Gold is up while oil is down, which means uncertainty is booming while the economy is weak. Outside of the 2014 surge in shale production, a weaker oil price has always warned of trouble ahead.

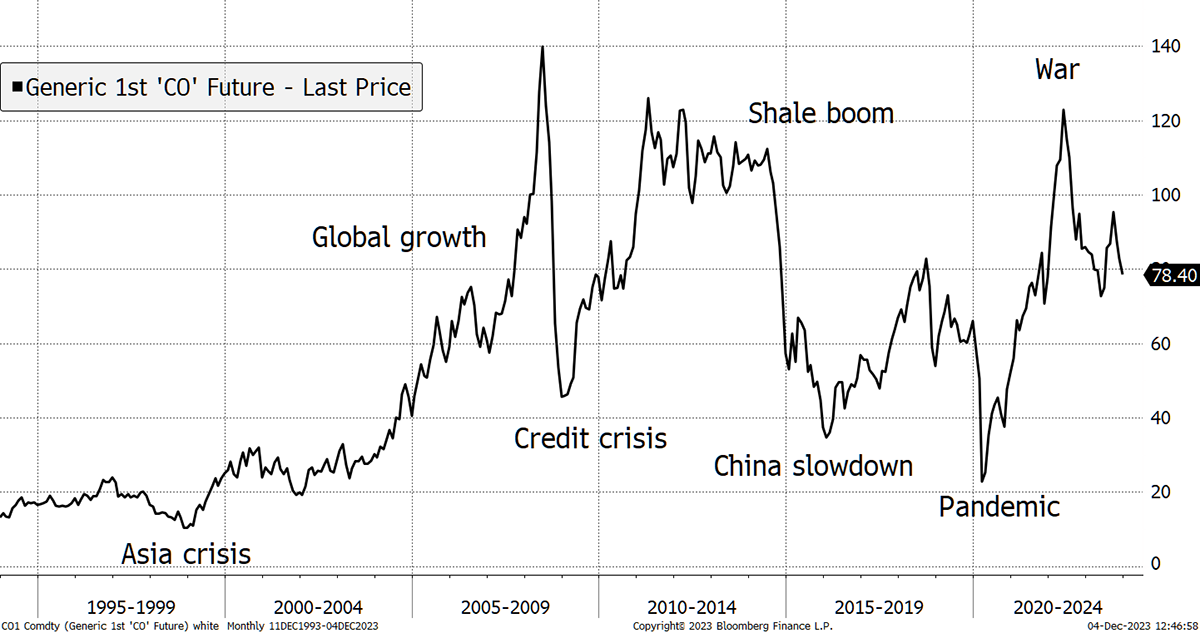

Oil Marks the Economic Cycle

Oil is once again in a downtrend but has yet to make a new cycle low, which would need to see a break below $70. It is noticeable how the last two major lows in 2020 and 2016 were lower than the previous low. Some would argue that it is telling us that the long-term prospect for oil is to leave it in the ground as we transition to cleaner sources. As much as I would like to agree with that, I believe the supply jump from the shale boom will not be repeated, and the pandemic was exceptional in destroying demand as the world stood still. Oil shocks really are shocks.

The chart above shows a triple top, like gold, until last week’s almighty breakout to a (short-lived) all-time high. That ought to mean, and according to the laws of triple tops, the next attempt for oil to challenge the $120 to $150 zone will see a breakout. I don’t expect that to happen soon because whatever the West’s demand profile looks like, Chinese demand is weighing down the price. Notice how closely the oil price resembles the Hang Seng Index.

