Monthly Rebalancing Report;

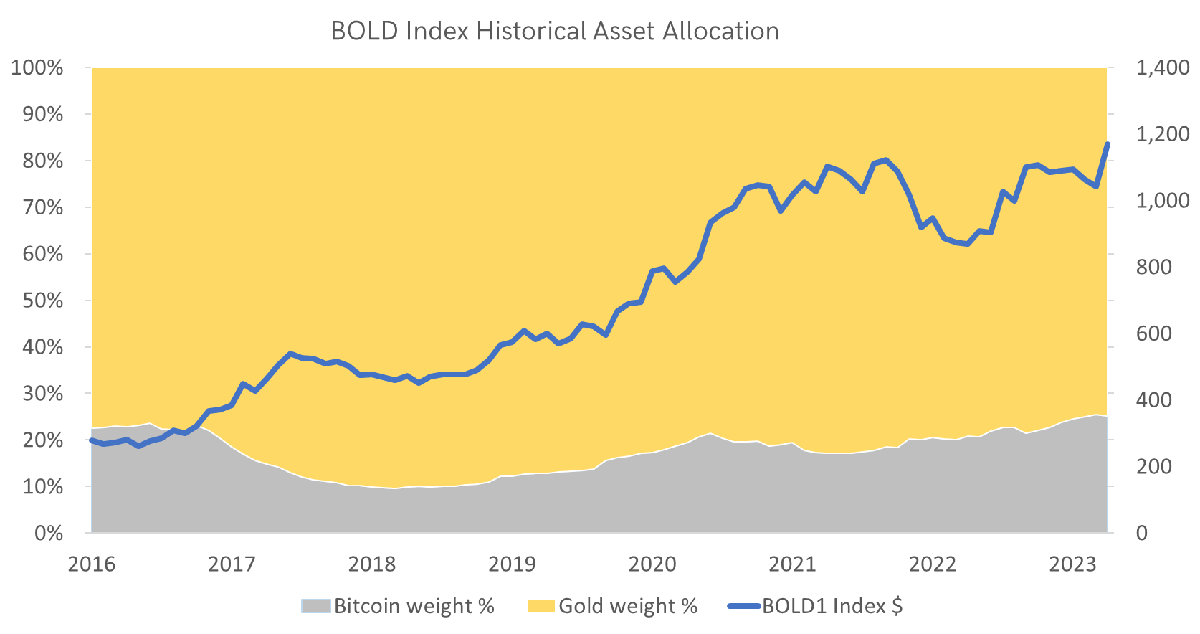

The Vinter ByteTree BOLD1 Index (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

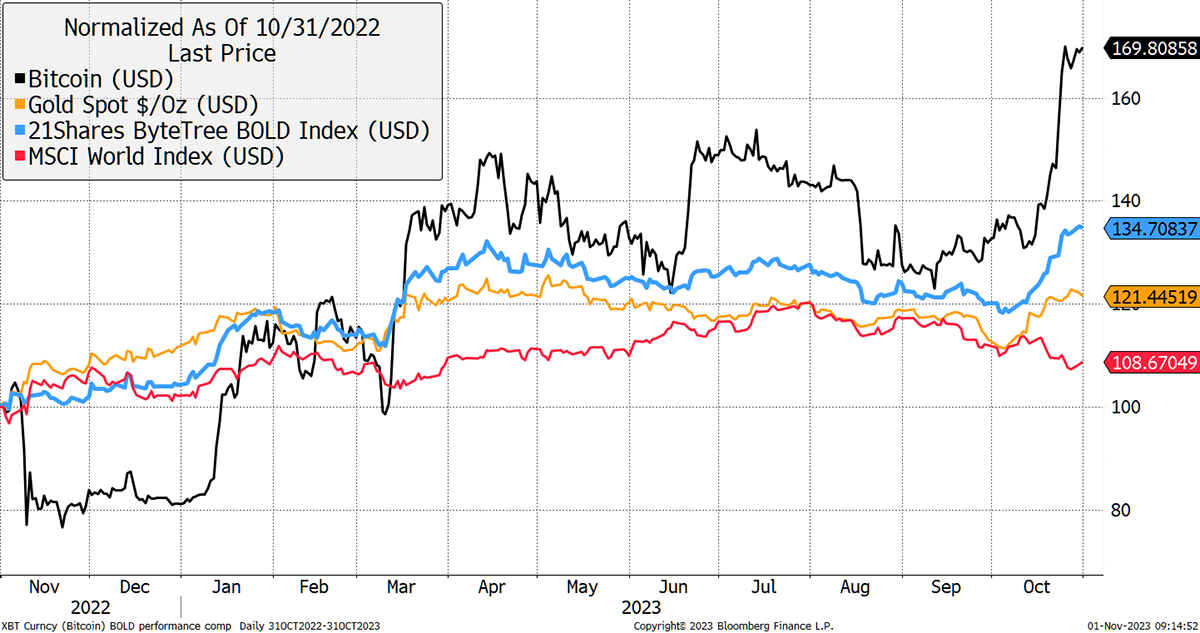

BOLD rose by 12.1% in October, taking the return for the year to 29.3% in USD terms. Over the month, Bitcoin rose by 28.0%, Gold rose by 7.3%, while equities fell by 3.0%. It has been a notable time for liquid alternative assets.

Over the past year, BOLD has captured 50% of Bitcoin’s performance, with approximately 25% exposure to Bitcoin. This illustrates the power of the monthly rebalancing transactions, which take profit from the stronger asset and reinvest into the weaker asset. In a sense, BOLD becomes an accumulation strategy for Bitcoin and Gold over time, with the lion’s share going to the more stable asset.

BOLD, Bitcoin, Gold, Nasdaq, and World Equities over One Year

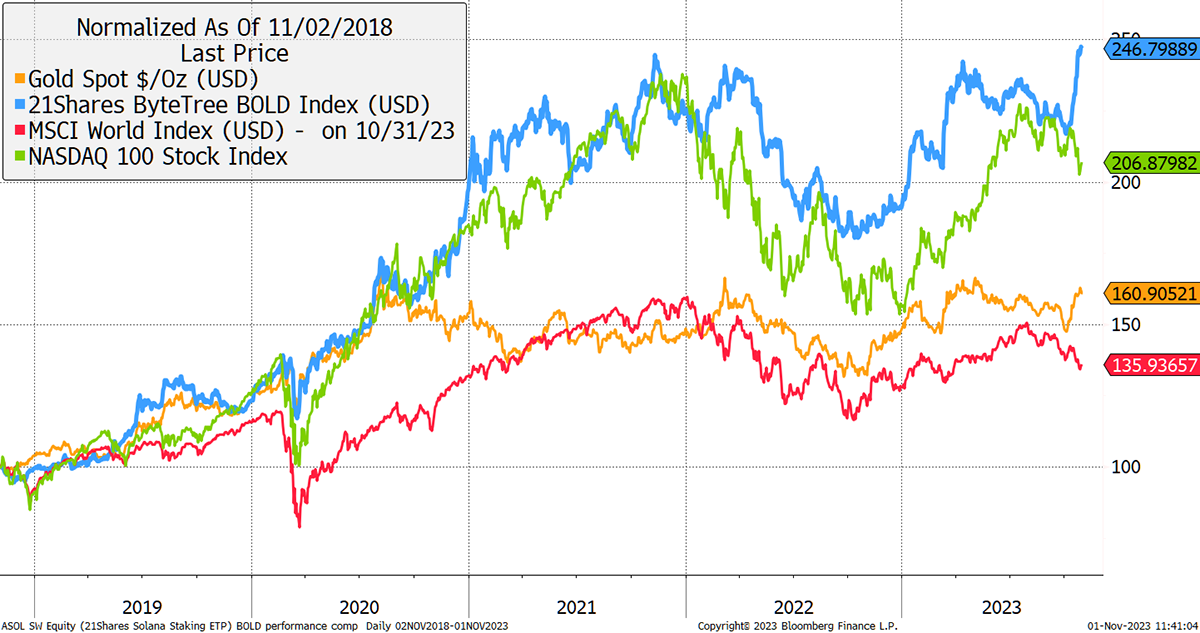

Bitcoin is up 440% over five years, and as a result, it can overwhelm comparisons with other assets. As a result, BOLD is more comparable to traditional asset classes. The MSCI World Equity Index is down 15%, and the NASDAQ is down 13%. In contrast, Gold is 3% off its all-time high, while BOLD just made one.

BOLD Makes an All-Time High

Bitcoin is down 48% from its high in November 2021, which makes BOLD’s new high all the more remarkable, once again demonstrating the added value from rebalancing transactions and asset allocation determined by volatility.

