It’s Raining Bitcoin ETFs

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 91;

Over the past month, Bitcoin has surprised us all, doubling down on the idea that it is a safe haven. If you have doubts about that, then don’t shoot the messenger, for those are the words of Blackrock’s CEO, Larry Fink. Back in March, when the banks were dropping like flies, Bitcoin surged. And then, during the autumn crisis season, it surged again.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Strong |

| On-chain | Improvement |

| Investment Flows | ETFs Hold Record BTC Holdings |

| Crypto | Alt Season |

| Macro | Beautifully Uncorrelated |

Technical

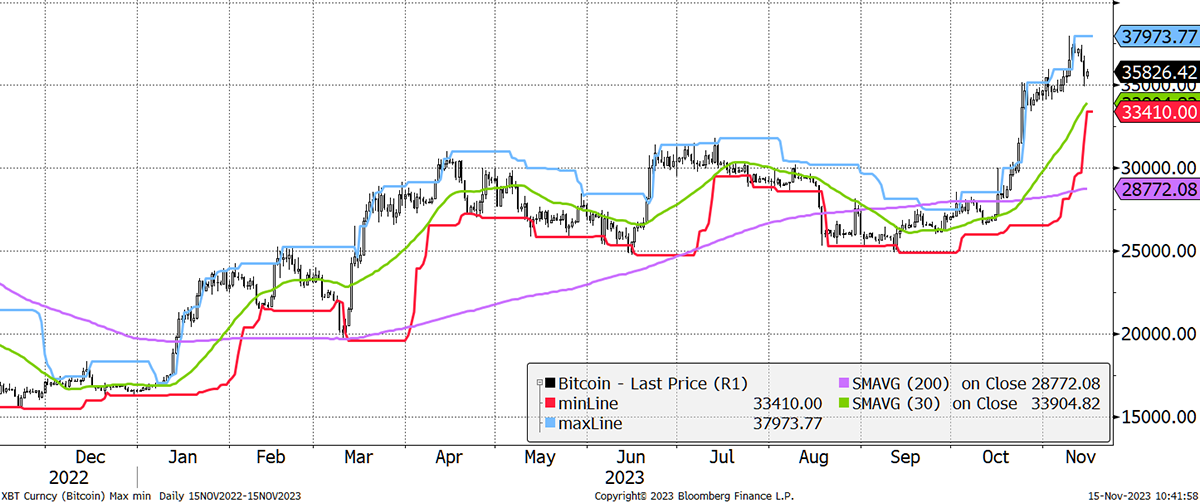

The price trend is in good shape, although a little extended. Before you worry about that too much, the current price is only 20% higher than in April. Besides, it’s raining Bitcoin ETFs, which we will get to.

BitUSD - Bitcoin in Dollars - ByteTrend Score 5/5

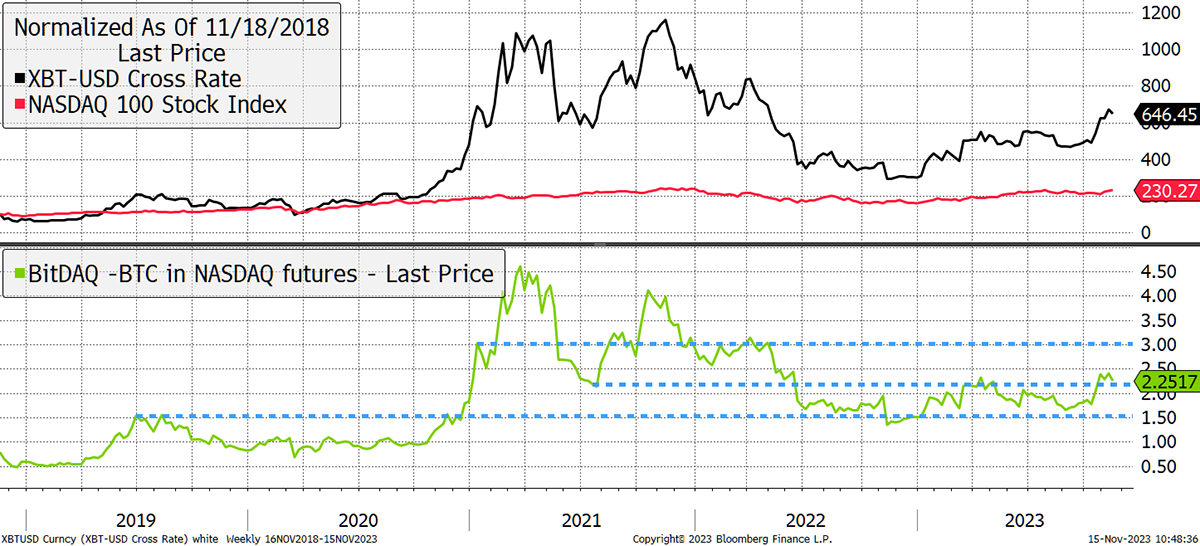

Against the super-strong NASDAQ, Bitcoin just made a new relative high. The lower chart shows a break of the bear range, with BitDAQ clearing the 2021 low. Next stop 3:1, which means 1 BTC = 3 NASDAQs.