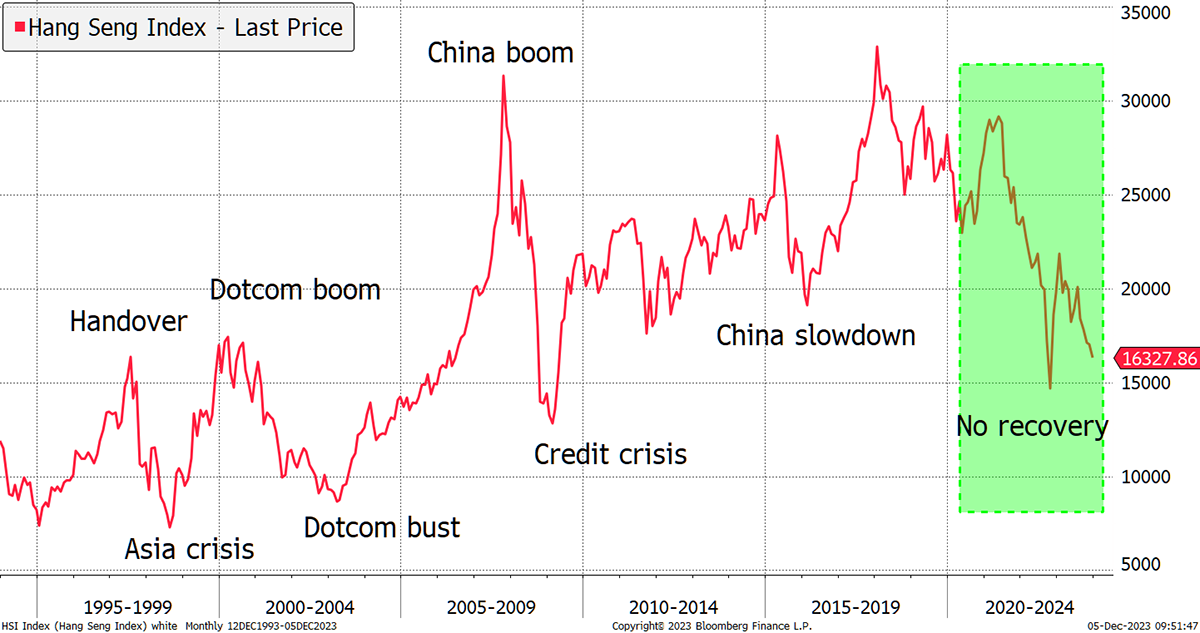

China Is Slowing

You’ll recall that, at the beginning of this year, I was positioned for a China recovery. They were late to end lockdown, and the expectation was for a billion people to go on a global spending spree. It didn’t happen, and the sales of luxury goods slumped, along with Chinese property prices. Their reopening didn’t set the heather alight.

With the Hang Seng at levels traded at levels seen in the mid-1990s, and with Chinese banks looking like ours did in 2007, it is becoming increasingly clear that the Chinese economy has a problem. It’s not pretty, and the capital flight is reflected in higher prices for the likes of bitcoin and gold, which enable wealth to be moved, or at least insulated.

