Munger’s Silver Trade

Disclaimer: Your capital is at risk. This is not investment advice.

Atlas Pulse Gold Report, Issue 88;

Berkshire sold their silver hoard at a modest profit and later regretted the trade, probably because it went against their ideology to “never bet against America” and their establishment credentials. The critics would say they were happy to punt silver when Berkshire Hathaway was worth less than $50 billion, but now they are worth $780 billion, it is no longer respectable.

Highlights

| Munger Tribute | Berkshire's Silver Trade |

| Macro | China to Print Money |

| Valuation | Gold vs Commodities |

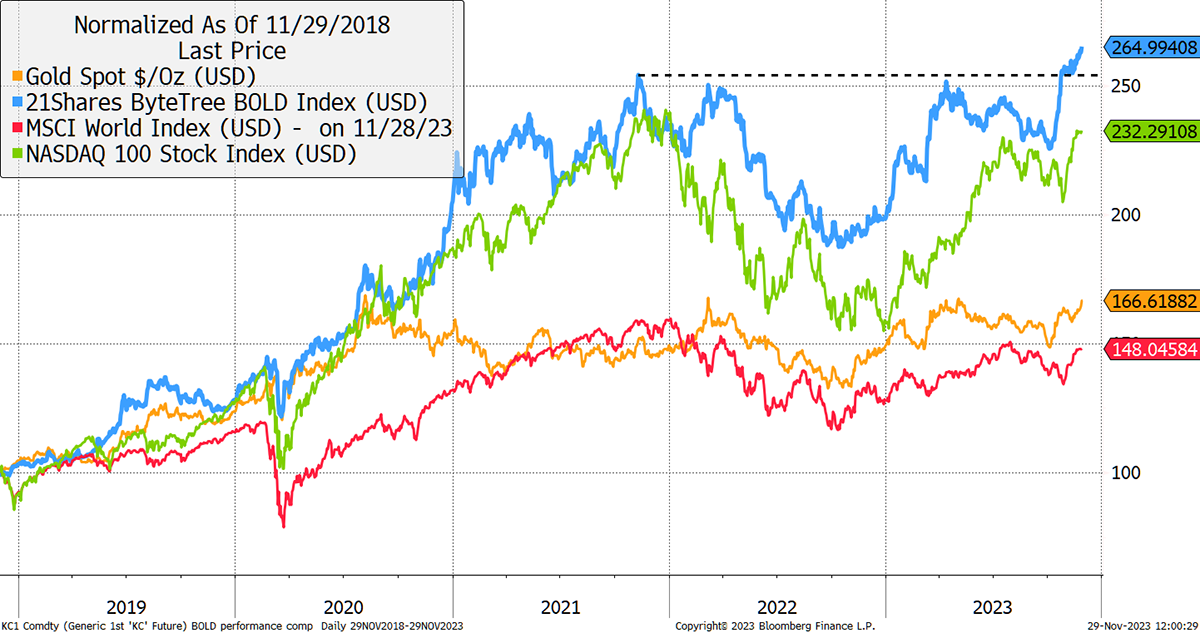

| BOLD | All-Time High |

Berkshire’s Silver Trade

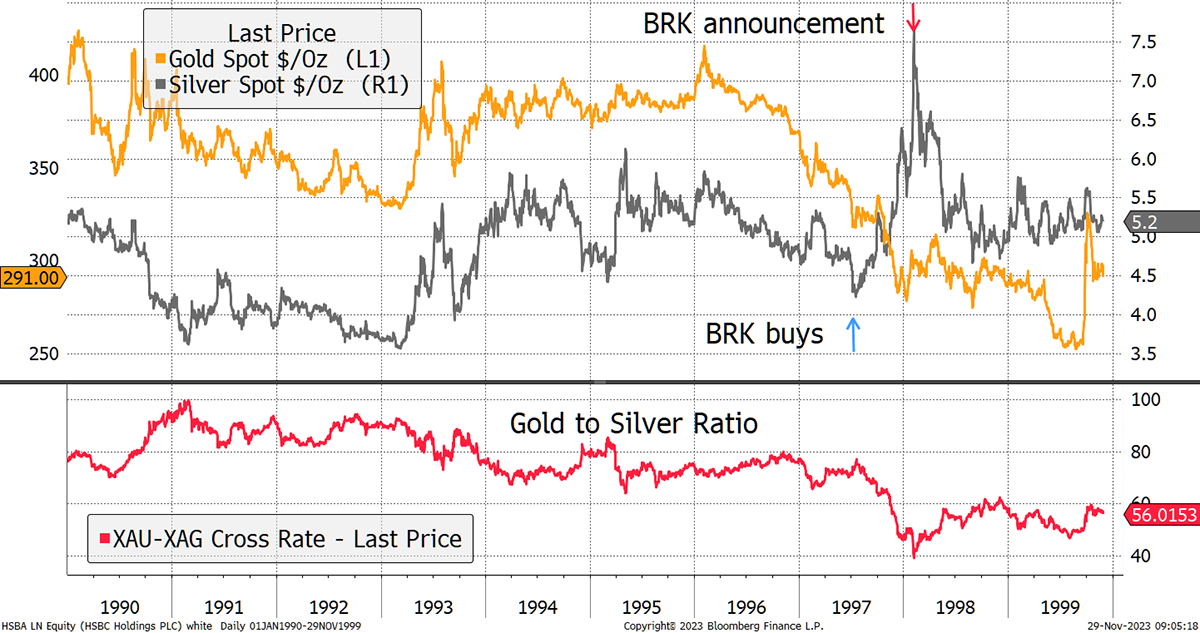

On 3 February 1998, Berkshire Hathaway shocked the silver market by announcing they had acquired 129,710,000 ounces in the London market and were taking delivery.

“Because of recent price movements in the silver market and because Berkshire Hathaway has received inquiries about its ownership of the metal, the company is releasing certain information that it would normally have published next month in its annual report. The company owns 129,710,000 ounces of silver. Its first purchase was made on July 25, 1997 and its most recent purchase was made on January 12, 1998.”

Their justification was that inventories had fallen, and market equilibrium was only likely at a somewhat higher price. The $3.50 level seen in 1991 and 1993 was the lowest low since the 1970s, and their entry point in mid-1997 at around $5 was timely. As rumours of their purchase spread, the price took off, only to give much back after the announcement a few months later.

Berkshire Buys Silver

They sold their silver hoard at a modest profit and later regretted the trade, probably because it went against their ideology to “never bet against America” and their establishment credentials. The critics would say they were happy to punt silver when Berkshire Hathaway was worth less than $50 billion, but now they are worth $780 billion, it is no longer respectable.

