Peak Rates Means Peak Dollar

Disclaimer: Your capital is at risk. This is not investment advice.

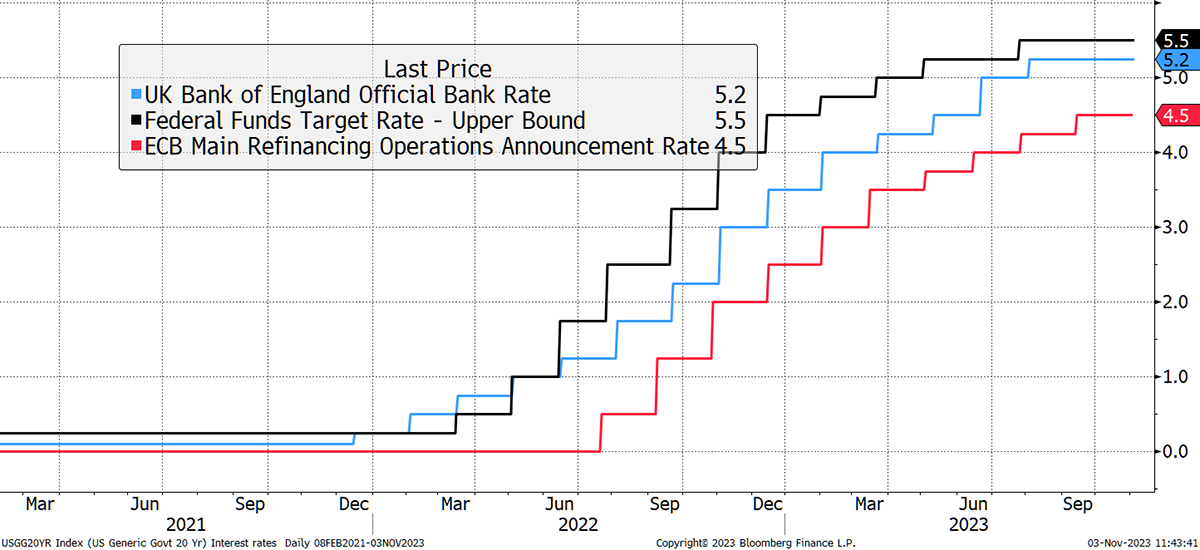

This week saw both the Bank of England and the Federal Reserve hold back on further interest rate hikes for the first time since the start of this cycle. It’s a big deal for the markets, and hopefully it brings relief.

Interest Rates Pause

No one knows what follows the fastest rate hiking cycle in history, but it feels like a peak that will last for a while. The optimists are looking for rate cuts, which may follow, or they may not. That’s important because 3 years of 5% is harsher than a few months of 6%, followed by a fall back to 0%. It’s not just the level of rates, but the length of time they last for too.

Many think all will be well because inflation is beaten, and we can return to zero rates. I think that is unlikely because the world has changed. The great structural driver of low inflation was globalization, and that now seems to be in reverse. Inflation is easing as the economy slows, but what happens when it picks up again?