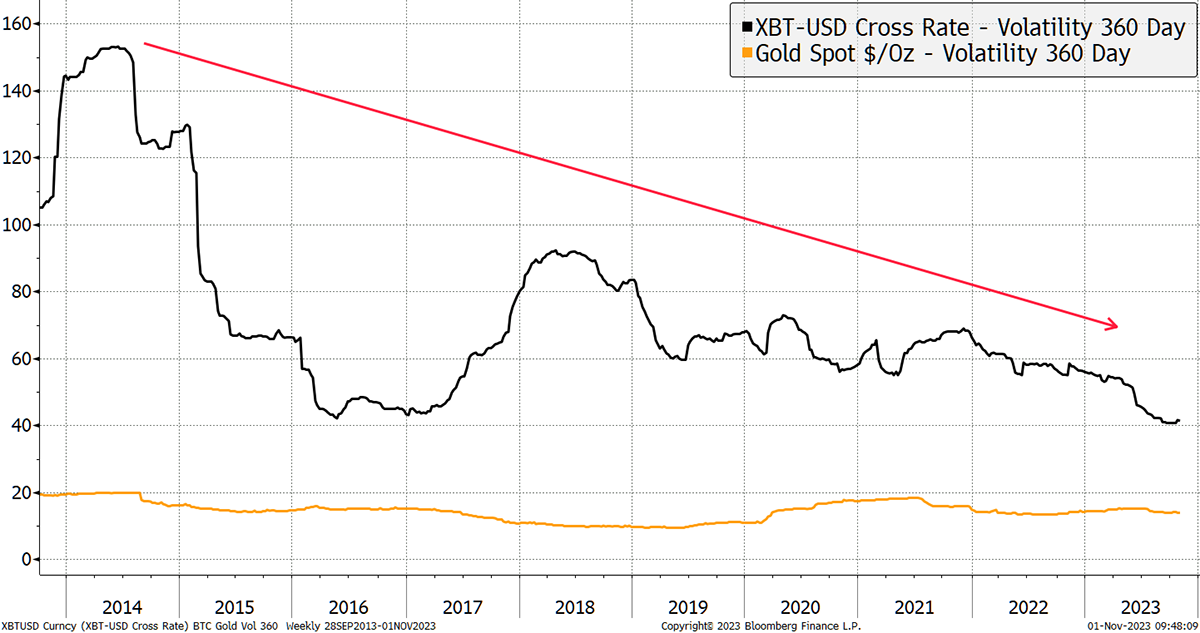

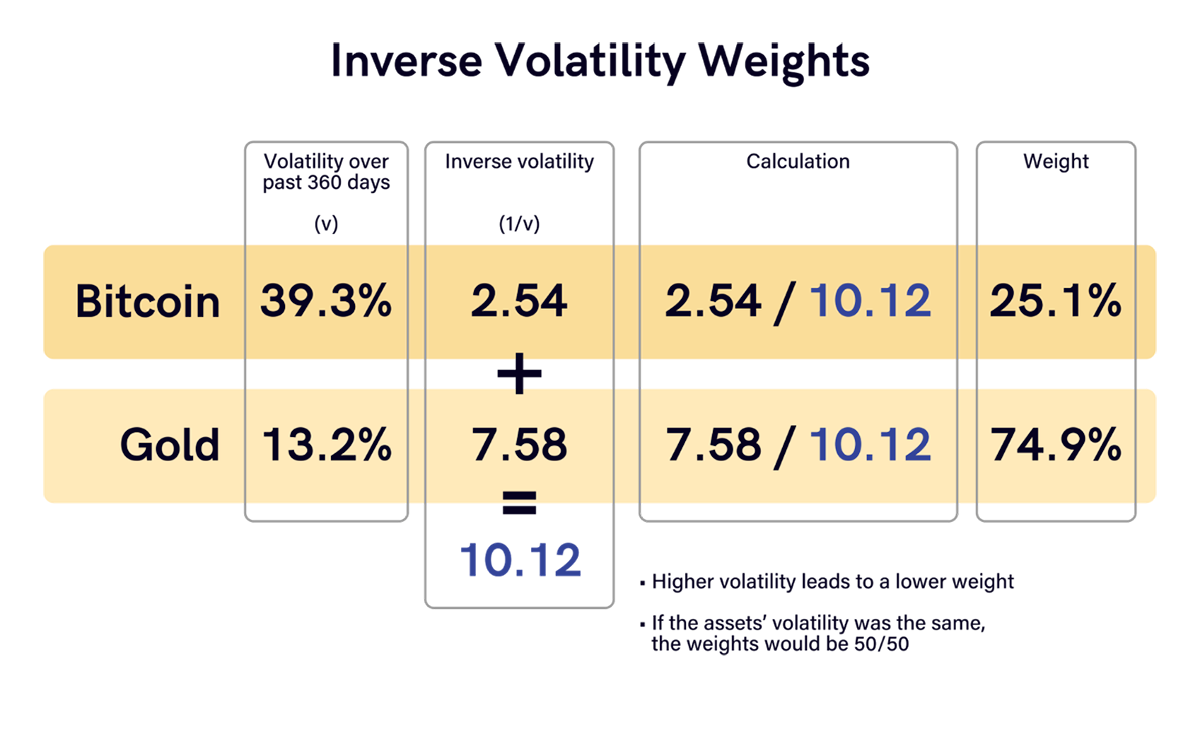

Bitcoin’s volatility for the past year rose slightly, while Gold’s fell. That means the new target weights for November will see Bitcoin reduced slightly and Gold increased accordingly.

Bitcoin and Gold Past 360-day Volatility

The BOLD methodology turns past volatility into the new target weight using simple maths. The new weights are 25.1% Bitcoin and 74.9% Gold.

However, the strong performance in Bitcoin last month has seen the weight grow to 29.2%. As a result, Gold exposure fell to 70.8%. That means the rebalancing reduced Bitcoin by 3.7% and reinvested the proceeds into Gold to achieve the new target weight.

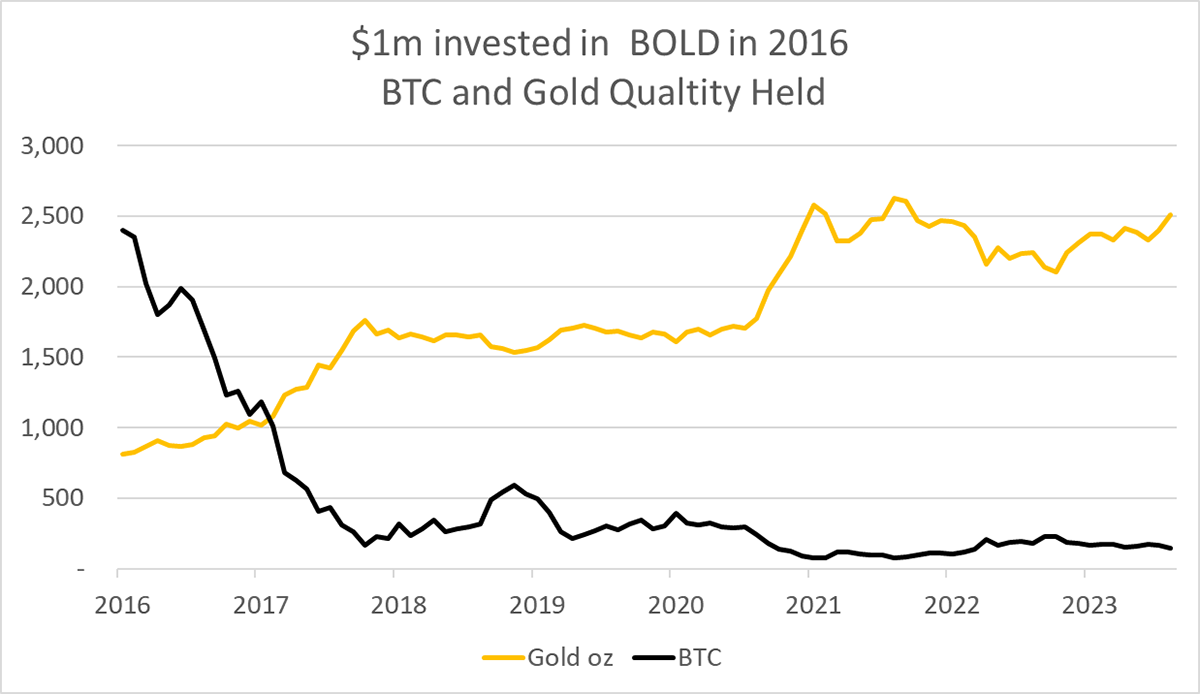

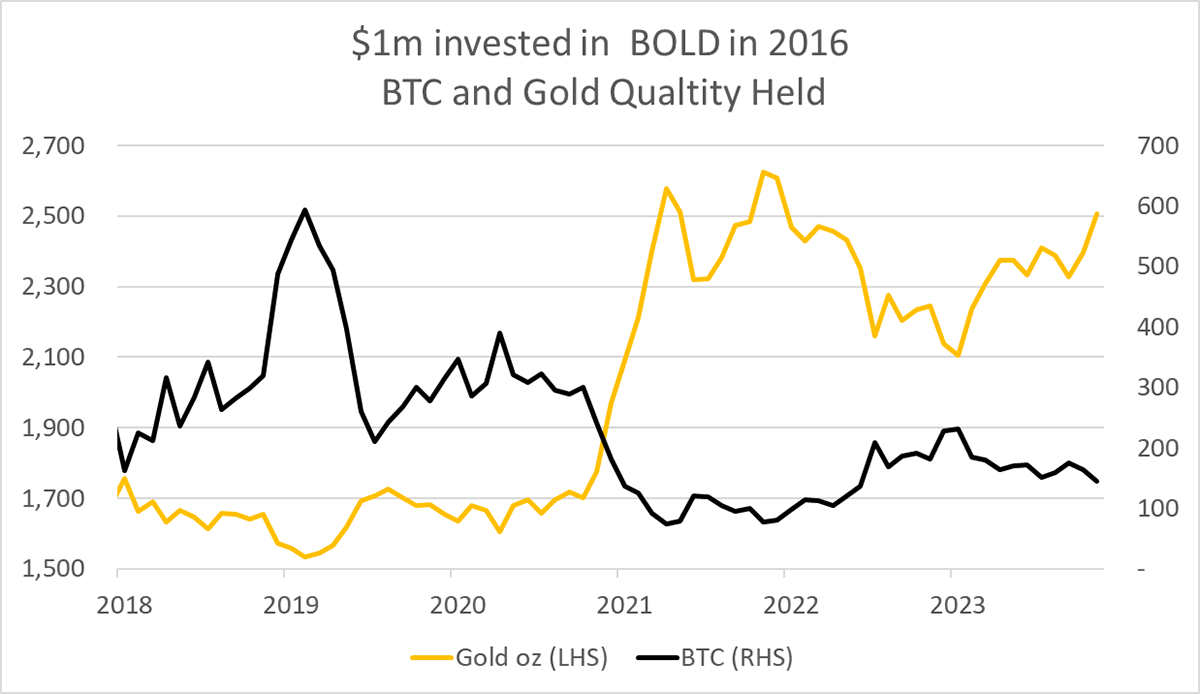

The excess return, over and above the resounding performance of the assets, comes from monthly rebalancing. That process repeatedly acquires the lagging asset, with Bitcoin so strong over the years, that has been Gold. This can be visualized by looking at the quantity of Bitcoin and Gold held over time.

An investor put $1,000,000 into BOLD in 2016, and the quantities of Bitcoin and Gold are shown in the chart below. Bitcoin rose 50x in 2016/7, and so any diversification was unwelcome. BOLD’s Bitcoin holdings fell from 2,399 BTC to 144 BTC today. On the Gold side, the investor started with 811 ounces of Gold, which grew to 2,507 ounces.

To lose 94% of Bitcoin in 2016/7 doesn’t sound appealing, but the price of Bitcoin fell by 85% in 2018, and more importantly, it is highly unlikely that Bitcoin will ever enjoy a growth spurt on that scale again. If it did, it would soon rank alongside the S&P 500. But it wasn’t all bad as the gold holdings more than trebled. In addition, had Bitcoin failed, the investor would have maintained the bulk of their investment and walked away virtually unscathed.

Since the 2018 Bitcoin bear market, the Bitcoin holdings accumulated at the expense of Gold. Then, when Bitcoin rallied in 2020/21, the gold holdings surged, while the Bitcoin holdings are not dissimilar today (144 BTC) to what they were in late 2017 (162 BTC). Don’t forget that Gold rose from 1,756 ounces to 2,507 ounces, an addition of 751 ounces, which is worth $1,500,000, or more than the original investment.

Bitcoin’s price is unlikely to be as vibrant in future cycles as it was in the past. But it will continue to be cyclical, and this proven excess return from volatility weighting and monthly rebalancing will be a powerful driver of excess return. Let’s not forget both Bitcoin and Gold have a promising outlook.

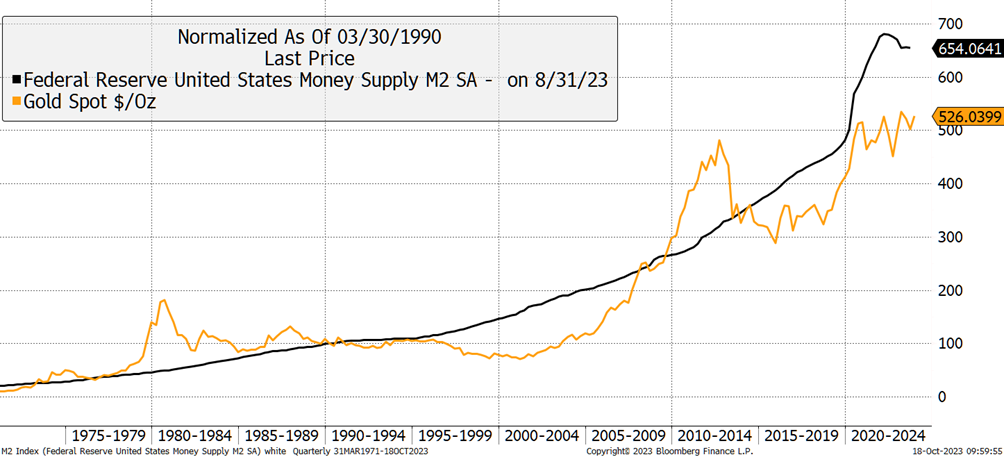

In ByteTree’s recent Atlas Pulse, I compared Gold with the US money supply since 1960. The chart is calibrated to March 1990, which is the average of the relationship over the past 63 years. Notice how Gold was overvalued in 1980 and 2011 and is undervalued today.

Gold Lags the Money Supply

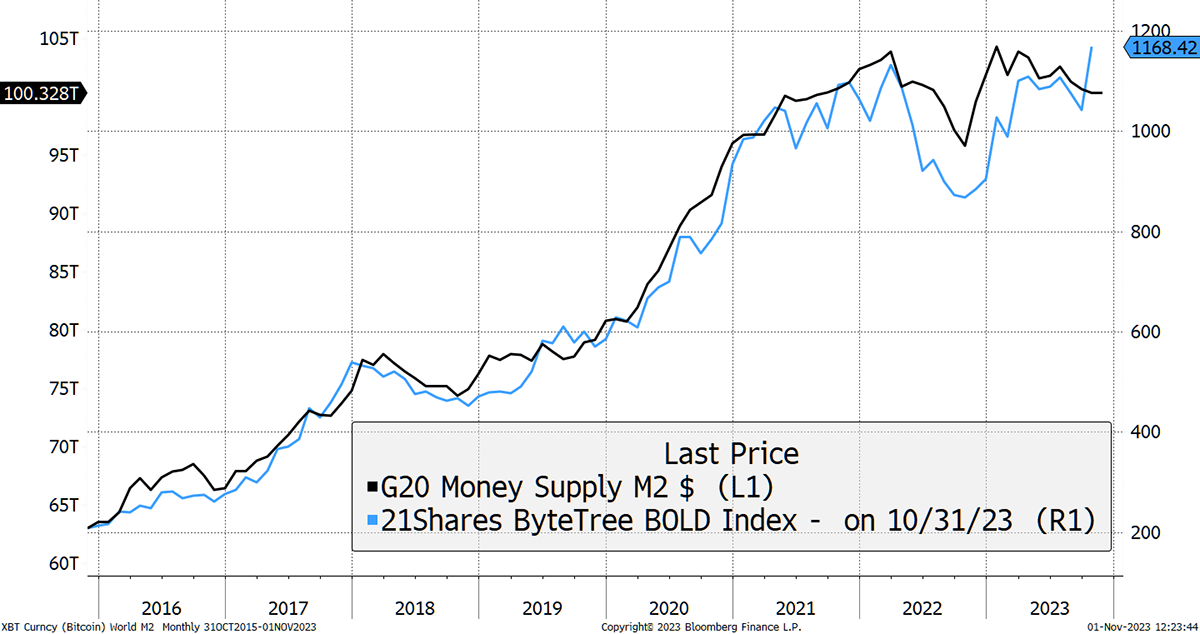

It is a powerful argument, and the close relationship between BOLD and the global money supply is fascinating. Just recently, we can see how the contraction in the money supply has fallen while Gold is playing its value card.

BOLD had a strong month, and this may be warning us that there may be an impending increase in the global money supply.

BOLD Leads the Money Supply

Bitcoin and Gold are liquid alternative assets. There are no earnings to disappoint, or CEO scandals, just two assets with limited supply that sit on the fringe of the formal financial system. It makes sense that their value should be related to the amount of money in the world.

Both Bitcoin and Gold are related to the money supply, but in different ways and at different times. The beauty of BOLD is that the combination more accurately follows the money supply than either Bitcoin or Gold themselves.

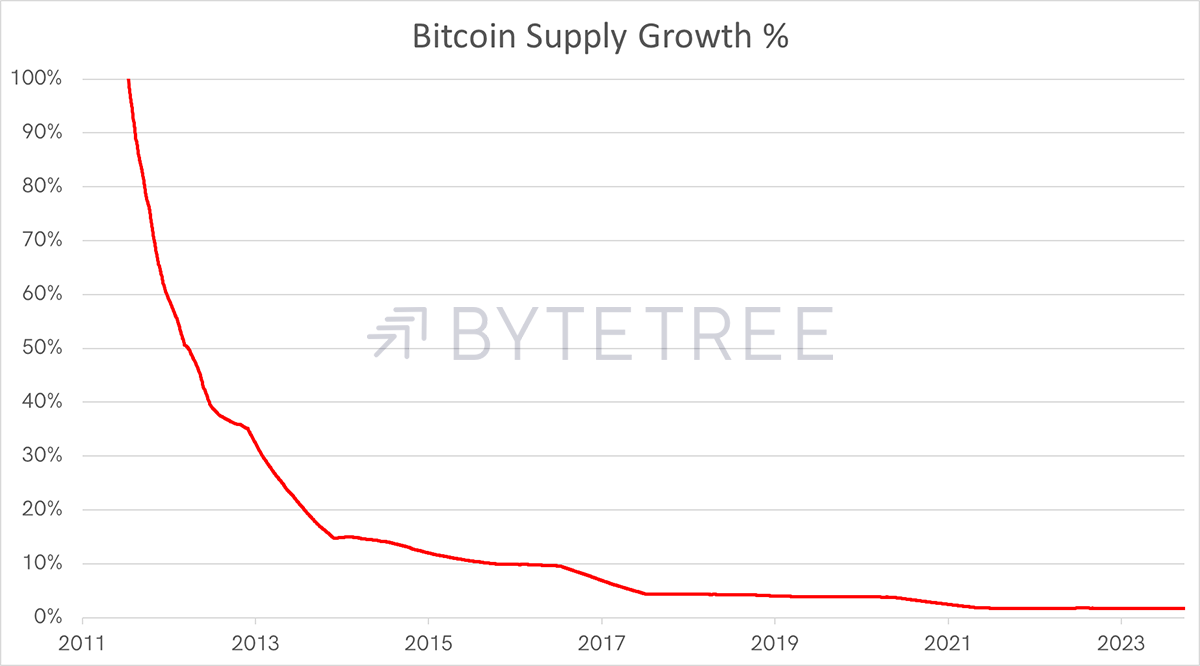

Limited supply is important for alternative assets because if you could print it infinitum, it would be worthless. There are 19,530,000 Bitcoin in circulation, a number that is capped at 21,000,000. That means 91.8% of all Bitcoins are already in circulation, and as a result of the four-year halving cycle, new supply growth will fall from 1.8% per annum to 0.9%. From next April, Bitcoin’s growth rate will fall below Gold’s.

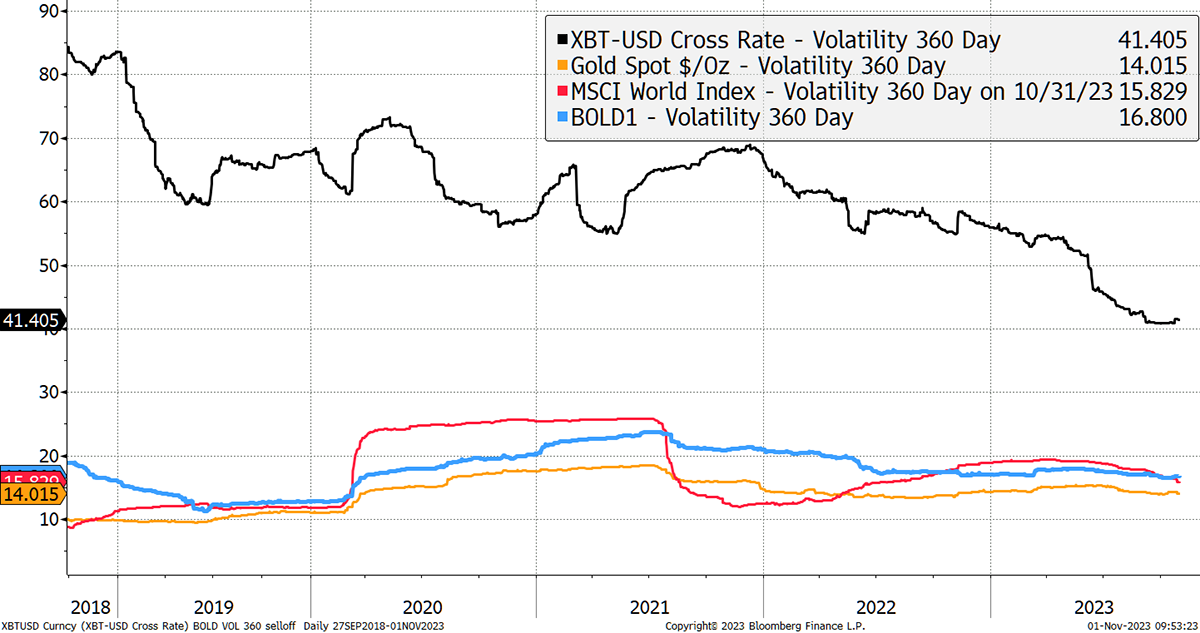

“Bitcoin is too volatile to take seriously” is something you often hear, but BOLD isn’t. Just as these assets complement each other to match the money supply, they have remarkably low volatility when combined. Bitcoin’s volatility has been falling, but BOLD has approximately the same volatility as global stocks and little more than Gold itself.

BOLD, Gold, Nasdaq, and World Equities 360-Day Volatility over Five Years

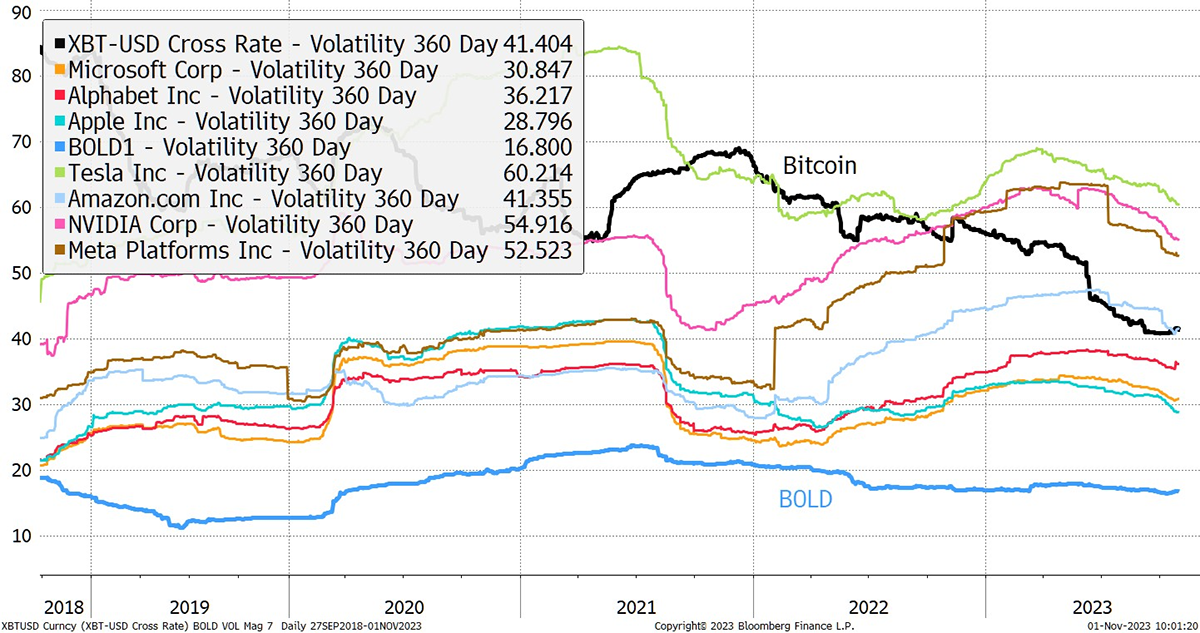

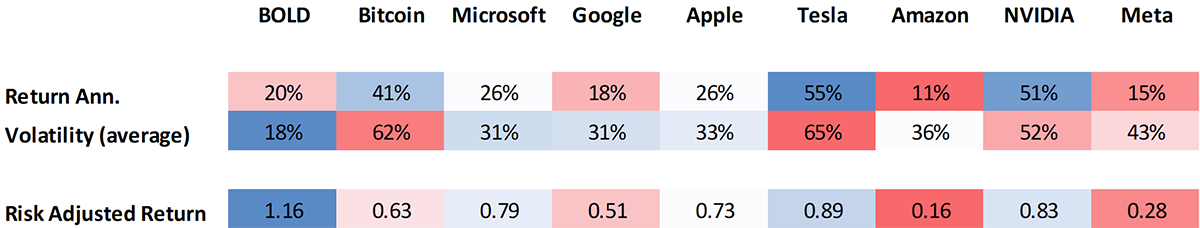

The Magnificent Seven is the nickname given to the world’s largest companies, which are all in the US tech sector. If Bitcoin was added to make the Magnificent 8, its volatility would be mid-way. It is less volatile than NVIDIA, Tesla and Meta, yet similar to Amazon and Google, with only Microsoft and Apple meaningfully lower.

Bitcoin Volatility Is Often Exaggerated

What is most striking is how low BOLD’s volatility is compared to these widely held companies. Moreover, it is much more stable despite Bitcoin’s periodic events.

The Magnificent 8, and BOLD, are compared on a risk-adjusted basis. That takes the five-year annualized return and divides it by the average volatility. The highest returns were Tesla and NVIDIA. The lowest risks were Microsoft and Google, with BOLD the clear winner. On a risk-adjusted basis, BOLD wins hands down.

Gold and Bitcoin - Stronger Together?

I was invited by Incrementum, ByteTree’s favourite competitor, to speak at a webinar. It was an excellent event, and I hope you enjoy the replay.

Summary

BOLD has made a new all-time high when neither Bitcoin nor Gold have. This demonstrates the timeliness of this concept. Before 2017, it was all about Bitcoin’s rapid adoption and growth. As that slows, investors seeking liquid alternative assets during these worrisome economic times would be wise to embrace Bitcoin and Gold via BOLD.

Contact

For information on investing in BOLD, contact bold@bytetree.com

Follow @ByteTree on X.com (formerly Twitter)

Further Information

Vinter Index Provider

21Shares BOLD ETP

ByteTree Bitcoin and Gold Research