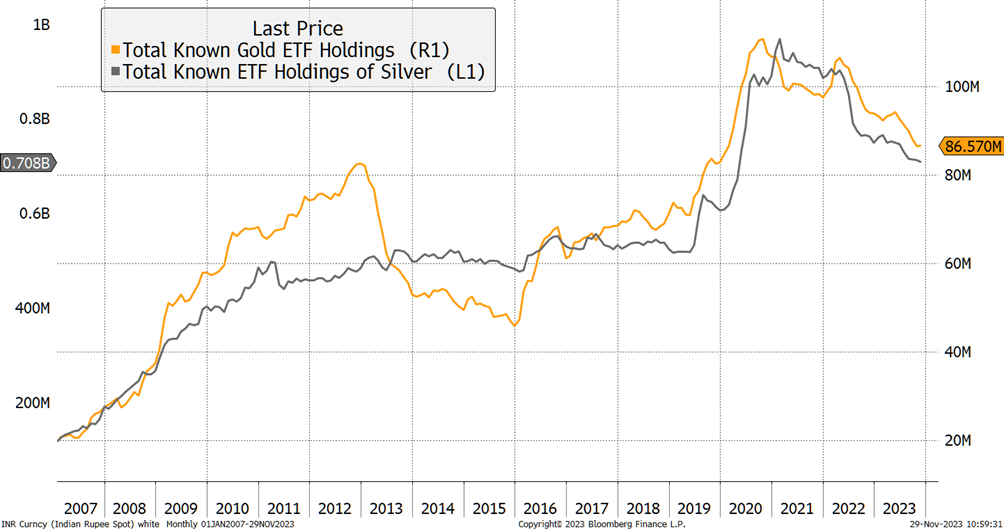

The 1997 silver trade amounted to 2% of their assets. Today that would be $15.6 billion, which is 80% of all the silver held by ETFs. Perhaps they simply outgrew commodities. Their recent investments have been more about transporting commodities via railways and pipelines and, of course, their 25.9% stake in Occidental Petroleum (OXY).

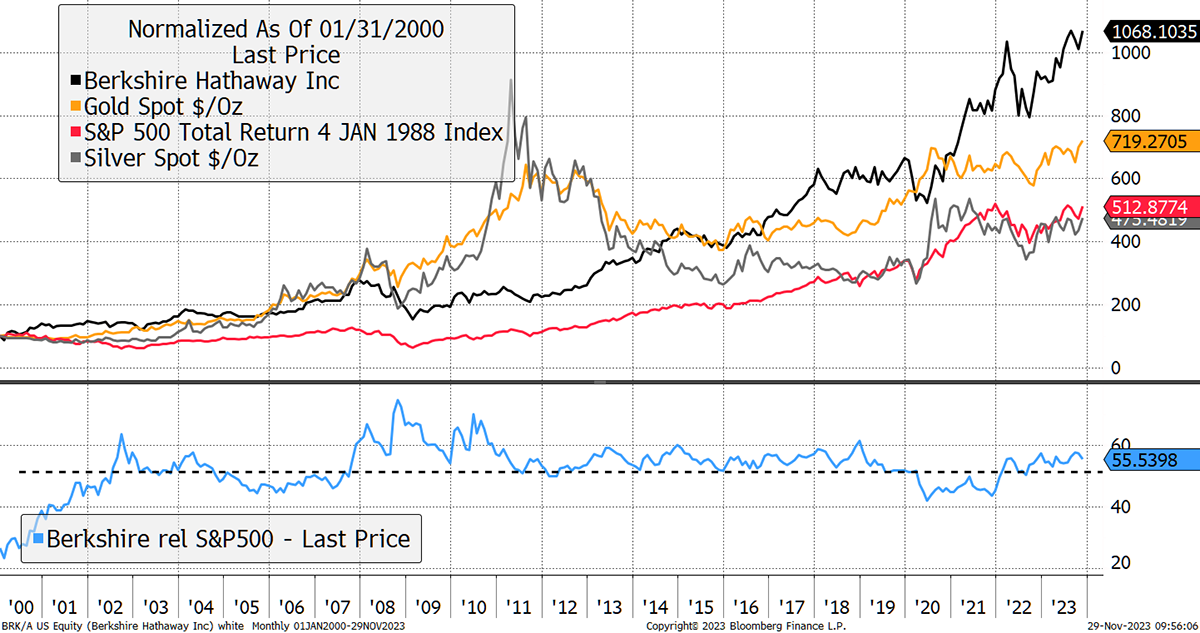

Munger was especially dismissive about gold, saying he had no interest in it. With Bitcoin, he went further, describing it as rat poison squared. I believe these shifting views came with success. It probably also irritated him that Berkshire lagged the gold price for much of the 21st century. Furthermore, and despite their gravitas, Berkshire hasn’t beaten the S&P 500, outside of bear markets, since 2003. Little wonder why he has been praising index funds in recent years.

Berkshire Beats Gold in the 21st Century

Gold, silver and bitcoin investors do not need to apologise for their anti-establishment trade, especially if they are personally worth less than $50 billion, which includes most of us. It is unquestionably hypocritical that Buffett and Munger were happy to embrace precious metals in their hungry youth, only to dismiss them when they no longer served a purpose.

