2023: A Challenging Year for Binance

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: BNB;

Binance was confronted with a cascade of challenges in 2023. As the year draws to a close, November further exacerbated the situation for the exchange following the multi-billion-dollar federal fine in the US and CZ’s resignation as CEO. Despite maintaining its position as the world's largest crypto exchange by volume, Binance suffered a significant blow to its reputation. The BNB price was also affected, showing a -8% year-to-date performance, largely influenced by its association with the Binance brand. This article delves into a comprehensive examination of Binance, analysing its market position and broader ecosystem.

Overview

Binance is the world’s largest crypto exchange, With over 160 million users and billions in daily trading volumes. It offers numerous services, including the trading of 350+ cryptocurrencies, futures trading, Binance NFT (marketplace), Binance P2P, and Binance Launchpad for launching tokens. It is arguably the most successful centralised crypto venture in existence. However, its market dominance has been declining consistently since the start of 2023 due to global regulatory pushback and intense competition in the sector.

Following the collapse of FTX in late 2022, many anticipated that Binance would emerge as the primary beneficiary, gaining a significant boost in market share. However, contrary to popular belief, even after FTX's downfall, Binance struggled to maintain its current market share, let alone expand it. This lack of market growth occurred concurrently with heightened regulatory scrutiny worldwide, particularly in the United States.

Binance Ecosystem

The Binance umbrella is huge and consists of numerous ecosystem applications and services. It serves as a blockchain/wallet/CEX/DEX for hundreds of millions of users across almost every country.

BNB Chain

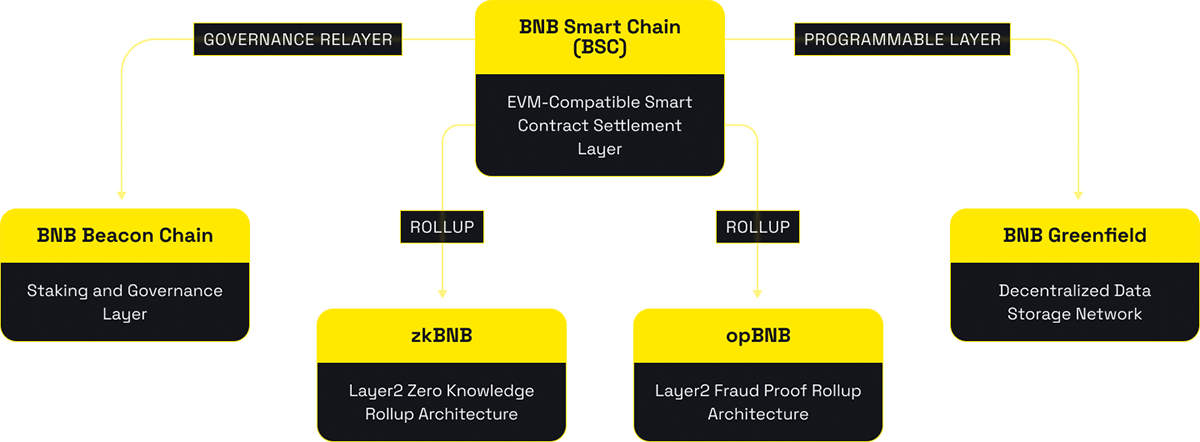

BNB Chain, also known as Build N Build Chain, is one of the largest and most popular blockchain ecosystems. The BNB Chain is primarily made of two chains: BNB Beacon Chain (BC) and BNB Smart Chain (BSC). BC is the governance and staking layer of the BNB Chain, i.e. it is responsible for voting and BNB token staking on the BNB Chain. BSC, on the other hand, is an EVM-compatible blockchain that brings smart contracts programmability and interoperability to the BNB Chain.

BNB Chain Architecture

There is, of course, much more to the BNB Chain architecture. BNB Chain uses zkBNB to provide developers with a favourable zero-knowledge-powered environment to build large-scale applications on the BNB Chain. Similarly, opBNB, powered using the Optimism OP stack, is a rollups-based layer-2 scaling solution for the BNB Chain. BNB Greenfield, on the other hand, is an in-house, decentralised data storage network for the BNB Chain.

BSC TVL

Given that the Binance Smart Chain (BSC) functions as the primary layer for smart contract development, a substantial portion of users engaging with BNB Chain-based dApps utilise features operating on the BSC. These users commonly interact with BSC dApps and often secure their tokens within these applications.

BSC has a TVL of $5bn, down from a high of $44bn on 10 May 2021. Although a large portion of this drop in dollar value is also associated with the drop in BNB price, it mainly indicates the loss of user trust.