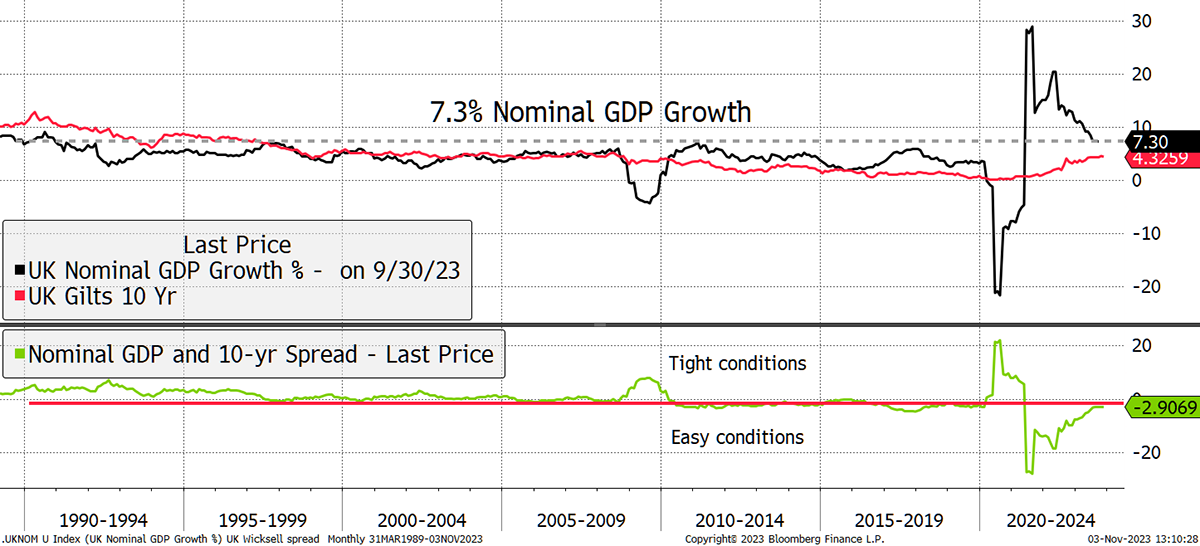

The late Swedish economist, Knut Wicksell, had a view on this. He taught us that the yield on the ten-year bond ought to approximate nominal GDP growth. That is the real economic growth plus inflation. Looking at the 10-year UK gilt, the yield is 4.3%, which is 2.9% below nominal GDP growth of 7.3% over the past year. Most of that was inflation rather than real growth, but still, it’s a big number that we rarely see. Fortunately, it is slowing.

UK Monetary Policy Close to Neutral

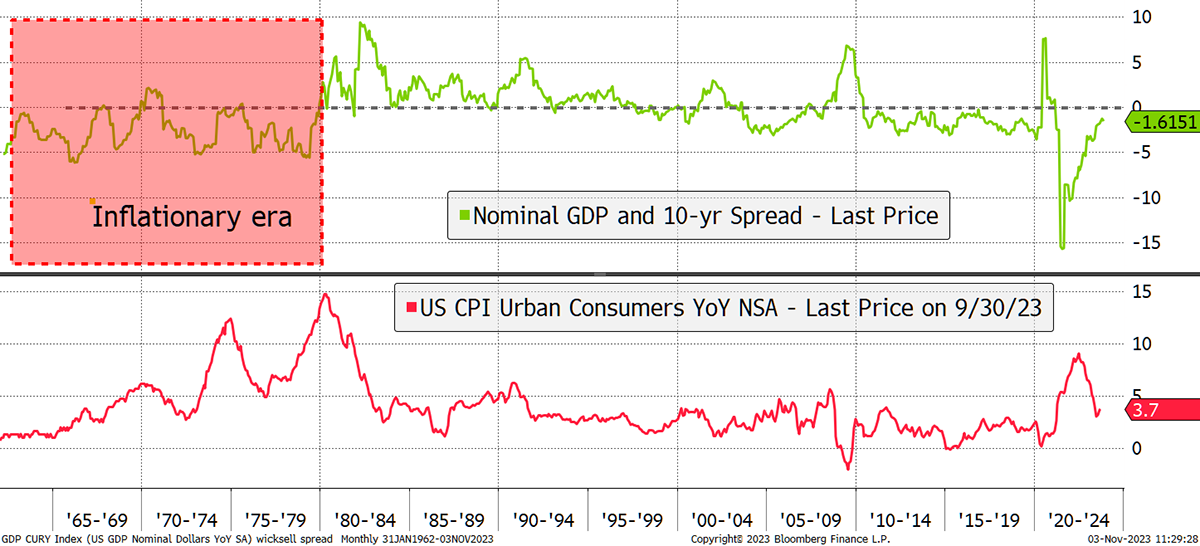

In the USA, we have data back to the 1960s. I have just shown the Wicksell spread and consumer price inflation. The important point is that the last inflationary era occurred in the 1960s and 1970s, which coincided with easy money, where the 10-year was persistently below the rate of nominal GDP growth. The disinflationary era of the 1980s and 1990s always had a positive Wicksell spread.

Today’s Wicksell spread in the US is -1.6%, which is similar to the 2008 to 2020 era. That is the years between the financial crisis and the pandemic. To assume rates are high enough to put inflation to bed is understandable in the short-term, but in the long-term?