But make no mistake, I am a super fan of these two great men. I visited Omaha in 2011 and got up close and personal. I read the memos, absorbed the wisdom, and laughed at the jokes. I agreed with much of their doctrine except their objection to alternative assets, which have a rightful place in portfolios. It is ok to bet against the system. I suspect Munger’s views have encouraged many institutional allocations to avoid alternative assets.

That is the good news. His lasting gift to us gold bugs is that the price is on the verge of an all-time high, and the world’s financial institutions are structurally underweight. We couldn’t have achieved that without him. Let the great bull market in alternative assets commence.

Charlie Munger RIP.

Investors are Heavily Underweight Gold and Silver at the Start of a Major Bull Run

Macro

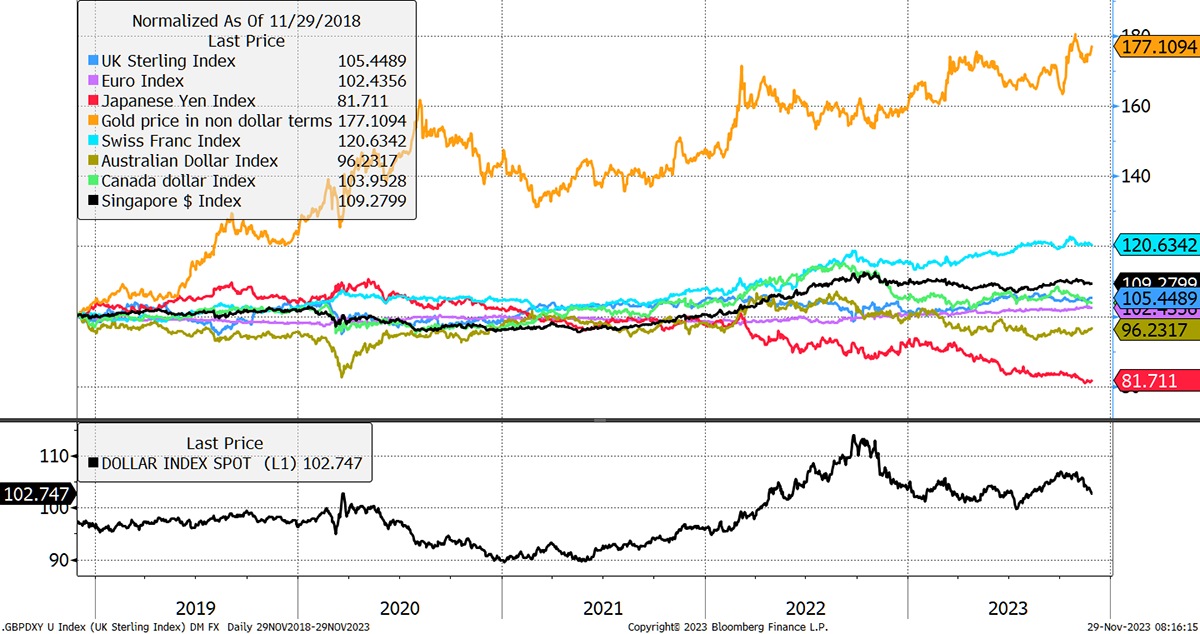

The recent strength in the gold price comes courtesy of a weak dollar. The price in euros or pounds has been less excitable, but even when measured in the world’s strongest currencies, the Singapore dollar and the Swiss franc, a new all-time high appears imminent across the board. I show the gold price in non-dollar terms (a currency average) alongside the major currencies. The lower chart shows the dollar index.

Gold’s Impending Breakout

Dollar weakness comes from a broadening consensus that interest rates have peaked and cuts are on the way. But there’s another simple idea that the dollar normally falls in bull markets while rising in bear markets. Maybe the weakness simply reflects the firing up of the printing presses.

If you are interested in currencies, please look at ByteTrend FX, which gives daily trend signals for FX, commodities and equities on X (Twitter). Today, another five currencies went into an uptrend against the dollar, leaving only the Turkish Lira in a downtrend, with the Indian Rupee close behind. It’s a powerful tool.

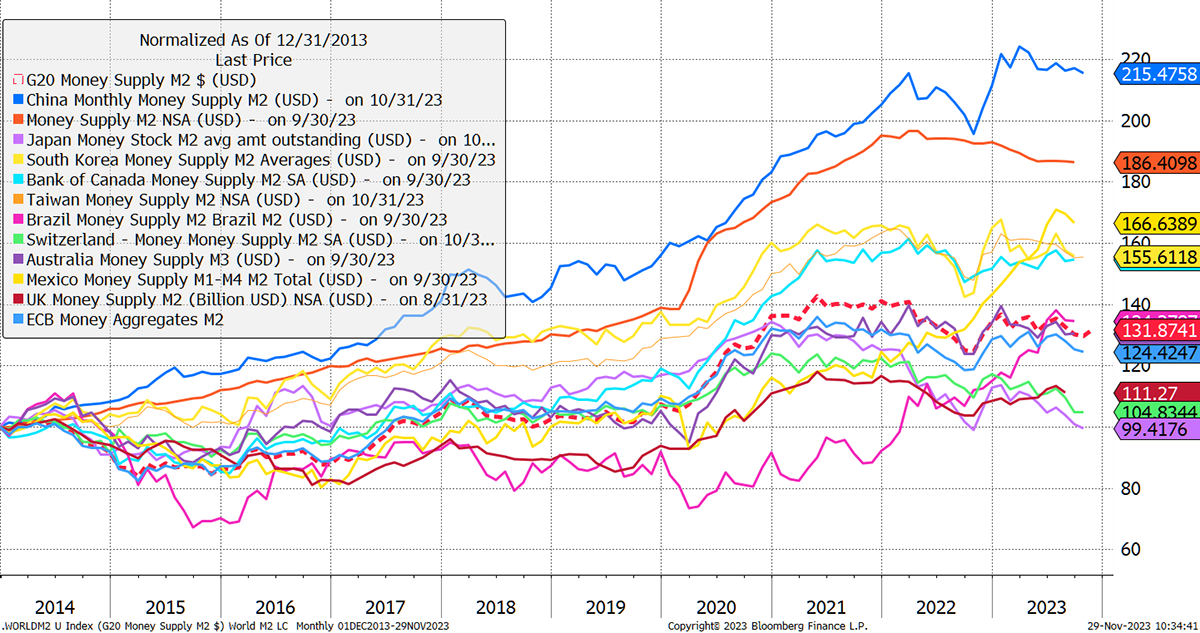

Alternative assets like freshly printed money more than anything else, and a falling dollar increases the number of dollars. A weaker dollar takes the pressure off China, which is looking for ways to stimulate its economy and prop up real estate prices. As I keep on saying, it doesn’t matter who’s printing money, provided someone is. The view on the street is that China will start printing money again soon. H/T Arthur Hayes.

China to Print Money

The dotted red line in the middle is the global G20 composite. It has turned up, which presumably means the central banks have had enough of tightening. It stands to reason that gold makes a new high when the money supply does the same.

The trouble with macro is when we look at debt and deficits, everything feels so terrifying. I recently took solace in a meeting with a frontier markets bond manager who allocates to countries such as Sri Lanka, Argentina, and Vietnam. These managers are geniuses at macro because they study around 100 countries with ever-changing dynamics, with some hopping from crisis to crisis.

I asked their opinion on how bad the state of Western macro was. They said it was terrible, but it can go on for a very long time. That’s the point. You might not like what you see, but there is no cliff edge in sight.

Physical Gold and Silver

If you are interested in buying physical gold or silver, our recommended bullion dealer is The Pure Gold Company. You can take delivery of your metal in the UK, US, Canada and Europe or leave it in their safe custody. The trading costs are low, while the quality of service is high, as shown on Trustpilot. For more details on The Pure Gold Company, please visit their website.

Valuation

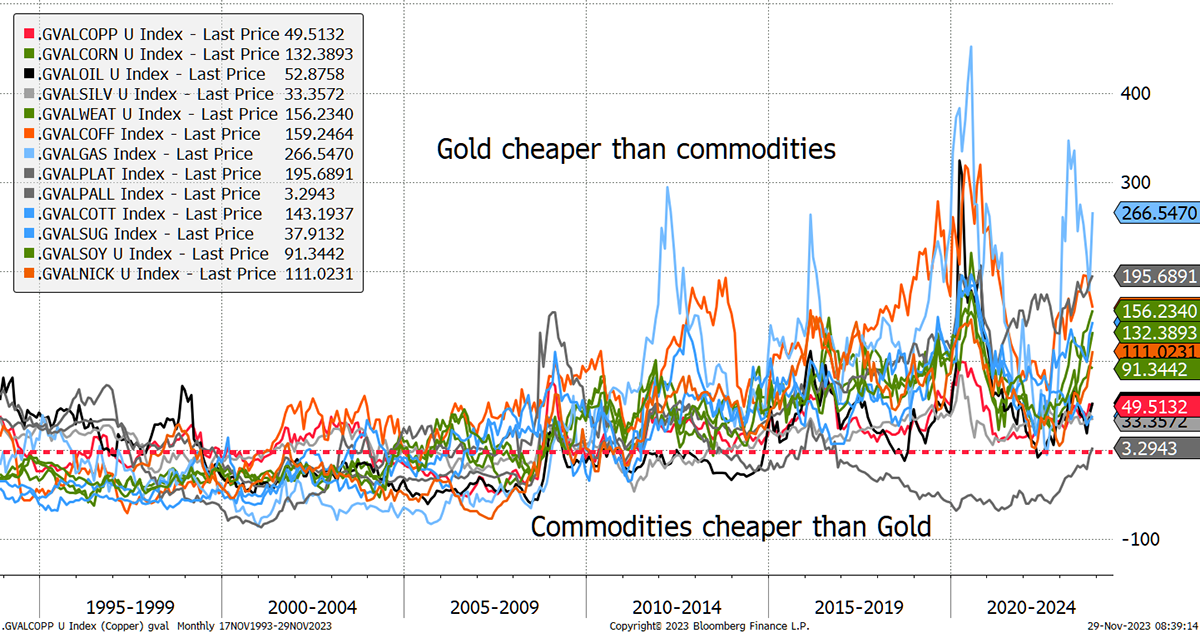

In recent issues of Atlas Pulse, I have shown how gold is rich vs US TIPS but cheap versus the money supply. The world has changed, and I concluded that the latter matters more. But there are other ways to keep gold in check, and this is a good time to revisit its relationship with commodity prices. I say that because many commodity prices are falling while gold and silver are rising.

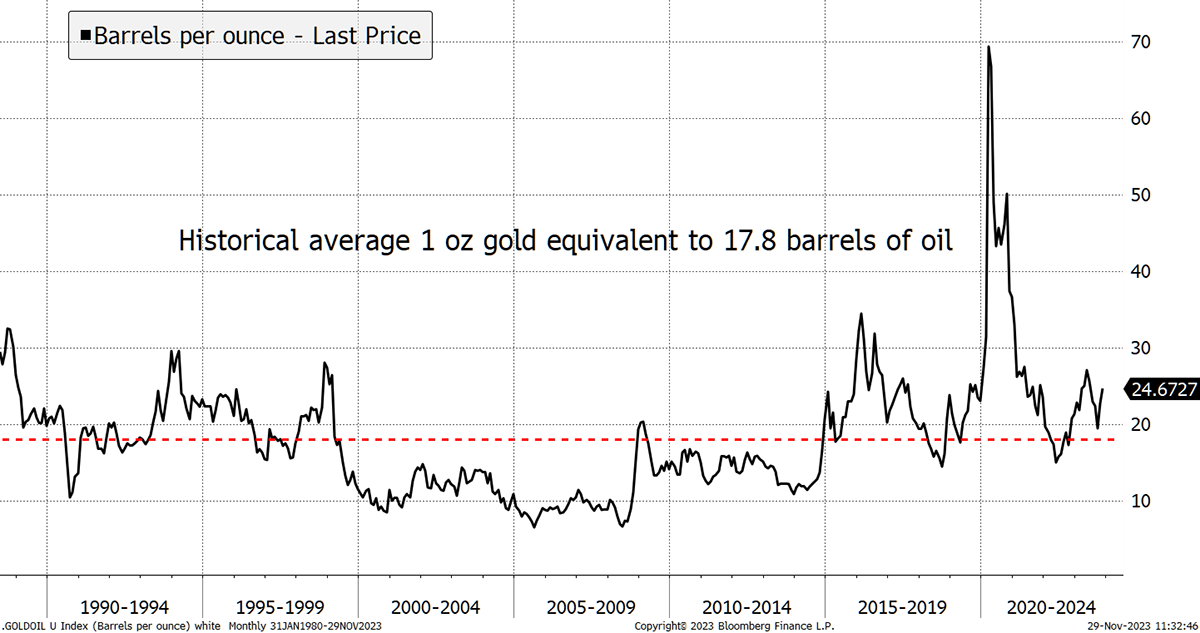

Take oil as an example. Over 35 years, an ounce of gold has mean reverted around the oil price with an average of 17.8 barrels. Today, that is 24.6 barrels, making oil slightly cheaper vs gold. Naturally, oil was much cheaper in 2020, when the world stopped.

Gold in Oil

I have replicated that for all major commodities. Now that palladium has reverted back to its mean, that is the grey line at the bottom, gold is now the most expensive commodity. That contrasts with 2000 and 2007/8, when gold was undervalued on this basis. Should we be worried about holding gold?

Gold at a Premium to Commodities

I don’t think so, but I would naturally assume that over the next 10 years or so, commodity prices will be priced to perform and will probably beat gold. For that to happen, we need the economy to be expanding at pace, and with China and Europe limping, that doesn’t seem likely in the short term, but it will come. That is the beauty of gold; it can appreciate when everything else is falling.

For those interested, the cheapest commodities, on this basis, are natural gas, platinum, coffee, wheat, cotton and corn. Coffee is the only one with positive price momentum on ByteTrend.

I am covering our BOLD Index on Friday following the monthly rebalancing. The highlight is the all-time high for BOLD when neither Bitcoin nor Gold has managed to do that.

BOLD All-Time High

Summary

These are fascinating times for investors. I have always enjoyed studying the gold market, but over the years, my allocation has ranged between 0% and 20%, leaving the other 80% or more to traditional assets.

In the ByteTree Venture Portfolio, I am highlighting UK deep-value stocks, which you keep hearing about, and in The Multi-Asset Investor, we are buying European healthcare. At least Munger would approve of most of what I do. Maybe when my assets under administration exceed $50 billion, I’ll follow his lead.

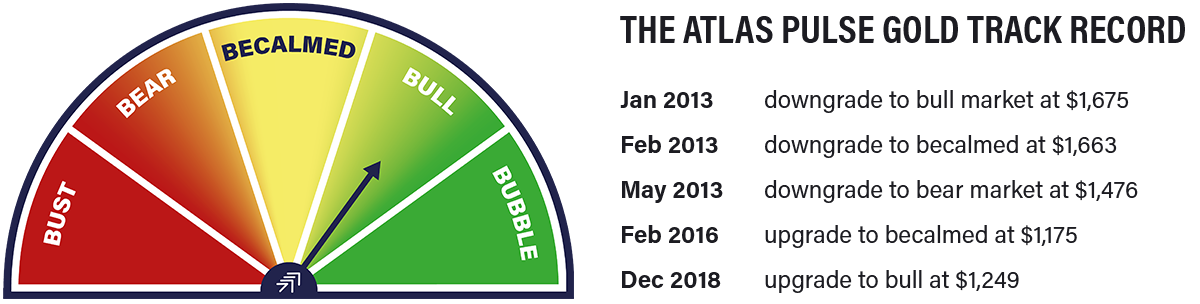

The Gold Dial Remains in Bull Market.

Comments ()