BitDAQ - Bitcoin in NASDAQ – ByteTrend Score 5/5

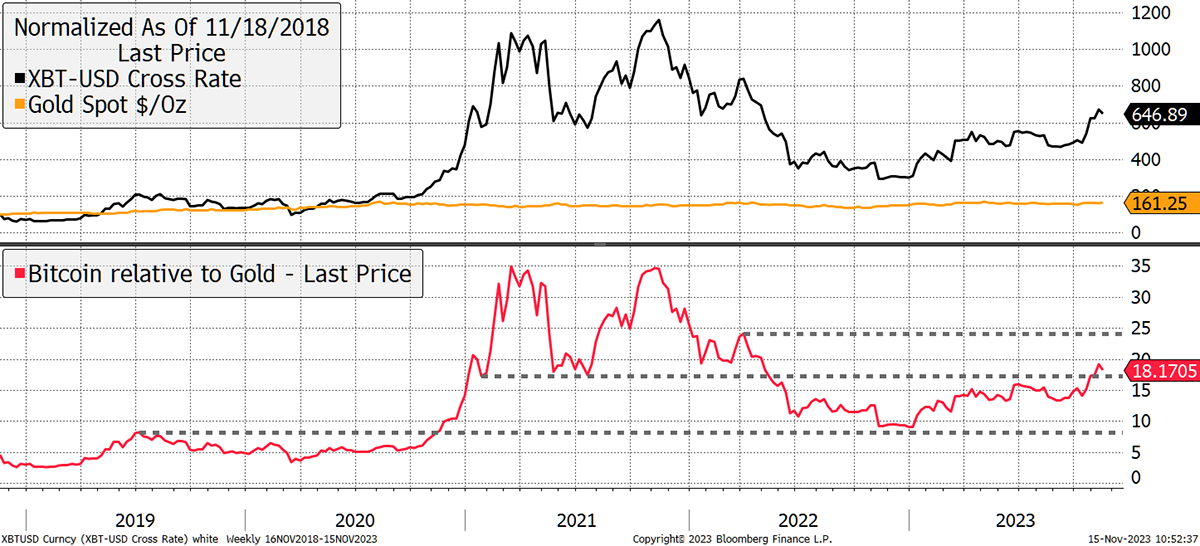

Against gold, it’s once again above the 2021 resistance. 1 BTC > 18 oz of gold and headed back towards 25 oz. This is a reminder that the gold bugs need a little Bitcoin.

Bitcoin in Gold – ByteTrend Score 5/5

These relationships confirm that Bitcoin’s trend is not only strong in dollars, but strong against other key assets. This is important for institutional adoption because they don’t buy alternative assets unless there’s a little extra return. Bitcoin is going mainstream, and the bear is behind us. The good times are here.

Investment Flows

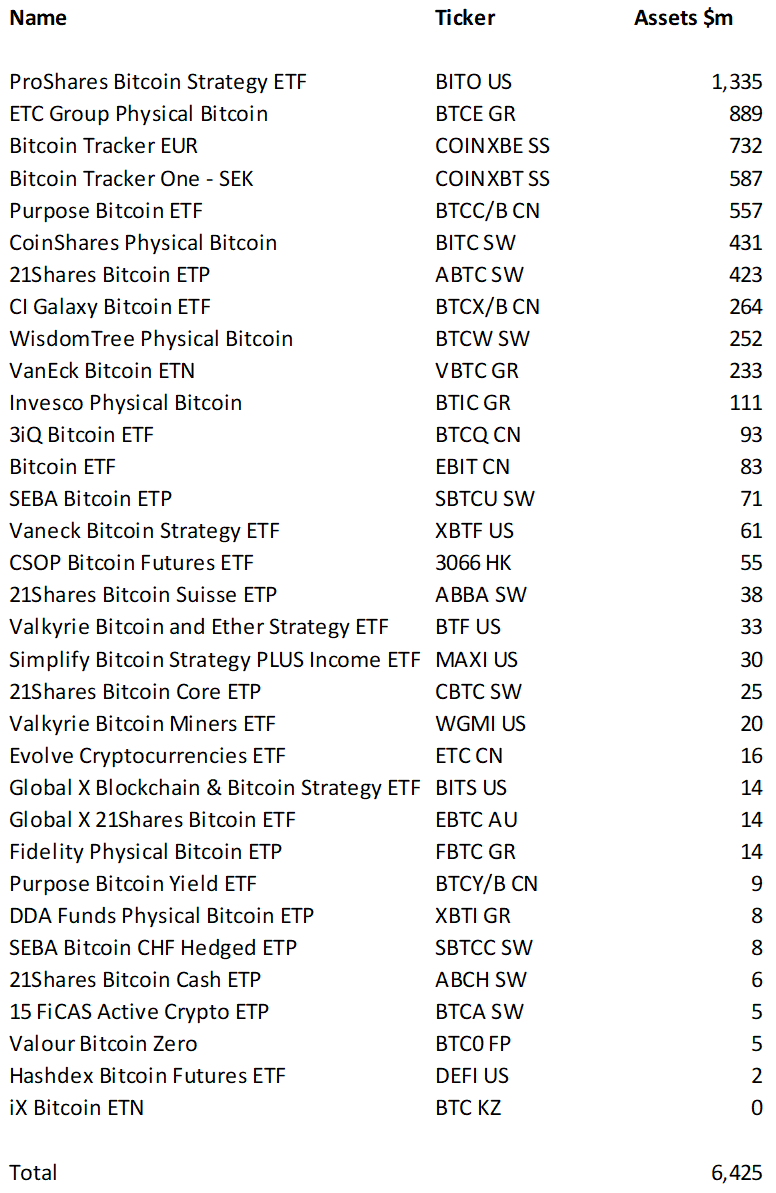

When I say it’s raining Bitcoin ETFs, it really is. Here are 33 Bitcoin ETFs ranked by assets. The largest, BITO, was launched in the USA in late 2021 and is already the biggest. That demonstrates the power of a US listing, and it only tracks Bitcoin futures rather than spot. The other large funds were all launched early enough to enjoy the strong market move that captured the 2020/21 price surge.

Source: Bloomberg

Most of the large ETFs are European and have been around for a while. I suspect if Europe offered a futures ETF, there would be no take-up because investors prefer spot. In the US, only futures ETFs have so far been approved. Just yesterday, ByteTree’s partner, 21Shares, launched two new futures products with Cathie Wood’s ARK:

- ARK 21Shares Active Bitcoin Futures Strategy ETF (ARKA)

- ARK 21Shares Active Ethereum Futures Strategy ETF (ARKZ)

But they really want a spot ETF because, as I wrote last month, BITO may be the biggest, but it lags the spot price by a wide margin. Since its launch in late ’21, Bitcoin is down 45%, while BITO is down 59%. It’s a huge gap, and regulators stalling on spot products are doing investors a disservice. Most countries are on side, including the European Union, Switzerland, Singapore, Hong Kong, Brazil, Australia, Canada, Dubai and others.

Sadly, in the UK, all Bitcoin funds, or allocation to Bitcoin within a fund, are banned. The United Kingdom would be wise to wake up and acknowledge what is happening elsewhere.

James Seyffart from Bloomberg Intelligence says there is a brief window for all 12 Bitcoin spot ETFs, currently pending approval, to be approved this month by the SEC. If not, there’s a 90% chance of approval in January. It’s coming.

At the top of the list is Grayscale (GBTC), where the discount has narrowed from 48% in December to just 12%. GBTC has been heavily covered on these pages, warning of the dangers of the premium in early 2021 and highlighting the opportunity of the discount more recently.

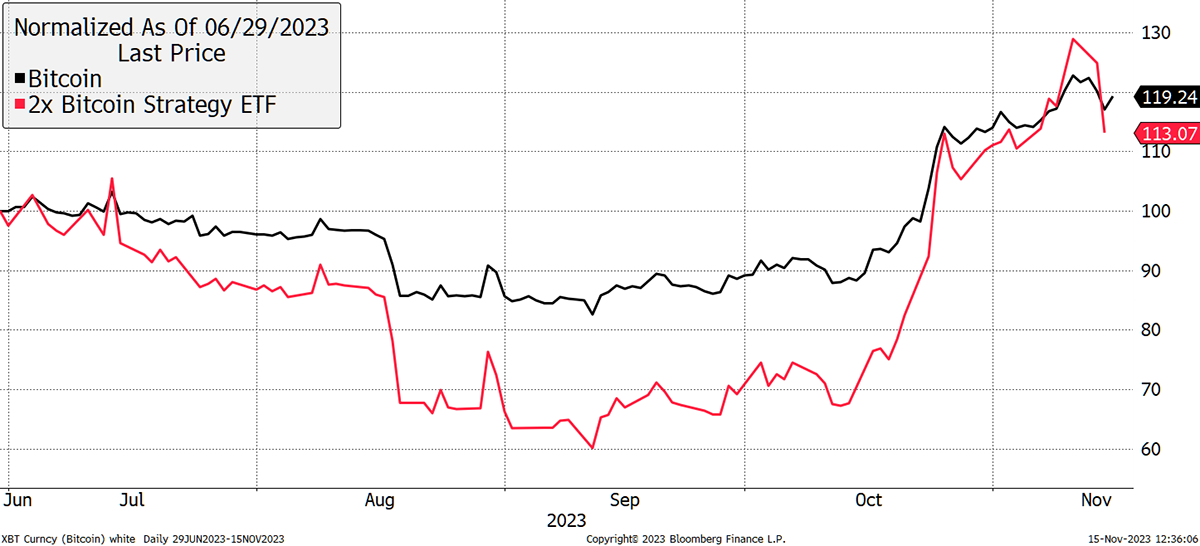

The ETFs don’t have this problem because they simply deliver the return of Bitcoin, which is all most investors ever wanted in the first place. That said, one ETF to avoid is the 2x Bitcoin Strategy (BITX). It launched in June, and BTC is +19% since. What has BITX done? 38%, perhaps? No, 13%.

I have been briefing against leveraged products for years, and I do not intend to stop. They are great for day traders but hopeless for investors with a time frame much above one day.

In our data, we combine the ETFs, or most of them, with GBTC and present the flows. As this has all become interesting again, we are upgrading the data, so stay tuned. In the meantime, I am delighted to say that the combined funds hold more BTC than ever before.