US Easy Money

There’s another problem, and that is the scale of the debt and, more importantly, the interest payments. For the US, interest payments exceed Medicaid and are closing in on the defense budget. The government has every incentive to keep rates as low as possible.

Easy money can be good for investors, but it doesn’t have to be. In 2001, the central banks slashed rates in the face of a recession, but the market didn’t bottom out for another two years. A similar thing happened in 2007, but the wait was a little shorter. Of course, the pandemic rate cuts proved explosive, but I can only presume the printing of $6 trillion might have helped give the market a push, and inflation to boot.

One thing we can be sure of is that if the US holds back on rate hikes, the dollar surge will reverse. That isn’t necessarily great for US equities. But always comes as a relief to the rest of the world.

Peak Rates Means Peak Dollar

But whatever happens to rates, unemployment is rising. Over the past 50 years, rising unemployment has been a good reason to remain cautious, but be clear that a bull market always kicks off before unemployment peaks. We must never forget that stocks are a leading indicator.

The economy may get worse before it gets better, but the opportunities are growing because value is becoming plentiful. The investor’s challenge is to find it.

A Week at ByteTree

In Venture, I recommended a mid cap gold miner with high operational gearing. That means as the gold price rises, it will rise much faster. Naturally, gold might fall, but an easing dollar and peak rates make that less likely.

In ByteFolio, the extraordinary strength in crypto was reiterated but has seen Bitcoin take the lead. We expect the market to broaden and will be discussing that on Monday.

It was a quiet week in the Multi-Asset Investor, but there was a lesson in understanding index-linked bonds. Next week will be livelier as I discuss the property market. Many property companies are trading cheaply and pay hefty real yields. I will explore that on Tuesday.

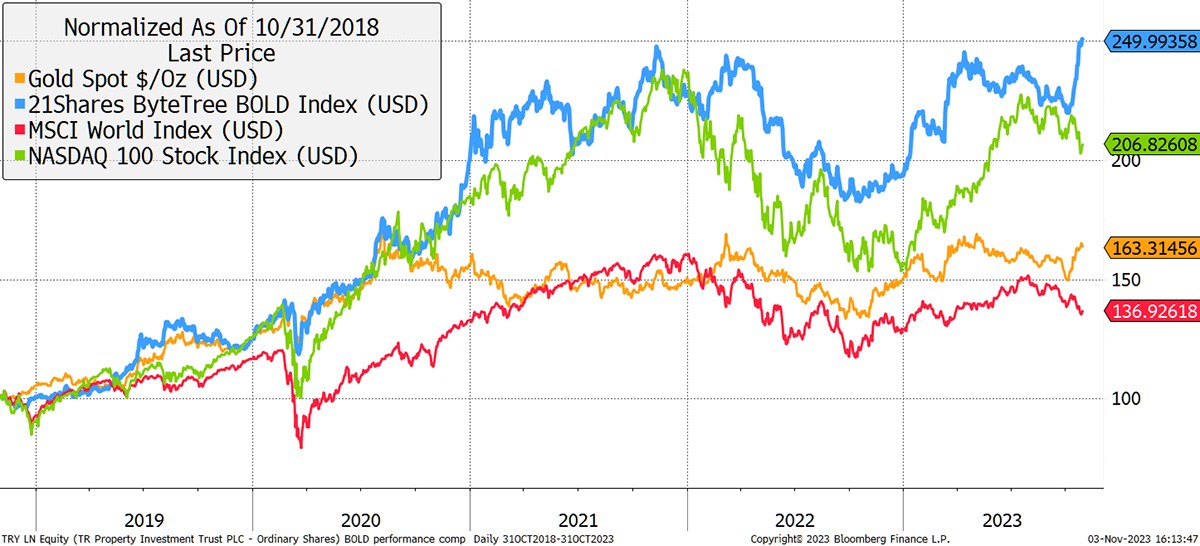

Leaving the best until last, the highlight of the week was our Bitcoin and Gold Index, BOLD, which made an all-time high.

If Finance Mated with Culture, the Result Would Be BOLD

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()