Stagflation

Disclaimer: Your capital is at risk. This is not investment advice.

US inflation expectations (breakevens) are rising again. This derives from the relationship between conventional bonds and inflation-linked bonds (TIPS). Breakevens are moving higher because conventionals are falling sharply while TIPS are more stable. TIPS have inflation protection built in, and so the resulting price difference reflects what investors expect inflation to be in future.

Investors have spent the past two years thinking that future inflation, over the next ten years, wouldn’t change much despite actual inflation soaring. This has caused much discussion and head-scratching in polite financial circles. But finally, and just as many assumed inflation to be dead and buried, expectations are rising again and quite sharply. This is definitely not something the Fed wants to see.

10-Year Inflation Expectations Are Rising

Yet shorter-term measures, such as 2-year expectations, are obediently sitting at 2%, which is the Fed’s target. This tells us that inflation is likely to behave in the short-term, as the economy slows, but then shoots higher when it later recovers.

2-Year Inflation Expectations Are Rising Much Less

That means the recession, when it finally comes, will quash demand, but the subsequent recovery, prompted by lower interest rates and stimulus, will not keep a lid on prices. Rising demand will not be met by an increase in supply as seamlessly as it has been over the last 40 years, characterized by globalization.

A scenario with lower rates and higher inflation is known as “stagflation” or “financial repression”, which the great strategist Russell Napier describes as “stealing from old people slowly.”

Stagflation doesn’t have to be bad for investors, provided they think differently. Conventional bonds are a very bad idea, as are highly valued equities. It’s time to be a value investor and embrace the likes of TIPS, gold, and a little Bitcoin to boot.

ByteTrend is Live

ByteTrend is live on X (Twitter). It’s a simple way to identify the strong and weak trends in markets. It’s a powerful system, and we’ll be talking much more about it. We have two accounts, one for crypto, and one for equity ETFs, commodities and FX. There’s much more to come.

I liked the message from commodities on Wednesday. It told you gold was in an uptrend, along with cocoa and sugar, while hogs were falling. I picture a breakfast counting gold coins while sipping sweet hot chocolate, but without a bacon sandwich.

A Week at ByteTree

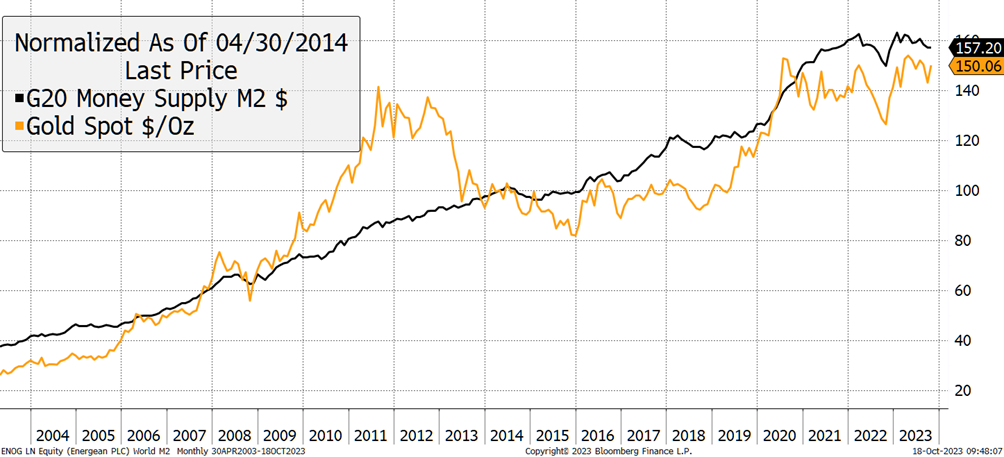

A busy week for gold, which I covered in Atlas Pulse. One of the charts showed gold against the global money supply. The norm is for the money supply to rise, and it will again soon once the central banks stop playing hardball. Do they have any choice?

Gold and the Global Money Supply

Gold is telling us that it is ready to move. In the piece, I wrote,

“I accept that the long-term driver of gold should be the money supply over inflation because M2 expands with the economy, whereas inflation only rises courtesy of economic mismanagement, which is theoretically optional. Gold is not just an inflation hedge; it’s an important asset, and its value must keep up with wealth creation, even if that is counter-cyclical. But real rates have been the convincing driver of the gold price over the medium term, and if temporarily overlooked, they will return. Gold is telling us that things are far from normal.”

ByteTree Venture tipped an undervalued mid cap gold miner, which will prove very profitable should gold break out to new highs. I think it will.

Venture can be accessed via the Morris on Markets and Professional Investor bundles – explore our subscription plans.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()