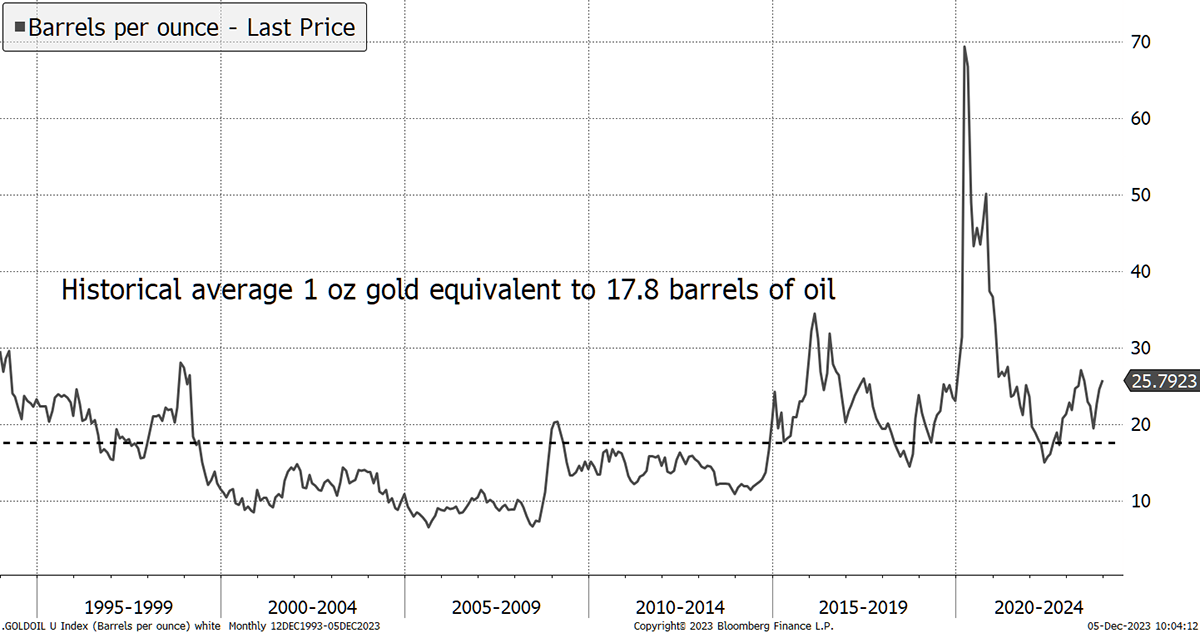

With gold strong and oil weak, it is important to check in. The historical average has seen an ounce of gold equate to 17.8 barrels of oil. At current prices, oil is undervalued but could get cheaper. But not by much because the pandemic freeze will not be repeated. I doubt oil breaks below $70 this cycle, but never say never.

Oil Is Cheap Gold

We still have some exposure to energy stocks, and I am comfortable hanging on. I see more chance of them doing well because they offer such excellent value, and this could be well placed as we are witnessing another momentum crash.

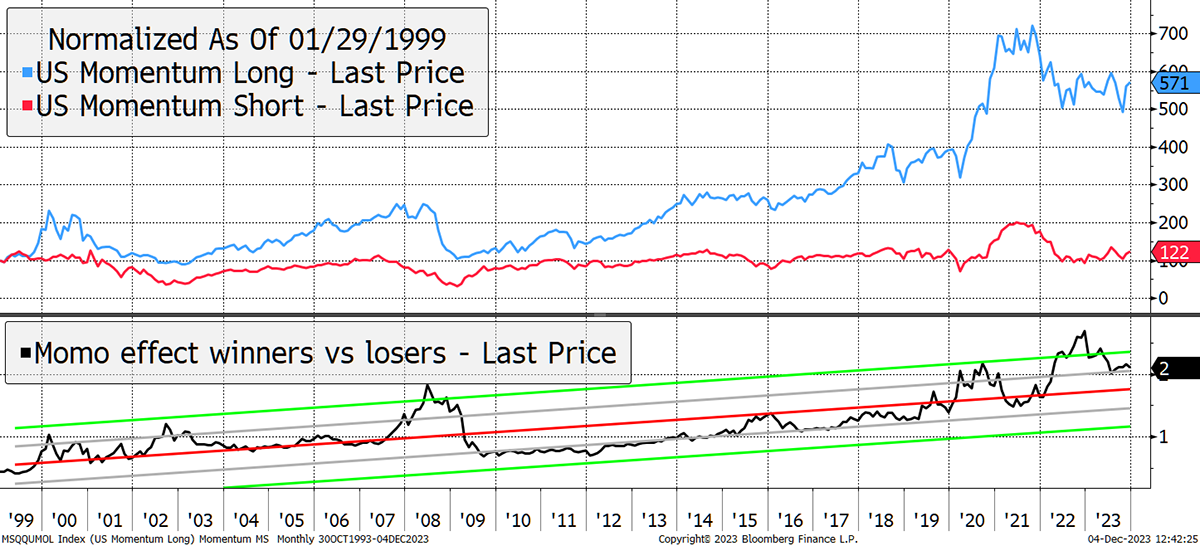

Momentum Crash

To remind you, momentum is one of the great unexplained market factors. Momentum investing generates excess return over the long term, but no one is certain why, and it’s still controversial in academic circles. I think it’s very simple: successful companies (the winners) are underappreciated and underpriced. They deliver positive surprises for longer than one would reasonably expect and deliver higher gains as a result. In contrast, weak companies (the losers) generally disappoint and continue to do so year after year.

Therefore, the skill in value investing is to be able to differentiate between value and value traps. Conversely, the skill in growth investing is to keep a level head. Growth stocks should cost more, but in recent years, the market has overdone it in both directions. Value is too cheap, while growth is too dear. Periodically, the momentum effect snaps the excesses back down to earth in a momentum crash. It is not the market that is necessarily crashing, but the momentum effect (momo).

Momo Crash

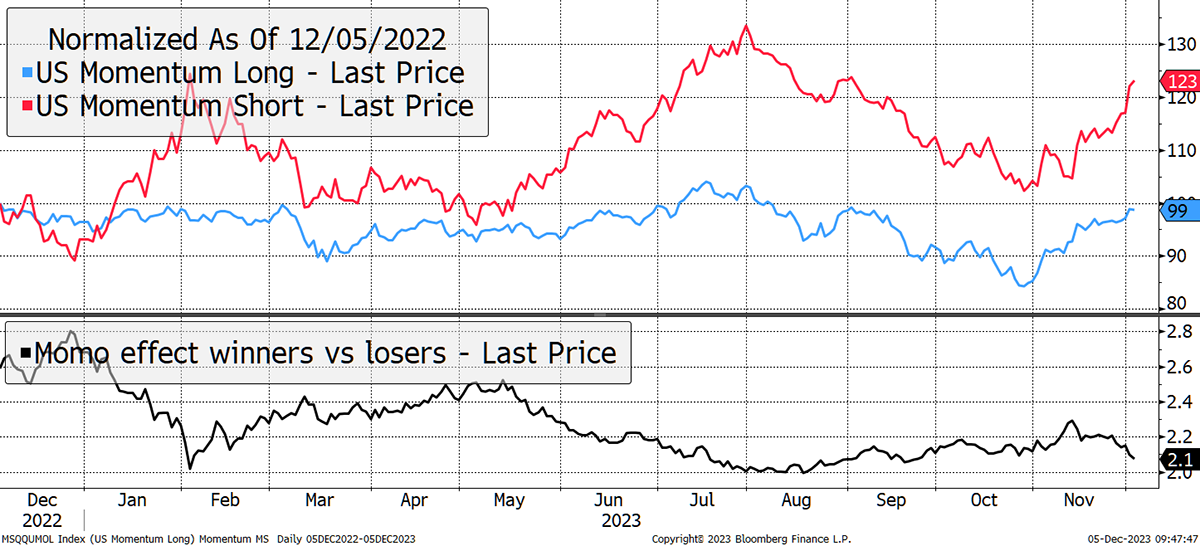

We last had a momo crash in October last year, and before that, in September 2020, once the signs became clear that the peak risks of the pandemic had passed. At that time, the virtual world had gone crazy as the real economy slumped. Just the idea of the end of lockdowns saw the real economy stocks surge. For whatever reason, this wasn’t repeated in China. Looking at the black line above, the momentum effect is still elevated and has plenty of room to keep on falling.

Zooming in on the last year, the red losers have beaten the winners, which would surprise many. Recall that the winners are a large group of stocks, not just the magnificent 7. Notice how the red line (losers) is rising more quickly than the blue line (winners), which means losers have been beating winners, and that’ll continue in this stock pickers environment.

Losers Are still Beating Winners

You may be interested to know that the iShares World Momentum ETF (IWFM) has lagged the world index by 23% over the past three years. Luckily, we sold it three years ago and haven’t held it since. In my opinion, if momo isn’t working, there’s something in the market that’s not quite right.

It means we need to be on our guard, which we are.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd