely a friend, given it is made up of 74.5% gold and 25.5% Bitcoin.

Gold and Friends of Gold (FOG)

The gold miners are feeling weak, but only because they have given back what they gained. We reduced gold last November in Soda, and in Whisky, we sold Fresnillo (FRES) in January and reduced silver (SSLN) in May along with palladium. I don’t feel we are heavily exposed to gold and FOG at present, and while prices may continue to come under pressure, we have done enough. Rebounds can happen quickly, and the world’s financial exposure to precious metals is surprisingly low. There is plenty of room for recovery.

A better way to reduce the risk of holding gold and FOG is to add a little Bitcoin alongside. It is remarkable how the two assets held together keep on bailing each other out. My latest here. I am sad to say I will not add BOLD to Soda until the regulator lifts the ban on holding Bitcoin within ETFs. It remains hard to buy on mainstream UK platforms, but it is possible.

Trade in Soda

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd