Liquity: Decentralised Borrowing Made Easy

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: LQTY;

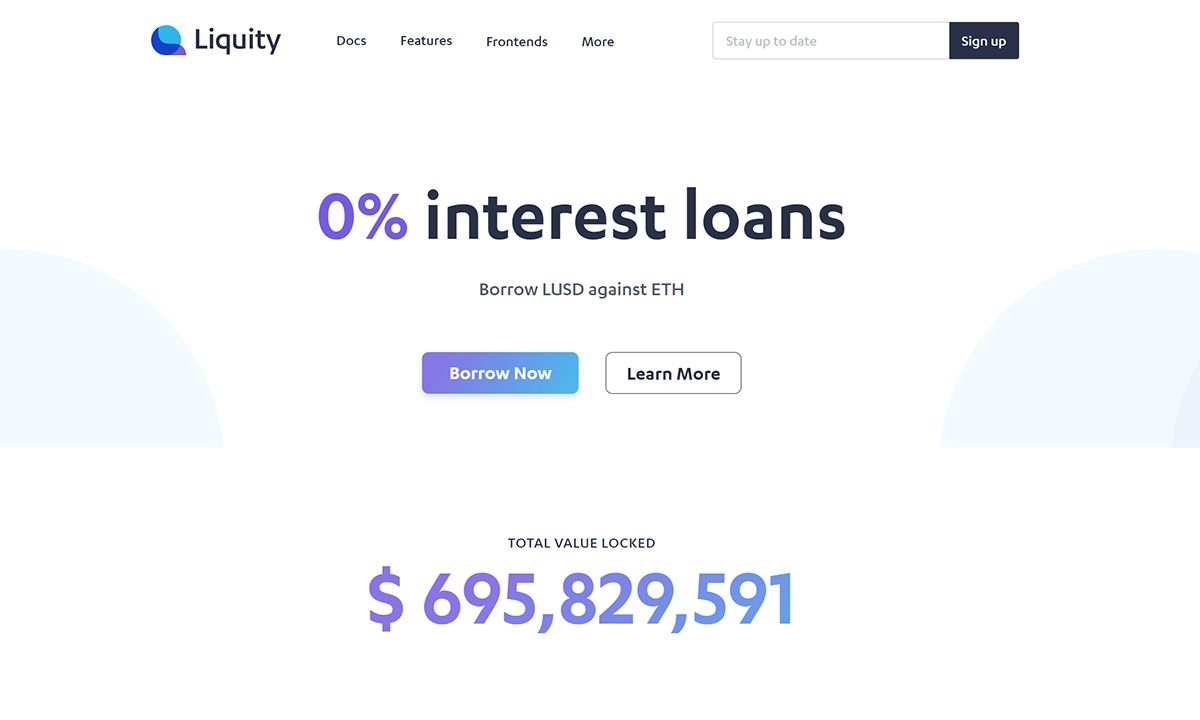

Liquity is a fully decentralised Ethereum-based borrowing protocol that allows users to borrow crypto using collateral. All debt created on Liquity is backed by ETH and has no expiration or interest. This Token Takeaway examines the fundamentals of Liquity and the value proposition of its native token, LQTY.

Overview

Uncertainty and high borrowing costs have been one of the biggest limitations in the crypto borrowing landscape. These are mainly fuelled by the fluctuating interest rates on crypto loans. It introduces instability into the DeFi borrowing market and hinders users from utilising their holdings to the fullest potential. The unpredictable shifts in borrowing costs create a less-than-ideal situation for users to enter this market. However, Liquity comes to the rescue!

Launched on 5 April 2021 by Robert Lauko and Rick Pardoe, Liquity is a DeFi dApp that runs on the Ethereum blockchain. It is a fully permission-less borrowing protocol that aims to create an environment for collateralised crypto borrowing with 0% interest rates and no payback period.

In early 2020, Liquity secured an undisclosed amount in a pre-seed funding round spearheaded by Tomahawk.VC. The platform further bolstered its financial backing with $2.4m raised in a seed funding round in September 2020. This round was led by Polychain Capital and received additional support from others, including a_capital, Lemniscap, 1kx, and the DFINITY Ecosystem Fund. As momentum continued to build, Liquity embarked on a Series A funding round in March 2021, a mere month before the platform went live. This funding round marked a $6m injection, with Pantera Capital taking the lead and contributions from notable entities such as Nima Capital, Greenfield.one, IOSG and AngelDAO.