On-chain

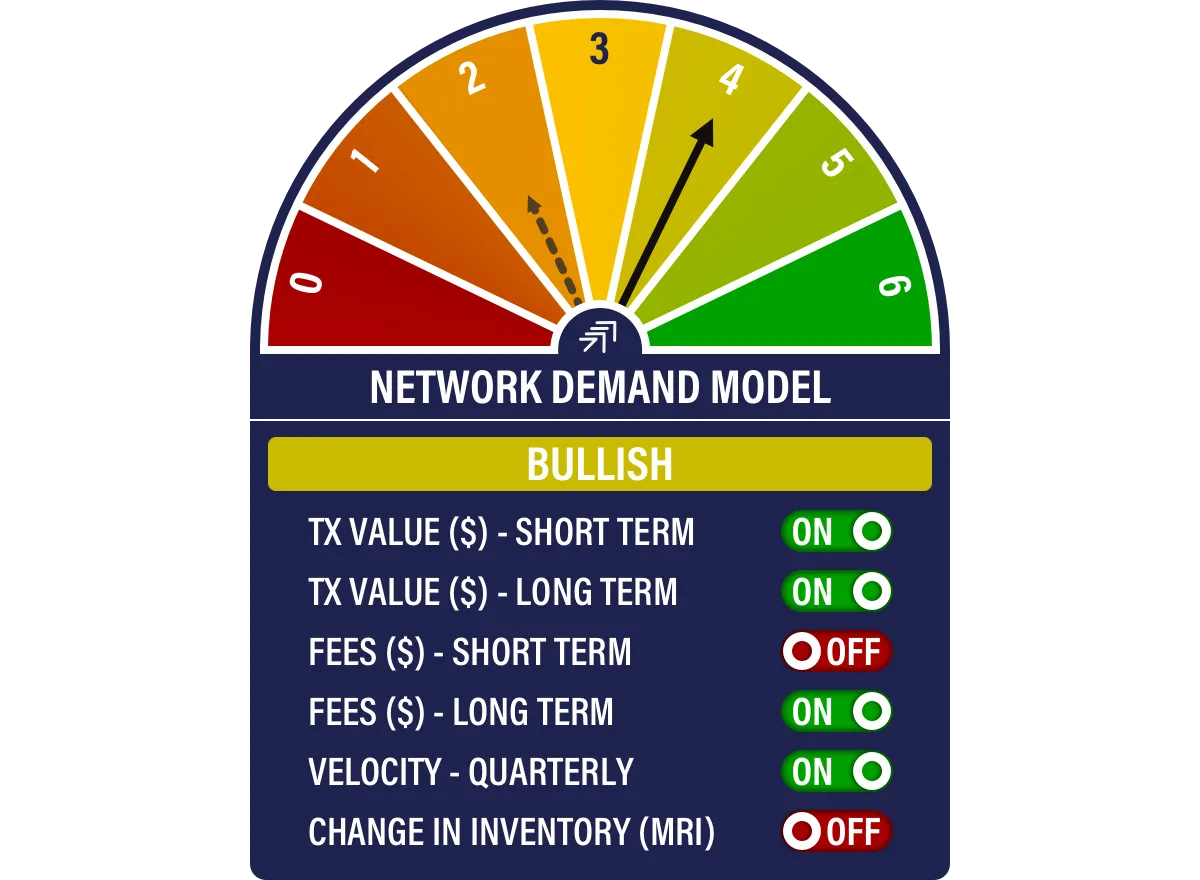

The Bitcoin Network Demand Model scores 4/6, up from 2/6 last month.

This is good news, and only short-term fees are holding us back, which will change soon, as you will see. I am also cooling on network velocity. It measures how quickly BTC circulates around the blockchain. It was a strong idea when the Bitcoin Network was in growth and adoption mode, but now it is in “asset credibility mode”. Today, we can take the network for granted, as it remains vibrant in both bull and bear markets, as proven time and again.

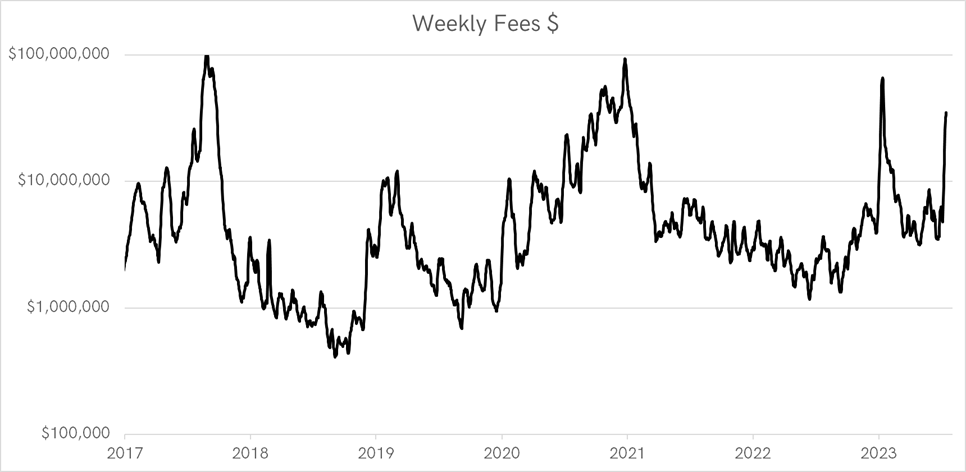

Last month, both fee measures were OFF, but fees have reawakened and are approaching past highs. The short-term fees model will turn positive imminently, so it’s bullish all around.

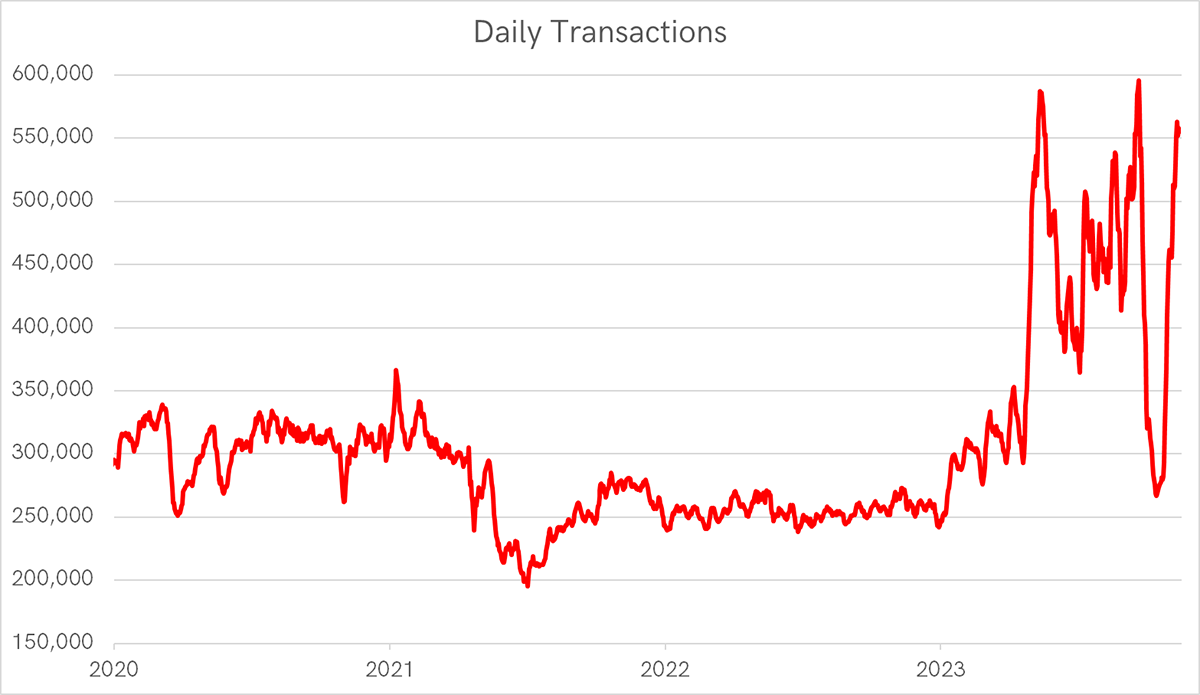

Higher fees are sometimes driven by more transactions. Last month, I was complaining about the fall in transactions, but they have returned to form. Some are attributing this to a return of the ordinals.

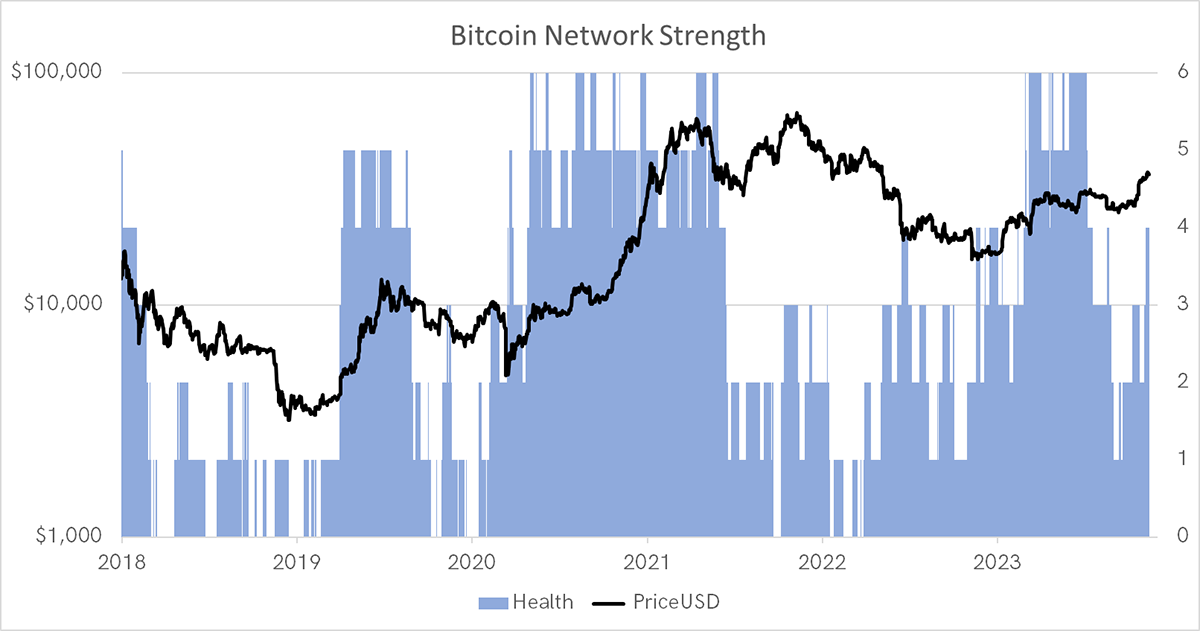

In any event, network activity is strong and growing again. The fair value of the network model is around $30,000. Price is a little ahead of itself, but it’s important to remember that the great rallies also look like this at the start.

Bitcoin Fair Value

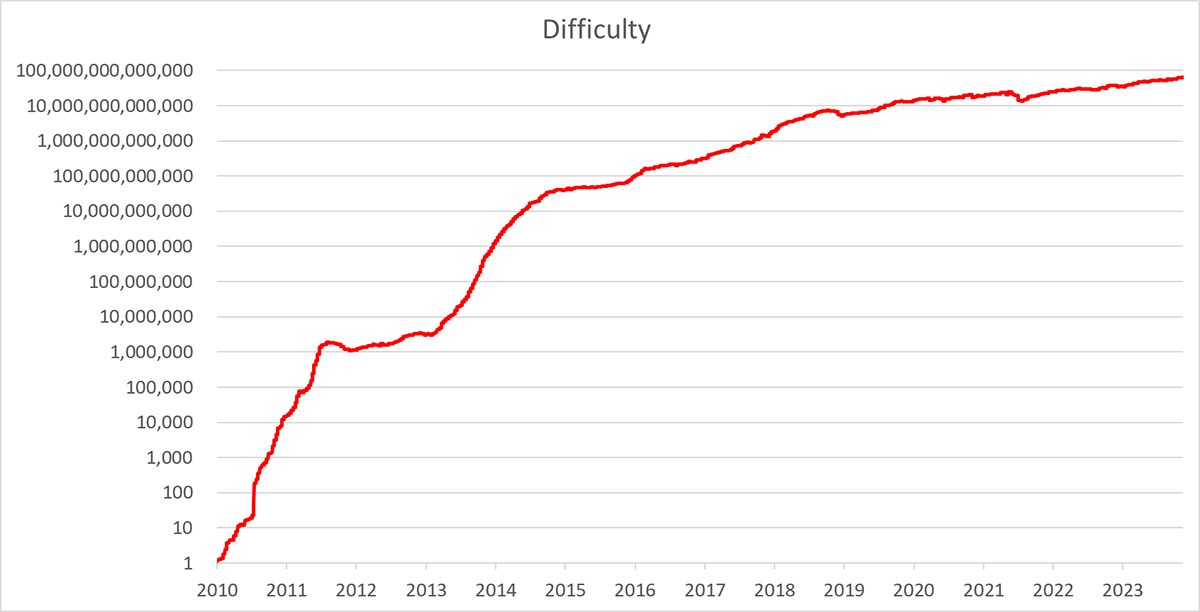

My final word on the blockchain is that as Bitcoin becomes more credible as an institutional asset, the difficulty grows. That means it is harder to mine, requiring more computing power. This secures the network and underpins its value. Difficulty is 10x the levels of 2 years ago and 100x the 2018 levels.

This is the real difference between Bitcoin and the rest of crypto.

Crypto

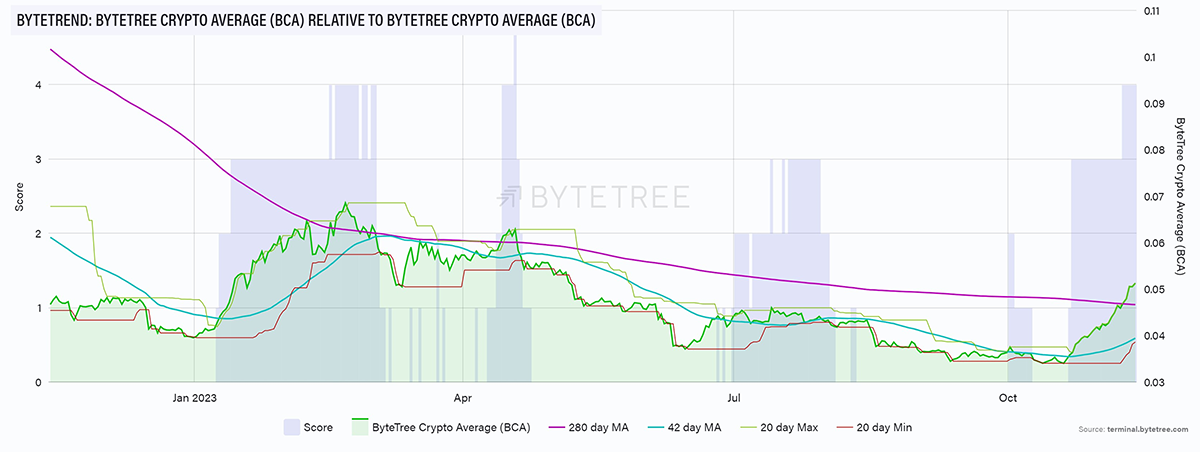

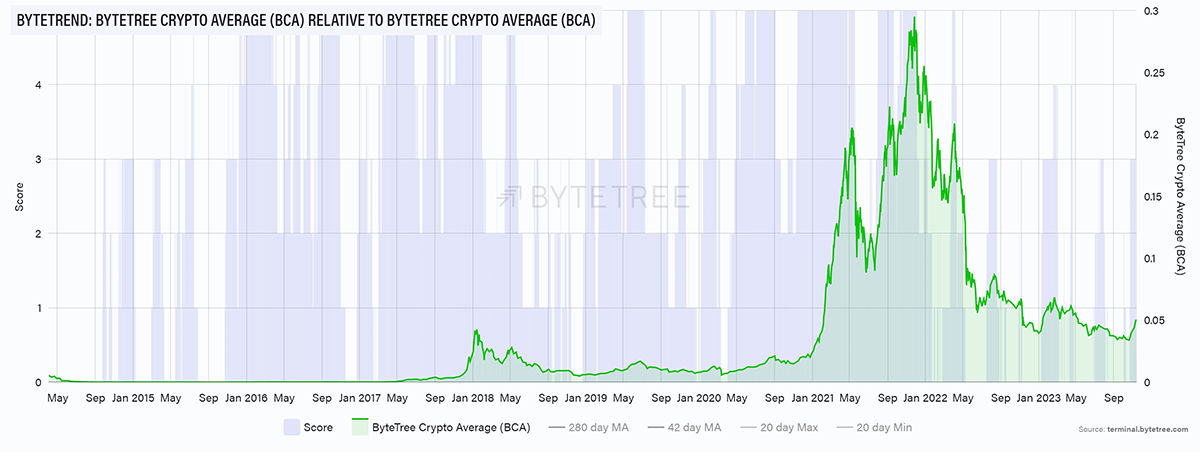

ByteFolio has sprung back into action with new ideas. Having avoided non-Bitcoin tokens for months, they’re back. When substituting BTC for a token, that’s not a negative but an opportunity that opens up from time to time. The tokens have had a brutal two years, and new leadership is emerging. The ByteTree Crypto Average (BCA) shows this and scores 4 of 5 stars. The only missing piece is for the 280-day moving average to turn up, which should happen soon.

It is the equal-weight daily average price change for the top 100 tokens and is therefore a breadth indicator. The below chart shows BCA since 2015, with the background showing the star count. When the trend is positive, it is better to have higher exposure to crypto.

A fifth star will be more reassuring, but the start gun has been fired.

Macro

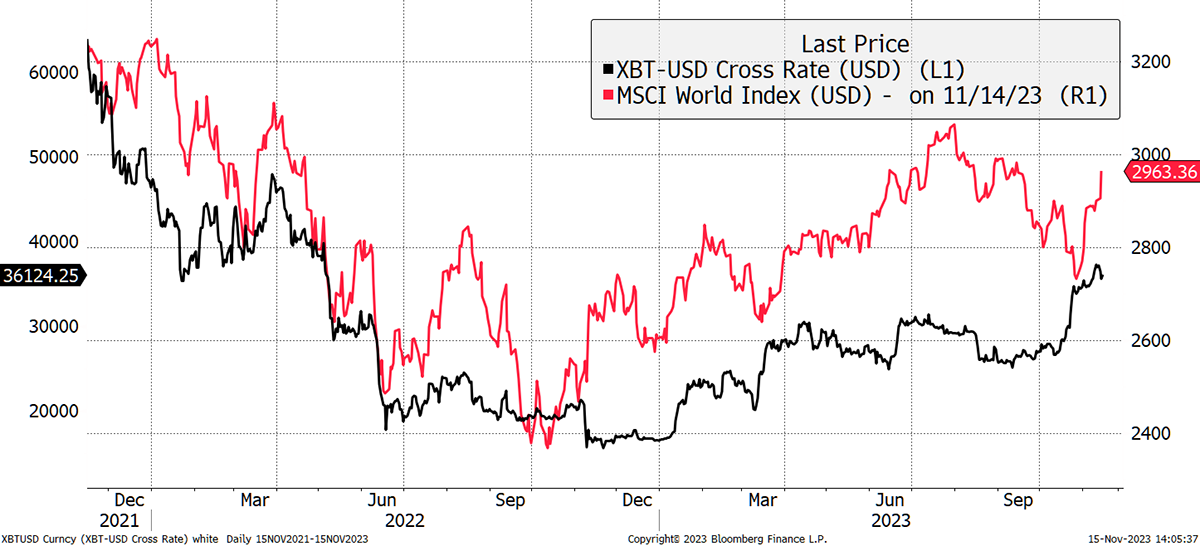

It never ceases to amaze me how Bitcoin leads financial markets. Just have a look at the past two years against the World Equity Index. On several occasions, it appears that Bitcoin is a leading indicator, and notably so over the past month.

Bitcoin Leads Equities

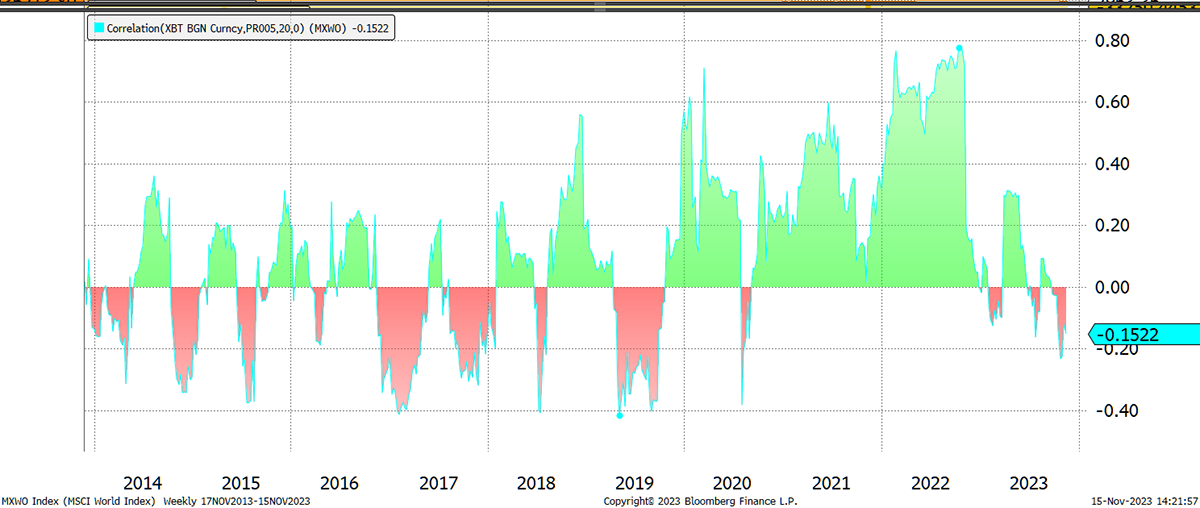

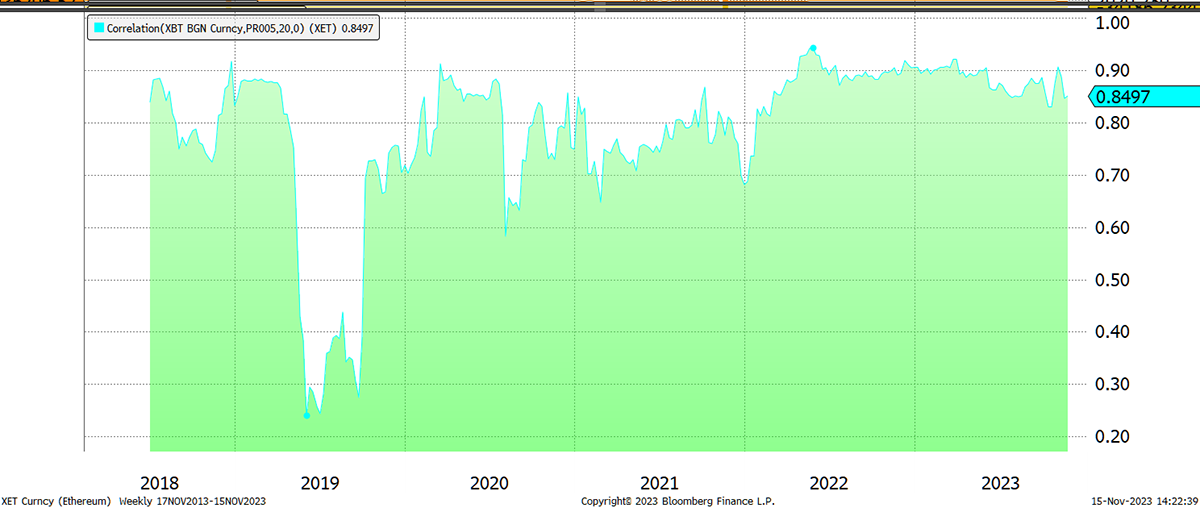

This demonstrates Bitcoin’s sensitivity to market liquidity. Because it leads, the correlation with global equities is surprisingly low. Admittedly, 2021/2 saw an elevated patch, but that period was marked by overwhelming liquidity. On average, it was positive but not that high due to the leading nature of Bitcoin.

Bitcoin’s Correlation with Equities Is Moderate

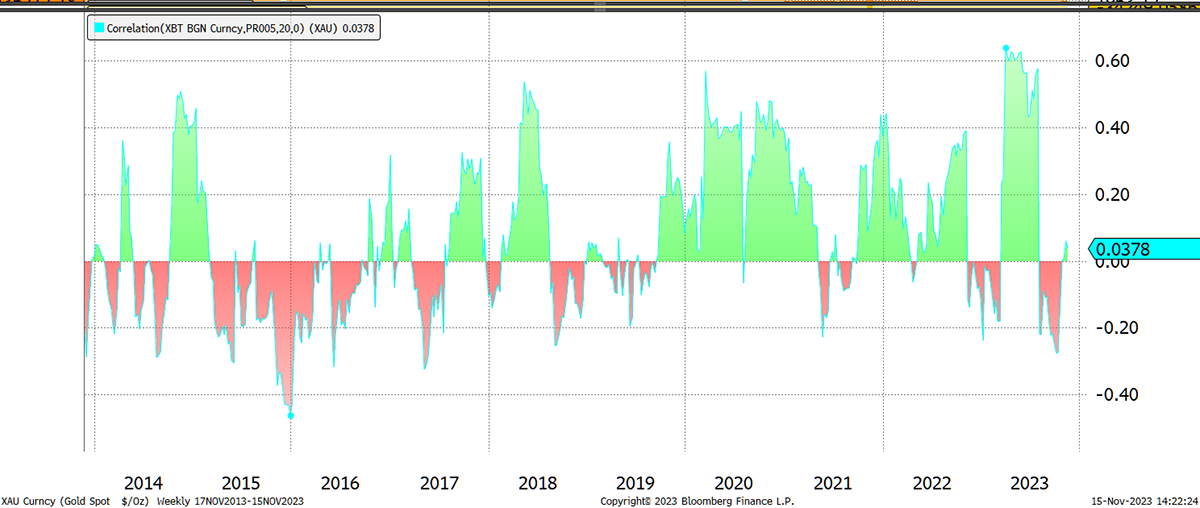

Gold has an average correlation slightly above zero, with brief peaks rarely above 40%. Most of these occurred alongside sharp moves in the dollar.

Bitcoin’s Correlation with Gold Is Near Zero

Finally, I show Bitcoin’s correlation with Ethereum, just to show you what high correlation really looks like. Not only is it typically 90%, but consistently so.

Bitcoin’s Correlation with Ethereum

This is important because low correlation improves portfolio diversification, and Bitcoin is clearly attractive as a portfolio diversifier. That is why the spot ETF launches are so important. We have already seen how BITO has raised well over a billion dollars in a tough market, and it’s a product that is destined to lag Bitcoin price because futures can do that. You can only imagine what the US market will throw at Bitcoin when they are presented with good spot products.

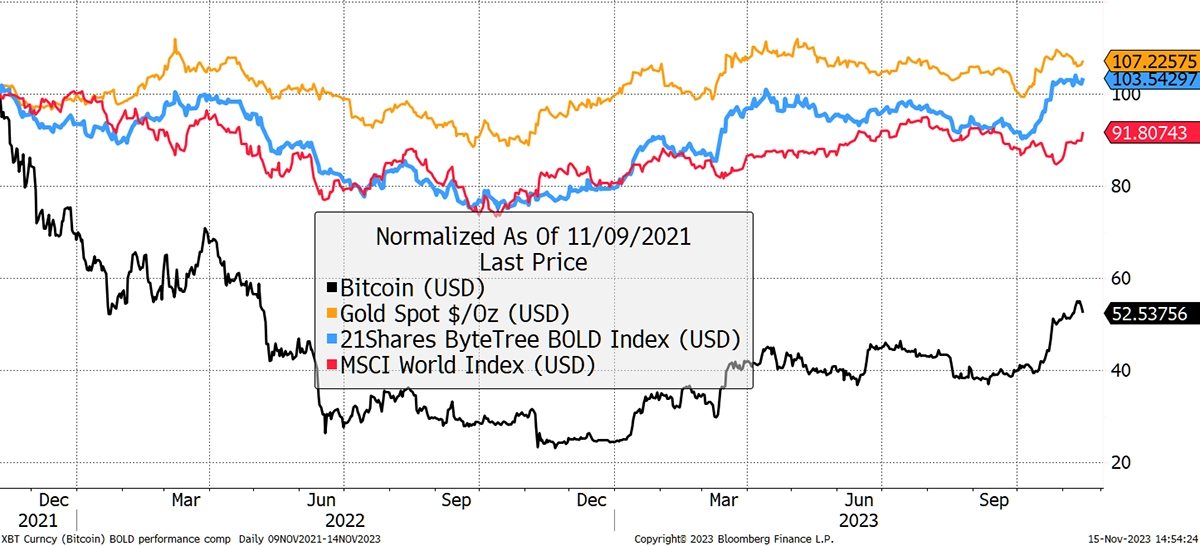

Talking of good products, I want to remind you of the power of diversification that comes with natural low correlation. ByteTree’s BOLD Index combines Bitcoin with Gold on a risk-weighted basis (roughly 25% BTC, 75% gold). Bitcoin peaked on 9 November 2021 and is down 48% since. Gold is up just 7% since that time, yet the BOLD Index is at an all-time high.

BOLD at an All-Time High

Summary

This demonstrates the power of rebalancing and diversification. With bonds no longer the safe asset they once were, Wall Street will scramble for Bitcoin ETFs when they launch.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.